false

0001377121

0001377121

2025-02-21

2025-02-21

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section

13 or 15(d)

of the Securities

Exchange Act of 1934

Date of Report (Date of earliest event

reported): February 21, 2025

PROTAGONIST THERAPEUTICS, INC.

(Exact name of registrant as specified

in its charter)

| Delaware |

|

001-37852 |

|

98-0505495 |

(State or other jurisdiction

of incorporation) |

|

(Commission

File Number) |

|

(IRS Employer

Identification No.) |

Protagonist Therapeutics, Inc.

7707 Gateway Blvd., Suite 140

Newark, California 94560-1160

(Address of principal executive offices,

including zip code)

(510) 474-0170

(Registrant’s telephone number, including

area code)

Not Applicable

(Former name or former address, if changed

since last report.)

Check the appropriate box below if the Form 8-K filing is intended

to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| ¨ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ¨ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ¨ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ¨ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class |

|

Trading Symbol(s) |

|

Name of each exchange on which

registered |

| Common Stock, par value $0.00001 |

|

PTGX |

|

The Nasdaq Stock Market LLC |

Indicate by check mark whether the registrant is an emerging

growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities

Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ¨

If an emerging

growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any

new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ¨

Item 2.02. Results of Operations

and Financial Condition.

On February 21, 2025, Protagonist Therapeutics,

Inc. reported its financial results for the fourth quarter and full year ended December 31, 2024. A copy of the press release titled “Protagonist

Reports Fourth Quarter and Full Year 2024 Financial Results and Provides Corporate Update” is furnished pursuant to Item 2.02 as

Exhibit 99.1 hereto and is incorporated herein by reference.

Item 9.01 Financial Statements

and Exhibits.

(d) Exhibits

The information in this report, including the exhibit hereto, shall

not be deemed to be “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended, or otherwise

subject to the liabilities of Section 11 and 12(a)(2) of the Securities Act of 1933, as amended. The information contained herein

and in the accompanying exhibit shall not be incorporated by reference into any filing with the U.S. Securities and Exchange Commission

made by Protagonist Therapeutics, Inc., whether made before or after the date hereof, regardless of any general incorporation language

in such filing.

SIGNATURE

Pursuant to the requirements of the Securities Exchange

Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| |

Protagonist Therapeutics, Inc. |

| Dated: February 21, 2025 |

|

| |

By: |

/s/ Asif Ali |

| |

Asif Ali |

| |

|

Chief Financial Officer |

Exhibit

99.1

Protagonist

Reports Fourth Quarter and Full Year 2024 Financial Results and Provides Corporate Update

$165.0

million icotrokinra (formerly JNJ-2113) milestone earned in Q4 2024, received in January 2025

PN-881,

a potential best-in-class oral IL-17 receptor antagonist peptide nominated as a development candidate in Q4 2024

Topline results for rusfertide Phase 3 VERIFY clinical trial in polycythemia vera expected in March 2025

Topline results for icotrokinra Phase 2b ANTHEM clinical trial in moderate to severe ulcerative colitis expected in March 2025

Cash,

cash equivalents, and marketable securities of $559.2 million as of December 31, 2024, combined with $165.0 million milestone payment,

anticipated to provide cash runway through at least end of 2028

NEWARK,

Calif., February 21, 2025 – Protagonist Therapeutics (Nasdaq: PTGX) (“Protagonist” or “the

Company”) today reported financial results for the fourth quarter and full year ended December 31, 2024, and provided a corporate

update.

“Protagonist

is quickly approaching multiple late-stage transformational events expected in the first quarter of this year, including the topline

results from the VERIFY Phase 3 study of rusfertide in polycythemia vera and from the ANTHEM Phase 2b ulcerative colitis study of icotrokinra”,

said Dinesh V. Patel, Ph.D., the Company’s President and CEO. “In addition, we look forward to progressing oral IL-17 peptide

antagonist PN-881 in clinical studies and nominating new development candidates from the oral obesity and oral hepcidin programs

this year. We are fortunate to be in a strong cash position, enabling the flexibility to progress these early-stage peptide drug candidates

independently into pre-clinical and clinical proof-of-concept studies over the coming years.”

2024

Key Highlights

Worldwide License and Collaboration

Agreement for Rusfertide with Takeda

| · | On

January 31, 2024, the Company and Takeda announced a worldwide license and collaboration

agreement for rusfertide (the “Takeda License and Collaboration Agreement”).

