Salarius Pharmaceuticals, Inc. (Nasdaq:

SLRX), a clinical-stage biopharmaceutical company using

protein inhibition and protein degradation to develop cancer

therapies for patients in need of new treatment options, today

reported financial results for the three months ended March 31,

2023 and provided a business update.

Financial Highlights

- Cash and cash equivalents were $9.3

million as of March 31, 2023, compared with $12.1 million as of

December 31, 2022.

- Net loss for the first quarter of

2023 was $5.3 million, or $2.23 per share, compared with net loss

for the first quarter of 2022 of $6.1 million, or $3.30 per share.

The decline reflects lower spending on seclidemstat in the 2023

quarter and one-time expenses of $2.0 million related to the

purchase of the targeted protein degrader program in the 2022

quarter.

“Earlier this week we announced that the U.S.

Food and Drug Administration (FDA) removed its partial clinical

hold on our Phase 1/2 trial with seclidemstat in patients with

Ewing sarcoma. We believe this is great news for patients as the

interim data we reported last December are powerful, showing a 60%

confirmed disease control rate and 7.4 months median time to tumor

progression for Ewing sarcoma first-relapse patients, with no

disease progression observed in either first- or second-relapse

patients who achieved confirmed disease control. As I mentioned

earlier this week, this decision puts us back on track to engage in

dialogue with the FDA on various topics relating to further

clinical development of seclidemstat, as well as possible

registration pathways,” said David Arthur, president and chief

executive officer.

“In addition, Salarius continued to execute on

plan during the first quarter of 2023 and recent weeks as we

advanced the development of SP-3164, our targeted protein degrader.

We are preparing to submit an Investigational New Drug, or IND,

application to the FDA later this quarter, with initiation of a

Phase 1 clinical trial expected to begin in the second half of the

year. To that end, we have completed two GLP toxicology studies

with no unexpected safety findings, and we are working to complete

the remaining activities prior to submitting the IND

application.

“The SP-3164 preclinical data we have been

sharing at prestigious medical and scientific conferences over the

past few months, including compelling antitumor activity in animal

models of diffuse large B cell lymphoma (DLBCL), follicular

lymphoma and multiple myeloma, suggest that SP-3164 may be useful

in treating non-Hodgkin lymphomas and other hematologic cancers,

alone or in combination with standard-of-care chemotherapy,” he

added. “We look forward to sharing further details of

our progress in the coming months.”

First Quarter Financial

Results

Research and development expenses were $3.7

million for the first quarter of 2023, compared with $4.4 million

for the first quarter of 2022. Spending associated with SP-3164 and

seclidemstat for the first quarter of 2023 was $2.4 million and

$1.3 million, respectively, compared with $2.2 million and $2.3

million, respectively, for the first quarter of 2022. General and

administrative expenses were largely flat at $1.7 million for both

periods.

Net cash used for operating activities during

the first quarter of 2023 was $3.2 million, compared with $3.5

million during the same quarter in 2022, with an increase in

overall spending offset by the receipt of $1.5 million during the

2023 quarter from the Cancer Prevention and Research Institute of

Texas.

As of March 31, 2023, Salarius had cash, cash

equivalents and restricted cash of $9.3 million, compared with

$12.1 million as of December 31, 2022. Current cash and cash

equivalents are expected to fund the company’s planned operations

through the third quarter 2023.

Seclidemstat Highlights

- The FDA removed its partial

clinical hold on Salarius’ Phase 1/2 trial evaluating seclidemstat

in combination with topotecan and cyclophosphamide as a potential

treatment for patients with Ewing sarcoma. Seclidemstat is the

company’s novel oral, reversible, targeted LSD1 inhibitor.

- Salarius presented data at the

Keystone Symposia on Epigenetics suggesting that seclidemstat may

have utility in treating small cell lung cancer (SCLC). In a 13

SCLC cell line panel, seclidemstat demonstrated significant

anti-proliferative single-agent activity. In addition, seclidemstat

demonstrated additive to synergistic activity in a subset of these

cell lines when combined with current standard of care treatment

options for second-line SCLC.

- The FDA has previously granted

seclidemstat Fast Track Designation, Orphan Drug Designation and

Rare Pediatric Disease Designation for Ewing sarcoma.

SP-3164 Targeted Protein Degrader

Highlights

- Two abstracts were presented at the

American Association for Cancer Research (AACR) Annual Meeting in

April 2023:

- One presentation demonstrated the

robust protein degradation effects of SP-3164 and its anticancer

activity in non-Hodgkin lymphoma (NHL) animal models. SP-3164’s

compelling antitumor activity in animal models of follicular

lymphoma, a type of NHL, as a single agent and in combination with

venetoclax (Venclexta®) or tazemetostat (Tazverik®) was also

demonstrated.

