Form 6-K - Report of foreign issuer [Rules 13a-16 and 15d-16]

September 03 2024 - 7:36AM

Edgar (US Regulatory)

UNITED

STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 6-K

REPORT OF FOREIGN PRIVATE ISSUER

PURSUANT TO RULE 13a-16 OR 15d-16 OF

THE SECURITIES EXCHANGE ACT OF 1934

FOR THE MONTH OF SEPTEMBER 2024

COMMISSION FILE NUMBER 000-51576

ORIGIN

AGRITECH LIMITED

(Translation of registrant's name into English)

No. 21

Sheng Ming Yuan Road, Changping District, Beijing 102206

(Address of principal executive office)

Indicate by check mark whether the registrant files or will file annual

reports under cover of Form 20-F or Form 40-F.

Form 20-F x Form 40-F ¨

Indicate by check mark if the registrant is submitting the Form 6-K

in paper as permitted by Regulation S-T Rule 101(b)(1): ¨

Indicate by check mark if the registrant is submitting the Form 6-K

in paper as permitted by Regulation S-T Rule 101(b)(7): ¨

Indicate by check mark whether the registrant by furnishing the information

contained in this Form is also thereby furnishing the information to the Commission pursuant to Rule 12g3-2(b) under the

Securities Exchange Act of 1934.

Yes ¨ No

x

If "Yes" is marked, indicate below the file number assigned

to the registrant in connection with Rule 12g3-2(b): 82- ¨

September 2024 Investor Deck

Origin Agritech Limited is filing herewith an investor

deck dated September 2024. See the attached Exhibit 99.1.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934,

the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| |

ORIGIN AGRITECH

LIMITED |

| |

|

|

| |

By: |

/s/

Weibin Yan |

| |

Name: |

Weibin Yan |

| |

Title: |

Chief Executive Officer

|

Dated: September 3, 2024

Exhibit Index

The following exhibits are filed as part of this Form 6-K

Exhibit 99.1

| ORIGIN AGRITECH LTD.

September 2024 | NASDAQ: SEED |

| Forward Looking Statements & Disclaimers |

| ABOUT US PROBLEM SOLUTION THE MARKET STRATEGY FINANCIALS OUR TEAM SUMMARY CONTACT

3

Origin Agritech at a Glance

Origin Agritech is a leading agtech company in China, specializing in the development and commercialization of

genetically modified crops, advanced crop seeds, and agricultural solutions to enhance crop yield and resilience.

Currently, we are specifically focused on enhancing corn crop yields through production of nutritionally enhanced corn (NEC) to achieve

our mission of solving China’s food security needs through industry leading technological innovations & socially responsible practices.

