Schultze Special Purpose Acquisition Corp. (NASDAQ: SAMA, SAMAW,

and SAMAU) (“SAMA”) and Clever Leaves International Inc. (“Clever

Leaves”) announced that following a special meeting of SAMA

stockholders held yesterday, they have completed their previously

announced business combination (the “Business Combination”),

pursuant to which Clever Leaves Holdings Inc. (“Holdco”), a newly

formed holding company, has acquired SAMA and Clever Leaves for

total consideration of approximately $205 million.

Upon completion of the Business Combination,

SAMA became a wholly owned subsidiary of Holdco and the shares of

common stock and warrants of SAMA were exchanged for common shares

and warrants of Holdco. The Holdco common shares and warrants are

expected to begin trading today on the Nasdaq Capital Market under

the ticker symbols “CLVR” and “CLVRW”, respectively.

Clever Leaves’ executive management team, led by

Kyle Detwiler, Chief Executive Officer; Andrés Fajardo, President;

and Julian Wilches, Chief Regulatory Officer; will continue to lead

the combined company. The board of directors of the combined

company will be composed initially of Kyle Detwiler, Andres

Fajardo, Gary Julien, Etienne Deffarges and Elisabeth DeMarse.

George J. Schultze, Chairman and CEO of SAMA

before the Business Combination, said, “We are very pleased to have

completed our merger with Clever Leaves, which delivers attractive

value to our stockholders. We believe that Clever Leaves is now

among the best-capitalized companies in the cannabis industry and

is well-positioned for substantial growth and profitability based

upon its disruptive, low-cost and vertically integrated operating

model. We look forward to working with its outstanding and highly

accomplished management team to create significant value over

time.”

Kyle Detwiler, CEO of Clever Leaves, added,

“Partnering with the SAMA team represents a great opportunity to

take our industry-leading platform to the next level as we are now

poised to benefit from a significantly enhanced balance sheet,

Nasdaq listing, and SAMA’s experience assisting companies such as

ours in prudently compounding profitable growth. We expect that our

combined expertise and resources will further enable us to

accelerate the commercialization of Clever Leaves’ high-quality

products as well as expand the company’s operations and

distribution in attractive markets around the world.”

Canaccord Genuity and EarlyBirdCapital served as

financial advisors to SAMA, while BTIG, LLC served as a capital

markets advisor, and Greenberg Traurig, LLP, Stikeman Elliott and

Posse Herrera Ruiz served as legal advisors. Cowen served as

financial advisor to Clever Leaves, while Freshfields Bruckhaus

Deringer US LLP, Dentons Canada LLP, and Brigard & Urrutia

Abogados SAS served as legal advisors.

About Schultze Special Purpose

Acquisition Corp.Schultze Special Purpose Acquisition

Corp. is a blank check company formed for the purpose of entering

into a merger, stock exchange, asset acquisition, stock purchase,

recapitalization, reorganization or other similar business

combination with one or more businesses or entities. SAMA’s sponsor

is an affiliate of Schultze Asset Management, LP, an alternative

investment management firm founded in 1998 that focuses on

distressed, special situation and event-driven securities and has

invested over $3.2 billion since inception with a notable

track-record through its active investment strategy. SAMA itself is

backed by an experienced team of operators and investors with a

successful track-record of creating material value in public and

private companies. For more information, please visit

https://samcospac.com/

About Clever Leaves International

Inc.Clever Leaves is a multi-national cannabis company

with a mission to operate in compliance with federal and state laws

and with an emphasis on ecologically sustainable, large-scale

cultivation and pharmaceutical-grade processing as the cornerstones

of its global cannabis business. With operations and investments in

the United States, Canada, Colombia, Germany and Portugal, Clever

Leaves has created an effective distribution network and global

footprint, with a foundation built upon capital efficiency and

rapid growth. Clever Leaves aims to be one of the industry’s

leading global cannabis companies recognized for its principles,

people, and performance while fostering a healthier global

community. For more information, please visit

https://cleverleaves.com/en/home/.

Forward Looking StatementsThis

press release includes forward-looking statements that involve

risks and uncertainties. Forward-looking statements are statements

that are not historical facts and may be identified by the words

“estimates,” “projected,” “expects,” “anticipates,” “forecasts,”

“plans,” “intends,” “believes,” “seeks,” “may,” “will,” “should,”

“future,” “propose” and variations of these words or similar

expressions (or the negative versions of such words or

expressions). Such forward-looking statements are subject to risks

and uncertainties, which could cause actual results to differ from

the forward-looking statements. Factors that may cause such

differences include, without limitation, the inability to recognize

the anticipated benefits of the Business Combination; the ability

to continue to meet Nasdaq’s listing standards following the

consummation of the Business Combination; expectations with respect

to future operating and financial performance and growth, including

if or when Clever Leaves or Holdco will become profitable; Clever

Leaves’ ability to execute its business plans and strategy and to

receive regulatory approvals; potential litigation involving the

parties; global economic conditions; geopolitical events, natural

disasters, acts of God and pandemics, including, but not limited

to, the economic and operational disruptions and other effects of

COVID-19; regulatory requirements and changes thereto; access to

additional financing; and other risks and uncertainties indicated

from time to time in filings with the SEC. The foregoing list of

factors is not exclusive. Additional information concerning certain

of these and other risk factors is contained in Holdco’s and SAMA’s

most recent filings with the SEC and is contained in the final

prospectus and definitive proxy statement, filed with the SEC by

Holdco and SAMA, respectively, on November 27, 2020. All subsequent

written and oral forward-looking statements concerning SAMA, Clever

Leaves or Holdco, the transactions described herein or other

matters and attributable to SAMA, Clever Leaves, Holdco or any

person acting on their behalf are expressly qualified in their

entirety by the cautionary statements above. Readers are cautioned

not to place undue reliance upon any forward-looking statements,

which speak only as of the date made. Each of SAMA, Clever Leaves

and Holdco expressly disclaims any obligations or undertaking to

release publicly any updates or revisions to any forward-looking

statements contained herein to reflect any change in their

expectations with respect thereto or any change in events,

conditions or circumstances on which any statement is based.

Schultze Special Purpose Acquisition Corp.George

J. Schultze: schultze@samco.netGary M.

Julien: gjulien@samco.net(914) 701-5260

Investor RelationsRaphael Gross

ICRraphael.gross@icrinc.com(203) 682-8253

Sean Mansouri, CFA or Cody SlachGateway Investor

RelationsCLVR@gatewayir.com (949) 574-3860

Media RelationsKCSA Strategic

CommunicationsMcKenna Millermmiller@kcsa.com(347) 487-6197

Schultze Special Purpose... (NASDAQ:SAMA)

Historical Stock Chart

From Mar 2025 to Apr 2025

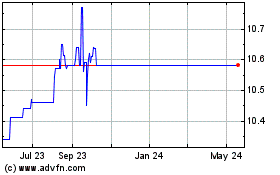

Schultze Special Purpose... (NASDAQ:SAMA)

Historical Stock Chart

From Apr 2024 to Apr 2025