Filed by Atlantic Union Bankshares Corporation

(Commission File No.: 001-39325)

Pursuant to Rule 425 of the Securities Act

of 1933

and deemed filed pursuant to Rule 14a-6

of the Securities Exchange Act of 1934

Subject Company: Sandy Spring Bancorp, Inc.

(Commission File No.: 000-19065)

This filing relates to the proposed merger of Sandy Spring Bancorp,

Inc. (“Sandy Spring”) with and into Atlantic Union Bankshares Corporation (“Atlantic Union”).

On January 23, 2025, Atlantic Union held its fourth quarter and

full year 2024 earnings conference call, during which management reviewed Atlantic Union’s financial results for the fourth quarter

and full year 2024, and discussed the proposed merger. The following are excerpts from a transcript of the call, a replay of which was

posted to Atlantic Union’s website on January 27, 2025.

PRESENTATION

John A. Asbury

President, Chief Executive Officer and Director

…

And on October 21, we added to the excitement by announcing our proposed

acquisition of Olney Maryland-based Sandy Spring Bancorp.

Let me begin with some perspective and a status report on the proposed

acquisition since last quarter. The acquisition of Sandy Spring will join the number one regional depository market share bank in Maryland

with the number one regional depository market share bank in Virginia. In our view, not only has there never been such a regional bank

franchise headquartered in the lower Mid-Atlantic, but there may also never be another, as we believe our combined franchise will not

be able to be replicated in our footprint.

We believe the proposed acquisition will benefit our customers and

markets with an expanded and even more convenient branch network, enhanced product offerings, a robust community benefit plan and access

to more capital. We also believe it will benefit our teammates with expanded career opportunities, resources and capabilities. And finally,

we believe it will benefit our shareholders by positioning us well to deliver differentiated financial performance.

As for the status of the merger, we were pleased to receive our merger

approvals from the Federal Reserve Bank of Richmond on January 13, seven weeks after filing applications. We are awaiting approval from

the Virginia Bureau of Financial Institutions and the Maryland Office of Financial Regulation. Assuming receipt of remaining regulatory

approvals, each company’s respective shareholder and stockholder approvals, as applicable, at the special meetings to be held on

February 5th, and the satisfaction of other closing conditions, we expect to close the transaction on April 1 of this year.

Our merger integration planning process is well underway with the Sandy

Spring team, and from the meetings I’ve attended, I remain highly confident in our cultural compatibility, the strategic logic of

the merger and its potential.

We’ve been delighted by both teams’ enthusiasm over what

we believe our combined franchise will offer to our customers and our communities.

…

We’re confident in the economy in all our markets and with our

increased presence in North Carolina and our planned expansion in Maryland with the Sandy Spring merger, we believe we do, and will, operate

in some of the most attractive and stable markets in the country.

….

Atlantic Union is a story of transformation from a Virginia community

bank to the largest regional bank headquartered in Virginia, to what will be the largest regional bank headquartered in the lower Mid-Atlantic

upon closing our proposed acquisition of Sandy Spring. Meanwhile, we remain more excited than ever about the growth opportunity in our

North Carolina markets, and we’re investing in them. We now have, and are continuing to build, the franchise we have long sought,

using our announced strategic plan as our guidepost.

QUESTION AND ANSWER

John A. Asbury

President, Chief Executive Officer and Director

…

And then, I think the last point that I’ll make, and I’ll

focus on Sandy Spring for a moment, is to remember while there’s any number of sort of Greater Washington commercial real estate-oriented

banks, don’t confuse that with Sandy Spring, which is the Maryland bank. They are a geographically compact franchise that exclusively

operates in what’s referred to as the Washington-Baltimore combined statistical area that has a population of 10 million people.

And that’s comparable to Chicago and Northern California – the San Francisco CSA. The unemployment rate in that combined statistical

area is 3.1%, and it is broadly one of the most highly educated and affluent markets in the country. So, this is a big market. It

is a diverse market in terms of its industries, the federal government influences it, but it’s not just about the federal government

and so we see opportunity. Time will tell exactly what’s going to go on up there. You know, clearly there’s a lot of conversation

and press around large office buildings and the government liquidating their very large old buildings, which are underutilized. That

doesn’t impact us. We don’t perceive that as impacting Sandy Spring because neither of us finance things that look like

that. So, we’ll see how it plays out over time. But it is the Nation’s capital and it’s not going away.

