UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 13D

Under the Securities Exchange Act of 1934

(Amendment No. 7)*

Tradeweb Markets Inc.

(Name of Issuer)

Class A Common Stock, par value $0.00001 per

share

(Title of Class of Securities)

892672106

(CUSIP Number)

Timothy Knowland

General Counsel, Corporate

London Stock Exchange Group plc

10 Paternoster Square

London

EC4M 7LS

Tel: +44 (0) 20 7797 1000

with a copy to:

Michael Levitt

Sebastian Fain

Freshfields Bruckhaus Deringer US LLP

3 World Trade Center

175 Greenwich Street

New York, NY 10007

Tel: (212) 277-4000

(Name, Address and Telephone Number of Person

Authorized to Receive Notices and Communications)

September 18, 2024

(Date of Event Which Requires Filing of this

Statement)

If the filing person has

previously filed a statement on Schedule 13G to report the acquisition that is the subject of this Schedule 13D, and is filing this schedule

because of §§240.13d-1(e), 240.13d-1(f) or 240.13d-1(g), check the following box. ¨

Note: Schedules filed in paper format shall

include a signed original and five copies of the schedule, including all exhibits. See Rule 13d-7 for other parties to whom copies are

to be sent.

| * | The remainder of this cover page

shall be filled out for a reporting person’s initial filing on this form with respect to the subject class of securities, and for

any subsequent amendment containing information which would alter disclosures provided in a prior cover page. |

The information required on the remainder of this cover page shall

not be deemed to be “filed” for the purpose of Section 18 of the Securities Exchange Act of 1934 (“Act”) or otherwise

subject to the liabilities of that section of the Act but shall be subject to all other provisions of the Act (however, see the Notes).

CUSIP No. 892672106

| 1 |

NAMES OF REPORTING PERSONS

Refinitiv US PME LLC |

| 2 |

CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP (SEE INSTRUCTIONS) |

| |

(a) ¨ (b) x |

| 3 |

SEC USE ONLY |

| 4 |

SOURCE OF FUNDS (SEE INSTRUCTIONS) |

| |

OO |

| 5 |

CHECK IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT TO ITEMS 2(D) OR 2(E) |

| |

¨ |

| 6 |

CITIZENSHIP OR PLACE OF ORGANIZATION |

| |

Delaware |

| NUMBER OF |

7 |

SOLE VOTING POWER |

| SHARES |

|

22,988,329 |

| BENEFICIALLY |

8 |

SHARED VOTING POWER |

| OWNED BY |

|

0 |

| EACH |

9 |

SOLE DISPOSITIVE POWER |

| REPORTING |

|

22,988,329 |

| PERSON |

10 |

SHARED DISPOSITIVE POWER |

| WITH |

|

0 |

| 11 |

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON |

| |

22,988,329 |

| 12 |

CHECK IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES (SEE INSTRUCTIONS) |

| |

¨ |

| 13 |

PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW (11) |

| |

16.5% |

| 14 |

TYPE OF REPORTING PERSON (SEE INSTRUCTIONS) |

| |

OO |

CUSIP No. 892672106

| 1 |

NAMES OF REPORTING PERSONS

Refinitiv US LLC |

| 2 |

CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP (SEE INSTRUCTIONS) |

| |

(a) ¨ (b) x |

| 3 |

SEC USE ONLY |

| 4 |

SOURCE OF FUNDS (SEE INSTRUCTIONS) |

| |

OO |

| 5 |

CHECK IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT TO ITEMS 2(D) OR 2(E) |

| |

¨ |

| 6 |

CITIZENSHIP OR PLACE OF ORGANIZATION |

| |

Delaware |

| NUMBER OF |

7 |

SOLE VOTING POWER |

| SHARES |

|

22,988,329 |

| BENEFICIALLY |

8 |

SHARED VOTING POWER |

| OWNED BY |

|

0 |

| EACH |

9 |

SOLE DISPOSITIVE POWER |

| REPORTING |

|

22,988,329 |

| PERSON |

10 |

SHARED DISPOSITIVE POWER |

| WITH |

|

0 |

| 11 |

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON |

| |

22,988,329 |

| 12 |

CHECK IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES (SEE INSTRUCTIONS) |

