false

0001015383

0001015383

2025-02-19

2025-02-19

0001015383

POWW:CommonStock0.001ParValueMember

2025-02-19

2025-02-19

0001015383

POWW:Sec8.75SeriesCumulativeRedeemablePerpetualPreferredStock0.001ParValueMember

2025-02-19

2025-02-19

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

DC 20549

FORM

8-K

CURRENT

REPORT

Pursuant

to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date

of Report (Date of earliest event reported): February 19, 2025

AMMO,

INC.

(Exact

name of registrant as specified in its charter)

| Delaware |

|

001-13101 |

|

83-1950534 |

(State

or other jurisdiction of

incorporation

or organization) |

|

(Commission

File

Number) |

|

(IRS

Employer

Identification

No.) |

7681

E. Gray Rd.

Scottsdale,

Arizona 85260

(Address

of principal executive offices)

(480)

947-0001

(Registrant’s

telephone number, including area code)

(Former

name or former address, if changed since last report)

Check

the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under

any of the following provisions:

| ☐ |

Written communications

pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

|

| ☐ |

Soliciting material pursuant

to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

|

| ☐ |

Pre-commencement communications

pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

|

| ☐ |

Pre-commencement communications

pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities

registered pursuant to Section 12(b) of the Act:

| Title

of each class |

|

Trading

Symbol(s) |

|

Name

of each exchange on which registered |

| Common Stock, $0.001 par

value |

|

POWW |

|

The Nasdaq Stock Market

LLC (Nasdaq Capital Market) |

| 8.75% Series A Cumulative

Redeemable Perpetual Preferred Stock, $0.001 par value |

|

POWWP |

|

The Nasdaq Stock Market

LLC (Nasdaq Capital Market) |

Indicate

by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405

of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging

growth company ☐

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

EXPLANATORY

NOTE

As

previously disclosed, AMMO, Inc. (the “Company”) reported that the Company’s financial statements as

of and for the years ended March 31, 2024, 2023, 2022 and 2021, as well as all interim periods within such years (collectively, the “Initial

Affected Periods”), including the auditors’ reports on the financial statements for all fiscal years within the Initial

Affected Periods and the auditors’ report on internal controls for the years ended March 31, 2024 and 2023 (collectively, the “Initial

Affected Financial Statements”), should no longer be relied upon. Furthermore, as previously disclosed, the Company’s

management concluded that a material weakness existed in the Company’s internal control over financial reporting during the Initial

Affected Periods and that the Company’s disclosure controls and procedures were not effective.

| Item 3.01. |

Notice of Delisting or Failure

to Satisfy a Continued Listing Rule or Standard; Transfer of Listing. |

On

February 19, 2025, the Company received an additional deficiency notification letter (the “Notice”) from the

Listing Qualifications Staff of The Nasdaq Stock Market LLC (“Nasdaq”). The Notice indicated that the Company

was not in compliance with Nasdaq Listing Rule 5250(c)(1) (the “Listing Rule”) as a result of the Company’s

failure to timely file its Quarterly Report on Form 10-Q for the quarter ended December 31, 2024 (the “Form 10-Q”),

as described more fully in the Company’s Form 12b-25 Notification of Late Filing filed with the Securities and Exchange Commission

(the “SEC”) on February 10, 2025 (the “Form 12b-25”). The Listing Rule requires Nasdaq-listed

companies to timely file all required periodic financial reports with the SEC.

As

reported in the Form 12b-25, the Form 10-Q cannot be filed within the prescribed time period without unreasonable effort or expense because

(i) the Audit Committee of the Board of Directors (the “Audit Committee”), in consultation with the Company’s

management, has determined that the financial statements for certain historical periods must be restated and (ii) an independent investigation

(the “Investigation”) conducted by a law firm retained by a Special Committee of the Board of Directors of

the Company, while nearing its conclusion, is still ongoing.

The

Company has until March 6, 2025, to submit an updated plan to regain compliance with the Listing Rule (the “Updated Plan”).

The Company intends to timely submit the Updated Plan. Pursuant to the Notice, if Nasdaq accepts the Updated Plan, Nasdaq has the discretion

to grant the Company an exception of up to 180 calendar days (the “Compliance Period”) from the Company’s

initial delinquent filing, or until May 19, 2025, to regain compliance with the Listing Rule. While the Company cannot provide specific

timing regarding the filing of the Form 10-Q, the Company continues to work diligently to complete the Form 10-Q and intends to file

the Form 10-Q as soon as practicable to regain compliance with the Listing Rule within the Compliance Period.

