— $100 million in annualized cost-savings

initiatives will benefit second half 2024 and first half 2025 —

— Strong progress on business review and

refocusing R&D investments on core growth areas —

Second quarter 2024 revenue was $637 million,

as reported:

- Total recurring revenue1 grew 3% as reported and 5% in constant

currency compared to the prior year period, excluding COVID-19

revenue and U.S. Donor Screening revenue

YTD 2024 revenue was $1.35 billion, as reported:

- Total recurring revenue1 grew 6% as reported and 7% in constant

currency compared to the prior year period, excluding COVID-19

revenue, a one-time third-party collaboration settlement and U.S.

Donor Screening revenue

QuidelOrtho Corporation (Nasdaq: QDEL) (the “Company” or

“QuidelOrtho”), a global provider of innovative in vitro diagnostic

technologies designed for point-of-care settings, clinical labs,

and transfusion medicine, today announced financial results for the

second quarter ended June 30, 2024.

“During the second quarter we performed in line with our

expectations across all segments and geographies while concurrently

undertaking a significant review of our assets, operations, and

opportunities for further company-wide savings,” said Brian J.

Blaser, President and Chief Executive Officer, QuidelOrtho. “The

findings of our internal review will serve as the foundation for

our long-range plan to drive growth and improve margins, as well as

focusing our R&D efforts and investments on the areas where we

see the greatest opportunity and return.”

Second Quarter 2024

The Company reported total revenue for the second quarter of

2024 of $637 million, compared to $665 million in the prior year

period. The decrease in total revenue was primarily due to lower

COVID-19 revenue in the second quarter of 2024 compared to the

prior year period. Foreign currency translation negatively impacted

second quarter 2024 results by 100 basis points. GAAP diluted loss

per share for the second quarter of 2024 was ($2.20), compared to

diluted loss per share of ($0.80) in the prior year period.

GAAP operating loss for the second quarter of 2024 was ($118)

million, compared to an operating loss of ($27) million in the

prior year period, and GAAP operating margin was (18%) compared to

(4%) in the prior year period. Second quarter 2024 results included

$31 million in integration-related charges and a $57 million asset

impairment charge related to long-term assets held for sale.

Adjusted diluted loss per share for the second quarter of 2024

was ($0.07), compared to adjusted diluted EPS of $0.26 in the prior

year period. Adjusted EBITDA was $90 million, compared to $113

million in the prior year period. Adjusted EBITDA margin was 14%,

compared to 17% in the prior year period. The year-over-year change

in adjusted diluted EPS and adjusted EBITDA was primarily due to

lower COVID-19 revenue.

1

Recurring revenue means revenues from

sales of our assays, reagents, consumables and services, and

excludes instruments.

Outlook and Near-Term Priorities

Blaser concluded, “During the second quarter, I had the

opportunity to engage with many of our customers, employees, and

investors, reinforcing my belief in QuidelOrtho’s long-term

opportunity. We evaluated our business and made progress on

aligning operating expenses with revenue expectations and focusing

our R&D efforts on key priorities. As we enter the second half

of the year, our strategic priorities remain clear: operate our

business to provide exceptional customer satisfaction and patient

care at the highest levels of quality and compliance; improve our

cost structure, focus on the areas of our product portfolio with

the highest growth potential and strengthen our position as a

leading in vitro diagnostic company.”

Conference Call Information

QuidelOrtho will hold a conference call beginning at 2:00 p.m.

PDT / 5:00 p.m. EDT to discuss its financial results. Interested

parties can access the call on the “Events & Presentations”

section of the “Investor Relations” page of the Company’s website

at https://ir.quidelortho.com. Presentation materials will also be

posted to the “Events & Presentations” section of the “Investor

Relations” page of the Company’s website at the time of the call.

Those unable to access the webcast may join the call via phone by

dialing 833-470-1428 (domestic) or +1 929-526-1599 (international)

and entering Conference ID number 533267.

