0001314727FALSE00013147272025-02-062025-02-06

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of

The Securities Exchange Act of 1934

Date of Report (Date of earliest event reported)

February 6, 2025

SONOS, INC.

(Exact name of registrant as specified in its charter)

| | | | | | | | | | | | | | |

| Delaware | | 001-38603 | | 03-0479476 |

(State or other jurisdiction of incorporation) | | (Commission File Number) | | (IRS Employer Identification No.) |

301 Coromar Drive

Santa Barbara, California 93117

(Address of principal executive offices, including zip code)

(805) 965-3001

(Registrant’s telephone number, including area code)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2):

| | | | | |

| ☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | |

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered |

| Common Stock, $0.001 par value | SONO | The Nasdaq Stock Market LLC |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. o

Item 2.02 Results of Operations and Financial Condition.

On February 6, 2025, Sonos, Inc. (the "Company") issued a press release announcing its financial results for its first fiscal quarter ended December 28, 2024. A copy of the press release is furnished hereto as Exhibit 99.1 and is incorporated herein by reference.

The information contained in this Item 2.02 and in Exhibit 99.1 to this Current Report on Form 8-K is being furnished and shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), nor shall it be deemed incorporated by reference in any filing under the Securities Act of 1933, as amended (the “Securities Act”), or the Exchange Act, regardless of any general incorporation language in such filing.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits.

| | | | | |

| Exhibit No. | |

| 99.1 | |

| 104 | Cover Page Interactive Data File (embedded within the Inline XBRL document). |

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | |

| | SONOS, INC. |

| | | |

| Date: February 6, 2025 | By: | /s/ Saori Casey |

| | | Saori Casey Chief Financial Officer

|

Sonos Reports First Quarter Fiscal 2025 Results

Q1 revenue near high-end of guidance range, announced reduction in force

Santa Barbara, CA – February 6, 2025 - Sonos, Inc. (Nasdaq: SONO) today reported First Quarter Fiscal 2025 results.

“Yesterday we implemented important organizational changes that mark the start of a new chapter of efficiency and growth for Sonos,” said Tom Conrad, Sonos Interim CEO. “I see tremendous opportunity in front of us. The team and I are hard at work improving the core experience for our customers while designing the next set of Sonos products and innovations. It’s an honor to show up every day to do this work with the talented Sonos team.”

“Our Q1 results show our team’s commitment to execution as we navigate a difficult environment,” commented Saori Casey, Sonos Chief Financial Officer. “We continue to make great progress in our transformation journey that will set us up well for the future.”

First Quarter Fiscal 2025 Financial Highlights (unaudited)

●Revenue of $551 million

●GAAP gross margin of 43.8%

●GAAP net income of $50.2 million, GAAP diluted earnings per share (EPS) of $0.40

●Non-GAAP net income1 of $79.2 million, Non-GAAP diluted EPS1 of $0.64

●Adjusted EBITDA1 of $91.2 million

Notes:

(1) Non-GAAP net income/Non-GAAP diluted earnings per share (EPS) and Adjusted EBITDA exclude stock-based compensation, legal and transaction related fees, amortization of intangibles, and restructuring and abandonment costs. See “Use of Non-GAAP Measures” and reconciliations to GAAP measures below.

Reorganization and Reduction in Force

●The company announced a reorganization and reduction in force involving approximately 12% of its employees in a Form 8-K filed with the SEC on February 5, 2025

●The company estimates that it will incur approximately $15 to $18 million of restructuring and related charges, substantially all of which are related to employee severance and benefits costs. The company expects to incur substantially all of the restructuring and related charges in the second quarter of fiscal 2025

Guidance

The company will provide guidance on its First Quarter Fiscal 2025 earnings call.

Supplemental Earnings Presentation

The company has posted a supplemental earnings presentation accompanying its First Quarter Fiscal 2025 results to the Earnings Reports section of its investor relations website at https://investors.sonos.com/reports-and-filings/default.aspx#section=earningsreports.

Conference Call, Webcast and Transcript

The company will host a webcast of its conference call and Q&A related to its First Quarter Fiscal 2025 results on February 6, 2025, at 4:15 p.m. Eastern Time (1:15 p.m. Pacific Time). Participants may access the live webcast in listen-only mode on the Sonos investor relations website at https://investors.sonos.com/news-and-events/default.aspx.

