Pool Corporation (Nasdaq/GSM:POOL) today reported results for the

third quarter of 2024.

“We generated third quarter net sales of $1.4 billion, down 3%

from the third quarter of 2023, supported by steady demand for

maintenance products while the discretionary portions of our

business continued to see pressure. During the quarter, we made

additional progress on our Pool360 technology rollouts and digital

marketing expansion, seeing strong private-label chemical sales

growth, higher Pool360 usage and sustained gross margins. Our

dedicated team remains focused on delivering a best-in-class

customer experience and positioning ourselves for future growth by

leveraging our connected software solutions and the power of our

nationwide, integrated distribution network, with an efficient

capital structure and strong cash flow generation,” commented Peter

D. Arvan, president and CEO.

Third quarter

ended September 30, 2024

compared to the third

quarter ended September 30,

2023

Net sales decreased 3% in the third quarter of

2024 to $1.4 billion compared to $1.5 billion in the third

quarter of 2023. Base business results approximated consolidated

results for the period. Following similar trends from the first

half of the year, our third quarter results were anchored by strong

sales of non-discretionary maintenance products, while sales of

pool construction and discretionary products remained soft compared

to the third quarter of 2023. Net sales benefited approximately 2%

from one more selling day in third quarter of 2024 versus the same

period in 2023.

Gross profit decreased 3% to $416.4 million in

the third quarter of 2024 from $428.7 million in the same period of

2023. Gross margin remained consistent at 29.1% for each of the

third quarters of 2024 and 2023.

Increases in our selling and administrative

expenses (operating expenses) moderated during the third quarter of

2024, growing 2% to $240.1 million compared to $234.3 million in

the third quarter of 2023. Expense increases in the quarter

primarily related to inflationary impacts, the expansion of our

network and our technology initiatives and were partially offset by

lower variable costs and a timing shift of certain expenses from

the third quarter of 2024 to the fourth quarter of 2024. As a

percentage of net sales, operating expenses increased to 16.8% in

the third quarter of 2024 compared to 15.9% in the same period of

2023.

Operating income in the third quarter of 2024

decreased 9% to $176.4 million from $194.4 million in 2023.

Operating margin was 12.3% in the third quarter of 2024 compared to

13.2% in the third quarter of 2023.

Interest and other non-operating expenses, net

for the third quarter of 2024 decreased $1.2 million compared to

the third quarter of 2023, primarily due to a decrease in average

debt between periods.

We recorded a $0.5 million tax benefit from

Accounting Standards Update (ASU) 2016-09, Improvements to Employee

Share-Based Payment Accounting, in the quarter ended September 30,

2024, compared to a tax benefit of $0.4 million realized in

the same period of 2023. This resulted in a $0.01 per diluted share

tax benefit in the third quarter of 2024 consistent with the $0.01

per diluted share tax benefit realized in the same period of

2023.

Net income decreased 9% to $125.7

million in the third quarter of 2024 compared to $137.8

million in the third quarter of 2023. Earnings per diluted share

decreased 7% to $3.27 in the third quarter of 2024 compared to

$3.51 in the same period of 2023. Without the impact from ASU

2016-09 in both periods, earnings per diluted share decreased 7% to

$3.26 compared to $3.50 in the third quarter of 2023.

Nine months

ended September 30, 2024 compared

to the nine months ended

September 30, 2023

Net sales for the nine months ended September

30, 2024 declined 5% to $4.3 billion from $4.5 billion in the nine

months ended September 30, 2023. Base business results

approximated consolidated results for the period. Gross margin

declined 40 basis points to 29.7% from 30.1% in the same period

last year.

Operating expenses for the nine months ended

September 30, 2024 increased 4% to $728.6 million compared to

$699.0 million for the same period in 2023. Operating income for

the nine months ended September 30, 2024 decreased 17% to $556.6

million compared to $667.2 million in the same period last year.

Operating margin for the nine months ended September 30, 2024 was

12.9% compared to 14.7% for the nine months ended

September 30, 2023.

Interest and other non-operating expenses, net

for the first nine months of 2024 decreased $6.5 million compared

to the same period last year, primarily due to a decrease in

average debt between periods.

