Riverview Bancorp, Inc. (Nasdaq:RVSB) today reported strong loan

and deposit growth both organically and through the acquisition of

American Pacific Bank, contributed to a 28% increase in net

interest income and a 47% increase in its loan portfolio for the

first fiscal quarter ended June 30, 2005 as compared to the same

period in the prior year. Net income was $1.8 million, or $0.33 per

diluted share, in the first quarter of fiscal 2006. To reflect its

larger loan portfolio, Riverview increased its loan loss provision

for the quarter to $450,000 versus $140,000 in the first quarter a

year ago. In the first fiscal quarter a year ago, which included

$828,000 pre-tax gain on the sale of the Camas branch and

operations center, or $0.11 per diluted share to earnings,

Riverview earned $2.2 million, or $0.45 per diluted share. On April

22, 2005, Riverview completed its acquisition of Portland,

Oregon-based American Pacific Bank, resulting in acquisition of

$127.2 million of total assets, $120.3 million of loans and $80.0

million of deposits. "Acquiring American Pacific Bank, a

high-performing community bank located in a premium, high-growth

area, is consistent with our ongoing strategy of expanding our

commercial banking franchise," said Pat Sheaffer, Chairman and CEO.

"We have shifted our loan portfolio mix by adding higher-yielding

commercial credits, grown core deposits and decreased our

dependence on CDs, which should result in higher margins going

forward. In addition, we expect this transaction to be accretive to

earnings within the first year." First Quarter Financial Highlights

(at or periods ended June 30, 2005 compared to June 30, 2004) --

Completed acquisition of American Pacific Bank. -- Added $450,000

to its loan loss provision, compared to $140,000. -- Net interest

income increased 28% to $7.1 million. -- Total assets increased 43%

to $737 million. -- Loans increased 47% to $561 million. -- Loan

mix shifted resulting in a greater concentration of land and

commercial real estate loans. -- Deposits grew 45% to $583 million,

with a 25% increase in transaction account balances. --

Non-performing assets were 0.33% of total assets. Balance Sheet

Growth "The loans added from American Pacific Bank are primarily

land and commercial real estate loans, all of which have undergone

a thorough underwriting by our lenders to make sure they conform to

our standards. These loans, along with our internally generated

loans, combined to increase the commercial real estate loans and

land development loans in our portfolio by 91%. They now account

for 61% of the portfolio at June 30, 2005, compared to 47% a year

ago," said Ron Wysaske, President and COO. Net loans at June 30,

2005 were $571 million compared to $390 million at June 30, 2004.

Permanent single-family loans represent just 6% of Riverview's loan

portfolio. Total assets increased 43% to a record $737 million at

June 30, 2005, compared to $515 million a year ago. Deposits grew

45% to $583 million compared to $403 million at June 30, 2004.

"Building transaction accounts continues to be our focus while we

decrease the emphasis on certificate of deposits," added Wysaske.

"We reduced interest sensitive wholesale deposits by $4.5 million

while we increased core deposits by $185 million; a 46% increase

over core deposits at June 30, 2004." Including the issuance of

$16.7 million in stock associated with the American Pacific Bank

acquisition, shareholders' equity increased 32% to $87.4 million,

from $66.2 million at the end of the first fiscal quarter last

year. Book value was $15.06 at June 30, 2005, compared to $13.28 a

year earlier. Tangible book value was $10.25 at June 30, 2005,

compared to $11.18 a year ago. Operating Results In the first

fiscal quarter, net interest income before the provision for loan

loss increased 28% to $7.1 million, compared to $5.6 for the like

quarter a year ago. For the quarter, the net interest margin was

4.70%, a five basis point improvement from the net interest margin

of 4.65% in previous quarter. The net interest margin was 4.90% in

the first fiscal quarter of 2005. Revenues (net interest income

before the provision for loan losses plus non-interest income)

increased 13% to $9.3 million for the quarter, compared to $8.2

million in the first fiscal quarter last year. Non-interest income

was $2.2 million in the first fiscal quarter of 2006, compared to

$2.6 million in the prior year's first quarter. Non-interest income

for the first fiscal quarter of 2006 decreased by 17% due to the

gain on sale of the Camas branch last year, in the first fiscal

quarter of 2005. Excluding the prior year's $828,000 pre-tax gain

on sale, non-interest income increased 21% compared to the like

quarter a year ago. "Acquisition and Sarbanes-Oxley-related

expenses were $300,000 in the first quarter, and I anticipate these

expenses to dramatically decrease going forward," Sheaffer added.