Ticker Symbol NASDAQ: SEED

Total Market Cap $17.8M USD

Share Price (Aug 1, 2024) $2.78

52-Week Range $1.37-6.38

Shares Outstanding 6.3M

HOW IT STARTED

oFounded in 1997

oHeritage in hybrid corn

breeding

oR&D developing GMO seed

traits & transgenic technology

oCollaborated with Chinese

agricultural institutes to

leverage their resources

WHERE WE ARE

oLarge-scale commercial

production of GMO seeds &

NEC corn in 2024

o3rd generation BT & GT GMO

corn BBL2-2 has been granted

Bio-Safety certificate in May

2024

oDrought resistance GMO corn

in final stage of safety

certificate approval

WHERE WE’RE GOING

oGene editing to increase the

speed of innovation

oUsing leading tech to create

corn varieties to meet

customers' needs

oFuture expansion from just

seeds to a vertically integrated

agritech company |

|

NASDAQ: SEED 4

ABOUT US PROBLEM SOLUTION THE MARKET STRATEGY FINANCIALS OUR TEAM SUMMARY CONTACT

Problem – Food Security & Climate Change

Tough Mismatch Import Dependent Climate Change Inflation |

|

NASDAQ: SEED 5

ABOUT US PROBLEM SOLUTION THE MARKET STRATEGY FINANCIALS OUR TEAM SUMMARY CONTACT

Rapid Transition Expected with Gov’t GMO Corn Approval

Despite having far fewer GMO corn acres than the US,

China’s growth rate is increasing, while the US is in decline

-

20

40

60

80

100

2022 2023 2024

百万

GMO Corn Acres Planted USA vs. China

USA China

0.0%

20.0%

40.0%

60.0%

80.0%

100.0%

0

20

40

60

80

100

1996

1997

1998

1999

2000

2001

2002

2003

2004

2005

2006

2007

2008

2009

2010

2011

2012

2013

2014

2015

2016

2017

2018

2019

2020

2021

2022

2023

2024

百万

Adoption of Genetically Engineered Corn Cops in the United States

(1996-2024)1,2

Acres Harvested % of Planted Acres (HT Corn) % of Planted Acres (Bt Corn)

Genetically engineered (GE) seed varieties were

commercially introduced in the US in 1996. Adoption

rates for these crops increased rapidly in the years

that followed. China is set to see the same rapid

growth that was experienced in the US with GMO

varieties now being approved by the government.

1USDA2USDA |

|

NASDAQ: SEED 6

ABOUT US PROBLEM SOLUTION THE MARKET STRATEGY FINANCIALS OUR TEAM SUMMARY CONTACT

Origin is Set to Reap the Benefits

If China’s GMO corn trend is anything like the USA’s, we are well positioned for success

0%

10%

20%

30%

40%

50%

60%

70%

80%

90%

-

10

20

30

40

50

60

70

80

90

2025E 2026E 2027E 2028E 2029E

百万

China’s Expected GMO Corn Acres / % of All Corn Planted

(2025-2029)

China GMO Corn Acres % of all corn planted |

|

NASDAQ: SEED 7

ABOUT US PROBLEM SOLUTION THE MARKET STRATEGY FINANCIALS OUR TEAM SUMMARY CONTACT

China’s GMO Corn

Growing Landscape

Government GMO Corn Approval in February 2023

660k

ACRES (4 million MU)

• To be planted this year

• 1% of the total corn harvest area

• Likely 90% GMO within 5 years

• Foreign companies not

allowed to produce GMO corn

in China

• Origin’s GMO corn hybrids are in the national demo

plot in 2024 and are ready for commercial

production |

|

NASDAQ: SEED 8

ABOUT US PROBLEM SOLUTION THE MARKET STRATEGY FINANCIALS OUR TEAM SUMMARY CONTACT

Our Solution: Three Technology Pillars

GERMPLASM

GENE EDITING

GMO TRAITS

• Origin’s huge library of

thriving hybrid corn

varieties are the solid

foundation for innovation

• Huge competitive

advantage vs. competition

• Origin is a leading player

in using gene editing to

create innovative new

corn varieties

• Breakthrough technology

significantly increases

breeding efficiency

• Origin has all of the

major GMO traits

integrated into its hybrid

corn and is awaiting

approval |

|

NASDAQ: SEED 9

ABOUT US PROBLEM SOLUTION THE MARKET STRATEGY FINANCIALS OUR TEAM SUMMARY CONTACT

Origin’s Germplasm Superiority

Our 27 years of R&D on hybrid corn provide a huge competitive advantage

GMO & GERMPLASM GO HAND-IN-HAND

• GMO traits only modify a few genetic traits; the

underlying seed variety needs to be of high quality to

ensure a superior product

IMPROVING REGULATORY ENVIRONMENT

• Chinese regulators are strengthening IP protection to

incentivize innovation in the agricultural industry,

making Origin’s germplasm more commercially

valuable

VALIDATED TECHNOLOGY

• 112 hybrids approved as new varieties in the last 27 years

• 4,000 new hybrids being tested across major corn

production regions in China each year

• Origin’s hybrids cover all major production regions in

China

INCREASING NEED FOR ELITE HYBRIDS

• Climate change has made and will continue to make

the growing environment more challenging,

exacerbating the need for elite corn hybrids

|

| NASDAQ: SEED

10

ABOUT US PROBLEM SOLUTION THE MARKET STRATEGY FINANCIALS OUR TEAM SUMMARY CONTACT

Germplasm Gene Mapping

• 1037 elite Inbred Lines

(100 DH derived lines)

• ~80 new elite DH lines used in making

R1 cross/year

• 700 exotic germplasm sources.

