Current Report Filing (8-k)

October 06 2022 - 3:08PM

Edgar (US Regulatory)

0001751783false00017517832022-10-062022-10-06

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(D) OF

THE SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of earliest event reported): October 6, 2022

Rhinebeck Bancorp, Inc.

(Exact Name of Registrant as Specified in Charter)

| | | | | |

Maryland | | | 001-38779 | | 83-2117268 |

(State or Other Jurisdiction) of Incorporation) | | | (Commission File No.) | | (I.R.S. Employer Identification No.) |

| | | | | |

2 Jefferson Plaza, Poughkeepsie, New York | | 12601 |

(Address of Principal Executive Offices) | | (Zip Code) |

Registrant’s telephone number, including area code:(845) 454-8555

Not Applicable

(Former name or former address, if changed since last report)

Securities registered pursuant to Section 12(b) of the Act:

| | | | |

Title of each class | | Trading Symbol(s) | | Name of each exchange on which registered |

Common Stock, par value $0.01 per share | | RBKB | | The NASDAQ Stock Market, LLC |

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17

CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17

CFR 240.13e-4(c))

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter). Emerging growth company ☒

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 8.01Other Events

On October 6, 2022, Rhinebeck Bancorp, Inc., the holding company for Rhinebeck Bank (the “Bank”), issued a press release announcing that the Bank and the New York State Department of Financial Services (“DFS”) reached a settlement regarding claims based on DFS’s detection of statistical differences in dealer reserve (i.e., dealer markup) charged by automobile dealers to different borrower groups on loans purchased by the Bank through its indirect automobile lending program.

While the Bank does not agree with the findings and denies the allegations, it agreed to a settlement so as not to engage in a lengthy and costly legal challenge.

The Bank has fully reserved for this settlement and there will be no further impact on earnings.

For additional information, reference is made to the press release dated October 6, 2022, which is attached hereto as an exhibit and incorporated herein by reference.

Item 9.01Financial Statements and Exhibits

(a)Financial Statements of Businesses Acquired. Not applicable.

(b)Pro Forma Financial Information. Not applicable.

(c)Shell Company Transactions. Not applicable.

(d) Exhibits.

Exhibit No.Description

| 104 | Cover Page Interactive Data File (embedded within the Inline XBRL document) |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, hereunto duly authorized.

| |

| RHINEBECK BANCORP, INC. |

| |

| |

| |

DATE: October 6, 2022 | By: /s/ Michael J. Quinn |

| Michael J. Quinn |

| President and Chief Executive Officer |

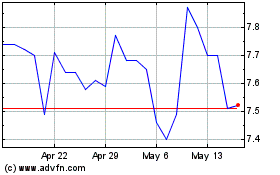

Rhinebeck Bancorp (NASDAQ:RBKB)

Historical Stock Chart

From Mar 2025 to Apr 2025

Rhinebeck Bancorp (NASDAQ:RBKB)

Historical Stock Chart

From Apr 2024 to Apr 2025