- Generated cash from operations of $11.3 million

- Reduced pre-production costs, primarily customer tooling, by

$6.9 million

- Grew revenue 2.7% year-over-year, reflecting ongoing pricing

benefit and higher overall sales

- Achieved gross margin of 13.6% versus 13.8% in prior-year

period (which included a 470 bps net benefit of one-time

pricing)

- Rethinking product portfolio and identifying opportunities to

optimize operational footprint and improve profitability

STRATTEC SECURITY CORPORATION (Nasdaq: STRT) (“Company”), a

leading provider of smart vehicle access, security and

authorization solutions for the global automotive industry,

reported financial results for its first quarter of fiscal year

2025, which ended September 29, 2024.

STRATTEC President and CEO Jennifer Slater said, “We delivered a

solid quarter through improved pricing, favorable mix, and by

providing innovative content on the right platforms. We are making

headway on rethinking the STRATTEC business model including the

evaluation of our product portfolio, determining an optimal

operating and cost structure and developing a strategy to

strengthen profitability and drive sustainability. We are in the

very early stages of the process as we delve further into the

operations to better understand the variability in performance of

the business and what needs to change to provide more consistent,

profitable results. We separately announced today the addition of a

chief people officer, a new role for this organization of over

3,300 people. We also appointed a new chief commercial officer who

brings a breadth of experience that incorporates the depth of

knowledge required to grow revenue profitably. We expect to

leverage the deep relationships we have with our customers and

provide high quality, timely and value-added solutions for our

mutual success.”

FY 2025 First Quarter Net

Sales

(compared with prior-year period, except where otherwise

noted)

Three Months Ended

Change

($ in thousands)

9/29/2024

10/1/2023

$

%

Adjusted Net Sales Attributable to

STRATTEC

$

139,052

$

127,406

$

11,646

9.1

%

One-time retroactive pricing

-

8,000

(8,000

)

-100.0

%

Net Sales Attributable to

STRATTEC

$

139,052

$

135,406

$

3,646

2.7

%

See Reconciliation of Net Sales

Attributable to STRATTEC and Adjusted Net Sales Attributable to

STRATTEC on Page 8

Net sales attributable to STRATTEC were $139.1 million, which

included $2.2 million of ongoing price increases to major customers

made subsequent to last year’s first quarter. This compares with

net sales of $135.4 million in fiscal first quarter 2024, which

included $8.0 million in one-time retroactive price increases.

Excluding that one-time pricing impact, adjusted net sales

attributable to STRATTEC1 increased by $11.6 million, or 9.1%.

After taking into account the impact of ongoing price increases,

the following summarizes noted changes to sales:

- Sales to Hyundai/Kia increased due to timing of customer demand

for power door products

- Sales to Ford Motor Company grew from new tailgate latch

content on the Ford F-Series pickups

- Sales to Commercial and Other OEM customers grew from new

business with Aston Martin

- Sales to Stellantis declined primarily due to inventory

destocking and lower production volumes

FY 2025 First Quarter Operation

Review

(compared with prior-year period, except where otherwise

noted)

Gross profit increased $0.2 million to $18.9 million. Gross

margin was 13.6% compared with 13.8% in prior-year period (which

included a 470 basis point benefit from one-time pricing).

Adjusted gross profit1 and adjusted gross margin1 improved as a

result of favorable sales mix and change in foreign exchange (“FX”)

rate of $2.7 million, improved pricing of $2.2 million, and $1.3

million reduction in raw material and purchased component costs.

The favorable change in FX provided a 190 basis point benefit to

gross margin between quarterly periods. These benefits more than

offset unfavorable impacts of $1.4 million in higher Mexico

manufacturing costs, $0.7 million of accrual for short-term

incentive bonus plans and $0.4 million of expedited shipping

costs.

