Registration No. 333-__________

As filed with the Securities

and Exchange Commission on December 30, 2024

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM S-8

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

Rezolute, Inc.

(Exact name of registrant as specified in its

charter)

| Nevada |

27-3440894 |

(State

or other jurisdiction

of incorporation or

organization) |

(I.R.S.

Employer

Identification No.) |

| |

|

275 Shoreline Drive, Suite 500

Redwood City, CA 94065

(Address, including zip code, of principal

executive offices) |

| |

| AMENDED

AND RESTATED REZOLUTE, INC. 2021 EQUITY INCENTIVE PLAN |

EVANS INDUCEMENT AWARD

SVP INDUCEMENT AWARD

NON-PLAN INDUCEMENT AWARDS |

| (Full

title of the plan) |

| |

Rezolute, Inc.

Attn: Nevan Charles Elam, CEO

275 Shoreline Drive, Suite 500

Redwood City, CA 94065

(Name and address of agent for service) |

| |

(650) 206-4507

(Telephone number, including area code, of

agent for service) |

Copies of communications

to:

Anthony W. Epps

Dorsey & Whitney LLP

1400 Wewatta Street, Suite

400

Denver, CO 80202

(303) 629-3400

Indicate by check mark whether the registrant

is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company.

See definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and

“emerging growth company” in Rule 12b-2 of the Exchange Act.

| |

Large accelerated filer |

¨ |

Smaller reporting company |

x |

| |

Accelerated filer |

¨ |

Emerging growth company |

¨ |

| |

Non-accelerated filer |

x |

|

|

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 7(a)(2)(B) of the Securities Act. ¨

EXPLANATORY NOTE

On December 5, 2024, the shareholders of

Rezolute, Inc. (the “Company” or the “Registrant”) approved the amendment to the Rezolute, Inc. 2021

Equity Incentive Plan (the “2021 Plan”) whereby an aggregate of 14,450,000 shares of common stock are available for issuance

under the 2021 Plan. For further information regarding the 2021 Plan, please refer to our definitive proxy statement on Schedule 14A

filed with the Securities and Exchange Commission (the “Commission”) on October 21, 2024.

Unless the context indicates otherwise, as used

in this registration statement on Form S-8 (the “Registration Statement”), the terms the “Company,” “Rezolute,”

“we,” “us,” and “our,” refer to Rezolute, Inc. and its subsidiaries.

This registration statement (“Registration

Statement”) is being filed solely for (i) the amendment to the Rezolute, Inc. 2021 Equity Incentive Plan (as amended,

the “2021 Plan”) whereby an aggregate of 14,450,000 shares of common stock (“Common Stock”) are available for

issuance under the 2021 Plan, (ii) the registration of 275,000 shares of Common Stock of the Company issued pursuant to an inducement

award of 275,000 stock options subject to time-based vesting which were granted by the Company to Daron Evans on January 23, 2024,

as an inducement to accept employment as the Chief Financial Officer of the Company, (iii) the registration of 150,000 shares of

Common Stock of the Company issued pursuant to an inducement award of 150,000 stock options subject to time-based vesting which were

granted by the Company to the Company’s Senior Vice President of Global Product Supply on November 30, 2024, as an inducement

to accept employment, and (iv) 1,075,000 shares of Common Stock issuable upon the exercise of stock options, which were approved

by the Compensation Committee of the Board of Directors of the Registrant and can be granted outside of the 2021 Plan but pursuant to

the terms of the 2021 Plan as if such stock options were granted under the 2021 Plan, as inducement awards pursuant to Rule 5635(c)(4) of

the Nasdaq Listing Rules. The Registrant previously registered shares of Common Stock for issuance under the 2021 Plan on July 28,

2021 (Commission File No. 333-258222) and November 7, 2022 (Commission File No. 333-268221) (the “Prior Registration

Statements”).

This Registration Statement relates to securities

of the same class as that to which the Prior Registration Statements relate and is filed in accordance with General Instruction E to

Form S-8. Accordingly, pursuant to General Instruction E, the Company hereby incorporates by reference herein the contents of the

Prior Registration Statements and hereby deems such contents to be a part hereof, except as otherwise updated or modified by this Registration

Statement.

PART I

INFORMATION REQUIRED IN THE SECTION 10(a) PROSPECTUS

The information specified in Item 1 and Item

2 of Part I of Form S-8 is omitted from the Registration Statement in accordance with the provisions of Rule 428 under

the Securities Act of 1933, as amended (the “Securities Act”), and the instructions set forth in the introductory note to

Part I of Form S-8. The documents containing the information specified in Part I of Form S-8 will be delivered to

the participants in the Rezolute, Inc. Amended and Restated 2021 Equity Incentive Plan as required by Rule 428(b)(1) under

the Securities Act. Such documents are not required to be, and are not, filed with the Securities and Exchange Commission either as part

of the Registration Statement or as a prospectus or prospectus supplement pursuant to Rule 424 under the Securities Act.

PART II

INFORMATION REQUIRED IN THE REGISTRATION STATEMENT

| Item 3. | Incorporation of Documents by Reference. |

The following documents of Rezolute, Inc.

