SonoSite, Inc. (Nasdaq:SONO), the world leader and

specialist in bedside and point-of-care ultrasound, today reported

financial results for the second quarter ended June 30, 2011.

REVENUE

Revenue for the second quarter of 2011 was $72.7 million, an

increase of 18% compared to $61.5 million in the second quarter of

2010.

Revenue for the first half of 2011 was $143.8 million compared

to $117.5 million in 2010, an increase of 22%.

Revenue from VisualSonics (VSI), Inc. was $8.3 million for the

quarter, up 7%. Revenues were $16.5 million for the first half of

2011, up 5%.

Foreign exchange contributed to a 4% favorable impact on second

quarter results and a 3% favorable impact on the first half of

2011.

Revenues were also negatively impacted in the second quarter by

a series of delayed orders between $4.0-$5.0 million.

SECOND QUARTER, FIRST HALF, AND MARKETING MILESTONES

- Sustained revenue growth in North

America, up 17% for the first half. Second quarter revenues were up

8%, and impacted by order delays.

- US Hospital revenues increased by 15%

for the first half, and 8% for the second quarter.

- International business increased by 3%

in the first half and 5% for the quarter. Results were favorably

impacted by growth in developing markets and currency.

- Emerging market growth in China and

India for the first half was 36% and 18% respectively; growth in

the second quarter was 33% for each country.

- Gross margins were stable, 70.4% for

the first half, and 70.5% in the second quarter.

- The company initiated a new marketing

campaign focused on patient safety and cost control, which

recognized Memorial Hermann Health System, in Houston, Texas for

outstanding leadership in patient safety using SonoSite’s bedside

ultrasound and customized training scheme.

- Important new evidence on cost and

safety benefits from bedside ultrasound use were presented at the

National Patient Safety Congress in Washington D.C. (the most

recognized patient safety forum in the United States).

- VisualSonics introduced the world’s

first ultrasound-guided photoacoustic imaging system, which

combines optical imaging with high-frequency ultrasound. The Vevo®

LAZR system, introduced in March 2011, is designed for pre-clinical

cancer research.

EBITDAS, EBITDA and OPERATING INCOME (EBIT)

Second Quarter:

EBITDAS was $6.4 million, 9% of revenue, down 29% over the prior

year, and in-line with company guidance related to the start-up of

the company’s three-year plan driven “strategic” initiatives.

These new strategic initiatives also impacted EBITDA, and EBIT.

EBITDA was $4.6 million, 6% of revenue, a decrease of 41% over the

prior year, and EBIT was $2.0 million, 3% of revenue, and down 68%

from prior year.

First Half Results

EBITDAS was $15.0 million, 10% of revenue and an increase of 5%

over the prior year.

EBITDA was $11.2 million, 8% of revenue, and a decrease of 7%

over the prior year.

EBIT was $6.0 million, 4% of revenue, and a decrease of 32%

compared to the prior year first half.

EPS

EPS was ($0.08) per share for the second quarter of 2011 versus

net income of $0.12 per share in 2010 and was ($0.01) per share for

the half versus net income of $0.20 per share in the prior year.

Additionally, the prior year’s first half EPS included $1.2

million, or $0.08 per share, in discrete tax benefits related to a

favorable resolution of uncertain tax positions. The reduction in

year-over-year results was driven by the initiation of the

company’s three- year strategic plan in the second quarter.

COMMENTARY

“We had a good quarter although slightly below our internal

forecast,” said Kevin M. Goodwin, SonoSite’s President and CEO.

“For the first half, we had strong and positive momentum achieving

revenue growth of 22%. In the second quarter, we had expectations

of an additional $4.0-$5.0 million in revenue, which ended up as

rolled-over orders; we also had an expected sequential decline in

our typically ‘lumpy’ government business. We anticipate though a

strong second half, which will be punctuated with a new product

release and the expected return of momentum in our government

business.”

Mr. Goodwin continued, “During the quarter, we also announced

two key senior management appointments; Jack Sparacio, Chief

Operating Officer, and Matthew Damron, Chief Marketing Officer.

Both are experienced veterans and are solid new additions. Jack

will focus on the continuous pursuit of operating margin gains,

while Matt will be the key player in stepping-up our marketing

execution globally.”

Marketing Investment Begins:

“Midway through the second quarter, we started a series of new

demand generation initiatives; early results have been positive and

‘above trend.’ While still early, these results initially validate

our decision to invest in these strategic marketing campaigns.”

Core Business:

“We continue to see strong fundamentals and customer alignment

for point-of-care visualization with healthcare reform minded

providers from around the USA. We are progressing strongly with a

robust new product rollout scheme which will begin this fall,” said

Mr. Goodwin.

