UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

___________________________________

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934

(Amendment No. )

___________________________________

Filed by the Registrant ☒

Filed by a Party other than the Registrant ☐

Check the appropriate box:

| | | | | |

| ☒ | Preliminary Proxy Statement |

| | |

| ☐ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| | |

| ☐ | Definitive Proxy Statement |

| | |

| ☐ | Definitive Additional Materials |

| | |

| ☐ | Soliciting Material Pursuant to §240.14a-12 |

PLBY GROUP, INC.

_________________________________________________________________________________________________

(Name of Registrant as Specified In Its Charter)

_________________________________________________________________________________________________

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check all boxes that apply):

| | | | | | | | | | | | | | |

| ☒ | | No fee required |

| ☐ | | Fee paid previously with preliminary materials |

| ☐ | | Fee computed in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11 |

PRELIMINARY PROXY STATEMENT – SUBJECT TO COMPLETION

DATED JANUARY 24, 2025

PLBY GROUP, INC.

10960 Wilshire Blvd., Suite 2200

Los Angeles, CA 90024

February [●], 2025

DEAR STOCKHOLDER:

It is my pleasure to invite you to attend a Special Meeting of Stockholders (the “Special Meeting”) of PLBY Group, Inc. (the “Company”). The Special Meeting will be held virtually on March 20, 2025, at 10:00 a.m., Pacific Time at www.virtualshareholdermeeting.com/PLBY2025SM. You may attend the virtual Special Meeting and vote your shares electronically during the meeting via live audio webcast by visiting www.virtualshareholdermeeting.com/PLBY2025SM. If you will not attend the Special Meeting virtually, you may also vote online, by telephone or by mail prior to the Special Meeting.

At the Special Meeting you will be asked to consider and vote on a proposal to approve, for purposes of Nasdaq Listing Rule 5635(b), the issuance by the Company of 16,956,842 shares of Common Stock, par value $0.0001 per share (the “Common Stock”), at a sale price of $1.50 per share to The Million S.a.r.l. (the “Purchaser”) pursuant to the terms of the Securities Purchase Agreement, dated December 14, 2024 (the “December Purchase Agreement”), by and between the Company and the Purchaser (the “Nasdaq Proposal”). The last reported sale price of the Company’s Common Stock on Nasdaq on December 13, 2024 was $1.41 per share, resulting in a sale price under the December Purchase Agreement that was approximately 6.4% greater than the closing price of the Company’s Common Stock on Nasdaq on the trading day immediately preceding execution of the agreement. At the Special Meeting, you may also be asked to consider and vote on a proposal to adjourn the Special Meeting to a later date or dates, if necessary or appropriate, to solicit additional proxies if there are insufficient votes to approve the Nasdaq Proposal at the time of the Special Meeting.

The enclosed Notice of Special Meeting of Stockholders and Proxy Statement describes the proposals to be considered and voted upon at the Special Meeting.

Whether or not you plan to attend the virtual Special Meeting, it is important that you be represented. To ensure that your vote will be received and counted, please vote online, by telephone or by mail by following the instructions included with the Notice of Internet Availability of Proxy Materials (“Notice of Internet Availability”) that will be provided to you, or promptly sign, date and return the proxy card in the postage-paid envelope (which will be provided to those stockholders who request to receive paper copies of these materials by mail).

I look forward to your engagement with the Special Meeting.

Sincerely,

Ben Kohn

Chief Executive Officer & President

Important Notice of Internet Availability for the Special Meeting of Stockholders to be held on March 20, 2025.

This year we will take advantage of the rules of the U.S. Securities and Exchange Commission (“SEC”) that allow us to furnish our proxy materials over the Internet. As a result, we are sending a Notice of Internet Availability of Proxy Materials to our shareholders rather than a full paper set of the proxy materials. The Notice of Internet Availability of Proxy Materials contains instructions on how to access our proxy materials on the Internet, as well as instructions on how stockholders may obtain a paper copy of our proxy materials. This process helps the environment and substantially reduces the costs associated with printing and distributing our proxy materials. To make it easier for you to vote, Internet and telephone voting are available. The instructions on the Notice of Internet Availability of Proxy Materials or, if you received a paper copy of the proxy materials, the proxy card, describe how to use these convenient services.

NOTICE OF SPECIAL MEETING OF PLBY GROUP, INC. STOCKHOLDERS

TO THE STOCKHOLDERS OF PLBY GROUP, INC.:

A Special Meeting of Stockholders (the “Special Meeting”) of PLBY Group, Inc. (the “Company”) will be held on March 20, 2025, at 10:00 a.m., Pacific Time. We have adopted a virtual format for the Special Meeting to provide a safe, consistent and convenient experience to all stockholders regardless of location. You may attend the virtual meeting by visiting www.virtualshareholdermeeting.com/PLBY2025SM.

The Special Meeting is being held for the following purposes:

1.To consider and vote to approve, for purposes of Nasdaq Listing Rule 5635(b), the issuance by the Company of 16,956,842 shares of Common Stock, par value $0.0001 per share (the “Common Stock”), at a sale price of $1.50 per share to The Million S.a.r.l. (the “Purchaser”), pursuant to the terms of the Securities Purchase Agreement, dated December 14, 2024 (the “December Purchase Agreement”), by and between the Company and the Purchaser (the “Nasdaq Proposal”); and

2.To consider and vote upon the proposal to adjourn or postpone the Special Meeting, from time to time, to a later date or dates, if necessary or appropriate, to solicit additional proxies if there are insufficient votes to adopt the Nasdaq Proposal (the “Adjournment Proposal”).

You may vote on these matters directly or by proxy. Whether or not you plan to virtually attend the Special Meeting, we ask that you vote by one of the following methods to ensure that your shares will be represented at the meeting in accordance with your wishes:

•Vote online by going to www.proxyvote.com and following the instructions on the website;

•Vote by phone by calling the toll-free telephone number 1-800-690-6903 and following the recorded instructions; or

•Vote by mail, by completing and returning a proxy card in the addressed stamped envelope (which will be provided to those stockholders who request to receive paper copies of proxy materials by mail).

Only stockholders of record at the close of business on January 23, 2025 are entitled to notice of, and to vote at, the Special Meeting or any adjournment or postponement of the meeting.

As permitted by the Securities and Exchange Commission (“SEC”), we are providing access to our proxy materials online under the SEC’s “notice and access” rules. As a result, unless you previously requested electronic or paper delivery on an ongoing basis, we are mailing to our stockholders a Notice of Internet Availability of Proxy Materials (the “Notice of Internet Availability”) instead of a paper copy of the proxy statement and a form of proxy card or voting instruction card. The Notice of Internet Availability contains instructions on how to access such proxy materials online. The Notice of Internet Availability also instructs you on how you may authorize a proxy to vote your shares over the Internet, how you can receive a paper copy of the proxy materials through the mail and how you can enroll in e-delivery. This distribution process is more resource and cost-efficient. The Notice of Internet Availability is first being mailed, and the proxy materials are expected to be made available, to our stockholders on or about [●], 2025.