| |

¨ |

| 13 |

PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW (11) |

| |

16.5% |

| 14 |

TYPE OF REPORTING PERSON (SEE INSTRUCTIONS) |

| |

OO |

CUSIP No. 892672106

| 1 |

NAMES OF REPORTING PERSONS

LSEGA, Inc. |

| 2 |

CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP (SEE INSTRUCTIONS) |

| |

(a) ¨ (b) x |

| 3 |

SEC USE ONLY |

| 4 |

SOURCE OF FUNDS (SEE INSTRUCTIONS) |

| |

OO |

| 5 |

CHECK IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT TO ITEMS 2(D) OR 2(E) |

| |

¨ |

| 6 |

CITIZENSHIP OR PLACE OF ORGANIZATION |

| |

Delaware |

| NUMBER OF |

7 |

SOLE VOTING POWER |

| SHARES |

|

22,988,329 |

| BENEFICIALLY |

8 |

SHARED VOTING POWER |

| OWNED BY |

|

0 |

| EACH |

9 |

SOLE DISPOSITIVE POWER |

| REPORTING |

|

22,988,329 |

| PERSON |

10 |

SHARED DISPOSITIVE POWER |

| WITH |

|

0 |

| 11 |

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON |

| |

22,988,329 |

| 12 |

CHECK IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES (SEE INSTRUCTIONS) |

| |

¨ |

| 13 |

PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW (11) |

| |

16.5% |

| 14 |

TYPE OF REPORTING PERSON (SEE INSTRUCTIONS) |

| |

CO |

CUSIP No. 892672106

| 1 |

NAMES OF REPORTING PERSONS

LSEG US Holdco, Inc. |

| 2 |

CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP (SEE INSTRUCTIONS) |

| |

(a) ¨ (b) x |

| 3 |

SEC USE ONLY |

| 4 |

SOURCE OF FUNDS (SEE INSTRUCTIONS) |

| |

OO |

| 5 |

CHECK IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT TO ITEMS 2(D) OR 2(E) |

| |

¨ |

| 6 |

CITIZENSHIP OR PLACE OF ORGANIZATION |

| |

Delaware |

| NUMBER OF |

7 |

SOLE VOTING POWER |

| SHARES |

|

22,988,329 |

| BENEFICIALLY |

8 |

SHARED VOTING POWER |

| OWNED BY |

|

0 |

| EACH |

9 |

SOLE DISPOSITIVE POWER |

| REPORTING |

|

22,988,329 |

| PERSON |

10 |

SHARED DISPOSITIVE POWER |

| WITH |

|

0 |

| 11 |

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON |

| |

22,988,329 |

| 12 |

CHECK IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES (SEE INSTRUCTIONS) |

| |

¨ |

| 13 |

PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW (11) |

| |

16.5% |

| 14 |

TYPE OF REPORTING PERSON (SEE INSTRUCTIONS) |

| |

OO |

CUSIP No. 892672106

| 1 |

NAMES OF REPORTING PERSONS

Refinitiv TW Holdings Ltd. |

| 2 |

CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP (SEE INSTRUCTIONS) |

| |

(a) ¨ (b) x |

| 3 |

SEC USE ONLY |

| 4 |

SOURCE OF FUNDS (SEE INSTRUCTIONS) |

| |

OO |

| 5 |

CHECK IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT TO ITEMS 2(D) OR 2(E) |

| |

¨ |

| 6 |

CITIZENSHIP OR PLACE OF ORGANIZATION |

| |

Cayman Islands |

| NUMBER OF |

7 |

SOLE VOTING POWER |

| SHARES |

|

96,933,192 |

| BENEFICIALLY |

8 |

SHARED VOTING POWER |

| OWNED BY |

|

0 |

| EACH |

9 |

SOLE DISPOSITIVE POWER |

| REPORTING |

|

96,933,192 |

| PERSON |

10 |

SHARED DISPOSITIVE POWER |

| WITH |

|

0 |

| 11 |

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON |

| |

96,933,192 |

| 12 |

CHECK IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES (SEE INSTRUCTIONS) |

