Universal Electronics Inc. (UEI), (NASDAQ: UEIC) reported

financial results for the three and twelve months ended December

31, 2024.

“UEI closed 2024 with strong performance, with sales above and

earnings at the top end of our guidance range,” stated UEI Chairman

and CEO Paul Arling. “Customer acquisition initiatives and

long-lead design wins are coming to fruition. Our perseverance and

commitment to the connected home channel is providing meaningful

contribution and drove revenue growth of 13% for the fourth quarter

of 2024. Combined with our ongoing cost initiatives, bottom line

results improved significantly compared to the prior year

quarter.”

“CES 2025 was a major success. We showcased new products and

technologies that ensure consumer privacy; introduce innovative

features; support on-device AI processing; and offer more OEM

monetization opportunities through enhanced services and

personalization leading to increased user engagement, to name a few

advancements. We received strong interest in our new products and

technologies from many new accounts and existing customers eager to

use our innovative features and functionality in their platforms.

Based on our orders and pleased with our progress, we are

reiterating our projections for top and bottom-line growth for

full-year 2025 and beyond.”

Financial Results for the Three Months

Ended December 31: 2024 Compared to 2023

- GAAP net sales were $110.5 million, compared to $97.6 million;

Adjusted Non-GAAP net sales were $110.5 million, compared to $97.6

million.

- GAAP gross margins were 28.4%, compared to 28.5%; Adjusted

Non-GAAP gross margins were 28.4%, compared to 28.5%.

- GAAP operating loss was $4.4 million, compared to $2.6 million;

Adjusted Non-GAAP operating income was $4.2 million, compared to

$0.2 million.

- GAAP net loss was $4.5 million, or $0.35 per share, compared to

$7.1 million, or $0.55 per share; Adjusted Non-GAAP net income was

$2.6 million, or $0.20 per diluted share, compared to Adjusted

Non-GAAP net loss $0.5 million, or $0.04 per share.

- GAAP gross margin, operating loss and net loss for the three

months ended December 31, 2024 include $0.7 million, equivalent to

70 basis points of gross margin or $0.04 per share (net of tax), of

excess manufacturing overhead costs resulting from the continued

transition of our global manufacturing footprint, specifically in

Mexico and Vietnam, and depreciation related to the mark-up from

cost to fair value of fixed assets acquired in business

combinations ("excess manufacturing costs"). GAAP gross margin,

operating loss and net loss for the three months ended December 31,

2023 include $1.6 million, equivalent to 160 basis points of gross

margin or $0.11 per share (net of tax), of excess manufacturing

costs.

- At December 31, 2024, cash and cash equivalents were $26.8

million.

Financial Results for the Twelve Months

Ended December 31: 2024 Compared to 2023

- GAAP net sales were $394.9 million, compared to $420.5 million;

Adjusted Non-GAAP net sales were $394.9 million, compared to $420.5

million.

- GAAP gross margins were 28.9%, compared to 23.2%; Adjusted

Non-GAAP gross margins were 28.9%, compared to 25.0%.

- GAAP operating loss was $15.3 million, compared to $85.3

million, including a $49.1 million non-cash charge for goodwill

impairment, which resulted from a decline in the company’s market

capitalization; Adjusted Non-GAAP operating income was $2.2

million, compared to Adjusted Non-GAAP operating loss of $10.1

million.

- GAAP net loss was $24.0 million, or $1.85 per share, compared

to $98.2 million, including the aforementioned non-cash charge, or

$7.64 per share; Adjusted Non-GAAP net loss was $0.6 million, or

$0.05 per share, compared to $10.0 million, or $0.78 per

share.

- GAAP gross margin, operating loss and net loss for the twelve

months ended December 31, 2024 include $4.5 million, equivalent to

110 basis points of gross margin or $0.27 per share (net of tax),

of excess manufacturing costs. GAAP gross margin, operating loss

and net loss for the twelve months ended December 31, 2023 include

$9.4 million, equivalent to 220 basis points of gross margin or

$0.60 per share (net of tax), of excess manufacturing costs.

