United Fire Group, Inc. (“UFG”) (Nasdaq: UFCS) today reported

financial results for the three-month period ended December 31,

2024, with a consolidated net income of $31.4 million ($1.21 income

per diluted share) and consolidated adjusted operating income of

$1.25 per diluted share.

“Our fourth quarter and full year results

reflect the continued progress we are making in the execution of

our strategic business plan,” said UFG President and CEO Kevin

Leidwinger. “The actions we have taken over the past two years to

deepen our underwriting expertise, evolve our capabilities, better

align with our distribution partners and improve our investment

returns are materializing in our results.

“In 2024, we achieved the highest level of net

written premiums in our company’s 79-year history. In addition, we

produced the best annual combined ratio and highest adjusted

operating income since 2015. These milestones reflect key steps on

our journey to consistently deliver superior financial and

operational performance.

“In the fourth quarter, net written premiums

grew 13% led by our core commercial and assumed reinsurance

business. Core commercial growth was driven by average renewal

increases of 11.9%, a substantial increase in new business

production and stable retention. On a full year basis, net written

premiums grew 15% to $1.2 billion.

“The fourth quarter combined ratio improved to

94.4%, the lowest in 11 quarters, while the full year combined

ratio improved 10.1 points to 99.2%. The underlying loss ratio

improved to 55.7% for the quarter and 57.9% for the year,

reflecting the ongoing benefits of strong earned rate achievement

exceeding loss trends and continued underwriting discipline

resulting in improved frequency outcomes. Prior year reserve

development remained neutral overall in the quarter while the

impact from catastrophes was well below historical averages at 1.6%

for the quarter and 5.4% for the year.

“The fourth quarter and full year expense ratios

were elevated due to investments in talent to deepen expertise

across the company, accelerated development of our new policy

administration system that is now poised for implementation in

2025, and increased performance-based compensation for employees

and agents due to current year achievements.

“Net investment income improved to $23.2 million

in the fourth quarter and $82.0 million for the full year. Fixed

maturity income increased to $70 million for the year as new money

yields remained strong. We also benefited from improved valuations

on our limited partnership portfolio for the full year. We expect

the fixed maturity portfolio to generate over $80 million of

annualized fixed maturity income, with potential for further

improvement from future reinvestment at higher rates.

“Reported book value per share decreased

slightly in the fourth quarter due to a change in after-tax

unrealized loss caused by increased interest rates. Our improved

annual earnings and return on equity of 8.2% allowed adjusted book

value per share to grow $1.95 for the year to $33.64.

“During the fourth quarter, we successfully

resolved the rating errors in our core commercial business that

were identified in the second quarter, resulting in no financial

impact to the company. As a result, we have reversed the $3.2

million contingent liability established in the second quarter.

“While 2024 marked a return to underwriting

profitability for UFG, our work is far from finished. We remain

confident in our ability to execute the business plan for improved

performance in the years ahead and are grateful for our people and

their dedication to delivering the deep expertise, specialized

capabilities, personal relationships and responsive service that

our partners and policyholders value.

“Finally, our hearts go out to all those

impacted by the devastating wildfires in Southern California. Our

claims and risk control professionals continue to assist

policyholders in the wake of the destruction. At this time, we

estimate losses in the range of $7 million to $10 million from this

tragic event.”

(1) Underlying loss ratio, underlying combined

ratio and adjusted book value per share are non-GAAP financial

measures. See Definitions of Non-GAAP Information and

Reconciliations to Comparable GAAP Measures for additional

information.(2) Net written premiums is a performance measure

reflecting the amount charged for insurance policy contracts issued

and recognized on an annualized basis at the effective date of the

policy. See Certain Performance Measures for additional

information.

Consolidated Financial Highlights:

|

Consolidated Financial Highlights(1) |

|

(Unaudited) |

Three Months Ended December 31, |

|

Twelve Months Ended December 31, |

|

(In thousands, except per share data) |

|

2024 |

|

|

|

2023 |

|

|

|

2024 |

|

|

|

2023 |

|

|

Net earned premiums |

$ |

308,137 |

|

|

$ |

264,366 |

|

|

$ |

1,176,750 |

|

|

$ |

1,034,587 |

|

|

Net written premiums |

|

278,529 |

|

|

|

246,830 |

|

|

|

1,231,470 |

|

|

|

1,066,901 |

|

| |

|

|

|

|

|

|

|

|

Combined ratio: |

|

|

|

|

|

|

|

|

Net loss ratio |

|

57.3 |

% |

|

|

64.8 |

% |

|

|

63.3 |

% |

|

|

74.4 |

% |

|

Underwriting expense ratio |

|

37.1 |

% |

|

|

34.4 |

% |

|

|

35.9 |

% |

|

|

34.9 |

% |

|

Combined ratio |

|

94.4 |

% |

|

|

99.2 |

% |

|

|

99.2 |

% |

|

|

109.3 |

% |

| |

|

|

|

|

|

|

|

|

Additional ratios: |

|

|

|

|

|

|

|

|

Net loss ratio |

|

57.3 |

% |

|

|

64.8 |

% |

|

|

63.3 |

% |

|

|

74.4 |

% |

|

Catastrophes |

|

1.6 |

% |

|

|

1.5 |

% |

|

|

5.4 |

% |

|

|

6.2 |

% |

|

Reserve development |

|

— |

% |

|

|

3.3 |

% |

|

|

— |

% |

|

|

6.0 |

% |

|

Underlying loss ratio (non-GAAP) |

|

55.7 |

% |

|

|

60.0 |

% |

|

|

57.9 |

% |

|

|

62.2 |

% |

|

Underwriting expense ratio |

|

37.1 |

% |

|

|

34.4 |

% |

|

|

35.9 |

% |

|

|

34.9 |

% |

|

Underlying combined ratio (non-GAAP) |

|

92.8 |

% |

|

|

94.4 |

% |

|

|

93.8 |

% |

|

|

97.1 |

% |

| |

|

|

|

|

|

|

|

|

Net investment income |

$ |

23,156 |

|

|

$ |

19,098 |

|

|

$ |

81,986 |

|

|

$ |

59,606 |

|

|

Net investment gains (losses) |

|

(1,318 |

) |

|

|

3,855 |

|

|

|

(5,429 |

) |

|

|

1,274 |

|

|

Other income (loss)(2) |

|

300 |

|

|

|

(1,039 |

) |

|

|

(9,388 |

) |

|

|

(4,983 |

) |

| |

|

|

|

|

|

|

|

|

Net income (loss) |

$ |

31,442 |

|

|

$ |

19,608 |

|

|

$ |

61,957 |

|

|

$ |

(29,700 |

) |

|

Adjusted operating income (loss) |

|

32,483 |

|

|

|

16,564 |

|

|

|

66,246 |

|

|

|

(30,706 |

) |

| |

|

|

|

|

|

|

|

|

Net income (loss) per diluted share |

$ |

1.21 |

|

|

$ |

0.77 |

|

|

$ |

2.39 |

|

|

$ |

(1.18 |

) |

|

Adjusted operating income (loss) per diluted share |

|

1.25 |

|

|

|

0.65 |

|

|

|

2.56 |

|

|

|

(1.22 |

) |

| |

|

|

|

|

|

|

|

|

Return on equity(3) |

|

|

|

|

|

8.2 |

% |

|

|

(4.0 |

)% |

|

|

|

|

|

|

|

|

|

|

|

(1) Underlying loss ratio, underlying combined

ratio and adjusted operating income (loss) are non-GAAP financial

measures. See Definitions of Non-GAAP Information and

Reconciliations to Comparable GAAP Measures for additional

information.(2) Other income (loss) is comprised of other income

(loss), interest expense and other non-underwriting expenses.(3)

Return on equity is calculated by dividing annualized net income by

average stockholders’ equity, which is calculated using a simple

average of the beginning and ending balances for the period.

Total Property & Casualty Underwriting

Results

Fourth quarter 2024

results:(All comparisons vs. fourth quarter 2023, unless

noted otherwise)

Net written premiums and net earned premiums

increased by 13% and 17%, respectively, in the fourth quarter of

2024, led by core commercial and assumed reinsurance business.

Commercial lines net written premiums excluding surety and

specialty increased 13%, supported by increased pricing with an

overall increase in average renewal premiums of 11.9%. Rate

increases accounted for 10.8% while exposure increases contributed

an additional 1.0%. Excluding the workers’ compensation line of

business, the overall average increase in renewal premiums was

12.9%, with 11.7% from rate increases and 1.1% from exposure

changes.

The combined ratio for the fourth quarter of

2024 was 94.4%, improving 4.8 points from 99.2% driven by

improvement in the underlying loss ratio. Prior year reserve

development, excluding catastrophe losses, was neutral for the

fourth quarter of 2024 compared to 3.3% of unfavorable development

in the fourth quarter of 2023. Catastrophe losses added 1.6 points

to the combined ratio, an increase of 0.1 points and below both the

five-year and 10-year historical averages. The underlying loss

ratio of 55.7% improved 4.3 points, reflecting improvement from a

combination of rate achievement, continued favorable claim

frequency, and lower large loss activity, most notably in the

surety portfolio, partially offset by an increase in the umbrella

loss ratio, reflecting continued uncertainty from the impact of

social inflation. The underwriting expense ratio of 37.1% increased

2.7 points driven by increased performance-based compensation for

employees and agents due to current year achievements.

Full year 2024 results:(All

comparisons vs. full year 2023, unless noted otherwise)

Net written premiums and net earned premiums

increased by 15% and 14%, respectively, led by core commercial,

assumed reinsurance and surety. Commercial lines net written

premiums excluding surety and specialty increased 13%, supported by

increased pricing with an overall increase in average renewal

premiums of 11.8%. Rate increases accounted for 10.1% while

exposure increases contributed an additional 1.6%. Excluding the

workers’ compensation line of business, the overall average

increase in renewal premiums was 12.9%, with 11.2% from rate

increases and 1.6% from exposure changes.