Net income for the nine months ended September

30, 2024 decreased 16% to $397.0 million compared to $471.8 million

for the nine months ended September 30, 2023. We recorded an

$8.3 million, or $0.21 per diluted share, tax benefit from ASU

2016-09 in the nine months ended September 30, 2024 compared to a

$5.9 million, or $0.15 per diluted share, tax benefit in the

same period of 2023.

Earnings per diluted share decreased 14% to

$10.30 in the first nine months of 2024 compared to $12.00 in the

same period of 2023. Without the impact from ASU 2016-09 in both

periods, earnings per diluted share was $10.09 in the first nine

months of 2024 compared to $11.85 in the same period of 2023.

Balance Sheet and Liquidity

Total net receivables, including pledged

receivables, decreased 8% at September 30, 2024 compared to

September 30, 2023, primarily due to our lower sales in 2024.

Our inventory management efforts contributed to an inventory

balance of $1.2 billion, down $78.8 million, or 6%, from

September 30, 2023. Total debt outstanding was $923.8 million

at September 30, 2024, down $110.1 million from September 30,

2023. As previously announced, during the third quarter of 2024, we

amended our credit facility to, among other items, extend the term

three years and increase our borrowing capacity.

Net cash provided by operations decreased to

$488.6 million in the first nine months of 2024 compared to $750.0

million in the first nine months of 2023, impacted by our prior

year inventory reduction efforts of $330.9 million during the first

nine months of 2023 and lower net income in 2024. Adjusted EBITDA

decreased 15% to $603.3 million for the nine months ended September

30, 2024 compared to $712.3 million last year.

Outlook

“With the 2024 swimming pool season behind us, we are

maintaining our 2024 full year earnings guidance of $11.06 to

$11.46 per diluted share, including the $0.21 tax benefit realized

this year. I would like to thank our many team members who continue

to deliver on areas of opportunity in this environment. As the

leading distributor to the swimming pool and outdoor living

products industry, we are committed to investing in continuous

improvements to enhance each customer’s experience, expanding our

marketing and technological tools, providing the broadest product

assortment through our long-standing partnerships with vendors,

optimizing our vertical integration capabilities, and building out

our digital ecosystem. We believe these organic growth drivers will

accelerate our abilities well into the future,” said Arvan.

Non-GAAP Financial Measures

This press release contains certain non-GAAP

measures (adjusted EBITDA and adjusted diluted EPS). See the

addendum to this release for definitions of our non-GAAP measures

and reconciliations of our non-GAAP measures to GAAP measures.

About Pool Corporation

POOLCORP is the world’s largest wholesale

distributor of swimming pool and related backyard products.

POOLCORP operates 447 sales centers in North America, Europe and

Australia, through which it distributes more than 200,000 products

to roughly 125,000 wholesale customers. For more information,

please visit www.poolcorp.com.

Forward-Looking Statements

This news release includes “forward-looking”

statements that involve risks and uncertainties that are generally

identifiable through the use of words such as “believe,” “expect,”

“anticipate,” “intend,” “plan,” “estimate,” “project,” “should,”

“will,” “may,” and similar expressions and include projections of

earnings. The forward-looking statements in this release are made

pursuant to the safe harbor provisions of the Private Securities

Litigation Reform Act of 1995. Forward-looking statements speak

only as of the date of this release, and we undertake no obligation

to update or revise such statements to reflect new circumstances or

unanticipated events as they occur. Actual results may differ

materially due to a variety of factors, including the sensitivity

of our business to weather conditions; changes in economic

conditions, consumer discretionary spending, the housing market,

inflation or interest rates; our ability to maintain favorable

relationships with suppliers and manufacturers; the extent to which

home-centric trends will continue to moderate or reverse;

competition from other leisure product alternatives or mass

merchants; our ability to continue to execute our growth

strategies; changes in the regulatory environment; new or

additional taxes, duties or tariffs; excess tax benefits or

deficiencies recognized under ASU 2016-09 and other risks detailed

in POOLCORP’s 2023 Annual Report on Form 10-K, 2024 Quarterly

Reports on Form 10-Q and other reports and filings filed with the

Securities and Exchange Commission (SEC) as updated by POOLCORP's

subsequent filings with the SEC.

