Filed by The Shyft Group, Inc.

(Commission File No.: 001-33582)

Pursuant to Rule 425 of the Securities Act of 1933

Subject Company: The Shyft Group, Inc.

(Commission File No.: 001-33582)

On December 17, 2024, The Shyft Group, Inc. (“Shyft”)

made the following communication to Shyft’s employees regarding Shyft’s proposed merger with Aebi Schmidt Holding AG (“Aebi

Schmidt”).

SHYFT AEBI SCHMIDT MERGER

LEADER TOOLKIT

Overview: As leaders at Shyft, you will play an important

role in communicating with your teams about our announcement that we plan to merge with Aebi Schmidt.

The following materials are designed to help assist you

in these conversations and to help answer questions you may receive:

| Press Release |

2 |

| Manager and Leader Talking Points |

9 |

| Employee Q&A |

11 |

| Customer Q&A |

13 |

We ask that you familiarize yourself

with these materials so you can be ready to discuss the announcement with employees and to help ensure everyone receives consistent information.

It is important that we speak with one voice.

Please keep in mind the following:

| • | Our top priority is assuring employees that this is an exciting announcement and represents the next

step in Shyft’s evolution. Please emphasize in communicating with your teams the benefits of this transaction for our stakeholders,

including our employees. |

| • | It is important that our employees know there will be no immediate changes and it is business as

usual. We want to ensure our employees understand that while this is exciting, it is just the first part of the process. |

| • | Your teams will look to you for guidance, and how you discuss this merger will affect how your team

members respond. We are counting on you to set the right tone, so I ask you to please stay confident, positive and focused on the

future. |

| • | Please be sensitive to employees’ needs and their concerns, but do not speculate about topics

beyond the messages we have provided. To the extent you receive questions that cannot be answered with the materials provided, it

is perfectly acceptable to say, “This was just announced. Let me look into those details and get back to you as soon as I can.” |

| • | Consistent with our company policy, only designated company spokespeople are authorized to speak

publicly about this announcement. Please remind your teams to send any inquiries from media or outside parties to Sydney Machesky

at Sydney.Machesky@theshyftgroup.com. |

CONFIDENTIAL: This toolkit is not for distribution inside or outside of the Company. It is intended to help guide your conversations with your teams regarding our announcement that we plan to merge with Aebi Schmidt.

Press Release

The Shyft Group to Merge with Aebi Schmidt Group

to Create

A Specialty Vehicles Leader

| · | Significant Scale in Attractive North American Market with Strong European

Presence |

| · | Highly

Complementary Portfolios Create Opportunities to Better Serve Customers and Drive Competitive

Growth |

| · | Expected

to Generate 2024E Pro Forma1 Revenue of ~$1.95 Billion2 and Adjusted

EBITDA3 of ~$200 Million+ Including Synergies |

| · | Drives

Significant Shareholder Value with $25 – $30 Million in Expected Synergies4

by Year 2, EPS Accretion in Year 1 and ROIC Greater than Cost of Capital in Year 3

Post Close |

| · | Barend

Fruithof, Current CEO of Aebi Schmidt, Named President and CEO Elect; James Sharman, Current

Chairman of Shyft Board, Named Chairman Elect |

| · | Combined

Company will Trade on NASDAQ |

NOVI, MI and FRAUENFELD (CH), December 16, 2024 /PRNewswire/ --

The Shyft Group (NASDAQ: SHYF) (“Shyft”), and Aebi Schmidt Group (“Aebi Schmidt”), today announced a

definitive agreement to combine in an all-stock merger to create a leading specialty vehicles company positioned for outsized

growth. Under the terms of the agreement, each outstanding share of Shyft common stock will be exchanged for 1.04 shares of the

combined company’s common stock. At closing, Shyft shareholders will own 48 percent of the combined company, with Aebi Schmidt

shareholders owning 52 percent. The transaction, which is structured to be tax-free to Shyft shareholders, has been unanimously

approved by the members of the Board of Directors present of each company.

The merger will combine Aebi Schmidt’s specialty vehicle products

and services, including commercial truck upfitting, snow and ice, street sweeping and pavement marking, airport snow and ice, and agricultural

solutions, with Shyft’s manufacturing, assembly, and upfit for the commercial, retail, and service specialty vehicle markets to

create a full-suite of offerings for both companies’ customers. The combined company will benefit from a scaled platform in the

attractive North American market, complemented by a strong European presence, and an enhanced financial profile to support profitable growth and deliver

additional value to shareholders.

