Shoals Technologies Group, Inc. (“Shoals” or the “Company”)

(Nasdaq: SHLS), a leading provider of electrical balance of system

(“EBOS”) solutions for the energy transition market, today

announced results for its second quarter ended June 30, 2024.

“The second quarter was a busy one for Shoals,

which included new commercial agreements, new product

introductions, and the initiation of our first share repurchase

program. The team executed well in the period, enabling Shoals to

exceed our second quarter outlook. While we are not immune to the

ongoing variability many are experiencing within our markets, we

remain focused on what we can control and influence: expanding our

offering, improving our operational capabilities, and taking

exceptional care of our customers. The early results can be seen in

backlog and awarded orders increasing by 18% year-over-year, to a

record $642.3 million at the end of the quarter,” said Brandon

Moss, CEO of Shoals.

“Looking ahead in the near-term, uncertainty and

volatility resulting from the current political cycle, potential

tariffs, and interest rates continues, and are impacting how

developers are planning out their projects this year and next. For

that reason, we are further adjusting our full-year outlook.

However, we believe data center growth, the re-shoring of U.S.

manufacturing, electrification of transportation, and increased

weather volatility, will continue to drive meaningful load-growth

in the coming years. Meeting the expected new demand will require

more generation capacity and we expect solar to be a prime

beneficiary. We believe the transformation you see occurring at

Shoals today, will set us up exceptionally well to lead our markets

in the coming years and we remain very excited about the

opportunity ahead,” added Mr. Moss.

Second Quarter 2023

Financial ResultsRevenue decreased 17%, to

$99.2 million, compared to $119.2 million for the

prior-year period, due to lower sales volumes primarily resulting

from project delays.

Gross profit was $40.0 million, compared to

$50.5 million in the prior-year period. Gross profit as a

percentage of revenue was 40.3% compared to 42.4% in the prior-year

period. The decline from the prior-year period was primarily due to

higher labor costs and reduced leverage on fixed costs.

General and administrative expenses were

$19.2 million, compared to $16.7 million during the same

period in the prior year. This increase was primarily the result of

planned increases in payroll expense due to higher headcount

supporting growth and legal fees related to the patent infringement

and wire insulation shrinkback matters.

Income from operations was $18.6 million,

compared to $31.6 million during the prior-year period.

Net income was $11.8 million compared to

$18.9 million during the prior-year period.

Net income attributable to Shoals Technologies

Group, Inc. was $11.8 million compared to $18.9 million

during the prior-year period. Basic and diluted net income per

share was $0.07 compared to basic and diluted net income per share

of $0.11 in the prior-year period.

Adjusted EBITDA* decreased $20.5 million to

$27.7 million compared to $48.2 million for the

prior-year period.

Adjusted net income* decreased

$13.4 million to $17.8 million compared to $31.2 million

during the prior-year period. Adjusted diluted earnings per share*

were $0.10 compared to $0.18 in the prior-year period.

* A reconciliation of the Company’s non-GAAP

measures to the most closely comparable U.S. generally accepted

accounting principles (“GAAP”) measures are found within this

release.

Backlog and Awarded OrdersThe

Company’s backlog and awarded orders as of June 30, 2024, were

$642.3 million, representing a 18% increase compared to the

prior-year period and a 4% sequential increase from March 31, 2024.

The increase in backlog and awarded orders as compared to the

prior-year period reflects traction with new customers, demand

resulting from projects in 2025 and beyond, and robust growth in

international markets, which comprises more than 12% of backlog and

awarded orders.

Backlog represents signed purchase orders or

contractual minimum purchase commitments with take-or-pay

provisions and awarded orders are orders we are in the process of

documenting a contract but for which a contract has not yet been

signed.

Third Quarter 2024 OutlookThe

Company is providing an outlook for the third quarter given the

near-term uncertainty in the utility scale solar market, which has

resulted in shifting order patterns. Based on current business

conditions, business trends and other factors, for the quarter

ending September 30, 2024, the Company expects:

- Revenue to be in

the range of $95 to $105 million

- Adjusted EBITDA to

be in the range of $25 to $30 million

Full Year 2024 OutlookBased on

current business conditions, business trends and other factors, for

the full year 2024, the Company expects:

- Revenue to be in

the range of $370 to $400 million

- Adjusted EBITDA* to

be in the range of $96 to $110 million

- Adjusted net

income* to be in the range of $62 to $76 million

- Cash Flow from

operations to be in the range of $62 to $82 million

- Capital

expenditures to be in the range of $15 to $20 million

- Interest expense to

be in the range of $15 to $20 million

A reconciliation of Adjusted EBITDA guidance and

Adjusted net income guidance, which are forward-looking measures

that are non-GAAP measures, to the most closely comparable GAAP

measures is not provided because we are unable to provide such

reconciliation without unreasonable effort. The inability to

provide a quantitative reconciliation is due to the uncertainty and

inherent difficulty in predicting the occurrence, the financial

impact and the periods in which the components of the applicable

GAAP measures and non-GAAP adjustments may be recognized. The GAAP

measures may include the impact of such items as non-cash

share-based compensation, amortization of intangible assets and the

tax effect of such items, in addition to other items we have

historically excluded from Adjusted EBITDA and Adjusted net income.

We expect to continue to exclude these items in future disclosures

of these non-GAAP measures and may also exclude other similar items

that may arise in the future.

Webcast and Conference Call

InformationCompany management will host a webcast and

conference call on August 6, 2024 at 5:00 p.m. Eastern Time,

to discuss the Company’s financial results.

Interested investors and other parties can

listen to a webcast of the live conference call by logging onto the

Investor Relations section of the Company’s website at

https://investors.shoals.com.

The conference call can be accessed live over

the phone by dialing 1-877-407-0789 (domestic) or +1-201-689-8562

(international). A telephonic replay will be available

approximately two hours after the call by dialing 1-844-512-2921 or

for international callers, +1-412-317-6671. The access ID number

for the replay is 13745188. The telephonic replay will be available

until 11:59 p.m. Eastern Time on August 20, 2024.

About Shoals Technologies Group,

Inc.Shoals Technologies Group, Inc. is a leading provider

of electrical balance of systems (EBOS) solutions for the energy

transition market. Since its founding in 1996, the Company has

introduced innovative technologies and systems solutions that allow

its customers to substantially increase installation efficiency and

safety while improving system performance and reliability. Shoals

Technologies Group, Inc. is a recognized leader in the renewable

energy industry whose solutions are deployed on over 62 GW of solar

systems globally. For additional information, please visit:

https://www.shoals.com.

Investor Relations Contact

Shoals Technologies Group, Inc.Email: investors@shoals.com

Forward-Looking StatementsThis

report contains forward-looking statements that are based on our

management’s beliefs and assumptions and on information currently

available to our management. Forward-looking statements include

information concerning our possible or assumed future results of

operations; including our financial guidance for the third quarter

of 2024 and for the full year ending December 31, 2024;

expectations regarding the utility scale solar market and our share

thereof; project delays; regulatory environment; pipeline and

orders; business strategies; technology developments; financing and

investment plans; warranty, litigation and liability accruals and

estimates of loss or gains; litigation strategy and expected

benefits or results from the current intellectual property and wire

insulation shrinkback litigation; potential growth opportunities,

including international growth, production and capacity at our

plants; and the effects of competition. Forward-looking statements

include statements that are not historical facts and can be

identified by terms such as “anticipate,” “believe,” “could,”

“estimate,” “expect,” “intend,” “may,” “plan,” “potential,”

“predict,” “project,” “seek,” “should,” “will,” “would” or similar

expressions and the negatives of those terms.

Forward-looking statements involve known and

unknown risks, uncertainties and other factors that may cause our

actual results, performance or achievements to be materially

different from any future results, performance or achievements

expressed or implied by the forward-looking statements.