The Company received an upfront cash payment of $300.0 million in April 2024 and is eligible to receive

up to $330.0 million in development, regulatory, and sales milestones, for a potential deal

value of up to $630.0 million, as well as an equal share of profits and losses in the U.S.

and royalties on net sales outside the U.S. |

| · | Under the terms of the agreement, the Company has the right to opt-out of

the 50:50 profit share after NDA filing. In that event, the Company would be eligible to receive opt-out fees of up to $400 million and

enhanced milestones of up to $975 million, as well as royalties on worldwide net sales. Takeda would maintain full ex-U.S. rights

under either scenario. |

Two

articles published in the New England Journal of Medicine (“NEJM”) in February 2024

| · | On February 7, 2024, the icotrokinra

Phase 2b FRONTIER 1 trial results in adults living with moderate-to-severe plaque psoriasis were published in the NEJM. |

| · | On February 21, 2024, the complete

Phase 2 REVIVE trial results for rusfertide, including efficacy and safety, were published in the NEJM. |

S&P

SmallCap 600 Index

| · | The Company joined the Index on July

3, 2024. |

Icotrokinra: Oral IL-23 Receptor

Antagonist

| · | Positive

topline results for the Phase 3 ICONIC-LEAD and ICONIC-TOTAL studies1 in moderate to severe plaque psoriasis, were reported

in Q4 2024. |

| o | In the ICONIC-LEAD study, once-daily icotrokinra

showed significant skin clearance versus placebo in adults and adolescents with moderate

to severe plaque psoriasis. At week 16, nearly two-thirds (64.7%) of patients treated with

icotrokinra achieved IGA3 scores of 0/1 (clear or almost clear skin), and 49.6% achieved

PASI 90, compared to 8.3% and 4.4% on placebo, respectively. Further increases in response

rates continued to be observed at week 24, with 74.1% of patients treated with icotrokinra

achieving IGA scores of 0/1, and 64.9% achieving PASI 90. Safety data was consistent with

the Phase 2 FRONTIER 1 and 2 studies. |

| o | A similar proportion of patients experienced

adverse events (AEs) between icotrokinra and placebo, with 49.3% and 49.1% of participants

experiencing a treatment emergent adverse event (TEAE) at week 16. In addition, positive

topline results from the Phase 3 ICONIC-TOTAL study showed once-daily icotrokinra met the

primary endpoint of IGA of 0/1 at week 16 compared to placebo. |

1

ICONIC-LEAD (NCT06095115) and ICONIC-TOTAL (NCT06095102)

Nomination

of PN-881, a potential best-in-class oral peptide IL-17 antagonist development candidate; additional discovery programs announced

| · | On

November 21, 2024, the Company announced the nomination of PN-881 following extensive preclinical

studies, including oral stability, potency, tissue distribution, and pharmacokinetics measurements,

and evaluation in immunologic pharmacodynamics and preclinical efficacy models. PN-881 demonstrated

in vitro blockade of IL-17 AA homodimer, FF homodimer and AF heterodimer. It demonstrated

approximately 100-fold greater potency than secukinumab, and similar potency to the most

potent approved antibody drugs and nanobody therapeutics currently in development. |

| · | The Company

expects expect to nominate an oral development candidate in the hepcidin mechanism-based hematology

program in Q4 2025, and an oral peptide-based development candidate in the metabolic/obesity

program in Q2 2025. |

Achievement

of a $165.0 million milestone

Under

the terms of the icotrokinra license and collaboration agreement with JNJ, as amended in November 2024, the Company earned a $165.0

million milestone during Q4 2024. The $165.0 million was received in January 2025.

Recent

and Upcoming Milestones

Rusfertide

| · | Protagonist

held an in-person PV Day on February 6, 2025, in New York; a replay of the webcast is available

at https://lifescievents.com/event/protagonist/ |

| | | |

| · | The

topline data for the Phase 3 VERIFY study2 in PV, which has a 32-week primary

efficacy endpoint, is expected in March of 2025. |

Icotrokinra

| · | Topline results for the Phase 2b ANTHEM multicenter, randomized, placebo- controlled, dose-ranging

study of icotrokinra for the treatment of moderately to severely active ulcerative colitis3,

are expected in March 2025. |

| | | |

| · | Topline results for the Phase 3 ICONIC-ADVANCE 1 and ICONIC-ADVANCE 2 superiority studies4, evaluating the safety and efficacy

of icotrokinra compared with both placebo and deucravacitinib in moderate to severe plaque psoriasis, are expected in Q2 2025. |

| · | Further

details of the Phase 3 ICONIC-LEAD and ICONIC-TOTAL studies are expected to be presented

at major medical conferences this year. |

2

VERIFY (NCT05210790)