No

assurance can be given that the Company will be able to regain compliance with the Listing Rule or maintain compliance with the other

continued listing requirements set forth in the Nasdaq Listing Rules. If the Company does not regain compliance with the Listing Rule

within the Compliance Period, Nasdaq could provide notice that the Company’s securities will become subject to delisting. If the

Company receives notice that its securities are being delisted, Nasdaq rules permit the Company to appeal any delisting determination

by Nasdaq staff to a hearings panel.

The

Notice has no immediate effect on the listing of the Company’s common stock or preferred stock on Nasdaq.

| Item 4.02. |

Non-Reliance

on Previously Issued Financial Statements or a Related Audit Report or Completed Interim Review. |

On

February 24, 2025, the Audit Committee, after consultation with the Company’s management and its accounting advisors and consultants,

concluded that the previously reported financial statements as of and for (i) the years ended March 31, 2020, 2019 and 2018 and December

31, 2017, (ii) all interim periods within such years and (iii) the transition period (the “Transition Period”)

from January 1, 2018 to March 31, 2018 (collectively, the “Prior Periods”), including the auditors’ reports

on the financial statements for all fiscal years within the Prior Periods and the Transition Period (collectively, the “Prior

Period Financial Statements”), should no longer be relied upon due to errors in such financial statements as addressed

in FASB ASC Topic 250, Accounting Changes and Error Corrections. Furthermore, the Company’s management concluded that a

material weakness existed in the Company’s internal control over financial reporting during the Prior Periods and that the Company’s

disclosure controls and procedures were not effective.

The

Audit Committee reached its conclusion based on a determination that the Prior Period Financial Statements contained accounting and financial

reporting errors resulting primarily from (i) inaccurate valuation of and accounting for share-based compensation awards granted to employees

and nonemployee directors, and issued in exchange for goods and services, (ii) inappropriate capitalization of certain share issuance

costs, and (iii) in appropriate accounting for certain convertible notes and warrants issued by the Company.

The

Company discussed the matters described in this Item 4.02 with the Company’s current independent registered public accounting firm,

Pannell Kerr Forster of Texas, P.C., and Marcum LLP, who served as the Company’s independent registered public accounting

firm from April 22, 2020 through April 8, 2021. The Company did not discuss the matters described in this Item 4.02with KWCO,

PC (“KWCO”), who served as the Company’s independent registered public accounting firm from April

20, 2017 to April 22, 2020, as KWCO is no longer registered with the Public Company Accounting Oversight Board.

Cautionary

Note Regarding Forward-Looking Statements

This

Current Report on Form 8-K contains express or implied “forward-looking statements” within the meaning of the “safe

harbor” provisions of the U.S. Private Securities Litigation Reform Act of 1995. Forward-looking statements can be identified by

words such as “target,” “believe,” “expect,” “will,” “may,” “anticipate,”

“estimate,” “would,” “positioned,” “future,” and other similar expressions that predict

or indicate future events or trends or that are not statements of historical matters. These forward-looking statements include, among

others, statements regarding the Company’s intent to timely submit the Updated Plan and the Company’s plans and expectations

about the completion and filing of the Form 10-Q. Forward-looking statements are neither historical facts nor assurances of future performance.

Instead, they are based only on Company management’s current beliefs, expectations and assumptions. Because forward-looking statements

relate to the future, they are subject to inherent uncertainties, risks and changes in circumstances that are difficult to predict and

many of which are outside of the Company’s control. Important factors that could cause actual results to differ materially from

those described in forward-looking statements include, but are not limited to, the timing of completion of the Investigation; Nasdaq’s

acceptance of the Updated Plan, and the duration of any extension that may be granted by Nasdaq; the potential inability to meet Nasdaq’s

continued listing requirements; uncertainties associated with the Company’s preparation of the Form 10-Q and the related financial

statements, including the possibility that accounting errors or corrections will be identified; the possibility of additional delays

in the filing of the Form 10-Q and the Company’s other SEC filings; risks related to the Company’s ability to implement and

maintain effective internal control over financial reporting in the future, which may adversely affect the accuracy and timeliness of

our financial reporting; risks related to the Company’s plans to remediate control and procedures deficiencies; and risks related

to the timing and results of the Company’s review of the effectiveness of internal control over financial reporting and related

disclosure controls and procedures. Therefore, investors should not rely on any of these forward-looking statements and should review

the risks and uncertainties described under the caption “Risk Factors” in the Company’s Annual Report on Form 10-K

filed with the SEC on June 13, 2024, and additional disclosures the Company makes in its other filings with the SEC, which are available

on the SEC’s website at www.sec.gov. Forward-looking statements are made as of the date of this Current Report on Form 8-K, and

except as provided by law, the Company expressly disclaims any obligation or undertaking to any update forward-looking statements.

| Item 7.01 | Regulation

FD Disclosure. |

On

February 25, 2025, the Company issued a press release disclosing receipt of the Notice. A copy of the press release is attached hereto

as Exhibit 99.1 and is incorporated by reference herein.

