The company launches WAVE, a generative

AI-powered dynamic audio advertising solution

Perion Network Ltd. (NASDAQ and TASE: PERI), a global technology

company whose synergistic solutions serve all major digital

advertising channels - including search, social, display, and

video/CTV, today reported its financial results for the third

quarter ended September 30, 2023.

“Once again, our business results proved that our strategically

diversified model gives us the agility to deliver continued

growth,” stated Tal Jacobson, Perion’s CEO. “Despite macroeconomic

headwinds, our third-quarter year-over-year revenue and adjusted

EBITDA increased 17% and 29%, respectively. These results were made

possible by the ability to leverage our technological capabilities

and focus resources on the strongest industry verticals to achieve

top-line profitability and margin expansion. Specifically, our

Retail Media solutions are tracking to significantly exceed our

annual revenue goal for 2023.”

“Our diversification remains a key differentiator for Perion,

powered by exceptional execution and ongoing investment in

technology,” added Mr. Jacobson.

Introducing WAVE

Reaffirming its commitment to technological innovation, Perion

expands its advertiser suite of solutions with the introduction of

WAVE (Waveform Audio Voice Engine), a generative AI-powered dynamic

audio solution that enables advertisers to generate personalized

audio advertising messages at scale. The power of the solution is

based on advanced algorithmic AI processing which combines

first-party data with voice, reaching consumer audiences with

tailored audio messages that adapt in real time to parameters such

as weather, location, daypart, and many others.

"We are focused on developing technology that creates deeper and

more meaningful consumer experiences," explained Mr. Jacobson.

"WAVE represents our commitment to changing the game for

advertisers, enabling us to tap into lucrative channels and create

entirely new categories. We envision a future where every consumer

interaction is customized, localized and commerce-enabled."

Albertsons is an early adopter that has seamlessly integrated

WAVE into several successful campaigns and is now looking to scale

the solution more broadly.

"When Perion introduced us to the AI script and voice, we were

blown away. It was very hard to detect that it was an actual AI

voice – right down to the nuances of how certain products are

pronounced, and the annunciation. To see the machine actually

learning those dialogue differences was super important to us,”

said Tony Colvin, Director – Paid Media, Albertsons Companies.

WAVE is launching into the Retail vertical, adding a richer,

multi-dimensional capability to each consumer touchpoint. Perion

plans to quickly roll out WAVE to additional verticals, including

QSR - Quick-Service Restaurants, automotive, and travel.

Third Quarter 2023 Business Highlights

● Retail Media1 revenue increased 112% year-over-year to $13.0

million, representing 13% of Display Advertising revenue compared

to 7% last year

● CTV revenue2 increased 39% year-over-year to $7.9 million,

representing 8% of Display Advertising revenue compared to 7% last

year

● Video revenue decreased 16% year-over-year, driven by shifting

inventory from video to display to gain higher profit, representing

32% of Display Advertising revenue, compared to 44% last year

● The number of Average Daily Searches increased by 86%

year-over-year to 31.3 million. The number of Search Advertising

publishers increased by 16% year-over-year to 164

1 Retail Media revenue includes all media channels, such as CTV,

video and others 2 Starting in the previous quarter, we changed our

methodology for measuring our CTV activity. We moved from measuring

CTV campaigns to measuring CTV channels. The CTV growth trend under

both methodologies remains in the same trajectory. Under our

updated methodology, revenue generated from CTV in the third

quarter of 2022 was $5.7 million vs. $7.4 million under the

previous methodology.

Third Quarter 2023 Financial Highlights1

In millions,

Three months ended

Nine months ended

except per share data

September 30,

September 30,

2023

2022

%

2023

2022

%

Display Advertising Revenue $

99.2

$

86.8

14%

$

278.5

$

236.9

18%

Search Advertising Revenue $

86.1

$

71.8

20%

$

230.5

$

193.7

19%

Total Revenue $

185.3

$

158.6

17%

$

509

$

430.6

18%

Contribution ex-TAC (Revenue ex-TAC)1 $

77.3

$

65

19%

$

219.6

$

180

22%

GAAP Net Income $

32.8

$

25.6

28%

$

78

$

60.5

29%

Non-GAAP Net Income1 $

42.4

$

29.9

42%

$

114.4

$

75.1

52%

Adjusted EBITDA1 $

42.7

$

33

29%

$

115.2

$

84.1

37%

Adjusted EBITDA to Revenue ex-TAC

55%

51%

52%

47%

Net Cash from Operations $

40.1

$

34.7

16%

$

105.2

$

83.9

25%

GAAP Diluted EPS $

0.65

$

0.53

23%

$

1.57

$

1.27

24%

Non-GAAP Diluted EPS1 $

0.84

$

0.61

38%

$

2.28

$

1.56

46%

Outlook for 2023 2

With the first three quarters of 2023 behind us, Perion

reiterates its annual revenue and adjusted EBITDA guidance.