(the “Company” or “Registrant”) filed with the Securities and Exchange Commission (the “Commission”)

are incorporated herein by reference:

All documents and reports subsequently filed

by the Company pursuant to Sections 13(a), 13(c), 14 and 15(d) of the Securities Exchange Act of 1934, as amended (the “Exchange

Act”), prior to the filing of a post-effective amendment which indicates that all securities offered hereby have been sold or which

deregisters all securities then remaining unsold, shall be deemed to be incorporated by reference into this Registration Statement and

to be a part hereof from the date of filing of such documents; provided, however, that documents or information deemed to have been furnished

and not filed in accordance with Commission rules shall not be deemed incorporated by reference into this Registration Statement.

Any statement contained in a document incorporated

or deemed to be incorporated by reference herein shall be deemed to be modified or superseded to the extent that a statement contained

herein or in any other subsequently filed document which also is or is deemed to be incorporated by reference herein modifies or supersedes

such statement. Any such statement so modified or superseded shall not be deemed, except as so modified or superseded, to constitute

a part of this Registration Statement.

Unless specifically stated to the contrary, none

of the information we disclose under Items 2.02 or 7.01 of any Current Report on Form 8-K that we may from time to time furnish

to the SEC will be incorporated by reference into, or otherwise included in, this prospectus. The information contained on or accessible

through any websites, including our website, is not and shall not be deemed to be incorporated by reference into this prospectus.

You may request a copy of these filings, other

than an exhibit to these filings unless we have specifically included or incorporated that exhibit by reference into the filing, at no

cost, by writing or telephoning us at the following address:

Rezolute, Inc.

275 Shoreline Drive, Suite 500

Redwood City, CA 94065

(650) 206-4507

| Item 4. | Description of Securities. |

Not applicable.

| Item 5. | Interests of Named Experts and Counsel. |

Not applicable.

| Item 6. | Indemnification of Directors

and Officers. |

Our officers and directors are indemnified under

Nevada law, our amended and restated Articles of Incorporation, as amended, (the “Articles of Incorporation”) and our amended

and restated bylaws, as amended, (the “Bylaws”) against certain liabilities. Our Articles of Incorporation, require us to

indemnify our directors and officers to the fullest extent permitted by the laws of the State of Nevada in effect from time to time.

Pursuant to our Articles of Incorporation, and

our Bylaws, each person who was or is made a party or is threatened to be made a party to or is otherwise involved in any action, suit

or proceeding, by reason of the fact that such person is or was a director or an officer of the Company or is or was serving at the request

of the Company as a director, officer, or trustee of another enterprise, (hereinafter an “lndemnitee”), whether the basis

of such proceeding is alleged action in an official capacity as a director, officer or trustee or in any other capacity while serving

as a director, officer or trustee, shall be indemnified and held harmless by the Company to the fullest extent permitted by the Nevada

Revised Statutes, as the same exists or may hereafter be amended, against all expense, liability and loss (including attorneys’

fees, judgments, fines, ERISA excise taxes or penalties and amounts paid in settlement) reasonably incurred or suffered by such Indemnitee

in connection therewith; provided, however, that, except as otherwise provided in our amended and restated Articles of Incorporation,

we shall not be required to indemnify or advance expenses to any such Indemnitee in connection with a proceeding initiated by such Indemnitee

unless such proceeding was authorized by the Board of Directors of the Company. However, Nevada Revised Statutes 78.138 currently provides

that, except as otherwise provided in the Nevada Revised Statutes, a director or officer shall not be individually liable to us or our

stockholders or creditors for any damages as a result of any act or failure to act in his or her capacity as a director or officer unless

it is proven that (i) the presumption established by Nevada Revised Statutes 78.138(3) has been rebutted, (ii) the director’s

or officer’s acts or omissions constituted a breach of his or her fiduciary duties as a director or officer, and (iii) such

breach involved intentional misconduct, fraud or a knowing violation of the law.

In addition, an lndemnitee shall also have the

right to be paid by the Company the expenses (including attorney’s fees) incurred in defending any such proceeding in advance of

its final disposition; provided, however, that, if Nevada Revised Statutes requires, an advancement of expenses incurred by an Indemnitee

in his capacity as a director or officer shall be made only upon delivery to the Company of an undertaking, by or on behalf of such Indemnitee,

to repay all amounts so advanced if it shall ultimately be determined by final judicial decision from which there is no further right

to appeal that such lndemnitee is not entitled to be indemnified for such expenses.

No director shall be personally liable to us

or our stockholders for any monetary damages for breaches of fiduciary duty as a director; provided that this provision shall not eliminate

or limit the liability of a director, to the extent that such liability is imposed by applicable law, (i) for any breach of the

director’s duty of loyalty to the Company or our stockholders; (ii) for acts or omissions not in good faith or which involve

intentional misconduct or a knowing violation of law; (iii) under Section 174 or successor provisions of the Nevada Revised

Statutes; or (iv) for any transaction from which the director derived a personal benefit. No amendment to or repeal of this provision

shall apply to or have any effect on the liability or alleged liability of any director for or with respect to any acts or omissions

of such director occurring prior to such amendment or repeal. If the Nevada Revised Statutes is amended to authorize corporate action

further eliminating or limiting the personal liability of directors, then the liability of a director of the Company shall be eliminated

or limited to the fullest extent permitted by Nevada Revised Statues, as so amended.

