false

0001169445

0001169445

2024-08-08

2024-08-08

0001169445

cpsi:CommonStockParValue0001PerShareCustomMember

2024-08-08

2024-08-08

0001169445

cpsi:CommonStockPurchaseRightsCustomMember

2024-08-08

2024-08-08

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, DC 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(D) OF THE

SECURITIES EXCHANGE ACT OF 1934

Date of report (Date of earliest event reported): August 8, 2024

TRUBRIDGE, INC.

(Exact Name of Registrant as Specified in Charter)

|

Delaware

|

000-49796

|

74-3032373

|

|

(State or Other Jurisdiction

of Incorporation)

|

(Commission File

Number)

|

(IRS Employer

Identification No.)

|

| |

|

|

|

54 St. Emanuel Street,

Mobile, Alabama

(Address of Principal Executive Offices)

|

|

36602

(Zip Code)

|

| |

|

|

|

(251) 639-8100

(Registrant’s telephone number, including area code)

|

| |

|

N/A

(Former Name or Former Address, if Changed Since Last Report)

|

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

|

Title of each Class

|

|

Trading Symbol(s)

|

|

Name of each exchange on which registered

|

|

Common stock, par value $0.001 per share

|

|

TBRG

|

|

The NASDAQ Stock Market LLC

|

|

Common Stock Purchase Rights

|

|

N/A

|

|

The NASDAQ Stock Market LLC

|

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act.

☐

Item 2.02. Results of Operations and Financial Condition.

On August 8, 2024, TruBridge issued a press release announcing financial information for its fiscal second quarter ended June 30, 2024. The press release is attached as Exhibit 99.1 to this Form 8-K and is furnished to, but not filed with, the Commission.

Item 9.01. Financial Statements and Exhibits.

(d) Exhibits.

|

ExhibitNumber

|

|

Exhibit

|

| |

|

|

|

99.1

|

|

|

| |

|

|

|

104

|

|

Cover Page Interactive Data File (embedded within the Inline XBRL document)

|

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

TRUBRIDGE, INC.

|

|

|

|

By:

|

/s/ Vinay Bassi

|

|

|

|

|

Vinay Bassi

|

|

|

|

|

Chief Financial Officer and Treasurer

|

|

Dated: August 8, 2024

Exhibit 99.1

TRUBRIDGE ANNOUNCES SECOND QUARTER 2024 RESULTS

MOBILE, ALA. (August 8, 2024) – TruBridge, Inc. (NASDAQ: TBRG), a healthcare solutions company, today announced financial results for the second quarter ended June 30, 2024.

Second Quarter 2024 Highlights

All comparisons are to the quarter ended June 30, 2023, unless otherwise noted

| |

●

|

Total bookings of $23.3 million compared to $21.0 million

|

| |

●

|

Total revenue of $84.7 million compared to $84.6 million

|

| |

●

|

Revenue Cycle Management (RCM) revenue of $54.1 million compared to $47.8 million

|

| |

o

|

RCM revenue represented 63.9% of TruBridge’s total revenue

|

| |

●

|

GAAP (loss) earnings per diluted share of $(0.34) compared to $(0.20)

|

| |

●

|

Non-GAAP earnings per diluted share of $0.16 compared to $0.40

|

| |

●

|

Adjusted EBITDA of $12.6 million compared to $11.2 million

|

Chris Fowler, chief executive officer of TruBridge, Inc., stated, “We are pleased with our second quarter performance, both operationally and financially. The team continued to build on our bookings momentum and cross-selling efforts, while we further enhanced our financial operations. Our solid revenue performance and adjusted EBITDA margin expansion in the quarter was punctuated by a significant improvement in cash flow from operations.

“Given the health of our pipeline and clear line of sight for the remainder of the year, we are reiterating guidance and are enthusiastic about our future outlook,” concluded Fowler.

Financial Guidance

For the third quarter of 2024, TruBridge expects to generate:

| |

●

|

Total revenue between $82 million and $85 million

|

| |

●

|

Adjusted EBITDA between $11.5 million and $13.5 million

|

For the full year 2024, TruBridge reiterates prior outlook of:

| |

●

|

Total revenue between $330 million and $340 million

|

| |

●

|

Adjusted EBITDA between $45 million and $50 million

|

TruBridge Announces Second Quarter 2024 Results

Page 2

August 8, 2024

Conference Call

TruBridge will hold a conference call and live webcast to discuss second quarter 2024 results on Thursday, August 8, 2024, at 3:30 p.m. Central time/4:30 p.m. Eastern time. To access this interactive teleconference, dial (800) 715-9871 and request connection to the TruBridge earnings conference call. A 30-day online replay will be available approximately one hour following the conclusion of the live webcast. To listen to the live webcast or access the replay, visit the Company’s investor relations website, investors.trubridge.com.

About TruBridge

We are a trusted partner to more than 1,500 healthcare organizations with a broad range of technology-first solutions that address the unique needs and challenges of diverse communities, promoting equitable access to quality care and fostering positive outcomes. TruBridge has over four decades of experience in connecting providers, patients and communities with innovative data-driven solutions that create real value by supporting both the financial and clinical side of healthcare delivery. Our industry leading HFMA Peer Reviewed® suite of revenue cycle management (RCM) offerings combine unparalleled visibility and transparency to enhance productivity and support the financial health of healthcare organizations across all care settings. We support efficient patient care with electronic health record (EHR) product offerings that successfully integrate data between care settings. Above all, we believe in the power of community and encourage collaboration, connection, and empowerment with our customers. We clear the way for care. For more information, please visit www.trubridge.com.