In millions

2022

2023

Guidance

YoY

Growth %3

Revenue

$640.3

$730-$750

16%

Adjusted EBITDA

$132.4

$167+

26%

Adjusted EBITDA to Revenue

21%

23%3

Adjusted EBITDA to Contribution ex-TAC

49%

54%3

1 Contribution ex-TAC, non-GAAP Net

Income, Adjusted EBITDA and non-GAAP Diluted EPS are non-GAAP

measures. See below reconciliation of GAAP to non-GAAP

measures.

2 We have not provided an outlook for GAAP

Income from operations or reconciliation of Adjusted EBITDA

guidance to GAAP Income from operations, the closest corresponding

GAAP measure, because we do not provide guidance for certain of the

reconciling items on a consistent basis due to the variability and

complexity of these items, including but not limited to the

measures and effects of our stock-based compensation expenses

directly impacted by unpredictable fluctuation in our share price

and amortization in connection with future acquisitions. Hence, we

are unable to quantify these amounts without unreasonable

efforts.

3 Calculated at revenue guidance midpoint.

Adjusted EBITDA year-over-year growth calculated based on $167

million.

Financial Comparison for the Third Quarter of 2023

Revenue: Revenue increased 17% to $185.3 million in the

third quarter of 2023 from $158.6 million in the third quarter of

2022. Display Advertising revenue increased 14% year-over-year,

accounting for 54% of total revenue, primarily due to a 112%

year-over-year increase in Retail revenue to $13.0 million and a

39% year-over-year increase in CTV revenue to $7.9 million. Search

Advertising revenue increased 20% year-over-year, accounting for

46% of revenue, with 86% increase in Average Daily Searches and 16%

increase in the number of publishers.

Traffic Acquisition Costs and Media Buy (“TAC”): TAC

amounted to $108.0 million, or 58% of revenue, in the third quarter

of 2023, compared with $93.6 million, or 59% of revenue, in the

third quarter of 2022. The margin expansion was primarily

attributed to favorable product mix and media buying optimization

through our platform.

GAAP Net Income: GAAP net income increased by 28% to

$32.8 million in the third quarter of 2023 compared with $25.6

million in the third quarter of 2022.

Non-GAAP Net Income: Non-GAAP net income was $42.4

million, or 23% of revenue, in the third quarter of 2023, compared

with $29.9 million, or 19% of revenue, in the third quarter of

2022. A reconciliation of GAAP to non-GAAP net income is included

in this press release.

Adjusted EBITDA: Adjusted EBITDA was $42.7 million, or

23% of revenue (and 55% of Contribution ex-TAC) in the third

quarter of 2023, compared with $33.0 million, or 21% of revenue

(and 51% of Contribution ex-TAC) in the third quarter of 2022. A

reconciliation of GAAP income from operations to Adjusted EBITDA is

included in this press release.

Cash Flow from Operations: Net cash provided by operating

activities in the third quarter of 2023 was $40.1 million, compared

with $34.7 million in the third quarter of 2022.

Net cash: As of September 30, 2023, cash and cash

equivalents, short-term bank deposits and marketable securities

amounted to $523.6 million, compared with $429.6 million as of

December 31, 2022.

Conference Call

Perion’s management will host a conference call to discuss the

results at 8:30 a.m. ET today:

● Registration link:

https://incommconferencing.zoom.us/webinar/register/WN_Mwx-qMqNRZKyt3FCZ1XXxQ

● Toll Free: 1-877-407-0779

● Toll/International: 1-201-389-0914

A replay of the call and a transcript will be available within

approximately 24 hours of the live event on Perion’s website.

About Perion Network Ltd.

Perion is a global multi-channel advertising technology company

that delivers synergistic solutions across all major channels of

digital advertising – including search advertising, social media,

display, video and CTV advertising. These channels converge at

Perion’s intelligent HUB (iHUB), which connects the company’s

demand and supply assets, providing significant benefits to brands

and publishers.