For the full year, the combined ratio was 99.2%,

improving 10.1 points from 109.3% driven by improvement in all

components of the loss ratio. Prior year reserve development,

excluding catastrophe losses, was neutral for the full year 2024

compared to 6.0% of unfavorable development in the full year 2023.

Catastrophe losses added 5.4 points to the combined ratio, an

improvement of 0.8 points and below both the five-year and 10-year

historical averages. The underlying loss ratio of 57.9% improved

4.3 points, reflecting improvement from a combination of

underwriting actions, increased pricing, expense management, lower

frequency trends and lower large loss activity in the property and

surety lines of business, partially offset by an increase in the

umbrella loss ratio. The underwriting expense ratio of 35.9%

increased 1.0 point primarily due to investments in talent to

deepen expertise across the company; accelerated development of our

new policy administration system that is now poised for

implementation in 2025; and increased performance-based

compensation for employees and agents due to current year

achievements.

Investment Results

Fourth quarter 2024

results:(All comparisons vs. fourth quarter 2023, unless

noted otherwise)

Net investment income was $23.2 million for

the fourth quarter of 2024, an increase of $4.1 million or

21.2%. Income from the fixed maturity portfolio increased by

$4.8 million due to portfolio management actions and investing

at higher interest rates. Other investment income increased by $1.2

million driven by $1.1 million of interest on cash and cash

equivalents. Income on other long-term investments decreased

$1.3 million driven by better returns in the fourth quarter of

2023. Dividends on equity securities decreased $0.5 million

due to the strategic re-allocation into fixed maturities.

Full year 2024 results:(All

comparisons vs. full year 2023, unless noted otherwise)

Net investment income was $82.0 million for the

full year 2024, an increase of $22.4 million or 37.5%. Interest on

fixed maturities was up $13.5 million or 23.9% as a result of

portfolio management actions, investing at higher rates, and the

strategic re-allocation of equity securities into fixed maturities,

which resulted in a decrease in dividend income of $3.2 million.

Income on other long-term investments was $8.0 million in 2024

compared to the depressed income of zero for 2023, as the valuation

of the investments in limited liability partnerships varies from

period to period due to the current market conditions. Other

investment income increased $5.6 million, driven by $4.8 million of

interest on cash and cash equivalents.

|

Investment Results |

|

(Unaudited) |

Three Months Ended December 31, |

|

Twelve Months Ended December 31, |

|

(In thousands) |

|

2024 |

|

|

|

2023 |

|

|

|

2024 |

|

|

|

2023 |

|

| Investment income: |

|

|

|

|

|

|

|

|

Interest on fixed maturities |

$ |

19,877 |

|

|

$ |

15,051 |

|

|

$ |

69,703 |

|

|

$ |

56,243 |

|

|

Dividends on equity securities |

|

— |

|

|

|

481 |

|

|

|

341 |

|

|

|

3,548 |

|

|

Income (loss) on other long-term investments |

|

2,150 |

|

|

|

3,460 |

|

|

|

7,939 |

|

|

|

(31 |

) |

|

Other |

|

3,692 |

|

|

|

2,456 |

|

|

|

14,951 |

|

|

|

9,324 |

|

| Total investment income |

$ |

25,719 |

|

|

$ |

21,448 |

|

|

$ |

92,934 |

|

|

$ |

69,084 |

|

|

Less investment expenses |

|

2,562 |

|

|

|

2,350 |

|

|

|

10,947 |

|

|

|

9,478 |

|

| Net investment income |

$ |

23,157 |

|

|

$ |

19,098 |

|

|

$ |

81,987 |

|

|

$ |

59,606 |

|

|

|

|

|

|

|

|

|

|

| Average yields on fixed income

securities pre-tax(1) |

|

4.15 |

% |

|

|

3.39 |

% |

|

|

3.73 |

% |

|

|

3.28 |

% |

| (1) Fixed income

securities yield excluding net unrealized investment gains/losses

and expenses. |

| |

Balance Sheet

| |

December 31, 2024 |

|

December 31, 2023 |

| (In

thousands) |

(unaudited) |

|

|

|

Invested assets |

$ |

2,093,094 |

|

|

$ |

1,886,494 |

|

| Cash |

|

200,949 |

|

|

|

102,046 |

|

| Total assets |

|

3,488,469 |

|

|

|

3,144,190 |

|

| Losses and loss settlement

expenses |

|

1,796,782 |

|

|

|

1,638,755 |

|

| Total liabilities |

|

2,706,938 |

|

|

|

2,410,445 |

|

| Net unrealized investment

gains (losses), after-tax |

|

(72,241 |

) |

|

|

(66,967 |

) |

| Total

stockholders’ equity |

|

781,531 |

|

|

|

733,745 |

|

| |

|

|

|

| Book value per share |

$ |

30.80 |

|

|

$ |

29.04 |

|

| Adjusted book value per

share(1) |

|

33.64 |

|

|

|

31.69 |

|

|

(1) Adjusted book value per share is a non-GAAP financial measure.

