First Financial Corporation (NASDAQ:THFF) today announced results

for the second quarter of 2024.

- Net income was $11.4 million

compared to the $16.0 million reported for the same period of

2023;

- Diluted net income per common share

of $0.96 compared to $1.33 for the same period of 2023;

- Return on average assets was 0.94%

compared to 1.34% for the three months ended June 30,

2023;

- Credit loss provision was $3.0

million compared to provision of $1.8 million for the second

quarter 2023; and

- Pre-tax, pre-provision net income

was $16.2 million compared to $21.2 million for the same period in

2023.1

The Corporation further reported results for the six months

ended June 30, 2024:

- Net income was $22.3 million

compared to the $32.0 million reported for the same period of

2023;

- Diluted net income per common share

of $1.89 compared to $2.66 for the same period of 2023;

- Return on average assets was 0.93%

compared to 1.33% for the six months ended June 30,

2023;

- Credit loss provision was $4.8

million compared to provision of $3.6 million for the six months

ended June 30, 2023; and

- Pre-tax, pre-provision net income

was $31.2 million compared to $42.6 million for the same period in

2023.1

_________________________1 Non-GAAP financial measure that

Management believes is useful for investors and management to

understand pre-tax profitability before giving effect to credit

loss expense and to provide additional perspective on the

Corporation’s performance over time as well as comparison to the

Corporation’s peers and evaluating the financial results of the

Corporation – please refer to the Non GAAP reconciliations

contained in this release.

Average Total Loans

Average total loans for the second quarter of 2024 were $3.20

billion versus $3.10 billion for the comparable period in 2023, an

increase of $100 million or 3.22%. On a linked quarter basis,

average loans increased $18 million or 0.55% from $3.18 billion as

of March 31, 2024.

Total Loans Outstanding

Total loans outstanding as of June 30, 2024, were $3.20

billion compared to $3.13 billion as of June 30, 2023, an

increase of $69 million or 2.21%, primarily driven by increases in

Commercial Construction and Development, Commercial Real Estate,

and Consumer Auto loans. On a linked quarter basis, total loans

increased $12.0 million or 0.38% from $3.19 billion as of March 31,

2024.

Norman D. Lowery, President and Chief Executive Officer,

commented “We are pleased with our second quarter results, as we

experienced another quarter of loan growth. We also saw our net

interest margin expand during the quarter as cost of funds pressure

moderated. We expect continued improvement in coming quarters.

Additionally on July 1st we closed our acquisition of SimplyBank

expanding our footprint into attractive southeastern Tennessee

markets.”

Average Total Deposits

Average total deposits for the quarter ended June 30, 2024,

were $4.11 billion versus $4.12 billion as of June 30,

2023.

Total Deposits

Total deposits were $4.13 billion as of June 30, 2024,

compared to $4.06 billion as of June 30, 2023, a $69 million

increase, or 1.70%. On a linked quarter basis, total deposits

increased $27.2 million, or 0.66%. Non-interest bearing deposits

were $748.5 million and time deposits were $585.8 million as of

June 30, 2024, compared to $817.4 million and $414.2 million,

respectively for the same period of 2023.

Shareholders’ Equity

Shareholders’ equity at June 30, 2024, was $530.7 million

compared to $496.9 million on June 30, 2023. During the last

twelve months, the Corporation has repurchased 228,457 shares of

its common stock. There were no shares repurchased during the

quarter. 518,860 shares remain available for repurchase under the

current repurchase authorization. During the quarter, the

Corporation paid a $0.45 per share quarterly dividend in April, and

declared a $0.45 quarterly dividend paid on July 15, 2024.

Book Value Per Share

Book Value per share was $44.92 as of June 30, 2024,

compared to $41.47 as of June 30, 2023, an increase of 8.33%.

Tangible Book Value per share was $37.12 as of June 30, 2024,

compared to $33.70 as of June 30, 2023, an increase of $3.42 per

share or 10.15%.

Tangible Common Equity to Tangible Asset

Ratio

The Corporation’s tangible common equity to tangible asset ratio

was 9.14% at June 30, 2024, compared to 8.44% at June 30,

2023.

Net Interest Income

Net interest income for the second quarter of 2024 was $39.3

million, compared to $42.2 million reported for the same period of

2023, a decrease of $2.9 million, or 6.86%, driven primarily by

higher interest expense. Interest income increased $4.5 million and

interest expense increased $7.4 million year-over-year.

