SIGA Technologies, Inc. (SIGA) (NASDAQ: SIGA), a commercial-stage

pharmaceutical company, today reported financial results for the

three and nine months ended September 30, 2024.

“Building on strong momentum, SIGA received $122

million in orders during the third quarter, including a significant

$112.5 million order for oral TPOXX under the 19C BARDA contract

and a $9 million order for oral TPOXX from the U.S. Department of

Defense,” said Diem Nguyen, Chief Executive Officer. “As of

September 30, 2024, the Company had approximately $146 million of

outstanding procurement orders, positioning the Company for

substantial revenue in the fourth quarter and 2025.

Deliveries related to the $112.5 million order began in late

September and continued into October. We remain committed to

diversifying and expanding our revenue base, enhancing shareholder

value, advancing our development programs, and continuing our

public health mission, while preparing to negotiate the next

contract with the U.S. Government.”Summary Financial

Results

|

($ in millions, exceptper share amounts) |

Three MonthsEnded September

30 |

|

Nine MonthsEnded September

30 |

|

|

|

2024 |

|

|

2023 |

|

|

|

2024 |

|

|

2023 |

|

|

Product sales(1) |

$8.9 |

|

$8.0 |

|

|

$53.5 |

|

$14.9 |

|

|

Total revenues |

$10.0 |

|

$9.2 |

|

|

$57.3 |

|

$23.4 |

|

|

Operating income (loss)(2) |

$0.5 |

|

($1.3 |

) |

|

$12.9 |

|

($8.1 |

) |

|

Income (loss) before income taxes(2) |

$1.9 |

|

($0.4 |

) |

|

$17.5 |

|

($5.1 |

) |

|

Net income (loss) |

$1.3 |

|

($0.4 |

) |

|

$13.5 |

|

($4.2 |

) |

|

Diluted income (loss) per share |

$0.02 |

|

($0.01 |

) |

|

$0.19 |

|

($0.06 |

) |

(1) Includes supportive services

related to product sales.

(2) Operating income (loss)

excludes, and income (loss) before income taxes includes other

income. Both line items exclude the impact of income taxes.

Recent Developments:

- In October 2024,

the Company announced that it obtained an exclusive license to a

portfolio of preclinical fully human monoclonal antibodies (mAbs)

from Vanderbilt University that have the potential to treatment a

broad range of orthopoxviruses, including smallpox and mpox. Under

the agreement, SIGA has exclusive rights to develop, manufacture,

and commercialize these mAbs globally. The U.S. Department of

Defense is currently funding the development of these mAbs as

potential orthopoxvirus treatments through Phase 1 clinical trials

under a contract awarded to a contract manufacturing organization

with proven biologics development and manufacturing expertise.

- In October 2024,

the Company announced its first sale of TPOXX (tecovirimat) in

Africa, made in response to a request from the Ministry of Health

in Morocco. This milestone sale occurred during the third

quarter.

- In August 2024,

the Company received a procurement contract and related order from

the U.S. Department of Defense for approximately $9 million of oral

TPOXX, as well as a small amount of IV TPOXX.

- In August 2024,

the Company reported that the National Institutes of Health’s (NIH)

National Institute of Allergy and Infectious Diseases (NIAID)

announced topline results from a preliminary analysis of the PALM

007 (Tecovirimat for Treatment of Monkeypox Virus) clinical trial

(NCT05559099). NIAID reported that the study did not meet its

primary endpoint of a statistically significant improvement in time

to lesion resolution within 28 days post-randomization for patients

in the Democratic Republic of the Congo with mpox who were

administered tecovirimat versus placebo. Improvement was observed,

however, in patients receiving tecovirimat whose symptoms began

seven days or fewer before randomization and in those with severe

or grave disease, defined by the World Health Organization as

having 100 or more skin lesions. The Company believes these data

are consistent to tecovirimat’s mechanism of action and support

further trials to assess its potential benefit in post exposure

prophylactic settings, or in patients who present for medical care

soon after symptoms, and in those with the most severe

disease.

- In July 2024, the Company received a

procurement order for $112.5 million of oral TPOXX from the U.S.

Government under the 19C BARDA contract, for delivery to the U.S.

Strategic National Stockpile (SNS).

Capital Management

Activity:

On April 11, 2024, a special cash dividend of $0.60

per share was paid, an increase of $0.15 per share from last year’s

special cash dividend. This dividend was declared on

March 12, 2024.

