Statement of Changes in Beneficial Ownership (4)

April 28 2020 - 4:09PM

Edgar (US Regulatory)

FORM 4

[ ]

Check this box if no longer subject to Section 16. Form 4 or Form 5 obligations may continue. See Instruction 1(b).

UNITED STATES SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

STATEMENT OF CHANGES IN BENEFICIAL OWNERSHIP OF SECURITIES

|

OMB APPROVAL

OMB Number:

3235-0287

Estimated average burden

hours per response...

0.5

|

|

Filed pursuant to Section 16(a) of the Securities Exchange Act of 1934 or Section 30(h) of the Investment Company Act of 1940

|

|

|

1. Name and Address of Reporting Person

*

Oaktree Huntington Investment Fund II, L.P. |

2. Issuer Name and Ticker or Trading Symbol

SunOpta Inc.

[

STKL

]

|

5. Relationship of Reporting Person(s) to Issuer

(Check all applicable)

_____ Director __X__ 10% Owner

_____ Officer (give title below) _____ Other (specify below)

|

|

(Last)

(First)

(Middle)

C/O OAKTREE CAPITAL MANAGEMENT, L.P., 333 SOUTH GRAND AVENUE, 28TH FLOOR |

3. Date of Earliest Transaction

(MM/DD/YYYY)

4/24/2020 |

|

(Street)

LOS ANGELES, CA 90071

(City)

(State)

(Zip)

|

4. If Amendment, Date Original Filed

(MM/DD/YYYY)

|

6. Individual or Joint/Group Filing

(Check Applicable Line)

___ Form filed by One Reporting Person

_

X

_ Form filed by More than One Reporting Person

|

Table I - Non-Derivative Securities Acquired, Disposed of, or Beneficially Owned

|

1.Title of Security

(Instr. 3)

|

2. Trans. Date

|

2A. Deemed Execution Date, if any

|

3. Trans. Code

(Instr. 8)

|

4. Securities Acquired (A) or Disposed of (D)

(Instr. 3, 4 and 5)

|

5. Amount of Securities Beneficially Owned Following Reported Transaction(s)

(Instr. 3 and 4)

|

6. Ownership Form: Direct (D) or Indirect (I) (Instr. 4)

|

7. Nature of Indirect Beneficial Ownership (Instr. 4)

|

|

Code

|

V

|

Amount

|

(A) or (D)

|

Price

|

| Special Shares, Series 2 (1) | 4/24/2020 | | J(1) | | 0 | A | $0.00 | 0 | D (1) | |

Table II - Derivative Securities Beneficially Owned (e.g., puts, calls, warrants, options, convertible securities)

|

1. Title of Derivate Security

(Instr. 3) | 2. Conversion or Exercise Price of Derivative Security | 3. Trans. Date | 3A. Deemed Execution Date, if any | 4. Trans. Code

(Instr. 8) | 5. Number of Derivative Securities Acquired (A) or Disposed of (D)

(Instr. 3, 4 and 5) | 6. Date Exercisable and Expiration Date | 7. Title and Amount of Securities Underlying Derivative Security

(Instr. 3 and 4) | 8. Price of Derivative Security

(Instr. 5) | 9. Number of derivative Securities Beneficially Owned Following Reported Transaction(s) (Instr. 4) | 10. Ownership Form of Derivative Security: Direct (D) or Indirect (I) (Instr. 4) | 11. Nature of Indirect Beneficial Ownership (Instr. 4) |

| Code | V | (A) | (D) | Date Exercisable | Expiration Date | Title | Amount or Number of Shares |

| Series B-1 Preferred Stock | (5) | 4/24/2020 | | P | | 2461.48 | | (5) | (5) | Common Shares | 984592 (6) | $1000.00 | 2461.48 (5) | D (2)(3)(4) | |