Financial Outlook

For the first quarter of 2025, the company expects GAAP net

sales to range between $87.0 million and $97.0 million, compared to

$91.9 million in the first quarter of 2024. GAAP loss per share for

the first quarter of 2025 is expected to range from $0.52 to $0.42,

compared to a GAAP loss per share of $0.67 in the first quarter of

2024.

For the first quarter of 2025, the company expects Adjusted

Non-GAAP net sales to range between $87.0 million and $97.0

million, compared to $91.9 million in the first quarter of 2024.

Adjusted Non-GAAP loss per share is expected to range from $0.21 to

$0.11 compared to Adjusted Non-GAAP loss of $0.26 per share in the

first quarter of 2024. The first quarter 2025 Adjusted Non-GAAP

loss per share estimate excludes $0.31 per share related to, among

other things, stock-based compensation, amortization of acquired

intangibles, litigation costs, foreign currency gains and losses

and the related tax impact of these adjustments. For a more

detailed explanation of Non-GAAP measures, please see the Use of

Non-GAAP Financial Metrics discussion, the Reconciliation of

Adjusted Non-GAAP Financial Results and the Reconciliation of

Adjusted Non-GAAP Financial Outlook and Financial Results, each

located elsewhere in this press release.

Conference Call

Information

UEI’s management team will hold a conference call today,

Thursday, February 20, 2025 at 4:30 p.m. ET / 1:30 p.m. PT, to

discuss its fourth quarter and full year 2024 earnings results,

review recent activity and answer questions. To attend the call

please register at

https://register.vevent.com/register/BId24421a0a551416d87a8c8bc2d789ceb

to receive a computer-generated dial-in number and a unique pin

number. The conference call will also be broadcast live on the

investor section of the UEI website where it will be available for

replay for 90 days.

Use of Non-GAAP Financial

Metrics

In addition to reporting financial results in accordance with

generally accepted accounting principles, or GAAP, UEI provides

Adjusted Non-GAAP information as additional information for its

operating results. References to Adjusted Non-GAAP information are

to non-GAAP financial measures. These measures are not required by,

in accordance with, or an alternative for, GAAP and may be

different from non-GAAP financial measures used by other companies.

UEI’s management uses these measures for reviewing the financial

results of UEI for budget planning purposes and for making

operational and financial decisions. Management believes that

providing these non-GAAP financial measures to investors, as a

supplement to GAAP financial measures, help investors evaluate

UEI’s core operating and financial performance and business trends

consistent with how management evaluates such performance and

trends. Additionally, management believes these measures facilitate

comparisons with the core operating and financial results and

business trends of competitors and other companies.

Adjusted Non-GAAP net sales are defined as net sales. Adjusted

Non-GAAP gross profit is defined as gross profit excluding

impairment of long-lived assets and stock-based compensation

expense. Adjusted Non-GAAP operating expenses are defined as

operating expenses excluding impairment of long-lived assets,

stock-based compensation expense, amortization of intangibles

acquired, costs associated with certain litigation efforts, factory

restructuring costs, legal judgment, severance, lease termination

costs and goodwill impairment. Adjusted Non-GAAP net income (loss)

is defined as net loss excluding the aforementioned items, foreign

currency gains and losses, the related tax effects of all

adjustments, as well as valuation allowances on certain deferred

tax assets and certain net deferred tax adjustments. Adjusted

Non-GAAP earnings (loss) per diluted share is calculated using

Adjusted Non-GAAP net income (loss). A reconciliation of these

financial measures to the most directly comparable GAAP financial

measures is included at the end of this press release.

The company will no longer exclude excess manufacturing overhead

costs resulting from the continued transition of its global

manufacturing footprint, specifically in Mexico and Vietnam, and

depreciation related to the mark-up from cost to fair value of

fixed assets acquired in business combinations from its Adjusted

Non-GAAP figures. This impacts Adjusted Non-GAAP gross profit,

gross margin, operating income (loss), income (loss) before

provision (benefit) from income taxes and net income (loss) in the

quarterly results for 2023 and 2024. There is no impact to GAAP

results. A reconciliation of these measures is posted on the

website in the Q4 2024 Quarterly Results section.

