false

0001671502

0001671502

2024-11-07

2024-11-07

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities

Exchange Act of 1934

Date of Report (Date of earliest event reported):

November 7, 2024

| QUOIN

PHARMACEUTICALS LTD. |

| (Exact name of registrant as specified in its charter) |

| State of Israel |

|

001-37846 |

|

92-2593104 |

(State or other jurisdiction

of incorporation) |

|

(Commission File Number) |

|

(I.R.S. Employer

Identification No.) |

|

42127 Pleasant Forest Court

Ashburn, VA |

|

20148-7349 |

| (Address of Principal Executive Offices) |

|

(Zip Code) |

Registrant’s telephone number, including

area code: (703) 980-4182

| Not applicable |

| (Former name or former address, if changed since last report) |

Check the appropriate box below if the Form 8-K

filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General

Instruction A.2. below):

| ¨ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ¨ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ¨ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ¨ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered

pursuant to Section 12(b) of the Act:

| Title of each class |

|

Trading

Symbol(s) |

|

Name of each exchange on which registered |

| American Depositary Shares, each representing one (1) Ordinary Share, no par value per share |

|

QNRX |

|

The Nasdaq Stock Market LLC |

| Ordinary Shares, no par value per share* |

|

|

|

N/A |

| * | Not for trading, but only in connection with the registration of the American Depositary Shares pursuant

to requirements of the Securities and Exchange Commission. |

Indicate by check

mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this

chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging

growth company ¨

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ¨

Item 2.02 Results of Operations and Financial

Condition.

On November 7, 2024,

Quoin Pharmaceuticals Ltd. (the “Company”) announced its third quarter 2024 financial results. A copy of the Company’s

press release is attached as Exhibit 99.1 hereto and incorporated by reference herein.

The information set forth

and incorporated by reference in this Item 2.02 shall not be deemed to be “filed” with the Securities and Exchange Commission

for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to

the liabilities of that section, and the Company does not incorporate it by reference into a filing under the Securities Act of 1933,

as amended, or the Exchange Act.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits.

SIGNATURES

Pursuant to the requirements

of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto

duly authorized.

| Date: November 8, 2024 |

QUOIN PHARMACEUTICALS LTD. |

| |

|

| |

|

| |

By: |

/s/ Gordon Dunn |

| |

Name: |

Gordon Dunn |

| |

Title: |

Chief Financial Officer |

Exhibit 99.1

Quoin

Pharmaceuticals Provides Corporate Update and Announces Third

Quarter 2024 Financial Results

Quoin

Initiates Peeling Skin Syndrome Clinical Program

Further

Expansion of International Reach for Netherton Syndrome Clinical Trials

Significant

Insider Share Purchases by the Entire Management Team

ASHBURN, Va.,

Nov. 07, 2024 (GLOBE NEWSWIRE) -- Quoin Pharmaceuticals Ltd. (NASDAQ: QNRX) (the “Company” or “Quoin”), a clinical-stage,

specialty pharmaceutical company focused on developing and commercializing novel treatments for rare and orphan diseases, today provides

a business update and announces financial results for the three and nine months ended Sept. 30, 2024.

Quoin CEO Dr.

Michael Myers said, “The third quarter has been marked by notable achievements, including expanding the clinical reach of our lead

product QRX003 into Peeling Skin Syndrome. We are now initiating an investigator-led clinical study in New Zealand to evaluate QRX003

for Peeling Skin Syndrome, for which there is no approved treatment or cure. This is the first step in a planned series of new indications

for QRX003 and we believe this will be the first ever formal clinical study for Peeling Skin Syndrome. We have also continued to make

real progress on the international expansion of our ongoing Netherton Syndrome clinical program with the announcement of the opening

of two additional sites in the United Kingdom at recognized centers of clinical excellence. We look forward to announcing additional

expansion into other countries in the future. Finally, the significant insider purchases made by the entire Quoin management team is

a clear reflection of our strong belief and confidence in Quoin’s growth trajectory and long-term value creation. As we continue

our commitment to the rare disease community, our focus remains on delivering life-changing treatments for underserved patient populations.

We are proud of the advancements we’ve made and look forward to the upcoming milestones in our clinical development programs.”

Recent Corporate

Highlights

| · | Peeling

Skin Syndrome (PSS) Study: In August, Quoin announced the planned initiation of

an investigator-led clinical study in New Zealand for QRX003 in pediatric patients with Peeling

Skin Syndrome. This rare genetic condition currently has no approved treatments or cures.

