SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d) OF THE

SECURITIES AND EXCHANGE ACT OF 1934

Date of report (date of earliest event

reported): September 29, 2014

RECON TECHNOLOGY, LTD

(Exact name of registrant as specified

in its charter)

| Cayman Islands |

|

001-34409 |

|

N/A |

|

(State or Other Jurisdiction

of Incorporation) |

|

(Commission File Number) |

|

(IRS Employer

Identification No.) |

Room 1902, Building C, King Long International

Mansion

No. 9 Fulin Road

Beijing, 100107

People’s Republic of China

(Address of principal executive offices

and zip code)

010-84945799

(Registrant’s telephone number, including

area code)

Check the appropriate box below if the Form 8-K filing is intended

to simultaneously satisfy the filing obligations of the registrant under any of the following provisions:

| ¨ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ¨ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ¨ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ¨ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Item 2.02 Results of Operations

and Financial Condition.

On September 29, 2014, Recon Technology,

Ltd. (the “Company”) issued a press release (the "Earnings Release") announcing the Company’s financial

and operational results and for its fiscal year ended on June 30, 2014. The Earnings Release contains certain non-GAAP financial

information. The reconciliation of such non-GAAP financial information to GAAP financial measures is included in the Earnings Release.

A copy of the press release is attached hereto as Exhibit 99.1.

In accordance with General Instruction

B.2 of Form 8-K, the information in this Current Report on Form 8-K (including the exhibits) is furnished and shall not be deemed

to be "filed" for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the "Exchange Act"),

or otherwise subject to the liabilities of that section, nor shall it be deemed incorporated by reference in any filing made by

the Company under the Securities Act of 1933, as amended, or the Exchange Act, except as expressly set forth by specific reference

in such a filing.

Item 7.01 Regulation FD Disclosure.

Attached as Exhibit 99.1 to this Current

Report is the form of presentation that the Company expects to use in connection with its presentations to certain potential investors

in the Company non-deal road show beginning on September 29, 2014.

Item 9.01 Financial Statements and Exhibits

(d) EXHIBITS.

| 99.1 | Press Release issued by Recon Technology, Ltd. dated

September 29, 2014. |

| Dated: September 29, 2014 |

RECON TECHNOLOGY, LTD |

| |

|

| |

By: |

/s/ Liu Jia |

| |

Name:

Its: |

Liu Jia

Chief Financial Officer |

EXHIBIT INDEX

Exhibits.

| 99.1 | Press Release issued by Recon Technology, Ltd. dated

September 29, 2014. |

Exhibit 99.1

| |

|

NASDAQ:RCON |

Recon Technology Reports Strong Gains

in FY 2014 and Announces Growth Goals

FY 2014 Results Were Boosted By Sharp

Increases in Oilfield Automation and Furnaces Revenues, Improved Gross Margins, and an Operating Profit Versus Operating Loss in

the Prior Year

BEIJING, September 29, 2014 -- Recon Technology, Ltd.(NASDAQ:

RCON), (“Recon” or the “Company”), a leading independent oilfield services provider operating primarily

in China, today reported that in its fiscal year ended June 30, 2014, the Company was able to record the following results:

| · | Revenues grew 22% to $15,181,815 from $12,442,444* in FY 2013 as sales

of oilfield hardware products to non-related parties more than doubled, |

| · | Adjusted net income attributable to Recon (non- U.S. GAAP)** grew

170% to approximately $831,550 from $307,440 in FY 2013 |

| · | Adjusted EBIDTA (non- U.S. GAAP) increased 88% year over year to $1,435,679,

from $763,800* |

| · | Net income attributable to Recon (U.S. GAAP) rose to approximately

$131,140 from approximately $6,450* in the prior year |

| · | Diluted EPS (U.S. GAAP) rose 1,400% to $0.03 from EPS of $0.002 in

FY 2013 |

| · | Adjusted diluted EPS** (non- U.S. GAAP) rose 137% to $0.19 compared

with $0.08 a year earlier |

* Based on the exchange rate of RMB6.1552 to US$1.00.

** Non- U.S. GAAP measures are explained in tables 3 and 4 below.

Non -U.S. GAAP adjusted net income and EPS exclude certain special non-cash after tax expenses totaling $ 700,419 ($0.16 per share)

that are included in net income

Other FY 2014 Highlights

| · | Hardware and Software sales to non-related parties grew 108.2%

year over year, offsetting a decline in revenues related to fracturing |

| · | Gross margins increased year-over-year from 32.7% to 34.7%,

in part reflecting the decline in lower margin fracturing related sales |

| · | Operating income increased from a loss in FY2013 of $91,751

to income of $459,813 |

| · | Current assets as of June 30, 2014, including approximately

$2.94 million in cash and cash equivalents, were approximately $25.1 million. |

| · | The Company reported no long term debt and total current liabilities

of approximately $8.18 million as of June 30, 2014 |

| · | Working capital as of June 30, 2014 was approximately $13.5

million |

| · | There were approximately 4.4 million weighted average outstanding

ordinary shares, on a fully diluted basis, as of June 30, 2014, up from approximately 4.0 million as of June 30, FY 2013, in part

reflecting a registered direct offering in November 2013 of 546,500 ordinary shares and warrants to initially purchase an aggregate

of 163,950 ordinary shares. This offering generated net proceeds of approximately $2.0 million. |

Continuing Strong Outlook

Commenting on results, Mr. Shenping Yin, Chairman and CEO of

Recon stated, “FY 2014 delivered a number of favorable highlights on both the top and bottom line despite reduced drilling

activity and fallout from burgeoning reforms of China’s oil industry. Our strong hardware sales, reflecting growing acceptance

by customers of our deep understanding of their needs and the excellent technology and know-how we can provide to improve their

production efficiency, safety and profits, was certainly a key highlight as was the swing into the black of results from operations.

While we didn’t generate significant revenues from our fracturing services this past year, we are optimistic we will see

these grow in the future based on our ongoing fracturing projects, which are located at not only Zhongyuan Oilfield, but also Northeast

Oilfield and Sichuan Province.”