A replay of the conference call will be available shortly after

the event on the “Investor Relations” page of the Company’s website

under the “Events & Presentations” section.

About QuidelOrtho Corporation

QuidelOrtho Corporation (Nasdaq: QDEL) is a world leader in in

vitro diagnostics, developing and manufacturing intelligent

solutions that transform data into understanding and action for

more people in more places every day.

Offering industry-leading expertise in immunoassay and molecular

testing, clinical chemistry, and transfusion medicine, bringing

fast, accurate and reliable diagnostics when and where they are

needed – from home to hospital, lab to clinic, so that patients,

clinicians and health officials can spot trends sooner, respond

quicker and chart the course ahead with accuracy and

confidence.

Building upon its many years of groundbreaking innovation,

QuidelOrtho continues to partner with customers across the

healthcare continuum and around the globe to forge a new diagnostic

frontier. One where insights and solutions know no bounds,

expertise seamlessly connects and a more informed path is

illuminated for each of us.

QuidelOrtho is advancing diagnostics to power a healthier

future.

For more information, please visit www.quidelortho.com.

Source: QuidelOrtho Corporation

Forward-Looking Statements

This press release contains “forward-looking statements” within

the meaning of the Private Securities Litigation Reform Act of

1995. These statements are any statement contained herein that is

not strictly historical, including, but not limited to,

QuidelOrtho’s commercial, integration, transformation and other

strategic goals, future financial condition and operating results,

including results of cost savings initiatives, and other future

plans, objectives, strategies, expectations and intentions. Without

limiting the foregoing, the words “may,” “will,” “would,” “should,”

“might,” “expect,” “anticipate,” “believe,” “estimate,” “plan,”

“intend,” “goal,” “project,” “strategy,” “future,” “continue” or

similar words, expressions or the negative of such terms or other

comparable terminology are intended to identify forward-looking

statements. Such statements are based on the beliefs and

expectations of QuidelOrtho’s management as of today and are

subject to significant known and unknown risks and uncertainties.

Actual results or outcomes may differ significantly from those set

forth or implied in the forward-looking statements. The following

factors, among others, could cause actual results to differ from

those set forth or implied in the forward-looking statements:

supply chain, production, logistics, distribution and labor

disruptions and challenges; the challenges and costs of

integrating, restructuring and achieving anticipated synergies as a

result of the business combination of Quidel Corporation and Ortho

Clinical Diagnostics Holdings plc; and other macroeconomic,

geopolitical, market, business, competitive and/or regulatory

factors affecting the business of QuidelOrtho generally, including

those discussed in QuidelOrtho’s Annual Report on Form 10-K for the

fiscal year ended December 31, 2023 and subsequent reports filed

with the Securities and Exchange Commission (the “Commission”),

including under Part I, Item 1A, “Risk Factors” of the Form 10-K.

You should not rely on forward-looking statements as predictions of

future events because these statements are based on assumptions

that may not come true and are speculative by their nature. All

forward-looking statements are based on information currently

available to QuidelOrtho and speak only as of the date hereof.

QuidelOrtho undertakes no obligation to update any of the

forward-looking information or time-sensitive information included

in this press release, whether as a result of new information,

future events, changed expectations or otherwise, except as

required by law.

Non-GAAP Financial Measures

This press release contains financial measures, including but

not limited to “constant currency” revenue and revenue changes,

“constant currency” recurring revenue and revenue changes,

“constant currency, ex-COVID-19” revenue and revenue changes,

“adjusted net (loss) income,” “adjusted diluted (loss) earnings per

share,” “adjusted EBITDA” and “adjusted EBITDA margin,” which are

considered non-GAAP financial measures under applicable rules and

regulations of the Commission. These non-GAAP financial measures

should be considered supplemental to, and not a substitute for,

financial information prepared in accordance with U.S. generally

accepted accounting principles (“GAAP”). “Constant currency”

