0001040130FALSE00010401302024-09-112024-09-11

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of report (Date of earliest event reported): September 11, 2024

PetMed Express, Inc.

(Exact name of registrant as specified in its charter)

| | | | | | | | | | | | | | |

Florida | | 000-28827 | | 65-0680967 |

(State or other jurisdiction of incorporation) | | (Commission File Number) | | (I.R.S. Employer Identification No.) |

420 South Congress Avenue, Delray Beach, Florida 33445

(Address of principal executive offices) (Zip Code)

(561) 526-4444

(Registrant’s telephone number, including area code)

Not Applicable

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

| | | | | |

o | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

o | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

o | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

o | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | |

Title of each class | Trading Symbol(s) | Name of each exchange on which registered |

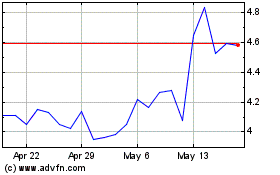

Common Stock, par value $.001 per share | PETS | NASDAQ |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company o

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the

Exchange Act. o

Item 5.02 Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers.

Appointment of Officer

On September 11, 2024, the Board of Directors of PetMed Express, Inc. (“Company”) appointed Robyn D’Elia to serve as the Company’s Chief Financial Officer and to assume the duties of principal financial officer effective September 16, 2024 (“Effective Date”).

Ms. D’Elia, age 52, brings over 25 years of experience in financial leadership and strategic planning across multiple industries. Before joining PetMeds, Ms. D’Elia served as CFO at Odeko, a privately held all-in-one operations partner for independent coffee shops, cafes and other shops, from 2022 to 2024. Prior to that, she spent 24 years at Bed Bath & Beyond, a Fortune 500 multi-channel retailer, where she held senior leadership roles of progressive responsibility within the finance organization including serving as CFO from 2018 to 2020. She oversaw significant financial growth with the company’s revenue expanding from $800 million to $11.5 billion, including $2 billion from digital channels. In 2020, Ms. D’Elia founded RMD Advisory, a consulting firm providing services in strategic planning, M&A, FP&A, and corporate governance. Through RMD, she advised a range of startup and public companies including Aerie Pharmaceuticals, which benefited from her leadership in cost reduction initiatives, contributing to its sale to Alcon for $930 million in 2022. Robyn also serves as a Board Member and Audit Committee Chair for itel, a privately held data and technology company that optimizes the property insurance claims process, a position she has held since 2021. Ms. D’Elia holds a Bachelors of Science in Accounting from Seton Hall University.

Robyn D’Elia Offer Letter

Ms. D’Elia’ Employment Agreement provides for an employment term of 3 years. As provided in the Employment Agreement, Ms. D’Elia will serve the Company on a full-time basis and will receive an annual base salary of $425,000, which may be increased in the discretion of the Company’s board of directors (the “Board”)(but may not be decreased other than as part of a proportionate reduction in management salaries and wages applicable to all senior management). Ms. D’Elia will also receive customary expense reimbursement (in accordance with the Company’s standard policies), and will receive the medical, health, and other benefits provided to Company employees generally, including participation in the Company’s 401(k) plan on the same basis as other employees generally. The Employment Agreement provides that Ms. D’Elia will be eligible to receive an annual performance bonus based on annual performance goals determined by the Board, with a target annual bonus of 75% of Ms. D’Elia’s base salary and a maximum bonus of 150% of base salary, pro rata for the Company’s fiscal year ending March 31, 2025. The agreement includes customary restrictive covenants, including confidentiality and non-solicitation covenants and a one-year post-employment non-compete restriction.

Under the Employment Agreement, Ms. D’Elia will be entitled to equity grants under the Company’s current or future equity plans, as follows: On September 16, 2024, Ms. D’Elia will receive a grant of restricted stock units (“RSUs”) equal to $1,000,000 divided by the Reference Price. The “Reference Price” shall be an amount equal to the higher of (i) the closing price of Company’s common stock on the Nasdaq Stock Market on the date of grant, and (ii) $4.00 per share (with foregoing clause (ii) being subject to equitable adjustment by the Board for stock splits, stock dividends, reverse stock splits, and the like occurring after the date of this Agreement). Such RSUs will vest in one-third increments on each of the first 3 anniversaries of the date of grant so long as Ms. D’Elia continues to be employed by the Company on each vesting date, and such RSUs will otherwise contain the standard provisions for RSU grants by the Company. Thereafter, Ms. D’Elia will be entitled to annual grants of RSUs and performance stock units (“PSUs”) consisting of a number of RSUs equal to $240,000 divided by the Reference Price and a number of PSUs equal to $360,000 divided by the Reference Price. The RSUs included in any such annual grants will vest in the same manner as the initial RSU grant, and the PSUs will vest if the PSU performance goals as determined by the Board are achieved, and will be earned over a three-year performance period.

The Employment Agreement provides that Ms. D’Elia’s employment may be terminated by either the Company or Ms. D’Elia at any time prior to the scheduled expiration date of the agreement, subject to notice requirements and subject to certain potential severance payment obligations based on the nature of the termination. Specifically, Ms. D’Elia’s employment may be terminated by the Company with or without “Cause” (as defined in the Employment Agreement) or by Ms. D’Elia with or without “Good Reason” (as defined in the Employment Agreement). “Cause” is customarily defined to include a material breach of the Employment Agreement, commission of a felony, and certain types of dishonesty and misconduct, all as more particularly defined in the Employment Agreement. “Good Reason” includes certain material

adverse changes in Ms. D’Elia’s duties, responsibilities, functions or title with the Company or a material breach of the Employment Agreement by the Company, as more particularly defined in the Employment Agreement.

In the event that the Company terminates Ms. D’Elia’s employment without Cause, or Ms. D’Elia resigns for Good Reason in the manner described or required in the Employment Agreement, the agreement provides that Ms. D’Elia will be entitled to receive, contingent on Ms. D’Elia delivering a general release of claims to the Company, severance compensation in the form of continuation of her base salary in effect at the time of termination, as well as reimbursement for COBRA premiums, for a period of 12 months after termination, she will also be eligible for a pro rata cash payment based on the achievement of performance goals related to her annual bonus opportunity as determined by the Board, and vesting of unvested RSUs and PSUs then held by her in the manner specified in the Employment Agreement. If such termination of employment occurs during the 12-month period following a “Change of Control” (as defined in the Employment Agreement), then Ms. D’Elia would be entitled to receive, contingent on delivery of a general release to the Company, severance compensation in the form of continuation of her base salary in effect at the time of termination and reimbursement for COBRA premiums for a period of 12 months after termination, she will also be eligible for a pro rata cash payment based on the achievement of performance goals related to her annual bonus opportunity as determined by the Board and accelerated vesting of all unvested RSUs then held by her, and vesting of unvested PSUs then held by her in the manner specified in the Employment Agreement.

The description in this report of Ms. D’Elia’s Offer Letter does not purport to be complete, and is qualified in its entirety by reference to the full text of the Offer Letter attached hereto as Exhibit 10.1, which is incorporated by reference herein.

Item 7.01 Regulation FD Disclosure

On September 12, 2024, the Company issued a press release announcing the appointment of Ms. D’Elia as Chief Financial Officer of the Company. A copy of the press release is attached hereto as Exhibit 99.1 and incorporated herein by reference.