Some of the key factors that could cause actual

results to differ from our expectations include, among others, if

demand for solar energy projects does not continue to grow or grows

at a slower rate than we anticipate, including as a result of

industry project delays, we may not be able to achieve our

anticipated level of growth and our business will suffer; if we

fail to accurately estimate the potential losses related to the

wire insulation shrinkback matter, or fail to recover the costs and

expenses incurred by us from the supplier, our profit margins,

financial results, business and prospects could be materially

adversely impacted; defects or performance problems in our products

or their parts, including those related to the wire insulation

shrinkback matter, could result in loss of customers, reputational

damage and decreased revenue, and may have a material adverse

effect on our business, financial condition and results of

operations; we may experience delays, disruptions, quality control

or reputational problems in our manufacturing operations in part

due to our vendor concentration; if we or our suppliers face

disputes with labor unions, we may not be able to achieve our

anticipated level of growth and our business could suffer; if we

fail to retain our key personnel and attract additional qualified

personnel, or successfully integrate our new Chief Executive

Officer, our business strategy and prospects could suffer; our

products are primarily manufactured and shipped from our production

facilities in Tennessee, and any damage or disruption at these

facilities may harm our business; we may face difficulties with

respect to the planned consolidation and relocation of our

Tennessee-based manufacturing and distribution operations, and may

not realize the benefits thereof; unsatisfactory safety performance

may subject us to penalties, negatively impact customer

relationships, result in higher operating costs, and negatively

impact employee morale and turnover; the market for our products is

competitive, and we may face increased competition as new and

existing competitors introduce EBOS system solutions and

components, which could negatively affect our results of operations

and market share; current macroeconomic events, including high

inflation, high interest rates, a potential recession, uncertainty

surrounding the election cycle and geopolitical instability could

impact our business and financial results; our industry has

historically been cyclical and experienced periodic downturns; the

interruption of the flow of raw materials from international

vendors has disrupted our supply chain, including as a result of

the imposition of additional duties, tariffs and other charges on

imports and exports; we are subject to risks associated with legal

proceedings and claims, including the patent infringement

complaints that we filed with the U.S. International Trade

Commission (the “ITC”) and two District Courts, the securities and

derivative litigation initiated in 2024, and other legal

proceedings and claims, which may or may not arise in the normal

course of our business; if we fail to, or incur significant costs

in order to, obtain, maintain, protect, defend or enforce our

intellectual property and other proprietary rights, including those

that are subject to the patent infringement complaints we filed

with the ITC and two District Courts, our business and results of

operations could be materially harmed; a loss of one or more of our

significant customers, their inability to perform under their

contracts, or their default in payment could harm or business and

negatively impact revenue, results of operations, and cash flow; we

may not repurchase all shares authorized for repurchase under our

share Repurchase Program, we cannot guarantee that the Repurchase

Program will enhance long-term stockholder value, and share

repurchases could increase the volatility of the price of our Class

A common stock; and our expansion outside the U.S. could subject us

to additional business, financial, regulatory and competitive

risks.

These and other important risk factors are

described more fully in the Company’s most recent Annual Report on

Form 10-K and subsequent Quarterly Reports on Form 10-Q and other

documents filed with the Securities and Exchange Commission and

could cause actual results to vary from expectations. Given these

uncertainties, you should not place undue reliance on

forward-looking statements. Also, forward-looking statements

represent our management’s beliefs and assumptions only as of the

date of this report. You should read this report with the

understanding that our actual future results may be materially

different from what we expect.

Except as required by law, we assume no

obligation to update these forward-looking statements, or to update

the reasons actual results could differ materially from those

anticipated in these forward-looking statements, even if new

information becomes available in the future.

Non-GAAP Financial Measures

Adjusted Gross Profit, Adjusted Gross

Profit Percentage, Adjusted EBITDA, Adjusted Net Income, and

Adjusted Diluted Earnings per Share (“EPS”)

We define Adjusted Gross Profit as gross profit

plus wire insulation shrinkback expenses. We define Adjusted Gross

Profit Percentage as Adjusted Gross Profit divided by revenue. We

define Adjusted EBITDA as net income plus (i) interest expense,

net, (ii) income tax expense, (iii) depreciation expense, (iv)

amortization of intangibles, (v) equity-based compensation, (vi)

wire insulation shrinkback expenses, and (vii) wire insulation

shrinkback litigation expenses. We define Adjusted Net Income as

net income attributable to Shoals Technologies Group, Inc. plus (i)

net income impact from assumed exchange of Class B common stock to

Class A common stock as of the beginning of the earliest period

presented, (ii) adjustment to the provision for income tax, (iii)

amortization of intangibles, (iv) amortization / write-off of

deferred financing costs, (v) equity-based compensation, (vi) wire

insulation shrinkback expenses, and (vii) wire insulation

shrinkback litigation expenses, all net of applicable income taxes.

We define Adjusted Diluted EPS as Adjusted Net Income divided by

the diluted weighted average shares of Class A common stock

outstanding for the applicable period, which assumes the exchange

of all outstanding Class B common stock for Class A common stock as

of the beginning of the earliest period presented.

Adjusted Gross Profit, Adjusted Gross Profit

Percentage, Adjusted EBITDA, Adjusted Net Income, and Adjusted

Diluted EPS are intended as supplemental measures of performance

that are neither required by, nor presented in accordance with,

GAAP. We present Adjusted Gross Profit, Adjusted Gross Profit

Percentage, Adjusted EBITDA, Adjusted Net Income, and Adjusted

Diluted EPS because we believe they assist investors and analysts

in comparing our performance across reporting periods on a

consistent basis by excluding items that we do not believe are

indicative of our core operating performance. In addition, we use

Adjusted Gross Profit, Adjusted Gross Profit Percentage, Adjusted

EBITDA, Adjusted Net Income, and Adjusted Diluted EPS: (i) as

factors in evaluating management’s performance when determining

incentive compensation, as applicable; (ii) to evaluate the

effectiveness of our business strategies; and (iii) because our

credit agreement uses measures similar to Adjusted EBITDA, Adjusted

Net Income and Adjusted Diluted EPS to measure our compliance with

certain covenants.