See Definitions of Non-GAAP Information and Reconciliations to

Comparable GAAP Measures for additional information. |

| |

The company’s book value per share was $30.80,

an increase of $1.76 per share, or 6.1%, from December 31,

2023. This increase is primarily related to an increase in net

income, partially offset with an increase in net unrealized losses

on fixed maturity securities and shareholder dividends during the

12-month period ended December 31, 2024.

Capital Management

During the fourth quarter of 2024, the company

declared and paid a $0.16 per share cash dividend to shareholders

of record as of November 29, 2024. UFG has paid a quarterly

dividend every quarter since March 1968.

Earnings Call Access Information

An earnings call will be held at 9:00 a.m. CT on

Wednesday, February 12, 2025, to allow securities analysts,

shareholders and other interested parties the opportunity to hear

management discuss the company’s fourth quarter of 2024

results.

Teleconference: Dial-in information for the call

is toll-free 1-844-492-3723 (international 1-412-542-4184). The

event will be archived and available for digital replay through

February 19, 2025. The replay access information is toll-free

1-877-344-7529 (international 1-412-317-0088); conference ID no.

4765665.

Webcast: An audio webcast of the teleconference

can be accessed at the company’s investor relations page at

https://ir.ufginsurance.com/event/ or

https://event.choruscall.com/mediaframe/webcast.html?webcastid=j4u0yn8Q.

The archived audio webcast will be available for one year.

Transcript: A transcript of the teleconference

will be available on the company’s website soon after the

completion of the teleconference.

About UFG

Founded in 1946 as United Fire & Casualty

Company, UFG, through its insurance company subsidiaries, is

engaged in the business of writing property and casualty

insurance.

The company is licensed as a property and

casualty insurer in all 50 states and the District of Columbia, and

is represented by approximately 1,000 independent agencies. A.M.

Best Company assigns a rating of “A-” (Excellent) for members of

the United Fire & Casualty Group. For more information about

UFG, visit www.ufginsurance.com.

Contact:

Investor RelationsEmail:

ir@unitedfiregroup.com

Media Inquiries Email:

news@unitedfiregroup.com

Disclosure of Forward-Looking Statements

This release may contain forward-looking

statements about our operations, anticipated performance and other

similar matters. The Private Securities Litigation Reform Act of

1995 provides a safe harbor under the Securities Act of 1933 and

the Securities Exchange Act of 1934 for forward-looking statements.

The forward-looking statements are not historical facts and involve

risks and uncertainties that could cause actual results to differ

from those expected and/or projected. Such forward-looking

statements are based on current expectations, estimates, forecasts

and projections about the company, the industry in which we

operate, and beliefs and assumptions made by management. Words such

as “expect(s),” “anticipate(s),” “intend(s),” “plan(s),”

“believe(s),” “continue(s),” “seek(s),” “estimate(s),” “goal(s),”

“remain(s) optimistic,” “target(s),” “forecast(s),” “project(s),”

“predict(s),” “should,” “could,” “may,” “will,” “might,” “hope,”

“can” and other words and terms of similar meaning or expression in

connection with a discussion of future operations, financial

performance or financial condition, are intended to identify

forward-looking statements. These statements are not guarantees of

future performance and involve risks, uncertainties and assumptions

that are difficult to predict. Therefore, actual outcomes and

results may differ materially from what is expressed in such

forward-looking statements. Information concerning factors that

could cause actual outcomes and results to differ materially from

those expressed in the forward-looking statements is contained in

Part I, Item 1A “Risk Factors” of our Annual Report on Form 10-K

for the year ended December 31, 2023 (“2023 Annual Report”),

filed with the Securities and Exchange Commission (“SEC”) on

February 29, 2024. The risks identified in our 2023 Annual

Report and in our other SEC filings are representative of the

risks, uncertainties, and assumptions that could cause actual

outcomes and results to differ materially from what is expressed in

the forward-looking statements. Readers are cautioned not to place

undue reliance on these forward-looking statements, which speak

only as of the date of this release or as of the date they are

made. Except as required under the federal securities laws and the

rules and regulations of the SEC, we do not have any intention or

obligation to update publicly any forward-looking statements,

whether as a result of new information, future events, or

otherwise, except as required by law. In addition, future dividend

payments are within the discretion of our Board of Directors and

will depend on numerous factors, including our financial condition,

our capital requirements and other factors that our Board of

Directors considers relevant.

Definitions of Non-GAAP Information and

Reconciliations to Comparable GAAP Measures

The company prepares its financial statements in

conformity with accounting principles generally accepted in the

United States of America (“GAAP”). Management uses certain non-GAAP

financial measures to evaluate its operations and profitability.