| Explanation of Responses: |

| (1) | Represents up to 6,000,0000 Special Shares, Series 2 (the "Special Voting Shares") that, subject to certain caps (the "Voting Trust Caps") as provided in the Voting Trust Agreement (as defined below), may be issued and deposited with OCM SunOpta Trustee LLC, an affiliate of the Reporting Persons (as defined below), as trustee (the "Trustee") for and on behalf of Oaktree Huntington Investment Fund II, L.P. ("OHIF") and other holders of Preferred Shares (as defined below) of SunOpta Foods Inc. (the "Subsidiary") from time to time pursuant to a voting trust agreement dated April 24, 2020 (the "Voting Trust Agreement"), among SunOpta Inc. (the "Company"), the Subsidiary, OHIF, Oaktree Organics, L.P. and the Trustee. The Special Shares serve as the mechanism for attaching exchanged voting to the Preferred Shares. As a result of the Voting Trust Caps, no Special Voting Shares have been issued to the Reporting Persons (as defined below). |

| (2) | OHIF directly owns the securities reported herein. This Form 4 is also being filed by (i) Oaktree Huntington Investment Fund II GP, L.P. ("OHIF GP") (ii) Oaktree Fund GP, LLC ("Fund GP") in its capacity as general partner of OHIF GP (iii) Oaktree Fund GP I, L.P. ("GP I") in its capacity as managing member of Fund GP; (iv) Oaktree Capital I, L.P. ("Capital I") in its capacity as the general partner of GP I; (v) OCM Holdings I, LLC ("Holdings I") in its capacity as the general partner of Capital I; (vi) Oaktree Holdings, LLC ("Holdings LLC") in its capacity as the managing member of Holdings I;. (vii) Oaktree Capital Group, LLC ("OCG") in its capacity as the managing member of Holdings LLC; |

| (3) | (Continued from footnote 2) (viii) Oaktree Capital Group Holdings GP, LLC ("OCGH GP") in its capacity as the duly appointed manager of OCG; (ix) Brookfield Asset Management, Inc. ("BAM") in its capacity as the indirect owner of the class A units of OCG and (x) Partners Limited, in its capacity as the sole owner of Class B Limited Voting Shares of BAM (each a "Reporting Person" and, collectively, the "Reporting Persons"). |

| (4) | Each Reporting Person disclaims beneficial ownership of all equity securities reported herein except to the extent of its respective pecuniary interest therein, and the filing of this Form 4 shall not be construed as an admission that any such Reporting Person is the beneficial owner of any equity securities covered by this Form 4. |

| (5) | Shares of the Series B-1 Preferred Stock of the Subsidiary (the "Preferred Shares") may be exchanged at any time into the number of Common Shares of the Company, subject to certain restrictions including those set forth in Note (6) below, equal to, per Preferred Share, the quotient of the liquidation preference of the Preferred Share divided by $2.50 (the "Exchange Price"), subject to customary anti-dilution adjustments, provided that the Exchange Price may not be lower than $2.00 (subject to adjustment in certain circumstances). The Preferred Shares have no expiration date. |

| (6) | The number of Common Shares reported herein represents the number of Common Shares that would be issuable upon the exchange of all of the 2,461.48 Preferred Shares held by OHIF without giving effect to the Exchange Caps and the Rights Plan Exchange Cap (each as defined in the Subsidiary's Second Amended and Restated Certificate of Incorporation). The Exchange Caps and the Rights Plan Exchange Cap limit the number Common Shares that are exchangeable by the Reporting Persons for the Preferred Shares. |

Reporting Owners

|

| Reporting Owner Name / Address | Relationships |

| Director | 10% Owner | Officer | Other |

Oaktree Huntington Investment Fund II, L.P.

C/O OAKTREE CAPITAL MANAGEMENT, L.P.

333 SOUTH GRAND AVENUE, 28TH FLOOR

LOS ANGELES, CA 90071 |

| X |

|

|

Oaktree Huntington Investment Fund II GP, L.P.

C/O OAKTREE CAPITAL MANAGEMENT, L.P.

333 SOUTH GRAND AVENUE, 28TH FLOOR

LOS ANGELES, CA 90071 |

| X |

|

|

Oaktree Fund GP, LLC

C/O OAKTREE CAPITAL MANAGEMENT, L.P.

333 SOUTH GRAND AVENUE, 28TH FLOOR

LOS ANGELES, CA 90071 |

| X |

|

|

OAKTREE FUND GP I, L.P.

C/O OAKTREE CAPITAL MANAGEMENT, L.P.

333 SOUTH GRAND AVENUE, 28TH FLOOR

LOS ANGELES, CA 90071 |

| X |

|

|

Oaktree Capital I, L.P.