The

information in this Item 7.01, including Exhibit 99.1, is being furnished pursuant to Item 7.01 and shall not be deemed to be “filed”

for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise

be subject to the liabilities of that section, nor shall it be deemed to be incorporated by reference in any filing under the Securities

Act of 1933, as amended, or the Exchange Act, except as shall be expressly set forth by specific reference in such filing.

| Item 9.01. | Financial

Statements and Exhibits. |

(d)

Exhibits

SIGNATURES

Pursuant

to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by

the undersigned hereunto duly authorized.

| |

AMMO, INC. |

| |

|

|

| Dated: February 25, 2025 |

By: |

/s/ Jared

R. Smith |

| |

|

Jared R. Smith |

| |

|

Chief Executive Officer |

Exhibit

99.1

AMMO,

Inc. Received Notification of Deficiency from Nasdaq Related to Delayed Filing of Quarterly Report on Form 10-Q

SCOTTSDALE,

Ariz., February 25, 2025 — AMMO, Inc. (Nasdaq: POWW, POWWP) (“AMMO,” “we,” “us,” “our”

or the “Company”), the owner of GunBroker.com, the largest online marketplace serving the firearms and shooting sports industries,

and a leading vertically integrated producer of high-performance ammunition and components, today announced that it received an expected

additional deficiency notification letter from the Listing Qualifications Staff of The Nasdaq Stock Market LLC (“Nasdaq”)

on February 19, 2025 (the “Notice”). The Notice indicated that the Company was not in compliance with Nasdaq Listing Rule

5250(c)(1) (the “Listing Rule”) as a result of the Company’s failure to timely file its Quarterly Report on Form 10-Q

for the quarter ended December 31, 2024 (the “Form 10-Q”), as described more fully in the Company’s Form 12b-25 Notification

of Late Filing filed with the Securities and Exchange Commission (the “SEC”) on February 10, 2025 (the “Form 12b-25”).

The Listing Rule requires Nasdaq-listed companies to timely file all required periodic financial reports with the SEC.

As

reported in the Form 12b-25, the Form 10-Q cannot be filed within the prescribed time period without unreasonable effort or expense because

(i) the Audit Committee of the Board of Directors, in consultation with the Company’s management, has determined that the financial

statements for certain historical periods must be restated and (ii) an independent investigation (the “Investigation”) conducted

by a law firm retained by a Special Committee of the Board of Directors of the Company, while nearing its conclusion, is still ongoing.

The

Company has until March 6, 2025, to submit an updated plan to regain compliance with the Listing Rule (the “Updated Plan”).

The Company intends to timely submit the Updated Plan. Pursuant to the Notice, if Nasdaq accepts the Updated Plan, Nasdaq has the discretion

to grant the Company an exception of up to 180 calendar days (the “Compliance Period”) from the due date of the Company’s

initial delinquent filing, or until May 19, 2025, to regain compliance with the Listing Rule. While the Company cannot provide specific

timing regarding the filing of the Form 10-Q, the Company continues to work diligently to complete the Form 10-Q and intends to file

the Form 10-Q as soon as practicable to regain compliance with the Listing Rule within the Compliance Period.

No

assurance can be given that the Company will be able to regain compliance with the Listing Rule or maintain compliance with the other

continued listing requirements set forth in the Nasdaq Listing Rules. If the Company does not regain compliance with the Listing Rule

within the Compliance Period, Nasdaq could provide notice that the Company’s securities will become subject to delisting. If the

Company receives notice that its securities are being delisted, Nasdaq rules permit the Company to appeal any delisting determination

by Nasdaq staff to a hearings panel.

The

Notice has no immediate effect on the listing of the Company’s common stock or preferred stock on Nasdaq.

About

AMMO, Inc.

With

its corporate offices headquartered in Scottsdale, Arizona, AMMO designs and manufactures products for a variety of aptitudes, including

law enforcement, military, sport shooting and self-defense. The Company was founded in 2016 with a vision to change, innovate and invigorate

the complacent munitions industry. AMMO promotes its own branded munitions, including its patented STREAK™ Visual Ammunition,

/stelTH/™ subsonic munitions, and armor piercing rounds for military use. For more information, please visit: www.ammo-inc.com.