The first clinical site and patient have been identified, and Quoin is actively evaluating

additional clinical sites in other countries. |

| · | Insider

Share Purchases: In September, Quoin’s CEO, COO and CFO made significant insider

share purchases, signaling strong leadership confidence in the company’s growth trajectory. |

| · | Netherton

Syndrome Clinical Trials Expansion: Quoin continued its efforts to broaden the clinical

trials for QRX003 as a potential treatment for Netherton Syndrome. In October 2024, the company

announced the opening of two additional clinical sites in the United Kingdom, recognized

centers of excellence for Netherton Syndrome, with plans to further expand in Western and

Eastern Europe. The UK sites will operate under Quoin’s open Investigational New Drug

(IND) application with the U.S. Food and Drug Administration (FDA). |

Financial

Highlights

| · | Cash

Position: Quoin had approximately $10.3 million in cash, cash equivalents and marketable

securities as of Sept. 30, 2024. This is expected to fund the Company’s operations

into late 2025. |

| · | Net

Loss: For the quarter ended Sept. 30, 2024, Quoin reported a net loss of approximately

$2.3 million compared to a net loss of approximately $1.9 million for the same period in

2023. For the nine months ended Sept. 30, 2024, the net loss was approximately $6.7 million

compared to $6.6 million for the nine months ended Sept. 30, 2023. |

Looking

Ahead

Quoin is committed

to advancing its clinical programs and remains focused on expanding the potential indications for QRX003. The company’s efforts

in initiating clinical studies in additional rare disease indications, such as Peeling Skin Syndrome, and expanding its global clinical

footprint for Netherton Syndrome trials are crucial steps in Quoin’s strategy to bring new treatments to patients with serious

unmet needs.

The Company

continues to evaluate M&A opportunities within the rare and orphan disease space as part of its long-term growth strategy.

Investors are

encouraged to read the Company’s Report on Form 10-Q when it is filed with the Securities and Exchange Commission (the “SEC”),

which will contain additional details about Quoin’s financial results as of and for the period ended Sept. 30, 2024.

About Quoin

Pharmaceuticals Ltd.

Quoin Pharmaceuticals

Ltd. is a clinical-stage specialty pharmaceutical company focused on developing and commercializing therapeutic products that treat rare

and orphan diseases. We are committed to addressing unmet medical needs for patients, their families, communities and care teams. Quoin’s

innovative pipeline comprises four products in development that collectively have the potential to target a broad number of rare and

orphan indications, including Netherton Syndrome, Peeling Skin Syndrome, Palmoplantar Keratoderma, Scleroderma, Epidermolysis Bullosa

and others. For more information, visit: www.quoinpharma.com or LinkedIn for updates.

Cautionary

Note Regarding Forward Looking Statements

The Company

cautions that statements in this press release that are not a description of historical facts are forward-looking statements within the

meaning of the Private Securities Litigation Reform Act of 1995. Forward-looking statements may be identified by the use of words referencing

future events or circumstances such as “expect,” “intend,” “plan,” “anticipate,” “believe,”

“look forward to,” and “will,” among others. All statements that reflect the Company’s expectations, assumptions,

projections, beliefs, or opinions about the future, other than statements of historical fact, are forward-looking statements, including,

without limitation, statements relating to: plans to initiate clinical study in peeling skin syndrome and the timing thereof, planned

series of new indications for QRX003, look forward to announcing additional expansion into other countries in the future, advancing the

Company’s clinical programs and expanding the potential indications for QRX003, initiating clinical studies in additional rare

disease indication (such as Peeling Skin Syndrome), expanding the Company’s global clinical footprint for Netherton Syndrome trials,

continuing to evaluate M&A opportunities in rare and orphan diseases, , plans to further expand in Western and Eastern Europe, the Company’s

expected cash runway, and Quoin’s belief that its products in development collectively have the potential to target a broad number

of rare and orphan indications, including Netherton Syndrome, Peeling Skin Syndrome, Palmoplantar Keratoderma, Scleroderma, Epidermolysis

Bullosa and others. Because such statements are subject to risks and uncertainties, actual results may differ materially from those expressed

or implied by such forward-looking statements. These forward-looking statements are based upon the Company’s current expectations

and involve assumptions that may never materialize or may prove to be incorrect. Actual results and the timing of events could differ

materially from those anticipated in such forward-looking statements as a result of various risks and uncertainties including, but not

limited to, the timing of the clinical studies may be delayed, the clinical studies may not generate the results anticipated, the Company

being unable to expand into a number of EU countries as planned, the Company needing to raise additional funds sooner than planned, or

the clinical studies not generating data which is sufficiently robust and comprehensive to support an NDA filing and the Company’s

ability to obtain regulatory approvals. More detailed information about the risks and uncertainties affecting the Company is summarized

in the Company’s Annual Report on Form 10-K for the year ended December 31, 2023 and in other filings the Company has made and

may make with the SEC in the future. One should not place undue reliance on these forward-looking statements, which speak only as of

the date on which they were made. The Company undertakes no obligation to update such statements to reflect events that occur or circumstances

that exist after the date on which they were made, except as may be required by law.

For further

information:

PCG Advisory

Jeff Ramson

646-863-6893

jramson@pcgadvisory.com

-Tables

Follow-

QUOIN PHARMACEUTICALS, LTD.