Important Notice of Internet Availability for the Special Meeting of Stockholders to be held on March 20, 2025. The Notice of Internet Availability and the proxy materials for the Special Meeting are available through the Internet at www.proxyvote.com. If you received proxy materials for the Special Meeting via email, the email contains voting instructions and links to the proxy statement for the Special Meeting on the Internet.

YOUR VOTE IS IMPORTANT. Whether or not you plan to virtually attend the Special Meeting, we urge you to submit your vote via the Internet, telephone or mail.

By Order of the Board of Directors:

Chris Riley

General Counsel and Secretary

February [●], 2025

PLBY Group, Inc.

___________________________________

Proxy Statement

___________________________________

Table of Contents

PROXY STATEMENT

OF

PLBY GROUP, INC.

GENERAL INFORMATION

This Proxy Statement and the enclosed form of proxy card are being furnished to you in connection with a Special Meeting of Stockholders (the “Special Meeting”) of PLBY Group, Inc. (“PLBY,” “we,” “us,” “our,” or the “Company”). The Special Meeting will be held virtually on March 20, 2025, at 10:00 a.m., Pacific Time. The Special Meeting will be held virtually. You may attend the virtual Special Meeting and vote your shares electronically during the meeting via live audio webcast by visiting www.virtualshareholdermeeting.com/PLBY2025SM. This Proxy Statement and the accompanying notice and form of proxy (the “proxy materials”) are first being made available to stockholders on or about [●], 2025.

At the Special Meeting you will be asked to consider and vote on a proposal to approve, for purposes of Rule 5653(b) (“Nasdaq Listing Rule 5635(b)”) of The Nasdaq Stock Market LLC (“Nasdaq”), the issuance by the Company of 16,956,842 shares of Common Stock, par value $0.0001 per share (the “Common Stock”), at a sale price of $1.50 per share to The Million S.a.r.l. (the “Purchaser”), pursuant to the terms of the Securities Purchase Agreement, dated December 14, 2024 (the “December Purchase Agreement”), by and between the Company and the Purchaser (the “Nasdaq Proposal”). The last reported sale price of the Company’s Common Stock on Nasdaq on December 13, 2024 was $1.41 per share, resulting in a sale price under the December Purchase Agreement that was approximately 6.4% greater than the closing price of the Company’s Common Stock on Nasdaq on the trading day immediately preceding execution of the agreement. At the Special Meeting, you may also be asked to consider and vote on a proposal to adjourn the Special Meeting to a later date or dates, if necessary or appropriate, to solicit additional proxies if there are insufficient votes to approve the Nasdaq Proposal at the time of the Special Meeting (the “Adjournment Proposal”).

We are furnishing proxy materials to our stockholders over the Internet, and providing a Notice of Internet Availability of Proxy Materials (the “Notice of Internet Availability”) by mail. We believe that this process expedites stockholders’ receipt of proxy materials while lowering the costs and reducing the environmental impact of our Special Meeting. The Notice of Internet Availability is first being mailed to stockholders of the Company on or about [●], 2025. Our Board of Directors (the “Board”) has fixed the close of business on January 23, 2025 as the record date for the determination of stockholders entitled to notice of, and to vote at, the Special Meeting. Except as set forth herein, only holders of Common Stock of record at the close of business on January 23, 2025 will be entitled to notice of, and to vote at, the Special Meeting.

You will not receive a printed copy of the proxy materials unless you request to receive these materials in hard copy by following the instructions provided in the Notice of Internet Availability. Instead, the Notice of Internet Availability will instruct you on how you may access and review all of the important information contained in the proxy materials. The Notice of Internet Availability also instructs you on how you may submit your proxy via the Internet, telephone or mail. If you received a Notice of Internet Availability by mail and would like to receive a printed copy of our proxy materials, you should follow the instructions for requesting such materials included in the Notice of Internet Availability.

Your proxy is being solicited by our Board. Your proxy may be revoked by written notice given to our Secretary at our headquarters at any time before being voted. You may also revoke your proxy by submitting a proxy with a later date, entering a new vote by Internet or by telephone or by voting during your virtual attendance at the Special Meeting. To vote online, please go to www.proxyvote.com and follow the instructions on the website. To vote by telephone, please call the toll-free telephone number 1-800-690-6903 and follow the recorded instructions. To vote by mail, please sign, date and return the proxy card in the postage-paid envelope (which will be provided to those stockholders who request to receive paper copies of these materials by mail). Votes submitted online or by mail must be received by 11:59 p.m., Eastern Time, on March 19, 2025. Submitting your vote online, by telephone or by mail will not affect your right to vote virtually during the Special Meeting, if you choose to do so. Proxies that are properly delivered to us and not revoked before the closing of the polls during the Special Meeting will be voted for the proposals described in this Proxy Statement in accordance with the instructions set forth in the Notice of Internet Availability. Your virtual presence at the Special Meeting does not of itself revoke your proxy.

Attendance at the Special Meeting

The Special Meeting will be held entirely online. Stockholders of record as of the Record Date will be able to attend and participate in the Special Meeting online by accessing www.virtualshareholdermeeting.com/PLBY2025SM. To join the Special Meeting you will need to have you 16 digit control number, which is included in your Notice of Internet Availability and proxy card. Even if you plan to attend the Special Meeting online, we recommend that you also vote by proxy as described herein so that your vote will be counted if you decide not to attend the Special Meeting or in the event of any technical difficulties during the Special Meeting.

Access to the Audio Webcast of the Special Meeting

The live audio webcast of the Special Meeting will begin promptly at 10:00 a.m. Pacific Time. Online access to the audio webcast will open approximately 15 minutes prior to the start of the Special Meeting to allow time for you to log in and test the computer audio system. We encourage our stockholders to access the meeting prior to the start time.

Log in Instructions

To attend the online Special Meeting, log in at www.virtualshareholdermeeting.com/PLBY2025SM. Stockholders will need their 16-digit control number, which appears on the notice and the instructions that accompanied the proxy materials. If you do not have a control number, please contact your broker, bank, or other nominee as soon as possible, so that you can be provided with a control number and gain access to the meeting.

Special Meeting Technical Assistance

There will be a support team ready to assist stockholders with any technical difficulties they may have accessing or hearing the virtual meeting. If you encounter any difficulties accessing the virtual meeting during the check-in or meeting time, please call the technical support number provided on the virtual meeting website at www.virtualshareholdermeeting.com/PLBY2025SM.

Availability of Live Audio Webcast to Team Members and Other Constituents

The live audio webcast will be available to not only our stockholders but also our team members and other constituents.