($ in thousands)

Three Months Ended

9/29/2024

10/1/2023

Gross profit

$

18,921

$

18,720

Add back (deduct):

Retroactive pricing

-

(7,100

)

Adjusted Gross Profit1

$

18,921

$

11,620

Net sales

$

139,052

$

135,406

Adjusted Net Sales

$

139,052

$

127,406

Gross margin

13.6

%

13.8

%

Adjusted Gross Margin

13.6

%

9.1

%

See Reconciliation of Net Sales, Gross

Profit and Gross Margin to non-GAAP Adjusted Net Sales, Adjusted

Gross Profit and Adjusted Gross Margin on Page 8

Engineering, selling and administrative expenses increased $1.2

million, or 9.9%, to $13.9 million primarily due to increased

accrual for short-term incentive plan compensation and

organizational investments. As a result, operating income decreased

$1.0 million to $5.1 million compared with the prior-year period.

Last year’s first quarter benefited by

$7.1 million for the one-time pricing impact.

Net income attributable to STRATTEC was $3.7 million compared

with $4.2 million last year. Diluted earnings per share were $0.92

compared with $1.05 last year. Adjusted net income attributable to

STRATTEC1 was $3.7 million compared with a loss of $0.6 million in

last fiscal year’s first quarter. Adjusted diluted earnings per

share was $0.92 compared with a loss of $0.14 in the prior-year

period.

1 Adjusted net sales, adjusted gross

profit, adjusted gross margin, adjusted net income attributable to

STRATTEC and adjusted diluted earnings per share are non-GAAP

financial measure. Further information can be found under “Non-GAAP

Financial Measures” and the reconciliations of GAAP financial

measures to non-GAAP financial measures that accompany this press

release.

Balance Sheet and

Liquidity

First quarter fiscal 2025 cash flow from operations was $11.3

million, compared with operating cash used in operations of $3.9

million in the prior year first quarter, primarily reflecting a

reduction in working capital between periods. Capital expenditures

in the first quarter of fiscal 2025 were $2.1 million, compared

with $2.9 million for the first quarter of fiscal 2024.

At September 29, 2024, STRATTEC had $34.4 million in cash and

cash equivalents, compared with $25.4 million at June 30, 2024.

Pre-production costs, which are primarily related to customer

tooling, declined $6.9 million. The Company’s objective is to

return the customer tooling balance to approximately $10 million by

the end of the fiscal year.

The Company’s 51% joint venture subsidiary ADAC-STRATTEC LLC had

$13.0 million in debt, unchanged from the end of fiscal 2024.

STRATTEC had $40 million and ADAC-STRATTEC LLC had $7 million in

borrowing capacity as of September 29, 2024.

Webcast and Conference

Call

The Company will host a conference call and webcast today to

review the financial and operating results for the period ended

September 29, 2024. A question-and-answer session will follow.

First Quarter Fiscal Year 2025

Conference Call

Date:

Monday, November 4, 2024

Time:

4:45 p.m. Eastern Time

Phone:

(201) 689-8470

Webcast and accompanying slide

presentation: investors.strattec.com

A telephonic replay will be available from 8:00 p.m. ET on the

day of the call through Monday, November 18, 2024. To listen to the

archived call, dial (412) 317-6671 and enter replay PIN 13749209.

The webcast replay will be available on the Investor Relations

section of the Company’s website investors.strattec.com, where a

transcript will be posted once available.

About STRATTEC

STRATTEC is a leading global provider of advanced automotive

access, security & authorization and select user interface

solutions. With a history spanning over 110 years, STRATTEC has

consistently been at the forefront of innovation in vehicle

security, transitioning from mechanical to integrated

electro-mechanical systems. The Company serves a broad range of

customers, including leading automotive OEMs, offering power access

solutions and advanced security systems that include door handles,

lift gates, latches, and key fobs.

For more information on STRATTEC and its solutions, visit

www.strattec.com.

Safe Harbor Statement

Certain statements contained in this release contain

“forward-looking statements” within the meaning of the Private

Securities Litigation Reform Act of 1995. These statements may be

identified by the use of forward-looking words or phrases such as

“anticipate,” “believe,” “could,” “expect,” “intend,” “may,”

“planned,” “potential,” “should,” “will,” and “would.” Such

forward-looking statements are inherently subject to many

uncertainties in the Company’s operations and business environment.

