ReShape Lifesciences Inc. (Nasdaq:

RSLS), the premier physician-led weight loss and metabolic

health-solutions company, today reported financial results for the

first quarter ended March 31, 2024 and provided a corporate

strategic update.

First Quarter 2024 and Subsequent

Highlights

- March 2024: Significantly strengthened the company’s

intellectual property portfolio related to an intragastric balloon

system. Specifically, received a Notice of Allowance from the U.S.

Patent and Trademark Office (USPTO) for patent application

18/370,819. The patent, number 11974934, was issued on May 7, 2024

and provides protection into at least January 2031, without

accounting for a potential Patent Term Extension (PTE).

- March 2024: Due to the continued impact on the company’s

revenue caused by the rise in glucagon-like peptide 1 (GLP-1)

receptor agonist prescriptions for weight loss, ReShape provided an

update on its 2024 cost reduction plan, including a further

Reduction in Force (RIF). Full implementation of the plan is

expected to result in further lowering operating expenses of

approximately $8.0 million in 2024, or more than a 50% reduction

compared to 2023, excluding one-time costs.

- February 2024: Announced that the first surgeries utilizing the

company’s next generation, enhanced Lap-Band® 2.0 FLEX, were

successfully performed by Adam Smith, D.O., Bariatric Surgery

Specialist and Chief Executive Officer of Ultimate Bariatrics in

Dallas, Fort Worth, TX, and Christine Ren-Fielding, M.D., Professor

of Surgery at NYU Grossman School of Medicine, Director of NYU

Langone Health’s Weight Management Program and Chief of the

Division of Bariatric Surgery.

- January 2024: Conducted bariatric fellows training for their

Lap-Band® System, highlighting the Lap-Band® 2.0 FLEX.

“During the first quarter and subsequent period,

we have remained focused on delivering shareholder value and are on

a path to profitability, executing the 2024 cost reductions we

outlined in March. To that end, we continue to fine-tune our lead

generation activities and invest in our growth drivers, including

the commercial launch of the Lap-Band® 2.0 FLEX,” stated Paul F.

Hickey, President and Chief Executive Officer of ReShape

Lifesciences®. “With the adoption of GLP-1s, the stigma around

obesity treatment is being replaced with medical intervention and

we are steadfast in our confidence that the number of people

seeking medical professionals, especially bariatric surgeons, will

continue to increase. The first surgeries utilizing ReShape’s next

generation, enhanced Lap-Band® 2.0 FLEX, designed to improve the

patient experience, were successfully performed in February and

additional surgeries have already taken place. Based on surgeon

feedback, including those who have used the Lap-Band® 2.0 FLEX, we

believe the market opportunity for the Lap-Band® franchise will

increase, over time.

“In March, we significantly strengthened

ReShape’s intellectual property portfolio surrounding the

intragastric balloon system, having received a Notice of Allowance

from the USPTO, and last week, had the patent issued. We will

continue to build a defensive ‘moat’ around our product portfolio,

innovation and commercialization efforts and, when necessary, we

will take offensive action to defend our position utilizing

non-dilutive funding. That said, as we continue through 2024, we

are making significant progress implementing our 2024 cost

reduction plan, which has included a further reduction in staff,

expected to lower operating expenses by roughly 50%, compared to

last year. These cuts are necessary to allow us to focus on our

growth initiatives, by optimizing the commercialization of the

Lap-Band® franchise. It is important to note that we are continuing

our high priority search for synergistic M&A opportunities and,

as previously reported, have engaged Maxim Group LLC, on an

exclusive basis, to assist in this process. Finding the right

partner will be key to the long-term success of ReShape

Lifesciences. We look forward to providing further updates as the

search continues.”

First Quarter Ended March 31, 2024,

Financial and Operating Results

Revenue totaled $1.9 million

for the three months ended March 31, 2024, which represents a

contraction of 15.0%, or $0.3 million compared to the same period

in 2023. The primary reason is due to a decrease in sales volume

primarily due to GLP-1 pharmaceuticals.

Gross Profit for both three

months ended March 31, 2023 and 2024, was $1.2 million. Gross

profit as a percentage of total revenue for the three months ended

March 31, 2024, was 59.9% compared to 53.5% for the same period in

2023. The increase in gross profit percentage is due to the

reduction in overhead related costs, primarily payroll, as the

Company had a reduction of employees late in 2023.

