SeaChange International, Inc. (NASDAQ:

SEAC), (“SeaChange” or the “Company”), a leading provider

of video delivery, advertising, streaming platforms, and emerging

Free Ad-Supported Streaming TV services (FAST) development, today

announced that its Board of Directors (the “Board”) adopted a Tax

Benefits Preservation Plan, dated August 16, 2023 (the “Plan”), by

and between the Company and Computershare Trust Company, N.A., as

rights agent, that is intended to protect and preserve the ability

of the Company to use its existing net operating loss carryforwards

and certain other tax assets (collectively, the “NOLs”) to reduce

the Company’s potential future federal income tax obligations.

As of January 31, 2023, the Company had United States federal

NOLs of approximately $131 million. The Plan is similar to the

Company’s previous Tax Benefits Preservation Plan, as amended,

dated March 4, 2019, by and between the Company and Computershare

Inc., as rights agent, which expired on March 4, 2022.

The Company’s use of its NOLs could be substantially limited if

the Company experiences an “ownership change” as defined in Section

382 of the Internal Revenue Code, as amended (“Section 382”). In

general, an ownership change would occur if one or more of the

Company’s stockholders who are deemed to be “5% shareholders” under

Section 382 collectively increase their aggregate ownership of the

Company’s common stock (the “Common Stock”) by more than 50

percentage points over the lowest percentage owned by such

stockholders at any time within a rolling three-year period.

In connection with the adoption of the Plan, on August 16, 2023,

the Board declared a dividend of one preferred share purchase right

(a “Right”) on each outstanding share of Common Stock to holders of

record as of the close of business on August 15, 2023 (the “Record

Date”). Shares of Common Stock issued after the Record Date will be

issued together with the Rights.

While the Plan is in effect, the Rights will become exercisable

on the tenth business day subsequent to the date any person or

group becomes an “Acquiring Person” under the Plan by acquiring

beneficial ownership of 4.9% or more of Common Stock then

outstanding or commences or announces an intention to commence a

tender or exchange offer pursuant to which such person or group

will become an Acquiring Person, without approval from the Board or

without meeting certain customary exceptions. Stockholders already

owning 4.9% or more of the outstanding Common Stock as of the time

of the first public announcement of the Plan will only become

Acquiring Persons if they acquire an additional 4.9% or more of the

outstanding Common Stock. In addition, in its discretion, the Board

may exempt certain persons whose acquisition of Common Stock is

determined by the Board not to jeopardize the Company’s ability to

utilize the NOLs.

Upon becoming exercisable, the Rights would entitle the holders

thereof (other than the Rights held by the Acquiring Person, which

will become null and void) to purchase additional shares of Common

Stock at a significant discount, resulting in significant dilution

to the economic interest and voting power of the Acquiring

Person.

The Rights will expire on August 16, 2024. The Rights may also

expire on an earlier date upon the occurrence of certain other

events specified in the Plan, including (i) the date on which the

Rights are redeemed or exchanged under the Plan, (ii) the

determination by the Board that the Plan is no longer necessary to

preserve the NOLs or a reorganization of the Company resulting in

stock transfer restrictions that provide protection for the NOLs

similar to that provided by the Plan, (iii) the repeal of Section

382 or (iv) the first day of a taxable year that the Board

determines that none of NOLs may be carried forward.

Subject to customary limitations, the Plan may be amended,

redeemed or terminated by the Board at any time prior to being

triggered or its expiration.

Additional details regarding the Plan are contained in a Current

Report on Form 8-K to be filed by SeaChange with the U.S.

Securities and Exchange Commission (the “SEC”).

About SeaChange International, Inc.

SeaChange International, Inc. (NASDAQ: SEAC)

provides first-class video streaming, linear TV, and video

advertising technology for operators, content owners, and

broadcasters globally. SeaChange technology enables operators,

broadcasters, and content owners to cost-effectively launch and

grow premium linear TV and direct-to-consumer streaming

services to manage, curate, and monetize their content. SeaChange

helps protect existing and develop new and incremental advertising

revenues for traditional linear TV and streaming services with its

unique advertising technology. SeaChange enjoys a rich heritage of

nearly three decades of delivering premium video software solutions

to its global customer base.