Section 78.7502 of the Nevada Revised Statutes

permits a corporation to indemnify, pursuant to that statutory provision, a present or former director, officer, employee or agent of

the corporation, or of another entity or enterprise for which such person is or was serving in such capacity at the request of the corporation,

who was or is a party or is threatened to be made a party to any threatened, pending or completed action, suit or proceeding, except

an action by or in the right of the corporation, against expenses, including attorneys’ fees, judgments, fines and amounts paid

in settlement actually and reasonably incurred in connection therewith, arising by reason of such person’s service in such capacity

if such person (i) is not liable pursuant to Section 78.138 of the Nevada Revised Statutes, or (ii) acted in good faith

and in a manner which he or she reasonably believed to be in or not opposed to the best interests of the corporation and, with respect

to a criminal action or proceeding, had no reasonable cause to believe his or her conduct was unlawful. In the case of actions brought

by or in the right of the corporation, however, no indemnification pursuant to Section 78.7502 of the Nevada Revised Statutes may

be made for any claim, issue or matter as to which such person has been adjudged by a court of competent jurisdiction, after exhaustion

of all appeals therefrom, to be liable to the corporation or for amounts paid in settlement to the corporation, unless and only to the

extent that the court in which the action or suit was brought or other court of competent jurisdiction determines upon application that

in view of all the circumstances of the case, such person is fairly and reasonably entitled to indemnity for such expenses as the court

deems proper.

Any discretionary indemnification pursuant to

Section 78.7502 of the Nevada Revised Statutes, unless ordered by a court or advanced to a director or officer by the corporation

in accordance with the Nevada Revised Statutes, may be made by a corporation only as authorized in each specific case upon a determination

that indemnification of the director, officer, employee or agent is proper in the circumstances. Such determination must be made (1) by

the stockholders, (2) by the board of directors by majority vote of a quorum consisting of directors who were not parties to the

action, suit or proceeding, (3) if a majority vote of a quorum consisting of directors who were not parties to the action, suit

or proceeding so orders, by independent legal counsel in a written opinion, or (4) if a quorum consisting of directors who were

not parties to the action, suit or proceeding cannot be obtained, by independent legal counsel in a written opinion.

Section 78.751 of the Nevada Revised Statutes

further provides that indemnification pursuant to Section 78.7502 of the Nevada Revised Statutes does not exclude any other rights

to which a person seeking indemnification or advancement of expenses may be entitled under our Articles of Incorporation, or any bylaw,

agreement, vote of stockholders or disinterested directors or otherwise, for either an action in the person’s official capacity

or an action in another capacity while holding office, except that indemnification, unless ordered by a court pursuant to Section 78.7502

of the Nevada Revised Statutes or for the advancement of expenses, may not be made to or on behalf of any director or officer finally

adjudged by a court of competent jurisdiction, after exhaustion of any appeals, to be liable for intentional misconduct, fraud or a knowing

violation of law, and such misconduct, fraud or violation was material to the cause of action.

As permitted by the Nevada Revised Statutes,

we have entered into indemnity agreements with each of our directors and executive officers. These agreements, among other things, require

us to indemnify each director and officer to the fullest extent permitted by law and advance expenses to each indemnitee in connection

with any proceeding in which indemnification is available.

We have an insurance policy covering our officers

and directors with respect to certain liabilities, including liabilities arising under the Securities Act, or otherwise.

See also the undertakings set out in response

to Item 9 herein.

| Item 7. | Exemption from Registration Claimed. |

Not applicable.

Item

Number |

Item

Name |

| 3.1 |

Amended

and Restated Articles of Incorporation of Rezolute, Inc. Nevada Merger Corporation (incorporated by reference to Exhibit

3.3 of the Company’s Form 8-K filed on June 21, 2021). |

| 3.2 |

Certificate

of Amendment, as filed with the Secretary of State of the State of Nevada on December 6, 2024 (incorporated by reference

to Exhibit 3.1 of the Company’s Form 8-K filed on December 10, 2024). |

| 3.3 |

Amended

and Restated Bylaws of Rezolute Nevada Merger Corporation (incorporated by reference to Exhibit 3.4 of the Company’s Form

10-K filed on September 15, 2021). |

| 4.1 |

Rezolute,

Inc. Amended and Restated 2021 Equity Incentive Plan (incorporated by reference to Exhibit 10.23 of the Company’s Form

10-K filed on September 15, 2022). |

| 4.2 |

2021

Incentive Compensation Plan Amendment (incorporated by reference to Appendix A of the Company’s Schedule 14A definitive

proxy statement filed on April 15, 2024). |

| 4.3 |

2021

Incentive Compensation Plan Amendment (incorporated by reference to Appendix A of the Company’s Schedule 14A definitive

proxy statement filed on October 21, 2024). |

| 5.1 |

Opinion of Dorsey & Whitney LLP* |

| 23.1 |

Consent of Plante & Moran, PLLC* |

| 23.2 |

Consent of Grant Thornton, LLP* |

| 23.3 |

Consent of Dorsey & Whitney LLP (included in Exhibit

5.1). |

| 24.1 |

Power of Attorney (contained on the

signature page to this registration statement).* |

| 99.1 |

Form of Award Agreement

for Inducement Award Outside of 2021 Equity Incentive Plan.* |

| 107 |

Filing Fee

Table * |

*Filed herewith

(a) The

undersigned registrant hereby undertakes:

(1) To

file, during any period in which offers or sales are being made, a post-effective amendment to this Registration Statement:

(i) To

include any prospectus required by Section 10(a)(3) of the Securities Act;

(ii) To

reflect in the prospectus any facts or events arising after the effective date of the Registration Statement (or the most recent post-effective

amendment thereof) which, individually or in the aggregate, represent a fundamental change in the information set forth in the Registration

