false

0000101295

0000101295

2023-03-30

2023-03-30

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): March 30, 2023

United-Guardian, Inc.

(Exact name of registrant as specified in its charter)

| Delaware |

001-10526 |

11-1719724 |

| (State or Other Jurisdiction of Incorporation) |

(Commission File Number) |

(I.R.S. Employer Identification No.) |

230 Marcus Boulevard

Hauppauge, New York 11788

(Address of Principal Executive Offices) (Zip Code)

(631) 273-0900

(Registrant's telephone number, including area code)

Not Applicable

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy

the filing obligation of the registrant under any of the following provisions:

| ☐ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class |

|

Trading Symbol(s) |

|

Name of each exchange on which registered |

| Common Stock, $0.10 par value per share |

|

UG |

|

NASDAQ Global Market |

Indicate by check mark whether the registrant is an emerging growth company

as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934

(§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant

has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant

to Section 13(a) of the Exchange Act. ☐

| Item 1.01. | Entry into a Material Definitive Agreement. |

On March 30, 2023, United-Guardian, Inc. (the “Company”) entered

into a manufacturing and supply agreement with Amsino Healthcare (USA), Inc. (“Amsino”), the successor in interest to Smiths

Medical, effective as of January 1, 2023 (the “Agreement”). This Agreement, modeled after a previously executed manufacturing

and supply agreement with Smiths Medical, provides the framework in which Amsino would manufacture and supply the Company with its pharmaceutical

product, Renacidin® Irrigation.

The Agreement provides for an initial term of six years from the effective

date, with the option to automatically renew for two successive two-year periods following the conclusion of the initial term, unless

earlier terminated pursuant to the Agreement. The Agreement also contains customary representations, warranties, and covenants on behalf

of the Company and Amsino, including those relating to regulatory and licensure requirements, quality control, product and facility inspections,

recall and adverse reaction procedures, indemnification, and confidentiality.

The forgoing summary of the Agreement

does not purport to be complete and is qualified in its entirety by reference to the full text of the Agreement, a copy of which is being

filed as Exhibit 10.2 to this Current Report on Form 8-K and incorporated herein by reference.

| Item 9.01. | Financial Statements and Exhibits. |

(d) Exhibits.

* Filed herewith.

† Certain exhibits and schedules to the Agreement have been omitted

pursuant to Item 601 of Regulation S-K. The registrant will furnish copies of any of the exhibits and schedules to the Securities and

Exchange Commission upon request.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly

caused this report to be signed on its behalf by the undersigned thereunto duly authorized.

| |

UNITED-GUARDIAN, INC. |

| |

|

| |

By: |

/s/ Donna Vigilante |

| |

Name: |

Donna Vigilante |

| |

Title: |

President |

Date: March 1, 2024

Exhibit 10.2

[***] Certain exhibits and schedules

to this agreement have been omitted pursuant to Item 601 of Regulation S-K.

MANUFACTURING AND SUPPLY AGREEMENT

Between

UNITED-GUARDIAN, INC.

And

AMSINO HEALTHCARE (USA), INC.

This

MANUFACTURING AND SUPPLY AGREEMENT (“Agreement”) is effective January 1, 2023 (“Effective Date”), and is made

and entered into by and between UNITED-GUARDIAN, INC. (“UNITED”), a corporation

organized and existing under the laws of the State of Delaware, USA, with its principal place of business at 230

Marcus Blvd., P.O. Box 18050, Hauppauge, NY 11788 and AMSINO HEALTHCARE (USA), INC. (“AMSINO”)

having offices at 330 Corporate Woods Pkwy, IL 60061.

WHEREAS, UNITED and AMSINO desire to enter into an Agreement for

AMSINO to Manufacture the Product (as defined below) for a fee payable by UNITED to AMSINO.

WHEREAS, AMSINO has the expertise and experience necessary to Manufacture

(as defined below) the Product.