For the first fiscal quarter of 2006, non-interest expense was $6.1

million compared to $4.8 million during the same period a year ago.

Net of intangible amortization, the efficiency ratio was 64.77% for

the quarter, compared to 57.54% in the first fiscal quarter of

2005. Credit Quality and Performance Measures Non-performing assets

were 0.33% of total assets at June 30, 2005, compared to 0.34% of

total assets a year ago. The allowance for loan losses was $6.5

million or 1.15% of total net loans outstanding at June 30, 2005,

compared to $4.5 million or 1.16% of total net loans at June 30,

2004. Riverview increased its allowance for loan losses by 45% to

account for the increase in total loans due to the American Pacific

acquisition. Riverview's first fiscal quarter 2006 return on

average assets (ROA) was 1.09%, compared to return on average

assets of 1.74% for the first fiscal quarter of 2005. Return on

average equity was 8.89% for the quarter, compared to 13.32% for

the same period last year. Conference Call Riverview Bancorp will

host a conference call Tuesday, July 19, at 8:00 a.m. PDT, to

discuss first quarter results. The conference call can be accessed

live by telephone at 303-262-2137. To listen to the call online go

to www.actioncast.acttel.com and use event ID 29412. An archived

recording of the call can be accessed by dialing 303-590-3000

access code 11033254# until Tuesday, July 26, 2005 or via the

Internet at www.actioncast.acttel.com and use event ID 29412.

Riverview Bancorp, Inc. (www.riverviewbank.com) is headquartered in

Vancouver, Washington -- just north of Portland, Oregon on the I-5

corridor. With assets of $737 million it is the parent company of

the 82 year-old Riverview Community Bank, as well as Riverview

Mortgage and Riverview Asset Management Corp. In addition to the

Oregon branches acquired from American Pacific Bank, there are 13

Southwest Washington full service branch locations, including nine

in Clark County along with two lending centers. Riverview offers

true community banking, focusing on providing the highest quality

service and financial products to commercial and retail customers.

Statements concerning future performance, developments or events,

concerning expectations for growth and market forecasts, and any

other guidance on future periods, constitute forward-looking

statements, which are subject to a number of risks and

uncertainties that might cause actual results to differ materially

from stated objectives. These factors include but are not limited

to: RVSB's ability to integrate the American Pacific acquisition

and efficiently manage expenses. Additional factors that could

cause actual results to differ materially are disclosed in

Riverview Bancorp's recent filings with the SEC, including but not

limited to Annual Reports on Form 10-K, quarterly reports on Form

10-Q and current reports on Form 8-K. -0- *T RIVERVIEW BANCORP,

INC. AND SUBSIDIARY CONSOLIDATED BALANCE SHEETS June 30, 2005,

March 31, 2005 and June 30, 2004 (In thousands, except share data)

(Unaudited) June 30, March 31, June 30, ASSETS 2005 2005 2004

-------- -------- -------- Cash (including interest-earning

accounts of $52,262, $45,501 and $17,235) $ 74,485 $ 61,719 $

37,341 Loans held for sale 159 510 821 Investment securities

available for sale, at fair value (amortized cost of $24,136,

$22,993 and $32,713) 24,148 22,945 32,079 Mortgage-backed

securities held to maturity, at amortized cost (fair value of

$2,297, $2,402 and $2,488) 2,260 2,343 2,448 Mortgage-backed

securities available for sale, at fair value (amortized cost of

$10,913, $11,756 and $14,386) 10,828 11,619 14,303 Loans receivable

(net of allowance for loan losses of $6,526 $4,395 and $4,489)