3

ANTHEM (NCT06049017)

4

ICONIC-ADVANCE 1 (NCT06143878) and ICONIC-ADVANCE 2 (NCT06220604)

Discovery

Programs

| · | The

Company expects to nominate an oral peptide-based development candidate in the obesity program

in Q2 2025, and an oral development candidate in the hepcidin mechanism-based hematology

program in Q4 2025. |

Fourth Quarter and Full Year 2024

Financial Results

Cash, Cash Equivalents,

and Marketable Securities: Cash, cash equivalents and marketable securities as of December 31, 2024, were $559.2 million as compared

to $341.6 million in the previous year.

| | |

Three Months Ended | | |

Twelve Months Ended | |

| | |

December 31, | | |

December 31, | |

| (in thousands, except per share amounts) | |

2024 | | |

2023 | | |

2024 | | |

2023 | |

| License and collaboration revenue | |

$ | 170,638 | | |

$ | 60,000 | | |

$ | 434,433 | | |

$ | 60,000 | |

| Research and development expense | |

$ | 34,904 | | |

$ | 28,899 | | |

$ | 138,128 | | |

$ | 120,161 | |

| General and administrative expense | |

$ | 8,954 | | |

$ | 8,052 | | |

$ | 43,462 | | |

$ | 33,491 | |

| Net income (loss) | |

$ | 131,674 | | |

$ | 27,335 | | |

$ | 275,188 | | |

$ | (78,955 | ) |

| Basic earnings (loss) per share | |

$ | 2.11 | | |

$ | 0.45 | | |

$ | 4.47 | | |

$ | (1.39 | ) |

| Diluted earnings (loss) per share | |

$ | 1.98 | | |

$ | 0.44 | | |

$ | 4.23 | | |

$ | (1.39 | ) |

Revenue: License

and collaboration revenue is derived from the Company’s License and Collaboration Agreement with Johnson & Johnson

(JNJ), as amended in November 2024 (the “JNJ Agreement”), and its Worldwide License and Collaboration Agreement for

Rusfertide with Takeda which became effective in March 2024 (the “Takeda Agreement”). Total License and collaboration

revenue increased by $374.4 million from $60.0 million for the year ended December 31, 2023, to $434.4 million for the year ended

December 31, 2024. The increase was attributable to:

| · | Revenue

recorded during the year ended December 31, 2024, pursuant to the Takeda Agreement, of 269.4

million; and |

| · | Revenue

from the JNJ Agreement which increased by $105.0 million for the year ended December 31,

2024, as compared to the prior year. The revenue reflects the achievement of non-refundable

milestones of $165.0 million and $60.0 million for the years ended December 31, 2024, and

2023, respectively. |

Research and Development

("R&D") Expenses: Increased by $6.0 million and $18.0 million for the fourth quarter and full year 2024, respectively,

from the prior year periods. The increases were due primarily to increases in drug discovery and pre-clinical research expenses.

General and Administrative

("G&A") Expenses: Increased by $0.9 million for the three months ended December 31, 2024, from the prior year period

primarily due to an increase in stock-based compensation. The increase of $10.0 million for the full year 2024 as compared to the prior

year was primarily due to $4.6 million in one-time advisory and legal fees related to the Takeda Collaboration Agreement and an increase

of $4.4 million in stock-based compensation and other personnel-related expenses.

Net Income (Loss):

Net income was $131.7 million, or $2.11 per basic share and $1.98 per diluted share, for the fourth quarter of 2024 as compared to net

income of $27.3 million, or $0.45 per basic and $0.44 per diluted share, for the fourth quarter of 2023. Net income was $275.2 million,

or $4.47 per basic share and $4.23 per diluted share, for the full year 2024, as compared to a net loss of $(79.0) million, or ($1.39)

per share, for the full year 2023.