Includes: patent expired germplasm

from, Euro and Chinese public

germplasm.

• Pipeline materials: 50,000. Includes:

BCx, Fx, DHs, pop, in evaluation stage.

HIGHLIGHTS |

|

NASDAQ: SEED 11

ABOUT US PROBLEM SOLUTION THE MARKET STRATEGY FINANCIALS OUR TEAM SUMMARY CONTACT

Origin is Creating More Resilient Crops

The field performance of our BBL2-2 transgenic maize has been outstanding

Non-genetically modified corn (Aoyu 510) BBL2-2 transgenic maize Aoyu 510 |

|

NASDAQ: SEED 12

ABOUT US PROBLEM SOLUTION THE MARKET STRATEGY FINANCIALS OUR TEAM SUMMARY CONTACT

Our GMO Trait Portfolio

Drought Resistance

Origin’s drought resistant gene is the only one

in China. Filed for biosafety certificate in May

2023. We expect approval in 2025.

Herbicide and Insect Resistance

The first and only triple stack GMO corn hybrid

entering the national demo plot and ready for

commercial production in 2023. Several elite

commercial hybrids in the new variety approval

process.

Next generation triple stack trait includes two bt

genes that not only resist lepidoptera but also

resistant to coleoptera dichotoma, a major pest in

Southern China. Approved for Bio-Safety

certificate in May 2024.

Phytase Corn

Origin's Phytase corn GMO is the first GMO corn

trait to receive biosafety certificate in 2009.

Phytase is an enzyme that is added to corn

feedstock so that livestock can absorb

essential nutrients. The use of phytase corn

should also reduce phosphate pollution

caused by animal waste and excessive

fertilizer use. |

|

NASDAQ: SEED 13

ABOUT US PROBLEM SOLUTION THE MARKET STRATEGY FINANCIALS OUR TEAM SUMMARY CONTACT

This is the effect of

nitrogen-efficiency

inbred B73 vs. control

samples |

|

NASDAQ: SEED 14

ABOUT US PROBLEM SOLUTION THE MARKET STRATEGY FINANCIALS OUR TEAM SUMMARY CONTACT

Major Milestone:

Origin Receives GMO Safety Certificate for Triple Stack Maize

Certification of transgenic maize, BBL2-2,

containing two insect-resistant genes

(Cry1Ab, Cry3Bb) and one herbicide-tolerance gene (Cp4-epsps):

• Enhances agricultural productivity &

sustainability

• Provides effective pest management &

reduces environmental impact

• Advancement in gene editing with high-yield corn inbred line

• Yield increase of over 50% in trials, pending

biosafety assessment

“

China Approves Gene-Edited Grain

Crops in Food Security Push

-May 2024

“

China approves first gene-edited

wheat in step to open up GM tech

to food crops

-May 2024 |

|

NASDAQ: SEED 15

ABOUT US PROBLEM SOLUTION THE MARKET STRATEGY FINANCIALS OUR TEAM SUMMARY CONTACT

Creating Compact Corn Using Gene Editing Technology

Using one-step phylogenetic techniques, knocking out the lac1 gene can achieve intelligent plant type in maize plants, with a

reduced angle between the upper leaves of the ear and no significant changes in the middle and lower parts of the ear.

POLLINATION GENE EDITING |

|

NASDAQ: SEED 16

ABOUT US PROBLEM SOLUTION THE MARKET STRATEGY FINANCIALS OUR TEAM SUMMARY CONTACT

Using Gene Editing Tech to Create Corn w/ an Extended Growth Period

Our gene editing technology is creating new corn materials with a delayed growth period to provide new ideas for

improving silage corn.