The conference call may also be accessed by dialing (888) 330-2454 with conference ID 8641747. Participants outside the U.S. can access the call by dialing (240) 789-2714 using the same conference ID.

An archived webcast of the conference call and a transcript of the company’s prepared remarks and Q&A session will also be available at https://investors.sonos.com/reports-and-filings/default.aspx#section=earningsreports following the call.

| | | | | | | | | | | | | | |

Consolidated Statements of Operations and Comprehensive Income |

(unaudited, in thousands, except share and per share amounts) |

|

|

|

|

|

|

| Three Months Ended |

|

| December 28, 2024 |

| December 30, 2023 |

Revenue |

| $ 550,857 |

| $ 612,869 |

Cost of revenue |

| 309,451 |

| 330,190 |

Gross profit |

| 241,406 |

| 282,679 |

Operating expenses |

|

|

|

|

Research and development |

| 80,838 |

| 79,235 |

Sales and marketing |

| 86,644 |

| 83,950 |

General and administrative |

| 25,831 |

| 39,799 |

Total operating expenses |

| 193,313 |

| 202,984 |

Operating income |

| 48,093 |

| 79,695 |

Other income (expense), net |

|

|

|

|

Interest income |

| 1,861 |

| 3,075 |

Interest expense |

| (110) |

| (105) |

Other (expense) income, net |

| (6,029) |

| 10,274 |

Total other (expense) income, net |

| (4,278) |

| 13,244 |

Income before (benefit from) provision for income taxes |

| 43,815 |

| 92,939 |

(Benefit from) provision for income taxes |

| (6,422) |

| 11,992 |

Net income |

| $ 50,237 |

| $ 80,947 |

|

|

|

|

|

Net income attributable to common stockholders: |

|

|

|

|

Basic and diluted |

| $ 50,237 |

| $ 80,947 |

|

|

|

|

|

| | | | | | | | | | | | | | |

Net income per share attributable to common stockholders: |

|

|

|

|

Basic |

| $ 0.41 |

| $ 0.65 |

Diluted |

| $ 0.40 |

| $ 0.64 |

|

|

|

|

|

Weighted-average shares used in computing net income per share attributable to common stockholders: |