Management also believes that disclosure of certain non-GAAP

financial measures enhances investor understanding of our financial

performance. Non-GAAP financial measures disclosed in this report

include: adjusted operating income, underlying loss ratio,

underlying combined ratio, and adjusted book value per share. The

company has provided the following definitions and reconciliations

of the non-GAAP financial measures:

Adjusted operating income:

Adjusted operating income is calculated by excluding net investment

gains and losses, after applicable federal and state income taxes

from net income (loss). Management believes adjusted operating

income is a meaningful measure for evaluating insurance company

performance and a useful supplement to GAAP information because it

better represents the normal, ongoing performance of our business.

Investors and equity analysts who invest in and report on the

insurance industry and the company generally focus on this metric

in their analyses.

|

Net Income Reconciliation |

| (Unaudited) |

Three Months Ended December 31, |

|

Twelve Months Ended December 31, |

|

(In thousands) |

|

2024 |

|

|

|

2023 |

|

|

|

2024 |

|

|

|

2023 |

|

| Income statement

data |

|

|

|

|

|

|

|

|

Net income (loss) |

$ |

31,442 |

|

|

$ |

19,608 |

|

|

$ |

61,957 |

|

|

$ |

(29,700 |

) |

|

Less: after-tax net investment gains (losses) |

|

(1,041 |

) |

|

|

3,044 |

|

|

|

(4,289 |

) |

|

|

1,006 |

|

|

Adjusted operating income (loss) |

$ |

32,483 |

|

|

$ |

16,564 |

|

|

$ |

66,246 |

|

|

$ |

(30,706 |

) |

| Diluted earnings per

share data |

|

|

|

|

|

|

|

|

Net income (loss) |

$ |

1.21 |

|

|

$ |

0.77 |

|

|

$ |

2.39 |

|

|

$ |

(1.18 |

) |

|

Less: after-tax net investment gains (losses) |

|

(0.04 |

) |

|

|

0.12 |

|

|

|

(0.17 |

) |

|

|

0.04 |

|

|

Adjusted operating income (loss) |

$ |

1.25 |

|

|

$ |

0.65 |

|

|

$ |

2.56 |

|

|

$ |

(1.22 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Underlying loss ratio and underlying

combined ratio: Underlying loss ratio represents the net

loss ratio less the impacts of catastrophes and non-catastrophe

prior year reserve development. The underlying combined ratio

represents the combined ratio less the impacts of catastrophes and

non-catastrophe prior year reserve development. The company

believes that the underlying loss ratio and underlying combined

ratio are meaningful measures to understand the underlying trends

in the core business in the current accident year, removing the

volatility of prior year impacts and catastrophes. Management

believes separate discussions on catastrophe losses and prior year

reserve development are important to understanding how the company

is managing catastrophe risk and in identifying developments in

longer-tailed business.

Prior year reserve development is the increase

(unfavorable) or decrease (favorable) in incurred loss and loss

adjustment expense at the valuation dates for losses which occurred

in previous calendar years. This measure excludes development on

catastrophe losses.

Catastrophe losses is an operational measure

which utilizes the designations of the Insurance Services Office

(“ISO”) and is reported with losses and loss adjustment expense

amounts net of reinsurance recoverables, unless specified

otherwise. In addition to ISO catastrophes, we also include as

catastrophes those events, which may include U.S. or international

losses, that we believe are, or will be, material to our

operations, either in amount or in number of claims made.

Catastrophes are not predictable and are unique in terms of timing

and financial impact. While management estimates catastrophe losses

as incurred, due to the inherently unique nature of catastrophe

losses, the impact in a reporting period is inclusive of

catastrophes that occurred in the reporting period, as well as

development on catastrophes that have occurred in prior

periods.

Adjusted book value per share:

Adjusted book value per share is calculated by dividing

shareholders' equity, excluding net unrealized investment gains and

losses, net of tax, by the number of common shares outstanding.

Management believes adjusted book value per share is a meaningful

measure for evaluating the company's net worth that is primarily

attributable to our business operations, because it removes the

effect of changing prices on invested assets that can fluctuate

from period to period. Book value per share is the most directly

comparable GAAP measure.

|

Book Value Per Share Reconciliation |

| (Unaudited) |

As of |

| (In

thousands) |

December 31, 2024 |

|

December 31, 2023 |

|

Shareholders' equity |

$ |

781,531 |

|

|

$ |

733,745 |

|

|

Less: Net unrealized investment gains (losses), net of tax |

|

(72,241 |

) |

|

|

(66,967 |

) |

|

Shareholders' equity, excluding net unrealized investment gains

(losses), net of tax |

$ |

853,772 |

|

|

$ |

800,712 |

|

| |

|

|

|

|

Common shares outstanding (basic) |

|

25,378 |

|

|

|

25,270 |

|

|

Book value per share |

$ |

30.80 |

|

|

$ |

29.04 |

|

|

Adjusted book value per share |

|

33.64 |

|

|

|

31.69 |

|

|

|

|

|

|

|

|

|

|

Certain Performance

Measures

The company uses the following measure to

evaluate its financial performance. Management believes a

discussion of this measure provides financial statement users with

a better understanding of the company’s results of operations. The

company has provided the following definition:

Net written premiums: Net

written premiums is frequently used by industry analysts and other

recognized reporting sources to facilitate comparisons of the

performance of insurance companies. Net written premiums is the

amount charged for insurance policy contracts issued and recognized

on an annualized basis at the effective date of the policy.