Investor Relations Contacts:

Kristin S. Byars985.801.5153kristin.byars@poolcorp.com

Curtis J. Scheel985.801.5341curtis.scheel@poolcorp.com

|

POOL CORPORATIONConsolidated Statements of

Income(Unaudited)(In thousands, except per share

data) |

|

|

|

|

|

|

|

Three Months Ended |

|

Nine Months Ended |

|

|

September 30, |

|

September 30, |

|

|

|

2024 |

|

|

|

2023 |

|

|

|

2024 |

|

|

|

2023 |

|

| Net

sales |

$ |

1,432,879 |

|

|

$ |

1,474,407 |

|

|

$ |

4,323,474 |

|

|

$ |

4,538,545 |

|

|

Cost of sales |

|

1,016,476 |

|

|

|

1,045,676 |

|

|

|

3,038,370 |

|

|

|

3,172,276 |

|

|

Gross profit |

|

416,403 |

|

|

|

428,731 |

|

|

|

1,285,104 |

|

|

|

1,366,269 |

|

|

Percent |

|

29.1 |

% |

|

|

29.1 |

% |

|

|

29.7 |

% |

|

|

30.1 |

% |

|

|

|

|

|

|

|

|

|

|

Selling and administrative expenses |

|

240,050 |

|

|

|

234,288 |

|

|

|

728,550 |

|

|

|

699,046 |

|

|

Operating income |

|

176,353 |

|

|

|

194,443 |

|

|

|

556,554 |

|

|

|

667,223 |

|

|

Percent |

|

12.3 |

% |

|

|

13.2 |

% |

|

|

12.9 |

% |

|

|

14.7 |

% |

|

|

|

|

|

|

|

|

|

|

Interest and other non-operating expenses, net |

|

12,355 |

|

|

|

13,599 |

|

|

|

39,818 |

|

|

|

46,327 |

|

|

Income before income taxes and equity in earnings |

|

163,998 |

|

|

|

180,844 |

|

|

|

516,736 |

|

|

|

620,896 |

|

|

Provision for income taxes |

|

38,361 |

|

|

|

43,079 |

|

|

|

119,891 |

|

|

|

149,339 |

|

|

Equity in earnings of unconsolidated investments, net |

|

64 |

|

|

|

78 |

|

|

|

180 |

|

|

|

235 |

|

| Net

income |

$ |

125,701 |

|

|

$ |

137,843 |

|

|

$ |

397,025 |

|

|

$ |

471,792 |

|

|

|

|

|

|

|

|

|

|

|

Earnings per share attributable to common stockholders: (1) |

|

|

|

|

|

|

|

|

Basic |

$ |

3.29 |

|

|

$ |

3.54 |

|

|

$ |

10.37 |

|

|

$ |

12.09 |

|

|

Diluted |

$ |

3.27 |

|

|

$ |

3.51 |

|

|

$ |

10.30 |

|

|

$ |

12.00 |

|

|

Weighted average common shares outstanding: |

|

|

|

|

|

|

|

|

Basic |

|

37,983 |

|

|

|

38,735 |

|

|

|

38,104 |

|

|

|

38,816 |

|

|

Diluted |

|

38,187 |

|

|

|

39,023 |

|

|

|

38,330 |

|

|

|

39,112 |

|

|

|

|

|

|

|

|

|

|

|

Cash dividends declared per common share |

$ |

1.20 |

|

|

$ |

1.10 |

|

|

$ |

3.50 |

|

|

$ |

3.20 |

|

(1) Earnings per share under the two-class

method is calculated using net income attributable to common

stockholders (net income reduced by earnings allocated to

participating securities), which was $125.0 million and $137.1

million for the three months ended September 30, 2024 and

September 30, 2023, respectively, and $395.0 million and

$469.3 million for the nine months ended September 30, 2024 and

September 30, 2023, respectively. Participating securities

excluded from weighted average common shares outstanding were

206,000 and 205,000 for the three months ended September 30, 2024

and September 30, 2023, respectively, and 206,000 and 207,000

for the nine months ended September 30, 2024 and September 30,

2023, respectively.