Investor Relations Contact

Asher Dewhurst, ICR Westwicke

TBRGIR@westwicke.com

Media Contact

Tracey Schroeder

Chief Marketing Officer

Tracey.schroeder@trubridge.com

(251) 639-8100

Forward-Looking Statements

This press release contains forward-looking statements within the meaning of the “safe harbor” provisions of the Private Securities Litigation Reform Act of 1995. These forward-looking statements can be identified generally by the use of forward-looking terminology and words such as “expects,” “anticipates,” “estimates,” “believes,” “predicts,” “intends,” “plans,” “potential,” “may,” “continue,” “should,” “will” and words of comparable meaning. Without limiting the generality of the preceding statement, all statements in this press release relating to the Company’s future financial and operational results are forward-looking statements. We caution investors that any such forward-looking statements are only predictions and are not guarantees of future performance. Certain risks, uncertainties and other factors may cause actual results to differ materially from those projected in the forward-looking statements. Such factors may include: saturation of our target market and hospital consolidations; unfavorable economic or market conditions that may cause a decline in spending for information technology and services; significant legislative and regulatory uncertainty in the healthcare industry; exposure to liability for failure to comply with regulatory requirements; pandemics and other public health crises and related economic disruptions; transition to a subscription-based recurring revenue model and modernization of our technology; competition with companies that have greater financial, technical and marketing resources than we have; potential future acquisitions that may be expensive, time consuming, and subject to other inherent risks; our ability to attract and retain qualified client service and support personnel; disruption from periodic restructuring of our sales force; potential delay in the development of markets for our RCM service offering; potential inability to properly manage growth in new markets we may enter; potential disruption of our business due to our ongoing implementation of a new enterprise resource planning software solution; exposure to numerous and often conflicting laws, regulations, policies, standards or other requirements through our international business activities; potential litigation against us; our reliance on an international workforce which exposes us to various business disruptions; our utilization of artificial intelligence, which could expose us to liability or adversely affect our business if we cannot compete effectively with others using artificial intelligence; potential failure to develop new products or enhance current products that keep pace with market demands; failure of our products to function properly resulting in claims for medical and other losses; breaches of security and viruses in our systems resulting in customer claims against us and harm to our reputation; failure to maintain customer satisfaction through new product releases free of undetected errors or problems; failure to convince customers to migrate to current or future releases of our products; failure to maintain our margins and service rates; increase in the percentage of total revenues represented by service revenues, which have lower gross margins; exposure to liability in the event we provide inaccurate claims data to payors; exposure to liability claims arising out of the licensing of our software and provision of services; dependence on licenses of rights, products and services from third parties; misappropriation of our intellectual property rights and potential intellectual property claims and litigation against us; interruptions in our power supply and/or telecommunications capabilities, including those caused by natural disaster; potential inability to secure additional financing on favorable terms to meet our future capital needs; our substantial indebtedness, and our ability to incur additional indebtedness in the future; pressures on cash flow to service our outstanding debt; restrictive terms of our credit agreement on our current and future operations; changes in and interpretations of financial accounting matters that govern the measurement of our performance; significant charges to earnings if our goodwill or intangible assets become impaired; fluctuations in quarterly financial performance due to, among other factors, timing of customer installations; volatility in our stock price; failure to maintain effective internal control over financial reporting; inherent limitations in our internal control over financial reporting; vulnerability to significant damage from natural disasters; market risks related to interest rate changes; potential material adverse effects due to macroeconomic conditions, including bank failures or changes in related regulation; and other risk factors described from time to time in our public releases and reports filed with the Securities and Exchange Commission, including, but not limited to, our most recent Annual Report on Form 10-K and our Quarterly Report on Form 10-Q for the quarter ended June 30, 2024. We also caution investors that the forward-looking information described herein represents our outlook only as of this date, and we undertake no obligation to update or revise any forward-looking statements to reflect events or developments after the date of this press release.

-MORE-

TruBridge Announces Second Quarter 2024 Results

Page 3

August 8, 2024

|

TruBridge, Inc.

|

|

Condensed Consolidated Statements of Income

|

|

(In '000s, except per share data)

|

|

(Unaudited)

|

| |

|

Three Months Ended June 30,

|

|

|

Six Months Ended June 30,

|

|

| |

|

2024

|

|

|

2023

|

|

|

2024

|

|

|

2023

|

|

|

Revenues

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

RCM

|

|

$ |

54,108 |

|

|

$ |

47,760 |

|

|

$ |

107,146 |

|

|

$ |

96,391 |

|

|

EHR

|

|

|

30,622 |

|

|

|

36,862 |

|

|

|

60,831 |

|

|

|

74,464 |

|

|

Total revenues

|

|

|

84,730 |

|

|

|

84,622 |

|

|

|

167,977 |

|

|

|

170,855 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Expenses

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Costs of revenue (exclusive of amortization and depreciation)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