Sales and Marketing Expenses

for the three months ended March 31, 2024, decreased by $1.2

million, or 53.3%, to $1.0 million, compared to $2.2 million for

the same period in 2023. The decrease is primarily due to a

decrease of $0.7 million in advertising and marketing expenses,

including consulting and professional marketing services, as the

Company has reevaluated its marketing approach and has moved to a

targeted digital marketing campaign, resulting in a reduction of

costs. The Company also had a reduction in payroll expenditure,

including commissions, stock compensation expense and travel of

$0.5 million, due to changes in sales personnel and lower

sales.

General and Administrative

Expenses for the three months ended March 31, 2024,

decreased by $2.3 million, or 55.6%, to approximately $1.9 million,

compared to $4.2 million for the same period in 2023. The decrease

is primarily due to a reduction in professional services, such as

audit and legal fees of $1.3 million primarily due to the fiscal

year 2022 restatement that occurred during the first quarter of

2023, public stock offering costs, and a reduction in

payroll-related expenses, including a reduction in stock-based

compensation expense of $0.5 million, due to changes within

personnel. The Company also had a decrease in rent and insurance of

$0.1 million as it moved its headquarters during the second quarter

of 2023 to a smaller facility to reduce costs.

Research and Development

Expenses Research and development expenses were

approximately $0.5 million for the three months ended March 31,

2024, remaining consistent with the same period in 2023, with a

slight decrease primarily in stock based compensation.

Cash and Cash Equivalents As of

March 31, 2024, the Company had net working capital of

approximately $4.4 million, primarily due to cash and cash

equivalents of $2.5 million, and $1.6 million of accounts

receivable.

A full discussion of the company’s financials is available in

our Annual Report on Form 10-Q, filed with the Securities and

Exchange Commission.

Conference Call Information

Management will host a conference call to

discuss ReShape’s financial and

operational results today at 4:30 pm ET. To participate

in the conference call please register with the following

Registration Link, and dial-in details will be provided.

Participants using this feature are requested to dial into the

conference call fifteen minutes ahead of time to avoid delays.

An archived replay will also be available on the

“Events and Presentations” section of ReShape’s website at:

https://ir.reshapelifesciences.com/events-and-presentations.

About ReShape Lifesciences®

ReShape Lifesciences® is America’s premier weight loss and

metabolic health-solutions company, offering an integrated

portfolio of proven products and services that manage and treat

obesity and metabolic disease. The FDA-approved Lap-Band® System

provides minimally invasive, long-term treatment of obesity and is

an alternative to more invasive surgical stapling procedures such

as the gastric bypass or sleeve gastrectomy. The investigational

Diabetes Bloc-Stim Neuromodulation™ (DBSN™) system utilizes a

proprietary vagus nerve block and stimulation technology platform

for the treatment of type 2 diabetes and metabolic disorders. The

Obalon® balloon technology is a non-surgical, swallowable,

gas-filled intra-gastric balloon that is designed to provide

long-lasting weight loss. For more information, please visit

www.reshapelifesciences.com.

Forward-Looking Safe Harbor

Statement This press release may contain forward-looking

statements within the meaning of the Private Securities Litigation

Reform Act of 1995. Actual results could differ materially from

those discussed due to known and unknown risks, uncertainties, and

other factors. These forward-looking statements generally can be

identified by the use of words such as "expect," "plan,"

"anticipate," "could," "may," "intend," "will," "continue,"

"future," other words of similar meaning and the use of future

dates. Forward-looking statements in this press release include

statements about the company’s projected decrease in operating

expenses for 2024, its belief that it is on a path to

profitability, and its expectation that the market opportunity for

Lap-Band will increase. These and additional risks and

uncertainties are described more fully in the company's filings

with the Securities and Exchange Commission, including those

factors identified as "risk factors" in our most recent Annual

Report on Form 10-K and subsequent Quarterly Reports on Form 10-Q.

We are providing this information as of the date of this press

release and do not undertake any obligation to update any

forward-looking statements contained in this document as a result

of new information, future events or otherwise, except as required

by law.