Promising Year Again For Furnaces and Burners

“As new wells are developed,” Mr. Yin continued,

“we believe we will see continued strong growth this year in sales of our burners and furnaces. Another promising growth

area is in down-hole tools, and we now have good experience with this technology and have seen strong opportunities. We also see

a continuing focus on developing new sources of energy in China. Natural gas obtained through fracturing will certainly be part

of this trend and as I’ve noted, we anticipate a pick up in our activity in the fracturing business in FY 2014.”

“Not least of all,” Mr. Yin added, “we are

cognizant of the need to further improve our profits and believe that further integration into our offerings of our higher margin

services will be one key to accomplishing this, as well as growing our business to include some down-hole services to add to the

up-ground business we have concentrated on to date.”

Growth in Automation Products

Mr. Yin continued, “In FY 2014, we see particularly good

continuing demand for ‘Digital Oil Field’ automation products and services, further enhanced by our recent appointment

as an authorized third party system integrator for world renowned automation leader ABB. While I believe this partnership, as well

as our partnerships with global oil servicing leaders such as Baker Hughes, Emerson and others reflects well on our abilities,

more importantly, it inspires further confidence in our customers and helps to expand the range of products and services we are

able to customize for the unique needs of the oil and gas fields in China.”

Growth Goals: Organic Growth Plus Acquisitions

“In recent weeks,” Mr. Yin said, “we have

focused on developing growth goals to guide the efforts of our still young Company that we believe is entering a new stage of development.

Our major focus going forward will continue to be on the organic development of our business, built on strong technology, our very

well developed solid relationships with China’s large oil companies, and our focus on building our business in China’s

most challenging oil fields away from large potential competitors. However, we believe we can supplement this growth with carefully

chosen acquisitions and joint ventures, and have put a greater effort into accomplishing this.”

Double Our Revenues Over Next 2 to 3 Years

“Looking ahead,” Mr. Yin said, “we believe

that an achievable goal for Recon is annual average revenue growth of a minimum of 20%. We further believe that if we couple this

with appropriate acquisitions, we can aim to double our revenues over the next two to three fiscal years.”

Mr. Yin concluded, “While pursuing these goals, we will

keep in mind the best interests of our shareholders, who we know would also like to see a growing bottom line as we grow our revenues,

and also don’t want us to stray from our areas of expertise. We think we have a very exciting future ahead and look forward

to continuing to inform shareholders of our progress.”

Please See Attached Tables

Recon Technology, Ltd. is China's first independent oil

and gas field service company listed on NASDAQ (RCON). Closely working with leading global partners, Recon has

achieved rapid growth supplying China's largest oil and gas exploration companies, including Sinopec and China National Petroleum

Corporation, with advanced automated technologies, efficient gathering and transportation equipment and reservoir stimulation measures.

The solutions Recon provides are aimed at increasing gas and petroleum extraction levels, reducing impurities improving safety

and lowering production costs. For additional information, please visit www.recon.cn

Cautionary Statements

Statements made in this release with respect to Recon’s

current plans, estimates, strategies and beliefs and other statements that are not historical facts are forward-looking statements

about the future performance of Recon. Forward-looking statements include, but are not limited to, those statements using words

such as “believe,” “expect,” “plans,” “strategy,” “prospects,” “forecast,”

“estimate,” “project,” “anticipate,” “aim,” “intend,” “seek,”

“may,” “might,” “could” or “should,” and words of similar meaning in connection

with a discussion of future operations, financial performance, events or conditions. From time to time, oral or written forward-looking

statements may also be included in other materials released to the public. These statements are based on management’s assumptions,

judgments and beliefs in light of the information currently available to it. Recon cautions investors that a number of important

risks and uncertainties could cause actual results to differ materially from those discussed in the forward-looking statements,

including but not limited to, product and service demand and acceptance, changes in technology, economic conditions, the impact

of competition and pricing, government regulation, and other risks contained in reports filed by the company with the Securities

and Exchange Commission. Therefore investors should not place undue reliance on such forward-looking statements. Actual results

may differ significantly from those set forth in the forward-looking statements.

All such forward-looking statements, whether written or oral,

and whether made by or on behalf of the company, are expressly qualified by the cautionary statements and any other cautionary

statements which may accompany the forward-looking statements. In addition, the company disclaims any obligation to update any

forward-looking statements to reflect events or circumstances after the date hereof.

Investor Relations Contacts:

China

Liu Jia Chief Financial Officer

Recon Technology, Ltd.

info@recon.cn

+86 (10) 84945799

U.S.

Ken Donenfeld

DGI Investor Relations

kdonenfeld@dgiir.com 1-212-425-5700

Recon Technology Financial Tables

Table 1: Gross Profit and Gross Profit

Margin

| | |

FY 2013 | | |

FY 2014 | | |

% Change | |

| Revenues (‘000 USD) | |

$ | 12,442 | | |

$ | 15,182 | | |

| +22% | |

| Cost of revenues | |

$ | 8,372 | | |

$ | 9,915 | | |

| +18.4% | |

| Gross profit | |

$ | 4,070 | | |

$ | 5,267 | | |

| +29.4% | |

| GP Margin (%) | |

| 32.7 | % | |

| 34.7 | % | |

| +2% | |

Table 2: Operating Expense and Operating Income

| Unit: ‘000 USD | |

FY 2013 | | |

FY 2014 | | |

% Change | |

| Selling and distribution expenses | |

| 995 | | |

| 860 | | |

| (13.6 | )% |

| % of revenue | |

| 8.0 | % | |

| 5.7 | % | |

| __ | |

| General and administrative expenses | |

| 1,784 | | |

| 2,632 | | |

| +47.6%

| |

| % of revenue | |

| 14.3 | % | |

| 17.3 | % | |

| __ | |

| Research and development expenses | |

| 1,383 | | |

| 1,315 | | |

| (4.9 | )% |

| % of revenue | |

| 11.1 | % | |

| 8.7 | % | |

| __ | |

| Operating expenses | |

$ | 4,162 | | |

$ | 4,806 | | |

| +15.5%

| |

| Operating income(loss) | |

| (91,751 | ) | |

| 459,812 | | |

| +601.2% | |

Table 3:

Adjusted EBITDA

Adjusted EBITDA. We define adjusted

EBITDA as net income (loss) adjusted for income tax expense, interest expense, loss from investment, non-cash stock compensation

expense, depreciation and amortization. We think it is useful to an equity investor in evaluating our operating performance because:

(1) it is widely used by investors in our industry to measure a company’s operating performance without regard to items such

as interest expense, depreciation and amortization, which can vary substantially from company to company depending upon accounting

methods and book value of assets, capital structure and the method by which the assets were acquired; and (2) it helps investors

more meaningfully evaluate and compare the results of our operations from period to period by removing the impact of our capital

structure and asset base from our operating results.

| | |

FY2013 | | |

FY2014 | | |

FY2014 | | |

Percentage |

| | |

RMB | | |

RMB | | |

USD | | |

Change |

| Reconciliation of Adjusted EBITDA | |

| | |

| | |

| | |

|

| to Net Income | |

| | |

| | |

| | |

|

| Net income | |

¥ | 619,541 | | |

¥ | 1,827,820 | | |

$ | 296,956 | | |

195.0% |

| Provision for income tax | |

| 286,871 | | |

| 961,136 | | |

| 156,150 | | |

235.0% |

| Interest expense and foreign currency adjustment | |

| 1,323,726 | | |

| 1,141,069 | | |

| 185,383 | | |

(13.8)% |

| Change in fair value of warrants liability | |

| - | | |

| (60,647 | ) | |

| (9,853 | ) | |

100% |

| Loss from investment | |

| - | | |

| 1,535,250 | | |

| 249,423 | | |

100% |

| Restricted shares issued for consulting services | |

| - | | |

| 407,593 | | |

| 66,219 | | |

100% |

| Share-based compensation expense | |

| 1,852,656 | | |

| 2,429,028 | | |

| 394,630 | | |

31.1% |

| Depreciation and amortization | |

| 618,552 | | |

| 595,647 | | |

| 96,771 | | |

(3.7)% |

| Adjusted EBITDA | |

¥ | 4,701,346 | | |

¥ | 8,836,896 | | |

$ | 1,435,679 | | |

88.0% |

Table 4:

Adjusted Net Income (Loss) and Adjusted

Earnings (Loss) Per Share

| | |

For the Years Ended | |

| | |

June 30, | |

| | |

2013 | | |

2014 | | |

2014 | |

| | |

RMB | | |

RMB | | |

USD | |

| Reconciliation of Net Income | |

| | |

| | |

| |

| to Adjusted Net Income attributable to Recon Technology, Ltd | |

| | |

| | |

| |

| Net income attributable to Recon Technology, Ltd | |

¥ | 39,698 | | |

¥ | 807,188 | | |

$ | 131,140 | |

| Special items: | |

| | | |

| | | |

| | |

| Change in fair value of warrants liability | |

| - | | |

| (60,647 | ) | |

| (9,853 | ) |

| Loss from investment | |

| - | | |

| 1,535,250 | | |

| 249,423 | |

| Restricted shares issued for consulting services | |

| - | | |

| 407,593 | | |

| 66,219 | |

| Share-based compensation expense | |

| 1,852,656 | | |

| 2,429,028 | | |

| 394,630 | |

| Adjusted net income attributable to Recon Technology, Ltd | |

¥ | 1,892,354 | | |

¥ | 5,118,412 | | |

$ | 831,559 | |

| | |

| | | |

| | | |

| | |

| Reconciliation of U.S. GAAP Earnings Per Share | |

| | | |

| | | |

| | |

| to Non U.S. GAAP Adjusted Earnings Per Share - diluted | |

| | | |

| | | |

| | |

| U.S. GAAP earnings per share - diluted | |

¥ | 0.01 | | |

¥ | 0.18 | | |

$ | 0.03 | |

| Impact of special items on earnings per share | |

| 0.47 | | |

| 0.99 | | |

| 0.16 | |

| Non U.S. GAAP adjusted earnings per share - diluted | |

¥ | 0.48 | | |

¥ | 1.17 | | |

$ | 0.19 | |

| Weighted - average shares -diluted | |

| 3,951,811 | | |

| 4,368,162 | | |

| 4,368,162 | |

Special

items are certain non-cash expenses that are included in our U.S. GAAP reported results. There was no income tax benefit associated

with the special items. The non-GAAP financial measures are provided to enhance investors' overall understanding of Recon's current

financial performance. These non-GAAP measures are not intended to replace the presentation of the

Company’s financial results in accordance with GAAP. Use of the terms non-GAAP adjusted EPS may differ from similar measures

reported by other companies. All of the non-GAAP measures discussed above are reconciled from their respective GAAP measures in

the “Reconciliation of U.S. GAAP Earnings Per Share to Non U.S. GAAP Adjusted Earnings Per Share - diluted" table set

forth above. We define adjusted EBITDA as net income (loss) adjusted for income tax expense, interest expense, loss from investment,

non-cash stock compensation expense, depreciation and amortization. We define non GAAP EPS as adjusted net income divided by the

total outstanding shares, on a fully-diluted basis. We define non-GAAP EPS as non-GAAP net income divided by

the weighted average outstanding shares, on a fully-diluted basis.