RCM

|

|

|

30,269 |

|

|

|

27,119 |

|

|

|

59,866 |

|

|

|

54,302 |

|

|

EHR

|

|

|

13,073 |

|

|

|

17,014 |

|

|

|

25,237 |

|

|

|

34,008 |

|

|

Total costs of revenue (exclusive of amortization and depreciation)

|

|

|

43,342 |

|

|

|

44,133 |

|

|

|

85,103 |

|

|

|

88,310 |

|

|

Product development

|

|

|

8,207 |

|

|

|

8,769 |

|

|

|

18,894 |

|

|

|

17,121 |

|

|

Sales and marketing

|

|

|

7,815 |

|

|

|

8,132 |

|

|

|

14,408 |

|

|

|

15,089 |

|

|

General and administrative

|

|

|

18,878 |

|

|

|

19,057 |

|

|

|

38,274 |

|

|

|

33,510 |

|

|

Amortization

|

|

|

9,107 |

|

|

|

5,858 |

|

|

|

14,975 |

|

|

|

11,341 |

|

|

Depreciation

|

|

|

400 |

|

|

|

579 |

|

|

|

800 |

|

|

|

1,095 |

|

|

Total expenses

|

|

|

87,749 |

|

|

|

86,528 |

|

|

|

172,454 |

|

|

|

166,466 |

|

|

Operating income (loss)

|

|

|

(3,019 |

) |

|

|

(1,906 |

) |

|

|

(4,477 |

) |

|

|

4,389 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Other income (expense):

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Other income

|

|

|

91 |

|

|

|

78 |

|

|

|

1,514 |

|

|

|

346 |

|

|

Interest expense

|

|

|

(4,242 |

) |

|

|

(2,664 |

) |

|

|

(8,315 |

) |

|

|

(5,334 |

) |

|

Total other expense

|

|

|

(4,151 |

) |

|

|

(2,586 |

) |

|

|

(6,801 |

) |

|

|

(4,988 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Loss before taxes

|

|

|

(7,170 |

) |

|

|

(4,492 |

) |

|

|

(11,278 |

) |

|

|

(599 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Income tax benefit

|

|

|

(2,121 |

) |

|

|

(1,655 |

) |

|

|

(3,713 |

) |

|

|

(846 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net income (loss)

|

|

$ |

(5,049 |

) |

|

$ |

(2,837 |

) |

|

$ |

(7,565 |

) |

|

$ |

247 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net income (loss) per common share—basic

|

|

$ |

(0.34 |

) |

|

$ |

(0.20 |

) |

|

$ |

(0.51 |

) |

|

$ |

0.02 |

|

|

Net income (loss) per common share—diluted

|

|

$ |

(0.34 |

) |

|

$ |

(0.20 |

) |

|

$ |

(0.51 |

) |

|

$ |

0.02 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Weighted average shares outstanding used in per common share computations:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Basic

|

|

|

14,313 |

|

|

|

14,200 |

|

|

|

14,273 |

|

|

|

14,168 |

|

|

Diluted

|

|

|

14,313 |

|

|

|

14,200 |

|

|

|

14,273 |

|

|

|

14,168 |

|

-MORE-

TruBridge Announces Second Quarter 2024 Results

Page 4

August 8, 2024

|

TruBridge, Inc.

|

|

Condensed Consolidated Balance Sheets

|

|

(In '000s, except per share data)

|

| |

|

June 30, 2024

(Unaudited)

|

|

|

Dec. 31, 2023

|

|

|

Assets

|

|

|

|

|

|

|

|

|

|

Current assets

|

|

|

|

|

|

|

|

|

|

Cash and cash equivalents

|

|

$ |

7,709 |

|

|

$ |

3,848 |

|

|

Accounts receivable, net of allowance for expected credit losses of $3,315 and $3,631, respectively

|

|

|

59,603 |

|

|

|

59,723 |

|

|

Financing receivables, current portion (net of allowance for expected credit losses of $332 and $319, respectively)

|

|

|

4,137 |

|

|

|

3,997 |

|

|

Inventories

|

|

|

793 |

|

|

|

475 |

|

|

Prepaid income taxes

|

|

|

2,307 |

|

|

|

1,628 |

|

|

Prepaid expenses and other

|

|

|

17,034 |

|

|

|

15,807 |

|

|

Assets of held for sale disposal group

|

|

|

- |

|

|

|

25,977 |

|

|

Total current assets

|

|

|

91,583 |

|

|

|

111,455 |

|

| |

|

|

|

|

|

|

|

|

|

Property & equipment, net

|

|

|

8,479 |

|

|

|

8,974 |

|

|

Software development costs, net

|

|

|

39,741 |

|

|

|

39,139 |

|

|

Operating lease assets

|

|

|

3,861 |

|

|

|

5,192 |

|

|

Financing receivables, net of current portion (net of allowance for expected credit losses of $56 and $97, respectively)