The information in this Item 7.01 and the related information in Exhibit 99.1 attached hereto shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”) or otherwise subject to the liabilities of that section and shall not be deemed incorporated by reference in any filing made by the Company under the Securities Act or the Exchange Act except as set forth by specific reference in such filing.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits

| | | | | | | | |

Exhibit No. | | Description |

| 10.1 | | |

| 99.1 | | |

104 | | Cover Page Interactive Data File (formatted as Inline XBRL) |

Forward-Looking Statements

This Current Report on Form 8-K, including Exhibit 99.1, contains forward-looking statements within the meaning of Section 27A of the Securities Act, and Section 21E of the Exchange Act. From time to time, the Company may also provide oral or written forward-looking statements in other materials the Company releases to the public. Such forward-looking statements are subject to the safe harbor created by the Private Securities Litigation Reform Act of 1995. Statements that refer to future events or circumstances are forward-looking statements, and include, but are not limited to, the Company’s expectations regarding the appointment of Ms. D’Elia as Chief Financial Officer. In addition, statements that the Company makes in this Current Report on Form 8-K that are not statements of historical fact may also be forward-looking statements. Words such as “expects,” “intends,” “goals,” “plans,” “believes,” “continues,” “may,” “should,” “anticipate,” “seek,” “estimate,” “outlook,” “future benefits,” “potential,” "estimates," "anticipates," and variations of such words and similar expressions are intended to identify forward-looking statements. Forward-looking statements are subject to risks and uncertainties that could cause actual results to be materially different from those indicated (both favorably and unfavorably). These statements are based on our beliefs, as well as assumptions we have used based upon information currently available to us. Because these statements reflect our current views concerning future events, these statements involve risks, uncertainties, and assumptions. For further information on other risk factors, please refer to the “Risk

Factors” contained in the Company’s Form 10-K, under Part I, Item 1A, for the year ended March 31, 2024 filed with the Securities and Exchange Commission. Caution should be taken not to place undue reliance on any such forward-looking statements. Forward-looking statements speak only as of the date when made and the Company undertakes no obligation to update any forward-looking statement, whether as a result of new information, future events or otherwise, except as required by law.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

Dated: September 11, 2024

| | | | | | | | |

| PETMED EXPRESS, INC. |

| By: | /s/ Sandra Compos |

| Name: | Sandra Campos |

| Title: | Chief Executive Officer and President |

Exhibit 10.1

EXECUTIVE EMPLOYMENT AGREEMENT

THIS EXECUTIVE EMPLOYMENT AGREEMENT (hereinafter “Agreement”) is made and entered into effective as of September 16, 2024, by and between PETMED EXPRESS, INC., a Florida corporation (“Company”), and ROBYN D’ELIA, an individual residing in the State of New Jersey (hereinafter called “Executive”).

RECITALS

WHEREAS, Company desires to retain the services of Executive as Chief Financial Officer of Company upon the terms and subject to the conditions set forth in this Agreement; and

WHEREAS, Executive desires to provide services to Company pursuant to the terms and conditions set forth in this Agreement

NOW THEREFORE, in consideration of the mutual covenants and promises set forth in this Agreement and other good and valuable consideration, the receipt and sufficiency of which are hereby acknowledged, the parties, intending to be legally bound, agree as follows:

1.DUTIES AND SCOPE OF EMPLOYMENT.

(a)Position and Duties. During the Term of Employment (as defined below), Executive shall be employed by Company as its Chief Financial Officer, reporting to the Chief Executive Officer of Company. As Chief Financial Officer, Executive shall have such duties, powers, and responsibilities as are customarily assigned to a Chief Financial Officer of a publicly held corporation. In addition, Executive shall have such other duties and responsibilities as the Chief Executive Officer may reasonably assign to her from time to time that are commensurate with and customary for a senior executive officer bearing Executive’s experience, qualifications, title, and position. Executive’s employment by Company shall be full-time, and Executive agrees to diligently and conscientiously devote all of her business time and attention to the performance of Executive’s duties hereunder and will not engage in any other business, profession, occupation, or activity for compensation; provided she may serve on the board of directors of one or more other companies or organizations with the specific prior written approval of the Chief Executive Officer, and only as long as serving on such boards does not prevent her from effectively and competently performing her duties under this Agreement. Nothing herein shall prohibit or restrict Executive from managing Executive’s own personal investments and/or engaging in civic, community, charitable, educational, religious, or non-profit activities as long as such activities do not materially interfere with Executive’s performance of her duties to Company as provided in this Agreement. As Chief Financial Officer, Executive will serve as Company’s “principal financial officer” for purposes of the rules and regulations of the Securities and Exchange Commission.

(b)Location of Employment Services. Executive will be primarily located in New York City, New York. In the event that Executive is required to travel to Florida for more than seven nights of required business travel per calendar month and executive chooses not to stay at a hotel (for purposes of clarification, all hotel stays are required to be at a Company approved hotel), Company will reimburse executive Two-Hundred and Fifty Dollars ($250) per night required for business travel for the rental of an apartment in Florida; provided further that the lease of such apartment and any obligation thereunder is entered into solely by Executive and for Executive’s convenience and comfort and is not a commitment or obligation of the Company. The maximum amount reimbursable to Executive per month for an apartment pursuant to this Section 1(b) shall not exceed Three-Thousand Dollars ($3,000). The terms in this paragraph are subject to change by mutual written agreement between Executive and Company.

(c)Subsidiaries and Affiliates. With respect to Company’s direct and indirect subsidiaries, affiliated corporations, partnerships, or joint ventures (collectively, “Related Entities”), Executive shall perform the above- described duties to promote these Related Entities and to promote and protect their respective interests to the same extent as the interests of Company without additional compensation. This shall include serving, at the direction of the Chief Executive Officer, as an officer or on the boards of directors of Related Entities.

2.COMPENSATION.

(a)Base Salary. During the Term of Employment, Executive shall be paid a base salary of Four Hundred Twenty-Five Thousand Dollars ($425,000.00) per year, pro-rated for any period less than twelve (12) months (the “Base Salary”). The Base Salary will be paid in accordance with Company’s customary payroll procedures and will be subject to tax and other applicable withholdings. The Base Salary may be increased by the Company (in its sole and absolute discretion), but not decreased, unless otherwise agreed to in writing by Executive or except in the case of a proportionate reduction in salary and wages of the other senior management employees of Company.

(c)Benefits. Executive is eligible to receive such medical, health, and other benefits as are provided by Company, in its discretion, from time to time to its employees generally. Executive will also be eligible to participate in Company’s 401(k) plan on the same basis as Company’s employees generally, and in other fringe benefits programs offered to all other senior management employees of the Company. Nothing in this Agreement will preclude Company from amending or terminating any of the employee benefit plans or programs applicable to employees of Company as long as such amendment or termination is applicable to all similarly situated employees.

(d)Vacation. Executive will receive four (4) weeks of paid vacation each calendar year, with such period prorated for the period of time she is employed for partial calendar years.

(e)Bonuses. For the fiscal year of Company ending March 31, 2025, and each complete fiscal year of Company thereafter during the Term of Employment, Executive shall be eligible to receive an annual bonus (the "Annual Bonus"); provided, that the Annual Bonus opportunity for the fiscal year of Company ending March 31, 2025 shall be adjusted by a fraction, the numerator of which is the number of days during such fiscal year that Executive was employed by Company and the denominator of which is the total number of days in the fiscal year. Executive's annual target bonus opportunity shall be equal to Seventy-Five Percent (75%) of Base Salary at the annualized rate in effect on the last day of Company’s fiscal year for which the annual bonus is paid (the "Target Bonus") with an annual opportunity to receive a maximum bonus of One Hundred Fifty Percent (150%) of Base Salary, each based on the achievement of performance goals determined by the Board and/or the Compensation Committee of the Board (the “Compensation Committee”); provided that, depending on results, Executive's actual bonus may be higher or lower than the Target Bonus, as determined by the Board based on the attainment of the performance goals. If threshold performance goals are not achieved, then Executive may not receive an Annual Bonus for such fiscal year. The Annual Bonus, if any, shall be paid by Company in cash in a reasonable period of time after the Board determines the achievement and amount of the Annual Bonus. Except as provided in Section 4(b)(iv)(C), to be eligible to receive the Annual Bonus, Executive must continue to be employed by Company on the date on which the Annual Bonus is paid.