These uncertainties include general economic conditions, in

particular, relating to the automotive industry, consumer demand

for the Company’s and its customers’ products, competitive and

technological developments, customer purchasing actions, changes in

warranty provisions and customer product recall policies, work

stoppages at the Company or at the location of its key customers as

a result of labor disputes, foreign currency fluctuations,

uncertainties stemming from U.S. trade policies, tariffs and

reactions to same from foreign countries, the volume and scope of

product returns, adverse business and operational issues resulting

from the continuing effects of the coronavirus (COVID-19) pandemic,

matters adversely impacting the timing and availability of

component parts and raw materials needed for the production of our

products and the products of our customers and fluctuations in our

costs of operation (including fluctuations in the cost of raw

materials). Shareholders, potential investors and other readers are

urged to consider these factors carefully in evaluating the

forward-looking statements and are cautioned not to place undue

reliance on such forward-looking statements. The forward-looking

statements made herein are only made as of the date of this press

release and the Company undertakes no obligation to publicly update

such forward-looking statements to reflect subsequent events or

circumstances occurring after the date of this release. In

addition, such uncertainties and other operational matters are

discussed further in the Company’s quarterly and annual filings

with the Securities and Exchange Commission.

Use of Non-GAAP Financial Metrics and Additional Financial

Information

In addition to reporting financial results in accordance with

generally accepted accounting principles, or GAAP, STRATTEC

provides Adjusted Non-GAAP information as additional information

for its operating results. References to Adjusted Non-GAAP

information are to non-GAAP financial measures. These measures are

not required by, in accordance with, or an alternative for, GAAP

and may be different from non-GAAP financial measures used by other

companies. STRATTEC’s management uses these measures for reviewing

the financial results of STRATTEC for budget planning purposes and

for making operational and financial decisions. Management believes

that providing these non-GAAP financial measures to investors, as a

supplement to GAAP financial measures, help investors evaluate

STRATTEC’s core operating and financial performance and business

trends consistent with how management evaluates such performance

and trends.

FINANCIAL TABLES FOLLOW

STRATTEC SECURITY

CORPORATION

Condensed Results of

Operations

(In thousands, except per share

amounts)

(Unaudited)

Three Months Ended

September 29, 2024

October 1, 2023

Net sales

$

139,052

$

135,406

Cost of goods sold

120,131

116,686

Gross profit

18,921

18,720

Engineering, selling and administrative

expenses

13,858

12,614

Income from operations

5,063

6,106

Equity loss from joint ventures

—

(265

)

Interest expense

(295

)

(220

)

Investment income

349

87

Other income, net

129

134

Income before provision for income taxes

and non-controlling interest

5,246

5,842

Provision for income taxes

1,498

1,387

Net income.

3,748

4,455

Net income attributable to non-controlling

interest

45

290

Net income attributable to STRATTEC

SECURITY CORPORATION

$

3,703

$

4,165

Earnings per share attributable to

STRATTEC SECURITY CORPORATION:

Basic

$

0.92

$

1.05

Diluted

$

0.92

$

1.05

Weighted Average shares outstanding:

Basic

4,005

3,948

Diluted

4,046

3,974

STRATTEC SECURITY

CORPORATION

Condensed Balance Sheet

Data

(In thousands, except share

amounts)

(Unaudited)

September 29, 2024

June 30, 2024

ASSETS

Current Assets:

Cash and cash equivalents

$

34,403

$

25,410

Receivables, net

102,266

99,297

Inventories:

Finished products

18,540

19,833

Work in process

15,520

15,461

Purchased materials

49,734

46,355

Inventories, net

83,794

81,649

Pre-production costs

15,265

22,173

Value-added tax recoverable

20,624

19,684

Other current assets

4,396

5,601

Total current assets.