“Combining with Aebi Schmidt is a powerful next step in Shyft’s

strategy as we leverage the strengths of both companies’ industry leading brands, innovative products, extensive customer relationships,

and manufacturing excellence,” said John Dunn, President and CEO of Shyft. “This transaction creates a more resilient company

with meaningful growth opportunities in the commercial truck space and

1 Aebi Schmidt financials presented on a Swiss GAAP FER

basis; Financials converted to USD using a EUR / USD exchange rate of 1.05 (as of 12/13/24)

2 Shyft 2024 figures based on management guidance as of

October 24, 2024 and pro forma revenue adjustment of $37M to show full year impact of ITU acquisition assuming the acquisition had closed

on January 1, 2024; Aebi Schmidt 2024 figures include pro forma adjustment to show full year impact of Ladog acquisition assuming the

acquisition had closed on January 1, 2024

3 Shyft Adjusted EBITDA excludes approximately $22.5M of

expense related to investment in Blue Arc and a pro forma adjustment of approximately $6.3M to include the full-year impact of the ITU

acquisition assuming the acquisition had closed on 1/1/24

4 Total synergies comprised of $20M to $25M cost synergies

and an additional $5M EBITDA opportunity from near-term revenue synergies

CONFIDENTIAL: This toolkit is not for distribution inside or outside of the Company. It is intended to help guide your conversations with your teams regarding our announcement that we plan to merge with Aebi Schmidt.

infrastructure related solutions. I am confident Shyft’s talented

team members will thrive within this newly combined platform and that this transaction is the best path forward to unlocking value for

our shareholders.”

Barend Fruithof, CEO of Aebi Schmidt said, “By bringing together

the capabilities and expertise of both companies, we are establishing a truly differentiated leader in the specialty vehicles industry

supported by our shared focus on customer-centric innovation and operational excellence. Aebi Schmidt has a proven track record of driving

strong financial performance and successfully executing M&A to deliver significant revenue and adjusted EBITDA growth. I firmly believe

this strategic combination offers a unique and highly compelling opportunity to create tremendous shareholder value.”

Merger Drives Long-Term Shareholder Value with Compelling Strategic

and Financial Benefits

| · | Scaled-Up Global Leader in North American and European Markets: The

transaction creates a leading specialty vehicle producer with a scaled platform in the attractive North American market, representing

approximately 75% of the combined company’s revenue, complemented by Aebi Schmidt’s European presence. The combined company

will be poised to capitalize on significant growth opportunities in attractive end-markets, including the high-margin commercial truck

market in North America. |

| · | Expanded Portfolio Better Positioned to Drive Customer Value and Outsized

Growth: The merger brings together two highly complementary product suites, providing customers with a diverse portfolio of leading

brands and premium products and services. The combination will enhance the ability to better serve customers and deliver increased value

through an expanded production footprint, sales distribution capabilities, innovative solutions, and in-house manufacturing of key vehicle

components. These combined capabilities will create a highly competitive company, better positioned to drive outsized growth. |

| · | Unlocks Achievable Synergies: Together, Shyft and Aebi Schmidt expect

to generate $20 to $25 million of annual run-rate cost synergies driven by cost optimization and operational efficiency gains across a

stronger distribution platform and approximately $5 million in additional adjusted EBITDA opportunity from near-term revenue synergies

from cross-selling and geographic expansion. These synergies are expected to be realized by the second year following the close of the

transaction, resulting in double-digit EBITDA margins of the combined organization. |

| · | Strengthens Financial Profile: The combined organization is expected

to generate long-term profitable growth, stronger margins, and enhanced free cash flow, supporting sustainable value creation and access

to lower cost capital. The combined company will have pro forma5 2024 estimated revenue of $1.95 billion6 and

adjusted EBITDA7 of $200 million+, including synergies. Pro forma net debt will be approximately $485 million as of September

30, 2024. |

5 Aebi Schmidt financials presented on a Swiss GAAP FER

basis; Financials converted to USD using a EUR / USD exchange rate of 1.05 (as of 12/13/24)

6 Shyft 2024 figures based on management guidance as of

October 24, 2024 and pro forma revenue adjustment of $37M to show full year impact of ITU acquisition assuming the acquisition had closed

on January 1, 2024; Aebi Schmidt 2024 figures include pro forma adjustment to show full year impact of Ladog acquisition assuming the

acquisition had closed on January 1, 2024

7 Shyft Adjusted EBITDA excludes approximately $22.5M of

expense related to investment in Blue Arc and a pro forma adjustment of approximately $6.3M to include the full-year impact of the ITU

acquisition assuming the acquisition had closed on 1/1/24

CONFIDENTIAL: This toolkit is not for distribution inside or outside of the Company. It is intended to help guide your conversations with your teams regarding our announcement that we plan to merge with Aebi Schmidt.

| · | Delivers Significant Value for Shareholders: The transaction is expected

to be accretive to EPS and generate Return on Invested Capital (ROIC) above Weighted Average Cost of Capital (WACC) by the first and third

years following the close of the transaction, respectively, creating a highly attractive opportunity for the shareholders of the combined

company. The combined company will be positioned to drive additional long-term upside through the acceleration of its growth strategy

focused on organic investments, portfolio opportunities, and future M&A opportunities. |

| · | Best-In-Class Management Team with Demonstrated Track-Record: Barend

Fruithof, CEO of Aebi Schmidt, will serve as CEO of the combined company and be based in the US. James Sharman, Chairman of Shyft, will

serve as the Chairman of the Board of Directors. John Dunn, Shyft CEO, will remain with the company following the close of the transaction

to support a seamless integration. Additional leadership will draw on the highly experienced teams of both companies. |

Governance Information

The Board of Directors will consist of 11 directors, with five directors

nominated by Shyft and six directors nominated by Aebi Schmidt. Seven of these directors will be independent.

Aebi Schmidt majority shareholder Peter Spuhler, an entrepreneurial

Swiss-based investor with a strong track record of successful investments in leading industrials companies, will own approximately 35%

of the combined company upon completion of the transaction.