Securities Entitled to Vote

Only stockholders of record at the close of business on the Record Date are entitled to notice of the Special Meeting. Such stockholders may vote shares held by them at the close of business on the Record Date at the Special Meeting. As of the close of business on the Record Date, there were 89,951,637 shares of our Common Stock outstanding held by 70 holders of record, including the Purchaser. Each share of Common Stock is entitled to one vote per share on each proposal to be considered by our stockholders. Consistent with Nasdaq rules, the Purchaser will be unable to cast a vote for any of its shares of Common Stock with respect to Proposal No. 1 and Proposal No. 2.

Beneficial owners of shares are also invited to attend the Special Meeting virtually and may vote their shares electronically during the Special Meeting by following the instructions posted at www.virtualshareholdermeeting.com/PLBY2025SM.

Stockholder of Record. If your Common Stock shares are registered directly in your name with our transfer agent, Continental Stock Transfer & Trust Company, you are considered the “stockholder of record” with respect to those shares. As a stockholder of record, you may vote electronically during the Special Meeting or vote by proxy in advance of the Special Meeting. Whether or not you plan to attend the Special Meeting virtually, we urge you to vote on the Internet as instructed in the Notice of Internet Availability that is mailed to you, by calling the toll-free telephone number 1-800-690-6903 and following the recorded instructions, or by proxy by mail, if you request a printed proxy card, to ensure your vote is counted.

Beneficial Owner. If your shares of Common Stock are held in a stock brokerage account or by a bank or other nominee, you are considered the “beneficial owner” of shares held in street name. The organization holding your account is considered the stockholder of record for purposes of voting at the Special Meeting. As a beneficial owner, you have the right to direct your broker, bank, or other agent on how to vote the shares in your account. Your brokerage firm, bank, or other agent will not be able to vote on the Nasdaq Proposal or the Adjournment Proposal unless they have your voting instructions, as these are considered non-routine matters and broker discretionary voting on these matters is prohibited, so it is very important that you indicate your voting instructions to the institution holding your shares. Beneficial owners of shares are also invited to attend the Special Meeting virtually and may vote their shares electronically during the Special Meeting.

Matters Scheduled for a Vote

There are two matters scheduled for a vote:

•Proposal No. 1 (the Nasdaq Proposal): To consider and vote to approve, for purposes of Nasdaq Listing Rule 5635(b), the issuance by the Company of 16,956,842 shares of Common Stock, at a sale price of $1.50 per share to the Purchaser pursuant to the terms of the December Purchase Agreement; and

•Proposal No. 2 (the Adjournment Proposal): To consider and vote upon the proposal to adjourn or postpone the Special Meeting, from time to time, to a later date or dates, if necessary or appropriate, to solicit additional proxies if there are insufficient votes to adopt the Nasdaq Proposal.

Board Voting Recommendation

Our Board recommends that you vote your shares:

•“FOR” the Nasdaq Proposal; and

•“FOR” the Adjournment Proposal.

How to Vote

For Proposal No. 1 and Proposal No. 2, you may vote “FOR”, “Against” or abstain from voting with respect to each such proposal. The procedures for voting are outlined below.

Stockholder of Record: Shares Registered in Your Name

If you are a stockholder of record as of the Record Date, you may vote during the Special Meeting by attending the Special Meeting online and following the instructions posted at www.virtualshareholdermeeting.com/PLBY2025SM, by proxy over the Internet, by telephone or by mail. If your proxy is properly executed in time to be voted at the Special Meeting, the shares represented by the proxy will be voted in accordance with the instructions you provide. Whether or not you plan to attend the Special Meeting virtually, we urge you to vote by proxy to ensure your vote is counted. You may still attend the Special Meeting virtually and vote electronically during the Special Meeting if you have already voted by proxy.

1.To vote during the Special Meeting, follow the instructions posted at www.virtualshareholdermeeting.com/PLBY2025SM. You will need the 16-digit control number included on your Notice of Internet Availability or your proxy card (if you received a paper copy of the proxy materials) or an email if one was sent to you to obtain your records and to vote.

2.To vote on the Internet, go to www.proxyvote.com and follow the instructions on the website. You will need the 16-digit control number included on your Notice of Internet Availability or your proxy card (if you received a paper copy of the proxy materials) or an email if one was sent to you to obtain your records and to vote.

3.To vote by telephone, please call the toll-free telephone number 1-800-690-6903 and follow the recorded instructions. You will need the 16-digit control number included on your Notice of Internet Availability or your proxy card (if you received a paper copy of the proxy materials) or an email if one was sent to you to obtain your records and to vote.

4.To vote by mail, sign, date and return the proxy card in the postage-paid envelope (which will be provided to those stockholders who request to receive paper copies of these materials by mail) to: Vote Processing, c/o Broadridge, 51 Mercedes Way, Edgewood, NY 11717. If you return your signed proxy card to us before the Special Meeting, we will vote your shares as you direct.

Beneficial Owner: Shares Registered in the Name of a Broker, Bank, or Other Agent

If you are a beneficial owner of shares registered in the name of your broker, bank, or other agent, you should have received a notice and voting instructions from that organization rather than from us. Simply follow the instructions to ensure that your vote is counted.

Beneficial owners may also vote their shares electronically during the Special Meeting by following the instructions posted at www.virtualshareholdermeeting.com/PLBY2025SM. You will need the 16-digit control number included on the notice and voting instructions received from your broker, bank or other agent.

We provide Internet proxy voting to allow you to vote your shares online, with procedures designed to ensure the authenticity and correctness of your proxy vote instructions. However, please be aware that you must bear any costs associated with your Internet access, such as usage charges from Internet access providers and telephone companies.

Vote Required

In accordance with our Amended and Restated Bylaws (our “Bylaws”), the presence at the Special Meeting, virtually or by proxy, of the holders of a majority of the shares of Common Stock issued and outstanding and entitled to vote, shall constitute a quorum for the transaction of business at the Special Meeting.

The affirmative vote of a majority of the voting power of the votes cast by stockholders present or represented at the Special Meeting is required to approve the Nasdaq Proposal. The total number of votes cast “FOR” will be counted for purposes of determining whether sufficient affirmative votes have been cast to approve the Nasdaq Proposal. The affirmative vote of a majority of the voting power of the votes cast by stockholders present or represented at the Special

Meeting is required to approve the Adjournment Proposal. The total number of votes cast “FOR” will be counted for purposes of determining whether sufficient affirmative votes have been cast to approve the Adjournment Proposal.

Abstentions from voting on a proposal by a stockholder at the Special Meeting, as well as broker non-votes, will be considered for purposes of determining the number of total votes present at the Special Meeting. However, in accordance with Delaware law and our Bylaws, abstentions will have no effect on the Nasdaq Proposal or the Adjournment Proposal. As there are no routine matters to be voted on at the Special Meeting, broker non-votes will not be considered in determining the approval of the Nasdaq Proposal or the Adjournment Proposal.

How to Obtain Proxy Materials

You will not receive a printed copy of the proxy materials unless you request to receive these materials in hard copy by following the instructions in the Notice of Internet Availability. Instead, the Notice of Internet Availability will instruct you on how you may access and review all of the important information contained in the proxy materials. The Notice of Internet Availability also instructs you how you may submit your proxy via the Internet.