NOW, THEREFORE, in consideration of the mutual promises and covenants

contained herein, the parties agree as follows:

| 1.1. | “Affiliate” means any person or entity that directly or indirectly through one or more intermediaries controls,

is controlled by, or is under common control with a party, where control means the direct or indirect, legal or beneficial ownership of

more than twenty percent (20%) of the outstanding voting rights in a company. |

| 1.2. | “BFS” means blow-fill-seal packaging technology. |

| 1.3. | “cGMP” means the FDA’s Current Good Manufacturing Practice Regulations (CFR Title 21) that apply to the manufacture,

processing, packing, or holding of a drug, or the FDA’s Quality System Regulation that applies to the design, manufacture, packaging,

labeling and storage of a finished device, as such are or may be applicable to the manufacture and packaging of the Product. |

| 1.4. | “Facility” means the facility of AMSINO located in Vernon Hills, IL used for Manufacture of the Product. |

| 1.5. | “FD&C Act” The Federal Food, Drug, and Cosmetic Act. |

| 1.6. | “Manufacture” includes all activities performed by AMSINO that are subject to cGMP, including but not limited to

the process by which AMSINO utilizes its BFS and other equipment to produce and package the Product as outlined in Schedule A. |

| 1.7. | “Materials” means the specific equipment, tooling and supplies used in connection with the Manufacture of the Product,

and not used in connection with the manufacture of other products by AMSINO. |

| 1.8. | “Price” means the charge by AMSINO to UNITED for Product supplied by AMSINO. All prices shall be in U.S. Dollars

and shall be as set forth on Schedule B. |

| 1.9. | “Product” means Renacidin® Irrigation, the pharmaceutical product listed on Schedule A attached hereto, in

its final single-use dosage form. UNITED received approval from the FDA of its application to market the Product on 12/16/2015. |

| 1.10. | “Quality Agreement” means a separate quality agreement that was signed by both parties, has an effective date of

Jan. 1, 2023, and refers to this agreement. |

| 1.11. | “Regulatory Authority” means any local, state, federal, or international regulatory agency, department, or bureau,

including the United States Food and Drug Administration (“FDA”), which is responsible for issuing approvals, licenses, registrations,

or authorizations necessary for the Manufacture, use, storage, import, transport, or sale of Product. |

| 1.12. | “Services” means the operations relating to the packaging of the Product, such as quality assurance, and shipping

as outlined in Schedule A. |

| 1.13. | “Specifications” means the specifications contained in or referred to in Exhibit A of the Quality Agreement, as

amended from time to time. |

| 1.14. | “Contract Year” means

the 12-month period and continuing for each 12-month period thereafter until this Agreement terminates. |

| 2.1 | Manufacture, Supply and Purchase Obligations. AMSINO shall Manufacture

Product at its FDA-approved plant at Vernon Hills, IL for and supply to UNITED, and UNITED shall purchase from AMSINO, such quantities

of the Product as UNITED may order from AMSINO in accordance with the terms and conditions of this Agreement. If AMSINO’s plant

has a power outage during production of the Product, AMSINO will notify UNITED within twenty-four (24) hours of the start of the power

outage. Based on firm orders and forecasts provided by UNITED, and at no cost to AMSINO, UNITED shall supply AMSINO with certain raw materials

needed to Manufacture the Product (“Raw Materials”), which are set forth on Schedule B. AMSINO shall Manufacture, test, release,

and ship Product to UNITED. AMSINO shall assume all responsibility and risk, up to the replacement value, for the safekeeping, storage,

and handling of all shipments of Raw Materials received from UNITED. |

| | | |

| | | UNITED shall purchase all of its requirements for Product from AMSINO and AMSINO shall sell Product exclusively to UNITED. AMSINO and

UNITED will meet annually to review the next 3-year capacity, volumes and strategy. If AMSINO cannot supply all of UNITED’s requirements

for Product short term or long term, AMSINO shall notify UNITED of its inability to supply of UNITED’s requirements for Product.