|

|

|

607 |

|

|

|

1,226 |

|

|

Other assets, net of current portion

|

|

|

8,337 |

|

|

|

7,314 |

|

|

Intangible assets, net

|

|

|

82,960 |

|

|

|

89,213 |

|

|

Goodwill

|

|

|

172,573 |

|

|

|

171,909 |

|

|

Deferred tax assets

|

|

|

4,146 |

|

|

|

- |

|

|

Total assets

|

|

$ |

412,287 |

|

|

$ |

434,422 |

|

| |

|

|

|

|

|

|

|

|

|

Liabilities & Stockholders' Equity

|

|

|

|

|

|

|

|

|

|

Current liabilities

|

|

|

|

|

|

|

|

|

|

Accounts payable

|

|

$ |

15,854 |

|

|

$ |

10,133 |

|

|

Current portion of long-term debt

|

|

|

3,074 |

|

|

|

3,141 |

|

|

Deferred revenue

|

|

|

9,842 |

|

|

|

8,677 |

|

|

Accrued vacation

|

|

|

5,458 |

|

|

|

5,410 |

|

|

Liabilities of held for sale disposal group

|

|

|

- |

|

|

|

977 |

|

|

Other accrued liabilities

|

|

|

17,481 |

|

|

|

19,892 |

|

|

Total current liabilities

|

|

|

51,709 |

|

|

|

48,230 |

|

| |

|

|

|

|

|

|

|

|

|

Long-term debt, net of current portion

|

|

|

176,964 |

|

|

|

195,270 |

|

|

Operating lease liabilities, net of current portion

|

|

|

2,512 |

|

|

|

3,074 |

|

|

Deferred tax liabilities

|

|

|

- |

|

|

|

1,230 |

|

|

Total liabilities

|

|

|

231,185 |

|

|

|

247,804 |

|

| |

|

|

|

|

|

|

|

|

|

Stockholders' Equity

|

|

|

|

|

|

|

|

|

|

Common stock, $0.001 par value; 30,000 shares authorized; 15,561 and 15,121 shares issued, respectively

|

|

|

15 |

|

|

|

15 |

|

|

Treasury stock, 615 and 572 shares, respectively

|

|

|

(17,434 |

) |

|

|

(17,075 |

) |

|

Accumulated other comprehensive gain

|

|

|

108 |

|

|

|

- |

|

|

Additional paid-in capital

|

|

|

197,846 |

|

|

|

195,546 |

|

|

Retained earnings

|

|

|

567 |

|

|

|

8,132 |

|

|

Total stockholders' equity

|

|

|

181,102 |

|

|

|

186,618 |

|

| |

|

|

|

|

|

|

|

|

|

Total liabilities and stockholders' equity

|

|

$ |

412,287 |

|

|

$ |

434,422 |

|

TruBridge Announces Second Quarter 2024 Results

Page 5

August 8, 2024

|

TruBridge, Inc.

|

|

Condensed Consolidated Statements of Cash Flows

|

|

(In '000s)

|

|

(Unaudited)

|

| |

|

Six Months Ended June 30,

|

|

| |

|

2024

|

|

|

2023

|

|

|

Operating activities:

|

|

|

|

|

|

|

|

|

|

Net income (loss)

|

|

$ |

(7,565 |

) |

|

$ |

247 |

|

|

Adjustments to net income (loss):

|

|

|

|

|

|

|

|

|

|

Provision for credit losses

|

|

|

358 |

|

|

|

181 |

|

|

Deferred taxes

|

|

|

(5,224 |

) |

|

|

(1,533 |

) |

|

Stock-based compensation

|

|

|

2,300 |

|

|

|

1,124 |

|

|

Depreciation

|

|

|

800 |

|

|

|

1,095 |

|

|

Gain on sale of business

|

|

|

(1,250 |

) |

|

|

- |

|

|

Amortization of acquisition-related intangibles

|

|

|

6,253 |

|

|

|

8,029 |

|

|

Amortization of software development costs

|

|

|

8,722 |

|

|

|

3,312 |

|

|

Amortization of deferred finance costs

|

|

|

213 |

|

|

|

180 |

|

|

Non-cash operating lease costs

|

|

|

897 |

|

|

|

1,211 |

|

|

Loss on disposal of property and equipment

|

|

|

- |

|

|

|

117 |

|

|

Changes in operating assets and liabilities:

|

|

|

|

|

|

|

|

|

|

Accounts receivable

|

|

|

654 |

|

|

|

(3,806 |

) |

|

Financing receivables

|

|

|

506 |

|

|

|

940 |

|

|

Inventories

|

|

|

(318 |

) |

|

|

(178 |

) |

|

Prepaid expenses and other

|

|

|

1,502 |

|

|

|

(2,017 |

) |

|

Accounts payable

|

|

|

5,750 |

|

|

|

7,448 |

|

|

Deferred revenue

|

|

|

1,769 |

|

|

|

(1,705 |

) |

|

Operating lease liabilities

|

|

|

(583 |

) |

|

|

(1,067 |

) |

|

Other liabilities

|

|

|

(2,375 |

) |

|

|

(2,278 |

) |

|

Prepaid income taxes

|

|

|

(679 |

) |

|

|

(1,110 |

) |

|

Net cash provided by operating activities

|

|

|

11,730 |

|

|

|

10,190 |

|

| |

|

|

|

|

|

|

|

|

|

Investing activities:

|

|

|

|

|

|

|

|

|

|

Purchase of business, net of cash acquired

|

|

|

(664 |

) |

|

|

- |

|

|

Sale of business, net of cash and cash equivalents sold

|

|

|

21,410 |

|

|

|

- |

|

|

Investment in software development

|

|

|

(9,324 |

) |

|

|

(12,143 |

) |

|

Purchases of property and equipment

|

|

|

(306 |

) |

|

|

(72 |

) |

|

Net cash provided by (used in) investing activities

|

|

|

11,116 |

|

|

|

(12,215 |

) |

| |

|

|

|

|

|

|

|

|

|

Financing activities:

|

|

|

|

|

|

|

|

|

|

Treasury stock purchases

|

|

|

(358 |

) |

|

|

(2,532 |

) |

|

Payments of long-term debt principal

|

|

|

(5,750 |

) |

|

|

(1,750 |

) |

|

Proceeds from revolving line of credit

|

|

|

21,072 |

|

|

|

11,602 |

|

|

Payments of revolving line of credit

|

|

|

(33,379 |

) |

|

|

(5,000 |

) |

|

Debt issuance cots

|

|

|

(529 |

) |

|

|

- |

|

|

Net cash provided by (used in) financing activities

|

|

|

(18,944 |

) |

|

|

2,320 |

|

| |

|

|

|

|

|

|

|

|

|

Increase in cash and cash equivalents

|

|

|

3,902 |

|

|

|

295 |

|

| |

|

|

|

|

|

|

|

|

|

Change in cash and cash equivalents included in assets sold

|

|

|

(41 |

) |

|

|

|

|

|

Cash and cash equivalents, beginning of period

|

|

|

3,848 |

|

|

|

6,951 |

|

|

Cash and cash equivalents, end of period

|

|

$ |

7,709 |

|

|

$ |

7,246 |

|

TruBridge Announces Second Quarter 2024 Results

Page 6

August 8, 2024

|

TruBridge, Inc.

|

|

Consolidated Bookings

|

|

(In '000s)

|

|

(Unaudited) (Non-GAAP)

|

| |

|

Three Months Ended June 30,

|

|

|

Six Months Ended June 30,

|

|

|

In '000s

|

|

2024

|

|

|

2023 (3)

|

|

|

2024

|

|

|

2023 (3)

|

|

|

RCM(1)

|

|

$ |

13,458 |

|

|

$ |

13,648 |

|

|

$ |

27,849 |

|

|

$ |

25,748 |

|

|

EHR(2)

|

|

|

9,832 |

|

|

|

7,322 |

|

|

|

19,010 |

|

|

|

15,069 |

|

|

Total

|

|

$ |

23,290 |

|

|

$ |

20,970 |

|

|

$ |

46,859 |

|

|

$ |

40,817 |

|

|

(1)

|

Generally calculated as the total contract price (for non-recurring, project-related amounts) and annualized contract value (for recurring amounts).

|

|

(2)

|

Generally calculated as the total contract price (for system sales) and annualized contract value (for support) for perpetual license system sales and total contract price for SaaS sales.

|

|

(3)

|

Adjustment was made to the 2023 bookings, due to 3rd Party Software, and Forms and Supplies being doubled accounted for in the total EHR bookings.

|

|

TruBridge, Inc.

|

|

Bookings Composition

|

|

(In '000s, except per share data)

|

|

(Unaudited) (Non-GAAP)

|

| |

|

Three Months Ended June 30,

|

|

|

Six Months Ended June 30,

|

|

| |

|

2024

|

|

|

2023 (3)

|

|

|

2024

|

|

|

2023 (3)

|

|

|

RCM

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net new(1)

|

|

$ |

6,453 |

|

|

$ |

3,395 |

|

|

$ |

15,446 |

|

|

$ |

9,749 |

|

|

Cross-sell(1)

|

|

|

7,004 |

|

|

|

10,253 |

|

|

|

12,402 |

|

|

|

15,999 |

|

|

EHR

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Non-subscription sales(2)

|

|

|

4,084 |

|

|

|

4,458 |

|

|

|

7,534 |

|

|

|

10,506 |

|

|

Subscription revenue(3)

|

|

|

5,749 |

|

|

|

2,864 |

|

|

|

11,477 |

|

|

|

4,563 |

|

|

Total

|

|

$ |

23,290 |

|

|

$ |

20,970 |

|

|

$ |

46,859 |

|

|

$ |

40,817 |

|

|

(1)

|

“Net new” represents bookings from outside the Company’s core EHR client base, and “Cross-sell” represents bookings from existing EHR customers. In each case, such bookings are generally comprised of recurring revenues to be recognized ratably over a one-year period and an average timeframe for commencement of bookings-to-revenue conversion of four to six months following contract execution.

|

|

(2)

|

Represents nonrecurring revenues that generally exhibit a timeframe for bookings-to-revenue conversion of five to six months following contract execution.

|

|

(3)

|

Represents recurring revenues to be recognized on a monthly basis over a weighted-average contract period of five years, with a start date in the next 12 months and an average timeframe for commencement of bookings-to-revenue conversion of five to six months following contract execution.

|

TruBridge Announces Second Quarter 2024 Results

Page 7

August 8, 2024

|

TruBridge, Inc.