Statement. Notwithstanding the foregoing, any increase or decrease in volume of securities offered (if the total dollar value of securities

offered would not exceed that which was registered) and any deviation from the low or high end of the estimated maximum offering range

may be reflected in the form of prospectus filed with the Commission pursuant to Rule 424(b) if, in the aggregate, the changes

in volume and price represent no more than a 20 percent change in the maximum aggregate offering price set forth in the “Calculation

of Registration Fee” table in the effective Registration Statement; and

(iii) To

include any material information with respect to the plan of distribution not previously disclosed in the Registration Statement or any

material change to such information in the Registration Statement;

Provided,

however, that paragraphs (a)(1)(i) and (a)(1)(ii) above do not apply if the information required to be included in a

post-effective amendment by those paragraphs is contained in reports filed with or furnished to the Commission by the registrant pursuant

to Section 13 or Section 15(d) of the Exchange Act that are incorporated by reference in the Registration Statement.

(2) That,

for the purpose of determining any liability under the Securities Act, each such post-effective amendment shall be deemed to be a new

Registration Statement relating to the securities offered therein, and the offering of such securities at that time shall be deemed to

be the initial bona fide offering thereof.

(3) To

remove from registration by means of a post-effective amendment any of the securities being registered which remain unsold at the termination

of the offering.

(b) The

undersigned registrant hereby undertakes that, for purposes of determining any liability under the Securities Act, each filing of the

registrant’s annual report pursuant to Section 13(a) or Section 15(d) of the Exchange Act that is incorporated

by reference in the Registration Statement shall be deemed to be a new Registration Statement relating to the securities offered therein,

and the offering of such securities at that time shall be deemed to be the initial bona fide offering thereof.

(c) Insofar

as indemnification for liabilities arising under the Securities Act may be permitted to directors, officers and controlling persons of

the registrant pursuant to the foregoing provisions, or otherwise, the registrant has been advised that in the opinion of the Commission

such indemnification is against public policy as expressed in the Securities Act and is, therefore, unenforceable. In the event that

a claim for indemnification against such liabilities (other than the payment by the registrant of expenses incurred or paid by a director,

officer or controlling person of the registrant in the successful defense of any action, suit or proceeding) is asserted by such director,

officer or controlling person in connection with the securities being registered, the registrant will, unless in the opinion of its counsel

the matter has been settled by controlling precedent, submit to a court of appropriate jurisdiction the question whether such indemnification

by it is against public policy as expressed in the Securities Act and will be governed by the final adjudication of such issue.

SIGNATURES

Pursuant to the requirements of the Securities

Act of 1933, the registrant certifies that it has reasonable grounds to believe that it meets all of the requirements for filing on Form S-8

and has duly caused this Registration Statement to be signed on its behalf by the undersigned, thereunto duly authorized, in Redwood

City, State of California, on December 30, 2024.

| |

REZOLUTE, INC. |

| |

|

| |

By: |

/s/

Nevan Charles Elam |

| |

|

Name: Nevan Charles Elam |

| |

|

Title: Chief Executive Officer |

POWER OF ATTORNEY

Each person whose signature appears below constitutes

and appoints Nevan Charles Elam, acting individually, as his or her true and lawful attorney-in-fact and agent, with full power of substitution

and resubstitution, for him or her and in his or her name, place, and stead, in any and all capacities, to sign any and all amendments

(including post-effective amendments, exhibits thereto and other documents in connection therewith) to this Registration Statement, and

to file the same, with all exhibits thereto, and other documents in connection therewith, with the Commission, granting unto said attorneys-in-fact

and agents, and each of them, full power and authority to do and perform each and every act and thing requisite and necessary to be done

in and about the premises, as fully to all intents and purposes as he or she might or could do in person, hereby ratifying and confirming

all that said attorneys-in-fact and agents, or either of them individually, or their or his substitute or substitutes, may lawfully do

or cause to be done by virtue hereof.

Pursuant to the requirements of the Securities

Act, this Registration Statement has been signed below by the following persons in the capacities and on the dates indicated.

| Signature |

|

Title |

|

Date |

| |

|

|

|

|

| /s/

Nevan Charles Elam |

|

Chief Executive Officer and Acting Chairman of the

Board |

|

December 30, 2024 |

| Nevan Charles Elam |

|

(Principal Executive and Financial Officer) |

|

|

| |

|

|

|

|

| /s/ Young-Jin

Kim |

|

Director |

|

December 30, 2024 |

| Young-Jin Kim |

|

|

|

|

| |

|

|

|

|

| /s/ Nerissa

Kreher |

|

Director |

|

December 30, 2024 |

| Nerissa Kreher |

|

|

|

|

| |

|

|

|

|

| /s/ Gil Labrucherie |

|

Director |

|

December 30, 2024 |

| Gil Labrucherie |

|

|

|

|

| |

|

|

|

|

| /s/ Philippe

Fauchet |

|

Director |

|

December 30, 2024 |

| Philippe Fauchet |

|

|

|

|

| |

|

|

|

|

| /s/ Wladimir

Hogenhuis |

|

Director |

|

December 30, 2024 |

| Wladimir Hogenhuis |

|

|

|

|

Exhibit 5.1

December 30, 2024

Rezolute, Inc.