- The other presentation demonstrated

SP-3164's compelling anticancer activity in cell lines and animal

models of multiple myeloma. In animal models, SP-3164 demonstrated

superior single-agent activity compared with the approved agents

lenalidomide (Revlimid®) and pomalidomide (Pomalyst®), and the

combination of SP-3164 and bortezomib (Velcade®) was shown to be

superior to the combination of pomalidomide and bortezomib.

- An oral presentation was delivered

at the Inaugural Molecular Glue Drug Development Summit:

- In a model of DLBCL, SP-3164

exhibited synergistic activity with the approved anti-CD20 drug

rituximab, resulting in tumor regression in 50% of treated

mice.

- The SP-3164 and rituximab

combination performed significantly better than the approved

regimen of lenalidomide and rituximab.

Upcoming 2023 BIO International

Convention and European Hematology Association 2023

Congress

Salarius will be participating in the 2023 BIO

International Convention in Boston June 5-8, and the European

Hematology Association 2023 Congress in Frankfurt, Germany June

8-11. Management plans to hold business development meetings with

representatives of biotechnology and pharmaceutical companies to

continue to expand awareness of both seclidemstat and SP-3164.

About Salarius

PharmaceuticalsSalarius Pharmaceuticals, Inc. is a

clinical-stage biopharmaceutical company developing therapies for

patients with cancer in need of new treatment options. Salarius’

product portfolio includes seclidemstat, Salarius’ lead candidate,

which is being studied as a potential treatment for pediatric

cancers, sarcomas and other cancers with limited treatment options,

and SP-3164, an oral small molecule protein degrader.

Seclidemstat has received fast track, orphan

drug and rare pediatric disease designations for Ewing sarcoma from

the U.S. Food and Drug Administration and is currently in a Phase

1/2 clinical trial for relapsed/refractory Ewing sarcoma. Salarius

is also exploring seclidemstat’s potential in several cancers with

high unmet medical need, with an investigator-initiated Phase 1/2

clinical study in hematologic cancers at MD Anderson Cancer Center.

Salarius has received financial support from the National Pediatric

Cancer Foundation to advance the Ewing program and was a recipient

of a Product Development Award from the Cancer Prevention and

Research Institute of Texas (CPRIT). SP-3164 is currently in

IND-enabling studies and anticipated to enter the clinic in 2023.

For more information, please visit salariuspharma.com or follow

Salarius on Twitter and LinkedIn.

Forward-Looking Statements This

press release contains “forward-looking statements” within the

meaning of the Private Securities Litigation Reform Act of 1995.

All statements, other than statements of historical facts, included

in this press release are forward-looking statements. These

forward-looking statements may be identified by terms such as

“will,” “believe,” “developing,” “expect,” “may,” “progress,”

“potential,” “could,” “look forward,” “encouraging,” “might,”

“should,” and similar terms or expressions or the negative thereof.

Examples of such statements include, but are not limited to,

statements relating to the following: the future of the company’s

Phase 1/2 trial of seclidemstat as a treatment for Ewing sarcoma

and FET-rearranged sarcomas, including our plans to engage in

further dialogue with the FDA on various topics relating to further

clinical development and possible registration pathways; the

advantages of protein degraders including the value of SP-3164 as a

cancer treatment; the timing of clinical trials for SP-3164 and

expected therapeutic options for SP-3164 and related effects and

projected efficacy;; the timing of Salarius’ IND submissions to the

FDA and subsequent timing for initiating clinical trials; interim

data related to Salarius’ clinical trials, including the timing of

when such data is available and made public; Salarius’ growth

strategy; the value of seclidemstat as a treatment for Ewing

sarcoma, Ewing-related sarcomas, and other cancers and its ability

to improve the life of patients; expanding the scope of Salarius’

research and focus to high unmet need patient populations;

milestones of Salarius’ current and future clinical trials,

including the timing of data readouts. Salarius may not actually

achieve the plans, carry out the intentions or meet the

expectations or objectives disclosed in the forward-looking

statements. You should not place undue reliance on these

forward-looking statements. These statements are subject to risks

and uncertainties which could cause actual results and performance

to differ materially from those discussed in the forward-looking

statements. These risks and uncertainties include, but are not

limited to, the following: Salarius’ ability to continue as a going

concern;; the sufficiency of Salarius’ capital resources; the

ability of, and need for, Salarius to raise additional capital to

meet Salarius’ business operational needs and to achieve its

business objectives and strategy; future clinical trial results and

the impact of such results on Salarius; that the results of studies

and clinical trials may not be predictive of future clinical trial

results; risks related to the drug development and the regulatory

approval process; the competitive landscape and other

industry-related risks; and other risks described in Salarius’

filings with the Securities and Exchange Commission, including its

Annual Report on Form 10-K for the fiscal year ended December 31,

2022, as revised or supplemented by its Quarterly Reports on Form

10-Q and other documents filed with the SEC. The forward-looking

statements contained in this press release speak only as of the

date of this press release and are based on management’s

assumptions and estimates as of such date. Salarius disclaims any

intent or obligation to update these forward-looking statements to

reflect events or circumstances that exist after the date on which

they were made.