|

|

Adjusted EBITDA - by Segment

|

|

(In '000s)

|

|

(Unaudited) (Non-GAAP)

|

| |

|

Three Months Ended June 30,

|

|

|

Six Months Ended June 30,

|

|

|

In '000s

|

|

2024

|

|

|

2023

|

|

|

2024

|

|

|

2023

|

|

|

RCM

|

|

$ |

7,804 |

|

|

$ |

5,682 |

|

|

$ |

14,202 |

|

|

$ |

13,580 |

|

|

EHR

|

|

|

4,770 |

|

|

|

5,545 |

|

|

|

7,826 |

|

|

|

12,289 |

|

|

Total

|

|

$ |

12,574 |

|

|

$ |

11,227 |

|

|

$ |

22,028 |

|

|

$ |

25,869 |

|

|

TruBridge, Inc.

|

|

Reconciliation of Non-GAAP Financial Measures

|

|

(In '000s)

|

|

(Unaudited)

|

| |

|

Three Months Ended June 30,

|

|

|

Six Months Ended June 30,

|

|

|

Adjusted EBITDA:

|

|

2024

|

|

|

2023

|

|

|

2024

|

|

|

2023

|

|

|

Net income (loss), as reported

|

|

$ |

(5,049 |

) |

|

$ |

(2,837 |

) |

|

$ |

(7,565 |

) |

|

$ |

247 |

|

|

Net Income Margin

|

|

|

(6.0% |

) |

|

|

(3.4% |

) |

|

|

(4.5% |

) |

|

|

0.1 |

% |

|

Depreciation expense

|

|

|

400 |

|

|

|

597 |

|

|

|

800 |

|

|

|

1,095 |

|

|

Amortization of software development costs

|

|

|

5,980 |

|

|

|

1,826 |

|

|

|

8,722 |

|

|

|

3,312 |

|

|

Amortization of acquisition-related intangibles

|

|

|

3,126 |

|

|

|

4,014 |

|

|

|

6,253 |

|

|

|

8,029 |

|

|

Stock-based compensation

|

|

|

1,501 |

|

|

|

(123 |

) |

|

|

2,300 |

|

|

|

1,124 |

|

|

Severance and other non-recurring charges

|

|

|

4,586 |

|

|

|

6,819 |

|

|

|

8,430 |

|

|

|

7,920 |

|

|

Interest expense

|

|

|

4,151 |

|

|

|

2,586 |

|

|

|

8,051 |

|

|

|

4,988 |

|

|

Gain on sale of AHT

|

|

|

- |

|

|

|

- |

|

|

|

(1,250 |

) |

|

|

- |

|

|

Provision (benefit) for income taxes

|

|

|

(2,121 |

) |

|

|

(1,655 |

) |

|

|

(3,713 |

) |

|

|

(846 |

) |

|

Total Adjusted EBITDA

|

|

$ |

12,574 |

|

|

$ |

11,227 |

|

|

$ |

22,028 |

|

|

$ |

25,869 |

|

|

Adjusted EBITDA Margin

|

|

|

14.8 |

% |

|

|

13.3 |

% |

|

|

13.1 |

% |

|

|

15.1 |

% |

-MORE-

TruBridge Announces Second Quarter 2024 Results

Page 8

August 8, 2024

|

TruBridge, Inc.

|

|

Reconciliation of Non-GAAP Financial Measures

|

|

(In '000s, except per share data)

|

|

(Unaudited)

|

| |

|

Three Months Ended June 30,

|

|

|

Six Months Ended June 30,

|

|

|

Non-GAAP Net Income and Non-GAAP EPS:

|

|

2024

|

|

|

2023

|

|

|

2024

|

|

|

2023

|

|

|

Net income (loss), as reported

|

|

$ |

(5,049 |

) |

|

$ |

(2,837 |

) |

|

$ |

(7,565 |

) |

|

$ |

247 |

|

|

Pre-tax adjustments for Non-GAAP EPS:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Amortization of acquisition-related intangible assets

|

|

|

3,126 |

|

|

|

4,014 |

|

|

|

6,253 |

|

|

|

8,029 |

|

|

Stock-based compensation

|

|

|

1,501 |

|

|

|

(123 |

) |

|

|

2,300 |

|

|

|

1,124 |

|

|

Severance and other nonrecurring charges

|

|

|

4,586 |

|

|

|

6,819 |

|

|

|

8,430 |

|

|

|

7,920 |

|

|

Non-cash interest expense

|

|

|

107 |

|

|

|

90 |

|

|

|

213 |

|

|

|

180 |

|

|

After-tax adjustments for Non-GAAP EPS:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Tax-effect of pre-tax adjustments, at 21%

|

|

|

(1,957 |

) |

|

|

(2,269 |

) |

|

|

(3,611 |

) |

|

|

(3,623 |

) |

|

Tax shortfall (windfall) from stock-based compensation

|

|

|

4 |

|

|

|

7 |

|

|

|

113 |

|

|

|

57 |

|

|

Non-GAAP net income

|

|

$ |

2,318 |

|

|

$ |

5,701 |

|

|

$ |

6,133 |

|

|

$ |

13,934 |

|

|

Weighted average shares outstanding, diluted

|

|

|

14,313 |

|

|

|

14,200 |

|

|

|

14,273 |

|

|

|

14,168 |

|

|

Non-GAAP EPS

|

|

$ |

0.16 |

|

|

$ |

0.40 |

|

|

$ |

0.43 |

|

|

$ |

0.98 |

|

|

TruBridge, Inc.

