0001089907

false

0001089907

2023-08-09

2023-08-09

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM

8-K

CURRENT REPORT

Pursuant to Section

13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date

of Earliest Event Reported): August 9, 2023

SWK

HOLDINGS CORPORATION

(Exact Name of the

Registrant as Specified in Its Charter)

Delaware

(State or Other Jurisdiction

of Incorporation)

| 001-39184 |

77-0435679 |

| (Commission

File Number) |

(IRS

Employer Identification No.) |

| |

|

| 5956

Sherry Lane, Suite 650, Dallas, TX |

75225 |

| (Address

of Principal Executive Offices) |

(Zip

Code) |

(972) 687-7250

(Registrant’s

Telephone Number, Including Area Code)

Check

the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under

any of the following provisions:

| o |

Written

communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| o |

Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| o |

Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| o |

Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered

pursuant to Section 12(b) of the Act:

| Title

of each class |

Trading

Symbol(s) |

Name

of each exchange on

which

registered |

Common

Stock, par value

$0.001 per

share |

SWKH |

The

Nasdaq Stock Market LLC |

Indicate

by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405

of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company o

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. o

| Item

2.02 |

Results

of Operations and Financial Condition. |

On August 9,

2023, SWK Holdings Corporation (the “Company”) held a conference call and live audio webcast to discuss its corporate and

financial results for the second quarter of 2023. An audio webcast is accessible via the Investors Events & Presentations section

of the Company’s website at https://swkhold.investorroom.com/events.

A

written transcript of this webcast presentation is being furnished by the Company on this Current Report on Form 8-K as Exhibit 99.1

and is incorporated by reference herein.

| Item

7.01 |

Regulation

FD Disclosure. |

The

information included in Item 2.02 of this Current Report on Form 8-K is incorporated by reference into this Item 7.01.

The

information furnished in Item 2.02 and this Item 7.01, including Exhibit

99.1, shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange

Act”), nor shall it be deemed incorporated by reference in any filing under the Securities Act of 1933, as amended, or the Exchange

Act, except as shall be expressly set forth by specific reference in such filing.

| Item

9.01 |

Financial

Statements and Exhibits. |

SIGNATURES

Pursuant to the requirements

of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned thereunto

duly authorized.

| SWK

HOLDINGS CORPORATION |

|

| |

|

|

| By: |

/s/

Joe D. Staggs |

|

| |

Joe

D. Staggs |

|

| |

President

and Interim Chief Executive Officer |

|

Date: August 11,

2023

Exhibit 99.1

SWK Holdings Corporation

(SWKH)

Q2 2023 Corporate

& Financial Results Conference Call

Wednesday, August

9, 2023, 5:00 PM ET.

Executives

Jason Rando, Tiberend Strategic Advisors

Jody Staggs, President and Chief Executive

Officer

Yvette Heinrichson, Chief Financial Officer

Analysts

Jacob Steven, Lake Street Capital Markets

Scott Jensen, Private Investor

Michael Diana, Maxim Group

Presentation

Operator: Good afternoon, and welcome to

the SWK Holdings Corporation Second Quarter 2023 Corporate and Financial Results Conference Call. (Operator Instructions). After today’s

presentation, there will be an opportunity to ask questions. (Operator Instructions). Please note this event is being recorded.

I would now like to turn the conference

over to Jason Rando with Tiberend Strategic Advisors. Please go ahead.

Jason Rando: Good evening, and thank

you for joining SWK Holdings’ Second Quarter 2023 Financial and Corporate Results Call. Earlier today, SWK Holdings issued a press release

detailing its financial results for the three months ended June 30, 2023. The press release can be found in the Investor Relations section

of swkhold.com under News Releases.

Before beginning today’s call, I

would like to make the following statement regarding forward-looking statements. Today we will be making certain forward-looking statements

about future expectations, plans, events and circumstances, including statements about our strategy, future operations and the development

of our consumer and drug product candidates, plans for future potential product candidates and studies and our expectations regarding

our capital allocation and cash resources. These statements are based on our current expectations, and you should not place undue reliance

on these statements.