For more information, visit Perion's website at

www.perion.com

Non-GAAP Measures

Non-GAAP financial measures consist of GAAP financial measures

adjusted to exclude certain items. This press release includes

certain non-GAAP measures, including Contribution ex-TAC, Adjusted

EBITDA, non-GAAP net income and non-GAAP diluted earnings per

share.

Contribution ex-TAC presents revenue reduced by traffic

acquisition costs and media buy, reflecting a portion of our

revenue that must be directly passed to publishers or advertisers

and presents our revenue excluding such items. We believe

Contribution ex-TAC is a useful measure in assessing the

performance of the Company because it facilitates a consistent

comparison against our core business without considering the impact

of traffic acquisition costs and media buy related to revenue

reported on a gross basis.

Adjusted Earnings Before Interest, Taxes, Depreciation and

Amortization ("Adjusted EBITDA") is defined as income from

operations excluding stock-based compensation expenses,

depreciation, amortization of acquired intangible assets, retention

and other acquisition-related expenses and gains and losses

recognized with respect to changes in the fair value of contingent

consideration.

Non-GAAP net income and non-GAAP diluted earnings per share are

defined as net income and net earnings per share excluding

stock-based compensation expenses, retention and other

acquisition-related expenses, revaluation of acquisition-related

contingent consideration, amortization of acquired intangible

assets and the related taxes thereon, non-recurring expenses,

foreign exchange gains and losses associated with ASC-842, as well

as gains and losses recognized with respect to changes in fair

value of contingent consideration.

The purpose of such adjustments is to give an indication of our

performance exclusive of non-cash charges and other items that are

considered by management to be outside of our core operating

results. These non-GAAP measures are among the primary factors

management uses in planning for and forecasting future periods.

Furthermore, the non-GAAP measures are regularly used internally to

understand, manage and evaluate our business and make operating

decisions, and we believe that they are useful to investors as a

consistent and comparable measure of the ongoing performance of our

business. However, our non-GAAP financial measures are not meant to

be considered in isolation or as a substitute for comparable GAAP

measures and should be read only in conjunction with our

consolidated financial statements prepared in accordance with GAAP.

Additionally, these non-GAAP financial measures may differ

materially from the non-GAAP financial measures used by other

companies. Due to the high variability and difficulty in making

accurate forecasts and projections of some of the information

excluded from these projected measures, together with some of the

excluded information not being ascertainable or accessible, we are

unable to quantify certain amounts that would be required for such

presentation without unreasonable effort. Consequently, no

reconciliation of the forward-looking non-GAAP financial measures

is included in this press release. A reconciliation between results

on a GAAP and non-GAAP basis is provided in the last table of this

press release.

Forward Looking Statements

This press release contains historical information and

forward-looking statements within the meaning of The Private

Securities Litigation Reform Act of 1995 with respect to the

business, financial condition and results of operations of Perion.

The words “will,” “believe,” “expect,” “intend,” “plan,” “should,”

“estimate” and similar expressions are intended to identify

forward-looking statements. Such statements reflect the current

views, assumptions and expectations of Perion with respect to

future events and are subject to risks and uncertainties. Many

factors could cause the actual results, performance or achievements

of Perion to be materially different from any future results,

performance or achievements that may be expressed or implied by

such forward-looking statements, or financial information,

including, but not limited to, the current war between Israel and

Hamas and any worsening of the situation in Israel such as further

mobilizations, the failure to realize the anticipated benefits of

companies and businesses we acquired and may acquire in the future,

risks entailed in integrating the companies and businesses we

acquire, including employee retention and customer acceptance; the

risk that such transactions will divert management and other

resources from the ongoing operations of the business or otherwise

disrupt the conduct of those businesses, potential litigation

associated with such transactions, and general risks associated

with the business of Perion including intense and frequent changes

in the markets in which the businesses operate and in general

economic and business conditions, loss of key customers, data

breaches, cyber-attacks and other similar incidents, unpredictable

sales cycles, competitive pressures, market acceptance of new

products, changes in applicable laws and regulations as well as

industry self-regulation, inability to meet efficiency and cost

reduction objectives, changes in business strategy and various

other factors, whether referenced or not referenced in this press

release. Various other risks and uncertainties may affect Perion

and its results of operations, as described in reports filed by

Perion with the Securities and Exchange Commission from time to

time, including its annual report on Form 20-F for the year ended

December 31, 2022 filed with the SEC on March 15, 2023. Perion does

not assume any obligation to update these forward-looking

statements.