Both Parties will work together to find a mutual solution. If AMSINO cannot cure within 180 days and start up its manufacturing then

UNITED is free to use other suppliers to meet its needs. UNITED may immediately move its assets (molds, associated filling systems, parison

heads (if any), and any other equipment) that is paid for by UNITED from AMSINO to other suppliers and may use Manufacture and Material

and any intellectual property thereon with the other suppliers. AMSINO shall use UNITED Materials, including but not limited to UNITED

molds and related equipment as set forth in Section 3.2 hereof, exclusively and solely for Manufacture of UNITED Product unless otherwise

agreed. |

| |

2.2 |

cGMP Compliance. AMSINO shall Manufacture the Product in accordance with the Specifications, with applicable

cGMP’s and with such other applicable laws and regulations as shall be set forth in the Quality Agreement. |

| |

|

|

| |

2.3 |

Services and Information to be provided by UNITED. |

| |

|

|

| |

|

(a) UNITED shall provide AMSINO with all necessary scientific

and technical data relating to the Product, including bulk Product specifications and Product formulations subject to the confidentiality

provisions set forth in paragraph 11 hereof to make the Product for UNITED. UNITED shall also provide all pertinent environmental health

and safety information necessary to assure safe handling and disposal of the Raw Materials and the Product by AMSINO’s employees.

In addition, UNITED shall, at its cost, make available to AMSINO, on an as-needed basis, the services of UNITED technicians who are familiar

with such data. |

| |

|

(b) Without diminishing the obligation of AMSINO to comply

with all applicable cGMP’s and other applicable laws and regulations, UNITED shall endeavor to notify AMSINO in writing within 30

days of any final changes to cGMP’s or other final rule or regulation of a Regulatory Authority of which UNITED becomes aware, that

apply to the Manufacture of the Product. |

| |

|

|

| |

2.4 |

FDA Debarment. AMSINO certifies that it is not debarred under subsection 306

(a) or (b) of the FD&C Act and that it has not and will not use in any capacity the services of any person debarred under such

law with respect to services to be performed under this Agreement. AMSINO further certifies that it will immediately notify UNITED

in writing if it becomes debarred under subsection 306 (a) or (b) of the FD&C Act. |

| 3. | LICENSE AND REGISTRATIONS |

| |

3.1 |

Regulatory Licenses.

AMSINO will be responsible for, and bear the costs of, filing for all necessary permits, establishment and facility licenses required

by Regulatory Authorities necessary for AMSINO to Manufacture the Product for UNITED under this Agreement. UNITED will be responsible

for, and bear the costs of, filing all necessary permits, licenses, registrations, certificates, approvals and other forms of authorization

from all Regulatory Authorities necessary for UNITED to market and sell the Product, including the marketing authorizations. To the extent

either party possesses relevant information, AMSINO and UNITED shall cooperate in obtaining all relevant permits, licenses, registrations,

certificates, approvals and other forms of authorizations. The obligation of purchase and supply as set forth in Section 2.1 shall become

effective upon the granting of the necessary permits and approvals by the Regulatory Authorities. |

| |

|

|

| |

|

In the event UNITED is required to file a regulatory submission due to AMSINO changing

its manufacturing process, equipment, or location, and such change was not requested by UNITED, then AMSINO shall be responsible for all

costs incurred by UNITED as a result of such change, including but not limited to the costs of a new mold, parison heads, or filling system,

new pilot and stability batches, and the costs of preparing and submitting any new regulatory filings that are required as a result of

AMSINO making such changes, including consultant costs. If a regulatory filing is required as the result of the occurrence of a Force

Majeure (as defined in paragraph 15.1 of this Agreement), then UNITED agrees to pay all of the costs of such filings. In situations where

the parties agree to make changes that benefit both parties, and that requires the filing of a new submission, the parties agree to share

equally in the costs of that new filing. |

| |

|

|

| |

|

AMSINO shall be responsible for the cost of producing any batches of Product that

are required as part of any new regulatory submission pursuant to this paragraph unless either (a) the new submission is the result of

a change requested by UNITED, or (b) the batches produced can be sold by UNITED. If new batches are required for a submission that benefits

both parties and which was mutually agreed upon by both parties, the cost of the submission batches will be shared equally unless they

can be marketed by UNITED, in which case the cost of such batches will be borne entirely by UNITED. |

| |

|

|

| |

3.2 |

Ownership. The molds, associated filling systems, parison heads (if any), and

any other equipment that is paid for by UNITED and used by AMSINO to Manufacture the Product (as set forth in Schedule B),shall be

owned by UNITED, and for the duration of this Agreement, UNITED will be solely responsible for insuring that equipment. Except as

otherwise set forth herein, AMSINO shall own and have property rights to all specific Materials and general manufacturing equipment

needed to Manufacture Product. Notwithstanding anything contained herein, AMSINO shall be the exclusive owner of any intellectual

property rights arising from AMSINO efforts hereunder that are not specifically related to the Product, its formulation or packaging. |

| |

4.1 |

Forecasts. On or prior to the

tenth (10th) calendar day of January, April, July and October in each year during the Term (defined below) of this Agreement,