561,012 429,449 382,057 Real estate owned - 270 460 Prepaid

expenses and other assets 2,166 1,538 3,604 Accrued interest

receivable 2,664 2,151 1,705 Federal Home Loan Bank stock, at cost

7,350 6,143 6,078 Premises and equipment, net 9,339 8,391 8,618

Deferred income taxes, net 2,483 2,624 3,089 Mortgage servicing

intangible, net 458 470 601 Goodwill 26,356 9,214 9,214 Core

deposit intangible, net 1,055 578 678 Bank owned life insurance

12,726 12,607 12,275 -------- -------- -------- TOTAL ASSETS

$737,489 $572,571 $515,371 ======== ======== ======== LIABILITIES

AND SHAREHOLDERS' EQUITY LIABILITIES: Deposit accounts $582,830

$456,878 $402,632 Accrued expenses and other liabilities 8,259

5,858 6,402 Advance payments by borrowers for taxes and insurance

98 313 94 Federal Home Loan Bank advances 58,904 40,000 40,000

-------- -------- -------- Total liabilities 650,091 503,049

449,128 SHAREHOLDERS' EQUITY: Serial preferred stock, $.01 par

value; 250,000 authorized, issued and outstanding, none - - -

Common stock, $.01 par value; 50,000,000 authorized, June 30, 2005

- 5,804,953 issued, 5,804,949 outstanding; 58 50 50 March 31, 2005

- 5,015,753 issued, 5,015,749 outstanding June 30, 2004 - 4,986,979

issued, 4,986,975 outstanding Additional paid-in capital 57,991

41,112 40,427 Retained earnings 30,737 29,874 27,786 Unearned

shares issued to employee stock ownership trust (1,340) (1,392)

(1,547) Accumulated other comprehensive loss (48) (122) (473)