How Your Proxy Will be Voted

When proxies are properly signed, dated and returned, the shares represented by the proxies will be voted in accordance with the instructions of the stockholder. If no specific instructions are given, you give authority to Marc Crossman and Chris Riley to vote the shares in accordance with the recommendations of our Board as described above. If the Special Meeting is adjourned, the proxy holders can vote your shares on the new meeting date as well, unless you have revoked your proxy.

How to Change Your Vote After Submitting Your Proxy

You can revoke your proxy at any time before the final vote at the Special Meeting. If you are a stockholder of record, you may revoke your proxy in any one of three ways:

1.A duly executed proxy card with a later date or time than the previously submitted proxy;

2.A written notice that you are revoking your proxy to our Secretary, Chris Riley, care of PLBY Group, Inc., 10960 Wilshire Blvd., Suite 2200, Los Angeles, CA 90024; or

3.A later-dated vote on the Internet or by telephone, or by a ballot cast online during the Special Meeting (simply virtually attending the Special Meeting will not, by itself, revoke your proxy).

If you are a beneficial owner, you may revoke your proxy by submitting new instructions to your broker, bank, or other agent, or if you have received a proxy from your broker, bank, or other agent giving you the right to vote your shares at the Special Meeting, by attending the meeting virtually and voting during the meeting.

Costs of Proxy Solicitation Borne by the Company

We will pay all the costs of preparing, mailing and soliciting proxies. We will ask brokers, banks, voting trustees and other nominees and fiduciaries to forward the proxy materials to the beneficial owners of our Common Stock and to obtain the authority to execute proxies. We will reimburse them for their reasonable expenses upon request. In addition to mailing proxy materials, our directors, officers and employees may solicit proxies in person, by telephone or otherwise. These individuals will not be specially compensated. In addition, we expect to pay approximately $6,500, plus certain other solicitation and related expenses, to InvestorCom for the solicitation of proxies, and we will indemnify InvestorCom with respect to information provided by us to InvestorCom.

How to Submit Stockholder Proposals for Our Next Annual Meeting

Our Bylaws, which were filed as Exhibit 3.2 to our Annual Report on Form 10-K for the year ended December 31, 2023, and are available via the SEC website at www.sec.gov, require that PLBY be furnished with written notice with respect to:

•the nomination of a person for election as a director, other than a person nominated by or at the direction of the Board; and

•the submission of a proposal, other than a proposal submitted by or at the direction of the Board, at a meeting of stockholders.

Under our Bylaws, timely written notice of stockholder nominations and business proposals to the Board pursuant to Article II, Section 8 of our Bylaws must be delivered to PLBY generally not later than 90 days nor earlier than 120 days prior to the first anniversary of the preceding year’s annual meeting. Accordingly, any eligible stockholder who wishes to have a nomination or business proposal considered at the 2025 annual meeting of PLBY stockholders must deliver a written notice (containing the information specified in our Bylaws regarding the stockholder and the proposed nominee or business proposal) to PLBY between February 13, 2025 and March 15, 2025.

In accordance with SEC Rule 14a-8, in order for any proposal of a stockholder to be considered for inclusion in our notice of meeting, proxy statement and proxy relating to the 2025 annual meeting of PLBY stockholders, the proposal must have been received by our Secretary by December 30, 2024.

In addition to satisfying the foregoing requirements, to comply with the SEC’s universal proxy rules, stockholders who intend to solicit proxies in support of director nominees other than our nominees must provide timely notice to us that sets forth the information required by Rule 14a-19 under the Securities Exchange Act of 1934, as amended (the “Exchange Act”), with such notice being postmarked or transmitted electronically to our Secretary, Chris Riley, care of PLBY Group, Inc., 10960 Wilshire Blvd., Suite 2200, Los Angeles, CA 90024. To the extent that any information required by Rule 14a-19 is not required under our Bylaws to be included with your notice, we must receive such additional information by April 14, 2025.

Householding

We have adopted a procedure approved by the SEC called “householding.” Under this procedure, service providers that deliver our communications to stockholders may deliver a single copy of our Notice of Internet Availability or Proxy Statement to multiple stockholders sharing the same address, unless one or more of these stockholders notifies us that they wish to continue receiving individual copies. Stockholders who participate in householding will continue to receive separate notices and/or proxy cards. This householding procedure reduces our printing costs and postage fees.

We will deliver promptly upon written or oral request a separate copy of our Notice of Internet Availability, Proxy Statement or Proxy Card, as applicable, to a stockholder at a shared address to which a single copy of the documents was delivered. Please contact Broadridge Financial Solutions, Inc. at 1-866-540-7095 or in writing at 51 Mercedes Way, Edgewood, New York 11717, Attention: Householding Department to request a separate copy of our Notice of Internet Availability, Proxy Statement or Proxy Card.

If you are eligible for householding, but you and other stockholders with whom you share an address currently receive multiple copies of our annual reports, proxy statements and/or notices of internet availability of proxy materials, or if you hold stock in more than one account, and in either case you wish to receive only a single copy of our Proxy Statement or Notice of Internet Availability for your household, please contact Broadridge Financial Solutions, Inc. at 1-866-540-7095 or in writing at 51 Mercedes Way, Edgewood, New York 11717, Attention: Householding Department.

How to Obtain the Results of Voting at the Special Meeting

Preliminary voting results will be announced at the Special Meeting. Final voting results will be published in a Current Report on Form 8-K filed with the SEC within four business days following the Special Meeting. If final voting results are not available to us within four business days following the Special Meeting, we will file a Current Report on Form 8-K to publish preliminary results and will file an additional Current Report on Form 8-K to publish the final voting results within four business days of such final voting results being made available to us.

Our Mailing Address

Our mailing address is PLBY Group, Inc., 10960 Wilshire Blvd., Suite 2200, Los Angeles, CA 90024.

PROPOSAL NO. 1 - THE NASDAQ PROPOSAL

We are asking our stockholders to approve the issuance by the Company to the Purchaser of 16,956,842 shares of Common Stock at a sale price of $1.50 per share, for a total purchase price of $25,435,263 pursuant to the December Purchase Agreement. The last reported sale price of the Company’s Common Stock on Nasdaq on December 13, 2024 was $1.41 per share, resulting in a sale price under the December Purchase Agreement that was approximately 6.4% greater than the closing price of the Company’s Common Stock on Nasdaq on the trading day immediately preceding execution of the agreement. We are seeking stockholder approval for the issuance of such shares, as their issuance would result in the Purchaser owning more than 20% of the total number of shares of Common Stock outstanding of the Company since the Purchaser agreed to acquire a significant ownership and voting position in the Company. If this Proposal No. 1 is not approved by our stockholders, the Company may need to raise cash financing from a different source, which would likely increase the difficulty that the Company would experience in obtaining adequate financing on terms as reasonable as those agreed to by the Purchaser.