Actual results may differ materially

due to our risks and uncertainties, including those detailed in the Risk Factors section of SWK Holdings’ 10-K filed with the SEC, and

other filings we make with the SEC from time to time. SWK Holdings disclaims any obligation to update information contained in these

forward-looking statements, whether as a result of new information, future events or otherwise.

Joining me from SWK Holdings on today’s

call are Jody Staggs, President and CEO, and Yvette Heinrichson, Chief Financial Officer. They will provide an update on SWK’s second

quarter 2023 corporate and financial results. Jody, go ahead.

Jody Staggs: Thank you, Jason, and

thanks, everyone, for joining our second quarter conference call. During the second quarter, we made progress on several key initiatives,

including closing a new $45 million credit facility, continuing the operational and financial turnaround at Enteris, and concluding two

long-running work outs.

Our financing business remains healthy,

and we generated a 15.4% realized yield during the quarter, and are working towards multiple new financing closings by years-end.

Tangible book value per share increased

to $18.95 per share, an 8% year-over-year increase after adjusting for the implementation of CECL.

During the quarter, we repurchased

$4.6 million of shares at an average price of $16.88, a 23% discount to the GAAP book value of $21.79.

There’s much to be excited about

at SWK. Second quarter results were largely in line with internal expectations as, financial segment non-GAAP net income totaled $7.6

million, representing a 12% annualized return on tangible book value. While we are pleased with the 12% return, we aim to improve on

it through diligent underwriting of life science loans and royalties, coupled with appropriate balance sheet leverage.

Our gross investment assets totaled

$234 million, compared with the total of $249 million at March 31, 2023 and $175 million at June 30, 2022. The sequential decline is

primarily due to the sale of our Acer loan to a third party for approximately $14 million.

Our portfolio effective yield was

14.5% compared with 15.5% in the first quarter of 2023. The sequential decrease is primarily due to the divestiture of the Acer loan.

Our realized yield in the quarter

was 15.4% compared with 15.3% in the first quarter of 2023. There were no early prepayments during the quarter. Looking ahead, our realized

yield should benefit from the recent reference rate increase, as well as pricing discipline on new financing proposals.

Turning to the portfolio, during

the quarter, we finalized the work out for the Flowonix loan, and after quarter’s-close, we finalized the work out for the Ideal royalty.

In both situations, we received cash at close, with the majority of recovery expected from future royalties. At this time, we believe

the cash received, combined with estimated future royalties, will exceed the carrying value of position. Thus, we do not anticipate taking

an impairment on either position. However, both positions will remain on non-accrual.

Looking at credit quality, we rate

our loans 1 to 5, with 5 being the highest score. During the quarter, we had one loan scored as a 2, while the Flowonix loan, which has

been in work out for several quarters with the discussed resolution achieved in late second quarter of 2023, was scored at 1. The remaining

loans were rated 3 or better. We rate our royalties green, yellow and red, and the Ideal and best non-accrued royalties were rated red,

while the remaining royalties were rated green.

Results in Enteris continued to improve,

and were in line with internal expectations. Revenue increased 55% sequentially to $200,000. And we expect revenue to accelerate in third

quarter and fourth quarter based on work generated from our former service partnership, which was signed in late April. Year-to-date,

we have about $2.0 million of CDMO projects, and are bidding on an additional $9.0 million of projects, which is an increase from $7.0

million of projects we were bidding on last quarter.

Second quarter Enteris operating

expense totaled $2.5 million compared with $1.4 million as at first quarter of 2023. However, the second quarter included a final R&D

payment, as well as employee retention payments, which cumulatively totaled approximately $1.0 million. We expect the Enteris quarterly

OpEx will be approximately $1.5 million per quarter in the back half of 2023. We are working with an advisor to evaluate strategic alternatives

for Enteris, and will provide an update when appropriate.