UNITED shall provide to AMSINO a commercially reasonable rolling forecast of Product for the twelve months following the month in which

such forecast is submitted. The first three (3) months of each forecast constitutes a firm order. |

| |

|

|

| |

4.2 |

Orders. UNITED shall issue quarterly Purchase Orders via e-mail before the tenth

(10th) calendar day of each calendar quarter, specifying quantity of Product, part numbers, FOB Vernon Hills, IL, and

delivery requirements for the calendar quarter following the one in which the Purchase Order was submitted. Upon issuance of a Purchase

Order, the Price of the Product is locked in. UNITED may cancel a Purchase Order for convenience at any time prior to delivery and

is permitted to cancel a Purchase Order at any time if AMSINO materially breaches the Agreement. |

| |

|

|

| |

4.3 |

Obsolete Inventory. Any UNITED specific obsolete materials purchased by AMSINO

to Manufacture the Product, including but not limited to Raw Materials, work in process, and packaging materials shall be reimbursed

to AMSINO by UNITED at AMSINO costs. The maximum amount of obsolete inventory that UNITED will reimburse AMSINO for will be that

associated with the first three (3) months of the most current forecast. At such time as agreed by both parties, UNITED shall bear

the cost of shipment to UNITED or all destruction costs related to said inventory unless otherwise agreed to in writing. UNITED's

obligation is limited to Raw Materials, packaging materials and work in process labor. Any finished goods produced under a firm order

shall be purchased by UNITED at the contracted price. |

| |

5.1 |

Terms of Delivery. AMSINO shall

deliver ordered quantities of the Product on or before the date specified in the applicable Purchase Order, provided such date is at least

sixty (60) business days after receipt of the Purchase Order, or the alternative date agreed upon in advance with UNITED. The Product

shall be shipped from AMSINO to a destination designated by UNITED. Each shipment shall be Free on Board Vernon Hills, IL. AMSINO shall

load Product on trucks at Facility. Thereafter, the transportation costs for shipment of Product from AMSINO to UNITED’s designated

location shall be borne by UNITED. Transportation shall be arranged by UNITED to occur in full-truckload quantities when possible. |

| |

|

|

| |

5.2 |

Shipments. AMSINO shall deliver with each batch of Product in a shipment a Certificate

of Compliance, accompanied by a statement that the batch was Manufactured according to this Agreement (including the Quality Agreement)

and that the Product was manufactured by AMSINO, together with any other batch related records specified in the Quality Agreement.

AMSINO shall also provide release documents at the time each batch of Product is shipped. |

| |

6.1 |

Payment. Payment of the Price

shall be made within thirty (30) days from date of receipt of the AMSINO invoice by UNITED. AMSINO shall date and send invoices to UNITED

for the Product upon shipment of the Product to UNITED. If UNITED fails to pay or procure payment of the full amount of any invoice when

due, and without in any manner excusing such violation, UNITED agrees to pay AMSINO interest at a rate of 1.5% per month (or the highest

rate permitted by applicable laws, if lower) on the amount due and owing to AMSINO, from the date the payment is due until paid. Without

prejudice to any of its other rights, AMSINO may withhold shipments of the Product if UNITED has not paid an invoice when due. |

| |

|

|

| |

6.2 |

Adjustment of Price. Prices

do not include, and UNITED is responsible for, any and all applicable taxes and governmental fees, assessments, duties and charges.