revenue and revenue changes, “constant currency” recurring revenue

and revenue changes, “constant currency, ex-COVID-19” revenue and

revenue changes, “adjusted net (loss) income,” “adjusted diluted

(loss) earnings per share,” “adjusted EBITDA” and “adjusted EBITDA

margin” eliminate impacts of certain non-cash, unusual or other

items that the Company does not consider indicative of its ongoing

operating performance, and the Company generally uses these

non-GAAP financial measures to facilitate management’s financial

and operational decision-making, including evaluation of the

Company’s historical operating results and comparison to

competitors’ operating results. The Company’s definitions of these

non-GAAP measures may differ from similarly titled measures used by

others. These non-GAAP financial measures reflect an additional way

of viewing aspects of the Company’s operations that, when viewed

with GAAP results and the reconciliations to corresponding GAAP

financial measures, may provide a more complete understanding of

factors and trends affecting the Company’s business. Because

non-GAAP financial measures exclude the effect of items that will

increase or decrease the Company’s reported results of operations,

management strongly encourages investors to review the Company’s

consolidated financial statements and reports filed with the

Commission in their entirety. Reconciliations of the non-GAAP

financial measures to the most directly comparable GAAP financial

measures are included in the tables accompanying this press

release.

QuidelOrtho

Consolidated Statements of

Operations

(Unaudited)

(In millions except per share

data)

Three Months Ended

Six Months Ended

June 30, 2024

July 2, 2023

June 30, 2024

July 2, 2023

Total revenues

$

637.0

$

665.1

$

1,348.0

$

1,511.2

Cost of sales, excluding amortization of

intangibles

361.0

368.6

739.9

766.1

Selling, marketing and administrative

188.2

179.1

392.9

381.5

Research and development

56.3

62.4

115.5

124.2

Amortization of intangible assets

51.9

51.4

103.6

102.2

Integration related costs

30.9

24.2

53.5

53.9

Goodwill impairment charge

—

—

1,743.9

—

Asset impairment charge

56.9

0.5

56.9

1.0

Other operating expenses

9.3

5.8

17.3

9.6

Operating (loss) income

(117.5

)

(26.9

)

(1,875.5

)

72.7

Interest expense, net

41.0

36.5

80.0

73.2

Other expense, net

4.4

1.0

6.3

3.9

Loss before income taxes

(162.9

)

(64.4

)

(1,961.8

)

(4.4

)

Benefit from income taxes

(15.2

)

(11.2

)

(108.1

)

—

Net loss

$

(147.7

)

$

(53.2

)

$

(1,853.7

)

$

(4.4

)

Basic loss per share

$

(2.20

)

$

(0.80

)

$

(27.67

)

$

(0.07

)

Diluted loss per share

$

(2.20

)

$

(0.80

)

$

(27.67

)

$

(0.07

)

Weighted-average shares outstanding -

basic

67.1

66.8

67.0

66.7

Weighted-average shares outstanding -

diluted

67.1

66.8

67.0

66.7

QuidelOrtho

Condensed Consolidated Balance

Sheets

(Unaudited)

(In millions)

June 30, 2024

December 31, 2023

ASSETS

Current assets:

Cash and cash equivalents

$

107.0

$

118.9

Marketable securities

—

48.4

Accounts receivable, net

269.5

303.3

Inventories

602.0

577.8

Prepaid expenses and other current

assets

310.0

262.1

Assets held for sale

52.8

—

Total current assets

1,341.3

1,310.5

Property, plant and equipment, net

1,326.7

1,443.8

Marketable securities

—

7.4

Right-of-use assets

177.2

169.6

Goodwill

732.5

2,492.0

Intangible assets, net

2,836.0

2,934.3

Deferred tax asset

24.7

25.9

Other assets

250.8

179.6

Total assets

$

6,689.2

$

8,563.1

LIABILITIES AND STOCKHOLDERS’

EQUITY

Current liabilities:

Accounts payable

$

237.4

$

294.8

Accrued payroll and related expenses

86.0

84.8

Income tax payable

3.5

11.1

Current portion of borrowings

356.4

139.8

Other current liabilities

249.1

303.3

Total current liabilities

932.4

833.8

Operating lease liabilities

177.7

172.8

Long-term borrowings

2,207.2

2,274.8

Deferred tax liability

127.9

192.2

Other liabilities

70.5

83.6

Total liabilities

3,515.7

3,557.2

Total stockholders’ equity

3,173.5

5,005.9

Total liabilities and stockholders’

equity

$

6,689.2

$

8,563.1

QuidelOrtho

Condensed Consolidated Statements

of Cash Flows

(Unaudited)

(In millions)

Six Months Ended

June 30, 2024

July 2, 2023

Cash (used for) provided by operating

activities

$

(98.6

)

$

158.3

Cash used for investing activities

(55.5

)

(111.2

)

Cash provided by (used for) financing

activities

144.0

(159.3

)

Effect of exchange rates on cash

(1.9

)

(2.1

)

Net decrease in cash, cash equivalents and

restricted cash

(12.0

)

(114.3

)

Cash, cash equivalents and restricted cash

at beginning of period

119.5

293.9

Cash, cash equivalents and restricted cash

at end of period

$

107.5

$

179.6

Reconciliation to amounts within the

consolidated balance sheets:

Cash and cash equivalents

$

107.0

$

178.6

Restricted cash in Other assets

0.5

1.0

Cash, cash equivalents and restricted

cash

$

107.5

$

179.6

QuidelOrtho

Reconciliation of Non-GAAP

Financial Information - Adjusted Net (Loss) Income

(In millions, except per share

data; unaudited)

Three Months Ended

Six Months Ended

June 30, 2024

Diluted EPS

July 2, 2023

Diluted EPS

June 30, 2024

Diluted EPS

July 2, 2023

Diluted EPS

Net loss

$

(147.7

)

$

(2.20

)

$

(53.2

)

$

(0.80

)

$

(1,853.7

)

$

(27.67

)

$

(4.4

)

$

(0.07

)

Adjustments:

Amortization of intangibles

51.9

51.4

103.6

102.2

Integration related costs

30.9

24.2

53.5

53.9

Goodwill impairment charge

—

—

1,743.9

—

Asset impairment charge

56.9

0.5

56.9

1.0

Incremental depreciation on PP&E fair

value adjustment

9.1

8.5

18.2

17.1

Credit Agreement amendment fees

4.0

—

4.0

—

Amortization of deferred cloud computing

implementation costs

3.0

1.5

5.9

3.1

EU medical device regulation transition

costs

0.5

0.7

1.1

1.5

Non-cash interest expense for deferred

consideration

—

0.1

—

0.7

Employee compensation charges

—

—

5.6

—

(Gain) loss on investments

(0.7

)

0.2

—

0.2

Other adjustments

1.1

—

1.8

1.5

Income tax impact of adjustments

(11.2

)

(15.2

)

(112.6

)

(37.3

)

Discrete tax items

(2.6

)

(1.3

)

(3.2

)

(1.1

)

Adjusted net (loss) income

$

(4.8

)

$

(0.07

)

$

17.4

$

0.26

$

25.0

$

0.37

$

138.4

$

2.06

Weighted-average shares outstanding -

diluted

67.1

67.2

67.3

67.2

QuidelOrtho

Reconciliation of Non-GAAP

Financial Information - Adjusted EBITDA

(In millions, unaudited)

Three Months Ended

Six Months Ended

June 30, 2024

July 2, 2023

June 30, 2024

July 2, 2023

Net loss

$

(147.7

)

$

(53.2

)

$

(1,853.7

)

$

(4.4

)

Depreciation and amortization

116.1

114.5

231.0

228.7

Interest expense, net

41.0

36.5

80.0

73.2

Benefit from income taxes

(15.2

)

(11.2

)

(108.1

)