Management believes net written premiums is a meaningful measure

for evaluating insurance company sales performance and geographical

expansion efforts. Net written premiums for an insurance company

consists of direct premiums written and premiums assumed, less

premiums ceded. Net earned premiums is calculated on a pro-rata

basis over the terms of the respective policies. Unearned premium

reserves are established for the portion of written premiums

applicable to the unexpired terms of the insurance policies in

force. The difference between net earned premiums and net written

premiums is the change in unearned premiums and the change in

prepaid reinsurance premiums.

Supplemental Tables

|

Income Statement |

| (Unaudited) |

Three Months Ended December 31, |

|

Twelve Months Ended December 31, |

|

(In thousands) |

|

2024 |

|

|

|

2023 |

|

|

|

2024 |

|

|

|

2023 |

|

| Revenues |

|

|

|

|

|

|

|

| Net earned premiums |

$ |

308,137 |

|

|

$ |

264,366 |

|

|

$ |

1,176,750 |

|

|

$ |

1,034,587 |

|

| Net investment income |

|

23,156 |

|

|

|

19,098 |

|

|

|

81,986 |

|

|

|

59,606 |

|

| Net investment gains

(losses) |

|

(1,318 |

) |

|

|

3,855 |

|

|

|

(5,429 |

) |

|

|

1,274 |

|

| Other

income (loss) |

|

3,200 |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

| Total

revenues |

$ |

333,175 |

|

|

$ |

287,319 |

|

|

$ |

1,253,307 |

|

|

$ |

1,095,467 |

|

| |

|

|

|

|

|

|

|

| Benefits, losses and

expenses |

|

|

|

|

|

|

|

| Losses and loss settlement

expenses |

$ |

176,486 |

|

|

$ |

171,289 |

|

|

$ |

744,605 |

|

|

$ |

769,414 |

|

| Amortization of deferred

policy acquisition costs |

|

76,834 |

|

|

|

63,291 |

|

|

|

281,338 |

|

|

|

244,991 |

|

| Other underwriting

expenses |

|

37,410 |

|

|

|

27,569 |

|

|

|

140,942 |

|

|

|

115,800 |

|

| Interest expense |

|

2,481 |

|

|

|

869 |

|

|

|

7,281 |

|

|

|

3,260 |

|

| Other

non-underwriting expenses |

|

419 |

|

|

|

170 |

|

|

|

2,107 |

|

|

|

1,723 |

|

| Total benefits, losses

and expenses |

$ |

293,630 |

|

|

$ |

263,188 |

|

|

$ |

1,176,273 |

|

|

$ |

1,135,188 |

|

|

|

|

|

|

|

|

|

|

|

Income (loss) before income taxes |

$ |

39,545 |

|

|

$ |

24,131 |

|

|

$ |

77,034 |

|

|

$ |

(39,721 |

) |

| Federal

income tax expense (benefit) |

|

8,103 |

|

|

|

4,523 |

|

|

|

15,077 |

|

|

|

(10,021 |

) |

|

Net income (loss) |

$ |

31,442 |

|

|

$ |

19,608 |

|

|

$ |

61,957 |

|

|

$ |

(29,700 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net Written Premiums by Line of Business |