(f)Equity Compensation.

(i)Initial Equity Grant. On the date on which Executive’s employment with Company commences, Executive will receive a grant (the “Initial Grant”) of restricted stock units (“RSUs”) under Company’s 2024 Omnibus Equity Compensation Plan (the “2024 Equity Plan”) or the Company’s 2024 Inducement Equity Plan (the “2024 Inducement Equity Plan,”, and together with the 2024 Equity Plan, the “Equity Plans”), with the Grant

being made out of one or both Equity Plans at Company’s discretion. The Initial Grant will consist of a number of RSUs equal to One-Million Dollars ($1,000,000) divided by the Reference Price (as defined below). The RSUs included in the Initial Grant will vest in one-third increments on each of the first three (3) anniversaries of the grant date of such RSUs and will otherwise be in accordance with the terms of Company’s standard form of RSU award agreements and the 2024 Equity Plan and/or 2024 Inducement Equity Plan, as more particularly determined by the Board; and the terms of this Agreement.

(ii)Annual Equity Grants Awarded in 2025, 2026 and 2027. During the Term of Employment, on the date following each of Company’s 2025, 2026 and 2027 annual meetings of shareholders on which the Board determines to make annual equity grants in the normal course of Company’s compensation cycle (i.e., for each of the 2025, 2026 and 2027 fiscal years), Executive will receive a grant (each an “Annual Grant”) of RSUs and performance stock units (“PSUs”) under the 2024 Equity Plan or under any successor equity compensation plan as may be adopted by Company and approved by Company’s shareholders and/or the Board (the “Applicable Equity Plan”); provided, that making such grants at the times specified above will be contingent on Company having a sufficient number of shares available under the Applicable Equity Plan in order to make the grant; and provided further, Company will make reasonable efforts to have a sufficient number of shares available for timely grants, but if the grants are not made at the times specified above, they will be made when additional shares become available under the Applicable Equity Plan under the same terms as would have applied if the grants had not been delayed. Each Annual Grant will consist of a number of RSUs equal to Two Hundred Forty Thousand ($240,000) divided by the Reference Price (as defined below) and a number of PSUs equal to Three Hundred Sixty Thousand ($360,000) divided by the Reference Price. For this purpose, “Reference Price” shall be an amount equal to the higher of (i) the closing price of Company’s common stock on the Nasdaq Stock Market on the date of grant, and (ii) $4.00 per share (with foregoing clause (ii) being subject to equitable adjustment by the Board for stock splits, stock dividends, reverse stock splits, and the like occurring after the date of this Agreement). Such RSUs will vest in one-third increments on each of the first three (3) anniversaries of the grant date of such RSUs and will otherwise be in accordance with the terms of Company’s standard form of RSU award agreements with respect to annual equity grants made in 2025, 2026 and 2027, respectively, and the Applicable Equity Plan and this Agreement, as more particularly determined by the Board. The PSUs will vest if the PSU performance goals as determined by the Board are achieved, and will be earned over a three-year performance period, and such PSUs will otherwise be in accordance with the terms of Company’s standard form of PSU award agreements with respect to annual equity grants made in 2025, 2026 and 2027, respectively, and the Applicable Equity Plan and this Agreement, as more particularly determined by the Board. In the event that the Applicable Equity Plan authorizes Company to grant options to purchase shares of capital stock of Company, then upon the mutual written agreement of Company and Executive, Company may award options to Executive in lieu of all or a portion of the RSUs and PSUs contemplated by this section, provided the value of the stock options awarded shall have the same value as the RSUs and PSUs that would have otherwise been granted using such valuation method as Company and Executive may agree.

(iii)Future Annual Equity Grants. Executive will be eligible for such additional annual equity compensation grants in subsequent years as shall be determined by the Board in its sole discretion.

(g)Withholding. Company shall be entitled to deduct or withhold from any amounts owing from Company to Executive any federal, state, local or foreign withholding taxes, excise taxes or employment taxes imposed with respect to Executive’s compensation or other payments from Company, including wages, bonuses, distributions and/or the receipt or vesting of incentive equity.

(h)Reimbursement of Business Expenses. Executive shall be entitled to reimbursement for all reasonable and necessary out-of-pocket business, entertainment, and travel expenses incurred by Executive in connection with the performance of Executive's duties hereunder in accordance with Company's expense reimbursement policies and procedures and such other applicable policies and procedures as may be in effect from time to time, including without limitation any travel and expense policy and any code of conduct or code of ethics.

(i)Clawback Provisions. Notwithstanding any other provisions in this Agreement to the contrary, any bonus (if any) and other compensation paid to Executive will be subject to such potential clawback as may be required to be made pursuant to applicable federal or state law, or pursuant to applicable stock exchange listing requirements, governing potential clawback of executive compensation upon a determination by legal counsel to Company that clawback is required by federal or state law or applicable stock exchange listing requirements. Specifically, Executive agrees that she will be subject to, and shall comply with, the PetMed Express, Inc. Executive Compensation Recovery Policy.

3.TERM OF EMPLOYMENT. The term of Executive’s employment under this Agreement shall commence on the date of this Agreement (the “Effective Date”) and shall continue until, and including, the last day of the 36-month period commencing on the Effective Date, unless terminated earlier in accordance with Section 4 of this Agreement (the “Term of Employment”).

4.TERMINATION.

(a)Types of Terminations. This Agreement and Executive’s employment hereunder shall terminate upon the happening of any of the following events:

(i)Executive’s death (“Termination Upon Death”);

(ii)the effective date of a written notice sent to Executive stating Company’s determination, made in good faith, that due to a mental or physical condition, Executive has been unable and failed to substantially render the services to be provided by Executive to Company for a period of at least (x) 180 days out of any consecutive 360 days or (y) 90 consecutive days (“Termination For Disability”);

(iii)the effective date of a written notice sent to Executive stating Company’s determination that it is terminating Executive’s employment for Cause (as defined below) (“Termination For Cause”);

(iv)the effective date of a termination set forth in a notice sent to Executive stating that Company is terminating Executive’s employment without Cause or for no stated reason (“Termination Without Cause”), which notice must be given by Company to Executive at least thirty (30) days in advance of the intended date of termination;

(v)the effective date of a termination based on a notice sent to Company from Executive stating that Executive is resigning without Good Reason or for no stated reason, which notice must be given by Executive to Company at least sixty (60) days in advance of the intended date of termination (a “Voluntary Resignation”); or,

(vi)a Good Reason Resignation (as defined below) by Executive, provided that such Good Reason Resignation is effected in accordance with the procedures set forth in Section 4(c)(v) below.