Nick Lorenzo

Stevens Inc.

Now just switching gears. I appreciate the organic NIM outlook for

2025…are there any changes to the pro forma Sandy Spring’s guide of 3.75% to 3.85%?

Robert M. Gorman

Executive Vice President and Chief Financial Officer

As regards to Sandy Spring, we really don’t see much change in

that outlook in terms of the 2025 impact of Sandy Spring. It might be a bit higher than – than the numbers you’re citing,

closer to the you know four handle, if you include purchase accounting accretion, which could be a bit higher based on rates going up

a bit since we announced the deal, there should be a bit more accretion. So, I would say, you know, between 3.75 and 4% would be the right

numbers on the combined basis.

Catherine Mealor

Keefe, Bruyette, & Woods, Inc.

Just a question back on the margin. Just -- I think, Rob, you touched

on this a little bit, but just wanted to dig in too. Can you talk about just the impact of Sandy Spring, the acquisition, and how we should

think about the move in rates since that deal was announced to where we are today? And that impact on kind of the core margin versus accretable

yield and how that might impact the marks?

Robert M. Gorman

Executive Vice President and Chief Financial Officer

Yeah. So yeah, on that question, Catherine, as you know, rates have

moved up a bit since we announced the deal. So, if we were to mark those – those loans on the balance sheet today, you’d see

a bit of a higher – higher mark, which will lead into more accretion income as we go forward.

So, the net impact of that is, you know, you might see a bit –

again, if we were to close a deal today and mark them today – you might see a bit higher tangible book value dilution, but higher

earnings EPS accretion and interest accretion coming through. But the earn back would kind of stay in that 2 to 2 and a quarter range.

So, in terms of the accretion impact, you’ll see more impact,

again, based on where rates are today and marking the book than we had projected at the announcement just because rates have increased.

But in terms of, you know, the overall net interest margin, I think, you know, as I just mentioned, we’ll probably see a bit of

a lift in the combined margin with accretion income. You know, we’re closer guiding up to, you know, more closer to the 4% range

than what we might have guided to at announcement.

Catherine Mealor

Keefe, Bruyette, & Woods, Inc.

Okay. And then how do we think about -- so the loan mark makes sense

to me. So, on the other side of the balance sheet, with less rate cuts, I would think there would be less ability to lower SASR’s

deposit costs as you kind of move through next year. How do you think about that as an offset?

Robert M. Gorman

Executive Vice President and Chief Financial Officer

Yes. Well one of the offsets there is also on the AUB side. We won’t

see -- 50% of our loan book is variable rate. We won’t see as much impact on that. So, it’s kind of washing out, if you will,

in terms of those when you combine the balance sheets. But we’ll continue to be aggressive.

Once we have the balance sheet combined and we close the transaction,

we’ll be looking at various deposit rate strategies to continue to bring the overall organization’s deposit rates down, but

specifically looking at Sandy Spring’s network or franchise.

John A. Asbury

President, Chief Executive Officer and Director

Catherine, two points. We’re sort of a natural hedge to each

other. They’re modestly liability sensitive, we’re modestly asset sensitive. So, part of the pressure that we always experience

when rates go down, they will lead to some extent. Now clearly, we’re larger than they are. But at the same time, when rates don’t

go down or go up, that pressures them because on the other side of the equation.

So, it’s a very good natural hedge for us both. And I will tell

you that selfishly, if you asked us to choose what scenario do you choose for rates to do here with a focus on the net interest margin

only. Rob, I would vote for leave them where they are. What would you vote for?

Robert M. Gorman

Executive Vice President and Chief Financial Officer

Yes. Yes I would agree.