—

Integration related costs

30.9

24.2

53.5

53.9

Goodwill impairment charge

—

—

1,743.9

—

Asset impairment charge

56.9

0.5

56.9

1.0

Credit Agreement amendment fees

4.0

—

4.0

—

Amortization of deferred cloud computing

implementation costs

3.0

1.5

5.9

3.1

EU medical device regulation transition

costs

0.5

0.7

1.1

1.5

Employee compensation charges

—

—

5.6

—

Tax indemnification income

—

(0.4

)

—

(0.1

)

(Gain) loss on investments

(0.7

)

0.2

—

0.2

Other adjustments

1.1

—

1.8

1.5

Adjusted EBITDA

$

89.9

$

113.3

$

221.9

$

358.6

QuidelOrtho

Revenues by Business Unit and

Region

(In millions, unaudited)

Three Months Ended

June 30, 2024

July 2, 2023

% Change

Currency Impact

Constant Currency (a)

Respiratory revenues

$

58.0

$

89.0

(34.8

)%

—

%

(34.8

)%

Non-Respiratory revenues

579.0

576.1

0.5

%

(1.1

)%

1.6

%

Total revenues

$

637.0

$

665.1

(4.2

)%

(0.9

)%

(3.3

)%

Three Months Ended

June 30, 2024

July 2, 2023

% Change

Currency Impact

Constant Currency (a)

Less: COVID-19 revenue

impact

Constant Currency (a)

ex COVID-19 Revenue

Labs

$

354.2

$

361.4

(2.0

)%

(1.0

)%

(1.0

)%

(0.5

)%

(0.5

)%

Transfusion Medicine

161.3

163.3

(1.2

)%

(1.7

)%

0.5

%

—

%

0.5

%

Point of Care

117.1

134.2

(12.7

)%

0.1

%

(12.8

)%

(33.1

)%

20.3

%

Molecular Diagnostics

4.4

6.2

(29.0

)%

0.4

%

(29.4

)%

(15.0

)%

(14.4

)%

Total revenues

$

637.0

$

665.1

(4.2

)%

(0.9

)%

(3.3

)%

(5.8

)%

2.5

%

Three Months Ended

June 30, 2024

July 2, 2023

% Change

Currency Impact

Constant Currency (a)

Less: COVID-19 revenue

impact

Constant Currency (a)

ex COVID-19 Revenue

North America

$

350.1

$

378.8

(7.6

)%

0.1

%

(7.7

)%

(9.7

)%

2.0

%

EMEA

81.1

80.6

0.6

%

(0.4

)%

1.0

%

(0.7

)%

1.7

%

China

81.6

81.3

0.4

%

(3.7

)%

4.1

%

—

%

4.1

%

Other

124.2

124.4

(0.2

)%

(3.1

)%

2.9

%

(0.4

)%

3.3

%

Total revenues

$

637.0

$

665.1

(4.2

)%

(0.9

)%

(3.3

)%

(5.8

)%

2.5

%

(a)

The term “constant currency” means we have

translated local currency revenues for all reporting periods to

U.S. dollars using currency exchange rates held constant for each

period. This additional non-GAAP financial information is not meant

to be considered in isolation from or as a substitute for financial

information prepared in accordance with GAAP.

Six Months Ended

June 30, 2024

July 2, 2023

% Change

Currency Impact

Constant Currency (a)

Respiratory revenues

$

195.3

$

354.6

(44.9

)%

—

%

(44.9

)%

Non-Respiratory revenues

1,152.7

1,156.6

(0.3

)%

(1.0

)%

0.7

%

Total revenues

$

1,348.0

$

1,511.2

(10.8

)%

(0.7

)%

(10.1

)%

Six Months Ended

June 30, 2024

July 2, 2023

% Change

Currency Impact

Constant Currency (a)

Less: COVID-19 revenue

impact

Constant Currency (a)

ex COVID-19 Revenue

Labs (b)

$

711.1

$

732.1

(2.9

)%

(0.9

)%

(2.0

)%

(0.6

)%

(1.4

)%

Transfusion Medicine

321.6

319.2

0.8

%

(1.5

)%

2.3

%

—

%

2.3

%

Point of Care

303.7

442.3

(31.3

)%

—

%

(31.3

)%

(61.0

)%

29.7

%

Molecular Diagnostics

11.6

17.6

(34.1

)%

—

%

(34.1

)%

(35.9

)%

1.8

%

Total revenues (b)