VisualSonics: Breakout technology

“We also announced in the quarter that VisualSonics launched its

new Vevo® LAZR ‘Photoacoustics’ imaging system. This fusion of

‘optical imaging,’ with ultra high-frequency ultrasound, is

believed to be a significant breakthrough for pre-clinical cancer

research and potentially cancer therapy management in the

future.”

“We are highly encouraged by early market insights gained from

leading scientists and researchers from around the world, and will

now pursue FDA approval for clinical applications with

photoacoustics. We see photoacoustics as a major addition to our

technology and opportunity portfolio, it will fuel an aggressive

pursuit of pre-clinical cancer research markets worldwide in the

next two years in our VisualSonics division,” said Mr. Goodwin.

Non-GAAP Measures

This release includes discussions of EBITDA and EBITDAS; these

are non-GAAP financial measures. SonoSite believes these measures

are a useful complement to results provided in accordance with

GAAP. “EBITDA” refers to operating income (EBIT) before

depreciation and amortization. “EBITDAS” refers to operating income

(EBIT) before depreciation, amortization and stock-based

compensation.

Conference Call Information

SonoSite will hold a conference call on July 25th at 1:30 pm

PT/4:30 pm ET. The call will be broadcast live and can be accessed

via http://www.sonosite.com/company/investors. A

replay of the audio webcast will be available beginning July 25th

at 5:30 pm PT and will be available until August 8th at 9:59 pm PT

by dialing 719-457-0820 or toll-free 888-203-1112. The confirmation

code 1770051 is required to access the replay. The call will also

be archived on SonoSite’s website.

About SonoSite

SonoSite, Inc. (www.sonosite.com) is the innovator and world

leader in bedside and point-of-care ultrasound and an industry

leader in ultra high-frequency micro-ultrasound technology and

impedance cardiography equipment. Headquartered near Seattle, the

company is represented by fourteen subsidiaries and a global

distribution network in over 100 countries. SonoSite’s small,

lightweight systems are expanding the use of ultrasound across the

clinical spectrum by cost-effectively bringing high-performance

ultrasound to the point of patient care.

Forward-looking Information and the

Private Litigation Reform Act of 1995

Certain statements in this press release are “forward-looking

statements” for the purposes of the safe harbor provisions of the

Private Securities Litigation Reform Act of 1995, including

statements relating to our future financial condition and results

of operations and statements regarding planned product launches and

the potential market opportunity for these products. These

forward-looking statements are based on the opinions and estimates

of our management at the time the statements are made and are

subject to risks and uncertainties that could cause actual results

to differ materially from those expected or implied by the

forward-looking statements. These statements are not guaranties of

future performance, are based on potentially inaccurate assumptions

and are subject to known and unknown risks and uncertainties,

including, without limitation, the risk that we do not achieve the

financial results that we expect, the risk we are unable to launch

our new products as and when expected, the risk that our existing

and new products do not achieve market success and the other

factors contained in Item 1A. “Risk Factors” section of our most

recent Annual Report on Form 10-K filed with the Securities and

Exchange Commission. We caution readers not to place undue reliance

upon these forward-looking statements that speak only as to the

date of this release. We undertake no obligation to publicly revise

any forward-looking statements to reflect new information, events

or circumstances after the date of this release or to reflect the

occurrence of unanticipated events.

SonoSite, Inc. Selected Financial Information

Condensed Consolidated Statements of

Operations (in thousands except per share data) (unaudited)

Three Months Ended June 30, Six Months

Ended June 30, 2011 2010 2011 2010

Revenue $ 72,713 $ 61,549 $ 143,794 $ 117,526 Cost of revenue

21,479 17,195 42,606

33,475 Gross margin 51,234 44,354 101,188 84,051

Operating expenses: Research and development 10,646 7,211

20,091 14,808 Sales, general and administrative 38,635

30,996 75,111 60,425

Total operating expenses 49,281 38,207 95,202 75,233

Operating income 1,953 6,147 5,986 8,818 Other loss,

net (3,114 ) (2,438 ) (5,476 ) (4,699 )

(Loss) income before income taxes (1,161 ) 3,709 510 4,119

Income tax (benefit) provision (72 ) 1,834

595 861 Net (loss) income

$ (1,089 ) $ 1,875 $ (85 ) $ 3,258 Net (loss)

income per share: Basic $ (0.08 ) $ 0.13 $ (0.01 ) $ 0.21

Diluted $ (0.08 ) $ 0.12 $ (0.01 ) $ 0.20

Weighted average common and potential common shares

outstanding: Basic 13,844 14,601

13,727 15,438 Diluted 13,844

15,100 13,727 15,950

Reconciliation of

Non-GAAP Measures - EBITDA and EBITDAS:

Operating income (EBIT) $ 1,953 $ 6,147 $ 5,986 $ 8,818

Depreciation and amortization 2,642 1,611

5,230 3,290 EBITDA 4,595 7,758 11,216

12,108 Stock-based compensation 1,774 1,200

3,813 2,208 EBITDAS $ 6,368 $

8,958 $ 15,029 $ 14,317

Condensed Consolidated Balance Sheets (in thousands)

(unaudited)

As of June 30, 2011 December

31, 2010 ASSETS Current Assets Cash and cash equivalents

$ 81,536 $ 78,690 Accounts receivable, net 77,759 81,516

Inventories 45,152 37,126 Deferred tax assets, current 8,977 7,801

Prepaid expenses and other current assets 14,555

12,384 Total current assets 227,979 217,517

Property and equipment, net 9,393 9,133 Deferred tax assets, net

3,245 4,373 Investment in affiliate 8,000 8,000 Goodwill 40,107

37,786 Identifiable intangible assets, net 44,811 47,423 Other

assets 4,772 4,823 Total assets $

338,307 $ 329,055

LIABILITIES AND

SHAREHOLDERS' EQUITY Current Liabilities Accounts payable $

12,885 $ 10,597 Accrued expenses 26,141 32,535 Deferred revenue

6,478 6,042 Total current

liabilities 45,504 49,174 Long-term debt, net 99,735 97,379

Deferred tax liability, net 2,600 1,811 Deferred revenue 14,215

15,236 Other non-current liabilities, net 12,714

12,565 Total liabilities $ 174,768 $

176,165 Commitments and contingencies

Shareholders' Equity: Common stock and additional paid-in capital

307,232 299,005 Accumulated deficit (149,059 ) (148,975 )

Accumulated other comprehensive income 5,366

2,860 Total shareholders' equity 163,539

152,890 Total liabilities and shareholders' equity $

338,307 $ 329,055

Condensed

Consolidated Statements of Cash Flow (in thousands) (unaudited)

Six Months Ended June 30, 2011 2010

Operating activities: Net (loss) income $ (85 ) $ 3,258

Adjustments to reconcile net (loss) income to net cash provided by

operating activities: Depreciation and amortization 5,284 3,344

Stock-based compensation 3,813 2,208 Deferred income tax provision

(50 ) (1,739 ) Amortization of debt discount and debt issuance

costs 2,539 2,402 Excess tax benefit from stock-based compensation

(1,123 ) (532 ) Other 494 (401 ) Changes in operating assets and

liabilities: Changes in working capital (9,237 ) 12,774

Net cash provided by operating activities 1,635

21,314 Investing activities: Purchases of investment

securities - (79,921 ) Proceeds from the sales/maturities of

investment securities - 89,298 Purchases of property and equipment

(1,821 ) (1,428 ) Investment in affiliate - (4,000 ) Purchase of

VisualSonics, Inc., net of cash acquired - (61,217 )

Net cash used in by investing activities (1,821 ) (57,268 )

Financing activities: Excess tax benefit from exercise

stock-based awards 1,123 532 Minimum tax withholding on stock-based

awards (803 ) (692 ) Stock repurchases including transaction costs

- (97,715 ) Payment of contingent purchase consideration for

LumenVu, Inc. (300 ) (425 ) Proceeds from exercise of stock-based

awards 4,431 3,271 Repayment of long-term debt (14 ) (8,838

) Net cash provided by (used in) financing activities 4,437

(103,867 ) Effect of exchange rate changes on cash and cash

equivalents (1,405 ) 1,233 Net change

in cash and cash equivalents 2,846 (138,588 ) Cash and cash

equivalents at beginning of year 78,690

183,065 Cash and cash equivalents at end of year $ 81,536

$ 44,477 Supplemental disclosure of cash flow

information: Cash paid for income taxes $ 2,180 $ 1,502

Cash paid for interest $ 2,160 $ 2,317

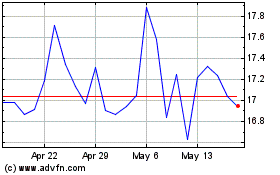

Sonos (NASDAQ:SONO)

Historical Stock Chart

From Jun 2024 to Jul 2024

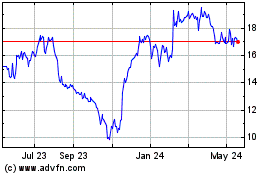

Sonos (NASDAQ:SONO)

Historical Stock Chart

From Jul 2023 to Jul 2024