Consolidated Balance Sheets

| | |

September 30, | | |

December 31, | |

| | |

2024 | | |

2023 | |

| | |

(Unaudited) | | |

| |

| ASSETS | |

| | | |

| | |

| Current assets: | |

| | | |

| | |

| Cash and cash equivalents | |

$ | 3,116,750 | | |

$ | 2,401,198 | |

| Investments | |

| 7,190,138 | | |

| 8,293,663 | |

| Prepaid expenses and other current assets | |

| 190,541 | | |

| 591,034 | |

| Total current assets | |

| 10,497,429 | | |

| 11,285,895 | |

| Prepaid expenses - long term | |

| 383,390 | | |

| 300,000 | |

| Intangible assets, net | |

| 508,334 | | |

| 583,334 | |

| Total assets | |

$ | 11,389,153 | | |

$ | 12,169,229 | |

| | |

| | | |

| | |

| LIABILITIES AND SHAREHOLDERS' EQUITY | |

| | | |

| | |

| Current liabilities: | |

| | | |

| | |

| Accounts payable | |

$ | 222,636 | | |

$ | 526,523 | |

| Accrued expenses | |

| 1,504,852 | | |

| 1,308,706 | |

| Accrued interest and financing expense | |

| 1,146,251 | | |

| 1,146,251 | |

| Due to officers - short term | |

| 600,000 | | |

| 600,000 | |

| Total current liabilities | |

| 3,473,739 | | |

| 3,581,480 | |

| | |

| | | |

| | |

| Due to officers - long term | |

| 2,473,733 | | |

| 2,923,733 | |

| Total liabilities | |

$ | 5,947,472 | | |

$ | 6,505,213 | |

| | |

| | | |

| | |

| Shareholders' equity: | |

| | | |

| | |

| Ordinary shares, no par value per share, 100,000,000 ordinary shares authorized at September 30, 2024 and December 31, 2023, respectively - 5,049,720 (5,049,720 ADS's) ordinary shares issued and outstanding at September 30, 2024 and 987,220 (987,220 ADS's) at December 31, 2023 | |

$ | - | | |

$ | - | |

| | |

| | | |

| | |

| Additional paid in capital | |

| 58,296,199 | | |

| 51,867,336 | |

| Accumulated deficit | |

| (52,854,518 | ) | |

| (46,203,320 | ) |

| Total shareholders' equity | |

| 5,441,681 | | |

| 5,664,016 | |

| Total liabilities and shareholders' equity | |

$ | 11,389,153 | | |

$ | 12,169,229 | |

QUOIN PHARMACEUTICALS,

LTD.

Consolidated

Statements of Operations (unaudited)

| | |

Nine months ended

September 30, | | |

Three months ended

September 30, | |

| | |

2024 | | |

2023 | | |

2024 | | |

2023 | |

| Operating expenses | |

| | | |

| | | |

| | | |

| | |

| General and administrative | |

$ | 4,590,936 | | |

$ | 4,685,241 | | |

$ | 1,357,715 | | |

$ | 1,366,464 | |

| Research and development | |

| 2,532,468 | | |

| 2,475,596 | | |

| 1,170,287 | | |

| 758,759 | |

| Total operating expenses | |

| 7,123,404 | | |

| 7,160,837 | | |

| 2,528,002 | | |

| 2,125,223 | |

| | |

| | | |

| | | |

| | | |

| | |

| Other (income) and expenses | |

| | | |

| | | |

| | | |

| | |

| Unrealized (gain) loss | |

| (23,043 | ) | |

| 11,926 | | |

| (31,729 | ) | |

| (2,119 | ) |

| Realized and accrued interest income | |

| (449,163 | ) | |

| (536,068 | ) | |

| (146,388 | ) | |

| (196,425 | ) |

| Total other income | |

| (472,206 | ) | |

| (524,142 | ) | |

| (178,117 | ) | |

| (198,544 | ) |

| Net loss | |

$ | (6,651,198 | ) | |

$ | (6,636,695 | ) | |

$ | (2,349,885 | ) | |

$ | (1,926,679 | ) |

| | |

| | | |

| | | |

| | | |

| | |

| Loss per ADS | |

| | | |

| | | |

| | | |

| | |

| Basic | |

$ | (1.63 | ) | |

$ | (7.61 | ) | |

$ | (0.47 | ) | |

$ | (1.95 | ) |

| Fully-diluted | |

$ | (1.63 | ) | |

$ | (7.61 | ) | |

$ | (0.47 | ) | |

$ | (1.95 | ) |

| | |

| | | |

| | | |

| | | |

| | |

| Weighted average number of ADS's outstanding | |

| | | |

| | | |

| | | |

| | |

| Basic | |

| 4,071,162 | | |

| 871,835 | | |

| 5,049,720 | | |

| 987,220 | |

| Fully-diluted | |

| 4,071,162 | | |

| 871,835 | | |

| 5,049,720 | | |

| 987,220 | |

v3.24.3

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

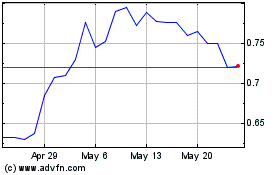

Quoin Pharmaceuticals (NASDAQ:QNRX)

Historical Stock Chart

From Nov 2024 to Dec 2024

Quoin Pharmaceuticals (NASDAQ:QNRX)

Historical Stock Chart

From Dec 2023 to Dec 2024