Among other limitations, Adjusted Gross Profit,

Adjusted Gross Profit Percentage, Adjusted EBITDA, Adjusted Net

Income, and Adjusted Diluted EPS do not reflect our cash

expenditures, or future requirements for capital expenditures or

contractual commitments; do not reflect the impact of certain cash

charges resulting from matters we consider not to be indicative of

our ongoing operations; and may be calculated by other companies in

our industry differently than we do or not at all, which may limit

their usefulness as comparative measures.

Because of these limitations, Adjusted Gross

Profit, Adjusted Gross Profit Percentage, Adjusted EBITDA, Adjusted

Net Income, and Adjusted Diluted EPS should not be considered in

isolation or as substitutes for performance measures calculated in

accordance with GAAP. You should review the reconciliation of gross

profit to Adjusted Gross Profit and Adjusted Gross Profit

Percentage, net income to Adjusted EBITDA, and net income

attributable to Shoals Technologies Group, Inc. to Adjusted Net

Income and Adjusted Diluted EPS below and not rely on any single

financial measure to evaluate our business.

| |

|

Shoals Technologies Group, Inc.Condensed

Consolidated Balance Sheets (Unaudited)(in thousands,

except shares and par value) |

| |

| |

June 30,2024 |

|

December 31,2023 |

| Assets |

|

|

|

| Current Assets |

|

|

|

|

Cash and cash equivalents |

$ |

3,189 |

|

|

$ |

22,707 |

|

|

Accounts receivable, net |

|

92,261 |

|

|

|

107,118 |

|

|

Unbilled receivables |

|

17,015 |

|

|

|

40,136 |

|

|

Inventory, net |

|

60,006 |

|

|

|

52,804 |

|

|

Other current assets |

|

4,784 |

|

|

|

4,421 |

|

|

Total Current Assets |

|

177,255 |

|

|

|

227,186 |

|

| Property, plant and equipment,

net |

|

26,932 |

|

|

|

24,836 |

|

| Goodwill |

|

69,941 |

|

|

|

69,941 |

|

| Other intangible assets,

net |

|

44,876 |

|

|

|

48,668 |

|

| Deferred tax assets |

|

461,676 |

|

|

|

468,195 |

|

| Other assets |

|

7,757 |

|

|

|

5,167 |

|

| Total

Assets |

$ |

788,437 |

|

|

$ |

843,993 |

|

| |

|

|

|

| Liabilities and

Stockholders’ Equity |

|

|

|

| Current Liabilities |

|

|

|

|

Accounts payable |

$ |

16,187 |

|

|

$ |

14,396 |

|

|

Accrued expenses and other |

|

9,683 |

|

|

|

22,907 |

|

|

Warranty liability—current portion |

|

31,148 |

|

|

|

31,099 |

|

|

Deferred revenue |

|

21,244 |

|

|

|

22,228 |

|

|

Long-term debt—current portion |

|

— |

|

|

|

2,000 |

|

|

Total Current Liabilities |

|

78,262 |

|

|

|

92,630 |

|

| Revolving line of credit |

|

146,750 |

|

|

|

40,000 |

|

| Long-term debt, less current

portion |

|

— |

|

|

|

139,445 |

|

| Warranty liability, less

current portion |

|

16,182 |

|

|

|

23,815 |

|

| Other long-term

liabilities |

|

2,657 |

|

|

|

3,107 |

|

| Total Liabilities |

|

243,851 |

|

|

|

298,997 |

|

| Commitments and

Contingencies |

|

|

|

| Stockholders’ Equity |

|

|

|

|

Preferred stock, $0.00001 par value - 5,000,000 shares authorized;