Net Interest Margin

The net interest margin for the quarter ended June 30,

2024, was 3.57% compared to the 3.81% reported at June 30,

2023. On a linked quarterly basis, the net interest margin

increased 4 basis points from 3.53% at March 31, 2024.

Nonperforming Loans

Nonperforming loans as of June 30, 2024, were $15.9 million

versus $13.3 million as of June 30, 2023. The ratio of

nonperforming loans to total loans and leases was 0.50% as of

June 30, 2024, versus 0.43% as of June 30, 2023.

Credit Loss Provision

The provision for credit losses for the three months ended

June 30, 2024, was $3.0 million, compared to $1.8 million for

the second quarter 2023. The increase in provision as well as

charge-offs discussed below were related to one previously

identified credit, reflecting further deterioration in collateral

values in the quarter.

Net Charge-Offs

In the second quarter of 2024 net charge-offs were $4.7 million

compared to $1.5 million in the same period of 2023.

Allowance for Credit Losses

The Corporation’s allowance for credit losses as of

June 30, 2024, was $38.3 million compared to $39.9 million as

of June 30, 2023. The allowance for credit losses as

a percent of total loans was 1.20% as of June 30, 2024,

compared to 1.28% as of June 30, 2023. On a linked quarter

basis, the allowance for credit losses as a percent of total loans

decreased 5 basis points from 1.25% as of March 31, 2024.

Non-Interest Income

Non-interest income for the three months ended

June 30, 2024 and 2023 was $9.9 million and $10.5 million,

respectively. The 2023 amount included a $760 thousand gain on the

sale of a branch which had been closed.

Non-Interest Expense

Non-interest expense for the three months ended

June 30, 2024, was $32.7 million compared to $31.3 million in

2023. This included $654 thousand of acquisition related expenses

during the quarter.

Efficiency Ratio

The Corporation’s efficiency ratio was 64.56% for the quarter

ending June 30, 2024, versus 58.01% for the same period in

2023.

Income Taxes

Income tax expense for the three months ended June 30,

2024, was $2.2 million versus $3.5 million for the same period in

2023. The effective tax rate for 2024 was 16.29% compared to 17.99%

for 2023.

About First Financial Corporation

First Financial Corporation (NASDAQ:THFF) is the holding company

for First Financial Bank N.A. First Financial Bank N.A., the fifth

oldest national bank in the United States, operates 70 banking

centers in Illinois, Indiana, Kentucky and Tennessee. Additional

information is available at www.first-online.bank.