275 Shoreline Drive, Suite 500

Redwood City, California 94065

Re: Registration Statement on Form S-8

Ladies and Gentlemen:

We have acted as counsel to Rezolute, Inc.,

a Nevada corporation (the “Company”), in connection with a Registration Statement on Form S-8 (the “Registration

Statement”) filed by the Company with the Securities and Exchange Commission (the “Commission”) under the

Securities Act of 1933, as amended (the “Securities Act”), relating to (i) up to 14,450,000 shares of the Company’s

common stock, par value $0.001 per share, that may be issued pursuant to the amended and restated Rezolute, Inc. 2021 Equity Incentive

Plan (the “Plan Shares”), (ii) the registration of 275,000 shares of Common Stock of the Company issued pursuant

to an inducement award of 275,000 stock options subject to time-based vesting which were granted by the Company to Daron Evans on January 23,

2024, as inducement to accept employment as the Chief Financial Officer of the Company (the “Evans Shares”), (iii) the

registration of 150,000 shares of Common Stock of the Company issued pursuant to an inducement award of 150,000 stock options subject

to time-based vesting which were granted by the Company to the Company’s Senior Vice President of Global Product Supply on November 30,

2024, as an inducement to accept employment (the “SVP Shares”), and (iv) 1,075,000 shares of Common Stock issuable

upon the exercise of stock options, which were approved by the Compensation Committee of the Board of Directors of the Registrant and

will be granted outside of the 2021 Plan but pursuant to the terms of the 2021 Plan as if such stock options were granted under the 2021

Plan, as inducement awards pursuant to Rule 5635(c)(4) of the Nasdaq Listing Rules (the “Inducement Pool Shares”

and together with the Evans Shares and The Plan Shares, the “Shares”).

We have examined such documents and have reviewed

such questions of law as we have considered necessary or appropriate for the purposes of our opinions set forth below. In rendering our

opinions set forth below, we have assumed the authenticity of all documents submitted to us as originals, the genuineness of all signatures

and the conformity to authentic originals of all documents submitted to us as copies. We have also assumed the legal capacity for all

purposes relevant hereto of all natural persons. As to questions of fact material to our opinions, we have relied upon certificates or

comparable documents of officers and other representatives of the Company and of public officials.

Based on the foregoing, we are of the opinion that

the Shares, when issued and delivered in accordance with the terms of the Plans and the respective award agreements as applicable, will

be validly issued, fully paid and non-assessable.

Our opinions expressed above are limited to the

Chapter 78 of the Nevada Revised Statutes.

We hereby consent to the filing of this opinion

as an exhibit to the Registration Statement. In giving this consent, we do not admit that we are within the category of persons whose

consent is required under Section 7 of the Securities Act or the rules and regulations of the Commission thereunder.

| |

Very truly yours, |

| |

|

| |

/s/ |

|

AWE/JKB

Exhibit 23.1

CONSENT OF INDEPENDENT

REGISTERED PUBLIC ACCOUNTING FIRM

We hereby consent to the incorporation by reference in this Registration Statement on Form S-8 of Rezolute, Inc. of our report dated September

14, 2023 relating to the consolidated financial statements of Rezolute, Inc. as of and for the year ended June 30, 2023, which report

appears in the Form 10-K of Rezolute, Inc. dated September 19, 2024.

/s/ Plante & Moran, PLLC

Cleveland, Ohio

December 30, 2024

Exhibit 23.2

CONSENT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING

FIRM

We have issued our report dated September 19,

2024 with respect to the consolidated financial statements of Rezolute, Inc. included in the Annual Report on Form 10-K for

the year ended June 30, 2024, which are incorporated by reference in this Registration Statement. We consent to the incorporation

by reference of the aforementioned report in this Registration Statement.

/s/ GRANT THORNTON LLP

Newport Beach, California

December 30, 2024

Exhibit 99.1

Stock Option Agreement

This Stock Option Agreement (this “Agreement”) is

made and entered into as of [DATE] by and between Rezolute, Inc., a Nevada corporation (the “Company”) and [EMPLOYEE

NAME] (the “Participant”).

Grant Date: ____________________________________

Exercise Price per Share: __________________________

Number of Option Shares: _________________________

Expiration Date: _________________________________

1. Grant

of Option.

1.1 Grant;

Type of Option. The Company hereby grants to the Participant an option (the “Option”) to purchase the total

number of shares of Common Stock of the Company equal to the number of Option Shares set forth above, at the Exercise Price set forth

above. The Option is being granted outside of the the Company's 2021 Equity Incentive Plan (the “Plan”) as an employment

inducement award under Rule 5635(c)(4) of the Nasdaq Listing Rules. Any capitalized term used but not defined in this Agreement

shall have the meaning given to the term in the Plan as it currently exists or may hereafter be amended. Although this grant is not being

made under the Plan, the terms of the award will be governed by both this Agreement and the terms of the Plan, including the administrative

provisions of the Plan. For the avoidance of doubt, the award, although subject generally to the same terms and conditions of the Plan

by reference to the Plan throughout this Agreement, is not being issued under the Plan.

1.2 Consideration;

Subject to Plan. The grant of the Option is made in consideration of the services to be rendered by the Participant to the

Company and is subject to the terms and conditions of the Plan. Capitalized terms used but not defined herein will have the meaning ascribed

to them in the Plan.

2. Exercise

Period; Vesting.

2.1 Vesting

Schedule. The Option will become vested and exercisable with respect to [NUMBER] shares on [VESTING SCHEDULE] until the Option

is 100% vested. The unvested portion of the Option will not be exercisable on or after the Participant's termination of Continuous Service.

2.2 Expiration.

The Option will expire on the Expiration Date set forth above, or earlier as provided in this Agreement or the Plan.