…

Stephen Scouten

Piper Sandler

Just quick clarification on the expected closing of Sandy Spring. I

think you said April 1st. Shareholder vote, February 5th. Is it possible that depending upon what you hear in the timing from Virginia

and Maryland, that could close earlier? Or is it just -- is that going to stay the plan given conversion dates and other kind of internal

plan?

John A. Asbury

President, Chief Executive Officer and Director

Good question. We expect that we will hear soon from both Maryland

and Virginia, everything is operating in the normal course. It is kind of interesting isn’t it, that just for the record, the Federal

Reserve came in faster than the states, which is not typically what we see. But everyone is going through their process.

Let’s assume that we get everything in in short order. I think

the question is, could we close in the month of March? Yes, we could. Would we do that? No. We would not. Why would we not do that? Because

it’s very complicated to close a merger in the last month of a quarter. We could do it, but we choose not to do it. Do you...

Robert M. Gorman

Executive Vice President and Chief Financial Officer

Yes. I agree with that. Yes. It’s a lot cleaner to do it on the

first of a new quarter. There’s a lot of accounting complexities and reporting requirements associated with a stub period in one

quarter. So, it’s just cleaner to do it with the new quarter starting.

Stephen Scouten

Piper Sandler

Yes. No. That makes perfect sense. And then I know you guys were commenting

on higher payoffs within your stand-alone portfolio. Are you -- has Sandy Spring, to your knowledge, experienced some of the same dynamics?

And do you have any updated commentary on what that could potentially do for the potential needed size of the CRE loan sale?

John A. Asbury

President, Chief Executive Officer and Director

I won’t comment on Sandy Spring. We can’t speak for them.

So, you’ll have to ask them. We presume they will release soon – next week. We’ll let them speak to exactly when that

will be.

…

Our agreement is we will sell $2 billion in terms of our that is our

agreement, and that’s what we will do.

…

Stephen Moss

Raymond James

Okay. So I guess maybe just with regard to purchase accounting here

and the NII guide. Just curious, what’s the -- how much accretion do you guys expect for 2025?

Robert M. Gorman

Executive Vice President and Chief Financial Officer

You mean increasing in terms of the interest income side?

Stephen Moss

Raymond James

Yes. That -- Yes.

Robert M. Gorman

Executive Vice President and Chief Financial Officer

So overall, on the deal we announced which was 25% or 22% accretive.

It’s going to go up a bit, assuming rates stay where they are, maybe closer to between 25% and 30%. So that’s what we’re

expecting out of the gates in terms of accretion income in terms of the impact on the net interest margin.

John A. Asbury

President, Chief Executive Officer and Director

Just for absolute clarity, you’re talking about the Sandy Spring

acquisition, right?

Robert M. Gorman

Executive Vice President and Chief Financial Officer

Yes. Is that what your question was?

...

Stephen Moss

Raymond James

And then in terms of the Sandy Spring transaction here, rates having

backed up a bit, I think, John, you alluded to, you fully expect to sell the entire $2 billion of CRE you mentioned before. And therefore,

I assume just given where rates are, you guys are also likely to take the entire equity raise down as it stands these days?

Robert M. Gorman

Executive Vice President and Chief Financial Officer

Yes. That’s right, Steve. We fully expect to take the entire

forward -- issue all of the shares related to that forward.

John A. Asbury

President, Chief Executive Officer and Director

The good news is we continue to hear from Morgan Stanley, who is at

work on this now. Who will actually conduct the commercial real estate portfolio sale - these markets are liquid. Demand is high. They

are pleased with the marks, I guess, you would say that they’re seeing as they’re conducting other real estate sales.

So, we feel good about -- I guess I would say, Rob, we would stand

by all of our original assumptions on the CRE sale.

Robert M. Gorman

Executive Vice President and Chief Financial Officer

Yes. At the moment, we would do that. Even though rates backed up a

bit, we still feel -- we had estimated about $0.90 on the dollar related to that $2 billion portfolio sale. We still feel pretty good

about that, even though rates backed up a bit.

John A. Asbury

President, Chief Executive Officer and Director

Faster [pace] also means less uncertainty. That portfolio sale will

happen faster than we would have thought because we weren’t expecting to be in a position to close when we hope to close.