Investor Contact:Rodger A. McHargueChief

Financial OfficerP: 812-238-6334E: rmchargue@first-online.com

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

Three Months Ended |

|

Six Months Ended |

| |

June 30, |

|

March 31, |

|

June 30, |

|

June 30, |

|

June 30, |

| |

2024 |

|

2024 |

|

2023 |

|

2024 |

|

2023 |

| END OF PERIOD

BALANCES |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Assets |

$ |

4,891,068 |

|

|

$ |

4,852,615 |

|

|

$ |

4,877,231 |

|

|

$ |

4,891,068 |

|

|

$ |

4,877,231 |

|

|

Deposits |

$ |

4,132,327 |

|

|

$ |

4,105,103 |

|

|

$ |

4,063,155 |

|

|

$ |

4,132,327 |

|

|

$ |

4,063,155 |

|

|

Loans, including net deferred loan costs |

$ |

3,204,009 |

|

|

$ |

3,191,983 |

|

|

$ |

3,134,638 |

|

|

$ |

3,204,009 |

|

|

$ |

3,134,638 |

|

|

Allowance for Credit Losses |

$ |

38,334 |

|

|

$ |

40,045 |

|

|

$ |

39,907 |

|

|

$ |

38,334 |

|

|

$ |

39,907 |

|

|

Total Equity |

$ |

530,670 |

|

|

$ |

520,766 |

|

|

$ |

496,888 |

|

|

$ |

530,670 |

|

|

$ |

496,888 |

|

|

Tangible Common Equity (a) |

$ |

438,569 |

|

|

$ |

428,430 |

|

|

$ |

403,824 |

|

|

$ |

438,569 |

|

|

$ |

403,824 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| AVERAGE

BALANCES |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total Assets |

$ |

4,813,308 |

|

|

$ |

4,804,364 |

|

|

$ |

4,818,760 |

|

|

$ |

4,808,836 |

|

|

$ |

4,835,122 |

|

|

Earning Assets |

$ |

4,556,839 |

|

|

$ |

4,566,461 |

|

|

$ |

4,581,652 |

|

|

$ |

4,561,650 |

|

|

$ |

4,597,389 |

|

|

Investments |

$ |

1,279,278 |

|

|

$ |

1,308,322 |

|

|

$ |

1,395,446 |

|

|

$ |

1,293,800 |

|

|

$ |

1,401,695 |

|

|

Loans |

$ |

3,197,695 |

|

|

$ |

3,180,147 |

|

|

$ |

3,097,836 |

|

|

$ |

3,188,921 |

|

|

$ |

3,083,276 |

|

|

Total Deposits |

$ |

4,113,826 |

|

|

$ |

4,045,838 |

|

|

$ |

4,121,097 |

|

|

$ |

4,079,832 |

|

|

$ |

4,186,629 |

|

|

Interest-Bearing Deposits |

$ |

3,413,752 |

|

|

$ |

3,326,090 |

|

|

$ |

3,297,110 |

|

|

$ |

3,369,921 |

|

|

$ |

3,352,350 |

|

|

Interest-Bearing Liabilities |

$ |

152,303 |

|

|

$ |

221,425 |

|

|

$ |

185,318 |

|

|

$ |

186,864 |

|

|

$ |

140,739 |

|

|

Total Equity |

$ |

517,890 |

|

|

$ |

522,720 |

|

|

$ |

501,686 |

|

|

$ |

520,305 |

|

|

$ |

494,760 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| INCOME STATEMENT

DATA |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net Interest Income |

$ |

39,294 |

|

|

$ |

38,920 |

|

|

$ |

42,187 |

|

|

$ |

78,214 |

|

|

$ |

86,522 |

|

|

Net Interest Income Fully Tax Equivalent (b) |

$ |

40,673 |

|

|

$ |

40,297 |

|

|

$ |

43,581 |

|

|

$ |

80,970 |

|

|

$ |

89,235 |

|

|

Provision for Credit Losses |

$ |

2,966 |

|

|

$ |

1,800 |

|

|

$ |

1,800 |

|

|

$ |

4,766 |

|

|

$ |

3,600 |

|

|

Non-interest Income |

$ |

9,905 |

|

|

$ |

9,431 |

|

|

$ |

10,453 |

|

|

$ |

19,336 |

|

|

$ |

19,828 |

|

|

Non-interest Expense |

$ |

32,651 |

|

|

$ |

33,422 |

|

|

$ |

31,346 |

|

|

$ |

66,073 |

|

|

$ |

63,667 |

|

|

Net Income |

$ |

11,369 |

|

|

$ |

10,924 |

|

|

$ |

15,987 |

|

|

$ |

22,293 |

|

|

$ |

31,967 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| PER SHARE

DATA |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Basic and Diluted Net Income Per Common Share |

$ |

0.96 |

|

|

$ |

0.93 |

|

|

$ |

1.33 |

|

|

$ |

1.89 |

|

|

$ |

2.66 |

|

|

Cash Dividends Declared Per Common Share |

$ |

0.45 |

|

|

$ |

0.45 |

|

|

$ |

0.54 |

|

|

$ |

0.90 |

|

|

$ |

0.54 |

|

|

Book Value Per Common Share |

$ |

44.92 |

|

|

$ |

44.08 |

|

|

$ |

41.47 |

|

|

$ |

44.92 |

|

|

$ |

41.47 |

|

|

Tangible Book Value Per Common Share (c) |

$ |

36.04 |

|

|

$ |

36.26 |

|

|

$ |

33.99 |

|

|

$ |

37.12 |

|

|

$ |

33.70 |

|

|

Basic Weighted Average Common Shares Outstanding |

|

11,814 |

|

|

|

11,803 |

|

|

|

12,022 |

|

|

|

11,809 |

|

|

|

12,040 |

|

_________________________(a) Tangible common equity is a

non-GAAP financial measure derived from GAAP-based amounts. We

calculate tangible common equity by excluding goodwill and other

intangible assets from shareholder’s equity.(b) Net interest

income fully tax equivalent is a non-GAAP financial measure derived

from GAAP-based amounts. We calculate net interest income fully tax

equivalent by adding back the tax equivalent factor of tax exempt

income to net interest income. We calculate the tax equivalent

factor of tax exempt income by dividing tax exempt income by the

net of tax rate of 75%.(c) Tangible book value per common

share is a non-GAAP financial measure derived from GAAP-based

amounts. We calculate the factor by dividing average tangible

common equity by average shares outstanding. We calculate average

tangible common equity by excluding average intangible assets from

average shareholder’s equity.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Key