none issued and outstanding as of June 30, 2024 and

December 31, 2023 |

|

— |

|

|

|

— |

|

|

Class A common stock, $0.00001 par value - 1,000,000,000 shares

authorized; 170,511,566 and 170,117,289 shares issued; 168,308,923

and 170,117,289 outstanding as of June 30, 2024 and

December 31, 2023, respectively |

|

2 |

|

|

|

2 |

|

|

Class B common stock, $0.00001 par value - 195,000,000 shares

authorized; none issued and outstanding as of June 30, 2024

and December 31, 2023 |

|

— |

|

|

|

— |

|

|

Additional paid-in capital |

|

468,787 |

|

|

|

470,542 |

|

|

Treasury stock, at cost, 2,202,643 and zero shares as of

June 30, 2024 and December 31, 2023, respectively |

|

(15,231 |

) |

|

|

— |

|

|

Retained earnings |

|

91,028 |

|

|

|

74,452 |

|

| Total stockholders'

equity |

|

544,586 |

|

|

|

544,996 |

|

| Total Liabilities and

Stockholders’ Equity |

$ |

788,437 |

|

|

$ |

843,993 |

|

| |

|

Shoals Technologies Group, Inc.Condensed

Consolidated Statements of Operations (Unaudited)(in

thousands, except per share amounts) |

| |

| |

Three Months Ended June 30, |

|

Six Months Ended June 30, |

|

|

|

2024 |

|

|

|

2023 |

|

|

|

2024 |

|

|

|

2023 |

|

| Revenue |

$ |

99,249 |

|

|

$ |

119,208 |

|

|

$ |

190,056 |

|

|

$ |

224,294 |

|

| Cost of

revenue |

|

59,252 |

|

|

|

68,691 |

|

|

|

113,599 |

|

|

|

125,520 |

|

| Gross

profit |

|

39,997 |

|

|

|

50,517 |

|

|

|

76,457 |

|

|

|

98,774 |

|

| Operating

expenses |

|

|

|

|

|

|

|

|

General and administrative expenses |

|

19,218 |

|

|

|

16,723 |

|

|

|

41,990 |

|

|

|

36,715 |

|

|

Depreciation and amortization |

|

2,198 |

|

|

|

2,158 |

|

|

|

4,302 |

|

|

|

4,323 |

|

|

Total operating expenses |

|

21,416 |

|

|

|

18,881 |

|

|

|

46,292 |

|

|

|

41,038 |

|

| Income from

operations |

|

18,581 |

|

|

|

31,636 |

|

|

|

30,165 |

|

|

|

57,736 |

|

| Interest expense, net |

|

(3,063 |

) |

|

|

(6,505 |

) |

|

|

(7,425 |

) |

|

|

(12,501 |

) |

| Income before income

taxes |

|

15,518 |

|

|

|

25,131 |

|

|

|

22,740 |

|

|

|

45,235 |

|

| Income tax expense |

|

(3,716 |

) |

|

|

(6,207 |

) |

|

|

(6,164 |

) |

|

|

(9,328 |

) |

| Net

income |

|

11,802 |

|

|

|

18,924 |

|

|

|

16,576 |

|

|

|

35,907 |

|

| Less: net income attributable

to non-controlling interests |

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

2,687 |

|

| Net income

attributable to Shoals Technologies Group, Inc. |

$ |

11,802 |

|

|

$ |

18,924 |

|

|

$ |

16,576 |

|

|

$ |

33,220 |

|

| |

|

|

|

|

|

|

|

| |

Three Months Ended June 30, |

|

Six Months Ended June 30, |

| |

|

2024 |

|

|

|

2023 |

|

|

|

2024 |

|

|

|

2023 |

|

| Earnings per share of

Class A common stock: |

|

|

|

|

|

|

|

|

Basic |

$ |

0.07 |

|

|

$ |

0.11 |

|

|

$ |

0.10 |

|

|

$ |

0.21 |

|

|

Diluted |

$ |

0.07 |

|

|

$ |

0.11 |

|

|

$ |

0.10 |

|

|

$ |

0.21 |

|

| Weighted average

shares of Class A common stock outstanding: |

|

|

|

|

|

|

|

|

Basic |

|

169,991 |

|

|

|

169,887 |

|

|

|

170,136 |

|

|

|

158,213 |

|

|

Diluted |

|

170,100 |

|

|

|

170,241 |

|

|

|

170,252 |

|

|

|

158,694 |

|

| |

|

Shoals Technologies Group, Inc.Condensed

Consolidated Statements of Cash Flows (Unaudited)(in

thousands) |

| |

| |

Six Months Ended June 30, |

|

|

|

2024 |

|

|

|

2023 |

|

| Cash Flows from

Operating Activities |

|

|

|

|

Net income |

$ |

16,576 |

|

|

$ |

35,907 |

|

|

Adjustments to reconcile net income to net cash provided by

