Form 8-K - Current report

October 01 2024 - 10:04AM

Edgar (US Regulatory)

0001113169falsePRICE T ROWE GROUP INC00011131692024-10-012024-10-01

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

___________________________

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): October 1, 2024

T. Rowe Price Group, Inc.

(Exact name of registrant as specified in its charter)

| | | | | | | | |

| Maryland | 000-32191 | 52-2264646 |

(State of

incorporation) | (Commission

File Number) | (IRS Employer

Identification No.) |

100 East Pratt Street, Baltimore, Maryland 21202

| | | | | |

| (Address of principal executive offices) | (Zip Code) |

Registrant's telephone number, including area code: (410) 345-2000

N/A

(Former Name of Former Address, if Changed Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | | | | | | | |

| | | | |

| Title of each class | | Trading Symbol | | Name of each exchange on which registered |

| Common Stock, par value $0.20 | | TROW | | The NASDAQ Stock Market LLC (Nasdaq Global Select Market) |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Section 5 - Corporate Governance and Management

Item 5.02. Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers.

(b) On October 1, 2024, T. Rowe Price Group, Inc. (the “Company”) announced that Justin Thomson, will step down as Head of International Equity, effective December 31, 2024, to assume a new position as head of the T. Rowe Price Investment Institute, and will remain a chief investment officer. Mr. Thomson will also step down from the Company's Management Committee, and will cease being an executive officer of the Company on December 31, 2024.

Section 9 - Financial Statements and Exhibits.

Item 9.01. Financial Statements and Exhibits.

(d) Exhibits.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, as amended, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

T. Rowe Price Group, Inc.

By: /s/ David Oestreicher

David Oestreicher

Vice President, General Counsel and Secretary

Date: October 1, 2024

NEWS RELEASE T. ROWE PRICE ANNOUNCES FORMATION OF THE T. ROWE PRICE INVESTMENT INSTITUTE 26-year company veteran Justin Thomson to lead new initiative focused on investment talent development and institutional/intermediary client education BALTIMORE (October 1, 2024) – T. Rowe Price, a global investment management firm and leader in retirement, announced it is forming the T. Rowe Price Investment Institute for the dual purposes of enhancing the firm’s investment talent development and strengthening the delivery of T. Rowe Price’s proprietary investment insights to clients. Justin Thomson, head of International Equity and chief investment officer, has been named to head the Institute, which is scheduled to launch on January 1, 2025. Thomson will create the Institute’s charter, which is expected to involve establishing a center of excellence for developing differentiated investment thought leadership and internal investment talent development. The work of the Institute will include curating and highlighting insights generated by T. Rowe Price’s leading investment research organization and developing educational content to help clients and T. Rowe Price investment professionals augment investment decision-making. As progress accelerates into next year under Thomson’s leadership, the Institute will pursue engagements with experts in business and academia and with other institutions on topics such as portfolio construction, behavioral finance, geopolitics, and others. The Institute will facilitate collaboration between these experts and T. Rowe Price investment professionals, developing insights that can be shared with clients. Thomson is a 26-year veteran of T. Rowe Price who helped conceive the firm’s International Small-Cap Equity Strategy and managed it for many years before stepping into his current leadership role in 2020. He has also been an important contributor to T. Rowe Price’s Asset Allocation Committee for the last nine years. Thomson is based in London, and his total investment experience spans more than 33 years. “Justin has a demonstrable record of success throughout his long tenure at T. Rowe Price,” said Eric Veiel, head of Global Investments and a chief investment officer. “He was a talented portfolio manager, and he has always been an influential voice within the investment organization. He is valued as a leader and mentor, and he’s highly respected by his colleagues and clients. The impressive skill set he has built over the course of his career makes him the perfect match for this important new role.” “The T. Rowe Price Investment Institute will be an important educational resource for our investment professionals and our clients,” Thomson said. “Risks are everywhere in the markets today. More than ever, investors and advisors need a place where they can find timely and actionable insights from people who are on the ground asking the right questions of the companies that are shaping the present and future of the financial markets and global economies. That’s why the time is right to establish this Institute and it’s why I also believe the time is right for cost-effective, skilled active asset management. Our intent with the Institute is to help investors do more than keep pace with markets by enabling better, more informed investment decisions.” ABOUT T. ROWE PRICE Founded in 1937, T. Rowe Price (NASDAQ – GS: TROW) helps individuals and institutions around the world achieve their long-term investment goals. As a large global asset management company known for investment excellence, retirement leadership, and independent proprietary research, the firm is built on a culture of integrity that puts client interests first. Clients rely on the award-winning firm for its retirement expertise and active management of equity, fixed income, alternatives, and multi-asset investment capabilities. T. Rowe Price serves millions of clients globally and manages US $1.61 trillion in assets under management as of August 31, 2024. About two-thirds of the assets under management are

retirement-related. News and other updates can be found on Facebook, Instagram, LinkedIn, X, YouTube, and troweprice.com/newsroom. # # # T. ROWE PRICE MEDIA CONTACTS Bill Benintende 443-248-2424 bill.benintende@troweprice.com Jamaal Mobley 410-345-3403 jamaal.mobley@troweprice.com Lara Naylor 410-215-7998 lara.naylor@troweprice.com Anne Read (EMEA) +44 (0)7507 114032 anne.read@troweprice.com Phoebe Ho (APAC) +852 6016 2912 phoebe.ho@troweprice.com

v3.24.3

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

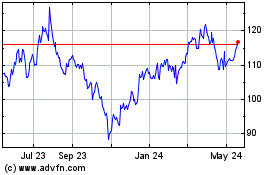

T Rowe Price (NASDAQ:TROW)

Historical Stock Chart

From Dec 2024 to Jan 2025

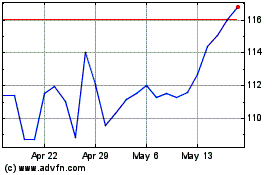

T Rowe Price (NASDAQ:TROW)

Historical Stock Chart

From Jan 2024 to Jan 2025