As used herein, the term “Cause” shall mean (i) commission of a willful act of dishonesty in the course of Executive’s duties hereunder or misappropriation of funds, theft, or embezzlement by Executive of funds or property of Company or any Related Entity, (ii) conviction by a court of competent jurisdiction of, or plea of no contest to, a crime constituting a felony or conviction in respect of, or plea of no contest to, any act involving fraud dishonesty or moral turpitude, (iii) Executive's engagement in dishonesty or illegal or disloyal conduct, or willful or grossly negligent misconduct, which is, in any such case, injurious to the interests, reputation or business of Company or its Related Entities as determined by the Board, (iv) Executive’s performance under the influence of controlled substances (other than those taken pursuant to a medical doctor’s orders), or continued

habitual intoxication, during working hours, (v) frequent or extended, and unjustifiable, absenteeism, (vi) Executive’s personal misconduct or refusal or material failure to timely perform her duties and responsibilities or to timely carry out the lawful directives of Company or any Related Entity, which, if capable of being cured shall not have been cured, within 30 days after Company shall have advised Executive in writing of its intention to terminate Executive’s employment; provided, that such right to cure shall not apply to any subsequent act or omission of a substantially similar nature or type, or (vii) Executive’s material non-compliance with the terms of this Agreement or any policy of Company or any Related Entity, which, if capable of being cured, shall not have been cured within 30 days after Company shall have advised Executive in writing of its intention to terminate Executive’s employment for such reason.

(b)Effect of Termination.

(i)In the event of Termination Upon Death or Termination For Disability, Executive (or Executive’s legal representative) shall be entitled to receive (i) on the next payroll date, wages in an amount equal to any earned but unpaid Base Salary owing by Company to Executive as of the termination date; (ii) within fourteen (14) days after Executive’s termination date, the value (based on Executive’s rate of annualized Base Salary on the termination date (but disregarding any decreases in Base Salary that are not permitted under Section 2(a) or that could serve as a trigger for a Good Reason Resignation) of her accrued but unused vacation days; and (iii) within the normal course, reimbursement for her business expenses incurred before the termination date as determined under Section 2(h) (collectively, the “Accrued Payments”).

(ii)In the event of a Termination For Cause or a Voluntary Resignation (or any other termination or resignation by Executive other than a Good Reason Resignation), Executive shall be entitled to receive only an amount equal to any Accrued Payments.

(iii)In the event of Termination Without Cause, a termination at the end of the Term of Employment, or a Good Reason Resignation, any of which occurs during a period that is outside the twelve (12)-month period commencing upon the date of a Change of Control, then upon Executive’s separation from service (within the meaning given to such term in Section 409A of the Internal Revenue Code of 1986, as amended (“Section 409A”):

(A)Executive shall be entitled to receive the Accrued Payments; and

(B)Other than a termination at the End of the Term of Employment, Executive shall be entitled to separation compensation (“Separation Compensation”) in the form of wages in an amount equal to the sum of (1) twelve (12) months of Executive’s Base Salary (at the rate in effect at time of termination but disregarding any decreases in Base Salary that are not permitted under Section 2(a) or that could serve as a trigger for a Good Reason Resignation) shall be payable in the manner set forth below; and

(C) Executive shall be eligible for a cash payment based on the achievement of performance goals related to her Annual Bonus opportunity as determined by the Board and/or the Compensation Committee (a “Pro Rata Bonus”). Once calculated, the Pro Rata Bonus shall be multiplied by a fraction, the numerator of which is the number of days during such fiscal year through and including Executive’s termination date and the denominator of which is the total number of days in the fiscal year. Any amount payable under this section will be paid in a lump sum to Executive at the same time the annual bonus is paid to Company’s employees who remained actively employed for the full year in which Executive’s termination date occurs; and

(D)Other than a termination at the End of the Term of Employment, for each separate award of RSUs held by Executive as of the termination date, a number of Executive’s unvested RSUs included in such award will vest equal to (i) the aggregate number of RSUs included in such award multiplied by a fraction,

the numerator of which is the number of days during the entire vesting period of such award during which Executive was employed by Company and the denominator of which is the total number of days in the entire vesting period of such award, minus (ii) the aggregate number of RSUs included in such award that vested prior to the effective date of termination. Any RSUs that vest pursuant to the terms of this subsection will be paid to Executive no later than the 15th day of the third month following the end of Company’s fiscal year in which such vesting occurs; and

(E)Other than a termination at the End of the Term of Employment, (A) for each separate award of PSUs held by Executive as of the termination date, a number of Executive’s unvested PSUs included in such award will vest equal to (i) the aggregate number of PSUs included in such award multiplied by a fraction, the numerator of which is the number of days during the entire vesting period of such award during which Executive was employed by Company and the denominator of which is the total number of days in the entire vesting period of such award, minus (ii) the aggregate number of PSUs included in such award that vested prior to the effective date of termination and (B) with all performance criteria based on Company’s or Executive’s performance deemed satisfied at target unless such criteria is required to be calculated at a later date because the inputs required for such calculation will not be available until such later date (or in the case of PSUs based on relative total shareholder return, deemed satisfied based on the actual percentile achievement against the applicable index measured as of shortened performance period ending on the earlier of Executive’s termination date or the date on which Company’s common stock ceases to trade publicly) ; and

(F)Other than a termination at the End of the Term of Employment, Company shall pay to Executive, in equal monthly installments (and subject to applicable tax and other withholdings), an amount equal to the premium payments for continuing medical, dental and vision coverage for Executive (and Executive’s family, if covered under Company’s group health plan as of the effective date of termination of employment) under the Consolidated Omnibus Budget Reconciliation Act of 1985 (COBRA) for the twelve (12)-month period following the effective date of termination, but only to the extent Executive and Executive’s family elects and remains entitled to COBRA continuation coverage during such time period (“Benefit Payments”).

(iv)In the event of Termination which occurs during the twelve (12)-month period commencing upon the date of a Change of Control, Without Cause or a Good Reason Resignation, any of which occurs during the twelve month period commencing upon the date of a Change of Control, then upon Executive’s separation from service (within the meaning given to such term in Section 409A of the Internal Revenue Code of 1986, as amended (“Section 409A”):

(A)Executive shall be entitled to receive the Accrued Payments; and

(B)Executive shall be entitled to receive Separation Compensation consisting of wages in an amount equal to twelve (12) months of Executive’s Base Salary (at the rate in effect at time of termination but disregarding any decreases in Base Salary that are not permitted under Section 2(a) or that could serve as a trigger for a Good Reason Resignation), which amount shall be payable in the manner set forth below; and

(C)Executive shall be entitled to a cash payment based on the achievement of performance goals related to her Annual Bonus opportunity as determined by the Board and/or the Compensation Committee (a “Change of Control Pro Rata Bonus”). Once calculated, the Change of Control Pro Rata Bonus shall be multiplied by a fraction, the numerator of which is the number of days during such fiscal year through and including Executive’s termination date and the denominator of which is the total number of days in the fiscal year. Any amount payable under this section will be paid in a lump sum to Executive at the same time the annual bonus is paid to Company’s employees who remained actively employed for the full year in which Executive’s termination date occurs; and

(D)All of Executive’s unvested RSUs will vest as of Executive’s termination date and will be paid to Executive no later than the 15th day of the third month following the end of Company’s fiscal year in which such vesting occurs; and

(E)Executive’s unvested PSUs will vest as of Executive’s termination date with all performance criteria based on Company’s or Executive’s performance deemed satisfied at target unless such critea is required to be calculated at a later date (or in the case of PSUs based on relative total shareholder return, deemed satisfied based on the actual percentile achievement against the applicable index measured as of shortened performance period ending on the earlier of Executive’s termination date or the date on which Company’s common stock ceases to trade publicly). Such vested PSUs will be paid to Executive no later than the 15th day of the third month following the end of Company’s fiscal year in which such vesting occurs; and

(F)Company shall provide to Executive, in equal monthly installments (and subject to applicable tax and other withholdings), an amount equal to the premium payments for continuing medical, dental and vision coverage for Executive (and Executive’s family, if covered under Company’s group health plan as of the effective date of termination of employment) under the Consolidated Omnibus Budget Reconciliation Act of 1985 (COBRA) for the twelve (12)-month period following the effective date of termination, but only to the extent Executive and Executive’s family elects and remains entitled to COBRA continuation coverage during such time period (also referred to as “Benefit Payments”).