* * *

Cautionary Note Regarding Forward-Looking Statements

Certain statements in this communication constitute “forward-looking

statements” within the meaning of the Private Securities Litigation Reform Act of 1995, Section 27A of the Securities Act of

1933, as amended, and Rule 175 promulgated thereunder, and Section 21E of the Securities Exchange Act of 1934, as amended, and

Rule 3b-6 promulgated thereunder, which statements involve inherent risks and uncertainties. Examples of forward-looking statements

include, but are not limited to, statements regarding the outlook and expectations of Atlantic Union and Sandy Spring, respectively, with

respect to the proposed transaction, the strategic benefits and financial benefits of the proposed transaction, including the expected

impact of the proposed transaction on the combined company’s future financial performance (including anticipated accretion to earnings

per share, the tangible book value earn-back period and other operating and return metrics), the timing of the closing of the proposed

transaction, and the ability to successfully integrate the combined businesses. Such statements are often characterized by the use of

qualified words (and their derivatives) such as “may,” “will,” “anticipate,” “could,”

“should,” “would,” “believe,” “contemplate,” “expect,” “estimate,”

“continue,” “plan,” “project,” “confident,” and “intend,” as well as words

of similar meaning or other statements concerning opinions or judgment of Atlantic Union or Sandy Spring or their respective management

about future events. Forward-looking statements are based on assumptions as of the time they are made and are subject to risks, uncertainties

and other factors that are difficult to predict with regard to timing, extent, likelihood and degree of occurrence, which could cause

actual results to differ materially from anticipated results expressed or implied by such forward-looking statements. Such risks, uncertainties

and assumptions, include, among others, the following:

| · | the

occurrence of any event, change or other circumstances that could give rise to the right of one or both of the parties to terminate the

merger agreement; |

| · | the

failure to obtain the remaining necessary regulatory approvals (and the risk that such approvals may result in the imposition of conditions

that could adversely affect the combined company or the expected benefits of the proposed transaction) and the possibility that the proposed

transaction does not close when expected or at all because required regulatory approval, the approval by Atlantic Union’s shareholders

or Sandy Spring’s stockholders, or other approvals and the other conditions to closing are not received or satisfied on a timely

basis or at all; |

| · | the

outcome of any legal proceedings that may be instituted against Atlantic Union or Sandy Spring; |

| · | the

possibility that the anticipated benefits of the proposed transaction, including anticipated cost savings and strategic gains, are not

realized when expected or at all, including as a result of changes in, or problems arising from, general economic and market conditions,

interest and exchange rates, monetary policy, laws and regulations and their enforcement, and the degree of competition in the geographic

and business areas in which Atlantic Union and Sandy Spring operate; |

| · | the

possibility that the integration of the two companies may be more difficult, time-consuming or costly than expected; |

| · | the

impact of purchase accounting with respect to the proposed transaction, or any change in the assumptions used regarding the assets acquired

and liabilities assumed to determine their fair value and credit marks; |

| · | the

possibility that the proposed transaction may be more expensive or take longer to complete than anticipated, including as a result of

unexpected factors or events; |

| · | the

diversion of management’s attention from ongoing business operations and opportunities; |

| · | potential

adverse reactions of Atlantic Union’s or Sandy Spring’s customers or changes to business or employee relationships, including

those resulting from the announcement or completion of the proposed transaction; |

| · | a

material adverse change in the financial condition of Atlantic Union or Sandy Spring; changes in Atlantic Union’s or Sandy Spring’s

share price before closing; |

| · | risks

relating to the potential dilutive effect of shares of Atlantic Union’s common stock to be issued in the proposed transaction; |

| · | general

competitive, economic, political and market conditions; |

| · | major

catastrophes such as earthquakes, floods or other natural or human disasters, including infectious disease outbreaks; |

| · | other

factors that may affect future results of Atlantic Union or Sandy Spring, including, among others, changes in asset quality and credit

risk; the inability to sustain revenue and earnings growth; changes in interest rates; deposit flows; inflation; customer borrowing,

repayment, investment and deposit practices; the impact, extent and timing of technological changes; capital management activities; and

other actions of the Federal Reserve Board and legislative and regulatory actions and reforms. |

These factors are not necessarily all of the factors that could cause

Atlantic Union’s, Sandy Spring’s or the combined company’s actual results, performance or achievements to differ materially

from those expressed in or implied by any of the forward-looking statements. Other factors, including unknown or unpredictable factors,

also could harm Atlantic Union’s, Sandy Spring’s or the combined company’s results.

