Salarius Pharmaceuticals, Inc. (Nasdaq:

SLRX), a clinical-stage biopharmaceutical company using

protein inhibition and protein degradation to develop cancer

therapies for patients in need of new treatment options, today

reported financial results for the three and 12 months ended

December 31, 2023 and provided a business update.

Financial Highlights

- Net loss for the fourth quarter of

2023 was $0.9 million, or $0.22 per share, compared with a net loss

for the fourth quarter of 2022 of $6.4 million, or $2.83 per share,

reflecting lower operating expenses resulting from the cost-savings

plan implemented in the third quarter of 2023.

- Net loss for 2023 was $12.5

million, or $3.84 per share, compared with a net loss for 2022 of

$31.6 million, or $14.88 per share. The 2022 net loss included a

one-time non-cash expense of $8.9 million, or $4.17 per share, due

to a loss on impairment of goodwill.

- Cash and cash equivalents were $5.9

million as of December 31, 2023, compared with $12.1 million as of

December 31, 2022. The company collected all its remaining CPRIT

payments during 2023.

In August 2023 Salarius announced a

comprehensive review of strategic alternatives focused on

maximizing shareholder value. While these efforts are ongoing, the

Company continues to support its clinical programs, as appropriate,

and the cost-savings measures approved by the Board of Directors

are designed to enable the Company to continue supporting such

activities. These measures included a reduction in certain

executive, clinical and research and development staff, and the

opportunistic engagement of consultants, among other

activities.

“During the second half of 2023 and the first

months of 2024, Salarius reduced operating expenses, allowing us to

extend our cash runway to generate additional clinical data in the

seclidemstat hematologic and Ewing sarcoma clinical trials. We

believe these data, if positive, will further enhance our

opportunities to maximize shareholder value,” said William McVicar,

Ph.D., Chairman of the Salarius Pharmaceuticals Board of Directors.

“As previously announced, the MD Anderson Cancer Center (MDACC)

investigator-initiated hematologic cancer trial is active and

enrolling patients, and we look forward to clinical trial updates

later this year. The Company’s Ewing sarcoma Phase 1/2 study is not

currently enrolling patients, but previously enrolled patients

continue to be followed.”

Fourth Quarter Financial

ResultsNet loss for the fourth quarter of 2023 was $0.9

million, or $0.22 per share, compared with a net loss for the

fourth quarter of 2022 of $6.4 million, or $2.83 per share. The

decrease was due to the cost-savings plan implemented in the third

quarter of 2023.

Research and development expenses were $0.06

million for the fourth quarter of 2023, compared with $4.7 million

for the fourth quarter of 2022, reflecting the above-mentioned

cost-savings plan.

Net cash used for operating activities during

the fourth quarter of 2023 was $1.5 million, compared with $4.7

million during the same quarter in 2022, reflecting the

above-mentioned cost-savings plan.

Full Year Financial ResultsNet

loss for 2023 was $12.5 million, or $3.84 per share, compared with

a net loss for 2022 of $31.6 million, or $14.88 per share. This

reduction of approximately $19.1 million resulted from an $8.9

million one-time non-cash expense for impairment of goodwill in

2022, significantly lower research and development expenses and

lower general and administrative expenses in 2023 resulting from

the Company’s idled clinical trial in late 2022, and cost-cutting

measures that began in the third quarter of 2023. Costs resulting

from the acquisition and development of SP-3164 in 2022 did not

repeat in 2023.

Research and development expenses were $7.2

million for 2023, compared with $15.8 million for 2022. The

decrease was principally due to the company’s lower spending on

SP-2577, which went on clinical hold during the fourth quarter of

2022 and remained idle through 2023, cost cutting measures

undertaken beginning in the third quarter of 2023 and SP-3164

acquisition costs in 2022 that did not repeat in 2023.

Net cash used in operating activities for 2023

was $12.8 million, compared with $17.6 million for 2022. The

decrease was primarily due to lower overall operating loss in the

current year.

As of December 31, 2023, Salarius had cash, cash

equivalents and restricted cash of $5.9 million, compared with

$12.1 million as of December 31, 2022. Current cash and cash

equivalents are expected to fund the company’s planned operations

into the first half of 2025.