(c)Additional Provisions.

(i)Subject to the provisions in the following paragraph, any amounts to be paid pursuant to Section 4(b)(iii)(B) or Section 4(b)(iv)(B) shall be paid in accordance with Company’s existing payroll or bonus payment practices, as applicable, subject to applicable taxes and withholdings.

(ii) The Separation Compensation described in Section 4(b)(iii)(B) or Section 4(b)(iv)(B) (if payable) will be paid according to Company’s normal payroll cycle in installments (“Separation Payments”). The Separation Payments will be paid over the six (6)-month period or twelve (12)-month period, as applicable, beginning with the first payroll after Executive’s separation from service; provided, the first payment will be delayed until the first payroll that occurs at least seven (7) days after Company’s receipt of a fully executed Release (as defined below) with the first payment inclusive of all Separation Payment amounts that would have been payable through the date of such first payment. Separation Payments and Benefit Payments, as well as any Pro Rata Bonus, shall be subject to tax withholdings and other required withholdings. Notwithstanding the foregoing, Executive’s right to receive any Separation Payments and Benefit Payments pursuant to this Agreement is conditioned upon Executive signing (and not revoking), by the twenty-first (21st) day after the date Executive receives a copy of a general release of claims (except those rights arising under this Agreement) in a form provided by Company (the “Release”). In the event that any payment described in Section 4(b)(iii) or Section 4(b)(iv) (as applicable) is not exempt from Code Section 409A, the payment timing is based on the signing of this Release, and the period in which Executive could timely sign and return the release spans two (2) calendar years, such payment will in all events be made in the second such calendar year.

(iii)Notwithstanding any provision of this Agreement to the contrary, the obligations and commitments under Section 5 of this Agreement shall survive and continue in full force and effect in accordance with their terms notwithstanding any termination of Executive’s employment for any reason or termination of this Agreement for any reason.

(iv)Notwithstanding anything in this Agreement to the contrary, Company shall have no obligation to pay any amounts payable under Section 4(b)(iii)(B) through (D) or 4(b)(iv)(B) through (F) of this Agreement (as applicable) during such times as Executive is in breach of Section 5 or Section 14 of this Agreement, after Company provides Executive with notice of such breach.

(v)Executive shall have the right to resign her employment for Good Reason (a “Good Reason Resignation”) if she has provided written notice to Company of the existence of the circumstances constituting Good Reason within thirty (30) days of the initial existence of such grounds and Company has had at least thirty (30) days from the date on which such notice is provided to cure such circumstances (and has failed to cure such circumstances within such period). If Company has not, within such thirty (30)-day period, cured the circumstances providing grounds for termination for Good Reason, Executive must terminate her employment within thirty (30) days thereafter. If Executive does not terminate her employment for Good Reason within such thirty (30)-day period after the expiration of Company’s cure period in the preceding sentence, Executive will be deemed to have waived her right to terminate for Good Reason with respect to such grounds. “Good Reason” shall be defined as follows:

(A) If Executive’s resignation occurs at any time other than the twelve (12)-month period commencing on the date of a Change of Control, “Good Reason” means the occurrence of any one or more of the following events to the extent that there is, or would be if not corrected, a material negative change in Executive’s employment relationship with Company: (A) there is a material adverse change or material diminution in Executive’s duties, responsibilities, functions or title with Company, (B) there is a material reduction in the compensation or equity grants payable to Executive hereunder, or (C) there is a material breach by Company of the provisions of this Agreement.

(B) If Executive’s resignation occurs during the twelve (12)-month period commencing on the date of a Change of Control, “Good Reason” means the occurrence of any one or more of the following events to the extent that there is, or would be if not corrected, a material negative change in Executive’s employment relationship with Company: (A) there is a material adverse change or material diminution in Executive’s duties, responsibilities, functions or title with Company, (B) there is a material reduction in the compensation or equity grants payable to Executive hereunder, (C) there is a material breach by Company of the provisions of this Agreement, (D) if Company is no longer a publicly traded company as a result of the Change of Control, Executive ceases to directly report to the Chief Executive Officer of Company’s ultimate parent company, or (E) the failure of any successor to Company to expressly assume and agree to discharge Company’s obligations to Executive under this Agreement in substantially the same form and substance as Company.

(vi)For purposes hereof, the term “Change of Control” shall have the meaning set forth in the 2022 Equity Plan, provided that in the event that Company adopts a new or amended employee equity plan, then the term “Change of Control” shall have the meaning set forth in such new or amended employee equity plan.

(vii)Upon termination of Executive’s employment for any reason, Executive shall be deemed to have resigned from all positions and directorships held with Company and its Related Entities, including, without limitation, any position as an officer, agent, trustee, or consultant of Company or any Related Entity, unless the Board expressly determines otherwise. Upon request of Company, Executive shall promptly sign and deliver to Company any and all documents reflecting such resignations as of the effective date of termination.

5.NON-COMPETITION, NON-SOLICITATION AND CONFIDENTIALITY.

(a)Certain Definitions.

“Company’s Business” means the online sale, marketing, or distribution of (i) prescription and non-prescription pet medications or health products or services, or (ii) foods, beverages, or supplies for dogs, cats, and horses.

“Competitor” means any company, other entity, or association or individual that directly or indirectly and engages in Company’s Business.

“Confidential Information” means any information with respect to Company or any Related Entity or Company’s Business, including, but not limited to: the trade secrets of Company and any Related Entities; manuals and documentation; databases; Company’s and any Related Entity’s existing and prospective clients and customers, sales lists, supplier and vendor lists, marketing plans, business plans, industry information acquired or prepared by Company, product specifications, product ideas, price lists, and other similar and related information in whatever form. The term “Confidential Information” does not include, and there shall be no obligation hereunder with respect to, information that is generally available or becomes generally available to the public other than as a result of a disclosure by Executive not otherwise permissible hereunder.

(b)Non-competition. Executive covenants and agrees that during the period of her employment with Company and during the Restricted Period (as defined below), Executive will not engage in or participate in Company’s Business or own, manage, engage in, participate in (on behalf of herself or any other person or entity), operate, control, become employed by, or render any service to (whether as owner, beneficial owner, partner, associate, agent, independent contractor, consultant, lender, employee, stockholder, director or officer or in any other capacity), or invest in any Competitor anywhere in the United States of America or Canada or any other place outside of the United States of America in which Company markets, sells, or distributes products. Notwithstanding the foregoing, nothing in this paragraph shall prohibit Executive from owning 2% or less of the stock of any publicly traded company. The term “Restricted Period” means the twelve (12)-month period immediately following the termination of Executive’s employment with Company, regardless of the reason for termination and regardless of who effects the termination. Notwithstanding the foregoing, nothing in this paragraph will prohibit Executive from being employed by or rendering services to a business enterprise with multiple separately managed business units (one or more of which engages in Company’s Business) so long as (i) Executive does not work in or provide services to the business unit that engages in Company’s Business, (ii) the business unit that engages in Company’s Business is not the principal business unit of the business enterprise; and (iii) Executive otherwise complies with the terms of this Agreement and does not engage in activities that actually or potentially competes with Company’s Business.