|

|

|

|

Basic |

| 122,071,586 |

| 125,181,717 |

Diluted |

| 124,731,619 |

| 126,742,153 |

|

|

|

|

|

Total comprehensive income |

|

|

|

|

Net income |

| 50,237 |

| 80,947 |

Change in foreign currency translation adjustment |

| (1,116) |

| (863) |

Net unrealized gain on marketable securities |

| (84) |

| — |

Comprehensive income |

| $ 49,037 |

| $ 80,084 |

| | | | | | | | | | | | | | |

Consolidated Balance Sheets |

(unaudited, in thousands, except par values) |

|

| As of |

|

| December 28, 2024 |

| September 28, 2024 |

Assets |

|

|

|

|

Current assets: |

|

|

|

|

Cash and cash equivalents |

| $ 279,955 |

| $ 169,732 |

Marketable securities |

| 47,902 |

| 51,426 |

Accounts receivable, net |

| 84,786 |

| 44,513 |

Inventories |

| 140,892 |

| 231,505 |

Prepaids and other current assets |

| 58,991 |

| 53,910 |

Total current assets |

| 612,526 |

| 551,086 |

Property and equipment, net |

| 95,028 |

| 102,148 |

Operating lease right-of-use assets |

| 47,935 |

| 50,175 |

Goodwill |

| 82,854 |

| 82,854 |

Intangible assets, net |

|

|

|

|

In-process research and development |

| — |

| 73,770 |

Other intangible assets |

| 84,488 |

| 14,266 |

Deferred tax assets |

| 9,654 |

| 10,314 |

Other noncurrent assets |

| 31,120 |

| 31,699 |

Total assets |

| $ 963,605 |

| $ 916,312 |

|

|

|

|

|

Liabilities and stockholders’ equity |

|

|

|

|

Current liabilities: |

|

|

|

|

Accounts payable |

| $ 162,080 |

| $ 194,590 |

Accrued expenses |

| 108,871 |

| 87,783 |

Accrued compensation |

| 28,509 |

| 15,701 |

Deferred revenue, current |

| 20,973 |

| 21,802 |

Other current liabilities |

| 52,081 |

| 46,277 |

Total current liabilities |

| 372,514 |

| 366,153 |

Operating lease liabilities, noncurrent |

| 56,786 |

| 56,588 |

| | | | | | | | | | | | | | |

Deferred revenue, noncurrent |

| 61,245 |

| 61,075 |

Deferred tax liabilities |

| 176 |

| 60 |

Other noncurrent liabilities |

| 3,757 |

| 3,816 |

Total liabilities |

| 494,478 |

| 487,692 |

|

|

|

|

|

Commitments and contingencies |

|

|

|

|

Stockholders’ equity: |

|

|

|

|

Common stock, $0.001 par value |

| 125 |

| 123 |

Treasury stock |

| (48,504) |

| (17,096) |

Additional paid-in capital |

| 521,121 |

| 498,245 |

Accumulated deficit |

| (697) |

| (50,934) |

Accumulated other comprehensive loss |

| (2,918) |

| (1,718) |

Total stockholders’ equity |

| 469,127 |

| 428,620 |

Total liabilities and stockholders’ equity |

| $ 963,605 |

| $ 916,312 |

| | | | | | | | | | | | | | |

Consolidated Statements of Cash Flows |

(unaudited, dollars in thousands) |

|

| Three Months Ended |

|

| December 28, 2024 |

| December 30, 2023 |

Cash flows from operating activities |

|

|

|

|

Net income |

| $ 50,237 |

| $ 80,947 |

Adjustments to reconcile net income to net cash provided by operating activities: |

|

|

|

|

Stock-based compensation expense |

| 25,334 |

| 19,358 |

Depreciation and amortization |

| 17,611 |

| 11,878 |

Provision for inventory obsolescence |

| 1,305 |

| 5,837 |

Restructuring and abandonment charges |

| — |

| 260 |

Deferred income taxes |

| 123 |

| (45) |

Other |

| 841 |

| 1,236 |

Foreign currency transaction loss (gain) |

| 2,129 |

| (7,388) |

Changes in operating assets and liabilities: |

|

|

|

|

Accounts receivable |

| (41,374) |

| (12,215) |

Inventories |

| 89,308 |

| 167,641 |

Other assets |

| (6,437) |

| (12,878) |

Accounts payable and accrued expenses |

| (5,940) |

| (7,429) |

Accrued compensation |

| 12,394 |

| 5,988 |

Deferred revenue |

| 1,513 |

| 3,660 |

Other liabilities |

| 9,129 |

| 18,551 |

Net cash provided by operating activities |

| 156,173 |

| 275,401 |

Cash flows from investing activities |

|

|

|

|

Purchases of marketable securities |

| (10,128) |

| — |

Purchases of property and equipment |

| (13,106) |

| (6,077) |

Maturities of marketable securities |

| 13,900 |

| — |

Net cash used in investing activities |

| (9,334) |

| (6,077) |

| | | | | | | | | | | | | | |

Cash flows from financing activities |

|

|

|

|

Payments for repurchase of common stock, including excise tax and commission |

| (27,165) |

| (23,484) |

Payments for repurchase of common stock related to shares withheld for tax in connection with vesting of restricted stock units |

| (9,044) |

| (3,745) |

Proceeds from exercise of stock options |

| 2,411 |

| 3,538 |

Net cash used in financing activities |

| (33,798) |

| (23,691) |

Effect of exchange rate changes on cash and cash equivalents |

| (2,818) |

| 1,478 |

Net increase in cash and cash equivalents |

| 110,223 |

| 247,111 |

Cash and cash equivalents |

|

|

|

|

Beginning of period |

| 169,732 |

| 220,231 |

End of period |

| $ 279,955 |

| $ 467,342 |

Supplemental disclosure |

|

|

|

|

Cash paid for interest |

| $ 63 |

| $ 58 |

Cash paid for taxes, net of refunds |

| $ 658 |

| $ 3,684 |

Cash paid for amounts included in the measurement of lease liabilities, net of tenant improvement reimbursements received |