Conference Call and Webcast

SIGA will host a conference call and webcast to

provide a business update today, Thursday, November 7, 2024, at

4:30 P.M. ET.

Participants may access the call by dialing

1-800-717-1738 for domestic callers or 1-646-307-1865 for

international callers. A live webcast of the call will also be

available on the Company's website at www.siga.com in the

Investor Relations section of the website, or by clicking here.

Please log in approximately 5-10 minutes prior to the scheduled

start time.

A replay of the call will be available for two

weeks by dialing 1-844-512-2921 for domestic callers or

1-412-317-6671 for international callers and using Conference ID:

1146096. The archived webcast will be available in the Investor

Relations section of the Company's website.ABOUT

SIGA

SIGA is a commercial-stage pharmaceutical company

and leader in global health focused on the development of

innovative medicines to treat and prevent infectious diseases. With

a primary focus on orthopoxviruses, we are dedicated to protecting

humanity against the world’s most severe infectious diseases,

including those that occur naturally, accidentally, or

intentionally. Through partnerships with governments and public

health agencies, we work to build a healthier and safer world by

providing essential countermeasures against these global health

threats. Our flagship product, TPOXX® (tecovirimat), is an

antiviral medicine approved in

the U.S. and Canada for the treatment of

smallpox and authorized in Europe and

the UK for the treatment of smallpox, mpox (monkeypox),

cowpox, and vaccinia complications. For more information about

SIGA, visit www.siga.com.

FORWARD-LOOKING STATEMENTS

This press release contains “forward-looking

statements” within the meaning of the Private Securities Litigation

Reform Act of 1995, as amended, including statements relating to

SIGA’s future business development and plans including with respect

to securing new contracts and the timing of delivery of ordered

oral TPOXX courses. Forward-looking statements include statements

regarding our future financial position, business strategy,

budgets, projected costs, plans and objectives of management for

future operations. The words “may,” “continue,” “estimate,”

“intend,” “plan,” “will,” “believe,” “project,” “expect,” “seek,”

“anticipate,” “could,” “should,” “target,” “goal,” “potential” and

similar expressions may identify forward-looking statements, but

the absence of these words does not necessarily mean that a

statement is not forward-looking. Such forward-looking statements

are subject to various known and unknown risks and uncertainties,

and SIGA cautions you that any forward-looking information provided

by or on behalf of SIGA is not a guarantee of future

performance. SIGA’s actual results could differ materially from

those anticipated by such forward-looking statements due to a

number of factors, some of which are beyond SIGA’s control,

including, but not limited to, (i) the risk that BARDA elects, in

its sole discretion as permitted under the 75A50118C00019 BARDA

Contract (the “BARDA Contract”), not to exercise the remaining

unexercised option under the BARDA Contract, (ii) the risk that

SIGA may not complete performance under the BARDA Contract on

schedule or in accordance with contractual terms, (iii) the risk

that the BARDA Contract or U.S. Department of

Defense contracts are modified or canceled at the request or

requirement of, or SIGA is not able to enter into new contracts to

supply TPOXX to, the U.S. Government, (iv) the risk that the

nascent international biodefense market does not develop to a

degree that allows SIGA to continue to successfully market TPOXX

internationally, (v) the risk that potential products, including

potential alternative uses or formulations of TPOXX that appear

promising to SIGA or its collaborators, cannot be shown to be

efficacious or safe in subsequent pre-clinical or clinical trials,

(vi) the risk that target timing for deliveries of product to

customers, and the recognition of related revenues, are delayed or

adversely impacted by the actions, or inaction, of contract

manufacturing organizations, or other vendors, within the supply

chain, or due to coordination activities between the customer and

supply chain vendors, (vii) the risk that SIGA or its collaborators

will not obtain appropriate or necessary governmental approvals to

market these or other potential products or uses, (viii) the risk

that SIGA may not be able to secure or enforce sufficient legal

rights in its products, including intellectual property protection,

(ix) the risk that any challenge to SIGA’s patent and other

property rights, if adversely determined, could affect SIGA’s

business and, even if determined favorably, could be costly, (x)