Background

On October 30, 2024, we entered into a Securities Purchase Agreement (the “October Purchase Agreement”) with Byborg Enterprises S.A, (“Byborg”), of which the Purchaser is a wholly owned subsidiary, pursuant to which Byborg agreed to purchase (either itself or through an affiliate) 14,900,000 shares of Common Stock at a sale price of $1.50 per share, for an aggregate purchase price of $22.35 million.

On October 30, 2024, we also entered into a standstill agreement (the “Standstill Agreement”) with Byborg. Pursuant to the Standstill Agreement, among other limitations, Byborg and its affiliates, inclusive of the Purchaser, agreed not to (i) join or participate in a “group” (as defined in Sections 13(d)(3) and 13(g)(3) of the Exchange Act) with any third party, or (ii) purchase shares of Common Stock that would result in Byborg and its affiliates owning in excess of 29.99% of the Company’s outstanding Common Stock in the aggregate following any acquisition of Common Stock, in each case, during the standstill period. The standstill period means any time from and after October 30, 2024 in which Byborg and its affiliates collectively own, beneficially or of record, more than 14.9% of the total outstanding shares of Common Stock. Prior to the closing of the transaction contemplated by the October Purchase Agreement, Byborg assigned its rights under the October Purchase Agreement to the Purchaser, and we sold and issued the 14,900,000 shares of Common Stock to the Purchaser at the closing of such transaction on November 5, 2024, resulting in the Purchaser owning over 16% of the outstanding shares of Common Stock.

Pursuant to the October Purchase Agreement, we also agreed to increase the size of our Board from five to seven directors as of January 1, 2025. As of that date, the Board was obligated to add a new independent director mutually agreed by us and the Purchaser, and the Purchaser has the right to nominate one individual to serve on the Board. The Purchaser will retain such right so long as it beneficially owns at least 7,450,000 shares of Common Stock.

On December 14, 2024, we entered into the December Purchase Agreement with the Purchaser, relating to the issuance and sale to the Purchaser of 16,956,842 shares of Common Stock at a sale price of $1.50 per share, for an aggregate purchase price of $25,435,263. The last reported sale price of the Company’s Common Stock on Nasdaq on December 13, 2024 was $1.41 per share, resulting in a sale price under the December Purchase Agreement that was approximately 6.4% greater than the closing price of the Company’s Common Stock on Nasdaq on the trading day immediately preceding execution of the agreement.

The closing of the transactions contemplated by the December Purchase Agreement is subject to certain closing conditions, including obtaining stockholder approval of the Nasdaq Proposal in accordance with the applicable rules and regulations of Nasdaq and our organizational documents, in addition to other customary closing conditions.

On December 14, 2024, we also entered into a License & Management Agreement with Byborg (the “LMA”), pursuant to which Byborg agreed to operate our Playboy Plus, Playboy TV (digital and linear) and Playboy Club businesses and to license the right to use certain of our trademarks and other intellectual property, resulting in Byborg becoming the Company’s most significant licensee based on expected revenue. The LMA has an initial term of fifteen years, with the operations and license rights pursuant to the LMA having commenced as of January 1, 2025, and the possibility for up to nine renewal terms of ten years each, subject to the terms and conditions set forth in the LMA.

Additional Information Regarding the December Purchase Agreement

The December Purchase Agreement contains certain representations and warranties, covenants and indemnities customary for transactions similar to the transactions contemplated by the December Purchase Agreement. The representations, warranties, and covenants contained in the December Purchase Agreement were made solely for the benefit of the parties thereto and may be subject to limitations agreed upon by such parties.

Subject to certain exceptions set forth in the December Purchase Agreement, neither the Purchaser nor any of its affiliates may transfer any of the Common Stock purchased under the December Purchase Agreement to any unaffiliated person until after November 5, 2025, subject to certain exceptions set forth in the December Purchase Agreement. The Company also granted certain limited registration rights to the Purchaser for registration after November 5, 2025 of the shares purchased under the December Purchase Agreement.

The December Purchase Agreement contains customary closing conditions, including obtaining stockholder approval of the Nasdaq Proposal in accordance with the applicable rules and regulations of Nasdaq and our organizational documents.

Reasons for Requesting Stockholder Approval

Our Common Stock is listed on the Nasdaq Global Stock Market, and as a result, we are subject to Nasdaq’s Listing Rules, including Nasdaq Listing Rule 5635(b). Nasdaq Listing Rule 5635(b) requires stockholder approval prior to an issuance of securities when the issuance or potential issuance will result in a “change of control” of a listed company, which for Nasdaq purposes may be deemed to occur when, as a result of an issuance, an investor or a group of investors acquires, or has the right to acquire, 20% or more of the outstanding shares of Common Stock or voting power of the Company and such ownership or voting power would be our largest ownership position.

As of the date of this Proxy Statement, the Purchase held approximate 16.6% of the Company’s outstanding Common Stock. The total number of shares of Common Stock issuable to the Purchaser under the December Purchase Agreement is 16,956,842, which is expected to result in the Purchaser owning approximately 29.9% of the shares of Common Stock then outstanding. The issuance of shares to the Purchaser pursuant to the December Purchase Agreement would thus result in the Purchaser owning 20% or more of the outstanding shares of Common Stock and becoming our largest stockholder, which may be deemed a “change of control” for purposes of Nasdaq Listing Rule 5635(b).

However, even if the issuance contemplated by the December Purchase Agreement does result in the Purchaser having the largest ownership and voting position in the Company, that fact alone may not be dispositive. Nasdaq ultimately considers all facts and circumstances concerning a transaction to determine if a change of control has occurred, including whether there are any other relationships or agreements between the company and the investor or group (such as the LMA). Stockholders should note that a “change of control” as described under Nasdaq Listing Rule 5635(b) applies only with respect to the application of such rule and does not constitute a “change of control” for purposes of Delaware law, our organizational documents or any other purpose. Accordingly, we are seeking stockholder approval to comply with Nasdaq Listing Rule 5635(b).

Possible Effects If the Nasdaq Proposal Is Approved

If the Nasdaq Proposal is approved by our stockholders, then, subject to the satisfaction of the other conditions set forth in the December Purchase Agreement the transactions contemplated thereby may have the following effects:

1.Improved Capital Levels and Reserves. The proceeds we would receive upon closing of the transaction would be substantial and would strengthen our balance sheet, increase our capital levels, and enhance our ability to execute our business plans and pursue opportunities for further growth.

2.Valuable Investor. We believe the Purchaser’s willingness to invest in us is valuable, particularly given our historic liquidity challenges, and that the Purchaser will be an effective strategic partner in our organization as we focus on reducing costs and improving profitability.