PERION NETWORK LTD. AND ITS SUBSIDIARIES

CONSOLIDATED STATEMENTS OF OPERATIONS

In thousands (except share and per share data)

Three months ended

Nine months ended

September 30,

September 30,

2023

2022

2023

2022

(Unaudited)

(Unaudited)

(Unaudited)

(Unaudited)

Revenue

Display Advertising

$

99,193

$

86,779

$

278,450

$

236,933

Search Advertising

86,112

71,836

230,475

193,653

Total Revenue

185,305

158,615

508,925

430,586

Costs and Expenses

Cost of revenue

9,805

7,540

26,953

21,014

Traffic acquisition costs and media buy

107,981

93,625

289,338

250,555

Research and development

7,763

7,766

24,352

25,135

Selling and marketing

14,171

12,591

42,983

39,884

General and administrative

7,712

1 7,609

21,668

1 19,743

Change in fair value of contingent consideration

1,982

1 (3,816)

16,584

1 (3,816)

Depreciation and amortization

3,425

3,704

10,191

10,097

Total Costs and Expenses

152,839

129,019

432,069

362,612

Income from Operations

32,466

29,596

76,856

67,974

Financial income, net

6,103

1,019

14,689

2,526

Income before Taxes on income

38,569

30,615

91,545

70,500

Taxes on income

5,748

5,033

13,533

9,952

Net Income

$

32,821

$

25,582

$

78,012

$

60,548

Net Earnings per Share

Basic

$

0.69

$

0.57

$

1.66

$

1.36

Diluted

$

0.65

$

0.53

$

1.57

$

1.27

Weighted average number of shares

Basic

47,392,072

45,146,639

46,915,616

44,544,483

Diluted

50,270,296

47,997,745

49,831,190

47,560,112

1 Reflects reclassification of $3.8

million of earnout liability in 2022 that was incurred in

connection with a transaction from general and administrative to

change in fair value of contingent consideration.

PERION NETWORK LTD. AND ITS SUBSIDIARIES

CONDENSED CONSOLIDATED BALANCE SHEETS

In thousands

September 30, December 31,

2023

2022

(Unaudited) (Audited) ASSETS Current

Assets Cash and cash equivalents

$

197,853

$

176,226

Restricted cash

1,327

1,295

Short-term bank deposits

253,950

253,400

Marketable securities

71,817

-

Accounts receivable, net

142,106

160,488

Prepaid expenses and other current assets

16,641

12,049

Total Current Assets

683,694

603,458

Long-Term Assets Property and equipment, net

3,012

3,611

Operating lease right-of-use assets

7,400

10,130

Goodwill and intangible assets, net

238,218

247,191

Deferred taxes

7,651

5,779

Other assets

75

49

Total Long-Term Assets

256,356

266,760

Total Assets

$

940,050

$

870,218

LIABILITIES AND SHAREHOLDERS' EQUITY Current

Liabilities Accounts payable

$

139,476

$

155,854

Accrued expenses and other liabilities

33,759

37,869

Short-term operating lease liability

3,940

3,900

Deferred revenue

1,530

2,377

Short-term payment obligation related to acquisitions

71,464

34,608

Total Current Liabilities

250,169

234,608

Long-Term Liabilities Payment obligation related to

acquisition

-

33,113

Long-term operating lease liability

4,415

7,580

Other long-term liabilities

12,023

11,783

Total Long-Term Liabilities

16,438

52,476

Total Liabilities

266,607

287,084

Shareholders' equity Ordinary shares

409

398

Additional paid-in capital

526,399

513,534

Treasury shares at cost

-1,002

-1,002

Accumulated other comprehensive loss

-1,161

-582

Retained earnings

148,798

70,786

Total Shareholders' Equity

673,443

583,134

Total Liabilities and Shareholders' Equity

$

940,050

$

870,218

PERION NETWORK LTD. AND ITS SUBSIDIARIES

CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS

In thousands

Three months ended Nine months ended

September 30,

September 30,

2023

2022

2023

2022

(Unaudited) (Unaudited) (Unaudited)