| $ (2,531) |

| $ 2,601 |

Supplemental disclosure of non-cash investing and financing activities |

|

|

|

|

Purchases of property and equipment in accounts payable and accrued expenses |

| $ 3,693 |

| $ 6,141 |

Right-of-use assets obtained in exchange for new operating lease liabilities |

| $ — |

| $ 7,637 |

Excise tax on share repurchases, accrued but not paid |

| $ 668 |

| $ — |

| | | | | | | | | | | | | | |

Reconciliation of GAAP to Non-GAAP Cost of Revenue and Gross Profit |

(unaudited, in thousands, except percentages) |

|

| Three Months Ended |

|

| December 28, 2024 |

| December 30, 2023 |

Reconciliation of GAAP cost of revenue |

|

|

|

|

GAAP cost of revenue |

| $ 309,451 |

| $ 330,190 |

Stock-based compensation expense |

| 1,349 |

| 654 |

Amortization of intangibles |

| 3,330 |

| 972 |

Non-GAAP cost of revenue |

| $ 304,772 |

| $ 328,564 |

|

|

|

|

|

Reconciliation of GAAP gross profit |

|

|

|

|

GAAP gross profit |

| $ 241,406 |

| $ 282,679 |

Stock-based compensation expense |

| 1,349 |

| 654 |

Amortization of intangibles |

| 3,330 |

| 972 |

Non-GAAP gross profit |

| $ 246,085 |

| $ 284,305 |

|

|

|

|

|

GAAP gross margin |

| 43.8% |

| 46.1% |

Non-GAAP gross margin |

| 44.7% |

| 46.4% |

| | | | | | | | | | | | | | |

Reconciliation of Selected Non-GAAP Financial Measures |

(unaudited, dollars in thousands) |

|

| Three Months Ended |

|

| December 28, 2024 |

| December 30, 2023 |

GAAP Research and Development |

| $ 80,838 |

| $ 79,235 |

Stock-based compensation |

| 13,315 |

| 8,979 |

Amortization of intangibles |

| 178 |

| 496 |

Restructuring and abandonment costs |

| (60) |

| 323 |

Non-GAAP Research and Development |

| $ 67,405 |

| $ 69,437 |

|

|

|

|

|

GAAP Sales and Marketing |

| $ 86,644 |

| $ 83,950 |

Stock-based compensation |

| 5,632 |

| 3,815 |

Amortization of intangibles |

| - |

| - |

Restructuring and abandonment costs |

| - |

| 113 |

Non-GAAP Sales and Marketing |

| $ 81,012 |

| $ 80,022 |

|

|

|

|

|

GAAP General and Administrative |

| 25,831 |

| 39,799 |

Stock-based compensation |

| 5,038 |

| 5,910 |

Legal and transaction related costs |

| 195 |

| 3,743 |

Amortization of intangibles |

| 23 |

| 24 |

Restructuring and abandonment costs |

| - |

| 132 |

Non-GAAP General and Administrative |

| $ 20,575 |

| $ 29,990 |

|

|

|

|

|

GAAP Operating Expenses |

| $ 193,313 |

| $ 202,984 |

Stock-based compensation |

| 23,985 |

| 18,704 |

Legal and transaction related costs |

| 195 |

| 3,743 |

Amortization of intangibles |

| 201 |

| 520 |

Restructuring and abandonment costs |

| (60) |

| 568 |

Non-GAAP Operating Expenses |

| $ 168,992 |

| $ 179,449 |

|

|

|

|

|

GAAP Operating Income |

| $ 48,093 |

| $ 79,695 |

Stock-based compensation |

| 25,334 |

| 19,358 |

Legal and transaction related costs |

| 195 |

| 3,743 |

Amortization of intangibles |

| 3,531 |

| 1,492 |

Restructuring and abandonment costs |

| (60) |

| 568 |

Non-GAAP Operating Income |

| $ 77,093 |

| $ 104,856 |

Depreciation |

| 14,080 |

| 10,386 |

Adjusted EBITDA (Non-GAAP) |

| $ 91,173 |