Non-GAAP DisclosuresIn addition

to the financial information prepared in conformity with GAAP, we

provide certain historical non-GAAP financial information.

Management believes that these non-GAAP financial measures assist

investors in making comparisons of period-to-period operating

results.

Management believes that the presentation of

this non-GAAP financial information provides investors with greater

transparency and facilitates comparison of operating results across

a broad spectrum of companies with varying capital structures,

compensation strategies, and amortization methods, which provides a

more complete understanding of our financial performance,

competitive position, and prospects for the future. However, the

non-GAAP financial measures presented in this release have certain

limitations in that they do not reflect all of the costs associated

with the operations of our business as determined in accordance

with GAAP. Therefore, investors should consider non-GAAP financial

measures in addition to, and not as a substitute for, or as

superior to, measures of financial performance prepared in

accordance with GAAP. Further, the non-GAAP financial measures

presented by the company may be different from similarly named

non-GAAP financial measures used by other companies.

Adjusted EBITDAManagement uses

Adjusted EBITDA in its evaluation of the company’s core results of

operations and trends between fiscal periods and believes that

these measures are important components of its internal performance

measurement process. Adjusted EBITDA is defined as net loss before

interest, taxes, depreciation and amortization, stock-based

compensation, and other one-time costs. Management uses Adjusted

EBITDA in its evaluation of the company’s core results of

operations and trends between fiscal periods and believes that

these measures are important components of its internal performance

measurement process. Therefore, investors should consider non-GAAP

financial measures in addition to, and not as a substitute for, or

as superior to, measures of financial performance prepared in

accordance with GAAP. Further, the non-GAAP financial measures

presented by the company may be different from similarly named

non-GAAP financial measures used by other companies.

CONTACTS:

ReShape Lifesciences

Contact: Paul

F. HickeyPresident and Chief Executive

Officer949-276-7223ir@ReShapeLifesci.com

Investor Relations Contact:Rx

Communications GroupMichael

Miller(917)-633-6086mmiller@rxir.com

RESHAPE LIFESCIENCES

INC.Consolidated Balance Sheets (dollars

in thousands; unaudited)