Although each of Atlantic Union and Sandy Spring believes that its

expectations with respect to forward-looking statements are based upon reasonable assumptions within the bounds of its existing knowledge

of its business and operations, there can be no assurance that actual results of Atlantic Union or Sandy Spring will not differ materially

from any projected future results expressed or implied by such forward-looking statements. Additional factors that could cause results

to differ materially from those described above can be found in (i) Atlantic Union’s most recent annual report on Form 10-K for

the fiscal year ended December 31, 2023 (and which is available at https://www.sec.gov/ix?doc=/Archives/edgar/data/0000883948/000088394824000030/aub-20231231x10k.htm),

quarterly reports on Form 10-Q, Current Reports on Form 8-K and other documents subsequently filed by Atlantic Union with the Securities

Exchange Commission (“SEC”), (ii) in Sandy Spring’s most recent annual report on Form 10-K for the fiscal year ended

December 31, 2023 (and which is available at https://www.sec.gov/ix?doc=/Archives/edgar/data/824410/000082441024000011/sasr-20231231.htm),

and its other filings with the SEC and quarterly reports on Form 10-Q, Current Reports on Form 8-K and other documents subsequently filed

by Sandy Spring with the SEC and (iii) the definitive joint proxy statement/prospectus related to the proposed transaction, which was

filed by Atlantic Union with the SEC on December 17, 2024 (and which is available at https://www.sec.gov/Archives/edgar/data/883948/000110465924129289/tm2428626-7_424b3.htm).

The actual results anticipated may not be realized or, even if substantially

realized, they may not have the expected consequences to or effects on Atlantic Union, Sandy Spring or each of their respective businesses

or operations. Investors are cautioned not to rely too heavily on any such forward-looking statements. Atlantic Union and Sandy Spring

urge you to consider all of these risks, uncertainties and other factors carefully in evaluating all such forward-looking statements made

by Atlantic Union and Sandy Spring. Forward-looking statements speak only as of the date they are made and Atlantic Union and/or Sandy

Spring undertake no obligation to update or clarify these forward-looking statements, whether as a result of new information, future events

or otherwise, except to the extent required by applicable law. All forward-looking statements attributable to Atlantic Union, Sandy Spring,

the combined company, or persons acting on Atlantic Union or Sandy Spring’s behalf, are expressly qualified in their entirety by

the cautionary statements set forth above.

Important Additional Information about the Transaction and Where

to Find It

This communication does not constitute an offer to buy or sell,

or the solicitation of an offer to buy or sell, any securities or a solicitation of any vote or approval. In connection with the

proposed transaction, Atlantic Union filed with the SEC a Registration Statement on Form S-4 on November 21, 2024 (the

“Registration Statement”), as amended on December 13, 2024 (and which is available

at https://www.sec.gov/Archives/edgar/data/883948/000110465924128354/tm2428626-4_s4a.htm), to register the shares of Atlantic

Union capital stock to be issued in connection with the proposed transaction. The Registration Statement includes a joint proxy

statement of Atlantic Union and Sandy Spring and also includes a prospectus of Atlantic Union. The Registration Statement was

declared effective by the SEC on December 17, 2024. Atlantic Union filed a definitive joint proxy statement/prospectus on December

17, 2024 (and which is available at https://www.sec.gov/Archives/edgar/data/883948/000110465924129289/tm2428626-7_424b3.htm),

and it was first mailed to Atlantic Union shareholders on December 18, 2024.