The prices for the Product for the first year following the Effective Date of this Agreement are provided in Schedule A. Thereafter,

AMSINO may increase once per year, provided that UNITED is notified in writing sixty (60) days in advance of each subsequent

adjustment. For any price increase in excess of 5% in any one year, within thirty (30) days after the receipt of notice of the price

increase, UNITED may request written documentation from AMSINO showing the increase in the amount of AMSINO’s costs for labor,

utility, packaging or components used in manufacturing the Product that is the basis for such price increase, and AMSINO shall

furnish such documentation within thirty (30) days thereafter, and any such price increase in excess of 5% will be limited to the

documented labor, utility, packaging and component cost increases. Any such adjustment to price shall be evidenced as an amendment

to Schedule A of this Agreement and signed by both parties. Notwithstanding the foregoing, if unforeseen market issues arise during

the term of the Agreement that require further consideration relative to price adjustments, the parties will promptly and fairly

address this issue. Price includes costs for loading Product on trucks and expedited freight under Section 5.2. |

| |

7.1 |

AMSINO’s

Warranty. AMSINO warrants to UNITED that the Product, at the time of delivery to UNITED as provided in Section 5: (i) will conform

to the Specifications as then in effect, (ii) were Manufactured in accordance with cGMP and other applicable legal requirements relating

to the manufacturing of Product, (iii) are free and clear of all liens or encumbrances; and (iv) are not adulterated as defined

under Title 21 - FOOD AND DRUGS: CHAPTER 9 - FEDERAL FOOD, DRUG, AND COSMETIC ACT: SUBCHAPTER V - DRUGS AND DEVICES: Part A - Drugs and

Devices: Sec. 351 - Adulterated drugs and devices. However, AMSINO shall not be responsible in the event adulteration was caused by adulterated

Raw Materials provided by UNITED. AMSINO further warrants to UNITED that through the expiration date of this Agreement, Product: (I) will

be free from any defects in material and workmanship, and (II) will not fail to meet Specifications for a reason that is attributable

to any deviations by AMSINO from cGMP. AMSINO acknowledges that the properties of the plastic bottle are such that they may be subject

to change based upon heat, cold and method of packaging, freight and handling. Due to the uncertainty of these variables, AMSINO agrees

to use commercially reasonable efforts in preparing Product for shipment. To the extent that a claim is made that Product fails to comply

with the Specifications and such claim is related solely to a deformity or defect in the Product that may be environmentally related,

it shall be UNITED’s obligation to show that the carrier stored and transported Product in accordance with the environmental parameters.

AMSINO’s sole obligation and UNITED's exclusive remedy for any breach of the warranty in this Section 7.1 will be replacement of

the defective Product or at UNITED’s sole option, instead of Product replacement, UNITED may request that AMSINO provide a refund

or credit for the price of the defective Product and AMSINO will provide said refund or credit for the price of the defective Product

to UNITED. |

| |

|

|

| |

7.2 |

Mutual Representations. Each party hereby represents and warrants that it has

the full power and authority to enter into and perform this Agreement, and each party knows of no contract, agreement, promise, undertaking

or other fact or circumstance that would prevent the full execution and performance of this Agreement. |

| 8. | QUALITY CONTROL REQUIREMENTS |

| |

8.1 |

General. AMSINO shall perform

quality control release testing of the Product, in accordance with cGMP and all other applicable regulatory requirements and agreed analytical

and other testing procedures for Product release. UNITED shall at its own expense conduct inspections and quality control testing necessary

to determine the acceptability of the Product. If United finds through their analytical testing that a result is out of specification,

then an investigation will be initiated. If United does not find the cause to be lab error, then AMSINO will be notified by United to

conduct an investigation. AMSINO’s investigation shall include a batch record review and a review of the manufacturing process.

AMSINO shall inform UNITED of their findings within twenty-one (21) days. UNITED shall determine the acceptability of the Product for

distribution into interstate commerce within thirty (30) days after receipt of delivery of the entire lot shipment for distribution into

interstate commerce within thirty (30) days after receipt of delivery of the entire lot shipment. Should UNITED fail to inspect the Product

within that time or fail to notify AMSINO of any deficiency of Product within thirty (30) days, UNITED shall be deemed to have inspected

and approved the Product. Notwithstanding anything herein to the contrary, the thirty (30) day notice provision shall not apply to any

latent defect that is not, or could not, be detected within that timeframe by standard accepted QC inspection protocols. If UNITED rejects

the inspected Product, the provisions of Section 9 – Rejection apply. |

| |

|

|

| |

8.2 |

Stability and Sterility Assurance. AMSINO shall send samples to Geneva Labs

to perform any sterility testing of the Product in accordance with cGMP and all other applicable regulatory requirements, such testing

costs to be borne by AMSINO. UNITED will be responsible for the cost of all analytical and stability and agreed analytical and testing

procedures with costs borne by UNITED. |

| |

|

|

| |

8.3 |

Quality Agreement. The Product shall be Manufactured in accordance with the

Quality Agreement. The parties shall agree upon reasonable tests to be undertaken by AMSINO prior to release and shipment of the