|

POOL CORPORATIONCondensed Consolidated

Balance Sheets(Unaudited)(In thousands) |

|

|

|

|

|

|

|

|

|

|

|

|

September 30, |

|

September 30, |

|

|

Change |

|

|

|

2024 |

|

2023 |

|

|

$ |

|

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Assets |

|

|

|

|

|

|

|

|

|

|

|

Current assets: |

|

|

|

|

|

|

|

|

|

|

|

|

Cash and cash equivalents |

$ |

91,347 |

|

$ |

85,220 |

|

$ |

6,127 |

|

|

7 |

% |

|

|

Receivables, net (1) |

|

119,538 |

|

|

140,997 |

|

|

(21,459 |

) |

|

(15) |

|

|

|

Receivables pledged under receivables facility |

|

306,155 |

|

|

320,585 |

|

|

(14,430 |

) |

|

(5) |

|

|

|

Product inventories, net (2) |

|

1,180,491 |

|

|

1,259,308 |

|

|

(78,817 |

) |

|

(6) |

|

|

|

Prepaid expenses and other current assets |

|

43,168 |

|

|

26,414 |

|

|

16,754 |

|

|

63 |

|

|

Total current assets |

|

1,740,699 |

|

|

1,832,524 |

|

|

(91,825 |

) |

|

(5) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Property and equipment, net |

|

243,308 |

|

|

213,732 |

|

|

29,576 |

|

|

14 |

|

|

Goodwill |

|

700,147 |

|

|

699,270 |

|

|

877 |

|

|

— |

|

|

Other intangible assets, net |

|

292,722 |

|

|

300,237 |

|

|

(7,515 |

) |

|

(3) |

|

|

Equity interest investments |

|

1,434 |

|

|

1,383 |

|

|

51 |

|

|

4 |

|

|

Operating lease assets |

|

309,648 |

|

|

293,673 |

|

|

15,975 |

|

|

5 |

|

|

Other assets |

|

79,431 |

|

|

89,915 |

|

|

(10,484 |

) |

|

(12) |

|

|

Total assets |

$ |

3,367,389 |

|

$ |

3,430,734 |

|

$ |

(63,345 |

) |

|

(2) |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Liabilities and stockholders’ equity |

|

|

|

|

|

|

|

|

|

|

|

Current liabilities: |

|

|

|

|

|

|

|

|

|

|

|

|

Accounts payable |

$ |

401,702 |

|

$ |

429,436 |

|

$ |

(27,734 |

) |

|

(6) |

% |

|

|

Accrued expenses and other current liabilities |

|

185,118 |

|

|

157,172 |

|

|

27,946 |

|

|

18 |

|

|

|

Short-term borrowings and current portion of long-term debt |

|

44,683 |

|

|

37,788 |

|

|

6,895 |

|

|

18 |

|

|

|

Current operating lease liabilities |

|

95,412 |

|

|

84,724 |

|

|

10,688 |

|

|

13 |

|

|

Total current liabilities |

|

726,915 |

|

|

709,120 |

|

|

17,795 |

|

|

3 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Deferred income taxes |

|

65,106 |

|

|

55,226 |

|

|

9,880 |

|

|

18 |

|

|

Long-term debt, net |

|

879,146 |

|

|

996,109 |

|

|

(116,963 |

) |

|

(12) |

|

|

Other long-term liabilities |

|

43,612 |

|

|

37,885 |

|

|

5,727 |

|

|

15 |

|

|

Non-current operating lease liabilities |

|

220,101 |

|

|

214,168 |

|

|

5,933 |

|

|

3 |

|

|

Total liabilities |

|

1,934,880 |

|

|

2,012,508 |

|

|

(77,628 |

) |

|

(4) |

|

|

Total stockholders’ equity |

|

1,432,509 |

|

|

1,418,226 |

|

|

14,283 |

|

|

1 |

|

|

Total liabilities and stockholders’ equity |

$ |

3,367,389 |

|

$ |

3,430,734 |

|

$ |

(63,345 |

) |

|

(2) |

% |

(1) The allowance for doubtful accounts was $10.0 million

at September 30, 2024 and $10.6 million at September 30,

2023.(2) The inventory reserve was $28.6 million at September

30, 2024 and $25.9 million at September 30, 2023.

