Form SC 13D/A - General statement of acquisition of beneficial ownership: [Amend]

September 19 2023 - 3:15PM

Edgar (US Regulatory)

| SECURITIES AND EXCHANGE COMMISSION |

|

| |

|

| Washington, D.C. 20549 |

|

| _______________ |

|

| |

|

| SCHEDULE 13D/A |

| |

INFORMATION TO BE INCLUDED IN STATEMENTS FILED PURSUANT

TO RULE 13d-1(a) AND AMENDMENTS THERETO FILED PURSUANT TO

RULE 13d-2(a) |

| |

| Under the Securities Exchange Act of 1934 |

| (Amendment No. 10) |

| |

|

Rocket Pharmaceuticals,

Inc. |

| (Name of Issuer) |

| |

|

Common Stock, par

value $0.01 per share |

| (Title of Class of Securities) |

| |

|

77313F106 |

| (CUSIP Number) |

| |

|

Eleazer Klein, Esq.

Adriana Schwartz, Esq. |

| 919 Third Avenue |

| New York, New York 10022 |

|

(212) 756-2000 |

| (Name, Address and Telephone Number of Person |

| Authorized to Receive Notices and Communications) |

| |

|

September 15, 2023 |

| (Date of Event which Requires |

| Filing of this Schedule) |

If the filing person has previously filed a statement on Schedule 13G to

report the acquisition that is the subject of this Schedule 13D, and is filing this schedule because of Rule 13d-1(e), 13d-1(f) or 13d-1(g),

check the following box. [ ]

NOTE: Schedules filed in paper format shall include a signed original

and five copies of the schedule, including all exhibits. See Rule 13d-7 for other parties to whom copies are to be sent.

(Continued on following pages)

(Page 1 of 6 Pages)

__________________

The information required on the remainder of this cover page shall not

be deemed to be “filed” for the purpose of Section 18 of the Securities Exchange Act of 1934 (“Act”) or

otherwise subject to the liabilities of that section of the Act but shall be subject to all other provisions of the Act (however, see

the Notes).

| CUSIP No. 77313F106 | SCHEDULE 13D/A | Page 2 of 6 Pages |

| 1 |

NAME OF REPORTING PERSON

RTW Investments, LP |

| 2 |

CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP |

(a) ¨

(b) ☒ |

| 3 |

SEC USE ONLY |

| 4 |

SOURCE OF FUNDS

AF |

| 5 |

CHECK BOX IF DISCLOSURE OF LEGAL PROCEEDING IS REQUIRED PURSUANT TO ITEMS 2(d) or 2(e) |

¨ |

| 6 |

CITIZENSHIP OR PLACE OF ORGANIZATION

Delaware |

NUMBER OF

SHARES

BENEFICIALLY

OWNED BY

EACH

REPORTING

PERSON WITH |

7 |

SOLE VOTING POWER

0 |

| 8 |

SHARED VOTING POWER

18,188,457 (including 30,852 shares of Common Stock issuable

upon exercise of warrants)* |

| 9 |

SOLE DISPOSITIVE POWER

0 |

| 10 |

SHARED DISPOSITIVE POWER

18,188,457 (including 30,852 shares of Common Stock issuable

upon exercise of warrants)* |

| 11 |

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH PERSON

18,188,457 (including 30,852 shares of Common Stock issuable

upon exercise of warrants)* |

| 12 |

CHECK IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES |

¨ |

| 13 |

PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW (11) (see Item 5)

20.21%* |

| 14 |

TYPE OF REPORTING PERSON

PN, IA |

| |

|

|

|

|

*The above-referenced shares of common stock,

par value $0.01 per share (the “Common Stock”) of Rocket Pharmaceuticals, Inc. (the “Issuer”),

reported hereunder are held by one or more funds (together the “RTW Funds”) managed by RTW Investments, LP (the

“RTW Investments”). RTW Investments, in its capacity as the investment manager of the RTW Funds, has the power to

vote and the power to direct the disposition of all such shares of Common Stock held by the RTW Funds. Roderick Wong, M.D.