Product, including all inspection methods to determine the acceptability of a batch, and such procedures shall be a part of or appended

to the Quality Agreement and incorporated therein. This section is subject to Section 8.1. |

| |

|

|

| |

8.4 |

Inspections. |

| |

|

|

| |

|

(a) In addition to the inspection of Section 8.1, UNITED shall

subject a Product to a quality control inspection in accordance with the applicable UNITED quality control standards and procedures at

UNITED’s discretion as set forth in the Quality Agreement. If UNITED rejects the inspected Product, the provisions of Section 9

– Rejection apply. |

| |

|

|

| |

|

(b) At a reasonable time but no more than once per year (or such

additional times as mandated by a Regulatory Authority or as necessary for investigation of an issue related to Quality Controls ), upon

at least 48 hours notice by UNITED to AMSINO, AMSINO shall permit UNITED, or its representatives, to inspect during regular business hours

AMSINO’s Facility or manufacturing facility for the purpose of assuring compliance with cGMP and any other applicable regulatory

and quality assurance requirements, procedures or standards. Upon reasonable prior notice by UNITED to AMSINO, AMSINO shall permit UNITED

to review periodically AMSINO’s quality control procedures and records, at reasonable times with a representative of AMSINO present,

in order to assure satisfaction of the requirements of this Agreement. The use of any third party representative shall be subject to AMSINO’s

reasonable consent. Any such representative shall be required as a condition to an inspection to execute AMSINO’s non-disclosure

agreement and to abide by such other conditions as AMSINO reasonably deems necessary for the protection of its confidential or proprietary

information. UNITED shall be responsible for any breach of confidentiality by any such representative. |

| |

|

|

| |

|

(c) AMSINO shall (i) fully cooperate with UNITED or its representatives

who may visit AMSINO’s production facility as provided in Section 8.4(b), (ii) take appropriate corrective action within 15 days

or another reasonable number of days as agreed to by the parties (or immediately if there are issues of safety, health, etc.) of notification

to comply with cGMP requirements, and (iii) when requested by UNITED, describe in writing corrective action planned or taken to UNITED

within fifteen (15) days of the manufacturing inspection. |

| |

8.5 |

Regulatory Inspections. In the

event that any portion of the AMSINO facility involved in the Manufacture of Product or any aspect of its quality control system that

is relevant to AMSINO’s Manufacture of the Product is the subject of an inspection by any Regulatory Authority or any other duly

authorized agency of any national, state, or local government, AMSINO shall notify UNITED promptly upon learning of such inspection and

shall supply UNITED with copies of any correspondence or portions of correspondence that relate to the Product. In the event that either

party receives any correspondence or other communication from any Regulatory Agency relating to the Manufacture of the Product, it shall

provide the other party with a copy of each such communication and the proposed response. |

| |

|

|

| |

8.6 |

Records. UNITED shall have the right to audit AMSINO’s’ records

relating to its performance under this Agreement. AMSINO shall maintain reserve samples, all batch and other packaging and analytical

records, all records of shipments of Product and all validation data relating to the Product, and other applicable records, for the

time periods required by applicable laws and regulations, and shall make such data available to UNITED and Regulatory Authorities

upon UNITED’s reasonable request or if required by law. |

| |

9.1 |

General. In the event that

any portion of the Product delivered to UNITED by AMSINO is damaged, UNITED may reject that portion by giving written notice to AMSINO

within thirty (30) days after receipt of delivery. In the event that any portion of the Product delivered to UNITED by AMSINO shall fail

to conform to any of the Specifications, UNITED may reject the entire shipment of Product by giving written notice to AMSINO within thirty

(30) days after receipt of delivery. AMSINO shall be given an opportunity to investigate whether or not the Product meets Specifications

and if it is agreed that the Products do not meet specifications, UNITED shall be entitled to return such non-conforming Products to AMSINO

at AMSINO’s expense, and to receive fully compliant Product in replacement, subject to AMSINO having in stock relevant materials

and components. At UNITED’s sole option, instead of Product replacement, UNITED may request a refund or credit for the non-conforming

