CHICAGO, IL , announced today the anticipated listing of a

NASDAQ-100 BuyWrite portfolio and a Nasdaq Internet portfolio. Both

new ETFs are expected to begin trading June 12, 2008, on the NASDAQ

Stock Market.

The anticipated ticker symbols and ETF portfolio names

follow:

-- PQBW - PowerShares NASDAQ-100 BuyWrite Portfolio

-- PNQI - PowerShares Nasdaq Internet Portfolio

"The PowerShares NASDAQ-100 BuyWrite Portfolio provides a

convenient, lower cost way for investors to access a covered call

strategy on the 100 largest non-financial companies listed on the

NASDAQ," said Bruce Bond, president and CEO of Invesco PowerShares.

"Investors may use this product to complement the PowerShares

QQQ(TM) in their portfolios.

"Additionally, the PowerShares Nasdaq Internet Portfolio

represents one of the broadest ETF internet funds available to

investors, and delivers the added benefits inherent to the ETF

structure."

The PowerShares NASDAQ-100 BuyWrite Portfolio (PQBW) is based on

the CBOE NASDAQ-100 BuyWrite Index(TM). The Index measures the

total rate of return of an NASDAQ-100� covered call strategy, which

consists of holding a portfolio indexed to the NASDAQ-100, and

selling a succession of one-month at-the-money NASDAQ-100� call

options. The CBOE NASDAQ-100 BuyWrite Index(TM) assumes that call

options are written on the third Friday of each month, held until

their expiration, and exercised options are settled in cash.

The PowerShares Nasdaq Internet Portfolio (PNQI) is based on the

NASDAQ Internet Index. The Index is designed to track the

performance of the largest and most liquid U.S.-listed companies

engaged in internet-related businesses. The modified market

capitalization index is rebalanced quarterly, and includes internet

software and services companies that are involved in

internet-related services, internet software, website services and

e-commerce.

Invesco PowerShares is leading the intelligent ETF revolution

through its family of more than 100 domestic, international and

active exchange-traded funds. With assets under management as of

April 30, 2008 of $13.86 billion, PowerShares ETFs trade on all of

the major U.S. stock exchanges that trade ETFs. For more

information, please visit us at www.invescopowershares.com.

Invesco PowerShares is a part of Invesco Ltd., a leading

independent global investment management company dedicated to

helping people worldwide build their financial security. By

delivering the combined power of its distinctive worldwide

investment management capabilities, including AIM, Atlantic Trust,

Invesco, Perpetual, PowerShares, Trimark, and WL Ross, Invesco

provides a comprehensive array of enduring investment solutions for

retail, institutional and high-net-worth clients around the world.

Operating in 20 countries, the company is currently listed on the

New York Stock Exchange under the symbol IVZ. Additional

information is available at www.invesco.com.

There are risks involved with investing in ETFs including

possible loss of money. Shares are not actively managed and are

subject to risk similar to stocks and covered call options, as well

as those risks related to short selling and margin maintenance.

Options strategies used by the fund may not be suitable for all

investors.

Shares are not FDIC insured, may lose value and have no bank

guarantee.

PowerShares NASDAQ-100 BuyWrite Portfolio Risk Information

There are additional risks involved in writing (selling) covered

call options on the stocks of the S&P 500 Index (Index). The

Fund, by writing covered call options on this Index, will give up

the opportunity to benefit from potential increases in the value of

the index stocks above the exercise prices of the options, but will

continue to bear the risk of declines in the value of the Index.

The premiums received from the options may not be sufficient to

offset any losses sustained from the volatility of the Index over

time.

In addition, exchanges may suspend trading of options in

volatile markets. If trading is suspended, the Fund may be unable

to write (sell) options at times that may be desirable or

advantageous for the Fund to do so. Trading suspensions may limit

the Fund's ability to achieve its investment objectives. The Fund

may be required to sell investments from its portfolio to make cash

settlement on (or transfer ownership of an Index stock to

physically settle) any options that are exercised. Such sales (or

transfers) may occur at inopportune times, and the Fund may incur

transaction costs that increase its expenses.

PowerShares NASDAQ Internet Portfolio Risk Information

The Fund is considered to be concentrated in the internet

software and services sector. This involves risks not associated

with a more diversified investment. These risks include, but are

not limited to, the internet software and services sector can be

significantly affected by competitive pressures, such as

technological developments, fixed-rate pricing and the ability to

attract and retain skilled employees, and the success of companies

in the industry is subject to the continued demand for internet

services. For example, as product cycles shorten and manufacturing

capacity increases, these companies could become increasingly

subject to aggressive pricing, which hampers profitability.

Profitability can also be affected by changing domestic and

international demand, research and development costs, availability

and price of components and product obsolescence.

Investing in securities of small and medium capitalization

companies involves greater risk than is customarily associated with

investing in larger, more established companies. These companies'

securities may be more volatile and less liquid than those of more

established companies. These securities may have returns that vary,

sometimes significantly, from the overall securities market. Often

small and medium capitalization companies and the industries in

which they are focused are still evolving and this may make them

more sensitive to changing market conditions.

The Chicago Board Options Exchange is the index provider for the

PowerShares NASDAQ-100 BuyWrite Portfolio. CBOE is not affiliated

with the Trust, the Adviser or the Distributor. The Adviser has

entered into a license agreement with the Index Provider to use the

Underlying Index. The PowerShares NASDAQ-100 BuyWrite Portfolio is

entitled to use its respective Underlying Index pursuant to a

sublicensing arrangement with the Adviser.

PowerShares� is a registered trademark of Invesco PowerShares

Capital Management LLC. Invesco PowerShares Capital Management LLC.

And Invesco Aim Distributors, Inc. are indirect, wholly owned

subsidiaries of Invesco Ltd.

Invesco Aim Distributors, Inc. is the distributor of the

PowerShares Exchange-Traded Fund Trust.

The information in the prospectus is not complete and may be

changed. The portfolio may not sell its shares until the

registration statement filed with the Securities and Exchange

Commission is effective. The prospectus is not an offer to sell the

portfolio shares, nor is the portfolio soliciting an offer to buy

its shares in any jurisdiction where the offer or sale is not

permitted.

An investor should consider the Fund's investment objectives,

risks, charges and expenses carefully before investing. For a copy

of the prospectus which contains this and other information about

the Fund call 800.983.0903. Please read the prospectus carefully

before investing.

Shares are not individually redeemable and owners of the shares

may acquire those shares from the Funds and tender those shares for

redemption to the Funds in Creation Unit aggregations only,

typically consisting of 100,000 shares.

Media Contacts: Kristin Sadlon Porter Novelli 212-601-8192 Email

Contact Bill Conboy BC Capital Partners 303-415-2290 Email

Contact

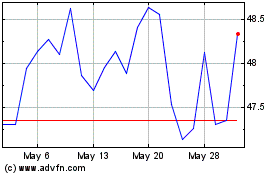

Invesco ETF Trust Invesc... (NASDAQ:PXI)

Historical Stock Chart

From Dec 2024 to Jan 2025

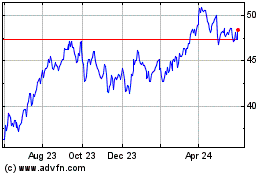

Invesco ETF Trust Invesc... (NASDAQ:PXI)

Historical Stock Chart

From Jan 2024 to Jan 2025