operating activities: |

|

|

|

|

Depreciation and amortization |

|

6,181 |

|

|

|

5,092 |

|

|

Amortization/write off of deferred financing costs |

|

2,781 |

|

|

|

692 |

|

|

Equity-based compensation |

|

9,110 |

|

|

|

11,968 |

|

|

Provision for credit losses |

|

— |

|

|

|

296 |

|

|

Provision for obsolete or slow-moving inventory |

|

466 |

|

|

|

3,140 |

|

|

Provision for warranty expense |

|

1,394 |

|

|

|

9,386 |

|

|

Deferred taxes |

|

6,519 |

|

|

|

8,953 |

|

|

Changes in assets and liabilities: |

|

|

|

|

Accounts receivable |

|

14,857 |

|

|

|

(46,820 |

) |

|

Unbilled receivables |

|

23,121 |

|

|

|

(4,951 |

) |

|

Inventory |

|

(7,668 |

) |

|

|

1,402 |

|

|

Other assets |

|

(791 |

) |

|

|

(2,064 |

) |

|

Accounts payable |

|

1,791 |

|

|

|

7,014 |

|

|

Accrued expenses and other |

|

(13,674 |

) |

|

|

92 |

|

|

Warranty liability |

|

(8,978 |

) |

|

|

(312 |

) |

|

Deferred revenue |

|

(984 |

) |

|

|

8,039 |

|

| Net Cash Provided by

Operating Activities |

|

50,701 |

|

|

|

37,834 |

|

| Cash Flows from

Investing Activities |

|

|

|

|

Purchases of property, plant and equipment |

|

(4,485 |

) |

|

|

(4,377 |

) |

| Net Cash Used in

Investing Activities |

|

(4,485 |

) |

|

|

(4,377 |

) |

| Cash Flows from

Financing Activities |

|

|

|

|

Distributions to non-controlling interests |

|

— |

|

|

|

(2,628 |

) |

|

Employee withholding taxes related to net settled equity

awards |

|

(865 |

) |

|

|

(3,576 |

) |

|

Payments on term loan facility |

|

(143,750 |

) |

|

|

(1,000 |

) |

|

Proceeds from revolving credit facility |

|

148,750 |

|

|

|

5,000 |

|

|

Repayments of revolving credit facility |

|

(42,000 |

) |

|

|

(33,000 |

) |

|

Deferred financing costs |

|

(2,638 |

) |

|

|

— |

|

|

Repurchase of Class A common stock |

|

(25,231 |

) |

|

|

— |

|

|

Other |

|

— |

|

|

|

(1,159 |

) |

| Net Cash Used in

Financing Activities |

|

(65,734 |

) |

|

|

(36,363 |

) |

| Net Decrease in Cash

and Cash Equivalents |

|

(19,518 |

) |

|

|

(2,906 |

) |

| Cash and Cash

Equivalents—Beginning of Period |

|

22,707 |

|

|

|

8,766 |

|

| Cash and Cash

Equivalents—End of Period |

$ |

3,189 |

|

|

$ |

5,860 |

|

| |

| |

|

Shoals Technologies Group,

Inc.Adjusted Gross Profit, Adjusted Gross

Profit Percentage, Adjusted EBITDA, Adjusted Net Income and

Adjusted Diluted Earnings per Share (“EPS”)

(Unaudited) |

Reconciliation of Gross Profit to Adjusted Gross

Profit and Adjusted Gross Profit Percentage (in thousands):

| |

Three Months Ended June 30, |

|

Six Months Ended June 30, |

| |

2024 |

|

2023 |

|

2024 |

|

2023 |

|

Revenue |

$ |

99,249 |

|

|

|

$ |

119,208 |

|

|

|

$ |

190,056 |

|

|

|

$ |

224,294 |

|

|

| Cost of revenue |

|

59,252 |

|

|

|

|

68,691 |

|

|

|

|

113,599 |

|

|

|

|

125,520 |

|

|

| Gross profit |

$ |

39,997 |

|

|

|

$ |

50,517 |

|

|

|

$ |

76,457 |

|

|

|

$ |

98,774 |

|

|

| Gross profit percentage |

|

40.3 |

|

% |

|

|

42.4 |

|

% |

|

|

40.2 |

|

% |

|

|

44.0 |

|

% |

| |

|

|

|

|

|

|

|

| Wire insulation shrinkback

expenses(a) |

$ |

466 |

|

|

|

$ |

9,488 |

|

|

|

$ |

466 |

|

|

|

$ |

11,494 |

|

|

| Adjusted gross profit |

$ |

40,463 |

|

|

|

$ |

60,005 |

|

|

|

$ |

76,923 |

|

|

|

$ |

110,268 |

|

|

| Adjusted gross profit

percentage |

|

40.8 |

|

% |

|

|

50.3 |

|

% |

|

|

40.5 |

|

% |

|

|

49.2 |

|

% |

Reconciliation of Net Income to Adjusted EBITDA

(in thousands):