|

POOL CORPORATIONCondensed Consolidated

Statements of Cash Flows(Unaudited)(In thousands) |

|

|

|

|

|

|

|

|

|

|

|

Nine Months Ended |

|

|

|

|

|

|

|

September 30, |

|

|

|

|

|

|

|

2024 |

|

|

|

2023 |

|

|

|

Change |

|

|

Operating activities |

|

|

|

|

|

|

|

|

|

| Net

income |

$ |

397,025 |

|

|

$ |

471,792 |

|

|

$ |

(74,767 |

) |

|

|

Adjustments to reconcile net income to net cash provided by

operating activities: |

|

|

|

|

|

|

|

|

|

|

|

Depreciation |

|

26,848 |

|

|

|

23,355 |

|

|

|

3,493 |

|

|

|

|

Amortization |

|

6,514 |

|

|

|

6,425 |

|

|

|

89 |

|

|

|

|

Share-based compensation |

|

14,391 |

|

|

|

14,592 |

|

|

|

(201 |

) |

|

|

|

Equity in earnings of unconsolidated investments, net |

|

(180 |

) |

|

|

(235 |

) |

|

|

55 |

|

|

|

|

Goodwill impairment |

|

— |

|

|

|

550 |

|

|

|

(550 |

) |

|

|

|

Other |

|

3,123 |

|

|

|

1,157 |

|

|

|

1,966 |

|

|

|

Changes in operating assets and liabilities, net of effects of

acquisitions: |

|

|

|

|

|

|

|

|

|

|

|

Receivables |

|

(80,362 |

) |

|

|

(110,078 |

) |

|

|

29,716 |

|

|

|

|

Product inventories |

|

181,326 |

|

|

|

330,850 |

|

|

|

(149,524 |

) |

|

|

|

Prepaid expenses and other assets |

|

57,151 |

|

|

|

(23,431 |

) |

|

|

80,582 |

|

|

|

|

Accounts payable |

|

(109,021 |

) |

|

|

20,667 |

|

|

|

(129,688 |

) |

|

|

|

Accrued expenses and other liabilities |

|

(8,196 |

) |

|

|

14,374 |

|

|

|

(22,570 |

) |

|

| Net

cash provided by operating activities |

|

488,619 |

|

|

|

750,018 |

|

|

|

(261,399 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

Investing activities |

|

|

|

|

|

|

|

|

|

|

Acquisition of businesses, net of cash acquired |

|

(4,435 |

) |

|

|

(11,500 |

) |

|

|

7,065 |

|

|

|

Purchases of property and equipment, net of sale proceeds |

|

(45,951 |

) |

|

|

(42,958 |

) |

|

|

(2,993 |

) |

|

|

Other investments, net |

|

944 |

|

|

|

(48 |

) |

|

|

992 |

|

|

| Net

cash used in investing activities |

|

(49,442 |

) |

|

|

(54,506 |

) |

|

|

5,064 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Financing activities |