(“Dr. Wong”) is the Managing Partner and Chief Investment Officer of RTW Investments. The percentage of Common

Stock held is based upon 89,972,262 shares of Common Stock reported to be outstanding in the Issuer's Prospectus filed pursuant to

Rule 424(b)(5) with the SEC on September 9, 2023, and the Company’s Current Report on Form 8-K filed with the SEC on September

15, 2023, after giving effect to the completion of the offering and the full exercise of the underwriters' over-allotment option,

all as described therein, and assumes the exercise of the warrants reported herein.

| CUSIP No. 77313F106 | SCHEDULE 13D/A | Page 3 of 6 Pages |

| 1 |

NAME OF REPORTING PERSON

Roderick Wong, M.D. |

| 2 |

CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP |

(a) ¨

(b) ☒ |

| 3 |

SEC USE ONLY |

| 4 |

SOURCE OF FUNDS

AF, OO |

| 5 |

CHECK BOX IF DISCLOSURE OF LEGAL PROCEEDING IS REQUIRED PURSUANT TO ITEMS 2(d) or 2(e) |

¨ |

| 6 |

CITIZENSHIP OR PLACE OF ORGANIZATION

United States of America |

NUMBER OF

SHARES

BENEFICIALLY

OWNED BY

EACH

REPORTING

PERSON WITH |

7 |

SOLE VOTING POWER

129,795 shares of Common Stock underlying director stock options |

| 8 |

SHARED VOTING POWER

18,188,457 (including 30,852 shares of Common Stock issuable

upon exercise of warrants)* |

| 9 |

SOLE DISPOSITIVE POWER

129,795 shares of Common Stock underlying director stock options |

| 10 |

SHARED DISPOSITIVE POWER

18,188,457 (including 30,852 shares of Common Stock issuable

upon exercise of warrants)* |

| 11 |

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH PERSON

18,188,457 (including 30,852 shares of Common Stock issuable

upon exercise of warrants)*

129,795 shares of Common Stock underlying director stock options |

| 12 |

CHECK IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES |

¨ |

| 13 |

PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW (11) (see Item 5)

20.32%* |

| 14 |

TYPE OF REPORTING PERSON

HC, IN |

| |

|

|

|

|

*The above-referenced shares of Common Stock of the

Issuer reported hereunder are held by the RTW Funds managed by RTW Investments. RTW Investments, in its capacity as the investment manager

of the RTW Funds, has the power to vote and the power to direct the disposition of all such shares of Common Stock held by the RTW Funds.

Dr. Wong is the Managing Partner and Chief Investment Officer of RTW Investments. The percentage of Common Stock held is based upon 89,972,262

shares of Common Stock reported to be outstanding in the Issuer's Prospectus filed pursuant to Rule 424(b)(5) with the SEC on September

9, 2023, and the Company’s Current Report on Form 8-K filed with the SEC on September 15, 2023, after giving effect to the completion

of the offering and the full exercise of the underwriters' over-allotment option, all as described therein, and assumes the exercise of

the stock options held by Dr. Wong and the warrants reported herein.

| CUSIP No. 77313F106 | SCHEDULE 13D/A | Page 4 of 6 Pages |

This Amendment No. 10 relates to and amends the Statement of Beneficial

Ownership on Schedule 13D of RTW Investments and Dr. Wong (each, a “Reporting Person” and collectively, the “Reporting

Persons”), initially filed jointly by the Reporting Persons with the U.S. Securities and Exchange Commission (“SEC”)

on January 16, 2018, and amended on November 29, 2018, April 16, 2019, December 13, 2019, January 8, 2021, March 29, 2021, August 31,

2021, September 21, 2022, October 11, 2022 and April 15, 2023 (as amended, the “Schedule 13D”), with respect to the

Common Stock of the Issuer.

Items 3, 4, 5(a)-(c),

6 and 7 of the Schedule 13D are hereby amended to the extent hereinafter expressly set forth. All capitalized terms used and not expressly

defined herein have the respective meanings ascribed to such terms in the Schedule 13D.

| Item 3. |

SOURCE AND AMOUNT OF FUNDS OR OTHER CONSIDERATION. |

| |

|

| Item 3 of the Schedule 13D is hereby amended to add the following: |

| |

| |

Item 4 of this Amendment No. 10 is incorporated herein by reference. |

| |

| Item 4. |

PURPOSE OF TRANSACTION. |

| |

|

| Item 4 of the Schedule 13D is hereby amended to add the following: |

| |

|

| |

On September

15, 2023, certain of the RTW Funds purchased pre-funded warrants to purchase 3,126,955 shares of Common Stock at a price of $15.99

per pre-funded warrant (the “Pre-Funded Warrants”) in the underwritten public offering described in the

Issuer’s Prospectus filed pursuant to Rule 424(b)(5) with the Securities and Exchange Commission (“SEC”) on