3.Dilution. If approved, the Nasdaq Proposal would result in the issuance of shares of Common Stock. As a result, our existing stockholders would own a smaller percentage of our outstanding shares of Common Stock and, accordingly, a smaller percentage interest in the voting power and liquidation value of the shares of Common Stock. Moreover, the approval of the Nasdaq Proposal would not limit our ability to engage in additional issuances of shares of Common Stock (or securities convertible into or exercisable or exchangeable for shares of Common Stock) for capital-raising or other purposes in the future, subject to

compliance with Nasdaq Listing Rules and other applicable laws or regulations. As a result, our stockholders could experience further dilution from such additional transactions we may pursue in the future.

4.Market Effects. Under the terms of the December Purchase Agreement, we will be required to provide limited registration rights to the Purchaser. Sales in the public market of the Common Stock could adversely affect the prevailing market price of the Common Stock and impair our ability to raise capital in future equity financings.

5.Concentration of Ownership and Influence. The concentration of ownership resulting from the transactions contemplated under the December Purchase Agreement with the Purchaser is significant and could have various implications for the Company and its stockholders, including when considered with the Company’s LMA with the Purchaser’s parent company. A total of 16,956,842 shares of Common Stock, at a sale price of $1.50 per share, will be issued to the Purchaser in connection with the closing, which is expected to result in the Purchaser having a pro forma beneficial ownership of approximately 29.9% of the Company’s shares of Common Stock then outstanding immediately following such issuance, assuming that no shares have been disposed of by the Purchaser and that no other shares are acquired by the Purchaser or its affiliates. Such ownership would become the largest ownership and voting position in the Company. Such a concentration of ownership could potentially adversely affect the prevailing market price and liquidity for shares of our Common Stock.

With a substantial ownership and voting position (which would be increased by the issuance of the shares pursuant to the December Purchase Agreement), a seat on the Board pursuant to the October Purchase Agreement and the importance of the LMA to the Company, the Purchaser and its affiliates will have considerable influence over the Company’s operations and strategic direction, including by exerting substantial control over matters requiring stockholder approval such as the election of directors, mergers, acquisitions, and other significant corporate transactions. This concentration of voting power could effectively limit the ability of other stockholders to influence corporate decisions, even those that might otherwise be more strongly contested.

Furthermore, the substantial ownership position held by the Purchaser and its affiliates could lead to potential conflicts of interest. The Purchaser’s interests may not necessarily align with interests of the broader base of stockholders and the Purchaser could use its ownership and voting position to influence the governance and strategic direction of the Company. In situations where the interests of the Purchaser diverge from those of other stockholders, the latter may find their interests subordinated, which could impact the overall governance and strategic direction of the Company.

The concentration of ownership in the Company by the Purchaser could adversely affect the market price and liquidity of the Company’s Common Stock. A stockholder with a significant stake could influence the market perception of the Company’s Common Stock, potentially leading to greater volatility in its trading price. Additionally, the potential for the Purchaser to exercise additional control could deter some investors, which may reduce the overall demand for our Common Stock and impact its liquidity. Stockholders might also find it more difficult to sell their shares at favorable prices, particularly in the event of significant market movements.

The concentration of ownership in the Company by the Purchaser and its affiliates could impact our ability to raise additional capital through future equity financing transactions if potential investors may be wary of investing in a company where a single stockholder holds a substantial interest. This could make it more difficult to raise additional capital through equity offerings or necessitate offering new securities at a discount to attract additional investors, which could increase our cost of capital and limit our financial flexibility in pursuing future growth opportunities.

In sum, while the December Purchase Agreement provides important capital for the Company, it also further expands a significant concentration of ownership and voting power in the Purchaser and its affiliates, which could have both positive and negative implications for the Company. Stockholders should carefully consider these potential effects when evaluating the impact of the December Purchase Agreement and determining whether to vote to approve the Nasdaq Proposal.

Possible Effects If the Nasdaq Proposal Is Not Approved

If the Nasdaq Proposal is not approved by our stockholders, several significant consequences could follow, which could actually and materially affect the Company’s financial stability and future operations:

1.Termination of Purchaser’s Obligations. In accordance with the December Purchase Agreement, failure to obtain stockholder approval for the Nasdaq Proposal would release the Purchaser from any obligation to consummate the transactions contemplated by the December Purchase Agreement. This means that we would lose a critical source of anticipated funding. The lack of this funding could jeopardize our operational initiatives and/or debt service that otherwise might be possible from the infusion of capital.

2.Adverse Impact on Liquidity. Without the completion of the transactions associated with the Nasdaq Proposal, our liquidity and capital resources could become strained. The absence of these funds could force the Company to reassess its financial strategy. We would likely need to conserve cash, potentially reducing or delaying key expenditures, which could slow down growth or even result in the scaling back of some operations.

3.Need for Alternative Financing. If the Nasdaq Proposal is not approved, we may need to seek alternative sources of financing to meet our operational and strategic needs. This might involve exploring other equity or new debt financing options. However, there is no assurance that such financing would be available on commercially reasonable terms, or that it would be available at all. The inability to secure alternative financing could place the Company at a competitive disadvantage, limit its ability to capitalize on growth opportunities, and potentially lead to financial distress.

4.Potential Dilution and Cost of Capital. If alternative equity financing is pursued, it may involve issuing shares at a lower price than anticipated in the intended transaction with the Purchaser, resulting in greater dilution to existing stockholders. Furthermore, any debt financing secured in place of the anticipated equity investment may come with higher interest rates or more restrictive covenants, which could increase the Company’s cost of capital and restrict its operational flexibility.

5.Impact on Nasdaq Listing. Failure to approve the Nasdaq Proposal may have implications for the Company’s ability to maintain its listing on the Nasdaq Stock Market. The Company could struggle to meet the continued listing requirements if the Nasdaq Proposal is not approved and that causes our stock price to decline, which could ultimately result in delisting. A delisting would likely have a negative impact on the liquidity of our stock and could significantly reduce the market price of our shares, making it more challenging to raise capital in the future.

Overall, the non-approval of the Nasdaq Proposal could have far-reaching negative consequences for the Company, affecting not only its immediate financial health but also its long-term strategic positioning and ability to grow and compete effectively in the market. It is crucial for stockholders to consider these potential outcomes when deciding how to vote on the proposal.

Securities Law Matters

The Nasdaq Proposal, together with the other disclosures contained in this Proxy Statement, is neither an offer to sell nor a solicitation of an offer to buy any of our securities. The issuance and sale of the securities pursuant to the December Purchase Agreement to the Purchaser will be exempt from registration under the Securities Act of 1933, as amended (the “Securities Act”), pursuant to Section 4(a)(2) of the Securities Act.

No Appraisal Rights

Under applicable Delaware law, our stockholders are not entitled to appraisal rights with respect to the proposed issuance and sale of the shares of Common Stock pursuant to the December Purchase Agreement, and we will not independently provide stockholders with any such rights.

Vote Required

The affirmative vote of the holders of a majority of the votes cast either virtually during the Special Meeting or represented by proxy at the Special Meeting will be required to approve the Nasdaq Proposal. Abstentions and broker non-votes, if any, will have no effect on the outcome of this proposal.