During the quarter, we closed a $45

million committed financing with First Horizon Bank, which replaced our prior $35 million facility. The new facility gives SWK additional

liquidity, as well as flexibility to pursue other balance sheet capital options.

During the quarter, we repurchased

272,492 shares at an average cost of $16.88. And year-to-date, we’ve repurchased approximately 327,000 shares for $5.6 million at an

average cost of $16.96. We view repurchasing shares at the current level as a highly attractive use of shareholders’ capital.

To summarize, the second quarter

of 2023 was a solid quarter for our financial segment with a 12% return on tangible equity. We were able to conclude work out process

for two of our nonaccrual loans with reasonable outcomes. We’re pursuing multiple core life science financings with attractive returns

and expect to close additional transactions by year-end. And our new credit facility provides additional liquidity plus flexibility going

forward.

With that, I would like to turn the

call to our CFO Yvette Heinrichson for an update on our financial performance for the quarter. Yvette, the call is yours.

Yvette Heinrichson: Thank you, Jody,

and good afternoon, everyone. Earlier today, we reported earnings for the second quarter of 2023. We reported GAAP pre-tax net income

of $5.4 million or $0.42 per diluted share. Our reported Q2 2023 net income of $3.9 million after income tax expense of $1.4 million

included a $2.5 million increase in finance receivables segment revenue, and a $0.1 million increase in our pharmaceutical development

segment revenue.

The $2.5 million increase in year-over-year

finance receivables segment revenue was primarily due to the $2.5 million increase and interest in fees earned due to funding new and

existing loans, a $0.8 million increase in interest income due to an overall increase in reference rates, and a net $0.5 million increase

in royalty revenue when compared to the same period of the previous year. The increase was partially offset by a $1.3 million decrease

in interest royalties and fees earned on finance receivables that were paid off in 2022 and 2023.

Absent any material unforeseen payoffs,

we still anticipate finance receivables revenue over the next two quarters of the year to be comparable to revenue reported in Q2 2023.

As Jody mentioned earlier, overall

operating expenses, which include interest, pharmaceutical, manufacturing, research and development expense, as well as general and administrative

expense, were $4.9 million during Q2 2023, compared to $4.6 million in Q2 2022.

Enteris operating expenses were $2.5

million in Q2 2023 compared to $2.4 million in Q2 2022. And finance receivable segment operating expenses were $2.4 million in Q2 2023

compared to $2.2 million in Q2 2022. The slight increase in finance receivable segment operating expenses was primarily due to a $0.2

million increase in interest expense due to a higher overall average balance on our credit facility.

And second quarter 2023 pharmaceutical

development segment operating expenses included a $0.4 million expense for employee bonus retention as well as $0.5 million final payment

to our CRO vendor. Neither of these expenses are expected to be repeated in the third quarter of 2023.

And finally, our finance receivables

portfolio decreased by $14.8 million from the first quarter of 2023. That resulted in a $0.7 million benefit to our allowance for credit

losses in Q2 2023.

As a reminder, in Q1 of this year,

we adopted the accounting standard known as CECL. Going forward, changes to the size of our finance receivables will result in a corresponding

percentage change to our allowance for credit losses, as was the case in Q2 2023.

Changes in the underlying assumptions

used to establish our initial loss rates will also result in changes to our allowance for credit losses. We did not have any changes

to these assumptions during the second quarter of 2023. Any future changes to our allowance for credit losses will run through the income

statement.

I will now turn the call back over

to Jody.

Jody Staggs: Thank you, Yvette. In

summary, the second quarter of 2023 was a solid period, with results in line with our expectations. We made material progress on key

initiatives during the first half of the year, and for the remainder of 2023, we will pursue our goals with an aim of creating value

for our owners.

Operator, let’s open the call for

questions.

Questions and Answers

Operator: We will now begin the question

and answer session. (Operator Instructions). Jacob Steven with Lake Street Capital Markets.