| |

|

|

|

|

|

|

| |

|

March 31, |

|

December 31, |

| |

|

2024 |

|

2023 |

|

ASSETS |

|

|

|

|

|

|

| Current assets: |

|

|

|

|

|

|

|

Cash and cash equivalents |

|

$ |

2,379 |

|

|

$ |

4,459 |

|

|

Restricted cash |

|

|

100 |

|

|

|

100 |

|

|

Accounts and other receivables |

|

|

1,566 |

|

|

|

1,659 |

|

|

Inventory |

|

|

3,467 |

|

|

|

3,741 |

|

|

Prepaid expenses and other current assets |

|

|

383 |

|

|

|

337 |

|

|

Total current assets |

|

|

7,895 |

|

|

|

10,296 |

|

| Property and equipment,

net |

|

|

54 |

|

|

|

60 |

|

| Operating lease right-of-use

assets |

|

|

226 |

|

|

|

250 |

|

| Deferred tax asset, net |

|

|

27 |

|

|

|

28 |

|

| Other intangible assets,

net |

|

|

— |

|

|

|

— |

|

| Other assets |

|

|

29 |

|

|

|

29 |

|

|

Total assets |

|

$ |

8,231 |

|

|

$ |

10,663 |

|

|

LIABILITIES AND STOCKHOLDERS’ EQUITY |

|

|

|

|

|

|

| Current liabilities: |

|

|

|

|

|

|

|

Accounts payable |

|

$ |

1,314 |

|

|

$ |

1,689 |

|

|

Accrued and other liabilities |

|

|

1,930 |

|

|

|

1,814 |

|

|

Warranty liability, current |

|

|

163 |

|

|

|

163 |

|

|

Operating lease liabilities, current |

|

|

112 |

|

|

|

111 |

|

|

Total current liabilities |

|

|

3,519 |

|

|

|

3,777 |

|

| Operating lease liabilities,

noncurrent |

|

|

127 |

|

|

|

151 |

|

| Common stock warrant

liability |

|

|

51 |

|

|

|

72 |

|

|

Total liabilities |

|

|

3,697 |

|

|

|

4,000 |

|

| Commitments and contingencies

(Note 14) |

|

|

|

|

|

|

| Stockholders’ equity: |

|

|

|

|

|

|

|

Preferred stock |

|

|

|

|

|

|

|

Series C convertible preferred stock |

|

|

— |

|

|

|

— |

|

|

Common stock |

|

|

23 |

|

|

|

23 |

|

|

Additional paid-in capital |

|

|

642,374 |

|

|

|

642,302 |

|

|

Accumulated deficit |

|

|

(637,727 |

) |

|

|

(635,574 |

) |

|

Accumulated other comprehensive loss |

|

|

(96 |

) |

|

|

(88 |

) |

|

Total stockholders’ equity |

|

|

4,534 |

|

|

|

6,663 |

|

|

Total liabilities and stockholders’ equity |

|

$ |

8,231 |

|

|

$ |

10,663 |

|

|

|

|

|

|

|

|

|

|

|

RESHAPE LIFESCIENCES INC.

Consolidated Statements of Operations (dollars in

thousands; unaudited)

| |

|

|

|

|

|

|

| |

|

Three Months Ended March 31, |

|

|

|

|

2024 |

|

|

|

2023 |

|

| Revenue |

|

$ |

1,944 |

|

|

$ |

2,287 |

|

| Cost of revenue |

|

|

779 |

|

|

|

1,063 |

|

| Gross profit |

|

|

1,165 |

|

|

|

1,224 |

|

| Operating

expenses: |

|

|

|

|

|

|

|

Sales and marketing |

|

|

1,019 |

|

|

|

2,182 |

|

|

General and administrative |

|

|

1,872 |

|

|

|

4,220 |

|

|

Research and development |

|

|

484 |

|

|

|

453 |

|

| Total operating expenses |

|

|

3,375 |

|

|

|

6,855 |

|

| Operating loss |

|

|

(2,210 |

) |

|

|

(5,631 |

) |

| Other expense

(income), net: |

|

|

|

|

|

|

|

Interest (income) expense, net |

|

|

(9 |

) |

|

|

5 |

|

|

Gain on changes in fair value of liability warrants |

|

|

(21 |

) |

|

|

(2,965 |

) |

|

(Gain) loss on foreign currency exchange, net |

|

|

24 |

|

|

|

(21 |

) |

|

Other |

|

|

(25 |

) |

|

|

(2 |

) |

| Loss before income tax

provision |

|

|

(2,179 |

) |

|

|

(2,648 |

) |

| Income tax expense

(benefit) |

|

|

14 |

|

|

|

14 |

|

| Net loss |

|

$ |

(2,193 |

) |

|

$ |

(2,662 |

) |

| |

|

|

|

|

|

|

The following table contains a reconciliation of GAAP net loss

to non-GAAP net loss Adjusted EBITDA attributable to common

stockholders for the months ended March 31, 2024 and 2023 (in

thousands):

| |

|

|

|

|

|

| |

Three Months Ended March 31, |

| |

2024 |

|

2023 |

|

GAAP net loss |

$ |

(2,193 |

) |

|

$ |

(2,662 |

) |

| Adjustments: |

|

|

|

|

|

|

Interest (income) expense, net |

|

(9 |

) |

|

|

5 |

|

|

Income tax expense (benefit) |

|

14 |

|

|

|

14 |

|

|

Depreciation and amortization |

|

6 |

|

|

|

48 |

|

|

Stock-based compensation expense |

|

72 |

|

|

|

222 |

|

|

Gain on changes in fair value of liability warrants |

|

(21 |

) |

|

|

(2,965 |

) |

| Adjusted EBITDA |

$ |

(2,131 |

) |

|

$ |

(5,338 |

) |

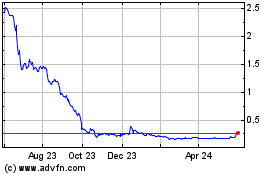

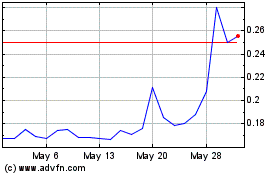

ReShape Lifesciences (NASDAQ:RSLS)

Historical Stock Chart

From Oct 2024 to Oct 2024

ReShape Lifesciences (NASDAQ:RSLS)

Historical Stock Chart

From Oct 2023 to Oct 2024