Listing Information

Upon completion of the transaction, the combined company will trade

on NASDAQ. The company will be a Swiss-domiciled stock corporation, headquartered in Switzerland, with a strong presence and significant

footprint in the US.

Transaction Financing, Timing and Approvals

The transaction is expected to close by mid-2025, subject to the

satisfaction of customary closing conditions, including receipt of customary regulatory approvals and approval by Shyft

shareholders. Shyft and Aebi Schmidt have secured fully-committed financing of the combined company at closing.

Investor Call

Shyft and Aebi Schmidt will hold an investor call at 8:30am ET / 2:30pm

CET today to discuss the details of the transaction. Presentation materials will be available online in advance of the call on Shyft’s

website at: theshyftgroup.com/investor-relations.

The conference call and webcast will be available via:

Webcast: https://theshyftgroup.com/investor-relations/webcasts/

Conference Call: 1-844-868-8845 (domestic) or 1-412-317-6591 (international)

A replay of the webcast will be made available on the Investor Relations

page of Shyft’s website after the conclusion of the call. A replay of the conference call will be available for the next week at

1-877-344-7529 (domestic) or 1-412-317-0088 (international) using the replay access code 9591257.

Advisors

CONFIDENTIAL: This toolkit is not for distribution inside or outside of the Company. It is intended to help guide your conversations with your teams regarding our announcement that we plan to merge with Aebi Schmidt.

Deutsche Bank is serving as exclusive financial advisor to Shyft and

provided a fairness opinion to the Board of Directors of Shyft. Davis Polk & Wardwell LLP is acting as legal advisor, with Lenz &

Staehelin acting as local Swiss counsel. Alantra is serving as exclusive financial advisor to Aebi Schmidt and Wuersch & Gering and

Baer & Karrer are acting as legal advisors. UBS and Zürcher Kantonalbank are providing committed debt financing for the transaction.

About The Shyft Group

The Shyft Group is a North American leader in specialty vehicle manufacturing,

assembly, and upfit for the commercial, retail, and service specialty vehicle markets. The company brings a 50-year legacy serving its

customers, which include first-to-last mile delivery companies across vocations, federal, state, and local government entities; the trades;

and utility and infrastructure segments. The Shyft Group is organized into two core business units: Shyft Fleet Vehicles and Services™

and Shyft Specialty Vehicles™. Today, its family of brands include Utilimaster®, Blue Arc™ EV Solutions, Royal®

Truck Body, DuraMag® and Magnum®, Strobes-R-Us, Spartan® RV Chassis, Red Diamond™ Aftermarket

Solutions, Builtmore Contract Manufacturing™, and Independent Truck Upfitters. The Shyft Group and its go-to-market brands are well

known in their respective industries for quality, durability, and first-to-market innovation. The Company employs approximately 3,000

employees and contractors across 19 locations, and operates facilities in Arizona, California, Florida, Indiana, Iowa, Maine, Michigan,

Missouri, Pennsylvania, Tennessee, Texas, and Saltillo, Mexico. The Company reported sales of $872 million in 2023. Learn more at TheShyftGroup.com.

About the Aebi Schmidt Group

The Aebi Schmidt Group is a world leading provider of smart

solutions for clean and safe transportation surfaces and the management of challenging terrain. The group’s unique range of

products includes its own vehicles and innovative attachments for custom vehicle equipment. The products, combined with

customer-tailored support and service, offer the perfect solution for nearly any challenge. The globally active group is

headquartered in Switzerland and achieved net revenue of EUR 935 million in 2023. It employs around 3,000 people in 16 sales

organizations and more than a dozen production sites worldwide. Through established partnerships with dealers, the company is

represented in 90 additional countries. Its portfolio consists of the product brands Aebi, Schmidt, Nido, Arctic, Monroe, Towmaster,

Swenson, Meyer, MB, and ELP – all well-established brands in their respective markets, some for more than 100 years. Learn

more at www.aebi-schmidt.com.

Forward-Looking Statements

Certain statements in this press release are forward-looking statements.

In some cases, Shyft has identified forward-looking statements by such words or phrases as "will likely result," "is confident

that," "expect," "expects," "should," "could," "may," "will continue to,"

"believe," "believes," "anticipates," "predicts," "forecasts," "estimates,"

"projects," "potential," "intends" or similar expressions identifying "forward-looking statements",

including the negative of those words and phrases. Such forward-looking statements are based on management’s current views and assumptions

regarding future events, future business conditions and the outlook for Shyft based on currently available information. These forward-looking

statements may include projections of Shyft’s future financial performance, Shyft’s anticipated growth strategies and anticipated

trends in Shyft’s business. These statements are only predictions based on management’s current expectations and projections

about future events. These statements involve known and unknown risks, uncertainties and other factors that may cause actual results to

be materially different from any results, levels of activity, performance or achievements expressed or

CONFIDENTIAL: This toolkit is not for distribution inside or outside of the Company. It is intended to help guide your conversations with your teams regarding our announcement that we plan to merge with Aebi Schmidt.

implied by any forward-looking statement and may include statements

regarding the expected timing and structure of the proposed transaction; the ability of the parties to complete the proposed transaction

considering the various closing conditions; the expected benefits of the proposed transaction, such as improved operations, enhanced

revenues and cash flow, synergies, growth potential, market profile, business plans, expanded portfolio and financial strength; the competitive

ability and position of the combined company following completion of the proposed transaction; and anticipated growth strategies and

anticipated trends in Shyft’s, Aebi Schmidt’s and, following the completion of the proposed transaction, the combined company’s

business.