Targeted Protein Inhibitor

(Seclidemstat) HighlightsSeclidemstat (SP-2577) is a novel

oral reversible inhibitor of the LSD1 enzyme that is being studied

as a treatment for hematologic cancers in an investigator-initiated

clinical trial at MDACC and in a Company-sponsored trial as a

treatment for Ewing sarcoma.

In December 2022, researchers at MDACC reported

interim clinical trial results evaluating seclidemstat in

combination with azacitidine for the treatment of myelodysplastic

syndrome and chronic myelomonocytic leukemia patients who relapsed

or progressed after hypomethylating agent therapy. Of eight

evaluable patients, four (50%) had an objective response. These

researchers reported a 90% probability of survival for 11 months in

patients receiving seclidemstat plus azacitidine. Typically,

overall survival is four to six months after failing therapy with

hypomethylating agents. The hematologic cancer Phase 1/2 clinical

trial being conducted at MDACC is now listed as active and

recruiting on clinical trials.gov – trial NCT04734990.

Seclidemstat has received fast track, orphan

drug and rare pediatric disease designations from the U.S. Food and

Drug Administration (FDA) for Ewing sarcoma and has been studied in

a Company-sponsored Phase 1/2 trial evaluating its use in

combination with topotecan and cyclophosphamide (TC) for the

treatment of relapsed/refractory Ewing sarcoma. To date, 13

relapsed Ewing sarcoma patients, including five patients with first

relapse and eight patients with second relapse, have been enrolled

at 600 mg or 900 mg of seclidemstat dosed twice daily in

combination with TC.

- The five first-relapse patients

demonstrated a 60% objective response rate (ORR) and a 60% disease

control rate (DCR), including one complete response and two partial

responses. Among the three patients achieving objective responses,

the median progression-free survival (mPFS) has not been reached

with these patients still alive with disease control and objective

responses at 17.4, 25.7 and 27.2 months, and increasing, after

starting seclidemstat + TC combination therapy.

- The eight second-relapse

patients demonstrated a 13% ORR, a 25% DCR and a mPFS of 1.6 months

(range: 0.0 months to 10.7 months).

- Together, the 13 first- and

second-relapse patients demonstrated a mPFS of 8.1 months (range:

2.0 months to 27.2 months). Five patients, or 38%, achieved

confirmed disease control and progression has not been observed in

any of these patients while on study.

Salarius has completed the FDA Type B End of

Phase 2 (EOP2) meeting process for the seclidemstat Ewing sarcoma

development program and has amended the current clinical trial

protocol to reflect guidance agreed to with FDA. There is currently

one patient enrolled in the Ewing sarcoma clinical trial who

recently achieved a partial response, defined as a 30% or greater

reduction in their target lesions, and this patient is continuing

treatment with seclidemstat plus TC therapy. The Ewing sarcoma

trial is currently active but is not enrolling additional

patients.

Targeted Protein Degrader (Molecular

Glue) HighlightsSP-3164 is an oral, next-generation

molecular glue that uses Salarius’ deuterium-enabled chiral

switching platform to stabilize the preferred (S)-enantiomer of

avadomide, an extensively studied clinical compound that has

demonstrated encouraging single-agent and combination-therapy

clinical efficacy in non-Hodgkin lymphoma (NHL) and other

hematologic malignancies. The addition of deuterium at the chiral

center of the molecule prevents conversion to the unwanted

(R)-enantiomer, allowing for isolation and development of the

preferred (S)-enantiomer into a potential new cancer treatment. In

July 2023 the FDA cleared the Company’s investigational new drug

(IND) application to commence a Phase 1 clinical trial with SP-3164

in patients with relapsed/refractory NHL. That trial has not

commenced.

About Salarius

PharmaceuticalsSalarius Pharmaceuticals, Inc. is a

clinical-stage biopharmaceutical company developing therapies for

patients with cancer in need of new treatment options. Salarius’

product portfolio includes seclidemstat, its lead candidate, which

is being studied as a potential treatment for pediatric cancers,

sarcomas and other cancers with limited treatment options, and

SP-3164, an oral small molecule protein degrader being developed

for the treatment of non-Hodgkin’s lymphoma. Salarius has received

financial support from the National Pediatric Cancer Foundation to

advance the Ewing sarcoma program and was a recipient of a Product

Development Award from the Cancer Prevention and Research Institute

of Texas (CPRIT). For more information, please visit

salariuspharma.com or follow Salarius on Twitter and LinkedIn.

