Riverview Bancorp Increases Cash Dividend by 9.7% to $0.17

June 16 2005 - 7:00AM

Business Wire

Riverview Bancorp, Inc. (Nasdaq:RVSB) announced its Board of

Directors declared on June 15, 2005, a $0.17 per share cash

dividend to be paid July 14, 2005, to shareholders of record on

June 30, 2005. This represents a 9.7% increase over the previous

quarter's cash dividend. "The increase in our dividend payment

reflects our solid performance in fiscal 2005 and our confidence in

the future as we expand our service territory into Oregon," said

Pat Sheaffer, Chairman and CEO. "This is our 31st consecutive cash

dividend and represents a 3.1% yield on the recent stock price."

The company plans to report fiscal first quarter results on July

19, 2005, and management will host a conference call later that

day. Complete conference call details will be made available in

early July. Riverview Bancorp, Inc. (www.riverviewbank.com) is

headquartered in Vancouver, Washington -- just north of Portland,

Oregon on the I-5 corridor. With assets of $573 million, it is the

parent company of the 82 year-old Riverview Community Bank, as well

as Riverview Mortgage and Riverview Asset Management Corp. There

are 13 Southwest Washington branches, including nine in Clark

County -- the second fastest growing county in the state, and one

lending center. The bank offers true community banking services,

focusing on providing the highest quality service and financial

products to commercial and retail customers. The company recently

announced the signing of a definitive merger agreement with

American Pacific Bank (Nasdaq:AMPB), a Portland, Oregon bank with

assets of $125 million. The company closed the transaction on April

22, 2005. Statements concerning future performance, developments or

events, concerning expectations for growth and market forecasts,

and any other guidance on future periods, constitute

forward-looking statements, which are subject to a number of risks

and uncertainties that might cause actual results to differ

materially from stated objectives. These factors include but are

not limited to: RVSB's ability to maintain current dividend

payments or increase dividend payouts to shareholders, regional

economic conditions and the company's ability to efficiently manage

expenses. Additional factors that could cause actual results to

differ materially are disclosed in Riverview Bancorp's recent

filings with the SEC, including but not limited to Annual Reports

on Form 10-K, quarterly reports on Form 10-Q and current reports on

Form 8-K.

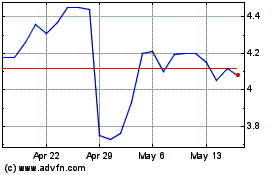

Riverview Bancorp (NASDAQ:RVSB)

Historical Stock Chart

From Jun 2024 to Jul 2024

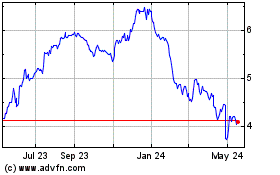

Riverview Bancorp (NASDAQ:RVSB)

Historical Stock Chart

From Jul 2023 to Jul 2024