Product and AMSINO will provide said refund or credit for the price of the non-conforming Product to UNITED. If there is a disagreement

as to whether product is conforming or not, the Product will be sent to an independent laboratory that is FDA approved for a final determination,

the cost of which shall be borne by the party whose determination of conformance or non-conformance was incorrect. If the test in question

is considered non-compendial, then it must be validated at the independent laboratory before their testing can begin. If it is determined

that the Product is non-conforming, UNITED shall destroy any non-conforming Product at AMSINO’s expense, and in accordance with

all applicable legal requirements. This section is subject to Section 8.1. AMSINO shall reimburse UNITED for the cost of all Raw Materials

lost as a result of Product failing to meet Product specifications. |

| |

|

|

| |

9.2 |

Dispute Resolution. If AMSINO disputes UNITED’s rejection of non-conforming

Product, the parties shall submit samples of the rejected Product for analysis to a mutually acceptable independent laboratory that

is FDA approved, whose decision in the matter shall be final and binding. If the test in question is considered non-compendial, then

it must be validated at the independent laboratory before their testing can begin. The costs of such analysis shall be borne by AMSINO,

unless such analysis shows that the Product met the Specifications, in which case UNITED shall bear the cost of such analysis. |

| |

10.1 |

AMSINO. Except to the extent

that UNITED is required to indemnify AMSINO under Section 10.1 of this Agreement, AMSINO shall defend, indemnify, and hold UNITED and

its Affiliates, as well as its shareholders, directors, officers, employees and agents harmless from any and all liability, loss, damage,

causes of action, suits, demands, settlements, costs, claims and expenses, including reasonable attorney’s fees, arising from third

party claims for death or injury to person or damage to tangible property as a consequence of a defective Product manufactured and supplied

by AMSINO under this Agreement or for any costs flowing from a warranty or other breach by AMSINO, unless the defect is caused by the

Raw Materials provided by UNITED to AMSINO. |

| |

|

|

| |

|

AMSINO SHALL NOT BE LIABLE FOR ANY INDIRECT, INCIDENTAL OR CONSEQUENTIAL DAMAGES SUSTAINED

OR INCURRED BY UNITED IN CONNECTION WITH THE PRODUCT SUPPLIED HEREUNDER except for indemnification obligations of Section 10.1. UNITED’s

damages incurred from its customers arising from AMSINO’s breach, and losses arising from AMSINO’s intentional or grossly

negligent acts. THE WARRANTIES SET OUT IN THIS AGREEMENT ARE EXCLUSIVE AND IN LIEU OF ALL OTHER EXPRESS OR IMPLIED WARRANTIES, INCLUDING

BUT NOT LIMITED TO, IMPLIED WARRANTIES OF MERCHANT ABILITY AND FITNESS FOR A PARTICULAR PURPOSE. AMSINO DISCLAIMS ALL OTHER EXPRESS OR

IMPLIED WARRANTIES. AMSINO’S MAXIMUM LIABILITY FOR ANY CLAIM IS LIMITED TO AND SHALL NOT EXCEED THE AMOUNT PAID TO AMSINO FOR SERVICES

AND PRODUCT. |

| |

|

|

| |

10.2 |

UNITED shall defend, indemnify and hold AMSINO and its Affiliates, their shareholders,

directors, officers, employees and agents harmless from and against any and all liability, loss, damage, causes of action, suits,

claims, demands, settlements, costs and expenses or judgments of any nature whatsoever, resulting from the Product or their marketing,

sale, clinical testing, clinical use or other use (or misuse), including any design defect, failure to warn or other product liability

or intellectual property claims, except to the extent AMSINO is required to indemnify UNITED under Section 10.1 of this Agreement.