Jacob Steven: Just wanted to touch

on the equity capital markets. We’ve seen them open up quite modestly over the last quarter here. How does this impact your ability to

deploy capital and your risk tolerance with making loans?

Jody Staggs: Yes, thanks, appreciate

the question. Thanks for dialing in. I would say there’s sort of two dynamics from that. The first of all is for a portfolio of companies

that are public. The ability to tap those equity markets is a positive. Most of our borrowers are in a cash burning situation pre-profit.

So that’s great for them. For situations where we’re out there trying to pursue a new loan, equity is almost always our number one competitor.

So in some ways, that’s a modest

negative, but I would say our pipeline is strong, and most of the companies we’re speaking with really don’t have access to the capital

markets in any sort of material shape. There’s a few that we’re speaking with that are public, and they maybe are considering that. But

it’s still fairly tough for small companies to access those in sort of any material means.

Jacob Steven: Okay. And maybe just

touch on the First Horizon Bank deal here. Does that change your lendable capital base, or do you need access to additional facilities?

How are you thinking about the capacity to grow the loan book here over the next 4 months?

Jody Staggs: Yes, absolutely. So

it increases our current capacity by $10 million. So we’ve got $45 million committed by First Horizon now. Our prior facility was $35

million. I think what this facility gives us is, first of all, the terms our partner -- I think it’s going to allow us to syndicate this

facility a bit more easily and that’s something we’re focused on now. So both our partner and SWK are focused on working with potential

partner banks to bring them into the facility. And we would love to take this up to $75 million or $80 million. So we’re working really

hard on that. I guess the challenge right now is the regional bank market is in somewhat of a challenged position. So those conversations

will take time, but it’s a focus.

The other, I think, positive of this

facility is it does allow us to issue an unsecured bond, and that’s something we’re considering as well. So we’ve got a couple of other

ways to bring on capital. The facility at $45 million is great and a good starting spot, but we believe that this business should support

much more leverage than that.

Jacob Steven: Okay. And then just

last one for me here. Any updated thoughts on the buyback? Are you guys just kind of plan to keep buying shares at a discount to book

value here, or how are you thinking about that moving forward?

Jody Staggs: Yes, absolutely. So

in May, the board did authorize a new $10 million buyback, which was great. And we appreciate their support and their belief that shares

are materially undervalued. Management shares that view. So we have a new broker we’re working with, and the new the new plan is, I would

say, a bit more flexible than our old plan. So you probably saw that we repurchased almost $5 million, $4.6 million during the quarter,

and we’re pushing $6 million year-to-date.

So the new plan seems to be working

quite a bit better and we’ll just continue to work the plan in terms of the stopping at this price, we’ve got tiers, and as we get these

reporting out, we’ll have an open period where we can maybe be more aggressive. But buying back the stock at the current price, I think

the valuation is quite attractive, and so that’s something that the board and management will continue to do.

Jacob Steven: Got it. Thanks. Best

of luck moving forward here.

Operator: (Operator Instructions).

Scott Jensen, a private investor.

Scott Jensen: Good quarter, Jody

and everyone on the team. Especially like the buyback, which was just mentioned, and pleasantly surprised on the two work outs. It’s

not going to be a hit to the bottom line, at least at this point.

My question, I guess, is on Enteris.

It looks like some good progress being made. And when you say $9 million in, future bids are out there, what is the kind of metrics that

you use to compete on those? Is it price, is it reputation? Like how can we kind of get an idea of how that bid ratio might work out?

Jody Staggs: Yes, great question.

We’re still learning a bit about that. So the majority of those bids, those proposals, stem from our partnership with a large firm pharma

service organization, which I’m not supposed to name. But we’ve been working with them since April in a formal arrangement, and we are

their preferred provider for certain phase one and phase two services. So they’ve got customers, they’ve got small biotechs, pharmas,

coming to them for help as they develop their programs and in for particular, dosing technologies. And that that partner is referring

them to us for certain of these services. So these are really warm leads.