(Unaudited) Cash flows from

operating activities Net Income

$

32,821

$

25,582

$

78,012

$

60,548

Adjustments required to reconcile net income to net cash provided

by operating activities: Depreciation and amortization

3,425

3,704

10,191

10,097

Stock-based compensation expense

4,425

3,236

10,927

8,365

Foreign currency translation

22

-64

9

-238

Accrued interest, net

-2,208

-825

-4,239

-2,006

Deferred taxes, net

-1,257

1,575

-1,733

1,327

Accrued severance pay, net

-187

-831

-462

-328

Gain from sale of property and equipment

-5

-5

-22

-10

Net changes in operating assets and liabilities

3,059

2,300

12,563

6,194

Net cash provided by operating activities

$

40,095

$

34,672

$

105,246

$

83,949

Cash flows from investing

activities Purchases of property and equipment, net of

sales

-152

-349

-503

-779

Investment in marketable securities, net of sales

597

-

-71,598

-

Short-term deposits, net

-28,650

31,600

-550

-1,800

Cash paid in connection with acquisitions, net of cash acquired

-

-

-

-9,570

Net cash provided by (used in) investing activities

$

(28,205)

$

31,251

$

(72,651)

$

(12,149)

Cash flows from financing

activities Proceeds from exercise of stock-based

compensation

150

3,147

2,338

4,441

Payments of contingent consideration

-

-

-13,256

-9,091

Net cash provided by (used in) financing activities

$

150

$

3,147

$

(10,918)

$

(4,650)

Effect of exchange rate changes on cash and cash equivalents

and restricted cash

-103

-110

-18

-288

Net increase in cash and cash equivalents and restricted

cash

11,937

68,960

21,659

66,862

Cash and cash equivalents and restricted cash at beginning of

period

187,243

103,437

177,521

105,535

Cash and cash equivalents and restricted cash at end of

period

$

199,180

$

172,397

$

199,180

$

172,397

PERION NETWORK LTD. AND ITS SUBSIDIARIES

RECONCILIATION OF GAAP TO NON-GAAP RESULTS

In thousands (except share and per share data)

Three months ended Nine months ended

September 30,

September 30,

2023

2022

2023

2022

(Unaudited) (Unaudited) Revenue

$

185,305

$

158,615

$

508,925

$

430,586

Traffic acquisition costs and media buy

107,981

93,625

289,338

250,555

Contribution ex-TAC

$

77,324

$

64,990

$

219,587

$

180,031

Three months ended Nine months ended

September 30, September 30,

2023

2022

2023

2022

(Unaudited) (Unaudited) GAAP Income from

Operations

$

32,466

$

29,596

$

76,856

$

67,974

Stock-based compensation expenses

4,425

3,236

10,927

8,365

Retention and other acquisition related expenses

401

288

658

1,518

Change in fair value of contingent consideration

1,982

-3,816

16,584

-3,816

Amortization of acquired intangible assets

3,017

3,295

8,972

8,896

Depreciation

408

409

1,219

1,201

Adjusted EBITDA

$

42,699

$

33,008

$

115,216

$

84,138

Three months ended Nine months ended

September 30,

September 30,

2023

2022

2023

2022

(Unaudited) (Unaudited) GAAP Net Income

$

32,821

$

25,582

$

78,012

$

60,548

Stock-based compensation expenses

4,425

3,236

10,927

8,365

Amortization of acquired intangible assets

3,017

3,295

8,972

8,896

Retention and other acquisition related expenses

401

288

658

1,518

Change in fair value of contingent consideration

1,982

-3,816

16,584

-3,816

Foreign exchange gains associated with ASC-842

-83

-80

-280

-824

Revaluation of acquisition related contingent consideration

149

342

441

602

Taxes on the above items

-291

1,067

-865

-145

Non-GAAP Net Income

$

42,421

$

29,914

$

114,449

$

75,144

Non-GAAP diluted earnings per share

$

0.84

$

0.61

$

2.28

$

1.56

Shares used in computing non-GAAP diluted earnings per

share

50,543,534

48,873,796

50,106,425

48,112,823

View source

version on businesswire.com: https://www.businesswire.com/news/home/20231101750361/en/

Perion Network Ltd. Dudi Musler, VP of Investor Relations +972

(54) 7876785 dudim@perion.com

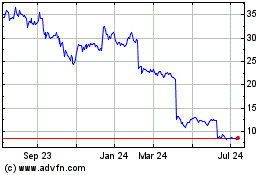

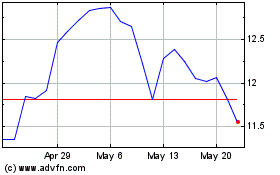

Perion Network (NASDAQ:PERI)

Historical Stock Chart

From Oct 2024 to Oct 2024

Perion Network (NASDAQ:PERI)

Historical Stock Chart

From Oct 2023 to Oct 2024