| |

Three Months Ended June 30, |

|

Six Months Ended June 30, |

|

|

|

2024 |

|

|

|

2023 |

|

|

|

2024 |

|

|

|

2023 |

|

| Net income |

$ |

11,802 |

|

|

$ |

18,924 |

|

|

$ |

16,576 |

|

|

$ |

35,907 |

|

| Interest expense, net |

|

3,063 |

|

|

|

6,505 |

|

|

|

7,425 |

|

|

|

12,501 |

|

| Income tax expense |

|

3,716 |

|

|

|

6,207 |

|

|

|

6,164 |

|

|

|

9,328 |

|

| Depreciation expense |

|

1,283 |

|

|

|

565 |

|

|

|

2,389 |

|

|

|

1,049 |

|

| Amortization of

intangibles |

|

1,896 |

|

|

|

2,021 |

|

|

|

3,792 |

|

|

|

4,043 |

|

| Equity-based compensation |

|

4,087 |

|

|

|

4,445 |

|

|

|

9,110 |

|

|

|

11,968 |

|

| Wire insulation shrinkback

expenses(a) |

|

466 |

|

|

|

9,488 |

|

|

|

466 |

|

|

|

11,494 |

|

| Wire insulation shrinkback

litigation expenses(b) |

|

1,372 |

|

|

|

— |

|

|

|

2,221 |

|

|

|

— |

|

| Adjusted EBITDA |

$ |

27,685 |

|

|

$ |

48,155 |

|

|

$ |

48,143 |

|

|

$ |

86,290 |

|

Reconciliation of Net Income Attributable to

Shoals Technologies Group, Inc. to Adjusted Net Income (in

thousands):

| |

Three Months Ended June 30, |

|

Six Months Ended June 30, |

|

|

|

2024 |

|

|

|

2023 |

|

|

|

2024 |

|

|

|

2023 |

|

| Net income attributable to

Shoals Technologies Group, Inc. |

$ |

11,802 |

|

|

$ |

18,924 |

|

|

$ |

16,576 |

|

|

$ |

33,220 |

|

| Net income impact from assumed

exchange of Class B common stock to Class A common stock (c) |

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

2,687 |

|

| Adjustment to the provision

for income tax (d) |

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

(653 |

) |

| Tax effected net income |

|

11,802 |

|

|

|

18,924 |

|

|

|

16,576 |

|

|

|

35,254 |

|

| Amortization of

intangibles |

|

1,896 |

|

|

|

2,021 |

|

|

|

3,792 |

|

|

|

4,043 |

|

| Amortization / write-off of

deferred financing costs |

|

155 |

|

|

|

342 |

|

|

|

2,781 |

|

|

|

692 |

|

| Equity-based compensation |

|

4,087 |

|

|

|

4,445 |

|

|

|

9,110 |

|

|

|

11,968 |

|

| Wire insulation shrinkback

expenses(a) |

|

466 |

|

|

|

9,488 |

|

|

|

466 |

|

|

|

11,494 |

|

| Wire insulation shrinkback

litigation expenses(b) |

|

1,372 |

|

|

|

— |

|

|

|

2,221 |

|

|

|

— |

|

| Tax impact of adjustments

(e) |

|

(1,970 |

) |

|

|

(4,041 |

) |

|

|

(4,501 |

) |

|

|

(6,908 |

) |

| Adjusted Net Income |

$ |

17,808 |

|

|

$ |

31,179 |

|

|

$ |

30,445 |

|

|

$ |

56,543 |

|

|

(a) |

For the six months ended June 30, 2024, represents (i) $0.5 million

of inventory write-downs of wire in connection with the

identification, repair and replacement of a subset of wire

harnesses presenting unacceptable levels of wire insulation

shrinkback. For the six months ended June 30, 2023, represents (i)