Additional factors that could cause actual results, level of

activity, performance or achievements to differ materially from the results, level of activity, performance or achievements

expressed or implied by the forward-looking statements include, among others, the non-satisfaction or non-waiver, on a timely basis

or otherwise, of one or more closing conditions to the proposed transaction; the prohibition or delay of the consummation of the

proposed transaction by a governmental entity; the risk that the proposed transaction may not be completed in the expected time

frame; unexpected costs, charges or expenses resulting from the proposed transaction; uncertainty of the expected financial

performance of the combined company following completion of the proposed transaction; failure to realize the anticipated benefits of

the proposed transaction, including as a result of delay in completing the proposed transaction or integration; the ability of the

combined company to implement its business strategy; difficulties and delays in achieving revenue and cost synergies of the combined

company; inability to retain and hire key personnel; negative changes in the relationships with major customers and suppliers that

adversely affect revenues and profits; disruptions to existing business operations; the occurrence of any event that could give rise

to termination of the proposed transaction; potential litigation in connection with the proposed transaction or other settlements or

investigations that may affect the timing or occurrence of the contemplated transaction or result in significant costs of defense,

indemnification and liability; risks related to ownership of Aebi Schmidt common stock; uncertainty as to the long-term value of the

combined company’s common stock; and the diversion of Shyft’s and Aebi Schmidt’s management’s time on

transaction-related matters. These risks, as well as other risks associated with the businesses of Shyft and Aebi Schmidt, will be

more fully discussed in the combined proxy statement/prospectus. Although management believes the expectations reflected in the

forward-looking statements are reasonable, Shyft cannot guarantee future results, level of activity, performance or achievements.

Moreover, neither management, Shyft nor any other person assumes responsibility for the accuracy and completeness of any of these

forward-looking statements. Shyft wishes to caution readers not to place undue reliance on any such forward-looking statements,

which speak only as of the date made. Shyft is under no duty to and specifically declines to undertake any obligation to publicly

revise or update any of these forward-looking statements after the date of this press release to conform its prior statements to

actual results, revised expectations or to reflect the occurrence of anticipated or unanticipated events.

Additional information concerning these and other factors that may impact

Shyft’s and Aebi Schmidt’s expectations and projections can be found in Shyft’s periodic filings with the SEC, including

Shyft’s Annual Report on Form 10-K for the fiscal year ended December 31, 2023, and any subsequent Quarterly Reports on Form 10-Q

and Current Reports on Form 8-K. Shyft’s SEC filings are available publicly on the SEC’s website at www.sec.gov.

No offer or solicitation

CONFIDENTIAL: This toolkit is not for distribution inside or outside of the Company. It is intended to help guide your conversations with your teams regarding our announcement that we plan to merge with Aebi Schmidt.

This communication is for informational purposes only and is not intended

to and shall not constitute an offer to buy or sell, or the solicitation of an offer to buy or sell, any securities, or a solicitation

of any vote or approval, nor shall there be any offer, solicitation or sale of securities in any jurisdiction in which such offer, solicitation

or sale would be unlawful prior to registration or qualification under the securities laws of any such jurisdiction. No offer of securities

shall be made in the United States absent registration under the U.S. Securities Act of 1933, as amended (“Securities Act”),

or pursuant to an exemption from, or in a transaction not subject to, such registration requirements.

Participants in the Solicitation

Shyft, Aebi Schmidt and certain of their respective directors and

executive officers and other members of their respective management and employees may be deemed to be participants in the

solicitation of proxies in connection with the proposed transaction. Information regarding the persons who may, under the rules of

the Securities and Exchange Commission (“SEC”), be deemed participants in the solicitation of proxies in connection with

the proposed transaction, including a description of their direct or indirect interests in the transaction, by security holdings or

otherwise, will be set forth in the combined proxy statement/prospectus and other relevant materials when it is filed with the SEC.

Information regarding the directors and executive officers of Shyft is contained in the sections entitled “Election of

Directors” and “Ownership of Securities” included in Shyft’s proxy statement for the 2024 annual

meeting of stockholders, which was filed with the SEC on April 3, 2024 (and which is available at https://www.sec.gov/ix?doc=/Archives/edgar/data/743238/000114036124017592/ny20010675x1_def14a.htm)

and in the section entitled “Directors, Executive Officers and Corporate Governance” included in Shyft’s

Annual Report on Form 10-K for the year ended December 31, 2023, which was filed with the SEC on February 22, 2024 (and which is

available at https://www.sec.gov/ix?doc=/Archives/edgar/data/743238/000143774924005136/shyf20231231c_10k.htm), and certain of

its Current Reports filed on Form 8-K. These documents can be obtained free of charge from the sources indicated below.

Additional information and where to find it

Aebi Schmidt will file a registration statement on Form S-4 with the

SEC in connection with the proposed transaction. The Form S-4 will contain a combined proxy statement/prospectus of Shyft and Aebi Schmidt.