POLLINATION GENE EDITING

INDUCTION LINE EXTENDED

REPRODUCTIVE PERIOD |

|

NASDAQ: SEED 17

ABOUT US PROBLEM SOLUTION THE MARKET STRATEGY FINANCIALS OUR TEAM SUMMARY CONTACT

Using Gene Editing Tech to Obtain New Dwarf Corn Varietals

The use of gene editing technology to create dwarf corn has shown significant effects, providing germplasm materials for

the cultivation of high-density corn varieties

POLLINATION GENE EDITING

INDUCTION LINE EXTENDED

REPRODUCTIVE PERIOD |

|

NASDAQ: SEED 18

ABOUT US PROBLEM SOLUTION THE MARKET STRATEGY FINANCIALS OUR TEAM SUMMARY CONTACT

Current GMO Corn Application Timeline

GMO Corn Variety 2024 2025 2026

AOYU 64BF

AOYU 63BF

AOYU 728

LIYU 16

AOYU 966

AOYU 288

AOYU 510

Time of Application Expected Approval

There are plenty more varieties in the pipeline |

|

NASDAQ: SEED 19

ABOUT US PROBLEM SOLUTION THE MARKET STRATEGY FINANCIALS OUR TEAM SUMMARY CONTACT

Origin’s Groundbreaking Gene-Editing Plant Breeding

2024

2022

2021

2016

2023 |

|

NASDAQ: SEED 20

ABOUT US PROBLEM SOLUTION THE MARKET STRATEGY FINANCIALS OUR TEAM SUMMARY CONTACT

NEC Supply Chain: Disrupting a $75B Industry

Origin is the first example of a vertically integrated business model in the space…

Eliminates the need for

expensive additives in hog feed

Doubles feedstock

company margins

No competition

for the product

Large market size

in China

2x

$75B

Expanding to NEC Corn Production

Dramatically Increases Market Size

*Market size in billions of dollars

$3.5

$4.6

$83.5

$417

HYBRID CORN SEED

GMO CORN SEED

CORN PRODUCTION

FEED/FOOD INDUSTRY |

|

NASDAQ: SEED 21

ABOUT US PROBLEM SOLUTION THE MARKET STRATEGY FINANCIALS OUR TEAM SUMMARY CONTACT

Our Business Model

Post

Harvest/Storage

New Hybrid

Development

Trade &

Transport

Field Grain

Production

Feed/Food

Processing

Industry

o With innovation, we control more

of the supply chain

o We grow NEC corn, rather than

simply sell seed

o This increases both our revenue

and profit potential

The Origin Agritech Advantage |

|

NASDAQ: SEED 22

ABOUT US PROBLEM SOLUTION THE MARKET STRATEGY FINANCIALS OUR TEAM SUMMARY CONTACT

Established Production Facilities & Distribution Channels

Growing ~5,000 Acres of NEC in Xinjiang

• Grown by Origin’s joint venture, Baodao Origin

Agritech and Livestock Co. Ltd.

Constructing 100,000 Ton Corn Drying Base

• Also in Xinjiang, with the $11.1 million investment

being funded by our JV partner and local banks

Expands Origin’s Market Opportunity >20x

• 112 hybrids approved as new varieties in last 26 years

• 4,000 new hybrids being tested across major corn

production regions in China each year

• Origin’s hybrids cover all major production regions in

China

In Negotiations for Similar Deals Nearby

• Our goal is to expand NEC production into all major

corn growing regions across China’s various provinces

|

|

NASDAQ: SEED 23

ABOUT US PROBLEM SOLUTION THE MARKET STRATEGY FINANCIALS OUR TEAM SUMMARY CONTACT

Projected Revenue Growth for Key Revenue Drivers

¥53

¥93 ¥105

¥180

¥295

¥470

¥670

¥959

$-

$15

$30

$45

$60

$75

$90

$105

$120

$135

¥-

¥100

¥200

¥300

¥400

¥500

¥600

¥700

¥800

¥900

¥1,000

2022 2023 2024E 2025E 2026E 2027E 2028E 2029E

USD Equivalent (Millions)