THE BOARD UNANIMOUSLY RECOMMENDS A VOTE “FOR” THE APPROVAL OF THE NASDAQ PROPOSAL (PROPOSAL NO. 1).

PROPOSAL NO. 2 - THE ADJOURNMENT PROPOSAL

As permitted by our Bylaws, we have agreed to ask you to approve a proposal to adjourn the Special Meeting, from time to time, to a later date or dates, if necessary or appropriate, to solicit additional proxies if there are insufficient votes to approve the Nasdaq Proposal at the time of the Special Meeting. If stockholders approve this proposal, subject to the terms of the December Purchase Agreement, for up to 90 days, we can adjourn the Special Meeting and any adjourned session of the Special Meeting and use the additional time to solicit additional proxies, including soliciting proxies from stockholders that have previously returned properly signed proxies voting against the Nasdaq Proposal. Among other things, approval of the proposal to adjourn the Special Meeting, from time to time, to a later date or dates, if necessary or appropriate, to solicit additional proxies if there are insufficient votes to approve the Nasdaq Proposal at the time of the Special Meeting could mean that, even if we received proxies representing a sufficient number of votes against the Nasdaq Proposal such that the proposal would be defeated, subject to the terms of the December Purchase Agreement, we could adjourn the Special Meeting for up to 90 days without a vote on such proposal and seek to convince the holders of those shares to change their votes to votes in favor of the proposal. Additionally, we may seek stockholder approval to adjourn the Special Meeting if a quorum is not present. Finally, pursuant to our Bylaws, the chairperson of the Special Meeting is permitted by our Bylaws to adjourn the Special Meeting even if our stockholders have not approved this proposal.

No Appraisal Rights

Under applicable Delaware law, our stockholders are not entitled to appraisal rights with respect to the adjournment vote, and we will not independently provide stockholders with any such rights.

Vote Required

The affirmative vote of the holders of a majority of the votes cast either virtually during the Special Meeting or represented by proxy at the Special Meeting will be required to approve the Adjournment Proposal. Abstentions and broker non-votes, if any, will have no effect on the outcome of this proposal.

THE BOARD UNANIMOUSLY RECOMMENDS A VOTE “FOR” THE APPROVAL OF THE ADJOURNMENT PROPOSAL (PROPOSAL NO. 2).

OWNERSHIP OF COMMON STOCK

The following table sets forth information regarding the beneficial ownership of the Company’s Common Stock as of January 23, 2025 (the Record Date) by:

•each person or “group” (as such term is used in Section 13(d)(3) of the Exchange Act) known by the Company to be the beneficial owner of more than 5% of shares of its Common Stock;

•each of the named executive officers and directors of the Company; and

•all current executive officers and directors of the Company as a group.

Beneficial ownership is determined according to the rules of the SEC, which generally provide that a person has beneficial ownership of a security if they possess sole or shared voting or investment power over that security, including options and warrants that are currently exercisable or exercisable within 60 days of January 23, 2025. Company stock issuable upon exercise of options and warrants currently exercisable or exercisable within 60 days of January 16, 2025 are deemed outstanding solely for purposes of calculating the percentage of total voting power of the beneficial owner thereof.

The beneficial ownership of our Common Stock is based on 89,951,637 shares of our Common Stock issued and outstanding as of January 23, 2025.

Unless otherwise indicated, the Company believes that each person named in the table below has sole voting and investment power with respect to all shares of Common Stock beneficially owned by them.

| | | | | | | | | | | | | | |

Name and Address of Beneficial Owners(1) | | Number of Shares of Company Common Stock | | % of Outstanding Shares |

| Greater than 5% Holders | | | | |

Rizvi Traverse Management, LLC(2) | | 18,270,914 | | | 20.3 | % |

The Million S.a.r.l.(3) | | 14,900,000 | | | 16.6 | % |

| | | | |

| Named Executive Officers and Directors | | | | |

Ben Kohn(4) | | 2,549,552 | | | 2.8 | % |

Marc Crossman(5) | | 19,608 | | | * |

Chris Riley(6) | | 384,680 | | | * |

Suhail Rizvi(2)(7) | | 18,270,914 | | | 20.3 | % |

Tracey Edmonds(8) | | 72,501 | | | * |

Juliana F. Hill(9) | | 84,089 | | | * |

James Yaffe(10) | | 97,467 | | | * |

| | | | |

Current Executive Officers and Directors as a group (7 individuals)(11) | | 21,478,811 | | | 23.5 | % |

*Less than 1%.

(1)Unless otherwise noted, the business address of each of the following entities or individuals is 10960 Wilshire Blvd., Suite 2200, Los Angeles California 90024.

(2)Represents 14,311,576 shares of Common Stock held by Rizvi Traverse Management, LLC and the funds (the “funds”) it controls (collectively, “Rizvi Traverse”), 3,727,779 shares held by Rizvi Master LLC (an entity solely controlled by Mr. Rizvi), 51,434 shares held by Rizvi Interests Inc. (an entity solely controlled by Mr. Rizvi), and 180,125 shares in respect of restricted stock units (“RSUs”) held by Mr. Rizvi which have vested. Does not include any shares Mr. Rizvi may be entitled to receive in lieu of payment of cash director fees or any shares held solely by Mr. John Giampetroni. Mr. Rizvi and Mr. Giampetroni are the managers of Rizvi Traverse. Each of Rizvi Traverse and the funds may be deemed to be the beneficial owner of the shares of Common Stock beneficially owned by such entities, but each disclaims beneficial ownership of such shares, except to the extent of any pecuniary interest therein. Each of Rizvi Traverse and Messrs. Rizvi and Giampetroni may be deemed to be the beneficial owner of the shares of Common Stock beneficially owned by Rizvi Traverse, but each disclaims beneficial ownership of such shares, except

to the extent of any pecuniary interest therein. The address of Rizvi Traverse and its affiliates, including Messrs. Rizvi and Giampetroni, is c/o Rizvi Traverse Management, LLC, 801 Northpoint Parkway, Suite 129, West Palm Beach, FL 33407.

(3)Consists of 14,900,000 shares held by the Purchaser. The Purchaser is a wholly owned subsidiary of Byborg. Byborg is a subsidiary of Docler Holding S.a.r.l. The address of the Purchaser and its affiliates is 44 Avenue John F. Kennedy, L-1855 Luxembourg, Grand Duchy of Luxembourg.