|

|

|

|

|

|

|

|

|

|

Proceeds from revolving line of credit |

|

1,146,900 |

|

|

|

1,154,601 |

|

|

|

(7,701 |

) |

|

|

Payments on revolving line of credit |

|

(1,274,400 |

) |

|

|

(1,497,501 |

) |

|

|

223,101 |

|

|

|

Payments on term loan under credit facility |

|

(18,750 |

) |

|

|

(6,250 |

) |

|

|

(12,500 |

) |

|

|

Proceeds from asset-backed financing |

|

623,900 |

|

|

|

465,500 |

|

|

|

158,400 |

|

|

|

Payments on asset-backed financing |

|

(606,300 |

) |

|

|

(422,700 |

) |

|

|

(183,600 |

) |

|

|

Payments on term facility |

|

— |

|

|

|

(47,313 |

) |

|

|

47,313 |

|

|

|

Proceeds from short-term borrowings and current portion of

long-term debt |

|

8,873 |

|

|

|

19,428 |

|

|

|

(10,555 |

) |

|

|

Payments on short-term borrowings and current portion of long-term

debt |

|

(8,643 |

) |

|

|

(19,182 |

) |

|

|

10,539 |

|

|

|

Payments of deferred financing costs |

|

(1,731 |

) |

|

|

(52 |

) |

|

|

(1,679 |

) |

|

|

Payments of deferred and contingent acquisition consideration |

|

— |

|

|

|

(551 |

) |

|

|

551 |

|

|

|

Proceeds from stock issued under share-based compensation

plans |

|

11,955 |

|

|

|

9,278 |

|

|

|

2,677 |

|

|

|

Payments of cash dividends |

|

(134,181 |

) |

|

|

(124,983 |

) |

|

|

(9,198 |

) |

|

|

Repurchases of common stock |

|

(159,408 |

) |

|

|

(187,110 |

) |

|

|

27,702 |

|

|

| Net

cash used in financing activities |

|

(411,785 |

) |

|

|

(656,835 |

) |

|

|

245,050 |

|

|

|

Effect of exchange rate changes on cash and cash equivalents |

|

(2,585 |

) |

|

|

952 |

|

|

|

(3,537 |

) |

|

|

Change in cash and cash equivalents |

|

24,807 |

|

|

|

39,629 |

|

|

|

(14,822 |

) |

|

|

Cash and cash equivalents at beginning of period |

|

66,540 |

|

|

|

45,591 |

|

|

|

20,949 |

|

|

|

Cash and cash equivalents at end of period |

$ |

91,347 |

|

|

$ |

85,220 |

|

|

$ |

6,127 |

|

|

ADDENDUM

Base Business

When calculating our base business results, we

exclude sales centers that are acquired, opened in new markets or

closed for a period of 15 months. We also exclude consolidated

sales centers when we do not expect to maintain the majority of the

existing business and existing sales centers that are consolidated

with acquired sales centers.

We generally allocate corporate overhead

expenses to excluded sales centers on the basis of their net sales

as a percentage of total net sales. After 15 months, we include

acquired, consolidated and new market sales centers in the base

business calculation including the comparative prior year

period.

We have not provided separate base business

income statements within this press release as our base business

results for the three and nine months ending September 30, 2024

closely approximated our consolidated results, and acquisitions and

sales centers excluded from base business contributed less than 1%

to the change in net sales.

The table below summarizes the changes in our sales center count

in the first nine months of 2024.

|

December 31, 2023 |

439 |

|

|

Acquired locations |

2 |

|

|

New locations |

9 |

|

|

Consolidated/closed locations |

(3 |

) |

|

September 30, 2024 |

447 |

|

Reconciliation of Non-GAAP Financial

Measures

The non-GAAP measures described below should be

considered in the context of all of our other disclosures in this

press release.

Adjusted EBITDA

As illustrated in detail in the reconciliation

table below, we define Adjusted EBITDA as net income or net loss

plus interest and other non-operating expenses, income taxes,

depreciation, amortization, share-based compensation, goodwill and

other impairments and equity in earnings or loss of unconsolidated

investments. Other companies may calculate Adjusted EBITDA

differently than we do, which may limit its usefulness as a

comparative measure.

Adjusted EBITDA is not a measure of performance

as determined by generally accepted accounting principles (GAAP).

We believe Adjusted EBITDA should be considered in addition to, not

as a substitute for, operating income or loss, net income or loss,

net cash flows provided by or used in operating, investing and

financing activities or other income statement or cash flow

statement line items reported in accordance with GAAP.

We have included Adjusted EBITDA as a

supplemental disclosure because management uses it to monitor our

performance, and we believe that it is widely used by our

investors, industry analysts and others as a useful supplemental

performance measure. We believe that Adjusted EBITDA, when viewed

with our GAAP results and the accompanying reconciliations,

provides an additional measure that enables management and

investors to monitor factors and trends affecting our ability to

service debt, pay taxes and fund capital expenditures.