Ratios |

Three Months Ended |

|

Six Months Ended |

|

| |

June 30, |

|

March 31, |

|

June 30, |

|

June 30, |

|

June 30, |

|

| |

2024 |

|

2024 |

|

2023 |

|

2024 |

|

2023 |

|

| Return on average assets |

0.94 |

|

% |

0.91 |

|

% |

1.34 |

|

% |

0.93 |

|

% |

1.33 |

|

% |

| Return on average common

shareholder's equity |

8.78 |

|

% |

8.36 |

|

% |

12.75 |

|

% |

8.57 |

|

% |

12.92 |

|

% |

| Efficiency ratio |

64.56 |

|

% |

67.21 |

|

% |

58.01 |

|

% |

65.87 |

|

% |

58.38 |

|

% |

| Average equity to average

assets |

10.76 |

|

% |

10.88 |

|

% |

10.48 |

|

% |

10.82 |

|

% |

10.27 |

|

% |

| Net interest margin (a) |

3.57 |

|

% |

3.53 |

|

% |

3.81 |

|

% |

3.55 |

|

% |

3.88 |

|

% |

| Net charge-offs to average

loans and leases |

0.59 |

|

% |

0.19 |

|

% |

0.20 |

|

% |

0.39 |

|

% |

0.23 |

|

% |

| Credit loss reserve to loans

and leases |

1.20 |

|

% |

1.25 |

|

% |

1.28 |

|

% |

1.20 |

|

% |

1.28 |

|

% |

| Credit loss reserve to

nonperforming loans |

240.85 |

|

% |

165.12 |

|

% |

300.10 |

|

% |

240.85 |

|

% |

300.10 |

|

% |

| Nonperforming loans to loans

and leases |

0.50 |

|

% |

0.76 |

|

% |

0.43 |

|

% |

0.50 |

|

% |

0.43 |

|

% |

| Tier 1 leverage |

12.14 |

|

% |

12.02 |

|

% |

11.49 |

|

% |

12.14 |

|

% |

11.49 |

|

% |

| Risk-based capital - Tier

1 |

14.82 |

|

% |

14.69 |

|

% |

14.44 |

|

% |

14.82 |

|

% |

14.44 |

|

% |

_________________________(a) Net interest margin is

calculated on a tax equivalent basis.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Asset