Forward-Looking Statements This

press release contains “forward-looking statements” within the

meaning of the Private Securities Litigation Reform Act of 1995.

All statements, other than statements of historical facts, included

in this press release are forward-looking statements. These

forward-looking statements may be identified by terms such as

“will,” “believe,” “developing,” “expect,” “may,” “progress,”

“potential,” “could,” “look forward,” “encouraging,” “might,”

“should,” and similar terms or expressions or the negative thereof.

Examples of such statements include, but are not limited to,

statements relating to the following: Salarius’ ability to continue

as a going concern, Salarius’ expectations regarding the

exploration of strategic alternatives, opportunities to extend

Salarius’ resources, the Company’s expected cash runway, the

Company’s expectations that the cost-savings measures will support

the generation of additional data from the ongoing Phase 1/2

clinical trials in hematologic cancers and Ewing sarcoma; the

future of the Company’s operations and product candidates; the

future of the Company’s preclinical studies and clinical trials and

development activities; the advantages of protein degraders

including the value of SP-3164 as a cancer treatment; the value of

seclidemstat as a treatment for Ewing sarcoma, Ewing-related

sarcomas, and other cancers and its ability to improve the life of

patients, and Salarius’ ability to remain listed on Nasdaq.

Salarius may not actually achieve the plans, carry out the

intentions or meet the expectations or objectives disclosed in

these forward-looking statements. You should not place undue

reliance on these forward-looking statements. These statements are

subject to risks and uncertainties which could cause actual results

and performance to differ materially from those discussed in the

forward-looking statements. These risks and uncertainties include,

but are not limited to, the following: the risk that exploration of

strategic alternatives may not result in any definitive transaction

or enhance stockholder value and may create a distraction or

uncertainty that may adversely affect our operating results,

business, or investor perceptions; the likelihood that the Company

will need to seek a dissolution and orderly wind-down of operations

if the Company is unable to raise capital or complete a strategic

transaction in the next several months; expectations regarding

future costs and expenses; our product candidates being in early

stages of development; the uncertainty about the paths of our

programs and our ability to evaluate and identify a path forward

for those programs, particularly given the constraints we have as a

small company with limited financial, personnel and other operating

resources (including with respect to the allocation of our limited

capital and the sufficiency of our capital in the near term for any

path we do select); Salarius’ ability to continue as a going

concern; the sufficiency of Salarius’ capital resources;

availability of suitable third parties with which to conduct

contemplated strategic transactions; whether the Company will be

able to pursue a strategic transaction, or whether any transaction,

if pursued, will be completed successfully and on attractive terms

or at all; whether our cash resources will be sufficient to fund

the Company’s foreseeable and unforeseeable operating expenses and

capital requirements; changes in the Company’s operating plans that

may impact its cash expenditures; the uncertainties inherent in

research and development, future clinical data and analysis; the

risks associated with reductions in workforce; the risk of not

having a full-time chief executive officer; future clinical trial

results and the impact of such results on Salarius; that the

results of studies and clinical trials may not be predictive of

future clinical trial results; the competitive landscape and other

industry-related risks; and other risks described in Salarius’

filings with the Securities and Exchange Commission, including its

Annual Report on Form 10-K for the fiscal year ended December 31,

2023, as revised or supplemented by its Quarterly Reports on Form

10-Q and other documents filed with the SEC. The forward-looking

statements contained in this press release speak only as of the

date of this press release and are based on management’s

assumptions and estimates as of such date. Salarius disclaims any

intent or obligation to update these forward-looking statements to

reflect events or circumstances that exist after the date on which

they were made.