The table below presents a reconciliation of net

income to Adjusted EBITDA.

|

(Unaudited) |

|

Three Months Ended |

|

|

Nine Months Ended |

| (In

thousands) |

|

September 30, |

|

|

September 30, |

|

|

|

|

2024 |

|

|

|

2023 |

|

|

|

2024 |

|

|

|

2023 |

|

| Net

income |

$ |

125,701 |

|

|

$ |

137,843 |

|

|

$ |

397,025 |

|

|

$ |

471,792 |

|

|

Adjustments to increase (decrease) net income: |

|

|

|

|

|

|

|

|

|

|

|

|

|

Interest and other non-operating expenses (1) |

|

12,230 |

|

|

|

13,647 |

|

|

|

39,484 |

|

|

|

47,054 |

|

|

|

Provision for income taxes |

|

38,361 |

|

|

|

43,079 |

|

|

|

119,891 |

|

|

|

149,339 |

|

|

|

Share-based compensation |

|

4,047 |

|

|

|

4,596 |

|

|

|

14,391 |

|

|

|

14,592 |

|

|

|

Equity in earnings of unconsolidated investments, net |

|

(64 |

) |

|

|

(78 |

) |

|

|

(180 |

) |

|

|

(235 |

) |

|

|

Goodwill impairment |

|

— |

|

|

|

550 |

|

|

|

— |

|

|

|

550 |

|

|

|

Depreciation |

|

9,257 |

|

|

|

8,063 |

|

|

|

26,848 |

|

|

|

23,355 |

|

|

|

Amortization (2) |

|

1,963 |

|

|

|

2,001 |

|

|

|

5,854 |

|

|

|

5,863 |

|

|

Adjusted EBITDA |

$ |

191,495 |

|

|

$ |

209,701 |

|

|

$ |

603,313 |

|

|

$ |

712,310 |

|

(1) Shown net of losses (gains) on foreign

currency transactions of $125 and $(48) for the three months ended

September 30, 2024 and September 30, 2023, respectively, and

$334 and $(727) for the nine months ended September 30, 2024 and

September 30, 2023, respectively.

(2) Excludes amortization of deferred

financing costs of $350 and $187 for the three months ended

September 30, 2024 and September 30, 2023, respectively, and

$660 and $562 for the nine months ended September 30, 2024 and

September 30, 2023, respectively. This non-cash expense is

included in Interest and other non-operating expenses, net on the

Consolidated Statements of Income.

Adjusted Diluted EPS

We have included adjusted diluted EPS, a

non-GAAP financial measure, in this press release as a supplemental

disclosure, because we believe this measure is useful to

management, investors and others in assessing our period-to-period

operating performance.

Adjusted diluted EPS is a key measure used by

management to demonstrate the impact of tax benefits from ASU

2016-09 on our diluted EPS and to provide investors and others with

additional information about our potential future operating

performance to supplement GAAP measures.

We believe this measure should be considered in

addition to, not as a substitute for, diluted EPS presented in

accordance with GAAP, and in the context of our other disclosures

in this press release. Other companies may calculate this non-GAAP

financial measure differently than we do, which may limit its

usefulness as a comparative measure.

The table below presents a reconciliation of

diluted EPS to adjusted diluted EPS.

|

(Unaudited) |

|

Three Months Ended |

|

Nine Months Ended |

|

|

|

|

September 30, |

|

September 30, |

|

|

|

|

|

2024 |

|

|

|

2023 |

|

|

|

2024 |

|

|

|

2023 |

|

|

|

Diluted EPS |

|

$ |

3.27 |

|

|

$ |

3.51 |

|

|

$ |

10.30 |

|

|

$ |

12.00 |

|

|

|

ASU 2016-09 tax benefit |

|

|

(0.01 |

) |

|

|

(0.01 |

) |

|

|

(0.21 |

) |

|

|

(0.15 |

) |

|

|

Adjusted diluted EPS |

|

$ |

3.26 |

|

|

$ |

3.50 |

|

|

$ |

10.09 |

|

|

$ |

11.85 |

|

|

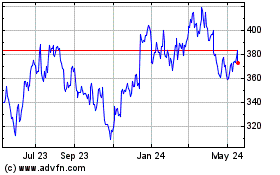

Pool (NASDAQ:POOL)

Historical Stock Chart

From Dec 2024 to Jan 2025

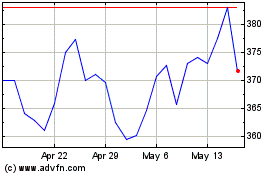

Pool (NASDAQ:POOL)

Historical Stock Chart

From Jan 2024 to Jan 2025