About

Protagonist

Protagonist

Therapeutics is a discovery through late-stage development biopharmaceutical company. Two novel peptides derived from Protagonist’s

proprietary discovery platform are currently in advanced Phase 3 clinical development, with New Drug Application submissions to the FDA

potentially in 2025. Icotrokinra (formerly, JNJ-2113) is a first-in-class investigational targeted oral peptide that selectively blocks

the Interleukin-23 receptor (“IL-23R”) which is licensed to JNJ Innovative Medicines (“JNJ”), formerly Janssen

Biotech, Inc. Following icotrokinra’s joint discovery by Protagonist and JNJ scientists pursuant to the companies’ IL-23R

collaboration, Protagonist was primarily responsible for development of icotrokinra through Phase 1, with JNJ assuming responsibility

for development in Phase 2 and beyond. Rusfertide, a mimetic of the natural hormone hepcidin, is currently in Phase 3 development for

the rare blood disorder polycythemia vera (PV). Rusfertide is being co-developed and will be co-commercialized with Takeda Pharmaceuticals

pursuant to a worldwide collaboration and license agreement entered into in 2024 under which the Company remains primarily responsible

for development through NDA filing. The Company also has a number of pre-clinical stage oral drug discovery programs addressing clinically

and commercially validated targets, including IL-17 oral peptide antagonist PN-881, oral hepcidin program, and oral obesity program.

More

information on Protagonist, its pipeline drug candidates and clinical studies can be found on the Company's website at https://www.protagonist-inc.com/.

Cautionary

Note on Forward-Looking Statements

This press release

contains forward-looking statements for purposes of the safe harbor provisions of the Private Securities Litigation Reform Act of 1995.

Forward-looking statements include statements regarding the potential benefits of icotrokinra and rusfertide, the timing of icotrokinra

and rusfertide clinical trials, and timing of developments and announcements in our discovery programs. In some cases, you can identify

these statements by forward-looking words such as "anticipate," "believe," "may," "will," "expect,"

or the negative or plural of these words or similar expressions. Forward-looking statements are not guarantees of future performance

and are subject to risks and uncertainties that could cause actual results and events to differ materially from those anticipated, including,

but not limited to, our ability to develop and commercialize our product candidates, our ability to earn milestone payments under our

collaboration agreements with Janssen and Takeda, our ability to use and expand our programs to build a pipeline of product candidates,

our ability to obtain and maintain regulatory approval of our product candidates, our ability to operate in a competitive industry and

compete successfully against competitors that have greater resources than we do, and our ability to obtain and adequately protect intellectual

property rights for our product candidates. Additional information concerning these and other risk factors affecting our business can

be found in our periodic filings with the Securities and Exchange Commission, including under the heading "Risk Factors" contained

in our most recently filed periodic reports on Form 10-K and Form 10-Q filed with the Securities and Exchange Commission. Forward-looking

statements are not guarantees of future performance, and our actual results of operations, financial condition and liquidity, and the

development of the industry in which we operate, may differ materially from the forward-looking statements contained in this press release.

Any forward-looking statements that we make in this press release speak only as of the date of this press release. We assume no obligation

to update our forward-looking statements, whether as a result of new information, future events or otherwise, after the date of this

press release.

Investor

Relations Contact

Corey

Davis, Ph.D.

LifeSci

Advisors

cdavis@lifesciadvisors.com

+1 212 915 2577

Media Relations

Contact

Virginia

Amann

ENTENTE Network of Companies

virginiaamann@ententeinc.com

+1 833 500 0061

PROTAGONIST

THERAPEUTICS, INC.

Consolidated

Statements of Operations

(Amounts

in thousands except share and per share data)