FOR ADDITIONAL INFORMATION WE URGE YOU TO PLEASE CAREFULLY STUDY

THE COMPANY’S ANNUAL REPORT ON FORM 10-K FILED WITH THE U.S. SECURITIES AND EXCHANGE COMMISSION ON SEPTEMBER 29, 2014

| RECON TECHNOLOGY, LTD |

| CONSOLIDATED BALANCE SHEETS |

| | |

| | |

| | |

| |

| | |

As of June 30, | | |

As of June 30, | | |

As of June 30, | |

| | |

2013 | | |

2014 | | |

2014 | |

| ASSETS | |

RMB | | |

RMB | | |

U.S. Dollars | |

| Current assets | |

| | | |

| | | |

| | |

| Cash and cash equivalents | |

¥ | 12,350,392 | | |

¥ | 18,094,586 | | |

$ | 2,939,723 | |

| Notes receivable | |

| 2,578,855 | | |

| - | | |

| - | |

| Trade accounts receivable, net | |

| 38,648,780 | | |

| 43,553,737 | | |

| 7,075,926 | |

| Trade accounts receivable- related parties, net | |

| 18,744,364 | | |

| 7,479,298 | | |

| 1,215,119 | |

| Inventories, net | |

| 13,271,070 | | |

| 14,336,602 | | |

| 2,329,185 | |

| Other receivables, net | |

| 19,131,503 | | |

| 18,293,043 | | |

| 2,971,966 | |

| Other receivables- related parties | |

| 742,528 | | |

| 1,414,433 | | |

| 229,795 | |

| Purchase advances, net | |

| 18,412,507 | | |

| 25,759,065 | | |

| 4,184,927 | |

| Purchase advances- related parties | |

| 394,034 | | |

| 394,034 | | |

| 64,016 | |

| Tax recoverable | |

| 575,650 | | |

| - | | |

| - | |

| Prepaid expenses | |

| 2,487,956 | | |

| 2,634,664 | | |

| 428,039 | |

| Prepaid expenses - related parties | |

| 366,000 | | |

| 230,000 | | |

| 37,367 | |

| Deferred tax asset | |

| 1,006,721 | | |

| 1,209,961 | | |

| 196,575 | |

| Total current assets | |

| 128,710,360 | | |

| 133,399,423 | | |

| 21,672,638 | |

| | |

| | | |

| | | |

| | |

| Property and equipment, net | |

| 1,709,846 | | |

| 1,321,538 | | |

| 214,703 | |

| Long-term trade accounts receivable, net | |

| - | | |

| 14,456,317 | | |

| 2,348,635 | |

| Long-term investment | |

| 1,549,450 | | |

| - | | |

| - | |

| Long-term other receivable | |

| 3,502,680 | | |

| 5,353,104 | | |

| 869,688 | |

| Total Assets | |

¥ | 135,472,336 | | |

¥ | 154,530,382 | | |

$ | 25,105,664 | |

| | |

| | | |

| | | |

| | |

| LIABILITIES AND EQUITY | |

| | | |

| | | |

| | |

| Current liabilities | |

| | | |

| | | |

| | |

| Short-term bank loans | |

¥ | 10,000,000 | | |

¥ | 10,000,000 | | |

$ | 1,624,643 | |

| Trade accounts payable | |

| 7,384,165 | | |

| 11,413,505 | | |

| 1,854,287 | |

| Trade accounts payable- related parties | |

| 3,994,718 | | |

| - | | |

| - | |

| Other payables | |

| 1,964,691 | | |

| 1,765,079 | | |

| 286,762 | |

| Other payable- related parties | |

| 4,239,675 | | |

| 3,306,024 | | |

| 537,111 | |

| Deferred revenue | |

| 3,381,382 | | |

| 4,419,824 | | |

| 718,063 | |

| Advances from customers | |

| 470,700 | | |

| 801,385 | | |

| 130,196 | |

| Accrued payroll and employees' welfare | |

| 1,992,783 | | |

| 417,624 | | |

| 67,849 | |

| Accrued expenses | |

| 488,730 | | |

| 203,051 | | |

| 32,989 | |

| Income before income tax | |

| 6,754,428 | | |

| 7,589,846 | | |

| 1,233,079 | |

| Short-term borrowings- related parties | |

| 5,503,279 | | |

| 5,207,728 | | |

| 846,070 | |

| Net Income | |

| 570,375 | | |

| - | | |

| - | |

| Deferred tax liability | |

| - | | |

| 180,186 | | |

| 29,274 | |

| Warrants liability | |

| - | | |

| 5,021,621 | | |

| 815,834 | |

| Total current liabilities | |

| 46,744,926 | | |

| 50,325,873 | | |

| 8,176,157 | |

| | |

| | | |

| | | |

| | |

| Comprehensive income | |

| | | |

| | | |

| | |

| | |

| | | |

| | | |

| | |

| Comprehensive income attributable to Recon Technology, Ltd | |

| | | |

| | | |

| | |

| Common stock, ($ 0.0185 U.S. dollar par value, 25,000,000 shares authorized; 3,951,811 and 4,717,336 shares issued and outstanding as of June 30, 2013 and June 30, 2014, respectively) | |

| 529,979 | | |

| 616,865 | | |

| 100,217 | |

| Earnings per common share - basic | |

| 69,516,447 | | |

| 83,061,058 | | |

| 13,494,453 | |

| Earnings per common share - diluted | |

| 3,023,231 | | |

| 4,148,929 | | |

| 674,053 | |

| Unappropriated retained earnings | |

| 8,749,963 | | |

| 8,431,453 | | |

| 1,369,810 | |

| Accumulated other comprehensive loss | |

| (293,201 | ) | |

| (279,275 | ) | |

| (45,374 | ) |

| Total shareholders’ equity | |

| 81,526,419 | | |

| 95,979,030 | | |

| 15,593,159 | |

| Non-controlling interest | |

| 7,200,991 | | |

| 8,225,479 | | |

| 1,336,348 | |

| Total equity | |

| 88,727,410 | | |

| 104,204,509 | | |

| 16,929,507 | |

| Total Liabilities and Equity | |

¥ | 135,472,336 | | |

¥ | 154,530,382 | | |

$ | 25,105,664 | |

The accompanying notes are an integral part of these consolidated financial statements

