As filed with the Securities and Exchange Commission on February 1, 2021

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE TO

(Rule 14d-100)

Tender Offer Statement under Section 14(d)(1) or 13(e)(1)

of the Securities Exchange Act of 1934

Prospect Capital Corporation

(Name of Subject Company (Issuer) and Filing Person (Offeror))

4.95% Senior Convertible Notes due 2022

(Title of Class of Securities)

74348TAR3

(CUSIP Number of Class of Securities)

John F. Barry III

Prospect Capital Corporation

10 East 40th Street, 42nd Floor

New York, New York 10016

(212) 448-0702

(Name, address, and telephone number of person authorized to receive notices and communications on behalf of filing persons)

Copies to:

Michael K. Hoffman, Esq.

Michael J. Schwartz, Esq.

Skadden, Arps, Slate, Meagher & Flom LLP

One Manhattan West

New York, New York 10001

(212) 735-3000

CALCULATION OF FILING FEE

|

|

|

|

|

|

|

|

|

|

|

TRANSACTION VALUATION(1)

|

|

AMOUNT OF FILING FEE(2)

|

|

$30,900,000.00

|

|

$3,371.19

|

|

|

|

|

|

|

|

|

|

|

|

(1)

|

Calculated solely for purposes of determining the amount of the filing fee. The calculation of the Transaction Valuation assumes that all $30,000,000 aggregate principal amount of the Company’s outstanding 4.95% Senior Convertible Notes due 2022 are purchased at the tender offer price of $1,030.00 per $1,000 principal amount of such notes.

|

|

(2)

|

The amount of the filing fee, calculated in accordance with Rule 0-11 of the Securities Exchange Act of 1934, as amended, and the Fee Rate Advisory #1 for Fiscal Year 2021, equals $109.10 for each $1,000,000 of the value of the transaction.

|

|

o

|

Check the box if any part of the fee is offset as provided by Rule 0-11(a)(2) and identify the filing with which the offsetting fee was previously paid. Identify persons filing by registration statement number, or the Form or Schedule and the date of its filing.

|

|

|

|

|

|

|

|

|

|

|

|

o Check the box if the filing relates solely to preliminary communications made before the commencement of a tender offer.

|

|

|

Check the appropriate boxes below to designate any transactions to which the statement relates:

|

|

|

o

|

Third-party tender offer subject to Rule 14d-1.

|

|

|

x

|

Issuer tender offer subject to Rule 13e-4.

|

|

|

o

|

Going-private transaction subject to Rule 13e-3.

|

|

|

o

|

Amendment to Schedule 13D under Rule 13d-2.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

o Check the box if the filing is a final amendment reporting the results of the tender offer.

|

This Tender Offer Statement on Schedule TO is filed by Prospect Capital Corporation, a Maryland corporation (the “Company”), and relates to the offer by the Company (the “Tender Offer”) to purchase, upon the terms and subject to the conditions set forth in the attached Offer to Purchase, dated February 1, 2021 (as it may be amended or supplemented from time to time, the “Offer to Purchase”), up to $30,000,000 aggregate principal amount of outstanding 4.95% Senior Convertible Notes due 2022 (the “Notes”), for cash in an amount equal to $1,030.00 per $1,000 principal amount of Notes purchased (exclusive of accrued and unpaid interest on such Notes).

A copy of the Offer to Purchase is filed with this Schedule TO as Exhibit (a)(1)(A) and (a)(1)(B), respectively. The Tender Offer will expire at 12:00 midnight, New York City time, on March 2, 2021 (one minute after 11:59 P.M., New York City time, on March 1, 2021), or any other date and time to which the Company extends the Tender Offer, unless earlier terminated. This Schedule TO is intended to satisfy the disclosure requirements of Rule 13e-4(c)(2) and Rule 13e-4(d)(1) under the Securities Exchange Act of 1934 (the “Exchange Act”), as amended.

The information set forth in the Offer to Purchase is incorporated by reference herein in response to Items 1 through 13 of Schedule TO, including as more specifically set forth below.

Item 1. Summary Term Sheet.

The information set forth in the Offer to Purchase under the heading “Summary Term Sheet” is incorporated herein by reference.

Item 2. Subject Company Information.

(a)Name and Address. The name of the subject company is Prospect Capital Corporation, a Maryland corporation. The Company’s principal executive offices are located at 10 East 40th Street, 42nd Floor, New York, New York 10016. The telephone number of its principal office is (212) 448-0702.

(b)Securities. The securities that are the subject of the Tender Offer are the Company’s outstanding Notes. As of January 29, 2021, there were $136,228,000 aggregate principal amount of Notes outstanding. The information set forth in the Offer to Purchase under the heading “Summary Term Sheet” is incorporated herein by reference.