Forward-Looking Statements

Certain statements in this press release and any oral statements

made regarding the contents of this press release may constitute

“forward-looking statements” within the meaning of the United

States Private Securities Litigation Reform Act of 1995, as amended

to date. Forward-looking statements can be identified by words such

as “may,” “might,” “will,” “should,” “could,” “expects,” “plans,”

“anticipates,” “believes,” “seeks,” “intends,” “estimates,”

“predicts,” “potential” or “continue,” the negative of these terms

and other comparable terminology. Examples of forward-looking

statements include, among others, statements that SeaChange makes

regarding the ability of the Company to use the NOLs to reduce the

Company’s potential future federal income tax obligations, the

limitations on the Company’s use of the NOLs upon an “ownership

change” under Section 382 and the ability of the Plan to protect

and preserve the Company’s ability to use NOLs, shares of Common

Stock issued after the Record Date being issued together with

Rights and other statements that are not purely statements of

historical fact. These forward-looking statements are made on the

basis of the current beliefs, expectations and assumptions of the

management of the Company and are subject to a number of known and

unknown risks and significant business, economic and competitive

uncertainties that could cause actual results to differ materially

from what may be expressed or implied in these forward-looking

statements. Risks that could cause actual results to differ

include, but are not limited to: weakened global economic

conditions, including inflation; a reduction in spending by

customers on video solutions and services would adversely affect

our business, financial condition and operating results; the

increase in labor, service and supply costs, including as a result

of inflationary pressures; the manner in which the multiscreen

video and over-the-top markets develop; our efforts to

become a company that primarily provides software solutions; the

inability to successfully compete in our marketplace; the failure

to respond to rapidly changing technologies related to multiscreen

video; the variability in the market for our products and services;

the loss of or reduction in demand, or the return of product, by

one of the Company’s large customers or the failure of revenue

acceptance criteria to have been satisfied in a given fiscal

quarter; the cancellation or deferral of purchases of our products

or final customer acceptance; a decline in demand or average

selling prices for our products and services; our entry into

fixed-price contracts, which could subject us to losses if the

Company has cost overruns; warranty claims on our products and any

significant warranty expense in excess of estimates; the

possibility that our software products contain serious errors or

defects; turnover in our senior management; our ability to retain

key personnel and hire additional personnel; the failure to achieve

our financial forecasts due to inaccurate sales forecasts or other

factors, including due to expenses the Company may incur in

fulfilling customer arrangements; the impact of our cost-savings

and restructuring programs; the Company’s ability to manage its

growth; the risks associated with international operations; risks

related to public health pandemics such as

the COVID-19 pandemic; the impact of the ongoing conflict

in Ukraine on our business; the success and timing of regulatory

submissions; litigation regarding intellectual property rights;

risk related to protection of our intellectual property; changes in

the regulatory environment; significant risks to our business when

SeaChange engages in the outsourcing of engineering work, including

outsourcing of software work overseas; fluctuations in foreign

currency exchange rates could negatively impact our financial

results and cash flows; weakened global economic conditions that

may harm our industry, business and results of operations; and

other risks that are described in further detail in the Company’s

reports filed from time to time with the SEC, which are available

at the SEC’s website at http://www.sec.gov, including but not

limited to, such information appearing under the caption “Risk

Factors” in the Company’s Annual Report on

Form 10-K, subsequent quarterly reports and in subsequent

filings SeaChange makes with the SEC from time to time,

particularly under the heading “Risk Factors.” Any forward-looking

statements should be considered in light of those risk factors. The

Company cautions readers that such forward-looking statements speak

only as of the date they are made. The Company disclaims any intent

or obligation to publicly update or revise any such forward-looking

statements to reflect any change in Company expectations or future

events, conditions or circumstances on which any such

forward-looking statements may be based, or that may affect the

likelihood that actual results may differ from those set forth in

such forward-looking statements.

SeaChange Contact:Matt Glover and Cameron

WilliamsGateway Group, Inc.949-574-3860SEAC@gateway-grp.com

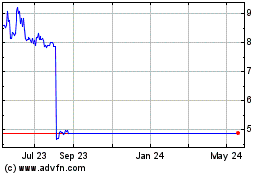

SeaChange (NASDAQ:SEAC)

Historical Stock Chart

From Dec 2024 to Jan 2025

SeaChange (NASDAQ:SEAC)

Historical Stock Chart

From Jan 2024 to Jan 2025