Aebi Schmidt and Shyft will prepare and file the combined proxy statement/prospectus with the SEC and Shyft will mail the combined proxy

statement/prospectus to its stockholders and file other documents regarding the proposed transaction with the SEC. This communication

is not a substitute for any registration statement, proxy statement/prospectus or other documents that may be filed with the SEC in connection

with the proposed transaction. INVESTORS SHOULD READ THE COMBINED PROXY STATEMENT/PROSPECTUS WHEN AVAILABLE AND SUCH OTHER DOCUMENTS FILED

OR TO BE FILED WITH THE SEC CAREFULLY AND IN THEIR ENTIRETY, AS WELL AS ANY AMENDMENTS OR SUPPLEMENTS TO THE COMBINED PROXY STATEMENT/PROSPECTUS

AND SUCH DOCUMENTS, BEFORE THEY MAKE ANY DECISION WITH RESPECT TO THE PROPOSED TRANSACTION, BECAUSE THEY CONTAIN IMPORTANT INFORMATION.

The Form S-4, the combined proxy statement/prospectus and all other documents filed with the SEC in connection with the transaction will

be available when filed free of charge on the SEC’s web site at www.sec.gov. Copies of documents filed with the SEC by Shyft will

be made

CONFIDENTIAL: This toolkit is not for distribution inside or outside of the Company. It is intended to help guide your conversations with your teams regarding our announcement that we plan to merge with Aebi Schmidt.

available free of charge on Shyft’s investor relations website

at https://theshyftgroup.com/investor-relations/.

Contacts

Shyft

Media

Sydney Machesky Director, Corporate Communications

The Shyft Group

Sydney.Machesky@theshyftgroup.com

586.413.4112

FGS Global

Jim Barron/Warren Rizzi

shyft@fgsglobal.com

Investors

Randy Wilson Vice President, Investor Relations and Treasury

The Shyft Group

Randy.Wilson@theshyftgroup.com

248.727.3755

Aebi Schmidt

Media

Thomas Schenkirsch

Head Group Strategic Development

Thomas.Schenkirsch@aebi-schmidt.com

Direct Phone: +41 44 308 58 55

CONFIDENTIAL: This toolkit is not for distribution inside or outside of the Company. It is intended to help guide your conversations with your teams regarding our announcement that we plan to merge with Aebi Schmidt.

Manager and Leader Talking Points

KEY MESSAGES & TALKING POINTS

To ensure our team is aligned, it’s important that our

leaders clearly communicate this announcement using approved messaging. Please rely on the talking points and FAQs provided below when

speaking to your teams.

| o | We announced a very exciting milestone for our company and our employees. |

| o | Shyft and Aebi Schmidt reached an agreement to combine in a merger to create a leading specialty vehicles

company positioned for outsized growth. |

| o | As you know, we’ve been working as One Shyft by investing in our people and enhancing the quality

of our products, operational efficiency and customer focus. |

| § | Merging with Aebi Schmidt will accelerate our strategy as we leverage the strengths

of our industry leading brands, extensive customer and channel knowledge, and manufacturing excellence. |

| o | Based out of Switzerland, Aebi Schmidt is a global leader in the specialty vehicles

industry with a proven history of growth and market leadership. |

| § | Like us, their company is a values-driven organization that prioritizes operational

excellence and, customer focus, and innovation. |

| o | This merger is about growing and strengthening our company for long-term success.

It unlocks a number of strategic benefits that will position us sustainable growth and also opportunities for our employees. |

| o | Our employees will be part of a larger, more competitive company and we will have the ability to deliver

even more market leading expertise to enhance both our customer service capabilities. |

| o | Shyft is always assessing opportunities to advance our strategy, provide better service to customers

and deliver value to shareholders. |

| o | This transaction has the potential to do all three and I’m confident that Aebi Schmidt is the

perfect partner for Shyft as we enter our next phase of growth. |

| § | For example, the combined company will have a scaled platform in North America, which as we know is

a highly attractive market. We will have a strong and significant footprint in the US and leverage Aebi Schmidt’s established presence

in Europe. |

| § | We will also combine Aebi Schmidt’s trusted portfolio of commercial vehicle upfitting, municipal,

infrastructure, and agricultural solutions with Shyft’s manufacturing, assembly, and upfit for the commercial, retail, and service

specialty vehicle markets to create a full suite of offerings for both customers of both Shyft and Aebi Schmidt. |

| o | This merger creates a more resilient company with meaningful growth opportunities in the commercial truck

space and infrastructure related solutions. |

CONFIDENTIAL: This toolkit is not for distribution inside or outside of the Company. It is intended to help guide your conversations with your teams regarding our announcement that we plan to merge with Aebi Schmidt.

| o | Barend Fruithof, CEO of Aebi Schmidt, will serve as CEO of the combined company and be based in the US.

James Sharman, Chairman of Shyft, will serve as the Chairman of the Board of Directors. |

| o | John Dunn will remain with the company following the close of the transaction to support a seamless integration. |

| · | What This Means for You: |

| o | We are confident that this merger creates significant opportunities for our team. |

| o | Employees will be able to grow professionally and personally as part of a larger, more competitive

company. |

| o | The announcement is just the first step in bringing our companies together. We expect the merger to

close by mid-2025. |

| o | So right now, the best thing we can do is remain focused on executing our strategic priorities, advancing

our product roadmaps and delivering for our customers. |

| o | We will work to keep you updated as we bring our companies together. |

| o | If you have additional questions, please reach out. |

| o | Thank you for your continued hard work and dedication. |

CONFIDENTIAL: This toolkit is not for distribution inside or outside of the Company. It is intended to help guide your conversations with your teams regarding our announcement that we plan to merge with Aebi Schmidt.