BEFORE MAKING ANY VOTING OR INVESTMENT DECISION, INVESTORS, SHAREHOLDERS

OF ATLANTIC UNION AND STOCKHOLDERS OF SANDY SPRING ARE URGED TO READ THE REGISTRATION STATEMENT ON FORM S-4, AS AMENDED, WHICH IS AVAILABLE

AT https://www.sec.gov/Archives/edgar/data/883948/000110465924128354/tm2428626-4_s4a.htm AND THE DEFINITIVE JOINT PROXY

STATEMENT/PROSPECTUS, WHICH IS AVAILABLE AT https://www.sec.gov/Archives/edgar/data/883948/000110465924129289/tm2428626-7_424b3.htm,

AS WELL AS ANY OTHER RELEVANT AMENDMENTS THERETO, DOCUMENTS FILED WITH THE SEC IN CONNECTION WITH THE TRANSACTION OR INCORPORATED

BY REFERENCE INTO THE DEFINITIVE JOINT PROXY STATEMENT/PROSPECTUS, BECAUSE THEY CONTAIN IMPORTANT INFORMATION REGARDING ATLANTIC UNION,

SANDY SPRING, THE TRANSACTION AND RELATED MATTERS REGARDING THE PROPOSED TRANSACTION AND ANY OTHER RELEVANT DOCUMENTS FILED WITH

THE SEC, AS WELL AS ANY AMENDMENTS OR SUPPLEMENTS TO THOSE DOCUMENTS, BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION ABOUT ATLANTIC UNION,

SANDY SPRING AND THE PROPOSED TRANSACTION AND RELATED MATTERS.

This communication does not constitute an offer to sell or the solicitation

of an offer to buy any securities or the solicitation of any vote or approval with respect to the proposed transaction between Atlantic

Union and Sandy Spring. No offer of securities shall be made except by means of a prospectus meeting the requirements of the Securities

Act of 1933, as amended, and no offer to sell or solicitation of an offer to buy shall be made in any jurisdiction in which such offer,

solicitation or sale would be unlawful prior to registration or qualification under the securities laws of such jurisdiction.

A copy of the Registration Statement, the definitive joint proxy statement/prospectus,

as well as other filings containing information about Atlantic Union and Sandy Spring, may be obtained, free of charge, at the SEC’s

website (http://www.sec.gov). You are also able to obtain these documents, free of charge, from Atlantic Union by accessing Atlantic Union’s

website at https://investors.atlanticunionbank.com or from Sandy Spring by accessing Sandy Spring’s website at https://sandyspringbancorp.q4ir.com/overview/default.aspx.

Copies of the Registration Statement, the definitive joint proxy statement/prospectus and the filings with the SEC that are incorporated

by reference therein can also be obtained, without charge, by directing a request to Atlantic Union Investor Relations, 4300 Cox Road,

Glen Allen, Virginia 23060, or by calling (804) 448-0937, or to Sandy Spring by directing a request to Sandy Spring Investor Relations,

17801 Georgia Avenue, Olney, Maryland 20832 or by calling (301) 774-8455. The information on Atlantic Union’s or Sandy Spring’s

respective websites is not, and shall not be deemed to be, a part of this communication or incorporated into other filings either company

makes with the SEC.

Participants in the Solicitation

Atlantic Union, Sandy Spring and certain of their respective directors,

executive officers and employees may be deemed to be participants in the solicitation of proxies from the shareholders of Atlantic Union

and stockholders of Sandy Spring in connection with the proposed transaction.

Information about the interests of the directors and executive officers

of Atlantic Union and Sandy Spring and other persons who may be deemed to be participants in the solicitation of shareholders of Atlantic

Union and stockholders of Sandy Spring in connection with the proposed transaction and a description of their direct and indirect interests,

by security holdings or otherwise, is included in Atlantic Union’s definitive joint proxy statement/prospectus related to the proposed

transaction, which was filed by Atlantic Union with the SEC on December 17, 2024 (and which is available at https://www.sec.gov/Archives/edgar/data/883948/000110465924129289/tm2428626-7_424b3.htm).