| |

¨ |

| 13 |

PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW (11) |

| |

45.5% |

| 14 |

TYPE OF REPORTING PERSON (SEE INSTRUCTIONS) |

| |

OO |

CUSIP No. 892672106

| 1 |

NAMES OF REPORTING PERSONS

Refinitiv Parent Limited |

| 2 |

CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP (SEE INSTRUCTIONS) |

| |

(a) ¨ (b) x |

| 3 |

SEC USE ONLY |

| 4 |

SOURCE OF FUNDS (SEE INSTRUCTIONS) |

| |

OO |

| 5 |

CHECK IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT TO ITEMS 2(D) OR 2(E) |

| |

¨ |

| 6 |

CITIZENSHIP OR PLACE OF ORGANIZATION |

| |

Cayman Islands |

| NUMBER OF |

7 |

SOLE VOTING POWER |

| SHARES |

|

119,921,521 |

| BENEFICIALLY |

8 |

SHARED VOTING POWER |

| OWNED BY |

|

0 |

| EACH |

9 |

SOLE DISPOSITIVE POWER |

| REPORTING |

|

119,921,521 |

| PERSON |

10 |

SHARED DISPOSITIVE POWER |

| WITH |

|

0 |

| 11 |

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON |

| |

119,921,521 |

| 12 |

CHECK IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES (SEE INSTRUCTIONS) |

| |

¨ |

| 13 |

PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW (11) |

| |

50.8% |

| 14 |

TYPE OF REPORTING PERSON (SEE INSTRUCTIONS) |

| |

OO |

CUSIP No. 892672106

| 1 |

NAMES OF REPORTING PERSONS

London Stock Exchange Group plc |

| 2 |

CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP (SEE INSTRUCTIONS) |

| |

(a) ¨ (b) x |

| 3 |

SEC USE ONLY |

| 4 |

SOURCE OF FUNDS (SEE INSTRUCTIONS) |

| |

OO |

| 5 |

CHECK IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT TO ITEMS 2(D) OR 2(E) |

| |

¨ |

| 6 |

CITIZENSHIP OR PLACE OF ORGANIZATION |

| |

England and Wales |

| NUMBER OF |

7 |

SOLE VOTING POWER |

| SHARES |

|

119,921,521 |

| BENEFICIALLY |

8 |

SHARED VOTING POWER |

| OWNED BY |

|

0 |

| EACH |

9 |

SOLE DISPOSITIVE POWER |

| REPORTING |

|

119,921,521 |

| PERSON |

10 |

SHARED DISPOSITIVE POWER |

| WITH |

|

0 |

| 11 |

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON |

| |

119,921,521 |

| 12 |

CHECK IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES (SEE INSTRUCTIONS) |

| |

¨ |

| 13 |

PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW (11) |

| |

50.8% |

| 14 |

TYPE OF REPORTING PERSON (SEE INSTRUCTIONS) |

| |

HC, CO |

Explanatory Note

This Amendment No. 7 (this “Amendment No.

7”) amends and supplements the beneficial ownership statement on Schedule 13D originally filed on February 8, 2021 (the “Original

Statement”), as amended by Amendment No. 1 (“Amendment No. 1”) filed on March 1, 2021, Amendment No. 2 (“Amendment

No. 2”) filed on March 12, 2021, Amendment No. 3 (“Amendment No. 3”) filed on June 30, 2021, Amendment No. 4 (“Amendment

No. 4”) filed on July 8, 2022, Amendment No. 5 (“Amendment No. 5”) filed on February 22, 2023 and Amendment No. 6 (“Amendment

No. 6”) filed on January 3, 2024, on behalf of (i) Refinitiv US PME LLC, a Delaware limited liability company, (ii) Refinitiv US

LLC, a Delaware limited liability company, (iii) LSEGA, Inc. a Delaware corporation, (iv) LSEG US Holdco, Inc., a Delaware corporation,

(v) Refinitiv TW Holdings Ltd., a Cayman Islands exempted company, (vi) Refinitiv Parent Limited, a Cayman Islands exempted company, and

(vii) London Stock Exchange Group plc, a public limited company organized in England and Wales. Each of the foregoing entities is hereinafter

individually referred to as a “Reporting Person” and collectively as the “Reporting Persons.” The Original Statement,

as amended by Amendment No. 1, Amendment No. 2, Amendment No. 3, Amendment No. 4, Amendment No. 5, Amendment No. 6 and this Amendment

No. 7 (the “Schedule 13D”), relates to the Class A Common Stock, par value $0.00001 per share (the “Class A Common Stock”),

of Tradeweb Markets Inc., a Delaware corporation (the “Issuer”). On December 31, 2023, as a result of an intragroup

reorganization of the London Stock Exchange Group plc, LSEG US Holdco, Inc. became the sole shareholder of LSEGA, Inc. LSEG US Holdco,

Inc. is a wholly-owned subsidiary of Refinitiv Parent Limited.