(c)Trading Market and Price. The information set forth in the Offer to Purchase under the heading “Market Price Information” is incorporated herein by reference.

Item 3. Identity and Background of Filing Person.

(a)Name and Address. The name of the filing person is Prospect Capital Corporation, a Maryland corporation. The Company’s principal executive offices are located at 10 East 40th Street, 42nd Floor, New York, New York 10016. The telephone number of its principal office is (212) 448-0702. The filing person is the subject person.

The following persons are directors and executive officers of Prospect Capital Corporation.

|

|

|

|

|

|

|

|

Name

|

Position

|

|

John F. Barry III

|

Director, Chairman of the Board and Chief Executive Officer

|

|

M. Grier Eliasek

|

Director, President and Chief Operating Officer

|

|

Andrew C. Cooper

|

Lead Independent Director

|

|

William J. Gremp

|

Director

|

|

Eugene S. Stark

|

Director

|

|

Kristin Van Dask

|

Chief Financial Officer, Chief Compliance Officer, Treasurer and Secretary

|

The business address and telephone number for all of the above directors and executive officers are c/o Prospect Capital Corporation, 10 East 40th Street, 42nd Floor, New York, New York 10016 and (212) 448-0702.

Item 4. Terms of the Transaction.

(a)Material Terms. The information set forth in the Offer to Purchase under the headings “Summary Term Sheet,” “The Tender Offer,” “Certain Considerations,” “Source of Funds” and “Certain U.S. Federal Income Tax Considerations” is incorporated herein by reference.

(b)Purchases. To the knowledge of the Company, based on reasonable inquiry, no Notes are owned by the Company or any officer, director or affiliate of any of the foregoing and therefore no Notes will be acquired from the Company or any officer, director or affiliate of the foregoing. The information set forth in the Offer to Purchase under the heading “Interest of Directors and Executive Officers; Transactions and Arrangements Concerning the Notes” is incorporated herein by reference.

Item 5. Past Contacts, Transactions, Negotiations and Agreements.

(e)Agreements Involving the Subject Company’s Securities. The Company is a party to the following agreements, arrangements or understandings that involve its subject securities:

•Supplemental Indenture (including the form of Note), dated as of April 11, 2017, by and between Prospect Capital Corporation and U.S. Bank National Association, as Trustee (filed as Exhibit 4.1 to the Company’s Current Report on Form 8-K, filed on April 11, 2017 and incorporated herein by reference).

•Indenture, dated as of February 16, 2012, between Prospect Capital Corporation and American Stock Transfer & Trust Company, LLC, as trustee (the “Original Trustee”) (filed as Exhibit (d)(7) to Post-Effective Amendment No. 1, filed on March 1, 2012 and incorporated herein by reference), as amended by the Agreement of Resignation, Appointment and Acceptance, dated as of March 12, 2012, by and among Prospect Capital Corporation, the Original Trustee and U.S. Bank National Association, as Trustee (filed as Exhibit (d)(13) to Post-Effective Amendment No. 3, filed on March 14, 2012 and incorporated herein by reference).

The information set forth in the documents referred to under the heading “Where You Can Find More Information” in the Offer to Purchase is incorporated herein by reference.

The information set forth in the Offer to Purchase under the headings “Summary Term Sheet,” “Interests of Directors and Executive Officers; Transactions and Arrangements Concerning the Notes,” “Certain Considerations-Treatment of Notes Not Tendered in the Tender Offer” and “The Information and Tender Agent” is incorporated herein by reference.

For information regarding the Company’s dividend reinvestment and direct stock purchase plan, see the information set forth in the Offer to Purchase under the heading “Dividend Reinvestment and Direct Stock Purchase Plan,” which is incorporated herein by reference.

Item 6. Purposes of the Transaction and Plans or Proposals.

(a)Purposes. The information set forth in the Offer to Purchase under the heading “The Tender Offer-Purpose of the Tender Offer” is incorporated herein by reference.

(b)Use of Securities Acquired. The information set forth in the Offer to Purchase under the heading “The Tender Offer-Payment for Notes” is incorporated herein by reference.

(c)Plans. At any given time, the Company may be evaluating or in discussions regarding one or more strategic transactions although, the Company currently has no material plans, proposals or negotiations described in Item 1006(c) of Regulation M-A under the Exchange Act to disclose at this time. The information set forth in the Offer to Purchase including under the headings “Certain Considerations-Treatment of Notes Not Tendered in the Tender Offer” and “Source of Funds” (and the documents incorporated by reference therein) is incorporated herein by reference.

Item 7. Source and Amount of Funds or Other Consideration.