| RECON TECHNOLOGY, LTD |

| CONSOLIDATED STATEMENTS OF OPERATIONS AND COMPREHENSIVE INCOME |

| | |

| | |

| | |

| |

| | |

For the years ended | |

| | |

June 30, | |

| | |

2013 | | |

2014 | | |

2014 | |

| | |

RMB | | |

RMB | | |

USD | |

| | |

| | |

| | |

| |

| Revenues | |

| | | |

| | | |

| | |

| Hardware and software | |

¥ | 41,408,517 | | |

¥ | 86,229,283 | | |

$ | 14,009,176 | |

| Service | |

| 25,464,003 | | |

| 477,778 | | |

| 77,622 | |

| Hardware and software - related parties | |

| 9,713,209 | | |

| 6,740,047 | | |

| 1,095,017 | |

| Total revenues | |

| 76,585,729 | | |

| 93,447,108 | | |

| 15,181,815 | |

| | |

| | | |

| | | |

| | |

| Cost of revenues | |

| | | |

| | | |

| | |

| Hardware and software | |

¥ | 26,617,786 | | |

¥ | 57,333,670 | | |

$ | 9,314,672 | |

| Service | |

| 18,567,123 | | |

| 77,107 | | |

| 12,527 | |

| Hardware and software - related parties | |

| 6,346,850 | | |

| 3,619,470 | | |

| 588,035 | |

| Total cost of revenues | |

| 51,531,759 | | |

| 61,030,247 | | |

| 9,915,234 | |

| Gross profit | |

| 25,053,970 | | |

| 32,416,861 | | |

| 5,266,581 | |

| | |

| | | |

| | | |

| | |

| | |

| | | |

| | | |

| | |

| Selling and distribution expenses | |

| 6,126,095 | | |

| 5,293,343 | | |

| 859,979 | |

| General and administrative expenses | |

| 10,978,942 | | |

| 16,198,947 | | |

| 2,631,750 | |

| Research and development expenses | |

| 8,513,680 | | |

| 8,094,333 | | |

| 1,315,040 | |

| Operating expenses | |

| 25,618,717 | | |

| 29,586,623 | | |

| 4,806,769 | |

| | |

| | | |

| | | |

| | |

| | |

| | | |

| | | |

| | |

| Income (loss) from operations | |

| (564,747 | ) | |

| 2,830,238 | | |

| 459,812 | |

| | |

| | | |

| | | |

| | |

| Other income (expenses) | |

| | | |

| | | |

| | |

| Subsidy income | |

| 2,257,344 | | |

| 1,250,509 | | |

| 203,163 | |

| Interest income | |

| 570,442 | | |

| 384,182 | | |

| 62,416 | |

| Interest expense | |

| (1,557,204 | ) | |

| (952,574 | ) | |

| (154,759 | ) |

| Loss from investment | |

| - | | |

| (1,535,250 | ) | |

| (249,423 | ) |

| Change in fair value of warrants liability | |

| - | | |

| 60,647 | | |

| 9,853 | |

| Gain (loss) from

foreign currency exchange | |

| 233,478 | | |

| (188,495 | ) | |

| (30,624 | ) |

| Other income (expense) | |

| (32,901 | ) | |

| 939,699 | | |

| 152,668 | |

| | |

| | | |

| | | |

| | |

| Income before income tax | |

| 906,412 | | |

| 2,788,956 | | |

| 453,106 | |

| Provision for income tax | |

| 286,871 | | |

| 961,136 | | |

| 156,150 | |

| Net Income | |

| 619,541 | | |

| 1,827,820 | | |

| 296,956 | |

| | |

| | | |

| | | |

| | |

| Less: Net income attributable to non-controlling interest | |

| 579,843 | | |

| 1,020,632 | | |

| 165,816 | |

| Net Income attributable to Recon Technology, Ltd | |

¥ | 39,698 | | |

¥ | 807,188 | | |

$ | 131,140 | |

| | |

| | | |

| | | |

| | |

| Comprehensive income | |

| | | |

| | | |

| | |

| Net income | |

| 619,541 | | |

| 1,827,820 | | |

| 296,956 | |

| Foreign currency translation adjustment | |

| (3,004 | ) | |

| 17,783 | | |

| 2,889 | |

| Comprehensive income | |

| 616,537 | | |

| 1,845,603 | | |

| 299,845 | |

| Less: Comprehensive income attributable to non-controlling interest | |

| 579,543 | | |

| 1,022,410 | | |

| 166,105 | |

| Comprehensive income attributable to Recon Technology, Ltd | |

¥ | 36,994 | | |

¥ | 823,193 | | |

$ | 133,740 | |

| | |

| | | |

| | | |

| | |

| Earnings per common share - basic | |

¥ | 0.01 | | |

¥ | 0.19 | | |

$ | 0.03 | |

| Earnings per common share - diluted | |

¥ | 0.01 | | |

¥ | 0.18 | | |

$ | 0.03 | |

| Weighted - average shares -basic | |

| 3,951,811 | | |

| 4,303,955 | | |

| 4,303,955 | |

| Weighted - average shares -diluted | |

| 3,951,811 | | |

| 4,368,162 | | |

| 4,368,162 | |

The accompanying notes are an integral part of these consolidated financial statements

| RECON TECHNOLOGY, LTD |

| CONSOLIDATED STATEMENTS OF CASH FLOWS |

| | |

| | |

| | |

| |

| | |

For the years ended June 30, | |

| | |

2013 | | |

2014 | | |

2014 | |

| | |

RMB | | |

RMB | | |

U.S. Dollars | |

| | |

| | |

| | |

| |

| Cash flows from operating activities: | |

| | | |

| | | |

| | |

| Net income | |

¥ | 619,541 | | |

¥ | 1,827,820 | | |

$ | 296,956 | |

| Adjustments to reconcile net income to net cash provided by (used in) operating activities: | |