Contact:

LHA Investor RelationsKim

Sutton Golodetzkgolodetz@lhai.com212-838-3777

|

SALARIUS PHARMACEUTICALS, INC.CONSOLIDATED

BALANCE SHEETS |

| |

| |

December 31, |

|

|

|

2023 |

|

|

|

2022 |

|

| |

|

|

|

| Assets |

|

|

|

| Current assets: |

|

|

|

|

Cash and cash equivalents |

$ |

5,899,910 |

|

|

$ |

12,106,435 |

|

|

Grants receivable from CPRIT |

|

— |

|

|

|

1,610,490 |

|

|

Prepaid expenses and other current assets |

|

619,763 |

|

|

|

803,373 |

|

| Total current assets |

|

6,519,673 |

|

|

|

14,520,298 |

|

| Other assets |

|

66,850 |

|

|

|

130,501 |

|

| Total assets |

$ |

6,586,523 |

|

|

$ |

14,650,799 |

|

| Liabilities and

stockholders' equity (deficit) |

|

|

|

| Current liabilities: |

|

|

|

|

Accounts payable |

$ |

602,853 |

|

|

$ |

2,858,330 |

|

|

Accrued expenses and other current liabilities |

|

406,745 |

|

|

|

1,407,861 |

|

|

Notes payable |

|

289,643 |

|

|

$ |

— |

|

| Total liabilities |

$ |

1,299,241 |

|

|

$ |

4,266,191 |

|

| |

|

|

|

| Commitments and contingencies

(NOTE 5) |

|

|

|

| |

|

|

|

| Stockholders' equity

(deficit): |

|

|

|

| Preferred stock, $0.0001 par

value; 10,000,000 shares authorized; none issued or

outstanding |

|

— |

|

|

|

— |

|

| Common stock, $0.0001 par

value; 100,000,000 shares authorized; 3,938,433 and 2,255,899

shares issued and outstanding at December 31, 2023 and

December 31, 2022, respectively |

|

393 |

|

|

|

225 |

|

| Additional paid-in

capital |

|

81,634,730 |

|

|

|

74,189,531 |

|

| Accumulated deficit |

|

(76,347,841 |

) |

|

|

(63,805,148 |

) |

| Total stockholders'

equity |

|

5,287,282 |

|

|

|

10,384,608 |

|

| Total liabilities and

stockholders' equity |

$ |

6,586,523 |

|

|

$ |

14,650,799 |

|

| |

|

|

|

|

|

|

|

|

CONDENSED CONSOLIDATED STATEMENTS OF

OPERATIONS |

| |

| |

Twelve Months EndedDecember 31 |

|

|

|

2023 |

|

|

|

2022 |

|

| Operating expenses: |

|

|

|

|

Research and development |

|

7,173,747 |

|

|

|

15,836,828 |

|

|

General and administrative |

|

5,721,197 |

|

|

|

7,138,403 |

|

|

Loss on impairment of goodwill |

|

— |

|

|

|

8,865,909 |

|

| Total operating expenses |

|

12,894,944 |

|

|

|

31,841,140 |

|

| Loss before other income

(expense) |

|

(12,894,944 |

) |

|

|

(31,841,140 |

) |

| Change in fair value of

warrant liability |

|

— |

|

|

|

14,454 |

|

| Interest income |

|

352,251 |

|

|

|

218,730 |

|

| Net loss |

$ |

(12,542,693 |

) |

|

$ |

(31,607,956 |

) |

| |

|

|

|

| Loss attributable to common

stockholders |

$ |

(12,542,693 |

) |

|

$ |

(31,607,956 |

) |

| |

|

|

|

| Loss per common share —

basic and diluted |

$ |

(3.84 |

) |

|

$ |

(14.88 |

) |

| Total net loss per share |

$ |

(3.84 |

) |

|

$ |

(14.88 |

) |

| Weighted-average number of

common shares outstanding — basic and diluted |

|

3,264,620 |

|

|

|

2,124,511 |

|

|

|

|

|

|

|

|

|

|

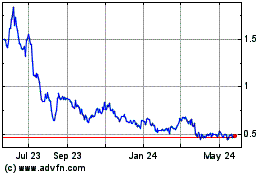

Salarius Pharmaceuticals (NASDAQ:SLRX)

Historical Stock Chart

From Dec 2024 to Jan 2025

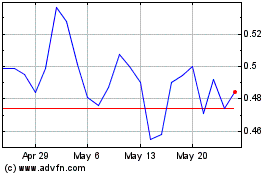

Salarius Pharmaceuticals (NASDAQ:SLRX)

Historical Stock Chart

From Jan 2024 to Jan 2025