Quality |

Three Months Ended |

|

Six Months Ended |

| |

June 30, |

|

March 31, |

|

June 30, |

|

June 30, |

|

June 30, |

| |

2024 |

|

2024 |

|

2023 |

|

2024 |

|

2023 |

| Accruing loans and leases past

due 30-89 days |

$ |

14,913 |

|

|

$ |

17,937 |

|

|

$ |

15,583 |

|

|

$ |

14,913 |

|

|

$ |

15,583 |

|

| Accruing loans and leases past

due 90 days or more |

$ |

1,353 |

|

|

$ |

1,395 |

|

|

$ |

682 |

|

|

$ |

1,353 |

|

|

$ |

682 |

|

| Nonaccrual loans and

leases |

$ |

14,563 |

|

|

$ |

22,857 |

|

|

$ |

12,616 |

|

|

$ |

14,563 |

|

|

$ |

12,616 |

|

| Other real estate owned |

$ |

170 |

|

|

$ |

167 |

|

|

$ |

90 |

|

|

$ |

170 |

|

|

$ |

90 |

|

| Nonperforming loans and other

real estate owned |

$ |

16,086 |

|

|

$ |

24,419 |

|

|

$ |

13,388 |

|

|

$ |

16,086 |

|

|

$ |

13,388 |

|

| Total nonperforming

assets |

$ |

18,978 |

|

|

$ |

27,307 |

|

|

$ |

16,302 |

|

|

$ |

18,978 |

|

|

$ |

16,302 |

|

| Gross charge-offs |

$ |

6,091 |

|

|

$ |

3,192 |

|

|

$ |

3,543 |

|

|

$ |

9,283 |

|

|

$ |

7,919 |

|

| Recoveries |

$ |

1,414 |

|

|

$ |

1,670 |

|

|

$ |

2,030 |

|

|

$ |

3,084 |

|

|

$ |

4,447 |

|

| Net

charge-offs/(recoveries) |

$ |

4,677 |

|

|

$ |

1,522 |

|

|

$ |

1,513 |

|

|

$ |

6,199 |

|

|

$ |

3,472 |

|

| |

|

|

|

|

|

| Non-GAAP

Reconciliations |

Three Months Ended June 30, |

| |

2024 |

|

2023 |

| ($in thousands, except

EPS) |

|

|

|

|

|

|

Income before Income Taxes |

$ |

13,582 |

|

|

$ |

19,494 |

|

| Provision for credit

losses |

|

2,966 |

|

|

|

1,800 |

|

| Provision for unfunded

commitments |

|

(300 |

) |

|

|

(100 |

) |

| Pre-tax, Pre-provision

Income |

$ |

16,248 |

|

|

$ |

21,194 |

|

| |

|

|

|

|

|

| Non-GAAP

Reconciliations |

Six Months Ended June 30, |

| |

2024 |

|

2023 |

| ($ in thousands, except

EPS) |

|

|

|

|

|

|

Income before Income Taxes |

$ |

26,711 |

|

|

$ |

39,083 |

|

| Provision for credit

losses |

|

4,766 |

|

|

|

3,600 |

|

| Provision for unfunded

commitments |

|

(300 |

) |

|

|

(100 |

) |

| Pre-tax, Pre-provision

Income |

$ |

31,177 |

|

|

$ |

42,583 |

|

| |

|

CONSOLIDATED BALANCE SHEETS(Dollar amounts in thousands, except per

share data) |

| |

|

|

|

|

|

| |

June 30, |

|

December 31, |

| |

2024 |

|

2023 |

| |

(unaudited) |

| ASSETS |

|

|

|

|

|

|

Cash and due from banks |

$ |

75,073 |

|

|

$ |

76,759 |

|

| Federal funds sold |

|

24,000 |

|

|

|

282 |

|

| Securities

available-for-sale |

|

1,205,751 |

|

|

|

1,259,137 |

|

| Loans: |

|

|

|

|

|

| Commercial |

|

1,782,646 |

|

|

|

1,817,526 |

|

| Residential |

|

748,044 |

|

|

|

695,788 |

|

| Consumer |

|

666,130 |

|

|

|

646,758 |

|

| |

|

3,196,820 |

|

|

|

3,160,072 |

|

| (Less) plus: |

|

|

|

|

|

| Net deferred loan costs |

|

7,189 |

|

|

|

7,749 |

|

| Allowance for credit

losses |

|

(38,334 |

) |

|

|

(39,767 |

) |

| |

|

3,165,675 |

|

|

|

3,128,054 |

|

| Restricted stock |

|

15,378 |

|

|

|

15,364 |

|

| Accrued interest

receivable |

|

23,733 |

|

|

|

24,877 |

|

| Premises and equipment,

net |

|

65,750 |

|

|

|

67,286 |

|

| Bank-owned life insurance |

|

114,767 |

|

|

|

114,122 |

|

| Goodwill |

|

86,985 |

|

|

|

86,985 |

|

| Other intangible assets |

|

5,116 |

|

|

|

5,586 |

|

| Other real estate owned |

|

170 |

|

|

|

107 |

|

| Other assets |

|

108,670 |

|

|

|

72,587 |

|

| TOTAL ASSETS |

$ |

4,891,068 |

|

|

$ |

4,851,146 |

|

| |

|

|

|

|

|

| LIABILITIES AND SHAREHOLDERS’