The information in the Offer to Purchase under the headings “The Tender Offer-Conditions to the Tender Offer,” “Certain Considerations-Conditions to the Consummation of the Tender Offer” and “Source of Funds” is incorporated herein by reference in response to Regulation M-A Items 7(a), (b) and (d).

Item 8. Interest in Securities of the Subject Company.

(a)Securities Ownership. To the knowledge of the Company, based on reasonable inquiry, no Notes are owned by the Company or any officer, director or affiliate of any of the foregoing and therefore no Notes will be acquired from the Company or any officer, director or affiliate of the foregoing. The information set forth in the Offer to Purchase under the heading “Interest of Directors and Executive Officers; Transactions and Arrangements Concerning the Notes” is incorporated herein by reference.

(b)Securities Transactions. The information set forth in the Offer to Purchase under the heading “Interest of Directors and Executive Officers; Transactions and Arrangements Concerning the Notes” is incorporated herein by reference.

Item 9. Persons/Assets, Retained, Employed, Compensated or Used.

(a)Solicitations or Recommendations. The information set forth in the Offer to Purchase under the headings “Summary Term Sheet” and “The Information and Tender Agent” is incorporated herein by reference.

Item 10. Financial Statements.

(a)Financial Statements. Not applicable.

(b)Pro Forma. Not applicable.

Item 11. Additional Information.

(a)Agreements, Regulatory Requirements and Legal Proceedings. Not applicable.

(c) Other Material Information. The information contained in the Offer to Purchase is incorporated herein by reference.

Item 12. Exhibits.

|

|

|

|

|

|

|

Exhibit

No.

|

Description

|

|

(a)(1)(A)

|

Offer to Purchase, dated February 1, 2021.

|

|

(a)(5)

|

Press Release, dated February 1, 2021, incorporated by reference to Exhibit 99.1 to the Company’s Current Report on Form 8-K, filed on February 1, 2021.

|

|

(b)

|

Sixth Amended and Restated Loan and Servicing Agreement, dated August 1, 2018, among Prospect Capital Funding LLC, Prospect Capital Corporation, the lenders from time to time party thereto, the managing agents from time to time party thereto, U.S. Bank National Association as Calculation Agent, Paying Agent and Documentation Agent, KeyBank National Association as Facility Agent, Key Equipment Finance Inc. and Royal Bank of Canada as Syndication Agents, and KeyBank National Association as Structuring Agent, Sole Lead Arranger and Sole Bookrunner (filed as Exhibit 10.1 to the Company’s Current Report on Form 8-K, filed on August 6, 2018 and incorporated herein by reference).

|

|

(d)(1)

|

Supplemental Indenture, dated as of April 11, 2017, by and between Prospect Capital Corporation and U.S. Bank National Association, as Trustee (filed as Exhibit 4.1 to the Company’s Current Report on Form 8-K, filed on April 11, 2017 and incorporated herein by reference).

|

|

(d)(2)

|

Indenture, dated as of February 16, 2012, between Prospect Capital Corporation and American Stock Transfer & Trust Company, LLC, as Trustee (filed as Exhibit (d)(7) to Post-Effective Amendment No. 1, filed on March 1, 2012 and incorporated herein by reference).

|

|

(d)(3)

|

Agreement of Resignation, Appointment and Acceptance, dated as of March 12, 2012, by and among Prospect Capital Corporation, American Stock Transfer & Trust Company, LLC, as Retiring Trustee, and U.S. Bank National Association, as Successor Trustee (filed as Exhibit (d)(13) to Post-Effective Amendment No. 3, filed on March 14, 2012 and incorporated herein by reference).

|

|

(g)

|

Not applicable.

|

|

(h)

|

Not applicable.

|

Item 13. Information Required by Schedule 13E-3.

Not applicable.

SIGNATURE

After due inquiry and to the best of my knowledge and belief, I certify that the information set forth in this statement is true, complete and correct.

|

|

|

|

|

|

|

PROSPECT CAPITAL CORPORATION

|

|

|

|

By: /s/ M. Grier Eliasek

|

|

Name: M. Grier Eliasek

|

|

Title: President and Chief Operating Officer

|

Dated: February 1, 2021

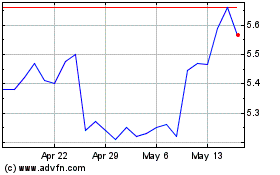

Prospect Capital (NASDAQ:PSEC)

Historical Stock Chart

From Jun 2024 to Jul 2024

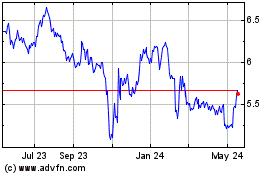

Prospect Capital (NASDAQ:PSEC)

Historical Stock Chart

From Jul 2023 to Jul 2024