3. Termination

of Continuous Service.

3.1 Termination

for Reasons Other Than Cause, Death, Disability. If the Participant's Continuous Service is terminated for any reason other

than Cause, death or Disability, the Participant may exercise the vested portion of the Option, but only within such period of time ending

on the earlier of: (a) the date three months following the termination of the Participant's Continuous Service or (b) the Expiration

Date.

3.2 Termination

for Cause. If the Participant's Continuous Service is terminated for Cause, the Option (whether vested or unvested) shall immediately

terminate and cease to be exercisable.

3.3 Termination

due to Disability. If the Participant's Continuous Service terminates as a result of the Participant's Disability, the Participant

may exercise the vested portion of the Option, but only within such period of time ending on the earlier of: (a) the date 12 months

following the Participant's termination of Continuous Service or (b) the Expiration Date.

3.4 Termination

due to Death. If the Participant's Continuous Service terminates as a result of the Participant's death, the vested portion

of the Option may be exercised by the Participant's estate, by a person who acquired the right to exercise the Option by bequest or inheritance

or by the person designated to exercise the Option upon the Participant's death, but only within the time period ending on the earlier

of: (a) the date 12 months following the Participant's termination of Continuous Service or (b) the Expiration Date.

4. Manner

of Exercise.

4.1 Election

to Exercise. To exercise the Option, the Participant (or in the case of exercise after the Participant's death or incapacity, the

Participant's executor, administrator, heir or legatee, as the case may be) must deliver to the Company an executed stock option exercise

agreement in such form as is approved by the Committee from time to time (the “Exercise Agreement”), which shall set

forth, inter alia:

(a) the

Participant's election to exercise the Option;

(b) the

number of shares of Common Stock being purchased;

(c) any

restrictions imposed on the shares; and

(d) any

representations, warranties and agreements regarding the Participant's investment intent and access to information as may be required

by the Company to comply with applicable securities laws].

If someone other than the Participant

exercises the Option, then such person must submit documentation reasonably acceptable to the Company verifying that such person has the

legal right to exercise the Option.

4.2 Payment

of Exercise Price. The entire Exercise Price of the Option shall be payable in full at the time of exercise to the extent permitted

by applicable statutes and regulations, either:

(a) in

cash or by certified or bank check at the time the Option is exercised;

(b) by

delivery to the Company of other shares of Common Stock, duly endorsed for transfer to the Company, with a Fair Market Value on the date

of delivery equal to the Exercise Price (or portion thereof) due for the number of shares being acquired, or by means of attestation whereby

the Participant identifies for delivery specific shares that have a Fair Market Value on the date of attestation equal to the Exercise

Price (or portion thereof) and receives a number of shares equal to the difference between the number of shares thereby purchased and

the number of identified attestation shares (a “Stock for Stock Exchange”);

(c) through

a “cashless exercise program” established with a broker;

(d) by

reduction in the number of shares otherwise deliverable upon exercise of such Option with a Fair Market Value equal to the aggregate Exercise

Price at the time of exercise;

(e) by

any combination of the foregoing methods; or

(f) in

any other form of legal consideration that may be acceptable to the Committee.

4.3 Withholding.

If the Company, in its discretion, determines that it is obligated to withhold any tax in connection with the exercise of the Option,

the Participant must make arrangements satisfactory to the Company to pay or provide for any applicable federal, state and local withholding

obligations of the Company. The Participant may satisfy any federal, state or local tax withholding obligation relating to the exercise

of the Option by any of the following means:

(a) tendering

a cash payment;

(b) authorizing

the Company to withhold shares of Common Stock from the shares of Common Stock otherwise issuable to the Participant as a result of the

exercise of the Option; provided, however, that no shares of Common Stock are withheld with a value exceeding the minimum amount of tax

required to be withheld by law; or

(c) delivering

to the Company previously owned and unencumbered shares of Common Stock.

The Company has the right to withhold

from any compensation paid to a Participant.

4.4 Issuance

of Shares. Provided that the Exercise Agreement and payment are in form and substance satisfactory to the Company, the Company

shall issue the shares of Common Stock registered in the name of the Participant, the Participant's authorized assignee, or the Participant's

legal representative which shall be evidenced by stock certificates representing the shares with the appropriate legends affixed thereto,

appropriate entry on the books of the Company or of a duly authorized transfer agent, or other appropriate means as determined by the

Company.

5. No

Right to Continued Employment; No Rights as Shareholder. Neither the Plan nor this Agreement shall confer upon the Participant

any right to be retained in any position, as an Employee, Consultant or Director of the Company. Further, nothing in the Plan or this

Agreement shall be construed to limit the discretion of the Company to terminate the Participant's Continuous Service at any time, with

or without Cause. The Participant shall not have any rights as a shareholder with respect to any shares of Common Stock subject to the

Option unless and until certificates representing the shares have been issued by the Company to the holder of such shares, or the shares

have otherwise been recorded on the books of the Company or of a duly authorized transfer agent as owned by such holder.

6. Transferability.

The Option is not transferable by the Participant other than to a designated beneficiary upon the Participant's death or by will or the

laws of descent and distribution, and is exercisable during the Participant's lifetime only by him or her. No assignment or transfer of

the Option, or the rights represented thereby, whether voluntary or involuntary, by operation of law or otherwise (except to a designated

beneficiary, upon death, by will or the laws of descent or distribution) will vest in the assignee or transferee any interest or right

herein whatsoever, but immediately upon such assignment or transfer the Option will terminate and become of no further effect.