EQUITY |

|

|

|

|

|

| Deposits: |

|

|

|

|

|

| Non-interest-bearing |

$ |

748,495 |

|

|

$ |

750,335 |

|

| Interest-bearing: |

|

|

|

|

|

| Certificates of deposit

exceeding the FDIC insurance limits |

|

112,679 |

|

|

|

92,921 |

|

| Other interest-bearing

deposits |

|

3,271,153 |

|

|

|

3,246,812 |

|

| |

|

4,132,327 |

|

|

|

4,090,068 |

|

| Short-term borrowings |

|

38,211 |

|

|

|

67,221 |

|

| FHLB advances |

|

108,575 |

|

|

|

108,577 |

|

| Other liabilities |

|

81,285 |

|

|

|

57,304 |

|

| TOTAL LIABILITIES |

|

4,360,398 |

|

|

|

4,323,170 |

|

| |

|

|

|

|

|

| Shareholders’ equity |

|

|

|

|

|

| Common stock, $.125 stated

value per share; |

|

|

|

|

|

| Authorized

shares-40,000,000 |

|

|

|

|

|

| Issued shares-16,165,023 in

2024 and 16,137,220 in 2023 |

|

|

|

|

|

| Outstanding shares-11,814,093

in 2024 and 11,795,024 in 2023 |

|

2,016 |

|

|

|

2,014 |

|

| Additional paid-in

capital |

|

144,632 |

|

|

|

144,152 |

|

| Retained earnings |

|

673,728 |

|

|

|

663,726 |

|

| Accumulated other

comprehensive income/(loss) |

|

(134,501 |

) |

|

|

(127,087 |

) |

| Less: Treasury shares at

cost-4,350,930 in 2024 and 4,342,196 in 2023 |

|

(155,205 |

) |

|

|

(154,829 |

) |

| TOTAL SHAREHOLDERS’

EQUITY |

|

530,670 |

|

|

|

527,976 |

|

| TOTAL LIABILITIES AND

SHAREHOLDERS’ EQUITY |

$ |

4,891,068 |

|

|

$ |

4,851,146 |

|

| |

|

CONSOLIDATED STATEMENTS OF INCOME AND COMPREHENSIVE INCOME(Dollar

amounts in thousands, except per share data) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

