Purple Innovation Stock Jumps After Debt Refinancing

January 23 2024 - 4:16PM

Dow Jones News

By Paul Ziobro

Shares of Purple Innovation rose in after-hours trading after

the mattress company said it completed a debt refinancing that gave

it more financial flexibility.

The stock was up 9.7% to 90 cents in late trading Tuesday, after

closing down 4.2% at 82 cents in the regular session. The stock had

been down more than 85% over the last 12 months.

The Lehi, Utah-based company said Coliseum Capital Management

and No Street Capital have assumed its two primary debt facilities

from its previous lenders. The loans will be consolidated into a

new, upsized term loan of $61 million.

The transaction will bring cash and cash equivalents to around

$48 million, the company said. The company's net liquidity

preceding the transaction was around $26 million.

In connection with the new loan, Purple issued warrants to the

lenders to buy 20 million Class A shares for $1.50 each, subject to

certain adjustments.

Purple Chief Executive Rob DeMartini said the company expects

fourth-quarter net revenue and adjusted earnings before interest,

taxes, depreciation and amortization will be within its guidance

range. It also expects revenue to rise in 2024, despite challenging

industry conditions.

Write to Paul Ziobro at paul.ziobro@wsj.com

(END) Dow Jones Newswires

January 23, 2024 17:01 ET (22:01 GMT)

Copyright (c) 2024 Dow Jones & Company, Inc.

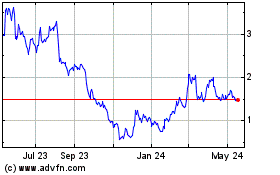

Purple Innovation (NASDAQ:PRPL)

Historical Stock Chart

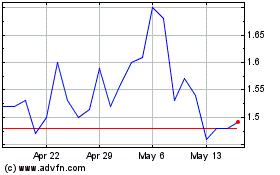

From Jan 2025 to Feb 2025

Purple Innovation (NASDAQ:PRPL)

Historical Stock Chart

From Feb 2024 to Feb 2025