| | | |

| | | |

| | |

| Depreciation | |

| 618,552 | | |

| 595,647 | | |

| 96,771 | |

| Loss from disposal of equipment | |

| 38,006 | | |

| 128,902 | | |

| 20,942 | |

| Provision/(recovery of) for doubtful accounts | |

| (749,121 | ) | |

| 1,518,778 | | |

| 246,747 | |

| Share based compensation | |

| 1,852,656 | | |

| 2,429,028 | | |

| 394,630 | |

| Loss from investment | |

| - | | |

| 1,535,250 | | |

| 249,423 | |

| Deferred tax provision/(benefit) | |

| 100,080 | | |

| (23,054 | ) | |

| (3,745 | ) |

| Change in fair value of warrants liability | |

| - | | |

| (60,647 | ) | |

| (9,853 | ) |

| Restricted shares issued for services | |

| - | | |

| 407,593 | | |

| 66,219 | |

| Changes in operating assets and liabilities: | |

| | | |

| | | |

| | |

| Notes receivable | |

| (2,578,855 | ) | |

| 2,578,855 | | |

| 418,972 | |

| Trade accounts receivable | |

| 25,107,519 | | |

| (5,291,233 | ) | |

| (859,636 | ) |

| Trade accounts receivable-related parties | |

| 672,175 | | |

| (3,819,299 | ) | |

| (620,500 | ) |

| Inventories | |

| 11,010,230 | | |

| (1,065,532 | ) | |

| (173,111 | ) |

| Other receivable, net | |

| (4,263,858 | ) | |

| (981,099 | ) | |

| (159,395 | ) |

| Other receivables related parties, net | |

| (724,799 | ) | |

| (671,905 | ) | |

| (109,161 | ) |

| Purchase advance, net | |

| (2,190,796 | ) | |

| (6,879,156 | ) | |

| (1,117,617 | ) |

| Purchase advance-related party, net | |

| 699,500 | | |

| - | | |

| - | |

| Tax recoverable | |

| 2,215,072 | | |

| 575,650 | | |

| 93,523 | |

| Prepaid expense | |

| (1,952,620 | ) | |

| (146,708 | ) | |

| (23,835 | ) |

| Prepaid expense - related party, net | |

| (366,000 | ) | |

| 136,000 | | |

| 22,095 | |

| Trade accounts payable | |

| (4,521,395 | ) | |

| 4,029,340 | | |

| 654,624 | |

| Trade accounts payable-related parties | |

| (1,344,513 | ) | |

| (3,994,718 | ) | |

| (648,999 | ) |

| Other payables | |

| (377,135 | ) | |

| (199,612 | ) | |

| (32,430 | ) |

| Other payables-related parties | |

| 3,140,416 | | |

| (933,651 | ) | |

| (151,685 | ) |

| Deferred income | |

| 90,309 | | |

| 1,038,442 | | |

| 168,710 | |

| Advances from customers | |

| (465,424 | ) | |

| 330,685 | | |

| 53,724 | |

| Accrued payroll and employees' welfare | |

| 1,043,204 | | |

| (1,575,159 | ) | |

| (255,907 | ) |

| Accrued expenses | |

| 12,314 | | |

| (285,679 | ) | |

| (46,413 | ) |

| Taxes payable | |

| (2,927,192 | ) | |

| 835,418 | | |

| 135,726 | |

| Net cash provided by (used in) operating activities | |

| 24,757,866 | | |

| (7,960,044 | ) | |

| (1,293,225 | ) |

| | |

| | | |

| | | |

| | |

| Cash flows from investing activities: | |

| | | |

| | | |

| | |

| Purchase of property and equipment | |

| (753,583 | ) | |

| (477,957 | ) | |

| (77,651 | ) |

| Long-term investment | |

| (1,549,450 | ) | |

| - | | |

| - | |

| Proceeds from disposal of equipment | |

| 162,000 | | |

| 141,716 | | |

| 23,024 | |

| Net cash used in investing activities | |

| (2,141,033 | ) | |

| (336,241 | ) | |

| (54,627 | ) |

| | |

| | | |

| | | |

| | |

| Cash flows from financing activities: | |

| | | |

| | | |

| | |

| Proceeds from short-term bank loans | |

| 10,000,000 | | |

| 23,500,000 | | |

| 3,817,910 | |

| Repayments of short-term bank loans | |

| (23,000,000 | ) | |

| (23,500,000 | ) | |

| (3,817,910 | ) |

| Proceeds from short-term borrowings | |

| 579,073 | | |

| - | | |

| - | |

| Proceeds from borrowings-related parties | |

| 1,962,450 | | |

| 5,007,728 | | |

| 813,577 | |

| Repayment of short-term borrowings | |

| (2,775,764 | ) | |

| (570,375 | ) | |

| (92,666 | ) |

| Repayment of short-term borrowings-related parties | |

| (582,477 | ) | |

| (5,303,279 | ) | |

| (861,594 | ) |

| Proceeds from sale of common stock, net of issuance costs | |

| - | | |

| 12,132,882 | | |

| 1,971,160 | |

| Proceeds from stock options exercised | |

| - | | |

| 2,704,909 | | |

| 439,451 | |

| Capital contribution in VIE | |

| 20,000 | | |

| - | | |

| - | |

| Net cash provided by (used in) financing activities | |

| (13,796,718 | ) | |

| 13,971,865 | | |

| 2,269,928 | |

| | |

| | | |

| | | |

| | |

| Effect of exchange rate fluctuation on cash and cash equivalents | |

| (3,006 | ) | |

| 68,614 | | |

| 11,150 | |

| | |

| | | |

| | | |

| | |

| Net increase (decrease) in cash and cash equivalents | |

| 8,817,109 | | |

| 5,744,194 | | |

| 933,226 | |

| Cash and cash equivalents at beginning of period | |

| 3,533,283 | | |

| 12,350,392 | | |

| 2,006,497 | |

| Cash and cash equivalents at end of period | |

¥ | 12,350,392 | | |

¥ | 18,094,586 | | |

$ | 2,939,723 | |

| | |

| | | |

| - | | |

| - | |

| | |

| | | |

| | | |

| | |

| Supplemental cash flow information | |

| | | |

| | | |

| | |

| Cash paid during the period for interest | |

¥ | 1,356,581 | | |

¥ | 939,416 | | |

$ | 152,622 | |

| Cash paid during the period for taxes | |

¥ | 832,028 | | |

¥ | 704,982 | | |

$ | 114,534 | |

| | |

| | | |

| | | |

| | |

| Non-cash investing and financing activities | |

| | | |

| | | |

| | |

| Issurance of common stock to prepay professional services | |

¥ | - | | |

¥ | 1,002,721 | | |

$ | 165,142 | |

The accompanying notes are an integral part of these consolidated financial statements

