Safe Harbor Financial Restructures Certain Deferred Consideration Obligations in Connection With 2022 Acquisition of Abaca

October 27 2023 - 6:30AM

SHF Holdings, Inc., d/b/a/ Safe Harbor Financial (“Safe

Harbor” or the “Company”) (NASDAQ: SHFS), a leader in

facilitating financial services and providing credit to the

regulated cannabis industry, announced today the restructuring of

certain deferred consideration payable to the shareholders of

Rockview Digital Solutions, Inc, d/b/a Abaca (“Abaca”), a

cannabis-focused financial technology platform that was acquired by

Safe Harbor in a transaction that closed on November 16, 2022. The

combination of Safe Harbor’s access to a wide range of financial

service offerings and Abaca’s industry-leading fintech software

solutions has produced a comprehensive and streamlined banking

solution for cannabis operators nationwide. The enhanced Safe

Harbor fintech platform now offers desktop and mobile banking,

treasury management, payment processing, cash handling, and

logistics, as well as new interest-bearing and credit products

announced earlier this year.

The restructured terms provide for: (i) a $2.00

conversion price on the $11.67 million in stock currently owed to

Abaca shareholders, resulting in the issuance of 5,835,822 shares

of SHF Holdings common stock, reducing anticipated dilution; (ii)

the delivery of warrants to the Abaca shareholders to purchase up

to 5 million shares of Company class A common stock at an exercise

price of $2.00 per share; and (iii) a payment of $1.5 million in

October 2025, which may be payable in stock, cash, or the

combination of both, at the Company’s option. The $3 million in

cash consideration scheduled to be distributed to Abaca

shareholders in both 2023 and 2024 remains unchanged.

In a joint statement from Sundie Seefried,

Founder and Chief Executive Officer of Safe Harbor, and Dan Roda,

Executive Vice President and Chief Operating Officer of Safe Harbor

and former Co-Founder and CEO of Abaca said, “This restructuring is

a win-win for shareholders of both companies, ensuring both the

long-term viability of Safe Harbor and the serviceability of the

remaining consideration obligations owed to the Abaca shareholders

in connection with last year’s acquisition. With the successful

completion of this transaction, we can focus on executing on the

next phase of our growth strategy, further cementing our position

as the leading facilitator and provider of financial services to

the U.S. cannabis industry.”

About Safe Harbor

Safe Harbor is among the first service providers

to offer compliance, monitoring and validation services to

financial institutions, providing traditional banking services to

cannabis, hemp, CBD, and ancillary operators, making communities

safer, driving growth in local economies, and fostering long-term

partnerships. Currently managing approximately 1000

cannabis-related relationships, Safe Harbor, through its financial

institution clients, implements high standards of accountability,

transparency, monitoring, reporting and risk mitigation measures

while meeting Bank Secrecy Act obligations in line with FinCEN

guidance on cannabis-related businesses. Now in its ninth year,

Safe Harbor has facilitated more than $20 billion in deposit

transactions for businesses with operations spanning over 40 states

and U.S. territories with regulated cannabis markets. For more

information, visit www.shfinancial.org.

Cautionary Statement Regarding Forward-Looking

Statements

Certain statements contained in this press

release constitute “forward-looking statements’’ within the meaning

of federal securities laws. Forward-looking statements may include,

but are not limited to, statements with respect to trends in the

cannabis industry; proposed changes in U.S. and state laws, rules,

regulations and guidance relating to Safe Harbor’s services; laws

and regulations, and guidance related to the cannabis industry

impacting Safe Harbor’s business operations; Safe Harbor’s growth

prospects and Safe Harbor’s market size; Safe Harbor’s value,

projected financial and operational performance, including relative

to its competitors; new product and service offerings Safe Harbor

may introduce in the future; the impact of recent volatility in the

capital markets, which may adversely affect the price of the

Company’s securities; the outcome of any legal proceedings that may

be instituted against Safe Harbor; other statements regarding Safe

Harbor’s expectations, hopes, beliefs, intentions or strategies

regarding the future; and the other risk factors discussed in Safe

Harbor’s filings from time to time with the Securities and Exchange

Commission. In addition, any statements that refer to projections,

forecasts or other characterizations of future events or

circumstances, including any underlying assumptions, are

forward-looking statements. The words “anticipate,” “believe,”

“continue,” “could,” “estimate,” “expect,” “intends,” “outlook,”

“may,” “might,” “plan,” “possible,” “potential,” “predict,”

“project,” “should,” “would,” and similar expressions may identify

forward-looking statements, but the absence of these words does not

mean that a statement is not forward-looking. Forward-looking

statements are predictions, projections and other statements about

future events that are based on current expectations and

assumptions and, as a result, are subject, are subject to risks and

uncertainties. These forward-looking statements involve a number of

risks and uncertainties (some of which are beyond the control of

Safe Harbor), and other assumptions, that may cause the actual

results or performance to be materially different from those

expressed or implied by these forward-looking statements.

Safe Harbor MediaNick Callaio, Marketing

Manager720.951.0619Nick@SHFinancial.org

Safe Harbor Investor

Relationsir@SHFinancial.org

KCSA Strategic CommunicationsPhil

Carlsonsafeharbor@kcsa.com

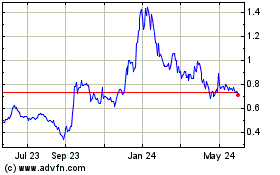

SHF (NASDAQ:SHFS)

Historical Stock Chart

From Dec 2024 to Jan 2025

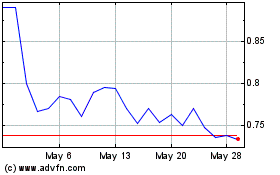

SHF (NASDAQ:SHFS)

Historical Stock Chart

From Jan 2024 to Jan 2025