| |

Three Months Ended |

|

Six Months Ended |

| |

June 30, |

|

June 30, |

| |

2024 |

|

2023 |

|

2024 |

|

2023 |

| |

|

|

|

|

|

|

|

(unaudited) |

| INTEREST INCOME: |

|

|

|

|

|

|

|

|

|

|

|

|

|

Loans, including related fees |

$ |

51,459 |

|

|

$ |

46,479 |

|

|

$ |

101,511 |

|

|

$ |

91,074 |

|

| Securities: |

|

|

|

|

|

|

|

|

|

|

|

|

| Taxable |

|

5,833 |

|

|

|

6,231 |

|

|

|

11,764 |

|

|

|

12,467 |

|

| Tax-exempt |

|

2,601 |

|

|

|

2,678 |

|

|

|

5,204 |

|

|

|

5,276 |

|

| Other |

|

878 |

|

|

|

841 |

|

|

|

1,695 |

|

|

|

2,112 |

|

| TOTAL INTEREST INCOME |

|

60,771 |

|

|

|

56,229 |

|

|

|

120,174 |

|

|

|

110,929 |

|

| INTEREST EXPENSE: |

|

|

|

|

|

|

|

|

|

|

|

|

| Deposits |

|

19,694 |

|

|

|

11,957 |

|

|

|

37,425 |

|

|

|

21,484 |

|

| Short-term borrowings |

|

959 |

|

|

|

1,294 |

|

|

|

1,935 |

|

|

|

2,102 |

|

| Other borrowings |

|

824 |

|

|

|

791 |

|

|

|

2,600 |

|

|

|

821 |

|

| TOTAL INTEREST EXPENSE |

|

21,477 |

|

|

|

14,042 |

|

|

|

41,960 |

|

|

|

24,407 |

|

| NET INTEREST INCOME |

|

39,294 |

|

|

|

42,187 |

|

|

|

78,214 |

|

|

|

86,522 |

|

| Provision for credit

losses |

|

2,966 |

|

|

|

1,800 |

|

|

|

4,766 |

|

|

|

3,600 |

|

| NET INTEREST INCOME AFTER

PROVISION |

|

|

|

|

|

|

|

|

|

|

|

|

| FOR LOAN LOSSES |

|

36,328 |

|

|

|

40,387 |

|

|

|

73,448 |

|

|

|

82,922 |

|

| NON-INTEREST INCOME: |

|

|

|

|

|

|

|

|

|

|

|

|

| Trust and financial

services |

|

1,318 |

|

|

|

1,185 |

|

|

|

2,652 |

|

|

|

2,502 |

|

| Service charges and fees on

deposit accounts |

|

6,730 |

|

|

|

7,054 |

|

|

|

13,437 |

|

|

|

13,872 |

|

| Other service charges and

fees |

|

286 |

|

|

|

196 |

|

|

|

509 |

|

|

|

400 |

|

| Securities gains (losses),

net |

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

| Interchange income |

|

135 |

|

|

|

— |

|

|

|

314 |

|

|

|

47 |

|

| Loan servicing fees |

|

414 |

|

|

|

264 |

|

|

|

683 |

|

|

|

549 |

|

| Gain on sales of mortgage

loans |

|

299 |

|

|

|

311 |

|

|

|

475 |

|

|

|

490 |

|

| Other |

|

723 |

|

|

|

1,443 |

|

|

|

1,266 |

|

|

|

1,968 |

|

| TOTAL NON-INTEREST INCOME |

|

9,905 |

|

|

|

10,453 |

|

|

|

19,336 |

|

|

|

19,828 |

|

| NON-INTEREST EXPENSE: |

|

|

|

|

|

|

|

|

|

|

|

|

| Salaries and employee

benefits |

|

17,380 |

|

|

|

16,946 |

|

|

|

34,710 |

|

|

|

34,104 |

|

| Occupancy expense |

|

2,201 |

|

|

|

2,132 |

|

|

|

4,560 |

|

|

|

4,731 |

|

| Equipment expense |

|

4,312 |

|

|

|

3,525 |

|

|

|

8,456 |

|

|

|

6,824 |

|

| FDIC Expense |

|

501 |

|

|

|

577 |

|

|

|

1,163 |

|

|

|

1,364 |

|

| Other |

|

8,257 |

|

|

|

8,166 |

|

|

|

17,184 |

|

|

|

16,644 |

|

| TOTAL NON-INTEREST

EXPENSE |

|

32,651 |

|

|

|

31,346 |

|

|

|

66,073 |

|

|

|

63,667 |

|

| INCOME BEFORE INCOME

TAXES |

|

13,582 |

|

|

|

19,494 |

|

|

|

26,711 |

|

|

|

39,083 |

|

| Provision for income

taxes |

|

2,213 |

|

|

|

3,507 |

|

|

|

4,418 |

|

|

|

7,116 |

|

| NET INCOME |

|

11,369 |

|

|

|

15,987 |

|

|

|

22,293 |

|

|

|

31,967 |

|

| OTHER COMPREHENSIVE INCOME

(LOSS) |

|

|

|

|

|

|

|

|

|

|

|

|

| Change in unrealized

gains/(losses) on securities, net of reclassifications and

taxes |

|

3,535 |

|

|

|

(15,808 |

) |

|

|

(7,561 |

) |

|

|

(1,570 |

) |

| Change in funded status of

post retirement benefits, net of taxes |

|

74 |

|

|

|

147 |

|

|

|

147 |

|

|

|

294 |

|

| COMPREHENSIVE INCOME

(LOSS) |

$ |

14,978 |

|

|

$ |

326 |

|

|

$ |

14,879 |

|

|

$ |

30,691 |

|

| PER SHARE DATA |

|

|

|

|

|

|

|

|

|

|

|

|

| Basic and Diluted Earnings per

Share |

$ |

0.96 |

|

|

$ |

1.33 |

|

|

$ |

1.89 |

|

|

$ |

2.66 |

|

| Weighted average number of

shares outstanding (in thousands) |

|

11,814 |

|

|

|

12,022 |

|

|

|

11,809 |

|

|

|

12,040 |

|

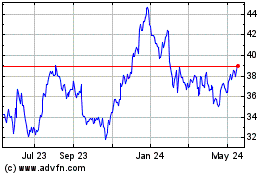

First Financial (NASDAQ:THFF)

Historical Stock Chart

From Dec 2024 to Jan 2025

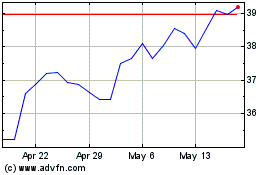

First Financial (NASDAQ:THFF)

Historical Stock Chart

From Jan 2024 to Jan 2025