RMB (Millions)

Total Revenue Revenue from GMO Revenue From NEC Revenue from hybrid seeds and other

Assumptions:

• In 5 years, China's GMO corn will account for 70% of the

total corn planting area, about 400 million mu. Origin

aims to have a 5% market share of about 20 million mu

(GMO seed sale & IP granting).

• Exchange rate $:¥:7.2622 (July 15)

• GMO seeds sale begins to contribute revenue in 2025

• GMO IP granting business begins to contribute revenue

in 2027 |

|

NASDAQ: SEED 24

ABOUT US PROBLEM SOLUTION THE MARKET STRATEGY FINANCIALS OUR TEAM SUMMARY CONTACT

Recent Financial Performance

66.1

92

14.8

17.7

-1.0%

0.0%

1.0%

2.0%

3.0%

4.0%

5.0%

6.0%

7.0%

8.0%

9.0%

0

10

20

30

40

50

60

70

80

90

100

2023 2024

1H 2023-24 (RMB Millions)

Revenue Gross Profit Operating Margin Net Margin |

|

NASDAQ: SEED 25

ABOUT US PROBLEM SOLUTION THE MARKET STRATEGY FINANCIALS OUR TEAM SUMMARY CONTACT

Comparable Chinese Firms w/ GMO Certificates

¥0 ¥2,000 ¥4,000 ¥6,000 ¥8,000 ¥10,000 ¥12,000 ¥14,000 ¥16,000 ¥18,000 ¥20,000

Origin

Beijing Guofeng Shengke Biotechnology Co., Ltd

Beijing Biotechnology Co., Ltd

Hangzhou Ruifeng Biotechnology Co., Ltd

Longping Biotechnology (Hainan) Co., Ltd

Beijing Dabeinong Biotechnology Co., Ltd

Current Valuation (RMB million yuan)

GMO Safety Certificate Approval: 2019

GMO Safety Certificate Approval: 2023

GMO Safety Certificate Approval: 2021

GMO Safety Certificate Approval: 2022

GMO Safety Certificate Approval: 2022

GMO Safety Certificate Approval: 2024 |

|

NASDAQ: SEED 26

ABOUT US PROBLEM SOLUTION THE MARKET STRATEGY FINANCIALS OUR TEAM SUMMARY CONTACT

Management & Key Personnel

Weibin Yan

CEO & Director

Mr. Weibin Yan, CEO of Origin, brings extensive leadership experience in the agricultural

and industrial sectors. He is the President of Hunan Xindaxin Group Ltd. He served as

CEO and Vice Chairman of LPHT from 2004 to 2016 (000998.SZ) and was the principal

founder and former Chairman of Ausnutria from 2003 to 2023 (1717.HK). He holds an

MBA and a bachelor’s degree in Industrial and Foreign Trade from Hunan University. Mr.

Yan has previously served as an independent director of Origin Agritech from 2017 to

2018.

Patrick Cheng

CFO & Director

Mr. Cheng brings over three decades of expertise in corporate management, investment,

and financial control. His career includes leadership roles in various industries such as

natural resources, property investment, and banking. He has served as an Independent

Non-Executive Director at Asiasec Properties Limited, Non-Executive Director and

former Chairman at Affluent Partners Holdings Limited, Chairman of DeTai Energy Group

Limited, and CEO & Executive Director at China Uptown Group Company Limited.

Li Yang

COO & Director

Li Yang has held key directorships in several prominent Hong Kong-listed companies,

including Executive Director and Former Chairman of Virtual Mind Holding, Executive

Director of Asia Television Holdings, and Vice Chairman of both Leyou Technologies

Holdings and China Best Group Holdings. His expertise spans natural resources,

agriculture, and technology. Li's strong background in corporate governance, strategic

planning, M&A, and operational management will be vital as Origin Agritech enhances its

market presence and expands its innovative agricultural technologies.