Exhibit 99.2

Corporate Presentation October 2014 Recon Technology, Ltd. (Nasdaq: RCON) 1

Safe Harbor Statement This document contains forward - looking statements as defined by the Private Securities Litigation Reform Act of 1995 . Forward - looking statements include statements concerning plans, objectives, goals, strategies, future events or performance, underlying assumptions, and any other statements other than statements of historical facts . These statements are subject to uncertainties and risks including, but not limited to, product and service demand and acceptance, changes in technology, economic conditions, the impact of competition and pricing, government regulation, and other risks contained in statements filed from time to time with the Securities and Exchange Commission . All such forward - looking statements, whether written or oral, and whether made by or on behalf of the company, are expressly qualified by the cautionary statements and any other cautionary statements which may accompany the forward - looking statements . In addition, the company disclaims any obligation to update any forward - looking statements to reflect events or circumstances after the date hereof . Recon assumes no obligation to update the information in this communication, except as otherwise required by law . Readers are cautioned not to place undue reliance on these forward - looking statements, which speak only as of the date hereof . This material is for information purposes only and does not constitute an offer to sell, a solicitation of an offer to buy, or a recommendation for any securities, financial instruments, or common or privately issued stock . No offering of securities shall be made except by means of a prospectus meeting the requirements of the Securities Act of 1933 , as amended . The statements, information and estimates contained herein are based on information that the presenter believes to be reliable as of today's date, but cannot be represented that such statements, information or estimates are complete or accurate . 2

Company Overview 3

Stock Symbol RCON Stock Price ( 9/25/2014) $4.99 IPO 2009 Revenue (Fiscal Year 2014) $15.2 Million Long - term debt None Average Gross Margin in % 35.03% Shares Outstanding 4.7 M Market Cap. ( 9/25/2014) $23.58 M Directors & Officers Ownership 30% Fiscal Year End June 30th Auditors Friedman LLP Legal EGS Company Overview Turning from net loss to net income in Fiscal year 2013 . 4 Source : Nasdaq

1999 2003 2004 2013 2011 2014 2009 Beijing BHD petroleum technology Ltd. was founded Nanjing Recon Technology Co.,Ltd. was founded N a njing Recon began implementation of "Digital Oilfield" for Sinopec's Jidong Oilfield. Recon was successfully listed on Nasdaq. First implementation of tie pipelines automation project for Southwest branch of Sinopec. Recon introduced Baker Hughes Frac - Point System to S inopec. Recon became a channel distributor of EMERSON DCS and RTU products to oil and gas customers in China Recon began to undertake large - scale oversea projects in Turkmenistan. Company Overview - Milestones After years of development, Recon has become a comprehensive engineering service company rather than simply a products provider Phase I Phase II Recon became a channel distributor of ABB automation and control products to oil and gas customers in China. 5

Company Overview - Strong R&D Team 29 Engineers 3 Professor Senior Engineers 8 Senior Engineers 40 + Technicians 8 Copyrights 25 Patents 6

Business Overview 7

Software Recon provides professional integrated solutions to oil and gas companies and their affiliates Hardware Services • Heating Furnace • Burner • Separators • Multiported - Valve • Process Automation Product • SCADA System • Expert System • Fracturing • Well Testing • Perforation Our Products & Service s 8

Downhole Service: • Fracturing • Perforation • RTU • SCADA System • Furnace • Burner • Multiported valve • Separator • Furnace • Burner Our Products & Service s Our operation focused on the upstream of oil and gas industry chain 9

Primary Customers: CNPC SINOPEC Our Products & Service s - Our Clients We have a solid client base 10 Example: Xibei Oilfield: No. 1 Oil Production Plant No. 2 Oil Production Plant No. 3 Oil Production Plant Tuha oilfield branch Turpan oil production plant Luke ooze oil production plant Shanshan oil production plant Santanghu oil production plant

Market - Oilfield Entry Permits Strict industry access standards build a high entry barrier to competitors 11

Higher Profit Margin Accurate Market Positioning Avoid Highly Competitive Products Focused on the Design and Applicability of Each Product 34.69% GP in FY 2014 12 Market - Company Characteristics Recon has good positioning strategy to support its development

Automation System Automation System Fracturing Technology Burner Price Advantages Strategic Cooperation Market - Brand Distributor for Multinational Companies 13

20% Average Annual Internal Revenue Growth Expand product lines Geographic Expansion: Kazakhstan, Turkmenistan, Chad and Niger Double Size in 2 - 3 years Organic Growth Acquisitions Further Increase Margins Increase Service Maintain good relationships with customers. Our Growth Strategies - Our Goals (Short - term) We intend to maintain and expand our leadership positions 14

Our Growth Strategies - Business Strategies Parternship with reputable international firms Enhance strategic cooperation with international market leader s Selectively seek acquisition opportunities Acquire oil/gas engineering manufacturers and/or automation products manufacturers and pursue vertical integration Further improve product s efficiency & reduce production costs Achieve greater economies of scale by adopting advanced production technologies Expansion of production for new oil/gas field s discoveries in China and elsewhere. New oil/gas field, such as shale gas production will need more compatible equipment Strategic Cooperation with multinational companies Maintaining competitive advantages, increasing profit margin. Expand products type & fuction to further maximize profitablity Improve products quality & production technology; develop new customized types of oil/gas engineerings 15

Our Growth Strategies - Supporting Growth . China’s Growing Demand For Oil and Gas 16 Source: BP Energy Outlook 2035 Bloomburg

Our Growth Strategies - Supporting Growth China ’ s big two oil companies are maintaining substantial expenditures in E&P 17

China ’ s Continuing Overseas Investment in Oil and Gas High automated technology and products instead of on - site laborers Long term good relationships with our customers • Our Advantages Our Growth Strategies - Supporting Growth 18