Contact:

LHA Investor RelationsKim

Sutton Golodetzkgolodetz@lhai.com212-838-3777

(Tables to follow)

|

SALARIUS PHARMACEUTICALS, INC. |

| |

|

CONDENSED CONSOLIDATED BALANCE SHEETS |

|

|

| |

3/31/2023 |

|

12/31/2022 |

| |

(Unaudited) |

|

|

| Assets |

|

|

|

| Current assets: |

|

|

|

|

Cash and cash equivalents |

$ |

9,273,682 |

|

|

$ |

12,106,435 |

|

|

Grants receivable from CPRIT |

|

130,000 |

|

|

|

1,610,490 |

|

|

Prepaid expenses and other current assets |

|

536,625 |

|

|

|

803,373 |

|

| Total current assets |

|

9,940,307 |

|

|

|

14,520,298 |

|

| Other assets |

|

114,852 |

|

|

|

130,501 |

|

| Total assets |

$ |

10,055,159 |

|

|

$ |

14,650,799 |

|

| Liabilities and

stockholders' equity |

|

|

|

| Current liabilities: |

|

|

|

|

Accounts payable |

$ |

3,510,905 |

|

|

$ |

2,858,330 |

|

|

Accrued expenses and other current liabilities |

|

985,393 |

|

|

|

1,407,861 |

|

| Total liabilities |

|

4,496,298 |

|

|

|

4,266,191 |

|

| |

|

|

|

| Commitments and contingencies

(Note 5) |

|

|

|

| |

|

|

|

| Stockholders' equity: |

|

|

|

| Preferred stock, $0.0001 par

value; 10,000,000 shares authorized; 0 issued and outstanding |

|

— |

|

|

|

— |

|

| Common stock, $0.0001 par

value; 100,000,000 shares authorized; 2,468,297 and 2,255,899

shares issued and outstanding at March 31, 2023 and

December 31, 2022, respectively |

|

246 |

|

|

|

225 |

|

| Additional paid-in

capital |

|

74,704,536 |

|

|

|

74,189,531 |

|

| Accumulated deficit |

|

(69,145,921 |

) |

|

|

(63,805,148 |

) |

| Total stockholders'

equity |

|

5,558,861 |

|

|

|

10,384,608 |

|

| Total liabilities and

stockholders' equity |

$ |

10,055,159 |

|

|

$ |

14,650,799 |

|

|

SALARIUS PHARMACEUTICALS, INC. |

|

|

|

CONDENSED CONSOLIDATED STATEMENTS OF

OPERATIONS |

|

|

|

(Unaudited) |

|

|

| |

Three Months Ended March 31, |

|

|

|

2023 |

|

|

|

2022 |

|

| Revenue: |

|

|

|

| Grant revenue |

$ |

— |

|

|

$ |

— |

|

| Operating expenses: |

|

|

|

|

Research and development |

|

3,725,588 |

|

|

|

4,439,475 |

|

|

General and administrative |

|

1,695,075 |

|

|

|

1,677,754 |

|

| Total operating expenses |

|

5,420,663 |

|

|

|

6,117,229 |

|

| Loss before other income

(expense) |

|

(5,420,663 |

) |

|

|

(6,117,229 |

) |

| Interest income, net and

other |

|

79,890 |

|

|

|

8,004 |

|

| Loss from continuing

operations |

|

(5,340,773 |

) |

|

|

(6,109,225 |

) |

| Net loss |

$ |

(5,340,773 |

) |

|

$ |

(6,109,225 |

) |

| |

|

|

|

| Loss per common

share — basic and diluted |

$ |

(2.23 |

) |

|

$ |

(3.30 |

) |

|

Weighted-average number of common shares outstanding — basic

and diluted |

|

2,391,964 |

|

|

|

1,850,208 |

|

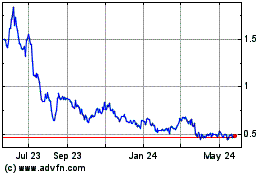

Salarius Pharmaceuticals (NASDAQ:SLRX)

Historical Stock Chart

From Dec 2024 to Jan 2025

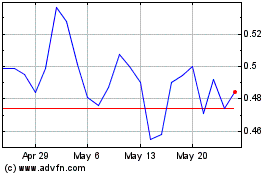

Salarius Pharmaceuticals (NASDAQ:SLRX)

Historical Stock Chart

From Jan 2024 to Jan 2025