| $ 115,242 |

| | | | | | | | | | | | | | |

Reconciliation of Net Income to Adjusted EBITDA |

(unaudited, dollars in thousands except percentages) |

|

| Three Months Ended |

|

| December 28, 2024 |

| December 30, 2023 |

(In thousands, except percentages) |

|

|

|

|

Net income |

| $ 50,237 |

| $ 80,947 |

Add (deduct): |

|

|

|

|

Depreciation and amortization |

| 17,611 |

| 11,878 |

Stock-based compensation expense |

| 25,334 |

| 19,358 |

Interest income |

| (1,861) |

| (3,075) |

Interest expense |

| 110 |

| 105 |

Other expense (income), net |

| 6,029 |

| (10,274) |

(Benefit from) provision for income taxes |

| (6,422) |

| 11,992 |

Legal and transaction related costs (1) |

| 195 |

| 3,743 |

Restructuring and abandonment costs (2) |

| (60) |

| 568 |

Adjusted EBITDA |

| $ 91,173 |

| $ 115,242 |

Revenue |

| $ 550,857 |

| $ 612,869 |

Net income margin |

| 9.1% |

| 13.2% |

Adjusted EBITDA margin |

| 16.6% |

| 18.8% |

(1) Legal and transaction-related costs consist of expenses related to our intellectual property ("IP") litigation against Alphabet and Google, as well as legal and transaction costs associated with our acquisition activity, which we do not consider representative of our underlying operating performance. |

(2) On August 14, 2024, we initiated a restructuring plan to reduce our cost base involving approximately 6% of our employees (the "2024 restructuring plan"). Substantially all restructuring related costs were incurred in the fourth quarter of fiscal 2024. In the first quarter of fiscal 2025, we recorded a gain resulting from the impact of remaining restructuring costs that were lower than our estimated liability. The gain was recognized as a credit in research and development expenses on the condensed consolidated statements of operations and comprehensive income. For fiscal 2024, restructuring and abandonment costs also include nominal remaining costs incurred related to the restructuring plan incurred on June 14, 2023. |

| | | | | | | | | | | | | | |

Reconciliation of GAAP Net Income to Non-GAAP Net Income |

(unaudited, in thousands, except share and per share amounts) |

|

| Three Months Ended |

|

| December 28, 2024 |

| December 30, 2023 |

Reconciliation of GAAP net income |

|

|

|

|

GAAP net income |

| $ 50,237 |

| $ 80,947 |

Stock-based compensation expense |

| 25,334 |

| 19,358 |

Legal and transaction related costs |

| 195 |

| 3,743 |

Amortization of intangibles |

| 3,531 |

| 1,492 |

Restructuring and abandonment costs |

| (60) |

| 568 |

Non-GAAP net income |

| $ 79,237 |

| $ 106,108 |

|

|

|

|

|

| | | | | | | | | | | | | | |

Net income per share |

|

|

|

|

GAAP net income per share, diluted |

| $ 0.40 |

| $ 0.64 |

Non-GAAP net income per share, diluted |

| $ 0.64 |

| $ 0.84 |

|

|

|

|

|

Shares used to calculate net income per share |

|

|

|

|

Weighted-average shares GAAP, diluted |

| 124,731,619 |

| 126,742,153 |

Weighted-average shares non-GAAP, diluted |

| 124,731,619 |

| 126,742,153 |

| | | | | | | | | | | | | | |

Reconciliation of Cash Flows Provided by Operating Activities to Free Cash Flow |