the risk that regulatory requirements applicable to SIGA’s products

may result in the need for further or additional testing or

documentation that will delay or prevent SIGA from seeking or

obtaining needed approvals to market these products, (xi) the risk

that the volatile and competitive nature of the biotechnology

industry may hamper SIGA’s efforts to develop or market its

products, (xii) the risk that changes in domestic or foreign

economic and market conditions may affect SIGA’s ability to advance

its research or may affect its products adversely, (xiii) the

effect of federal, state, and foreign regulation, including drug

regulation and international trade regulation, on SIGA’s

businesses, (xiv) the risk of disruptions to SIGA’s

supply chain for the manufacture of TPOXX®, causing delays in

SIGA’s research and development activities, causing delays or the

re-allocation of funding in connection with SIGA’s government

contracts, or diverting the attention of government staff

overseeing SIGA’s government contracts, (xv) risks associated with

actions or uncertainties surrounding the debt ceiling, (xvi)

the risk that the U.S. or foreign governments'

responses (including inaction) to national or global economic

conditions or infectious diseases, are ineffective and may

adversely affect SIGA’s business, and (xvii) risks associated with

responding to an mpox outbreak, as well as the risks and

uncertainties included in Item 1A “Risk Factors” of our Annual

Report on Form 10-K for the year ended December 31,

2023 and SIGA's subsequent filings with the Securities

and Exchange Commission. SIGA urges investors and security holders

to read those documents free of charge at

the SEC's website at http://www.sec.gov. All such

forward-looking statements are current only as of the date on which

such statements were made. SIGA does not undertake any obligation

to update publicly any forward-looking statement to reflect events

or circumstances after the date on which any such statement is made

or to reflect the occurrence of unanticipated events.