Information about the directors and executive officers of Atlantic

Union and their ownership of Atlantic Union common stock is also set forth in the definitive proxy statement for Atlantic Union’s

2024 Annual Meeting of Shareholders, as filed with the SEC on Schedule 14A on March 26, 2024 (and which is available at https://www.sec.gov/ix?doc=/Archives/edgar/data/0000883948/000155837024003888/aub-20240507xdef14a.htm).

Information about the directors and executive officers of Atlantic Union, their ownership of Atlantic Union common stock, and Atlantic

Union’s transactions with related persons is set forth in the sections entitled “Directors, Executive Officers and Corporate

Governance,” “Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters,” and “Certain

Relationships and Related Transactions, and Director Independence” included in Atlantic Union’s annual report on Form 10-K

for the fiscal year ended December 31, 2023, which was filed with the SEC on February 22, 2024 (and which is available at https://www.sec.gov/ix?doc=/Archives/edgar/data/0000883948/000088394824000030/aub-20231231x10k.htm),

and in the sections entitled “Corporate Governance,” “Executive Officers” and “Stock Ownership of Directors,

Executive Officers and Certain Beneficial Owners” included in Atlantic Union’s definitive proxy statement in connection with

its 2024 Annual Meeting of Shareholders, as filed with the SEC on March 26, 2024 (and which is available at https://www.sec.gov/ix?doc=/Archives/edgar/data/0000883948/000155837024003888/aub-20240507xdef14a.htm).

To the extent holdings of Atlantic Union’s common stock by the directors and executive officers of Atlantic Union have changed from

the amounts of Atlantic Union’s common stock held by such persons as reflected therein, such changes have been or will be reflected

on Statements of Change in Ownership on Form 4 filed with the SEC.

Information about the directors and executive officers of Sandy Spring

and their ownership of Sandy Spring common stock can also be found in Sandy Spring’s definitive proxy statement in connection with

its 2024 Annual Meeting of Stockholders, as filed with the SEC on April 10, 2024 (and which is available at https://www.sec.gov/ix?doc=/Archives/edgar/data/824410/000119312524091479/d784978ddef14a.htm)

and other documents subsequently filed by Sandy Spring with the SEC. Information about the directors and executive officers of Sandy Spring,

their ownership of Sandy Spring common stock, and Sandy Spring’s transactions with related persons is set forth in the sections

entitled “Directors, Executive Officers and Corporate Governance,” “Security Ownership of Certain Beneficial Owners

and Management and Related Stockholder Matters,” and “Certain Relationships and Related Transactions, and Director Independence”

included in Sandy Spring’s annual report on Form 10-K for the fiscal year ended December 31, 2023, which was filed with

the SEC on February 20, 2024 (and which is available at https://www.sec.gov/ix?doc=/Archives/edgar/data/824410/000082441024000011/sasr-20231231.htm),

and in the sections entitled “Corporate Governance,” “Transactions with Related Persons” and “Stock Ownership

Information” included in Sandy Spring’s definitive proxy statement in connection with its 2024 Annual Meeting of Stockholders,

as filed with the SEC on April 10, 2024 (and which is available at https://www.sec.gov/ix?doc=/Archives/edgar/data/824410/000119312524091479/d784978ddef14a.htm).

To the extent holdings of Sandy Spring common stock by the directors and executive officers of Sandy Spring have changed from the amounts

of Sandy Spring common stock held by such persons as reflected therein, such changes have been or will be reflected on Statements of Change

in Ownership on Form 4 filed with the SEC. Free copies of these documents may be obtained as described in the preceding paragraph.

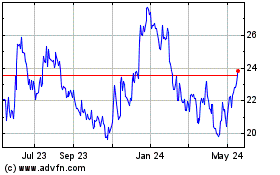

Sandy Spring Bancorp (NASDAQ:SASR)

Historical Stock Chart

From Feb 2025 to Mar 2025

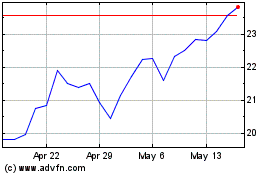

Sandy Spring Bancorp (NASDAQ:SASR)

Historical Stock Chart

From Mar 2024 to Mar 2025