7. Change

in Control.

7.1 Acceleration

of Vesting. In the event of a Change in Control, notwithstanding any provision of the Plan or this Agreement to the contrary,

the Option shall become immediately vested and exercisable with respect to 100% of the shares subject to the Option. To the extent practicable,

such acceleration of vesting and exercisability shall occur in a manner and at a time which allows the Participant the ability to participate

in the Change in Control with respect to the shares of Common Stock received.

7.2 Cash-out.

In the event of a Change in Control, the Committee may, in its discretion and upon at least ten (10) days' advance notice to the

Participant, cancel the Option and pay to the Participant the value of the Option based upon the price per share of Common Stock received

or to be received by other shareholders of the Company in the event. Notwithstanding the foregoing, if at the time of a Change in Control

the Exercise Price of the Option equals or exceeds the price paid for a share of Common Stock in connection with the Change in Control,

the Committee may cancel the Option without the payment of consideration therefor.

8. Tax

Liability and Withholding. Notwithstanding any action the Company takes with respect to any or all income tax, social insurance,

payroll tax, or other tax-related withholding (“Tax-Related Items”), the ultimate liability for all Tax-Related Items

is and remains the Participant's responsibility and the Company (a) makes no representation or undertakings regarding the treatment

of any Tax-Related Items in connection with the grant, vesting, or exercise of the Option or the subsequent sale of any shares acquired

on exercise; and (b) does not commit to structure the Option to reduce or eliminate the Participant's liability for Tax-Related Items.

9. Compliance

with Law. The exercise of the Option and the issuance and transfer of shares of Common Stock shall be subject to compliance

by the Company and the Participant with all applicable requirements of federal and state securities laws and with all applicable requirements

of any stock exchange on which the Company's shares of Common Stock may be listed. No shares of Common Stock shall be issued pursuant

to this Option unless and until any then applicable requirements of state or federal laws and regulatory agencies have been fully complied

with to the satisfaction of the Company and its counsel. The Participant understands that the Company is under no obligation to register

the shares with the Securities and Exchange Commission, any state securities commission or any stock exchange to effect such compliance.

10. Notices.

Any notice required to be delivered to the Company under this Agreement shall be in writing and addressed to the Director of Accounting

of the Company at the Company's principal corporate offices. Any notice required to be delivered to the Participant under this Agreement

shall be in writing and addressed to the Participant at the Participant's address as shown in the records of the Company. Either party

may designate another address in writing (or by such other method approved by the Company) from time to time.

11. Governing

Law. This Agreement will be construed and interpreted in accordance with the laws of the State of Nevada without regard to

conflict of law principles.

12. Interpretation.

Any dispute regarding the interpretation of this Agreement shall be submitted by the Participant or the Company to the Committee for review.

The resolution of such dispute by the Committee shall be final and binding on the Participant and the Company.

13. Options

Subject to Provisions of the Plan. This Agreement and the Option hereunder is granted as an employee inducement award and is

subject to the provisions of the Plan. The terms and provisions of the Plan as it may be amended from time to time are hereby incorporated

herein by reference. In the event of a conflict between any term or provision contained herein and a term or provision of the Plan, the

applicable terms and provisions of the Plan will govern and prevail.

14. Successors

and Assigns. The Company may assign any of its rights under this Agreement. This Agreement will be binding upon and inure to

the benefit of the successors and assigns of the Company. Subject to the restrictions on transfer set forth herein, this Agreement will

be binding upon the Participant and the Participant's beneficiaries, executors, administrators and the person(s) to whom this Agreement

may be transferred by will or the laws of descent or distribution.

15. Severability.

The invalidity or unenforceability of any provision of the Plan or this Agreement shall not affect the validity or enforceability of any

other provision of the Plan or this Agreement, and each provision of the Plan and this Agreement shall be severable and enforceable to

the extent permitted by law.

16. Discretionary

Nature of Plan. The Plan is discretionary and may be amended, cancelled or terminated by the Company at any time, in its discretion.

The grant of the Option in this Agreement does not create any contractual right or other right to receive any Options or other Awards

in the future. Future Awards, if any, will be at the sole discretion of the Company. Any amendment, modification, or termination of the

Plan shall not constitute a change or impairment of the terms and conditions of the Participant's employment with the Company.

17. Amendment.

The Committee has the right to amend, alter, suspend, discontinue or cancel the Option, prospectively or retroactively; provided, that,

no such amendment shall adversely affect the Participant's material rights under this Agreement without the Participant's consent.

18. No

Impact on Other Benefits. The value of the Participant's Option is not part of his or her normal or expected compensation for

purposes of calculating any severance, retirement, welfare, insurance or similar employee benefit.

19. Clawback

or Recoupment. The Option shall be subject to recovery or other penalties pursuant to (i) any Company clawback policy, as may

be adopted or amended from time to time, or (ii) any applicable law, rule or regulation or applicable stock exchange rule, including,

without limitation, Section 304 of the Sarbanes-Oxley Act of 2002, Section 954 of the Dodd-Frank Wall Street Reform and Consumer

Protection Act and any applicable stock exchange listing rule adopted pursuant thereto.

20. Counterparts.

This Agreement may be executed in counterparts, each of which shall be deemed an original but all of which together will constitute one

and the same instrument. Counterpart signature pages to this Agreement transmitted by facsimile transmission, by electronic mail

in portable document format (.pdf), or by any other electronic means intended to preserve the original graphic and pictorial appearance

of a document, will have the same effect as physical delivery of the paper document bearing an original signature.