|

|

Electronic Health Record (EHR) Revenue Composition

|

|

(In '000s)

|

|

(Unaudited)

|

| |

|

Three Months Ended June 30,

|

|

|

Six Months Ended June 30,

|

|

| |

|

2024

|

|

|

2023

|

|

|

2024

|

|

|

2023

|

|

|

Recurring revenues - EHR

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Acute Care EHR

|

|

$ |

26,666 |

|

|

$ |

30,013 |

|

|

$ |

54,160 |

|

|

$ |

59,353 |

|

|

Post-acute Care EHR

|

|

|

- |

|

|

|

3,729 |

|

|

|

582 |

|

|

|

7,636 |

|

|

Total recurring revenues - EHR

|

|

|

26,666 |

|

|

|

33,742 |

|

|

|

54,742 |

|

|

|

66,989 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Non-recurring revenues - EHR

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Acute Care EHR

|

|

|

3,956 |

|

|

|

2,775 |

|

|

|

6,008 |

|

|

|

6,750 |

|

|

Post-acute Care EHR

|

|

|

- |

|

|

|

345 |

|

|

|

81 |

|

|

|

725 |

|

|

Total non-recurring revenues - EHR

|

|

|

3,956 |

|

|

|

3,120 |

|

|

|

6,089 |

|

|

|

7,475 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total EHR revenues

|

|

$ |

30,622 |

|

|

$ |

36,862 |

|

|

$ |

60,831 |

|

|

$ |

74,464 |

|

-MORE-

TruBridge Announces Second Quarter 2024 Results

Page 9

August 8, 2024

Explanation of Non-GAAP Financial Measures

We report our financial results in accordance with accounting principles generally accepted in the United States of America, or “GAAP.” However, management believes that, in order to properly understand our short-term and long-term financial and operational trends, investors may wish to consider the impact of certain non-cash or non-recurring items, when used as a supplement to financial performance measures that are prepared in accordance with GAAP. These items result from facts and circumstances that vary in frequency and impact on continuing operations. Management uses these non-GAAP financial measures in order to evaluate the operating performance of the Company and compare it against past periods, make operating decisions, and serve as a basis for strategic planning. These non-GAAP financial measures provide management with additional means to understand and evaluate the operating results and trends in our ongoing business by eliminating certain non-cash expenses and other items that management believes might otherwise make comparisons of our ongoing business with prior periods more difficult, obscure trends in ongoing operations, or reduce management’s ability to make useful forecasts. In addition, management understands that some investors and financial analysts find these non-GAAP financial measures helpful in analyzing our financial and operational performance and comparing this performance to our peers and competitors.

As such, to supplement the GAAP information provided, we present in this press release and during the live webcast discussing our financial results the following non-GAAP financial measures: Adjusted EBITDA, Adjusted EBITDA Margin, Non-GAAP net income, and Non-GAAP earnings per share (“EPS”).

We calculate each of these non-GAAP financial measures as follows:

| |

●

|

Adjusted EBITDA – Adjusted EBITDA consists of GAAP net income as reported and adjusts for (i) depreciation expense; (ii) amortization of software development costs; (iii) amortization of acquisition-related intangibles; (iv) stock-based compensation; (v) severance and other nonrecurring charges; (vi) interest expense; (vii) gain on sale of AHT; and (xiii) the provision (benefit) for income taxes.

|

| |

●

|

Adjusted EBITDA Margin – Adjusted EBITDA Margin is calculated as Adjusted EBITDA, as defined above, divided by total revenue.

|

| |

●

|

Non-GAAP net income – Non-GAAP net income consists of GAAP net income as reported and adjusts for (i) amortization of acquisition-related intangible assets; (ii) stock-based compensation; (iii) severance and other non-recurring charges; (iv) non-cash interest expense; (v) gain on sale of AHT; and (vi) the total tax effect of items (i) through (v).

|

| |

●

|

Non-GAAP EPS – Non-GAAP EPS consists of Non-GAAP net income, as defined above, divided by weighted average shares outstanding (diluted) in the applicable period.

|

Certain of the items excluded or adjusted to arrive at these non-GAAP financial measures are described below:

| |

●

|

Amortization of acquisition-related intangibles – Acquisition-related amortization expense is a non-cash expense arising primarily from the acquisition of intangible assets in connection with acquisitions or investments. We exclude acquisition-related amortization expense from non-GAAP financial measures because we believe (i) the amount of such expenses in any specific period may not directly correlate to the underlying performance of our business operations and (ii) such expenses can vary significantly between periods as a result of new acquisitions and full amortization of previously acquired intangible assets. Investors should note that the use of these intangible assets contributed to revenue in the periods presented and will contribute to future revenue generation, and the related amortization expense will recur in future periods.

|

TruBridge Announces Second Quarter 2024 Results

Page 10

August 8, 2024

| |

●

|

Stock-based compensation – Stock-based compensation expense is a non-cash expense arising from the grant of stock-based awards. We exclude stock-based compensation expense from non-GAAP financial measures because we believe (i) the amount of such expenses in any specific period may not directly correlate to the underlying performance of our business operations and (ii) such expenses can vary significantly between periods as a result of the timing and valuation of grants of new stock-based awards, including grants in connection with acquisitions. Investors should note that stock-based compensation is a key incentive offered to employees whose efforts contributed to the operating results in the periods presented and are expected to contribute to operating results in future periods, and such expense will recur in future periods.