About Universal

Electronics

Universal Electronics Inc. (NASDAQ: UEIC) is the global leader

in wireless universal control solutions for the home. The company

brings to life millions of innovative control products each year

that focus on a user-centric approach to building control products

and applications that simplify user interaction with highly complex

technologies in the home, removing interoperability challenges as a

roadblock for user adoption, with privacy first and a secure by

design approach to today's smart devices. Our products are offered

by the world's leading brands in home entertainment and the

connected home markets, including Fortune 500 customers Daikin,

Carrier, Comcast, Vivint Smart Home, Samsung, Sony, Hunter Douglas

and Somfy. The company's pioneering breakthrough innovations

include its award-winning voice control entertainment remote

controls and QuickSet Cloud, the world's leading platform for

automated device and service discovery, set-up and control, and

user experience personalization for the home. For more information,

visit www.uei.com.

Forward-looking

Statements

This press release and accompanying schedules contain

"forward-looking statements" within the meaning of federal

securities laws, including net sales, profit margin and earnings

trends, estimates and assumptions; our expectations about new

product introductions; and similar statements concerning

anticipated future events and expectations that are not historical

facts. We caution you that these statements are not guarantees of

future performance and are subject to numerous risks and

uncertainties, including those we identify below and other risk

factors that we identify in our annual report on Form 10-K for the

year ended December 31, 2023 and the periodic reports filed and

furnished since then.

Risks that could affect forward-looking statements in this press

release include: our continued ability to timely develop and

deliver innovative control solutions and technologies that are

accepted by our customers, both near- and long-term; our ability to

attract new customers and to successfully capture sales in all

markets we serve, including in the climate control and connected

home markets as anticipated by management; our ability to continue

optimizing our manufacturing footprint and realize the lower

concentration risks as expected by management; our ability to

maintain our market share in the traditional subscription broadcast

market; our ability to manage through the worldwide inflationary

pressures and macroeconomic conditions; our ability to continue to

manage our business, inventories and cash flows to achieve our net

sales, margins and earnings through financial discipline,

operational efficiency, product line management, liquidity

requirements, capital expenditures and other investment spending

expectations; our continued ability to successfully enforce our

patented technology, including with respect to our litigation

against Roku; our continued ability to strategically enhance,

expand, and monetize our IP portfolios; the continued fluctuation

in our market capitalization; the use of artificial intelligence

applications which could result in cybersecurity incidents that

implicate the personal data of end users or other unintended

ethical, reputational, competitive harm or legal liability; the

direct and indirect impact we may experience with respect to our

business and financial results and management’s ability to

anticipate and mitigate the impact stemming from the continued

economic uncertainty affecting consumers’ confidence and spending,

natural disasters or other events beyond our control, public health

crises (including an outbreak of infectious disease), governmental

actions, including the changes in or enhanced use of laws,

regulations and policies may have on our business including the

impact of decreased governmental incentive programs worldwide or of

enhanced or expanded trade regulations, including the expanded use

of tariffs, pertaining to importation of our products, the effects

of political unrest, war, terrorist activities, or other

hostilities; the effects and uncertainties and other factors more

fully described in our reports filed with the SEC. Since it is not

possible to predict or identify all of the risks, uncertainties and

other factors that may affect future results, the above list should

not be considered a complete list. Further, any of these factors

could cause actual results to differ materially from the

expectations we express or imply in this press release. We make

these forward-looking statements as of February 20, 2025, and we

undertake no obligation to publicly update or revise any

forward-looking statement, whether as a result of new information,

future events or otherwise.

UNIVERSAL ELECTRONICS

INC.