(unaudited, dollars in thousands) |

|

| Three Months Ended |

|

| December 28, 2024 |

| December 30, 2023 |

Cash flows provided by operating activities |

| $ 156,173 |

| $ 275,401 |

Less: Purchases of property and equipment |

| (13,106) |

| (6,077) |

Free cash flow |

| $ 143,067 |

| $ 269,324 |

| | | | | | | | | | | | | | |

Revenue by Product Category |

(unaudited, dollars in thousands) |

|

| Three Months Ended |

|

| December 28, 2024 |

| December 30, 2023 |

(In thousands) |

|

|

|

|

Sonos speakers |

| $ 467,142 |

| $ 503,011 |

Sonos system products |

| 60,274 |

| 84,562 |

Partner products and other revenue |

| 23,441 |

| 25,296 |

Total revenue |

| $ 550,857 |

| $ 612,869 |

| | | | | | | | | | | | | | |

Revenue by Geographical Region |

(unaudited, dollars in thousands) |

|

| Three Months Ended |

|

| December 28, 2024 |

| December 30, 2023 |

Americas |

| $ 324,583 |

| $ 392,439 |

Europe, Middle East and Africa |

| 197,612 |

| 191,817 |

Asia Pacific |

| 28,662 |

| 28,613 |

Total revenue |

| $ 550,857 |

| $ 612,869 |

| | | | | | | | | | | | | | |

Stock-based Compensation |

(unaudited, dollars in thousands) |

|

| Three Months Ended |

|

| December 28, 2024 |

| December 30, 2023 |

(In thousands) |

|

|

|

|

Cost of revenue |

| $ 1,349 |

| $ 654 |

Research and development |

| 13,315 |

| 8,979 |

Sales and marketing |

| 5,632 |

| 3,815 |

General and administrative |

| 5,038 |

| 5,910 |

Total stock-based compensation expense |

| $ 25,334 |

| $ 19,358 |

| | | | | | | | | | | | | | |

Amortization of Intangibles |

(unaudited, dollars in thousands) |

|

| Three Months Ended |

|

| December 28, 2024 |

| December 30, 2023 |

Cost of revenue |

| $ 3,330 |

| $ 972 |

Research and development |

| 178 |

| 496 |

Sales and marketing |

| - |

| - |

General and administrative |

| 23 |

| 24 |

Total amortization of intangibles |

| $ 3,531 |

| $ 1,492 |

Use of Non-GAAP Measures

We have provided in this press release financial information that has not been prepared in accordance with generally accepted accounting principles (“U.S. GAAP”), including adjusted EBITDA, adjusted EBITDA margin, free cash flow, non-GAAP gross margin, net income excluding stock-based compensation, legal and transaction related fees, amortization of intangibles, and restructuring and abandonment costs and diluted earnings per share excluding stock-based compensation, legal and transaction related fees, amortization of intangibles and restructuring and abandonment costs. These non-GAAP financial measures are not based on any standardized methodology prescribed by U.S. GAAP and are not necessarily comparable to similarly titled measures presented by other companies. We use these non-GAAP financial measures to evaluate our operating performance and trends and make planning decisions. We believe that these non-GAAP financial measures help identify underlying trends in our business that could otherwise be masked by the effect of the expenses and other items that we exclude in these non-GAAP financial measures. Accordingly, we believe that these non-GAAP financial measures provide useful information to investors and others in understanding and evaluating our operating results, enhancing the overall understanding of our past performance and future prospects and allowing for greater transparency with respect to a key financial metric used by our management in its financial and

operational decision-making. Non-GAAP financial measures should not be considered in isolation of, or as an alternative to, measures prepared in accordance with U.S. GAAP. Investors are encouraged to review the reconciliation of these financial measures to their nearest U.S. GAAP financial equivalents provided in the financial statement tables above. We define Adjusted EBITDA as net income adjusted to exclude the impact of depreciation and amortization, stock-based compensation expense, interest income, interest expense, other income, income taxes, restructuring and abandonment costs, legal and transaction related fees and other items that we do not consider representative of our underlying operating performance. We define Adjusted EBITDA margin as Adjusted EBITDA divided by revenue. We define free cash flow as net cash from operations less purchases of property and equipment. We define non-GAAP gross margin as GAAP gross margin, excluding stock-based compensation and amortization of intangible assets. We calculate non-GAAP net income excluding stock-based compensation, legal and transaction related fees, amortization of intangibles and restructuring and abandonment costs as net income less stock-based compensation, legal and transaction related fees, amortization of intangibles and restructuring and abandonment costs. We calculate non-GAAP diluted earnings per share excluding stock-based compensation, legal and transaction related fees, amortization of intangibles and restructuring and abandonment costs as net income less stock-based compensation, legal and transaction related fees, amortization of intangibles and restructuring and abandonment costs divided by our number of shares at fiscal year end. We do not provide a reconciliation of forward-looking non-GAAP financial measures to their comparable GAAP financial measures because we cannot do so without unreasonable effort due to unavailability of information needed to calculate reconciling items and due to the variability, complexity and limited visibility of the adjusting items that would be excluded from the non-GAAP financial measures in future periods. When planning, forecasting and analyzing future periods, we do so primarily on a non-GAAP basis without preparing a GAAP analysis as that would require estimates for items such as stock-based compensation, which is inherently difficult to predict with reasonable accuracy. Stock-based compensation expense is difficult to estimate because it depends on our future hiring and retention needs, as well as the future fair market value of our common stock, all of which are difficult to predict and subject to constant change. In addition, for purposes of setting annual guidance, it would be difficult to quantify stock-based compensation expense for the year with reasonable accuracy in the current quarter. As a result, we do not believe that a GAAP reconciliation would provide meaningful supplemental information about our outlook.