(c)Non-solicitation. Executive covenants and agrees that, during the Restricted Period, she will not on Executive’s own behalf or on behalf of any other person or entity, (A) hire, cause to be hired, or solicit or attempt to solicit the employment of any person who was employed by Company or any Related Entity at any time during the one (1) year period immediately preceding the Restricted Period, or seek to persuade any employee of Company to discontinue employment, (B) solicit or encourage any customer, client or supplier of Company or any independent contractor providing services to Company to terminate or diminish its relationship with Company, (C) seek to persuade any customer, client or supplier, or prospective customer, client or supplier, of Company to conduct with anyone else any business or activity that such customer, client or supplier, or prospective customer, client or supplier, conducts or could conduct with Company or any Related Entity, or (D) solicit or encourage any person or entity that has or does refer business to Company for the purpose of having such person or entity refer business to a competing business.

(d)Representations and Covenants by Executive. Executive represents and warrants that: (i) Executive’s execution, delivery and performance of this Agreement do not and will not conflict with, breach, violate or cause a default under any contract, agreement, instrument, order, judgment or decree to which Executive is a party or by which Executive is bound; (ii) Executive is not a party to or bound by any employment agreement, noncompete agreement or confidentiality agreement with any other person or entity (other than Company) and Executive is not subject to any other agreement that would prevent or in any manner restrict Executive from performing Executive’s duties for Company or otherwise complying with this Agreement; (iii) Executive is not subject to or in breach of any nondisclosure agreement, including any agreement concerning trade secrets or confidential information owned by any other party; and (iv) upon the

execution and delivery of this Agreement by Company, this Agreement shall be the valid and binding obligation of Executive, enforceable in accordance with its terms.

(e)Non-disclosure of Confidential Information. Executive hereby acknowledges and represents that Executive has consulted with independent legal counsel regarding Executive’s rights and obligations under this Agreement and that Executive fully understands the terms and conditions contained herein and Executive agrees that Executive will not, directly or indirectly: (i) use, disclose, reverse engineer or otherwise exploit for Executive’s own benefit or for the benefit of anyone other than Company the Confidential Information except as authorized by Company; (ii) during Executive’s employment with Company, use, disclose, or reverse engineer (x) any confidential information or trade secrets of any former employer or third party, or (y) any works of authorship developed in whole or in part by Executive during any former employment or for any other party, unless authorized in writing by the former employer or third party; or (iii) upon Executive’s resignation or termination (x) retain Confidential Information, including any copies existing in any form (including electronic form), that are in Executive’s possession or control, or (y) destroy, delete or alter the Confidential Information without Company’s consent. Notwithstanding the foregoing, Executive may use the Confidential Information in the course of performing Executive’s duties on behalf of Company or any Related Entity provided that such use is made in good faith and on a reasonable basis. Notwithstanding the terms of this Agreement, Confidential Information may be disclosed by Executive when and to the limited extent compelled by written notice from a government agency or when and to the limited extent compelled by legal process or court order by a court of competent jurisdiction, provided that, to the extent legally permissible, Executive shall give Company prompt written notice of such request or order and the Confidential Information to be disclosed as far in advance of its disclosure as possible so that Company may seek an appropriate protective order. Upon separation of employment or suspension (for any reason), Executive will immediately surrender possession of all Confidential Information to Company. Nothing in this Agreement is intended to discourage or restrict Executive from reporting any theft of trade secrets pursuant to the Defend Trade Secrets Act of 2016 (the “DTSA”) or other applicable state or federal law. The DTSA prohibits retaliation against an employee because of whistleblower activity in connection with the disclosure of trade secrets, so long as any such disclosure is made either (i) in confidence to an attorney or a federal, state, or local government official and solely to report or investigate a suspected violation of the law, or (ii) under seal in a complaint or other document filed in a lawsuit or other proceeding. In addition, nothing contained in this Agreement shall be deemed to prevent Executive from disclosing any information or facts concerning matters Executive reasonably believes to be illegal discrimination, illegal harassment; illegal retaliation; a wage and hour violation; sexual assault; or acts recognized as against a clear public policy mandate.

(f)Inventions and Patents. Executive acknowledges that all (i) inventions, innovations, improvements, developments, methods, designs, analysis, drawings, reports, processes, novel concepts, ideas, copyrights, trademarks and service marks relating to any present or prospective activities of Company, including but not limited to marketing plans or techniques, processes, software, formula, techniques and improvements to the foregoing or to know how, and all similar or related information (whether or not patentable) that relate to Company’s Business, (ii) research and development and (iii) existing or future products or services that are, to any extent, conceived, developed or made by Executive while employed by Company or any Related Entity (“Work Product”) belong to Company or such Related Entity. Executive shall promptly disclose such Work Product to Company and, at the cost and expense of Company, perform all actions reasonably necessary or requested by Company (whether during or after the Term of Employment) to establish and confirm such ownership (including, without limitation, executing assignments, consents, powers of attorney and other instruments).

(g)Additional Acknowledgements.

(i)Executive acknowledges that (x) Executive’s position is a position of trust and responsibility with access to Confidential Information of Company, (y) the Confidential Information, and the relationship between Company and each of its employees, customers, tenants, and vendors, are valuable assets of Company

and may not be converted to Executive’s own use and (z) the restrictions contained in this Section 5 are reasonable and necessary to protect the legitimate business interests of Company and will not impair or infringe upon Executive’s right to work or earn a living after Executive’s employment with Company ends.

(ii)Executive acknowledges that monetary damages will not be an adequate remedy for Company in the event of a breach of this Agreement and that it would be impossible for Company to measure damages in the event of such a breach. Therefore, Executive agrees that, in addition to other rights that Company may have in law or equity, Company is entitled to seek an injunction preventing Executive from any breach of this Agreement.

(iii)In the event of a breach or violation of any restriction in Section 5(b) or 5(c) of this Agreement, the time limitations set forth in such restriction shall be extended for a period of time equal to the period of time until such breach or violation has been cured.

(iv)The parties agree that the foregoing restrictive covenants are reasonable and necessary to protect Company’s legitimate business interests. The parties, however, do not intend to include a provision that contravenes the public policy of any state. Therefore, if any provision of this Section 5 is unlawful, against public policy or otherwise declared void, such provision shall not be deemed part of this Agreement, which otherwise shall remain in full force and effect. If, at the time of enforcement of this Agreement, a court or other tribunal holds that the duration, scope or area restriction stated herein is unreasonable under the circumstances then existing, the parties agree that the court should enforce the restrictions to the extent it deems reasonable.

(v)Executive hereby agrees that prior to accepting employment with any other person or entity during the term of employment or during the Restricted Period following the termination date, Executive will provide such prospective employer with written notice of the existence of this Agreement and the provisions of this Section 5 of this Agreement, with a copy of such notice delivered simultaneously to Company in accordance with Section 8 of this Agreement.

(vi)Notwithstanding any provision of this Agreement, the obligations and commitments of this Section 5 shall survive and continue in full force and effect in accordance with their terms notwithstanding any termination of Executive’s employment for any reason or termination of this Agreement for any reason.

6.REMEDIES. Executive agrees and acknowledges that a breach on the part of Executive of the covenants contained in Section 5 may cause irreparable harm to Company and that damages arising out of such breach may be difficult to determine. Executive, therefore, further agrees that in addition to all other remedies provided at law or at equity, Company shall be entitled to seek specific performance and temporary and permanent injunctive relief, from any court of competent jurisdiction restraining any further breach of any such covenant by Executive, her employers, employees, partners, agents or other associates, or any of them, without the necessity of proving actual damage to Company by reason of any such breach.

7.ASSIGNMENT. Company may assign this Agreement and any of the rights or obligations hereunder to any third party in connection with the sale, merger, consolidation, reorganization, liquidation or transfer, in whole or in part, of Company’s control and/or ownership of its assets or business. In such event, Executive continues to be bound by the terms of this Agreement. An assignment of this Agreement by Executive or any right or obligation hereunder is strictly prohibited.