CONSOLIDATED BALANCE

SHEETS

(In thousands, except

share-related data)

(Unaudited)

December 31, 2024

December 31, 2023

ASSETS

Current assets:

Cash and cash equivalents

$

26,783

$

42,751

Accounts receivable, net

114,182

112,596

Contract assets

10,346

4,240

Inventories

79,355

88,273

Prepaid expenses and other current

assets

9,478

7,325

Income tax receivable

2,350

3,666

Total current assets

242,494

258,851

Property, plant and equipment, net

34,207

44,619

Intangible assets, net

24,038

25,349

Operating lease right-of-use assets

14,322

18,693

Deferred income taxes

6,425

6,787

Other assets

1,868

1,573

Total assets

$

323,354

$

355,872

LIABILITIES AND STOCKHOLDERS’

EQUITY

Current liabilities:

Accounts payable

$

72,031

$

57,033

Lines of credit

36,960

55,000

Accrued compensation

20,927

20,305

Accrued sales discounts, rebates and

royalties

5,204

5,796

Accrued income taxes

2,161

1,833

Other accrued liabilities

21,008

21,181

Total current liabilities

158,291

161,148

Long-term liabilities:

Operating lease obligations

9,232

12,560

Deferred income taxes

1,931

1,992

Income tax payable

72

435

Other long-term liabilities

723

817

Total liabilities

170,249

176,952

Commitments and contingencies

Stockholders’ equity:

Preferred stock, $0.01 par value,

5,000,000 shares authorized; none issued or outstanding

—

—

Common stock, $0.01 par value, 50,000,000

shares authorized; 25,712,940 and 25,346,383 shares issued on

December 31, 2024 and 2023, respectively

257

253

Paid-in capital

344,697

336,938

Treasury stock, at cost, 12,666,443 and

12,459,845 shares on December 31, 2024 and 2023, respectively

(371,930

)

(369,973

)

Accumulated other comprehensive income

(loss)

(28,350

)

(20,758

)

Retained earnings

208,431

232,460

Total stockholders’ equity

153,105

178,920

Total liabilities and stockholders’

equity

$

323,354

$

355,872

UNIVERSAL ELECTRONICS

INC.

CONSOLIDATED INCOME

STATEMENTS

(In thousands, except per share

amounts)

(Unaudited)

Three Months Ended December

31,

Twelve Months Ended December

31,

2024

2023

2024

2023

Net sales

$

110,454

$

97,594

$

394,879

$

420,457

Cost of sales

79,132

69,756

280,885

322,897

Gross profit

31,322

27,838

113,994

97,560

Research and development expenses

7,044

6,779

29,723

31,281

Selling, general and administrative

expenses

23,598

23,346

91,811

98,490

Factory restructuring charges

862

325

3,585

4,015

Legal judgment

4,172

—

4,172

—

Goodwill impairment

—

—

—

49,075

Operating income (loss)

(4,354

)

(2,612

)

(15,297

)

(85,301

)

Interest income (expense), net

(705

)

(1,044

)

(3,361

)

(4,332

)

Other income (expense), net

(45

)

(854

)

60

(2,621

)

Income (loss) before provision for income

taxes

(5,104

)

(4,510

)

(18,598

)

(92,254

)

Provision for (benefit from) income

taxes

(575

)

2,592

5,431

5,984

Net income (loss)

$

(4,529

)

$

(7,102

)

$

(24,029

)

$

(98,238

)

Earnings (loss) per share:

Basic

$

(0.35

)

$

(0.55

)

$

(1.85

)

$

(7.64

)

Diluted

$

(0.35

)

$

(0.55

)

$

(1.85

)

$

(7.64

)

Shares used in computing earnings (loss)

per share:

Basic

13,032

12,902

12,959

12,855

Diluted

13,032

12,902

12,959

12,855

UNIVERSAL ELECTRONICS

INC.