I would need to check, but we’re

picking up the vast majority of that revenue. The partner is keeping a bit of it, and really, for them, the benefit is getting these

biotechs, quality CDMO services, and moving them through the clinical progression, so they can hopefully, use our partner’s technology,

patented technology, once they get out to market.

I wish I had some number to tell

you we’ll pick up X percent, but the rates have been great so far. The early proposals we put out, we’re winning lots of those, and I

think we’ll definitely win our fair share of these new ones, particularly given that these are coming through warm leads. But at this

time, I don’t have a great rubric of the percent, and I’m still kind of working with Paul and the team at Enteris to understand that

a bit better myself.

Scott Jensen: And then just kind

of a continuation, as you say, strategic options, possibly for Enteris. Clearly, one of the things that you’ve benefited from over the

past number of years have been the paybacks from some of the Cara royalties. And it seems like they’re making good progress, at least

their report this week on their oral program. Would that be something where you’d still maintain some kind of future royalty access,

or would it just depend on the bid or the options that you’re presented with?

Jody Staggs: Yes, I think we would

retain that. It’s really a financial asset at this point in time. We like royalties, we understand it. We think we understand what the

value is. So there’s no reason we couldn’t retain that. I tend to think the people that might be interested in the CDMO business

are not really that interested in a royalty from a third party. So I would envision that we would retain that. There is another royalty

there at Enteris as well. We haven’t talked too much about it and it’s just a royalty. There are no milestones; there’s an active program

going on there. And then we’re actually working on some other proposals as well. So I think all of those types of things, which are really

financial assets, SWK would keep. I just don’t see a CDMO buyer really being that interested in those.

Scott Jensen: Excellent. Well, thank

you. Keep up the good work and let’s hope your broker keeps up buying it back.

Operator: Michael Diana with Maxim

Group.

Michael Diana: Now that SVB has been

gone for about 4 months, do you notice any change in the competitive environment?

Jody Staggs: Initially, I think the

answer is yes. So there for a period of time, capital was really scarce. I think -- and actually, we’ve got -- one of our signed term

sheets is a refi from SVB. And we’re speaking -- I think my colleagues are speaking with another situation now, which again, is another

SVB situation where they’ve got an SVB facility. So I think we have seen those opportunities. Now SVB, a lot of those professionals now

have moved on, and I think they’re really active. If you look at First Citizens and some of these people, they’re getting back out there.

So there definitely has been an opportunity,

particularly in the smaller side, where we play a lot in some of the less sponsor-back channels. I gather the new owner of SVB, and in

some of the places the banks where those folks are going, they’re probably moving up the quality spectrum. So yes, it is an opportunity.

I think it’s not sort of the flood that we thought we might see when SVB and Signature went under, if that makes sense.

Michael Diana: Okay, great. Thank

you.

Operator: It appears are no further

questions. This concludes our question-and-answer session. I would like to turn the conference back over to Jody Staggs for any closing

remarks.

Jody Staggs: Appreciate everyone

speaking again. Hopefully, we’ve expressed the excitement we feel for what we’ve achieved so far this year, and the opportunities ahead.

Again, appreciate your support and dialing in, and feel free to reach out to myself, Yvette, or the Tiberend team, and if you have any

questions. Hope you have a good evening. Bye-bye.

Operator: The conference has now

concluded. Thank you for attending today’s presentation. You may now disconnect.

v3.23.2

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

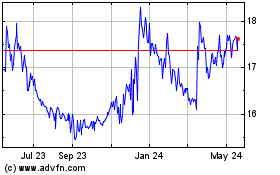

SWK (NASDAQ:SWKH)

Historical Stock Chart

From Nov 2024 to Dec 2024

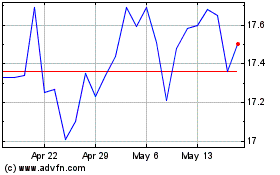

SWK (NASDAQ:SWKH)

Historical Stock Chart

From Dec 2023 to Dec 2024