| (Unaudited) |

Three Months Ended December 31, |

|

Twelve Months Ended December 31, |

|

(In thousands) |

|

2024 |

|

|

|

2023 |

|

|

|

2024 |

|

|

|

2023 |

|

| Net written

premiums(1) |

|

|

|

|

|

|

|

| Commercial lines: |

|

|

|

|

|

|

|

| Other liability(2) |

$ |

90,508 |

|

|

$ |

79,393 |

|

|

$ |

369,454 |

|

|

$ |

325,900 |

|

| Fire and allied lines(3) |

|

54,203 |

|

|

|

51,742 |

|

|

|

253,796 |

|

|

|

249,029 |

|

| Automobile |

|

53,776 |

|

|

|

46,667 |

|

|

|

258,257 |

|

|

|

218,710 |

|

| Workers’ compensation |

|

14,011 |

|

|

|

10,530 |

|

|

|

61,838 |

|

|

|

49,128 |

|

| Surety(4) |

|

10,013 |

|

|

|

11,964 |

|

|

|

52,524 |

|

|

|

47,564 |

|

|

Miscellaneous |

|

3,201 |

|

|

|

1,356 |

|

|

|

13,086 |

|

|

|

4,776 |

|

| Total

commercial lines |

$ |

225,712 |

|

|

$ |

201,652 |

|

|

$ |

1,008,955 |

|

|

$ |

895,107 |

|

| |

|

|

|

|

|

|

|

| Personal lines: |

|

|

|

|

|

|

|

| Fire and allied lines(5) |

$ |

3,804 |

|

|

$ |

136 |

|

|

$ |

14,201 |

|

|

$ |

4,545 |

|

| Automobile |

|

764 |

|

|

|

— |

|

|

|

2,449 |

|

|

|

— |

|

|

Miscellaneous |

|

— |

|

|

|

1 |

|

|

|

5 |

|

|

|

14 |

|

| Total

personal lines |

$ |

4,568 |

|

|

$ |

137 |

|

|

$ |

16,655 |

|

|

$ |

4,559 |

|

| Assumed

reinsurance(6) |

|

48,249 |

|

|

|

45,041 |

|

|

|

205,860 |

|

|

|

167,236 |

|

|

Total |

$ |

278,529 |

|

|

$ |

246,830 |

|

|

$ |

1,231,470 |

|

|

$ |

1,066,901 |

|

| (1) Net written

premiums is a performance measure reflecting the amount charged for

insurance policy contracts issued and recognized on an annualized

basis at the effective date of the policy. See Certain Performance

Measures for additional information.(2) Commercial lines “Other

liability” is business insurance covering bodily injury and

property damage arising from general business operations, accidents

on the insured’s premises and products manufactured or sold.(3)

Commercial lines “Fire and allied lines” includes fire, allied

lines, commercial multiple peril and inland marine.(4) Commercial

lines “Surety” previously referred to as “Fidelity and surety.”(5)