CONSOLIDATED STATEMENTS OF

CASH FLOWS

(In thousands)

(Unaudited)

Year Ended December

31,

2024

2023

Cash flows from operating activities:

Net income (loss)

$

(24,029

)

$

(98,238

)

Adjustments to reconcile net income (loss)

to net cash provided by (used for) operating activities:

Depreciation and amortization

18,058

22,927

Provision for credit losses

1,081

70

Deferred income taxes

(256

)

(1,149

)

Shares issued for employee benefit

plan

1,063

1,293

Employee and director stock-based

compensation

6,700

8,809

Impairment of goodwill

—

49,075

Impairment of long-lived assets

333

7,963

Changes in operating assets and

liabilities:

Accounts receivable and contract

assets

(12,174

)

5,040

Inventories

6,239

51,458

Prepaid expenses and other assets

764

2,860

Accounts payable and accrued

liabilities

15,733

(21,379

)

Accrued income taxes

1,310

(3,539

)

Net cash provided by (used for) operating

activities

14,822

25,190

Cash flows from investing activities:

Acquisitions of property, plant and

equipment

(4,572

)

(8,116

)

Acquisitions of intangible assets

(3,856

)

(5,761

)

Net cash provided by (used for) investing

activities

(8,428

)

(13,877

)

Cash flows from financing activities:

Borrowings under lines of credit

102,193

78,000

Repayments on lines of credit

(120,000

)

(111,000

)

Treasury stock purchased

(1,957

)

(1,779

)

Net cash provided by (used for) financing

activities

(19,764

)

(34,779

)

Effect of foreign currency exchange rates

on cash and cash equivalents

(2,598

)

(523

)

Net increase (decrease) in cash and cash

equivalents

(15,968

)

(23,989

)

Cash and cash equivalents at beginning of

period

42,751

66,740

Cash and cash equivalents at end of

period

$

26,783

$

42,751

Supplemental cash flow information:

Income taxes paid

$

3,481

$

13,176

Interest paid

$

4,738

$

7,015

UNIVERSAL ELECTRONICS

INC.

RECONCILIATION OF ADJUSTED

NON-GAAP FINANCIAL RESULTS

(In thousands, except per share

amounts)

(Unaudited)

Three Months Ended December

31,

Twelve Months Ended December

31,

2024

2023

2024

2023

Net sales:

Net sales - GAAP

$

110,454

$

97,594

$

394,879

$

420,457

Adjusted Non-GAAP net sales

$

110,454

$

97,594

$

394,879

$

420,457

Cost of sales:

Cost of sales - GAAP (1)

$

79,132

$

69,756

$

280,885

$

322,897

Impairment of long-lived assets (2)

—

—

—

(7,723

)

Stock-based compensation expense

(34

)

(32

)

(106

)

(125

)

Adjusted Non-GAAP cost of sales

79,098

69,724

280,779

315,049

Adjusted Non-GAAP gross profit

$

31,356

$

27,870

$

114,100

$

105,408

Gross margin:

Gross margin - GAAP (1)

28.4

%

28.5

%

28.9

%

23.2

%

Impairment of long-lived assets (2)

—

%

—

%

—

%

1.8

%

Stock-based compensation expense

0.0

%

0.0

%

0.0

%

0.0

%

Adjusted Non-GAAP gross margin

28.4

%

28.5

%

28.9

%

25.0

%

Operating expenses:

Operating expenses - GAAP

$

35,676

$

30,450

$

129,291

$

182,861

Impairment of long-lived assets (2)

—

—

—

(100

)

Stock-based compensation expense

(1,650

)

(1,945

)

(6,594

)

(8,684

)

Amortization of acquired intangible

assets

(223

)

(281

)

(909

)

(1,137

)

Litigation costs (3)

(157

)

(83

)

(689

)

(1,687

)

Factory restructuring charges (4)

(863

)

(325

)

(3,585

)

(4,015

)

Legal judgment (5)

(4,172

)

—

(4,172

)

—

Severance (6)

(960

)

(180

)

(960

)

(2,635

)

Lease termination (7)

(476

)

—

(476

)

—

Goodwill impairment (8)

—

—

—

(49,075

)

Adjusted Non-GAAP operating expenses

$

27,175

$

27,636

$

111,906

$

115,528

Operating income (loss):

Operating income (loss) - GAAP (1)

$

(4,354

)

$

(2,612

)

$

(15,297

)