C/O OAKTREE CAPITAL MANAGEMENT, L.P.

333 SOUTH GRAND AVENUE, 28TH FLOOR

LOS ANGELES, CA 90071 |

| X |

|

|

OCM HOLDINGS I, LLC

C/O OAKTREE CAPITAL MANAGEMENT, L.P.

333 SOUTH GRAND AVENUE, 28TH FLOOR

LOS ANGELES, CA 90071 |

| X |

|

|

OAKTREE HOLDINGS, LLC

C/O OAKTREE CAPITAL MANAGEMENT, L.P.

333 SOUTH GRAND AVENUE, 28TH FLOOR

LOS ANGELES, CA 90071 |

| X |

|

|

Oaktree Capital Group, LLC

C/O OAKTREE CAPITAL MANAGEMENT, L.P.

333 SOUTH GRAND AVENUE, 28TH FLOOR

LOS ANGELES, CA 90071 |

| X |

|

|

Oaktree Capital Group Holdings GP, LLC

C/O OAKTREE CAPITAL MANAGEMENT, L.P.

333 SOUTH GRAND AVENUE, 28TH FLOOR

LOS ANGELES, CA 90071 |

| X |

|

|

BROOKFIELD ASSET MANAGEMENT INC.

C/O OAKTREE CAPITAL MANAGEMENT, L.P.

333 SOUTH GRAND AVENUE, 28TH FLOOR

LOS ANGELES, CA 90071 |

| X |

|

|

Signatures

|

| OAKTREE HUNTINGTON INVESTMENT FUND II, LP. By: OAKTREE HUNTINGTON INVESTMENT FUND II GP, L.P. Its: GP, By: OAKTREE FUND GP, LLC, its GP, By: Oaktree Fund GP I, L.P. Its: Managing Member, By: /s/ Ting He, Authorized Signatory | | 4/28/2020 |

| **Signature of Reporting Person | Date |

| OAKTREE HUNTINGTON INVESTMENT FUND II GP, L.P. Its: GP, By: OAKTREE FUND GP, LLC, its GP, By: Oaktree Fund GP I, L.P. Its: Managing Member, By: /s/ Ting He, Authorized Signatory | | 4/28/2020 |

| **Signature of Reporting Person | Date |

| OAKTREE FUND GP, LLC By: Oaktree Fund GP I, L.P. Its: Managing Member By: /s/ Ting He, Authorized Signatory | | 4/28/2020 |

| **Signature of Reporting Person | Date |

| OAKTREE FUND GP I, L.P. By: /s/ Ting He, Authorized Signatory | | 4/28/2020 |

| **Signature of Reporting Person | Date |

| OAKTREE CAPITAL I, L.P. By: /s/ Ting He, Vice President | | 4/28/2020 |

| **Signature of Reporting Person | Date |

| OCM HOLDINGS I, LLC By: /s/ Ting He, Vice President | | 4/28/2020 |

| **Signature of Reporting Person | Date |

| OAKTREE HOLDINGS, LLC By: /s/ Ting He, Vice President | | 4/28/2020 |

| **Signature of Reporting Person | Date |

| OAKTREE CAPITAL GROUP, LLC By: Oaktree Capital Group Holdings GP, LLC Its: Manager By: /s/ Ting He, Vice President | | 4/28/2020 |

| **Signature of Reporting Person | Date |

| OAKTREE CAPITAL GROUP HOLDINGS GP, LLC By: /s/ Ting He, Vice President | | 4/28/2020 |

| **Signature of Reporting Person | Date |

| BROOKFIELD ASSET MANAGEMENT INC. By: /s/ Jessica Diab, Vice President, Legal & Regulatory | | 4/28/2020 |

| **Signature of Reporting Person | Date |

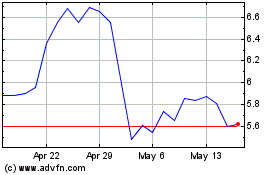

SunOpta (NASDAQ:STKL)

Historical Stock Chart

From Jun 2024 to Jul 2024

SunOpta (NASDAQ:STKL)

Historical Stock Chart

From Jul 2023 to Jul 2024