September 13, 2023, and the Issuer's Current Report on Form 8-K filed with the SEC on September 15, 2023. The Pre-Funded Warrants

have an exercise price of $0.01 and may be exercised, at any time and from time to time on or after September 15, 2023 until they

have been exercised in full. The Pre-Funded Warrants contain an exercise limitation prohibiting the holder from exercising the

Pre-Funded Warrants until such time as the holder, together with the Reporting Persons and certain other related parties, would not

beneficially own after any such exercise more than 9.99% of the then issued and outstanding Common Stock (the

“Blocker”). Due to the Blocker, the Pre-Funded Warrants beneficially owned by certain of the RTW Funds

are not presently exercisable. |

| |

|

| |

The Pre-Funded Warrants were purchased using the working capital of the RTW Funds. |

| |

|

| |

The foregoing summary of the Pre-Funded Warrants does not purport to be complete and is qualified in its entirety by, the full text of the Form of Pre-Funded Warrant, which is included as Exhibit 7 hereto and is incorporated by reference herein. |

| CUSIP No. 77313F106 | SCHEDULE 13D/A | Page 5 of 6 Pages |

| Item 5. |

INTEREST IN SECURITIES OF THE COMPANY. |

|

| |

|

|

| Items 5(a)-(c) of the Schedule 13D is hereby amended and restated as follows: |

| |

| (a) |

See rows (11) and (13) of the cover pages to this Schedule 13D for the aggregate number of shares of Common Stock and percentages of the shares of Common Stock beneficially owned by the Reporting Persons. The aggregate percentage of the shares of Common Stock reported to be beneficially owned by each Reporting Person is based upon 89,972,262 shares of Common Stock reported to be outstanding in the Issuer's Prospectus filed pursuant to Rule 424(b)(5) with the SEC on September 9, 2023, and the Company’s Current Report on Form 8-K filed with the SEC on September 15, 2023, after giving effect to the completion of the offering and the full exercise of the underwriters' over-allotment option, all as described therein, and assumes the exercise of the warrants reported herein and, in the case of Dr. Wong, assumes the exercise of the stock options held by Dr. Wong. |

| |

|

| (b) |

See rows (7) through (10) of the cover page to this Schedule 13D for the number of shares of Common Stock as to which each Reporting Person has the sole or shared power to vote or direct the vote and sole or shared power to dispose or to direct the disposition. |

| |

|

| (c) |

Other than as described in Item 4, no transactions in the shares of Common Stock were effected in the past sixty (60) days or in the 60 days prior to the date of event that required the filing of this statement by the Reporting Persons. |

| Item 6. |

CONTRACTS, ARRANGEMENTS, UNDERSTANDINGS OR RELATIONSHIPS WITH RESPECT TO SECURITIES OF THE ISSUER. |

| |

| Item 6 of the Schedule 13D is hereby amended to add the following: |

| |

| |

Item 4 of this Amendment No. 10 is incorporated herein by reference. |

| Item 7. |

MATERIAL TO BE FILED AS EXHIBITS. |

| |

|

| Item 7 of the Schedule 13D is hereby amended to add the following: |

| |

| Exhibit 7: |

Form of Pre-Funded Warrant, dated as of September 15, 2023 (incorporated by reference to Exhibit 4.1 to the Issuer’s Current Report on Form 8-K filed on September 15, 2023). |

| CUSIP No. 77313F106 | SCHEDULE 13D/A | Page 6 of 6 Pages |

SIGNATURES

After reasonable inquiry

and to the best of my knowledge and belief, I certify that the information set forth in this statement is true, complete and correct.

| DATED: September 19, 2023 |

| |

| |

| RTW INVESTMENTS, LP |

| |

|

| |

|

| By: |

/s/ Roderick Wong, M.D. |

|

| Name: |

Roderick Wong, M.D. |

|

| Title: |

Managing Partner |

|

| |

|

| |

|

| |

|

| /s/ Roderick Wong, M.D. |

|

| RODERICK WONG, M.D. |

|

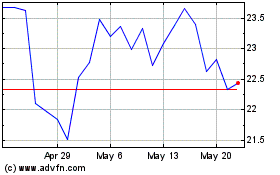

Rocket Pharmaceuticals (NASDAQ:RCKT)

Historical Stock Chart

From Feb 2025 to Mar 2025

Rocket Pharmaceuticals (NASDAQ:RCKT)

Historical Stock Chart

From Mar 2024 to Mar 2025