Our Growth Strategies - Positive Trends Reform of China SEOs: Diversified Ownership --- More Opportunities for Private Companies, like RCON More Opportunities • Private Capital to sales unit • Distribution Business • Private Investment SINOPEC • Joint Cooperat ion • Jointly Develop Projects • Oil and Gas Exploration CNPC 19

20 Financial Highlights

Total Revenue Gross Profit Operating Expenses Net Income 0 1000 2000 3000 4000 5000 6000 2011FY 2012FY 2013FY 2014FY 3128 3810 4082 5267 (values in 000's USD ) -5000 -4000 -3000 -2000 -1000 0 1000 2011FY 2012FY 2013FY 2014FY -4492 -601 6.415 297 (values in 000's USD ) 0 1000 2000 3000 4000 5000 6000 7000 2011FY 2012FY 2013FY 2014FY 6418 4400 4139 4807 (values in 000's USD ) 0 5000 10000 15000 20000 2011FY 2012FY 2013FY 2014FY 9853 11889 12478 15182 (values in 000's USD ) Financial Highlights Key Financials Measures Have Improved Year Over Year . 21

Financial Highlights Strong financial results in FY 2014 FY 2014 FY 2013 Percentage Revenues ( ‘ 000 USD ) ($1.00 = 6.1552 RMB) $ 15,182 $ 12,442 +22% Net income attributable to Recon Technology (U.S. GAAP, ‘ 000 USD) $ 6 $ 134 +1,933% Adjusted net income attributable to Recon Technology (non GAAP, ‘000 USD)* $ 307 $831 +170% Adjusted EBITDA (non GAAP, ‘000 USD)* $ 749 $ 1,436 +91.7 % Adjusted diluted EPS (non GAAP) $ 0.19 $ 0.08 + 137% Diluted EPS (GAAP) $ 0.03 $ 0.002 + 1740 % * Non GAAP adjusted net income and EPS exclude certain special non - cash after tax expenses totaling $700,419($0.16 per share) that are included in net income. • Hardware and Software sales to non - related parties grew 108.2% year over year, offsetting a decline in revenues related to fracturing • Gross margins increased year - over - year from 32.7% to 34.7%, in part reflecting the decline in lower margin fracturing related sales • Operating income went from a loss in FY2013 of $91,751 to income of $459,812 • Adjusted EBITDA (non - GAAP) almost doubled year over year to approximately $1,435,680 and compared with approximately $296,956 in reported net income 22

Financial Highlights Gross Profit Operating Exp./ Income FY 2013 FY 2014 % Change Revenues (‘000 USD) $ 12,442 $ 15,182 +22% Cost of revenues $ 8,372 $ 9,915 +18.4% Gross profit $4,070 $ 5,267 +29.4% GP Margin (%) 32.71% 34.69% +2% Unit: ‘000 USD FY 2013 FY 2014 % Change Selling and distribution expenses 995 860 - 13.6 % % of revenue 8.0% 5.7% __ General and administrative expenses 1,784 2,631 +47.6 % % of revenue 14.3% 17.3% __ Research and development expenses 1,383 1,315 - 4.9 % % of revenue 11.1% 8.7% __ Operating expenses $ 4,162 $ 4,806 +15.5 % 23 Strong financial results in FY 2014

Financial Highlights FY 2013 2014 Net income attributable to Recon Technology, Ltd $ 6,450 $ 131,140 Special items (A) : Change in fair value of warrants liability - (9,853) Loss from investment - 249,423 Restricted shares issued for consulting services - 66,219 Share - based compensation expense 300,990 394,630 Adjusted net income attributable to RCON $ 307,440 $ 831,559 U.S. GAAP earnings per share - diluted - 0.002 0.03 Impact of special items on earnings per share 0.08 0.16 Non U.S. GAAP adjusted earnings per share - diluted (B) $ 0.08 $ 0.19 Weighted - average shares - diluted 3,951,811 4,368,162 (A) Special items are certain non - cash expenses that are included in our U.S. GAAP reported results. There was no income tax benefit associated with the special items. The non - GAAP financial measures are provided to enhance investors' overall understanding of Recon's current financial performance. 24 Strong financial results in FY 2014

Management Team 25

Yin, Shenpin Chairman and CEO Founder Responsible for overall strategies, planning, and business development 11 years of experience in automation industry Chen, Guangqiang Chief Technology Officer Founder Responsible for overall strategies, planning, and business development 27 years of experience in oil/gas industry Nelson N.S. Wong Independent Director Audit committee Chairman 30 years of experience in auditing Hu, Jijun Independent Director Compensation Committee Chairman 25 years of experience in oilfield development and management Zhao, Shudong Independent Director Nominating Committee Chairman 45 years of experience in oilfield development and management Management team - Experienced and dedicated senior management team Liu,Jia Chief Finance Officer Responsible for financ ing and reporting 6 years of financial management experience Li,Donglin T echnical M anager Responsible for on - sight engineering 28 years of experience in oil engineering Zheng,Yucai Technical Engineer Responsible for technical Implementer 40 years of experience in downhole engineering Yan,Yingwu T echnical M anager responsible for project management 16 years of experience in oilfield engineering 26

First & Foremost: Improve Safety, Improve Production, Reduce Costs China ’ s Continuing Demand for Energy No Manufacture: Low Fixed Cost + Bottom Line Improvement Continuing Expanding Product Line Geographic Expansion Shale Gas Opportunity: Fracturing Diversified Ownership Reform in China Potential Acquisitions Summary of Investment Highlights 27

• China: • Liu Jia • Recon Technology, Ltd. • info@recon.cn • +86 (10) 84945799 • U.S. • Ken Donenfeld • DGI Investor Relations • kdonenfeld@dgiir.com • 1 - 212 - 425 - 5700 Contact Info 28

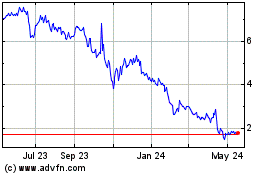

Recon Technology (NASDAQ:RCON)

Historical Stock Chart

From Oct 2024 to Nov 2024

Recon Technology (NASDAQ:RCON)

Historical Stock Chart

From Nov 2023 to Nov 2024