|

| |

●

|

Severance and other nonrecurring charges – Non-recurring charges relate to certain severance and other charges incurred in connection with activities that are considered non-recurring. We exclude non-recurring expenses (primarily related to costs associated with our recent business transformation initiative and transaction-related costs) from non-GAAP financial measures because we believe (i) the amount of such expenses in any specific period may not directly correlate to the underlying performance of our business operations and (ii) such expenses can vary significantly between periods.

|

| |

●

|

Non Cash Interest expense – Non-cash interest expense includes amortization of deferred debt issuance costs. We exclude non-cash interest expense from non-GAAP financial measures because we believe these non-cash amounts relate to specific transactions and, as such, may not directly correlate to the underlying performance of our business operations.

|

| |

●

|

Interest expense: Interest incurred on our term loan and revolving credit facility.

|

| |

●

|

Gain on sale of AHT: Represents the excess of proceeds received over the net assets sold from our sale of AHT, our previously wholly-owned post-acute business, in January 2024.

|

| |

●

|

Tax shortfall (windfall) from stock-based compensation – ASU 2016-09, Improvements to Employee Share-Based Payment Accounting, became effective for the Company during the third quarter of 2017 and changes the treatment of tax shortfall and excess tax benefits arising from stock based compensation arrangements. Prior to ASU 2016-09, these amounts were recorded as an increase (for excess benefits) or decrease (for shortfalls) to additional paid-in capital. With the adoption of ASU 2016-09, these amounts are now captured in the period’s income tax expense. We exclude this component of income tax expense from non-GAAP financial measures because we believe (i) the amount of such expenses or benefits in any specific period may not directly correlate to the underlying performance of our business operations; and (ii) such expenses or benefits can vary significantly between periods as a result of the valuation of grants of new stock-based awards, the timing of vesting of awards, and periodic movements in the fair value of our common stock.

|

Management considers these non-GAAP financial measures to be important indicators of our operational strength and performance of our business and a good measure of our historical operating trends, in particular the extent to which ongoing operations impact our overall financial performance. In addition, management may use Adjusted EBITDA, Non-GAAP net income and/or Non-GAAP EPS to measure the achievement of performance objectives under the Company’s stock and cash incentive programs. Note, however, that these non-GAAP financial measures are performance measures only, and they do not provide any measure of cash flow or liquidity. Non-GAAP financial measures are not alternatives for measures of financial performance prepared in accordance with GAAP and may be different from similarly titled non-GAAP measures presented by other companies, limiting their usefulness as comparative measures. Non-GAAP financial measures have limitations in that they do not reflect all of the amounts associated with our results of operations as determined in accordance with GAAP. Additionally, there is no certainty that we will not incur expenses in the future that are similar to those excluded in the calculations of the non-GAAP financial measures presented in this press release. Investors and potential investors are encouraged to review the “Unaudited Reconciliation of Non-GAAP Financial Measures” above.

v3.24.2.u1

Document And Entity Information

|

Aug. 08, 2024 |

| Document Information [Line Items] |

|

| Entity, Registrant Name |

TRUBRIDGE, INC.

|

| Document, Type |

8-K

|

| Document, Period End Date |

Aug. 08, 2024

|

| Entity, Incorporation, State or Country Code |

DE

|

| Entity, File Number |

000-49796

|

| Entity, Tax Identification Number |

74-3032373

|

| Entity, Address, Address Line One |

54 St. Emanuel Street

|

| Entity, Address, City or Town |

Mobile

|

| Entity, Address, State or Province |

AL

|

| Entity, Address, Postal Zip Code |

36602

|

| City Area Code |

251

|

| Local Phone Number |

639-8100

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Entity, Emerging Growth Company |

false

|

| Amendment Flag |

false

|

| Entity, Central Index Key |

0001169445

|

| CommonStockParValue0001PerShare Custom [Member] |

|

| Document Information [Line Items] |

|

| Title of 12(b) Security |

Common stock, par value $0.001 per share

|

| Trading Symbol |

TBRG

|

| Security Exchange Name |

NASDAQ

|

| CommonStockPurchaseRights Custom [Member] |

|

| Document Information [Line Items] |

|

| Title of 12(b) Security |

Common Stock Purchase Rights

|

| Security Exchange Name |

NASDAQ

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=cpsi_CommonStockParValue0001PerShareCustomMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=cpsi_CommonStockPurchaseRightsCustomMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

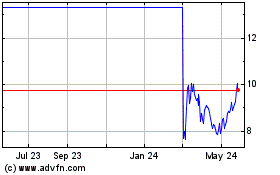

TruBridge (NASDAQ:TBRG)

Historical Stock Chart

From Dec 2024 to Jan 2025

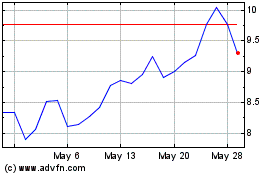

TruBridge (NASDAQ:TBRG)

Historical Stock Chart

From Jan 2024 to Jan 2025