Employee Q&A

| 1. | Why are we doing this transaction? |

| · | Together with Aebi Schmidt we are creating a leading specialty vehicles producer.

|

| · | As you know, we’ve been working as One Shyft by investing in our people

and enhancing the quality of our products, operational efficiency and customer focus. |

| · | These efforts have strengthened Shyft’s leadership position and merging

with Aebi Schmidt will accelerate our strategy as we leverage the strengths of our industry leading brands, extensive customer and channel

knowledge, and manufacturing excellence. |

| · | We are confident that our talented team members will thrive within a larger,

more competitive platform and deliver value for customers and shareholders. |

| 2. | How does this announcement impact me? |

| · | We are confident that this merger creates significant opportunities for our

team as employees will be able to grow professionally and personally as part of a larger, more competitive company. |

| · | This is an exciting milestone in our history but today is just the first step

in bringing our companies together. |

| · | Until the transaction closes, it’s business as usual and Shyft and Aebi

Schmidt will operate as separate companies. |

| · | We will keep you updated with relevant developments, as appropriate. |

| 3. | Will there be any changes to my role or the structure of my team as a result of this merger? |

| · | Until the transaction closes, it’s business as usual. |

| · | We do not anticipate any material changes in day-to-day business operations

in the interim, including changes to individual role responsibilities and team structures. |

| · | We should all remain focused and ensuring we continue to meet the needs of

our customers. |

| 4. | Will there be layoffs associated with this announcement? |

| · | This merger is focused on growth, opportunity, and securing a stronger

future for Shyft. An important part of our continued success as a combined company is the strength and talent of our two

teams. |

| · | We are bringing together market leading expertise of both organizations, and believe that employees will be able to grow as part of a larger, more competitive company. |

| · | We expect the US operations to remain headquartered in Michigan and do not expect significant changes to our workforce or operations as

a result of this transaction. |

| · | Until the transaction closes, it’s business as usual and Shyft and Aebi

Schmidt will operate as separate companies. |

| 5. | Will there be facility closures or consolidations? |

| · | This merger is focused on growth, opportunity, and securing a stronger future

for Shyft, including having a larger platform in North America while expanding our reach into Europe. |

CONFIDENTIAL: This toolkit is not for distribution inside or outside of the Company. It is intended to help guide your conversations with your teams regarding our announcement that we plan to merge with Aebi Schmidt.

| · | As you know, the service and product portfolios of Shyft and Aebi Schmidt

are complementary in nature. |

| · | We expect the US operations to remain headquartered in Michigan and do not expect significant changes to our workforce or operations as

a result of this transaction. |

| · | Until the transaction closes, it’s business as usual and Shyft and Aebi

Schmidt will operate as separate companies. |

| 6. | What is the plan for integrating the two companies? How long do you think it will take? |

| · | We will form an integration team and select leaders from both companies to

serve on the senior leadership team. |

| · | We will be working closely with Aebi Schmidt to develop a smooth and seamless

integration plan. |

| · | We are committed to keeping our employees updated and to running a transparent

integration process. |

| · | Both Shyft and Aebi Schmidt have a strong track record of swift integration

following M&A transactions. |

| 7. | If Barend is going to be the new CEO, what happens to John Dunn? |

| · | John will continue to serve as CEO of Shyft until the transaction closes.and will play a critical integration role. |

| · | John has been instrumental in our growth and success and we look forward to

continuing to benefit from his leadership in his role once the merger closes. |

| · | Additional details on the combined company structure will

be announced in due time. |

| 8. | Will Barend be based in Novi or elsewhere? |

| · | Barend plans to spend significant time in the US, including

possibly relocating, as we bring the Shyft and Aebi Schmidt business cultures together. |

| · | The combined company will have a significant presence in

the U.S. as we are scaling our platform in the North American market, which represents ~75% of the combined company’s 2024E pro

forma revenue. |

| 9. | Will some employees have to relocate? |

| · | Until the transaction closes, it’s business as usual and Shyft and Aebi

Schmidt will operate as separate companies. |

| · | Employees will be an important part of a larger, more competitive company

with expanded reach in key markets around the world. We are confident that our team will have opportunities to grow and thrive. |

| · | We do not anticipate any material changes in day-to-day business operations

in the interim, including employee relocations. |

| · | Any potential employee relocations will be communicated well in advance. |

| 10. | Will my benefits or pay be impacted by this merger? |

| · | We do not anticipate any material changes in day-to-day business operations

in the interim, including benefits or pay. |

| · | Any future changes to your benefits or pay will be communicated well in advance. |

| 11. | When will we know more? And who can I contact if I have questions? |

| · | We will keep you updated with relevant developments, as appropriate. |

| · | If you have any questions, please do not hesitate to contact your manager. |

CONFIDENTIAL: This toolkit is not for distribution inside or outside of the Company. It is intended to help guide your conversations with your teams regarding our announcement that we plan to merge with Aebi Schmidt.