$

(85,301

)

Impairment of long-lived assets (2)

—

—

—

7,823

Stock-based compensation expense

1,684

1,977

6,700

8,809

Amortization of acquired intangible

assets

223

281

909

1,137

Litigation costs (3)

157

83

689

1,687

Factory restructuring costs (4)

863

325

3,585

4,015

Legal judgment (5)

4,172

—

4,172

—

Severance (6)

960

180

960

2,635

Lease termination (7)

476

—

476

—

Goodwill impairment (8)

—

—

—

49,075

Adjusted Non-GAAP operating income

(loss)

$

4,181

$

234

$

2,194

$

(10,120

)

Adjusted Non-GAAP operating income (loss)

as a percentage of net sales

3.8

%

0.2

%

0.6

%

(2.4

)%

UNIVERSAL ELECTRONICS

INC.

RECONCILIATION OF ADJUSTED

NON-GAAP FINANCIAL RESULTS

(In thousands, except per share

amounts)

(Unaudited)

Three Months Ended December

31,

Twelve Months Ended December

31,

2024

2023

2024

2023

Net income (loss):

Net income (loss) - GAAP (1)

$

(4,529

)

$

(7,102

)

$

(24,029

)

$

(98,238

)

Impairment of long-lived assets (2)

—

—

—

7,823

Stock-based compensation expense

1,684

1,977

6,700

8,809

Amortization of acquired intangible

assets

223

281

909

1,137

Litigation costs (3)

157

83

689

1,687

Factory restructuring costs (4)

863

325

3,585

4,015

Legal judgment (5)

4,172

—

4,172

—

Severance (6)

960

180

960

2,635

Lease termination (7)

476

—

476

—

Goodwill impairment (8)

—

—

—

49,075

Foreign currency (gain) loss

132

1,258

326

3,501

Income tax provision on adjustments

410

2,516

7,511

8,200

Other income tax adjustments (9)

(1,924

)

—

(1,924

)

1,377

Adjusted Non-GAAP net income (loss)

$

2,624

$

(482

)

$

(625

)

$

(9,979

)

Diluted shares used in computing

earnings (loss) per share:

GAAP

13,032

12,902

12,959

12,855

Adjusted Non-GAAP

13,249

12,902

12,959

12,855

Diluted earnings (loss) per

share:

Diluted earnings (loss) per share -

GAAP

$

(0.35

)

$

(0.55

)

$

(1.85

)

$

(7.64

)

Total adjustments

$

0.54

$

0.51

$

1.81

$

6.87

Adjusted Non-GAAP diluted earnings (loss)

per share

$

0.20

$

(0.04

)

$

(0.05

)

$

(0.78

)

(1)

GAAP gross margin, operating loss

and net loss for the three months ended December 31, 2024 include

$0.7 million, equivalent to 70 basis points of gross margin or

$0.04 per share (net of tax), of excess manufacturing overhead

costs resulting from the continued transition of our global

manufacturing footprint, specifically in Mexico, and depreciation

related to the mark-up from cost to fair value of fixed assets

acquired in business combinations ("excess manufacturing costs").

GAAP gross margin, operating loss and net loss for the three months

ended December 31, 2023 include $1.6 million, equivalent to 160

basis points of gross margin or $0.11 per share (net of tax), of

excess manufacturing costs.

GAAP gross margin, operating loss

and net loss for the twelve months ended December 31, 2024 include

$4.5 million, equivalent to 110 basis points of gross margin or

$0.27 per share (net of tax), of excess manufacturing costs. GAAP

gross margin, operating loss and net loss for the twelve months

ended December 31, 2023 include $9.4 million, equivalent to 220

basis points of gross margin or $0.60 per share (net of tax), of

excess manufacturing costs.

(2)

The twelve months ended December

31, 2023 included impairment charges relating to machinery and

equipment and leasehold improvements associated with the closure of

our southwestern China factory, which ceased operations in

September 2023. In addition, we also incurred impairment charges

relating to machinery and equipment at our Mexico factory as we

reduced its capacity due to lower demand.