Forward Looking Statements

This press release contains forward-looking statements that involve risks and uncertainties. These forward-looking statements include statements regarding our long-term outlook, financial, growth and business strategies and opportunities, our product roadmap, market growth and our market share, our ability to expand our footprint with existing customers, our operating model and cost structure, our expectations with respect to restructuring and related charges and the timing and amounts of such charges, and other factors affecting variability in our financial results. These forward-looking statements are only predictions and may differ materially from actual results due to a variety of factors, including, but not limited to: difficulties in and effect of implementing improvements to our operating model and cost structure; the risk that restructuring and related charges may be greater than anticipated or not occur in the expected time frame; local law requirements in various jurisdictions regarding elimination of positions; our ability to accurately forecast product demand and effectively forecast and manage owned and channel inventory levels; our ability to introduce software updates to our new app on a timely basis and otherwise deliver on our action plan to address issues caused by our new app and related customer commitments; our ability to maintain, enhance and protect our brand image; the impact of global economic, market and political events, including continued inflationary pressures, high interest rates and, in certain markets, foreign currency exchange rate fluctuations; changes in consumer income and overall consumer spending as a result of economic or political uncertainty or conditions; changes in consumer spending patterns; our ability to successfully introduce new products and services and maintain or expand the success of our existing products; the success of our efforts to expand our direct-to-consumer channel; the success of our financial, growth and business strategies; our ability to compete in the market and maintain or expand

market share; our ability to maintain relationships with our channel, distribution and technology partners; our ability to meet product demand and manage any product availability delays; supply chain challenges, including shipping and logistics challenges and component supply-related challenges; our ability to protect our brand and intellectual property; our use of artificial intelligence; and the other risk factors identified in our filings with the Securities and Exchange Commission (the “SEC”), including our most recent Annual Report on Form 10-K and subsequent filings. Copies of our SEC filings are available free of charge at the SEC’s website at www.sec.gov, on our investor relations website at https://investors.sonos.com/reports-and-filings/default.aspx or upon request from our investor relations department. All forward-looking statements herein reflect our opinions only as of the date of this press release, and we undertake no obligation, and expressly disclaim any obligation, to update forward-looking statements herein in light of new information or future events. Sonos and Sonos product names are trademarks or registered trademarks of Sonos, Inc. All other product names and services may be trademarks or service marks of their respective owners.

About Sonos

Sonos (Nasdaq: SONO) is one of the world’s leading sound experience brands. As the inventor of multi-room wireless home audio, Sonos’ innovation helps the world listen better by giving people access to the content they love and allowing them to control it however they choose. Known for delivering an unparalleled sound experience, thoughtful home design aesthetic, simplicity of use and an open platform, Sonos makes the breadth of audio content available to anyone. Sonos is headquartered in Santa Barbara, California. Learn more at www.sonos.com.

Investor Contact

James Baglanis

IR@sonos.com

Press Contact

Erin Pategas

PR@sonos.com

Source: Sonos

v3.25.0.1

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

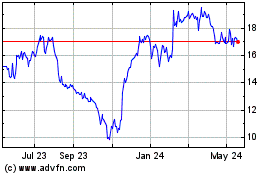

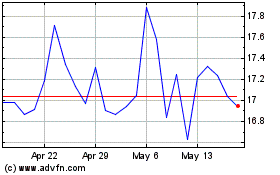

Sonos (NASDAQ:SONO)

Historical Stock Chart

From Jan 2025 to Feb 2025

Sonos (NASDAQ:SONO)

Historical Stock Chart

From Feb 2024 to Feb 2025