Customer Q&A

| 12. | Why is this good for customers? |

| · | The merger brings together two highly complementary product suites, and the

combined company will offer customers a diverse portfolio of leading brands and premium products and services. |

| · | The combination will create opportunities to deliver customer value through

an expanded production footprint, sales distribution capabilities, innovative solutions, and in-house manufacturing of key vehicle components. |

| 13. | Will there be any changes to customers’ existing contracts? |

| · | Until the transaction closes – which we expect to occur by mid-2025

– it’s business as usual and Shyft and Aebi Schmidt will operate as separate companies. |

| · | Your contract will remain the same. |

| 14. | Will you be serving new locations? |

| · | As a combined company, we will have an even stronger portfolio of leading

brands and premium products, more commercial capabilities, and a larger platform in North America while expanding our reach into Europe. |

| 15. | Will you be offering any new products? |

| · | The merger brings together two highly complementary product suites, and the

combined company will offer customers a diverse portfolio of leading brands and premium products and services. |

| · | The combination will create opportunities to deliver customer value through

an expanded production footprint, sales distribution capabilities, innovative solutions, and in-house manufacturing of key vehicle components. |

| 16. | Will you be increasing prices? |

| · | Until the transaction closes, it’s business as usual and we don’t

anticipate any changes. |

| · | Post-closing, our transaction does not depend on price increases to achieve

synergies and we have not built in changes to our pricing structures. |

| · | We look forward to strengthening our partnership with you and remain focused

on providing Shyft’s leading products and services to our valued customers like you. |

| 17. | What are the next steps in the process? |

| · | For now, nothing changes for you. |

| · | Until the transaction closes, it’s business as usual and Shyft and Aebi

Schmidt will operate as separate companies. |

| · | We expect the merger to close by mid-2025 and will keep you updated with relevant

developments, as appropriate. |

| 18. | Will our point of contact change? Who can I contact with additional questions? |

| · | All points of contact will remain the same through the closing of the transaction. |

| · | Afterwards, if there are any changes, we will inform you well in advance. |

| · | We look forward to strengthening our partnership with you as a result of this

merger. |

CONFIDENTIAL: This toolkit is not for distribution inside or outside of the Company. It is intended to help guide your conversations with your teams regarding our announcement that we plan to merge with Aebi Schmidt.

No offer or solicitation

This communication is for informational purposes only and is not intended

to and shall not constitute an offer to buy or sell, or the solicitation of an offer to buy or sell, any securities, or a solicitation

of any vote or approval, nor shall there be any offer, solicitation or sale of securities in any jurisdiction in which such offer, solicitation

or sale would be unlawful prior to registration or qualification under the securities laws of any such jurisdiction. No offer of securities

shall be made in the United States absent registration under the U.S. Securities Act of 1933, as amended (“Securities Act”),

or pursuant to an exemption from, or in a transaction not subject to, such registration requirements.

Participants in the Solicitation

Shyft, Aebi Schmidt and certain of their respective directors and executive

officers and other members of their respective management and employees may be deemed to be participants in the solicitation of proxies

in connection with the proposed transaction. Information regarding the persons who may, under the rules of the Securities and Exchange

Commission (“SEC”), be deemed participants in the solicitation of proxies in connection with the proposed transaction,

including a description of their direct or indirect interests in the transaction, by security holdings or otherwise, will be set forth

in the combined proxy statement/prospectus and other relevant materials when it is filed with the SEC. Information regarding the directors

and executive officers of Shyft is contained in the sections entitled “Election of Directors” and “Ownership

of Securities” included in Shyft’s proxy statement for the 2024 annual meeting of stockholders, which was filed with the

SEC on April 3, 2024 (and which is available at https://www.sec.gov/ix?doc=/Archives/edgar/data/743238/000114036124017592/ny20010675x1_def14a.htm)

and in the section entitled “Directors, Executive Officers and Corporate Governance” included in Shyft’s Annual

Report on Form 10-K for the year ended December 31, 2023, which was filed with the SEC on February 22, 2024 (and which is available at

https://www.sec.gov/ix?doc=/Archives/edgar/data/743238/000143774924005136/shyf20231231c_10k.htm), and certain of its Current Reports

filed on Form 8-K. These documents can be obtained free of charge from the sources indicated below.

Additional information and where to find it

Aebi Schmidt will file a registration statement on Form S-4 with the

SEC in connection with the proposed transaction. The Form S-4 will contain a combined proxy statement/prospectus of

Shyft and Aebi Schmidt. Aebi Schmidt and Shyft will prepare and file

the combined proxy statement/prospectus with the SEC and Shyft will mail the combined proxy statement/prospectus to its stockholders and

file other documents regarding the proposed transaction with the SEC. This communication is not a substitute for any registration statement,

proxy statement/prospectus or other documents that may be filed with the SEC in connection with the proposed transaction. INVESTORS SHOULD

READ THE COMBINED PROXY STATEMENT/PROSPECTUS WHEN AVAILABLE AND SUCH OTHER DOCUMENTS FILED OR TO BE FILED WITH THE SEC CAREFULLY AND IN

THEIR ENTIRETY, AS WELL AS ANY AMENDMENTS OR SUPPLEMENTS TO THE COMBINED PROXY STATEMENT/PROSPECTUS AND SUCH DOCUMENTS, BEFORE THEY MAKE

ANY DECISION WITH RESPECT TO THE PROPOSED TRANSACTION, BECAUSE THEY CONTAIN IMPORTANT INFORMATION. The Form S-4, the combined proxy statement/prospectus

and all other documents filed with the SEC in connection with the transaction will be available when filed free of charge on the SEC’s

web site at www.sec.gov. Copies of documents filed with the SEC by Shyft will be made available free of charge on Shyft’s investor

relations website at https://theshyftgroup.com/investor-relations/.