(3)

The three and twelve months ended

December 31, 2024 and 2023, include expenses related to our various

litigation matters involving Roku, Inc. and certain other related

entities including three Federal District Court cases, two

International Trade Commission investigations and the defense of

various inter partes reviews and appeals before the US Patent and

Trademark Board. In addition, the twelve months ended December 31,

2023 include $1.2 million of expenses associated with non-recurring

legal matters involving internal investigations at our

manufacturing plants.

(4)

The three and twelve months ended

December 31, 2024 include severance and other exit costs associated

with the closure of our southwestern and eastern China factories

and the streamlining of our Mexico factory. The three and twelve

months ended December 31, 2023 include severance and other exit

costs associated with the closure of our southwestern China factory

and downsizing of our Mexico factory.

(5)

The three and twelve months ended

December 31, 2024 include an adverse judgment against one of our

China subsidiaries. We have appealed this ruling and expect a

decision on our appeal in early to mid-April 2025.

(6)

The three and twelve months ended

December 31, 2024 and 2023, include severance costs associated with

a reduction in headcount at our corporate offices.

(7)

The three and twelve months ended

December 31, 2024 include lease termination costs associated with

one of our Mexico facilities.

(8)

During the twelve months ended

December 31, 2023, we recorded a goodwill impairment charge of

$49.1 million as a result of our market capitalization being

significantly less than the carrying value of our equity.

(9)

The three and twelve months ended

December 31, 2024 include a $0.4 million valuation allowance

recorded against the deferred tax assets at our eastern China

entity as a result of its shutdown as well as a $2.3 million

adjustment due to the revaluation of net deferred tax assets at our

remaining China factory resulting from the expiration of a tax

incentive that increased the statutory rate. The twelve months

ended December 31, 2023 includes a $1.4 million valuation allowance

recorded against the deferred tax assets at our southwestern China

entity as a result of its closure.

UNIVERSAL ELECTRONICS

INC.

RECONCILIATION OF ADJUSTED

NON-GAAP FINANCIAL OUTLOOK AND FINANCIAL RESULTS

(In thousands, except per share

amounts)

(Unaudited)

Three Months Ended March

31,

2025

2024

Low Range

High Range

Actual

Net sales:

Net sales - GAAP

$

87,000

$

97,000

$

91,900

Total adjustments (1)

—

—

—

Adjusted Non-GAAP net sales

$

87,000

$

97,000

$

91,900

Loss per share:

Loss per share - GAAP

$

(0.52

)

$

(0.42

)

$

(0.67

)

Total adjustments (2)

$

0.31

$

0.31

$

0.41

Adjusted Non-GAAP loss per share

$

(0.21

)

$

(0.11

)

$

(0.26

)

(1)

The three months ended March 31,

2025 and 2024 do not include any Non-GAAP adjustments to net

sales.

(2)

The three months ended March 31,

2025 and 2024 include adjustments for stock-based compensation

expense, amortization of acquired intangibles, costs associated

with certain litigation efforts, foreign currency gains and losses

and the related tax impact of these adjustments. The three months

ended March 31, 2024 also includes adjustments for factory

restructuring costs.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20250220073200/en/

UEI: Bryan Hackworth, CFO, UEI, 480-530-3000 Investors: Kirsten

Chapman, Alliance Advisors, investors@uei.com or

ueiinvestor@allianceadvisors.com, 415-433-3777

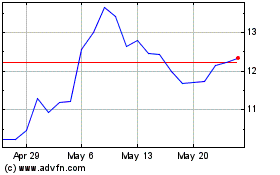

Universal Electronics (NASDAQ:UEIC)

Historical Stock Chart

From Jan 2025 to Feb 2025

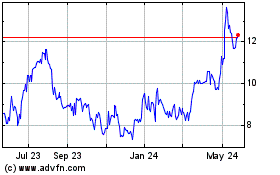

Universal Electronics (NASDAQ:UEIC)

Historical Stock Chart

From Feb 2024 to Feb 2025