260,748

253,814

Deferred income taxes

17,235

17,593

Other long-term assets

6,363

6,698

Net property, plant and equipment

82,521

86,184

$

366,867

$

364,289

LIABILITIES AND SHAREHOLDERS’

EQUITY

Current Liabilities:

Accounts payable

$

59,461

$

54,911

Accrued Liabilities:

Payroll and benefits

25,421

28,953

Value-added tax payable

10,982

9,970

Environmental

1,390

1,390

Warranty

10,698

10,695

Other

11,619

12,369

Total current liabilities

119,571

118,288

Borrowings under credit facilities –

long-term

13,000

13,000

Accrued pension obligations

1,417

1,379

Accrued postretirement obligations

1,041

1,050

Other long-term liabilities

4,778

4,957

Shareholders’ Equity:

Common stock, authorized 18,000,000

shares, $.01 par value, 7,624,120 issued shares at September 29,

2024 and 7,586,920 issued shares at June 30, 2024

76

76

Capital in excess of par value

101,218

101,024

Retained earnings

254,315

250,612

Accumulated other comprehensive loss

(17,104

)

(15,689

)

Less: treasury stock, at cost (3,597,715

shares at September 29, 2024 and 3,589,126 shares at June 30,

2024)

(135,471

)

(135,478

)

Total STRATTEC SECURITY CORPORATION

shareholders’ equity

203,034

200,545

Non-controlling interest

24,026

25,070

Total shareholders’ equity

227,060

225,615

$

366,867

$

364,289

STRATTEC SECURITY

CORPORATION

Condensed Cash Flow Statement

Data

(In Thousands)

(Unaudited)

Three Months Ended

September 29, 2024

October 1, 2023

CASH FLOWS FROM OPERATING

ACTIVITIES:

Net income

$

3,748

$

4,455

Adjustments to reconcile net income to net

cash provided by (used in) operating activities:

Depreciation

3,662

4,385

Foreign currency transaction gain

(1,005

)

(226

)

Unrealized loss on peso forward

contracts

652

—

Stock-based compensation expense

188

505

Equity loss of joint ventures.

—

265

Loss on settlement of pension

obligation

283

—

Change in operating assets and

liabilities:

Receivables

(3,189

)

2,333

Inventories

(2,145

)

(3,770

)

Other assets

5,881

(7,665

)

Accounts payable and accrued

liabilities

2,998

(4,054

)

Other, net

264

(100

)

Net cash provided by (used in)

operating activities

11,337

(3,872

)

CASH FLOWS FROM INVESTING

ACTIVITIES:

Proceeds from sale of interest in joint

ventures.

—

2,000

Purchase of property, plant and

equipment

(2,073

)

(2,920

)

Net cash used in investing

activities

(2,073

)

(920

)

CASH FLOWS FROM FINANCING

ACTIVITIES:

Borrowings under credit facilities

3,000

2,000

Repayment of borrowings under credit

facilities

(3,000

)

(2,000

)

Exercise of stock options and employee

stock purchases

13

17

Net cash provided by financing

activities

13

17

Foreign currency impact on cash

(284

)

(131

)

NET INCREASE (DECREASE) IN CASH AND

CASH EQUIVALENTS

8,993

(4,906

)

CASH AND CASH EQUIVALENTS

Beginning of period

25,410

20,571

End of period

$

34,403

$

15,665

SUPPLEMENTAL DISCLOSURE OF CASH FLOW

INFORMATION:

Cash paid during the period for:

Income taxes

$

4,081

$

764

Interest

$

280

$

218

Non-cash investing activities:

Change in capital expenditures in accounts

payable

$

(506

)

$

(193

)

STRATTEC SECURITY CORPORATION

NON-GAAP FINANCIAL MEASURES

The following information provides definitions and

reconciliations of the non-GAAP financial measures presented in

this earnings release to the most directly comparable financial

measures calculated and presented in accordance with generally

accepted accounting principles (GAAP). The Company has provided

this non-GAAP financial information, which is not calculated or

presented in accordance with GAAP, as information supplemental and

in addition to the financial measures presented in this earnings

release that are calculated and presented in accordance with GAAP.