Forward-Looking Statements

Certain statements in this communication are forward-looking

statements. In some cases, Shyft has identified forward-looking statements by such words or phrases as “will likely result,”

“is confident that,” “expect,” “expects,” “should,” “could,” “may,”

“will continue to,” “believe,” “believes,” “anticipates,” “predicts,” “forecasts,”

“estimates,” “projects,” “potential,” “intends” or similar expressions identifying “forward-looking

statements”, including the negative of those words and phrases. Such forward-looking statements are based on management’s

current views and assumptions regarding future events, future business conditions and the outlook for Shyft based on currently available

information. These forward-looking statements may include projections of Shyft’s future financial performance, Shyft’s anticipated

growth strategies and anticipated trends in Shyft’s business. These statements are only predictions based on management’s

current expectations and projections about future events. These statements involve known and unknown risks, uncertainties and other factors

that may cause actual results to be materially different from any results, levels of activity, performance or achievements expressed or

implied by any forward-looking statement and may include statements regarding the expected timing and structure of the proposed transaction;

the ability of the parties to complete the proposed transaction considering the various closing conditions; the expected benefits of the

proposed transaction, such as improved operations, enhanced revenues and cash flow, synergies, growth potential, market profile, business

plans, expanded portfolio and financial strength; the competitive ability and position of the combined company following completion of

the proposed transaction; and anticipated growth strategies and anticipated trends in Shyft’s, Aebi Schmidt’s and, following

the completion of the proposed transaction, the combined company’s business.

Additional factors that could cause actual results, level of activity,

performance or achievements to differ materially from the results, level of activity, performance or achievements expressed or implied

by the forward-looking statements include, among others, the non-satisfaction or non-waiver, on a timely basis or otherwise, of one or

more closing conditions to the proposed transaction; the prohibition or delay of the consummation of the proposed transaction by a governmental

entity; the risk that the proposed transaction may not be completed in the expected time frame; unexpected costs, charges or expenses

resulting from the proposed transaction; uncertainty of the expected financial performance of the combined company following completion

of the proposed transaction; failure to realize the anticipated benefits of the

proposed transaction, including as a result of delay in completing the

proposed transaction or integration; the ability of the combined company to implement its business strategy; difficulties and delays in

achieving revenue and cost synergies of the combined company; inability to retain and hire key personnel; negative changes in the relationships

with major customers and suppliers that adversely affect revenues and profits; disruptions to existing business operations; the occurrence

of any event that could give rise to termination of the proposed transaction; potential litigation in connection with the proposed transaction

or other settlements or investigations that may affect the timing or occurrence of the contemplated transaction or result in significant

costs of defense, indemnification and liability; risks related to ownership of Aebi Schmidt common stock; uncertainty as to the long-term

value of the combined company’s common stock; and the diversion of Shyft’s and Aebi Schmidt’s management’s time

on transaction-related matters. These risks, as well as other risks associated with the businesses of Shyft and Aebi Schmidt, will be

more fully discussed in the combined proxy statement/prospectus. Although management believes the expectations reflected in the forward-looking

statements are reasonable, Shyft cannot guarantee future results, level of activity, performance or achievements. Moreover, neither management,

Shyft nor any other person assumes responsibility for the accuracy and completeness of any of these forward-looking statements. Shyft

wishes to caution readers not to place undue reliance on any such forward-looking statements, which speak only as of the date made. Shyft

is under no duty to and specifically declines to undertake any obligation to publicly revise or update any of these forward-looking statements

after the date of this communication to conform its prior statements to actual results, revised expectations or to reflect the occurrence

of anticipated or unanticipated events.

Additional information concerning these and other factors that may impact

Shyft’s and Aebi Schmidt’s expectations and projections can be found in Shyft’s periodic filings with the SEC, including

Shyft’s Annual Report on Form 10-K for the fiscal year ended December 31, 2023, and any subsequent Quarterly Reports on Form 10-Q

and Current Reports on Form 8-K. Shyft’s SEC filings are available publicly on the SEC’s website at www.sec.gov.

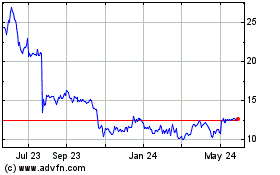

Shyft (NASDAQ:SHYF)

Historical Stock Chart

From Nov 2024 to Dec 2024

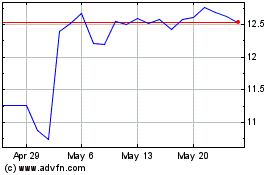

Shyft (NASDAQ:SHYF)

Historical Stock Chart

From Dec 2023 to Dec 2024