Contacts:Suzanne

Harnettsharnett@siga.com

and

|

Investors |

Media |

|

Jennifer Drew-Bear, Edison GroupJdrew-bear@edisongroup.com |

Holly Stevens, Berry & Companyhstevens@berrypr.com |

|

SIGA TECHNOLOGIES, INC.CONDENSED

CONSOLIDATED BALANCE SHEETS (UNAUDITED)As

of |

|

|

|

|

|

September 30, 2024 |

|

|

December 31, 2023 |

|

|

ASSETS |

|

|

|

|

|

|

|

|

|

Current assets |

|

|

|

|

|

|

|

|

|

Cash and cash equivalents |

|

$ |

99,269,756 |

|

|

$ |

150,145,844 |

|

|

Accounts receivable |

|

|

12,089,010 |

|

|

|

21,130,951 |

|

|

Inventory |

|

|

62,024,473 |

|

|

|

64,218,337 |

|

|

Prepaid expenses and other current assets |

|

|

7,302,979 |

|

|

|

3,496,028 |

|

|

Total current assets |

|

|

180,686,218 |

|

|

|

238,991,160 |

|

|

|

|

|

|

|

|

|

|

|

|

Property, plant and equipment, net |

|

|

1,411,315 |

|

|

|

1,331,708 |

|

|

Deferred tax asset, net |

|

|

12,104,765 |

|

|

|

11,048,118 |

|

|

Goodwill |

|

|

898,334 |

|

|

|

898,334 |

|

|

Other assets |

|

|

253,605 |

|

|

|

2,083,535 |

|

|

Total assets |

|

$ |

195,354,237 |

|

|

$ |

254,352,855 |

|

|

LIABILITIES AND STOCKHOLDERS’ EQUITY |

|

|

|

|

|

|

|

|

|

Current liabilities |

|

|

|

|

|

|

|

|

|

Accounts payable |

|

$ |

1,260,762 |

|

|

$ |

1,456,316 |

|

|

Accrued expenses and other current liabilities |

|

|

7,184,514 |

|

|

|

10,181,810 |

|

|

Deferred IV TPOXX® revenue |

|

|

13,729,440 |

|

|

|

20,788,720 |

|

|

Income tax payable |

|

|

127,815 |

|

|

|

21,690,899 |

|

|

Total current liabilities |

|

|

22,302,531 |

|

|

|

54,117,745 |

|

|

|

|

|

|

|

|

|

|

|

|

Other liabilities |

|

|

3,609,572 |

|

|

|

3,376,203 |

|

|

Total liabilities |

|

|

25,912,103 |

|

|

|

57,493,948 |

|

|

Commitments and contingencies |

|

|

|

|

|

|

|

|

|

Stockholders’ equity |

|

|

|

|

|

|

|

|

|

Common stock ($.0001 par value, 600,000,000 shares authorized,

71,369,274 and 71,091,616, issued and outstanding at September 30,

2024 and December 31, 2023, respectively) |

|

|

7,137 |

|

|

|

7,109 |

|

|

Additional paid-in capital |

|

|

238,033,324 |

|

|

|

235,795,420 |

|

|

Accumulated deficit |

|

|

(68,598,327 |

) |

|

|

(38,943,622 |

) |

|

Total stockholders’ equity |

|

|

169,442,134 |

|

|

|

196,858,907 |

|

|

Total liabilities and stockholders’ equity |

|

$ |

195,354,237 |

|

|

$ |

254,352,855 |

|

|

SIGA TECHNOLOGIES, INC.CONDENSED

CONSOLIDATED STATEMENTS OF OPERATIONS AND COMPREHENSIVE

INCOME/(LOSS) (UNAUDITED) |

|

|

|

|

|

Three Months Ended September 30, |

|

|

Nine Months Ended September 30, |

|

|

|

|

2024 |

|

|

2023 |

|

|

2024 |

|

|

2023 |

|

|

Revenues |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Product sales and supportive services |

|

$ |

8,942,875 |

|

|

$ |

7,958,289 |

|

|

$ |

53,496,869 |

|

|

$ |

14,924,058 |

|

|

Research and development |

|

|

1,066,906 |

|

|

|

1,276,882 |

|

|

|

3,753,658 |

|

|

|

8,512,303 |

|

|

Total revenues |

|

|

10,009,781 |

|

|

|

9,235,171 |

|

|

|

57,250,527 |

|

|

|

23,436,361 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Operating expenses |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Cost of sales and supportive services |

|

|

1,620,510 |

|

|

|

896,537 |

|

|

|

17,157,508 |

|

|

|

3,021,145 |

|

|

Selling, general and administrative |

|

|

4,822,591 |

|

|

|

5,999,761 |

|

|

|

18,228,786 |

|

|

|

14,660,828 |

|

|

Research and development |

|

|

3,024,593 |

|

|

|

3,648,117 |

|

|

|

8,966,905 |

|

|

|

13,810,307 |

|

|

Total operating expenses |

|

|

9,467,694 |

|

|

|

10,544,415 |

|

|

|

44,353,199 |

|

|

|

31,492,280 |

|

|

Operating income/(loss) |

|

|

542,087 |

|

|

|

(1,309,244 |

) |

|

|

12,897,328 |

|

|

|

(8,055,919 |

) |

|

Other income, net |

|

|

1,330,505 |

|

|

|

883,148 |

|

|

|

4,590,935 |

|

|

|

2,964,482 |

|

|

Income/(Loss) before income taxes |

|

|

1,872,592 |

|

|

|

(426,096 |

) |

|

|

17,488,263 |

|

|

|

(5,091,437 |

) |

|

(Provision)/Benefit for income taxes |

|

|

(528,647 |

) |

|

|

33,030 |

|

|

|

(4,034,362 |

) |

|

|

904,638 |

|

|

Net and comprehensive income/(loss) |

|

$ |

1,343,945 |

|

|

$ |

(393,066 |

) |

|

$ |

13,453,901 |

|

|

$ |

(4,186,799 |

) |

|

Basic income/(loss) per share |

|

$ |

0.02 |

|

|

$ |

(0.01 |

) |

|

$ |

0.19 |

|

|

$ |

(0.06 |

) |

|

Diluted income/(loss) per share |

|

$ |

0.02 |

|

|

$ |

(0.01 |

) |

|

$ |

0.19 |

|

|

$ |

(0.06 |

) |

|

Weighted average shares outstanding: basic |

|

|

71,368,585 |

|

|

|

71,084,735 |

|

|

|

71,191,019 |

|

|

|

71,453,397 |

|

|

Weighted average shares outstanding: diluted |

|

|

71,766,503 |

|

|

|

71,084,735 |

|

|

|

71,853,341 |

|

|

|

71,453,397 |

|

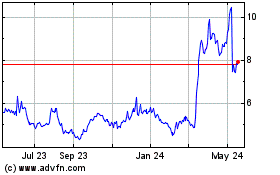

SIGA Technologies (NASDAQ:SIGA)

Historical Stock Chart

From Nov 2024 to Dec 2024

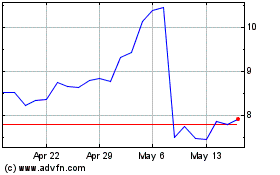

SIGA Technologies (NASDAQ:SIGA)

Historical Stock Chart

From Dec 2023 to Dec 2024