About

GunBroker.com

GunBroker.com

is the largest online marketplace dedicated to firearms, hunting, shooting and related products. Aside from merchandise bearing its logo,

GunBroker.com currently sells none of the items listed on its website. Third-party sellers list items on the site and Federal and state

laws govern the sale of firearms and other restricted items. Ownership policies and regulations are followed using licensed firearms

dealers as transfer agents. Launched in 1999, GunBroker.com is an informative, secure and safe way to buy and sell firearms, ammunition,

air guns, archery equipment, knives and swords, firearms accessories and hunting/shooting gear online. GunBroker.com promotes responsible

ownership of guns and firearms. For more information, please visit: www.gunbroker.com.

Cautionary

Note Regarding Forward Looking Statements

This

press release contains express or implied “forward-looking statements” within the meaning of the “safe harbor”

provisions of the U.S. Private Securities Litigation Reform Act of 1995. Forward-looking statements can be identified by words such as

“target,” “believe,” “expect,” “will,” “may,” “anticipate,” “estimate,”

“would,” “positioned,” “future,” and other similar expressions that predict or indicate future events

or trends or that are not statements of historical matters. These forward-looking statements include, among others, statements regarding

the Company’s intent to timely submit the Updated Plan and the Company’s plans and expectations about the completion and

filing of the Form 10-Q. Forward-looking statements are neither historical facts nor assurances of future performance. Instead, they

are based only on Company management’s current beliefs, expectations and assumptions. Because forward-looking statements relate

to the future, they are subject to inherent uncertainties, risks and changes in circumstances that are difficult to predict and many

of which are outside of the Company’s control. Important factors that could cause actual results to differ materially from those

described in forward-looking statements include, but are not limited to, the timing of completion of the Investigation; Nasdaq’s

acceptance of the Updated Plan, and the duration of any extension that may be granted by Nasdaq; the potential inability to meet Nasdaq’s

continued listing requirements; uncertainties associated with the Company’s preparation of the Form 10-Q and the related financial

statements, including the possibility that accounting errors or corrections will be identified; and the possibility of additional delays

in the filing of the Form 10-Q and the Company’s other SEC filings. Therefore, investors should not rely on any of these forward-looking

statements and should review the risks and uncertainties described under the caption “Risk Factors” in the Company’s

Annual Report on Form 10-K filed with the SEC on June 13, 2024, and additional disclosures the Company makes in its other filings with

the SEC, which are available on the SEC’s website at www.sec.gov. Forward-looking statements are made as of the date of

this press release, and except as provided by law, the Company expressly disclaims any obligation or undertaking to any update forward-looking

statements.

Investor

Contact:

CoreIR

Phone:

(212) 655-0924

IR@ammo-inc.com

Source: AMMO, Inc.

v3.25.0.1

Cover

|

Feb. 19, 2025 |

| Document Type |

8-K

|

| Amendment Flag |

false

|

| Document Period End Date |

Feb. 19, 2025

|

| Entity File Number |

001-13101

|

| Entity Registrant Name |

AMMO,

INC.

|

| Entity Central Index Key |

0001015383

|

| Entity Tax Identification Number |

83-1950534

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity Address, Address Line One |

7681

E. Gray Rd.

|

| Entity Address, City or Town |

Scottsdale

|

| Entity Address, State or Province |

AZ

|

| Entity Address, Postal Zip Code |

85260

|

| City Area Code |

(480)

|

| Local Phone Number |

947-0001

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Entity Emerging Growth Company |

false

|

| Common Stock, $0.001 par value |

|

| Title of 12(b) Security |

Common Stock, $0.001 par

value

|

| Trading Symbol |

POWW

|

| Security Exchange Name |

NASDAQ

|

| 8.75% Series A Cumulative Redeemable Perpetual Preferred Stock, $0.001 par value |

|

| Title of 12(b) Security |

8.75% Series A Cumulative

Redeemable Perpetual Preferred Stock, $0.001 par value

|

| Trading Symbol |

POWWP

|

| Security Exchange Name |

NASDAQ

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=POWW_CommonStock0.001ParValueMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=POWW_Sec8.75SeriesCumulativeRedeemablePerpetualPreferredStock0.001ParValueMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

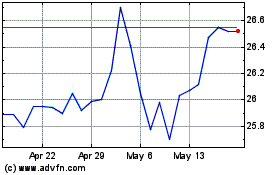

AMMO (NASDAQ:POWWP)

Historical Stock Chart

From Feb 2025 to Mar 2025

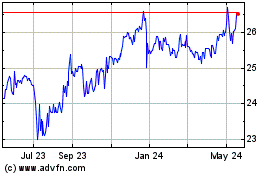

AMMO (NASDAQ:POWWP)

Historical Stock Chart

From Mar 2024 to Mar 2025