$8.9 million of wire insulation shrinkback warranty expenses

related to the identification, repair and replacement of a subset

of wire harnesses presenting unacceptable levels of wire insulation

shrinkback, recorded during the three months ended June 30, 2023

and (ii) $2.6 million of inventory write-downs of defective wire in

connection with the identification, repair and replacement of a

subset of wire harnesses presenting unacceptable levels of wire

insulation shrinkback, including $2.0 million and $0.6 million,

respectively, recorded during the three months ended March 31, 2023

and June 30, 2023. We consider expenses incurred in connection with

the identification, repair and replacement of the impacted wire

harnesses distinct from normal, ongoing service identification,

repair and replacement expenses that would be reflected under

ongoing warranty expenses within the operation of our business,

which we do not exclude from our non-GAAP measures. In the future,

we also intend to exclude from our non-GAAP measures the benefit of

liability releases, if any. We believe excluding expenses from

these discrete liability events provides investors with a better

view of the operating performance of our business and allows for

comparability through periods. See Note 8 - Warranty Liability, in

our condensed consolidated financial statements on Form 10-Q for

more information. |

|

|

|

|

(b) |

For the three and six months ended June 30, 2024, represents $1.4

million and $2.2 million, respectively, of expenses incurred in

connection with the lawsuit initiated by the Company against the

supplier of the defective wire. We consider this litigation

distinct from ordinary course legal matters given the expected

magnitude of the expenses, the nature of the allegations in the

Company’s complaint, the amount of damages sought, and the impact

of the matter underlying the litigation on the Company’s financial

results. In the future, we also intend to exclude from our non-GAAP

measures the benefit of recovery, if any. We believe excluding

expenses from these discrete litigation events provides investors

with a better view of the operating performance of our business and

allows for comparability through periods. See Note 13 - Commitments

and Contingencies, in our condensed consolidated financial

statements on Form 10-Q for more information. |

|

|

|

|

(c) |

Reflects net income to Class A common stock from assumed exchange

of corresponding shares of our Class B common stock formerly held

by our founder and management. |

|

|

|

|

(d) |

Shoals Technologies Group, Inc. is subject to U.S. Federal income

taxes, in addition to state and local taxes. The adjustment to the

provision for income tax reflects the effective tax rates below,

and for the period prior to March 10, 2023, assumes Shoals

Technologies Group, Inc. owned 100% of the units in Shoals Parent

LLC. |

| |

|

| |

Three Months Ended June 30, |

|

Six Months Ended June 30, |

| |

2024 |

|

2023 |

|

2024 |

|

2023 |

|

Statutory U.S. Federal income tax rate |

21.0 |

|

% |

|

21.0 |

|

% |

|

21.0 |

|

% |

|

21.0 |

|

% |

| Permanent adjustments |

0.9 |

|

% |

|

0.5 |

|

% |

|

0.8 |

|

% |

|

0.4 |

|

% |

| State and local taxes (net of

federal benefit) |

2.8 |

|

% |

|

3.3 |

|

% |

|

2.7 |

|

% |

|

3.1 |

|

% |

| Effective income tax rate for

Adjusted Net Income |

24.7 |

|

% |

|

24.8 |

|

% |

|

24.5 |

|

% |

|

24.5 |

|

% |

|

(e) |

Represents the estimated tax impact of all Adjusted Net Income

add-backs, excluding those which represent permanent differences

between book versus tax. |

|

|

|

Reconciliation of Diluted Weighted Average

Shares Outstanding to Adjusted Diluted Weighted Average Shares

Outstanding (in thousands, except per share amounts):

| |

Three Months Ended June 30, |

|

Six Months Ended June 30, |

|

|

|

2024 |

|

|

|

2023 |

|

|

|

2024 |

|

|

|

2023 |

|

| Diluted weighted average

shares of Class A common stock outstanding, excluding Class B

common stock |

|

170,100 |

|

|

|

170,241 |

|

|

|

170,252 |

|

|

|

158,694 |

|

| Assumed exchange of Class B

common stock to Class A common stock |

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

11,491 |

|

| Adjusted diluted weighted

average shares outstanding |

|

170,100 |

|

|

|

170,241 |

|

|

|

170,252 |

|

|

|

170,185 |

|

| |

|

|

|

|

|

|

|

| Adjusted Net Income |

$ |

17,808 |

|

|

$ |

31,179 |

|

|

$ |

30,445 |

|

|

$ |

56,543 |

|

| Adjusted Diluted EPS |

$ |

0.10 |

|

|

$ |

0.18 |

|

|

$ |

0.18 |

|

|

$ |

0.33 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

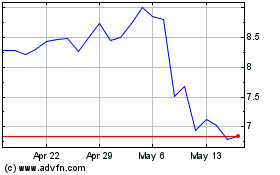

Shoals Technologies (NASDAQ:SHLS)

Historical Stock Chart

From Jan 2025 to Feb 2025

Shoals Technologies (NASDAQ:SHLS)

Historical Stock Chart

From Feb 2024 to Feb 2025