8.NOTICES. All notices and other communications provided to either party hereto under this Agreement shall be in writing and delivered by certified or registered mail, postage prepaid, by e-mail if also sent via first class U.S. mail, or by national overnight delivery service (such as Federal Express), to such party at its/her address set forth below, or at such other address as may be designated by either party in conformity with the provisions of this Section 8, with any such notices being deemed given when actually received by the recipient.:

to Company: c/o PetMed Express, Inc. 420 South Congress Avenue, Delray Beach, FL 33445 email: scampos@petmeds.com

: To Executive’s address as reflected on the payroll records of Company

9.GOVERNING LAW. This Agreement shall be subject to and governed by the laws of the State of Florida, without giving effect to the principles of conflicts of law under Florida law that would require or permit the application of the laws of a jurisdiction other than the State of Florida and irrespective of the fact that the parties now or at any time may be residents of or engage in activities in a different state.

10.DISPUTE RESOLUTION.

(a)Arbitration. Company and Executive agree that any dispute, controversy or claim arising out of or related in any way to Executive’s employment relationship with Company, the termination of that relationship, this Agreement, and/or any breach of this Agreement, shall be submitted to and decided by binding arbitration in Palm Beach County in the State of Florida. By accepting employment with Company, Executive accepts and consents to be bound by this agreement to arbitrate (the “Arbitration Provision”). This Arbitration Provision covers all grievances, disputes, claims or causes of action that otherwise could be brought in a federal, state or local court under applicable federal, state or local laws, arising out of or relating to Executive’s employment with Company and the termination thereof, including claims Executive may have against Company or against its officers, directors, supervisors, managers, employees or agents in their capacity as such or otherwise. The claims covered by this Arbitration Provision include, but are not limited to, claims for breach of any contract or covenant (express or implied); tort claims; claims for wages or other compensation due; claims for wrongful termination (constructive or actual); claims for discrimination or harassment (including, but not limited to, harassment or discrimination based on race, age, color, sex, gender, national origin, alienage or citizenship status, creed, religion, marital status, partnership status, military status, predisposing genetic characteristics, medical condition, psychological condition, mental condition, criminal accusations and convictions, disability, sexual orientation, or any other trait or characteristic protected by federal, state or local law); claims for violation of any federal, state, local or other governmental law, statute, regulation or ordinance; and claims or disputes concerning the validity, enforceability, arbitrability or scope of this Arbitration Provision. Claims not covered by this Arbitration Provision are claims for workers’ compensation or unemployment compensation benefits; at Company’s sole option, claims by Company for injunctive or other equitable relief for the breach or threatened breach of the covenants above; and any other claims that, as a matter of law, Company and Executive cannot agree to arbitrate. Nothing herein shall impair Executive’s right to report possible violations of law to any government agency or cooperate with any agency’s investigation.

Company and Executive expressly intend and agree that: (a) class, collective and/or representative action procedures shall not be asserted, nor will they apply, in any arbitration pursuant to this Arbitration Provision;

(b)Executive will not assert class, collective and/or representative action claims against Company or its officers, directors, supervisors, managers, employees or agents in arbitration or otherwise; and (c) Executive shall only submit her own, individual claims in arbitration and will not seek to represent the interests of any other person. Further, Company and Executive expressly intend and agree that any claims by Executive will not be joined, consolidated or heard together with claims of any other employee.

The Arbitrator shall apply the substantive law of the State of Florida or federal law (and the law of remedies, if applicable) as applicable to the claims asserted and shall apply the same rules of evidence as a federal court. Arbitration shall be administered in accordance with the AAA Employment Arbitration Rules in effect at the time the arbitration is commenced. To the extent not provided for in the AAA Employment Arbitration Rules, the Arbitrator has the power to order discovery upon a showing that discovery is necessary for a party to have a fair opportunity to present a claim or defense, and the Arbitrator shall decide all discovery disputes. Executive’s agreements to arbitrate and participate only in her individual capacity are contracts under the Federal Arbitration

Act and any other laws validating such agreements. No failure to strictly enforce these agreements will constitute a waiver or create any future waivers. If any part of this Arbitration Provision is adjudged to be void or otherwise unenforceable, in whole or in part, the void or unenforceable portion shall be severed, and such adjudication shall not affect the validity of the remainder of this Arbitration Provision and/or this Agreement. Any arbitral award determination shall be final and binding upon the parties. Judgment on the award rendered by the arbitrator may be entered in any court having jurisdiction thereof.

Notwithstanding the foregoing, any claims or actions, whether for damages, injunctive relief or other relief, for any violation or breach of the covenants set forth in Section 5 and the remedies set forth in Section 6, including but not limited to the actions described in Section 6, (i) shall be excluded from the Arbitration Provision and its applicability, and (ii) shall be resolved exclusively in the State of Florida in the state courts located in Palm Beach County, Florida or in the United States District Court for the Southern District of Florida.

(b)Injunctive Relief. Nothing in the Arbitration Provision and/or this Agreement shall prevent Company from applying to and obtaining from a court of competent jurisdiction a writ of attachment, a temporary restraining order, a permanent restraining order, a temporary injunction, a permanent injunction, or other injunctive relief available to safeguard and protect Company’s interests, including but not limited to Company’s interests in the restrictive covenants contained herein. Any action, suit or other proceeding initiated for these purposes shall be brought in the State of Florida in the state courts located in Palm Beach County, Florida or in the United States District Court for the Southern District of Florida, and Company and Executive each agree to submit themselves to the exclusive personal jurisdiction and venue of those courts for such purposes.

WAIVER OF JURY TRIAL. COMPANY AND EXECUTIVE UNDERSTAND AND AGREE THAT THEY ARE WAIVING ANY RIGHT TO JURY TRIAL WITH RESPECT TO ANY DISPUTE, CONTROVERSY OR CLAIM ARISING OUT OF OR RELATED IN ANY WAY TO EXECUTIVE’S EMPLOYMENT RELATIONSHIP WITH COMPANY, THE TERMINATION OF THAT RELATIONSHIP, THIS AGREEMENT, AND/OR ANY BREACH OF THIS AGREEMENT. COMPANY AND EXECUTIVE EXPRESSLY ACKNOWLEDGE AND AGREE THAT THEY ARE WAIVING ANY RIGHT THEY MAY HAVE TO A JURY TRIAL BY SIGNING THIS AGREEMENT.

(c)

11.INVALIDITY. Any provision herein which in any way contravenes the applicable laws of any country, state or jurisdiction shall be severed from this Agreement and deemed not to be considered part of this Agreement and this Agreement shall not be invalid as a whole because of any such determination.

12.INDULGENCE. No indulgence extended by either party hereto to the other party shall be construed as a waiver of any breach on the part of such other party, nor shall any waiver of one breach be construed as a waiver of any rights or remedies with respect to any subsequent breach.

13.ENTIRE AGREEMENT AND CHANGES TO BE IN WRITING. Except as otherwise indicated herein, this Agreement shall constitute the entire agreement between Executive and Company concerning the subject matter hereof. This Agreement supersedes and preempts any prior employment agreement or other understandings, agreements or representations by or among the parties, written or oral, that may have related to the subject matter hereof. No provisions of this Agreement may be modified, waived or discharged unless such waiver, modification or discharge is agreed to in writing, signed by Executive and an authorized officer of Company.

14.NON-DISPARAGEMENT. Executive agree to not make any statements, written or oral, while employed by Company and thereafter, which would be reasonably likely to disparage or damage Company and its Related Entities or the personal or professional reputation of any present or former employees, officers or

members of the managing or directorial boards or committees of Company or the Related Entities. This Section 14 shall not prohibit Executive from making truthful statements in connection with a legal proceeding or in response to a reference request, and nothing in this Section 14 prohibits Executive from discussing or disclosing information about unlawful acts in the workplace, such as harassment or discrimination or any other conduct that Executive has reason to believe is unlawful.