Dezhi Deng

Head of Research

Deng joined Origin in September 2008 and has since led the R&D team to establish key

platforms for maize biotechnology, including genetic transformation, maize vitro embryo

doubling, and gene editing. His leadership contributed to the development of insect-resistant and herbicide-tolerant genetically modified maize BBL2-2, which received a

safety certificate in 2024. Deng's team also published groundbreaking work on maize

gene editing in Nature Impurities. Over the past decade, he has led or participated in

nearly ten major national and provincial-level projects and secured over 10 Chinese and

PCT patents.

Dr. Gengchen Han

Chairman of the Board and Founder

Dr. Gengchen Han, Chairman, has over 40 years of experience in seed research and

business, especially corn. Dr. Han earned his Ph.D. in Plant Breeding and Cytogenetics

from Iowa State University, worked at CIMMYT in Mexico, and Asia/pacific Region in

Pioneer Hi-bred International from 1990 to 1996. |

|

NASDAQ: SEED 27

ABOUT US PROBLEM SOLUTION THE MARKET STRATEGY FINANCIALS OUR TEAM SUMMARY CONTACT

Key Strategic Alliances

*More partnerships in the works!

Henan Agricultura l

University

N atio nal Maize

Impro vement Center

China A gr icultur al

University

China Academy o f

Agricultural S ciences |

|

NASDAQ: SEED 28

ABOUT US PROBLEM SOLUTION THE MARKET STRATEGY FINANCIALS OUR TEAM SUMMARY CONTACT

Why Invest in Origin Agritech?

Nascent multi-billion dollar

market for GMO corn

Leader in gene editing

Speeding up the pace

of innovation and

staying ahead of

competitors

Seeds -> Vertically

Integrated Corn

Company

NEC corn to drive growth

Harvesting 5,000

acres in Xinjiang

GMO revenues to kick in

Big growth driver

Low-cost structure

Should drive

significant margin

expansion &

profitability

US traded on NASDAQ

Ticker: SEED

Our company is built on solid fundamentals with a clear path to organic growth |

|

NASDAQ: SEED 29

ABOUT US PROBLEM SOLUTION THE MARKET STRATEGY FINANCIALS OUR TEAM SUMMARY CONTACT

Origin’s elite hybrid corn

(germplasm)

Use gene editing to turn

on & off genes to create

what the customer wants

(i.e. high protein)

Integrate GMO traits into

new varieties (herbicide

& insect resistant) to make

corn even better, with a

higher yield

We contract & grow the new NEC

variety for the customer, including

processing, drying & fulfilment

(feedstock co. or hog farmer)

Why Invest in Origin Agritech?

We give our customers what they want |

|

NASDAQ: SEED 30

ABOUT US PROBLEM SOLUTION THE MARKET STRATEGY FINANCIALS OUR TEAM SUMMARY CONTACT

For Mandarin Speakers:

Kate Lang

+86 186.1839.3368

bing.lang@originseed.com.cn

Matt Abenante, Strategic Investor Relations, LLC

347.947.2093

matthew@strategic-ir.com

You’ve heard from us.

we want to hear from you.

|

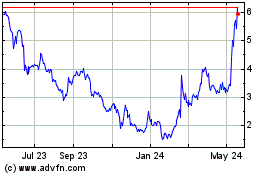

Origin Agritech (NASDAQ:SEED)

Historical Stock Chart

From Feb 2025 to Mar 2025

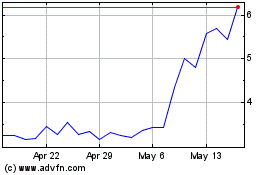

Origin Agritech (NASDAQ:SEED)

Historical Stock Chart

From Mar 2024 to Mar 2025