Capitalized terms used herein but not defined

shall have the meanings ascribed to them in the Original Statement. This Amendment No. 7 amends the Schedule 13D as specifically set forth

herein. Except as set forth on the cover pages hereto and as set forth below, all previous Items in the Schedule 13D remain unchanged.

| Item 4. |

Purpose of the Transaction |

The penultimate paragraph of Item 4 is hereby

supplemented by adding the below disclosure immediately prior to the last sentence in such paragraph:

On June 10, 2024, Murray Roos resigned from the

Board of the Issuer, effective June 10, 2024. On September 18, 2024, the Board of the Issuer appointed Daniel Maguire as a Class I director,

effective September 18, 2024. Mr. Maguire will hold office until the annual meeting of the Issuer’s stockholders to be held in

2026 and until his successor shall be elected and qualified or until his earlier death, resignation, retirement, disqualification or removal.

Mr. Maguire was designated to serve on the Board by Refinitiv Parent pursuant to the Stockholders Agreement.

| Item 5. |

Interest in Securities of the Issuer |

The first two sentences of paragraphs (a) and

(b) of Item 5 are hereby amended and restated as follows:

(a) and (b) Calculations of the percentage of shares of Class A Common

Stock beneficially owned assume that 116,292,668 shares of Class A Common Stock were outstanding as of July 18, 2024, as reported in the

Issuer’s Quarterly Report on Form 10-Q filed with the Securities and Exchange Commission on July 25, 2024, and also takes into account

the shares of Class A Common Stock underlying any shares of Class B Common Stock or non-voting common units (the “LLC Interests”)

of Tradeweb Markets LLC, a subsidiary of the Issuer, held by Reporting Persons, as applicable. Each of the Reporting Persons may be deemed

to be the beneficial owner of the shares of Class A Common Stock listed on such Reporting Person’s cover page.

SIGNATURE

After reasonable inquiry and to the best of my

knowledge and belief, I certify that the information set forth in this statement is true, complete and correct.

Dated: September 19, 2024

| REFINITIV

US PME LLC |

|

| |

|

| By: |

/s/

Lisa Condron |

|

| |

Lisa Condron as Attorney-in-Fact

|

|

| |

|

| REFINITIV

US LLC |

|

| |

|

| By: |

/s/

Lisa Condron |

|

| |

Lisa Condron as Attorney-in-Fact

|

|

| |

|

| LSEGA,

INC. |

|

| |

|

| By: |

/s/

Lisa Condron |

|

| |

Lisa Condron as Attorney-in-Fact

|

|

| |

|

| LSEG US

HOLDCO, INC. |

|

| |

|

| By: |

/s/ Lisa Condron |

|

| |

Lisa Condron as Attorney-in-Fact

|

|

| |

|

| REFINITIV

TW HOLDINGS LTD. |

|

| |

|

| By: |

/s/

Lisa Condron |

|

| |

Lisa Condron as Attorney-in-Fact

|

|

| |

|

| REFINITIV

PARENT LIMITED |

|

| |

|

| By: |

/s/

Lisa Condron |

|

| |

Lisa Condron as Attorney-in-Fact

|

|

| |

|

| LONDON

STOCK EXCHANGE GROUP PLC |

|

| |

|

| By: |

/s/

Lisa Condron |

|

| |

Lisa Condron as Attorney-in-Fact

|

|

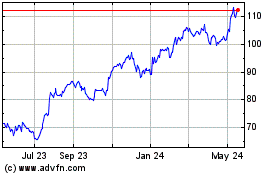

Tradeweb Markets (NASDAQ:TW)

Historical Stock Chart

From Jan 2025 to Feb 2025

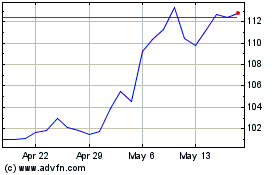

Tradeweb Markets (NASDAQ:TW)

Historical Stock Chart

From Feb 2024 to Feb 2025