-------- -------- -------- Total shareholders' equity 87,398 69,522

66,243 -------- -------- -------- TOTAL LIABILITIES AND

SHAREHOLDERS' EQUITY $737,489 $572,571 $515,371 ======== ========

======== RIVERVIEW BANCORP, INC. AND SUBSIDIARY CONSOLIDATED

STATEMENTS OF INCOME Three Months Ended (In thousands, except share

data) June 30, (Unaudited) 2005 2004 INTEREST INCOME: ----------

---------- Interest and fees on loans receivable $ 9,597 $ 6,626

Interest on investment securities-taxable 186 124 Interest on

investment securities-non taxable 43 44 Interest on mortgage-backed

securities 145 160 Other interest and dividends 254 139 ----------

---------- Total interest income 10,225 7,093 ---------- ----------

INTEREST EXPENSE: Interest on deposits 2,471 1,043 Interest on

borrowings 656 496 ---------- ---------- Total interest expense

3,127 1,539 ---------- ---------- Net interest income 7,098 5,554

Less provision for loan losses 450 140 ---------- ---------- Net

interest income after provision for loan losses 6,648 5,414

---------- ---------- NON-INTEREST INCOME: Fees and service charges

1,486 1,170 Asset management fees 364 272 Gain on sale of loans

held for sale 126 175 Gain on sale of real estate owned 21 - Loan

servicing income 27 19 Gain on sale of land and fixed assets - 828

Bank owned life insurance income 120 154 Other 43 22 ----------

---------- Total non-interest income 2,187 2,640 ----------

---------- NON-INTEREST EXPENSE: Salaries and employee benefits

3,399 2,646 Occupancy and depreciation 803 773 Data processing 365

249 Amortization of core deposit intangible 49 81 Advertising and

marketing expense 231 251 FDIC insurance premium 15 15 State and

local taxes 135 153 Telecommunications 63 64 Professional fees 363

123 Other 673 477 ---------- ---------- Total non-interest expense

6,096 4,832 ---------- ---------- INCOME BEFORE INCOME TAXES 2,739

3,222 PROVISION FOR INCOME TAXES 918 1,023 ---------- ----------

NET INCOME $ 1,821 $ 2,199 ---------- ---------- Earnings per

common share: Basic $ 0.34 $ 0.46 Diluted 0.33 0.45 Weighted

average number of shares outstanding: Basic 5,389,547 4,790,785

Diluted 5,457,270 4,864,583 RIVERVIEW BANCORP, INC. AND SUBSIDIARY

FINANCIAL HIGHLIGHTS (Unaudited) At or for the At or for the three

year ended months ended June 30, March 31, 2005 2004 2005

---------------------- ----------- (Dollars in thousands, except

share data) FINANCIAL CONDITION DATA

----------------------------------------------------------------------

Average interest-earning assets $ 608,973 $ 458,378 $479,512

Average interest-bearing liabilities 505,581 375,594 388,426 Net

average earning assets 103,392 82,784 91,086 Non-performing assets

2,420 1,730 726 Non-performing loans 2,420 1,270 456 Allowance for

loan losses 6,526 4,489 4,395 Average interest-earning assets to

average interest-bearing liabilities 120.45% 122.04% 123.45%

Allowance for loan losses to non- performing loans 269.67% 353.46%

963.82% Allowance for loan losses to net loans 1.15% 1.16% 1.01%

Non-performing loans to total net loans 0.43% 0.33% 0.10%

Non-performing assets to total assets 0.33% 0.34% 0.13%

Shareholders' equity to assets 11.85% 12.85% 12.14% Number of

banking facilities 17 14 14 At the At three months ended year ended

June 30, March 31, LOAN DATA 2005 2004 2005

---------------------------------- ----------- --------- --------

Residential: One-to-four-family $ 34,324 $ 43,124 $ 36,514

Multi-family 2,037 5,046 2,568 Construction: One-to-four-family

48,932 45,191 44,415 Commercial real estate 29,390 1,453 11,138

Commercial 67,239 58,608 58,042 Consumer: Secured 29,040 28,576

28,782 Unsecured 4,811 1,966 1,668 Land 36,924 24,784 29,151

Commercial real estate 318,631 180,771 224,691 -----------

--------- -------- 571,328 389,519 436,969 Less: Deferred loan

fees, net 3,790 2,973 3,125 Allowance for loan losses 6,526 4,489

4,395 ----------- --------- -------- Loans receivable, net $

561,012 $ 382,057 $429,449 =========== ========= ======== RIVERVIEW

BANCORP, INC. AND SUBSIDIARY FINANCIAL HIGHLIGHTS (Unaudited) At or

for At or for the three the months end year ended June 30, March

31, SELECTED OPERATING DATA 2005 2004 2005

------------------------------------- ----------

--------------------- (Dollars in thousands, except share data)

Efficiency ratio (4) 65.65% 58.97% 65.70% Efficiency ratio net of

intangible amortization 64.77% 57.54% 64.46% Efficiency ratio net

of intangible amortization and impairment charge 64.77% 57.54%

61.63% Coverage ratio net of intangible amortization 117.38%

116.90% 119.28% Return on average assets (1) 1.09% 1.74% 1.24%

Return on average assets excluding impairment charge (1) 1.09%

1.74% 1.40% Return on average equity (1) 8.89% 13.32% 9.56% Return

on average equity excluding impairment charge (1) 8.89% 13.32%

10.87% Net interest margin 4.70% 4.90% 4.74% PER SHARE DATA

-------------- Basic earnings per share (3) $0.34 $0.46 $1.36

Diluted earnings per share (3) 0.33 0.45 1.33 Book value per share

(2) 15.06 13.28 13.86 Tangible book value per share (2) 10.25 11.18

11.81 Market price per share: High for the period 21.800 21.000

22.500 Low for the period 20.330 19.490 19.490 Close period end

21.350 20.730 21.250 Cash dividends declared per share 0.170 0.155

0.620 Average number of shares outstanding: Basic (3) 5,389,547

4,790,785 4,816,745 Diluted (3) 5,457,270 4,864,583 4,891,173 (1)

Amounts are annualized. (2) Amounts calculated include ESOP shares

not committed to be released. (3) Amounts calculated exclude ESOP

shares not committed to be released and include common stock

equivalents. (4) Non-interest expense divided by net interest

income plus non-interest income. *T

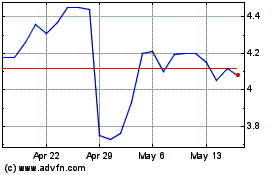

Riverview Bancorp (NASDAQ:RVSB)

Historical Stock Chart

From Jun 2024 to Jul 2024

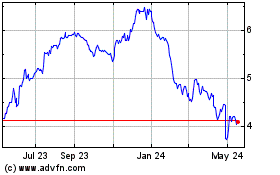

Riverview Bancorp (NASDAQ:RVSB)

Historical Stock Chart

From Jul 2023 to Jul 2024