15.STRICT COMPLIANCE. Executive’s or Company’s failure to insist upon strict compliance with any provision of this Agreement or the failure to assert any right Executive or Company may have hereunder shall not be deemed to be a waiver of such provision or right or any other provision or right of this Agreement. The waiver, whether express or implied, by either party of a violation of any of the provisions of this Agreement shall not operate or be construed as a waiver of any subsequent violation of any such provision.

16.280G. Notwithstanding any other provision of this Agreement, or any other agreement, plan, or arrangement to the contrary, if any portion of any payment or benefit to Executive under this Agreement, or under any other agreement, plan, or arrangement (in the aggregate, “Total Payments”), would constitute an “excess parachute payment” under Section 280G of the Code, and would, but for this Section 16, result in the imposition on Executive of an excise tax (the “Excise Tax”) under Section 4999 of the Internal Revenue Code (the “Code”), then the Total Payments to be made to Executive shall either be (a) delivered in full, or (b) delivered in a reduced amount that is $1.00 less than the amount that would cause any portion of such Total Payments to be subject to the Excise Tax, whichever of the foregoing results in the receipt by Executive of the greatest benefit on an after-tax basis (taking into account the Excise Tax, as well as the applicable federal, state, and local income and employment taxes, for which Executive shall be deemed to pay at the highest marginal rate for the applicable calendar year). To the extent the foregoing reduction applies, then any such payment or benefit shall be reduced or eliminated by applying the following principles, in order: (1) the cash payments that are exempt from Section 409A shall first be reduced (if necessary, to zero); (ii) then, if further reductions are necessary, the cash payments that are not exempt from Section 409A shall be reduced (if necessary, to zero); and (iii) then, if further reductions are necessary, the other benefits that are exempt from Section 409A shall be reduced (if necessary, to zero); and (iv) finally, if still further reductions are necessary, the other benefits that are not exempt from Section 409A shall be forfeited. The determination of whether the Excise Tax or the foregoing reduction will apply will be made by independent auditors selected and paid by Company (which may be the regular auditor of Company, acting on the advice of Company’s outside legal counsel).

17.COMPLIANCE WITH SECTION 409A.

(a)General Compliance. This Agreement is intended to comply with Section 409A of the Code (“Section 409A”) or an exemption thereunder and shall be construed and administered in accordance with Section 409A. Any payments under this Agreement that may be excluded from Section 409A either as separation pay due to an involuntary separation from service or as a short-term deferral shall be excluded from Section 409A to the maximum extent possible. For purposes of Section 409A, each installment payment provided under this Agreement shall be treated as a separate payment. Any payments to be made under this Agreement upon a termination of employment shall only be made upon a "separation from service" under Section 409A. Notwithstanding the foregoing, Company makes no representations that the payments and benefits provided under this Agreement comply with Section 409A, and in no event shall Company be liable for all or any portion of any taxes, penalties, interest, or other expenses that may be incurred by Executive on account of non-compliance with Section 409A. To the extent that any payments made or benefits provided pursuant to this Agreement are reimbursements or in-kind payments, to the extent necessary to comply with Code Section 409A, the amount of such payments or benefits during any calendar year will not affect the amounts or benefits provided in any other calendar year, the payment date will in no event be later than the last day of the calendar year immediately following the calendar year in which an expense was incurred, and the right to any such payments or benefits will not be subject to liquidation or exchange for another payment or benefit.

(b)Specified Employee. Notwithstanding any other provision of this Agreement, if any payment or benefit provided to Executive in connection with Executive’s termination of employment is determined to constitute "nonqualified deferred compensation" within the meaning of Section 409A and Executive is determined to be a "specified employee" as defined in Section 409A(a)(2)(b)(i), then such payment or benefit shall not be paid until the first payroll date to occur following the six-month anniversary of the date of termination of employment or, if earlier, on Executive's death (the "Specified Employee Payment Date"). The aggregate of any payments that would otherwise have been paid before the Specified Employee Payment Date shall be paid to Executive in a lump sum on the Specified Employee Payment Date and thereafter, any remaining payments shall be paid without delay in accordance with their original schedule.

18.SURVIVAL. Any provision of this Agreement that is expressly or by implication intended to survive the termination of this Agreement shall survive or remain in effect after the termination of this Agreement.

19.COUNTERPARTS. This Agreement may be executed in separate counterparts, either one of which need not contain the signature of more than one party, but both such counterparts taken together shall constitute one and the same agreement. Counterparts may be delivered via facsimile, electronic mail (including .pdf or any electronic signature complying with the U.S. federal ESIGN Act of 2000, e.g., www.docusign.com) or other transmission method and any counterpart so delivered shall be deemed to have been duly and validly delivered and be valid and effective for all purposes.

20.UNDERSTANDING OF EXECUTIVE; CONSULTATION WITH COUNSEL. Executive represents to Company that Executive has read this Agreement in its entirety, that Executive understands it and that Executive has entered into it voluntarily. Executive hereby further acknowledges and represents that Executive has consulted with independent legal counsel regarding Executive’s rights and obligations under this Agreement and that Executive fully understands the terms and conditions contained herein, including without limitation the obligations, restrictions, and provisions set forth in Section 5, 6, 9, and 10 of this Agreement.

[signatures follow]

IN WITNESS WHEREOF, the parties intending to be legally bound have executed this Executive Employment Agreement as of the date first set forth above.

PETMED EXPRESS, INC.

By:

Sandra Y. Campos Chief Executive Officer

EXECUTIVE

By:

Robyn D’Elia

EXHIBIT 99.1

PetMed Express, Inc. Announces Appointment of Robyn D’Elia as Chief Financial Officer

D’Elia Brings More than 25 Years of Strategic Finance and Retail Leadership Experience to PetMeds

DELRAY BEACH, Fla., September 12, 2024 (GLOBE NEWSWIRE) – PetMed Express, Inc., dba PetMeds and parent company of PetCareRx, (Nasdaq: PETS) (the "Company") today announced the appointment of retail and ecommerce veteran Robyn D’Elia as Chief Financial Officer (“CFO”) effective September 16, 2024. D’Elia brings over 25 years of experience in financial leadership and strategic planning across multiple industries, including 24 years at Bed Bath & Beyond where she served in senior leadership roles across finance for two decades, and served as CFO from 2018 to 2020. Most recently D’Elia served as CFO at Odeko, a privately held all-in-one operations partner for independent coffee shops, cafes and other shops. As CFO at PetMeds, D’Elia will oversee the Company’s entire finance organization and report directly to President and CEO Sandra Campos.

“We are excited to welcome Robyn as PetMeds new Chief Financial Officer,” said Sandra Campos, President and CEO. “Robyn brings a wealth of expertise in financial leadership, with a strong track record of financial discipline, operational rigor and deep experience in technical accounting. Her exceptional ability to help scale organizations, having been a part of the leadership team that oversaw tremendous growth at Bed Bath & Beyond, aligns perfectly with our vision for the future of PETS. Robyn’s strategic insight and proven ability to navigate complex financial landscapes will be invaluable as we continue to expand and deliver long-term value for our shareholders, customers, and employees.”

Robyn D’Elia said, “I am thrilled to be joining PetMeds at such a pivotal time and look forward to leading the Company’s finance organization, working to solidify our financials and strengthen our foundation to ensure we are well positioned to deliver healthy, profitable growth to drive long-term shareholder value.”

About Robyn D’Elia