Personal lines “Fire and allied lines” includes fire, allied lines,

homeowners and inland marine.(6) Assumed reinsurance includes Funds

at Lloyd's |

| |

|

Net Earned Premiums, Net Losses and Loss Settlement

Expenses and Net Loss Ratio by Line of Business |

|

Three Months Ended December 31, |

|

2024 |

|

|

|

2023 |

|

| (In thousands,

except ratios) |

|

|

Net Losses |

|

|

|

|

|

Net Losses |

|

|

| |

|

and Loss |

|

|

|

|

|

and Loss |

|

|

|

Net |

|

Settlement |

|

Net |

|

Net |

|

Settlement |

|

Net |

|

Earned |

|

Expenses |

|

Loss |

|

Earned |

|

Expenses |

|

Loss |

|

(Unaudited) |

Premiums |

|

Incurred |

|

Ratio |

|

Premiums |

|

Incurred |

|

Ratio |

| Commercial lines |

|

|

|

|

|

|

|

|

|

|

|

|

Other liability |

$ |

91,016 |

|

|

$ |

82,052 |

|

|

|

90.2 |

% |

|

$ |

83,239 |

|

|

$ |

54,991 |

|

|

|

66.1 |

% |

|

Fire and allied lines |

|

62,019 |

|

|

|

16,515 |

|

|

|

26.6 |

|

|

|

61,869 |

|

|

|

31,994 |

|

|

|

51.7 |

|

|

Automobile |

|

63,276 |

|

|

|

28,893 |

|

|

|

45.7 |

|

|

|

54,068 |

|

|

|

39,792 |

|

|

|

73.6 |

|

|

Workers’ compensation |

|

14,914 |

|

|

|

8,233 |

|

|

|

55.2 |

|

|

|

12,626 |

|

|

|

13,908 |

|

|

|

110.2 |

|

|

Surety |

|

15,537 |

|

|

|

(179 |

) |

|

|

(1.2 |

) |

|

|

12,311 |

|

|

|

6,591 |

|

|

|

53.5 |

|

|

Miscellaneous |

|

3,223 |

|

|

|

611 |

|

|

|

19.0 |

|

|

|

1,180 |

|

|

|

663 |

|

|

|

56.2 |

|

| Total

commercial lines |

$ |

249,985 |

|

|

$ |

136,125 |

|

|

|

54.5 |

% |

|

$ |

225,293 |

|

|

$ |

147,939 |

|

|

|

65.7 |

% |

| |

|

|

|

|

|

|

|

|

|

|

|

| Personal lines |

|

|

|

|

|

|

|

|

|

|

|

|

Fire and allied lines |

$ |

3,814 |

|

|

$ |

5,110 |

|

|

|

134.0 |

% |

|

$ |

165 |

|

|

$ |

(229 |

) |

|

|

(138.8 |

)% |

|

Automobile |

|

639 |

|

|

|

424 |

|

|

|

66.4 |

% |

|

|

— |

|

|

|

(511 |

) |

|

|

NM |

|

|

Miscellaneous |

|

2 |

|

|

|

4 |

|

|

|

NM |

|

|

|

4 |

|

|

|

66 |

|

|

|

NM |

|

| Total

personal lines |

$ |

4,455 |

|

|

$ |

5,538 |

|

|

|

124.3 |

% |

|

$ |

169 |

|

|

$ |

(674 |

) |

|

|

(398.8 |

)% |

| Assumed

reinsurance |

|

53,697 |

|

|

|

34,823 |

|

|

|

64.9 |

|

|

|

38,904 |

|

|

|

24,024 |

|

|

|

61.8 |

|

|

Total |

$ |

308,137 |

|

|

$ |

176,486 |

|

|

|

57.3 |

% |

|

$ |

264,366 |

|

|

$ |

171,289 |

|

|

|

64.8 |

% |

| NM = Not

meaningful |

| |

|

Net Earned Premiums, Net Losses and Loss Settlement

Expenses and Net Loss Ratio by Line of Business |

|

Twelve Months Ended December 31, |

|

2024 |

|

|

|

2023 |

|

| (In thousands,

except ratios) |

|

|

Net Losses |

|

|

|

|

|

Net Losses |

|

|

| |

|

and Loss |

|

|

|

|

|

and Loss |

|

|

|

Net |

|

Settlement |

|

Net |

|

Net |

|

Settlement |

|

Net |

|

Earned |

|

Expenses |

|

Loss |

|

Earned |

|

Expenses |

|

Loss |

|

(Unaudited) |

Premiums |

|

Incurred |

|

Ratio |

|

Premiums |

|

Incurred |

|

Ratio |

| Commercial lines |

|

|

|

|

|

|

|

|

|

|

|

|

Other liability |

$ |

343,027 |

|

|

$ |

283,034 |

|

|

|

82.5 |

% |

|

$ |

320,762 |

|

|

$ |

249,106 |

|

|

|

77.7 |

% |

|

Fire and allied lines |

|

252,142 |

|

|

|

125,807 |

|

|

|

49.9 |

|

|

|

244,674 |

|

|

|

183,533 |

|

|

|

75.0 |

|

|

Automobile |

|

239,964 |

|

|

|

138,517 |

|

|

|

57.7 |

|

|

|

208,874 |

|

|

|

176,667 |

|

|

|

84.6 |

|

|

Workers’ compensation |

|

54,815 |

|

|

|

37,524 |

|

|

|

68.5 |

|

|

|

53,039 |

|

|

|

33,224 |

|

|

|

62.6 |

|

|

Surety |

|

60,285 |

|

|

|

14,812 |

|

|

|

24.6 |

|

|

|

39,922 |

|

|

|

22,259 |

|

|

|

55.8 |

|

|

Miscellaneous |

|

9,802 |

|

|

|

5,742 |

|

|

|

58.6 |

|

|

|

2,702 |

|

|

|

940 |

|

|

|

34.8 |

|

| Total

commercial lines |

$ |

960,035 |

|

|

$ |

605,436 |

|

|

|

63.1 |

% |

|

$ |

869,973 |

|

|

$ |

665,729 |

|

|

|

76.5 |

% |

| |

|

|

|

|

|

|

|

|

|

|

|

| Personal lines |

|

|

|

|

|

|

|

|

|

|

|

|

Fire and allied lines |

$ |

14,237 |

|

|

$ |

8,325 |

|

|

|

58.5 |

% |

|

$ |

4,733 |

|

|

$ |

3,402 |

|

|

|

71.9 |

% |

|

Automobile |

|

1,214 |

|

|

|

732 |

|

|

|

60.3 |

% |

|

|

— |

|

|

|

(837 |

) |

|

|

NM |

|

|

Miscellaneous |

|

10 |

|

|

|

197 |

|

|

|

NM |

|

|

|

22 |

|

|

|

(82 |

) |

|

|

NM |

|

| Total

personal lines |

$ |

15,461 |

|

|

$ |

9,254 |

|

|

|

59.9 |

% |

|

$ |

4,755 |

|

|

$ |

2,483 |

|

|

|

52.2 |

% |

| Assumed

reinsurance |

|

201,254 |

|

|

|

129,915 |

|

|

|

64.6 |

|

|

|

159,859 |

|

|

|

101,202 |

|

|

|

63.3 |

|

|

Total |

$ |

1,176,750 |

|

|

$ |

744,605 |

|

|

|

63.3 |

% |

|

$ |

1,034,587 |

|

|

$ |

769,414 |

|

|

|

74.4 |

% |

| |

|

|

|

|

|

|

|

|

|

|

|

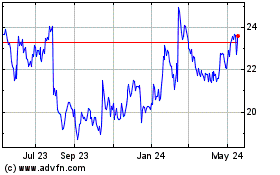

United Fire (NASDAQ:UFCS)

Historical Stock Chart

From Jan 2025 to Feb 2025

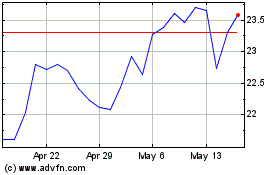

United Fire (NASDAQ:UFCS)

Historical Stock Chart

From Feb 2024 to Feb 2025