(4)Consists of 1,208,757 shares of Common Stock held by Mr. Kohn, 75,361 shares of Common Stock held directly by Cold Springs Trust, of which Mr. Kohn is a beneficiary, 50,000 shares of Common Stock held directly by Bircoll Kohn Family Trust, for which Mr. Kohn is a trustee and a controlling person, 445,309 shares of Common Stock held directly by Woodburn Dr LP, an entity controlled by Mr. Kohn, and 1,340,795 shares of Common Stock that Mr. Kohn has the right to acquire within 60 days of January 23, 2025 through the exercise of options. Does not include shares beneficially owned by Rizvi Traverse, of which Mr. Kohn may have an indirect pecuniary interest of less than 1% as a result of non-controlling equity interests held by Mr. Kohn in affiliates of Rizvi Traverse, shares issuable upon the settlement of RSUs or shares issuable upon the settlement of performance-based restricted stock units (“PSUs”) that may occur more than 60 days from January 23, 2025 or shares of Common Stock that Mr. Kohn has the right to acquire through the exercise of options that will vest more than 60 days from January 23, 2025. Mr. Kohn disclaims beneficial ownership of the shares owned by Cold Springs Trust, Bircoll Kohn Family Trust and Woodburn Dr LP, except to the extent of his pecuniary interest therein.

(5)Consists of 19,608 shares of Common Stock held by Mr. Crossman’s wife. Does not include shares issuable upon the settlement of RSUs that may occur more than 60 days from January 23, 2025. Mr. Crossman disclaims beneficial ownership of his wife’s shares, except to the extent of any pecuniary interest therein.

(6)Consists of 185,295 shares of Common Stock and 199,385 shares of Common Stock that Mr. Riley has the right to acquire within 60 days of January 23, 2025 through the exercise of stock options. Does not include shares issuable upon the settlement of RSUs or shares of Common Stock issuable upon the settlement of PSUs that may occur more than 60 days from January 23, 2025 or shares of Common Stock that Mr. Riley has the right to acquire through the exercise of stock options that will vest more than 60 days from January 23, 2025.

(7)Mr. Rizvi, a member of the Company’s Board, is a manager of Rizvi Traverse. Mr. Rizvi disclaims beneficial ownership of all shares held by Rizvi Traverse referred to in footnote (2) above, except to the extent of any pecuniary interest therein.

(8)Consists of 72,501 shares of Common Stock.

(9)Consists of 84,089 shares of Common Stock. Does not include shares issuable upon the settlement of RSUs that may occur more than 60 days from January 23, 2025.

(10)Consists of 97,467 shares of Common Stock.

(11)Represents such shares of Common Stock held as of January 23, 2025 and potential stock issuable upon exercise of options or the vesting of RSUs within 60 days of January 23, 2025 as set forth in footnotes (2) through (10) above.

WHERE TO GET ADDITIONAL INFORMATION

As a reporting company, we are subject to the informational requirements of the Exchange Act and accordingly file our Annual Report on Form 10-K, Quarterly Reports on Form 10-Q, Current Reports on Form 8-K, proxy statements, and other information with the SEC. As an electronic filer, our public filings are maintained on the SEC’s website that contains reports, proxy and information statements, and other information regarding issuers that file electronically with the SEC. The address of that website is http://www.sec.gov. In addition, our Annual Report on Form 10-K, Quarterly Reports on Form 10-Q, Current Reports on Form 8-K, and amendments to those reports filed or furnished pursuant to Section 13(a) or 15(d) of the Exchange Act may be accessed free of charge through our website as soon as reasonably practicable after we have electronically filed such material with, or furnished it to, the SEC. The address of that website is https://www.plbygroup.com/investors/sec-filings.

COST OF PROXY STATEMENT AND SOLICITATION

We will bear the cost of preparing and distributing this Proxy Statement and the solicitation of proxies on behalf of the Board. In addition to the use of the mail, proxies may be solicited by us personally, by telephone, or by similar means. None of our directors, officers, or employees will be specifically compensated for those activities.

We expect to pay approximately $6,500, plus certain other solicitation and related expenses, to InvestorCom for the solicitation of proxies, and we will indemnify InvestorCom with respect to information provided by us to InvestorCom. We will also reimburse brokerage firms, custodians, nominees, fiduciaries, and other persons holding our shares in their names, or in the names of nominees, at approved rates for their reasonable expenses in forwarding proxy materials to beneficial owners of securities held of record by them and obtaining their proxies.

STOCKHOLDER COMMUNICATIONS

General. We provide an informal process for stockholders to send communications to our Board and its members. Stockholders who wish to contact the Board or any of its members may do so by writing to PLBY Group, Inc., 10960 Wilshire Blvd., Suite 2200, Los Angeles, CA 90024. At the direction of the Board, all mail received will be opened and screened for security purposes. Correspondence directed to an individual Board member is referred to that member. Correspondence not directed to a particular Board member is referred to our Secretary, Chris Riley, care of PLBY Group, Inc., 10960 Wilshire Blvd., Suite 2200, Los Angeles, CA 90024.

Submission of Stockholder Proposals and Director Nominations for the 2025 Annual Meeting. In accordance with SEC Rule 14a-8, stockholders who intend to have a proposal or director nomination considered for inclusion in our notice of meeting, proxy statement and proxy relating to our 2025 annual meeting of stockholders must have submitted the proposal or director nomination to us by December 30, 2024. In accordance with our Bylaws, for a proposal or director nomination to be brought before the 2025 annual meeting of stockholders, a stockholder’s notice of the proposal or director nomination that the stockholder wishes to present must be delivered to Secretary, Chris Riley, care of PLBY Group, Inc., 10960 Wilshire Blvd., Suite 2200, Los Angeles, CA 90024 not less than 90 nor more than 120 days prior to the first anniversary of the 2024 Annual Meeting. Accordingly, any notice given pursuant to our Bylaws, and outside the process of Rule 14a-8, must be received no earlier than February 13, 2025 and no later than March 15, 2025. We reserve the right to reject, rule out of order or take other appropriate action with respect to any proposal or director nomination that does not comply with these and other applicable requirements.

In addition to satisfying the foregoing requirements, to comply with the SEC’s universal proxy rules, stockholders who intend to solicit proxies in support of director nominees other than our nominees must provide notice to us that sets forth the information required by Rule 14a-19 under the Exchange Act, with such notice being postmarked or transmitted electronically to our Secretary, Chris Riley, care of PLBY Group, Inc., 10960 Wilshire Blvd., Suite 2200, Los Angeles, CA 90024. To the extent that any information required by Rule 14a-19 is not required under our Bylaws to be included with your notice, we must receive such additional information by April 14, 2025.

PROXY CARD

The form of proxy card for the Special Meeting is set forth on the following pages. Actual proxy cards will be provided to those stockholders of record as of the Record Date who request to receive paper copies of these materials by mail.

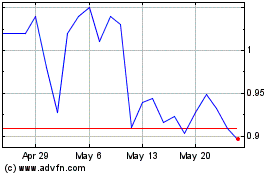

PLBY (NASDAQ:PLBY)

Historical Stock Chart

From Feb 2025 to Mar 2025

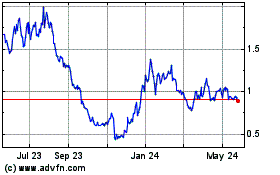

PLBY (NASDAQ:PLBY)

Historical Stock Chart

From Mar 2024 to Mar 2025