21. Acceptance.

The Participant hereby acknowledges receipt of a copy of the Plan and this Agreement. The Participant has read and understands the terms

and provisions thereof, and accepts the Option subject to all of the terms and conditions of the Plan and this Agreement. The Participant

acknowledges that there may be adverse tax consequences upon exercise of the Option or disposition of the underlying shares and that the

Participant should consult a tax advisor prior to such exercise or disposition.

[signature

page follows]

IN WITNESS WHEREOF, the parties hereto have executed this Agreement

as of the date first above written.

| |

Rezolute, Inc. |

| |

|

| |

By |

|

| |

Name: |

| |

Title: |

| |

|

| |

[EMPLOYEE NAME] |

| |

|

| |

By |

|

| |

Name: |

Exhibit 107

Calculation of Filing Fee Tables

Form S-8

(Form Type)

Rezolute, Inc.

(Exact Name of Registrant as Specified in its

Charter)

Table 1: Newly Registered and Carry Forward

Securities

Security

Type |

|

|

Security

Class Title |

|

Fee

Calculation

Rule |

|

Amount

Registered(1) |

|

|

Proposed

Maximum

Offering

Price Per

Unit |

|

|

Maximum Aggregate

Offering Price |

|

|

Fee Rate |

|

|

Amount of

Registration

Fee |

|

| Equity |

|

|

Common Stock, $0.001 par value, to be issued pursuant to outstanding Options under the 2021 Equity Incentive Plan |

|

Rule 457(c) and Rule 457(h) |

|

|

10,052,707 |

(2) |

|

$ |

3.58 |

(4) |

|

$ |

35,988,691.06 |

|

|

$ |

0.00015310 |

|

|

$ |

5,509.87 |

|

| Equity |

|

|

Common Stock, $0.001 par value, to be issued pursuant to Awards to be granted under the 2021 Equity Incentive Plan |

|

Rule 457(c) and Rule 457(h) |

|

|

4,080,451 |

(3) |

|

$ |

4.51 |

(5) |

|

$ |

18,402,834.01 |

|

|

$ |

0.00015310 |

|

|

$ |

2,817.47 |

|

| Equity |

|

|

Common Stock, $0.001 par value per share issuable as inducement grants |

|

Other |

|

|

275,000 |

|

|

$ |

1.02 |

|

|

$ |

280,500.00 |

|

|

|

$0.00015310 |

|

|

$ |

42.95 |

|

| Equity |

|

|

Common Stock, $0.001 par value per share issuable as inducement grants |

|

Other |

|

|

150,000 |

|

|

$ |

5.04 |

|

|

$ |

756,000.00 |

|

|

|

$0.00015310 |

|

|

$ |

115.74 |

|

| Equity |

|

|

Common Stock, $0.001 par value per share issuable as inducement grants |

|

Other |

|

|

1,075,000 |

|

|

$ |

2.44(6) |

|

|

$ |

2,623,000.00 |

|

|

|

$0.00015310 |

|

|

$ |

401.58 |

|

| |

Total Offering Amounts |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

$ |

58,051,025.07 |

|

| |

Total Fee Offsets |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

- |

|

| |

Net Fee Due |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

$ |

8,887.60 |

|

| (1) |

Pursuant to Rule 416(a) of the Securities Act of 1933, as amended (the “Securities Act”), this Registration Statement covers any additional shares of the Registrant’s common stock, par value $0.001 (the “Common Stock”) that become issuable under the Registrant’s 2021 Stock Incentive Plan by reason of any stock dividend, stock split, recapitalization or other similar transaction effected without the Registrant’s receipt of consideration which results in an increase in the number of the outstanding shares of Common Stock. |

| (2) |

Includes Common Stock reserved for future issuance upon exercise of outstanding options granted under the 2021 Stock Incentive Plan. Excludes 316,842 shares of common stock reserved for stock option exercises prior to December 24, 2024. |

| (3) |

Includes Common Stock reserved for future issuance upon exercise of options, grant of restricted stock and restricted stock units (including performance-based restricted stock and stock units), dividend equivalents, and other share-based awards that may be granted under the 2021 Stock Incentive Plan. |

| (4) |

Estimated pursuant to Rule 457(h) under the Securities Act solely for the purpose of calculating the registration fee on the basis of the weighted average exercise price of the outstanding options. |

| (5) |

Estimated in accordance with Rules 457(c) and (h) under the Securities Act solely for the purpose of calculating the registration fee on the basis of the average of the high and low prices of the Registrant’s Common Stock as reported on the Nasdaq Capital Market on December 24, 2024. |

| (6) |

This estimate is made pursuant to Rule 457(h)(1) of the Securities Act solely for purposes of calculating the registration fee. The proposed maximum offering price per unit and maximum aggregate offering price are calculated using a weighted-average exercise price for the Registrant's Common Stock subject to such inducement grants. |

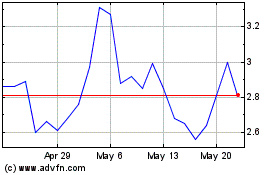

Rezolute (NASDAQ:RZLT)

Historical Stock Chart

From Jan 2025 to Feb 2025

Rezolute (NASDAQ:RZLT)

Historical Stock Chart

From Feb 2024 to Feb 2025