$

1,348.0

$

1,511.2

(10.8

)%

(0.7

)%

(10.1

)%

(14.3

)%

4.2

%

Six Months Ended

June 30, 2024

July 2, 2023

% Change

Currency Impact

Constant Currency (a)

Less: COVID-19 revenue

impact

Constant Currency (a)

ex COVID-19 Revenue

North America

$

784.0

$

961.6

(18.5

)%

(0.2

)%

(18.3

)%

(21.8

)%

3.5

%

EMEA

165.9

161.9

2.5

%

0.1

%

2.4

%

(1.4

)%

3.8

%

China

157.7

151.9

3.8

%

(4.0

)%

7.8

%

—

%

7.8

%

Other

240.4

235.8

2.0

%

(2.3

)%

4.3

%

(0.1

)%

4.4

%

Total revenues (b)

$

1,348.0

$

1,511.2

(10.8

)%

(0.7

)%

(10.1

)%

(14.3

)%

4.2

%

(a)

The term “constant currency” means we have

translated local currency revenues for all reporting periods to

U.S. dollars using currency exchange rates held constant for each

period. This additional non-GAAP financial information is not meant

to be considered in isolation from or as substitute for financial

information prepared in accordance with GAAP.

(b)

The six months ended July 2, 2023,

includes an approximate $19 million settlement award from a third

party related to one of the Company’s collaboration agreements.

QuidelOrtho

Revenues reconciliation to

non-GAAP measures

(In millions, unaudited)

Three Months Ended

June 30, 2024

July 2, 2023

% Change

Currency Impact

Constant Currency (a)

Total revenues

$

637.0

$

665.1

(4.2

)%

(0.9

)%

(3.3

)%

COVID-19 revenue

(18.9

)

(55.9

)

Instrument revenue

(35.0

)

(43.0

)

U.S. Donor Screening revenue

(32.3

)

(33.9

)

Total recurring revenue(b), ex-COVID-19

and U.S Donor Screening revenue

$

550.8

$

532.3

3.5

%

(1.1

)%

4.6

%

Six Months Ended

June 30, 2024

July 2, 2023

% Change

Currency Impact

Constant Currency (a)

Total revenues

$

1,348.0

$

1,511.2

(10.8

)%

(0.7

)%

(10.1

)%

COVID-19 revenue

(69.1

)

(272.0

)

Instrument revenue

(75.8

)

(80.9

)

U.S. Donor Screening revenue

(65.4

)

(65.2

)

One-time third-party settlement

—

(19.2

)

Total recurring revenue(b), ex-COVID-19,

U.S. Donor Screening revenue, and one-time third-party

settlement

$

1,137.7

$

1,073.9

5.9

%

(1.2

)%

7.1

%

(a)

The term “constant currency” means we have

translated local currency revenues for all reporting periods to

U.S. dollars using currency exchange rates held constant for each

period. This additional non-GAAP financial information is not meant

to be considered in isolation from or as a substitute for financial

information prepared in accordance with GAAP.

(b)

Recurring revenue means revenues from

sales of our assays, reagents, consumables and services, and

excludes instruments.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240731099599/en/

Investor Contact: Juliet Cunningham Vice President,

Investor Relations IR@quidelortho.com

Media Contact: D. Nikki Wheeler Senior Director,

Corporate Communications media@quidelortho.com

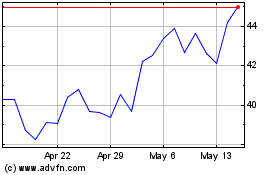

QuidelOrtho (NASDAQ:QDEL)

Historical Stock Chart

From Dec 2024 to Jan 2025

QuidelOrtho (NASDAQ:QDEL)

Historical Stock Chart

From Jan 2024 to Jan 2025