| | |

Three Months Ended | | |

Twelve Months Ended | |

| | |

December 31, | | |

December 31, | |

| | |

2024 | | |

2023 | | |

2024 | | |

2023 | |

| License and collaboration revenue | |

$ | 170,638 | | |

$ | 60,000 | | |

$ | 434,433 | | |

$ | 60,000 | |

| Operating expense: | |

| | | |

| | | |

| | | |

| | |

| Research and development (1) | |

| 34,904 | | |

| 28,899 | | |

| 138,128 | | |

| 120,161 | |

| General and administrative (1) | |

| 8,954 | | |

| 8,052 | | |

| 43,462 | | |

| 33,491 | |

| Total operating expense | |

| 43,858 | | |

| 36,951 | | |

| 181,590 | | |

| 153,652 | |

| Income (loss) from operations | |

| 126,780 | | |

| 23,049 | | |

| 252,843 | | |

| (93,652 | ) |

| Interest income | |

| 6,853 | | |

| 4,242 | | |

| 26,315 | | |

| 14,898 | |

| Other income (expense), net | |

| 31 | | |

| 44 | | |

| 250 | | |

| (201 | ) |

| Income (loss) before income tax expense | |

| 133,664 | | |

| 27,335 | | |

| 279,408 | | |

| (78,955 | ) |

| Income tax expense | |

| 1,990 | | |

| - | | |

| 4,220 | | |

| - | |

| Net income (loss) | |

$ | 131,674 | | |

$ | 27,335 | | |

$ | 275,188 | | |

$ | (78,955 | ) |

| Net income (loss) per share, basic | |

$ | 2.11 | | |

$ | 0.45 | | |

$ | 4.47 | | |

$ | (1.39 | ) |

| Net income (loss) per share, diluted | |

$ | 1.98 | | |

$ | 0.44 | | |

$ | 4.23 | | |

$ | (1.39 | ) |

| Weighted-average shares used to compute net income (loss) per share, basic | |

| 62,328,468 | | |

| 60,387,606 | | |

| 61,566,989 | | |

| 56,763,559 | |

| Weighted-average shares used to compute net income (loss) per share, diluted | |

| 66,406,817 | | |

| 61,796,205 | | |

| 65,077,722 | | |

| 56,763,559 | |

(1) Amount

includes non-cash stock-based compensation expense.

Stock-based

Compensation

(In

thousands)

| | |

Three Months Ended | | |

Twelve Months Ended | |

| | |

December 31, | | |

December 31, | |

| | |

2024 | | |

2023 | | |

2024 | | |

2023 | |

| Research and development | |

$ | 5,322 | | |

$ | 3,890 | | |

$ | 20,919 | | |

$ | 17,061 | |

| General and administrative | |

| 3,771 | | |

| 2,711 | | |

| 16,635 | | |

| 12,232 | |

| Total stock-based compensation expense | |

$ | 9,093 | | |

$ | 6,601 | | |

$ | 37,554 | | |

$ | 29,293 | |

PROTAGONIST

THERAPEUTICS, INC.

Selected

Consolidated Balance Sheet Data

(In

thousands)

| | |

December 31, | | |

December 31, | |

| | |

2024 | | |

2023 | |

| Cash, cash equivalents and marketable securities | |

$ | 559,165 | | |

$ | 341,617 | |

| Working capital | |

| 544,243 | | |

| 334,303 | |

| Total assets | |

| 744,725 | | |

| 357,951 | |

| Deferred revenue | |

| 30,567 | | |

| - | |

| Accumulated deficit | |

| (340,522 | ) | |

| (615,710 | ) |

| Total stockholders' equity | |

| 675,295 | | |

| 336,677 | |

v3.25.0.1

Cover

|

Feb. 21, 2025 |

| Cover [Abstract] |

|

| Document Type |

8-K

|

| Amendment Flag |

false

|

| Document Period End Date |

Feb. 21, 2025

|

| Entity File Number |

001-37852

|

| Entity Registrant Name |

PROTAGONIST THERAPEUTICS, INC.

|

| Entity Central Index Key |

0001377121

|

| Entity Tax Identification Number |

98-0505495

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity Address, Address Line One |

7707 Gateway Blvd.

|

| Entity Address, Address Line Two |

Suite 140

|

| Entity Address, City or Town |

Newark

|

| Entity Address, State or Province |

CA

|

| Entity Address, Postal Zip Code |

94560-1160

|

| City Area Code |

510

|

| Local Phone Number |

474-0170

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Common Stock, par value $0.00001

|

| Trading Symbol |

PTGX

|

| Security Exchange Name |

NASDAQ

|

| Entity Emerging Growth Company |

false

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

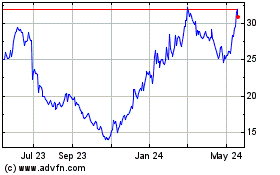

Protagonist Therapeutics (NASDAQ:PTGX)

Historical Stock Chart

From Jan 2025 to Feb 2025

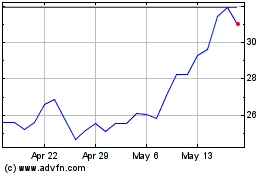

Protagonist Therapeutics (NASDAQ:PTGX)

Historical Stock Chart

From Feb 2024 to Feb 2025