Such non-GAAP financial measures should not be considered superior

to, as a substitute for or alternative to, and should be considered

in conjunction with, the GAAP financial measures presented in this

earnings release. Adjusted net sales, adjusted gross profit,

adjusted gross margin, adjusted net income attributable to STRATTEC

and adjusted diluted earnings per shares are not measures

determined in accordance with GAAP and may not be comparable with

net sales, adjusted gross profit, adjusted gross margin, adjusted

net income and adjusted diluted earnings per share as used by other

companies. Nevertheless, STRATTEC believes that providing these

non-GAAP financial measures are important for investors and other

readers of the Company’s financial statements and assists in

understanding the comparison of the current quarter’s financial

results to the historical periods' financial results.

Reconciliation of Net Sales to Adjusted

Net Sales

($ in thousands)

Three Months Ended

9/29/2024

10/1/2023

Net sales (GAAP)

$

139,052

$

135,406

One-time retroactive pricing from

customers

-

(8,000

)

Adjusted net sales

$

139,052

$

127,406

Reconciliation of Gross Profit to

Adjusted Gross Profit

($ in thousands)

Three Months Ended

9/29/2024

10/1/2023

Gross profit (GAAP)

$

18,921

$

18,720

One-time retroactive pricing from

customers

-

(8,000

)

One-time retroactive pricing to

suppliers

-

900

Adjusted gross profit

$

18,921

$

11,620

Reconciliation of Gross Margin to

Adjusted Gross Margin

Three Months Ended

9/29/2024

10/1/2023

Gross margin (GAAP)

13.6

%

13.8

%

One-time retroactive pricing from

customers

(5.4

)

One-time retroactive pricing to

suppliers

-

0.7

Adjusted gross margin

13.6

%

9.1

%

Reconciliation of Net Income

Attributable to STRATTEC to Adjusted Net Income Attributable to

STRATTEC

($ in thousands)

Three Months Ended

9/29/2024

10/1/2023

Net income attributable to STRATTEC

SECURITY CORPORATION (GAAP)

$

3,703

$

4,165

One-time retroactive pricing from

customers

-

(8,000

)

One-time retroactive pricing to

suppliers

-

900

Non-controlling interest impact of

retroactive pricing

-

1,014

Tax impact of retroactive pricing (1)

-

1,364

Adjusted net income attributable to

STRATTEC SECURITY CORPORATION

$

3,703

$

(557

)

Reconciliation of Diluted Earnings Per

Share to Adjusted Earnings Per Share

Three Months Ended

9/29/2024

10/1/2023

Diluted earnings per share (GAAP)

$

0.92

$

1.05

One-time retroactive pricing from

customers

-

(2.01

)

One-time retroactive pricing to

suppliers

-

0.23

Non-controlling interest impact of

retroactive pricing

-

0.26

Tax impact of retroactive pricing (1)

-

0.34

Adjusted diluted earnings per share

$

0.92

$

(0.14

)

(1) The tax impact is calculated using the

statutory tax rate for the impacted jurisdiction

Supplemental Information

Impact of Retroactive Pricing

in Fiscal Year 2024

($ in thousands)

One-time Pricing Impact to:

Q1 FY2024

Q2 FY2024

Q3 FY2024

Q4 FY2024

FY 2024

Net Sales

$

8,000

$

1,600

NM(1)

NM

$

9,700

Cost of Goods Sold(2)

(900

)

(910

)

-

-

(1,700

)

Gross Profit

$

7,100

$

690

NM

NM

$

8,000

Gross Margin Contribution

4.7

%

2.4

%

NM

NM

1.3

%

(1) Not meaningful

(2)After factoring in impact of supplier

one-time price increases

View source

version on businesswire.com: https://www.businesswire.com/news/home/20241104421525/en/

Investors: Deborah K. Pawlowski Alliance Advisors IR

Phone: 716-843-3908 Email: dpawlowski@allianceadvisors.com

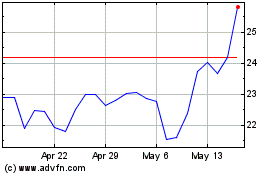

Strattec Security (NASDAQ:STRT)

Historical Stock Chart

From Feb 2025 to Mar 2025

Strattec Security (NASDAQ:STRT)

Historical Stock Chart

From Mar 2024 to Mar 2025