UNITED SHALL NOT BE LIABLE FOR ANY INDIRECT, INCIDENTAL OR CONSEQUENTIAL DAMAGES INCLUDING, WITHOUT LIMITATION, LOST PROFITS OR LOSS

REVENUE SUSTAINED OR INCURRED BY AMSINO IN CONNECTION WITH THE PRODUCT PURCHASED HEREUNDER. UNITED’S MAXIMUM LIABILITY FOR

ANY CLAIM OF ANY KIND FOR LOSS OR DAMAGE ARISING OUT OF OR IN CONNECTION WITH OR RESULTING FROM THIS AGREEMENT IS THE PRICE ALLOCABLE

TO THE PRODUCT GIVING RISE TO THE CLAIM. |

| |

|

|

| |

10.3 |

Defense Control. To the extent a party shall be required to indemnify the other

party; such indemnifying party shall have control of the defense and settlement thereof, but no party shall settle a claim that admits

fault on the part of the other party without such party’s written consent, not to be unreasonably withheld or delayed. The

obligation to indemnify shall be applicable so long as the indemnified party gives prompt notice of the claim to the indemnifying

party and provides the indemnifying party with such assistance as is reasonably required under the facts and circumstances. |

| |

11.1 |

General. Each party shall hold in strictest confidence

all information supplied by the other party (“Discloser”), including but not limited to all written material, product samples,

Specifications, drawings, designs, plans, layouts, forecasts, product formulations, business plans and financial information, procedures,

computer programs, models, prototypes or other information of any description (“Confidential Information”) received from

the Discloser for a period of seven (7) years after the date of disclosure. During the period of confidentiality, the receiving party

(“Recipient”) agrees not to divulge any of the Confidential Information to any third party (except to employees and legal

or financial advisors on a need-to-know basis, all of whom shall be required by Recipient to be bound by the same degree of confidentiality

as Recipient), nor to use the Confidential Information for any purpose other than as agreed by the Discloser. |

| |

11.2 |

Confidential Information may

be disclosed either orally or in writing, including graphic material and electronic, magnetic or other data, may be disclosed either orally

or in writing to an employee of the Recipient on a need to know basis only. When disclosed in writing, the information will be labeled

as confidential by the Discloser. When disclosed orally, such information will be identified as confidential at the time of disclosure,

with subsequent confirmation in writing referencing the type of information disclosed. Regardless of whether such information is labeled

or confirmed in writing, any such information that would be known to a reasonable person under the circumstances shall be deemed Confidential

Information. Confidential Information shall not be deemed to include: |

| (a) | information which is or becomes generally available to the public otherwise than through a breach of this Agreement; |

| (b) | information which Recipient can establish, by its written records, was in its possession prior to the disclosure hereunder, or was

developed independently of any disclosure hereunder; or |

| | | |

| | (c) | information which is approved in writing by the Discloser for release by Recipient. |

| |

11.3 |

It is understood and agreed that

the disclosure of Confidential Information by the Discloser shall not grant Recipient any express, implied or other license or rights

to patents or trade secrets of the Discloser (including any subsidiary or Affiliate thereof), nor shall it constitute any sort of joint

venture or undertaking between the parties. |

| |

|

|

| |

11.4 |

Recipient shall secure documents,

information, items of work-in-process and work products that embody Confidential Information in the same manner that it secures its own

confidential information of like sensitivity. In addition, Recipient shall maintain reasonable procedures to prevent loss of any confidential

or proprietary documents. In the event of any loss, the Discloser shall be promptly notified of such loss. |

| |

|

|

| |

11.5 |

Recipient agrees to return all

Confidential Information, including all copies thereof upon written demand by the Discloser. |

| |

|

|

| |

11.6 |

All materials, drawings, designs,

specifications, notes, memoranda, or data furnished shall be and remain the property of the Discloser. |

| |

|

|

| |

11.7 |

Recipient shall not be in breach

of this Agreement if it discloses Confidential Information pursuant to a demand by a court or judicial or governmental authority of proper

jurisdiction (including the FDA) with which Recipient is obliged to comply, provided Recipient will provide Discloser with reasonable

notice of such demand and take such steps as Discloser may reasonably request to assist Recipient in obtaining a protective order preventing

or limiting the disclosure and/or any other measures requiring that the Confidential Information be protected. |

| |

12.1 |

Term. This Agreement shall be binding on both parties as of the

Effective Date specified above and, unless terminated in accordance with Section 12.2 or 12.3 below, shall remain in full force and

effect for 6 years from Effective Date. (“Initial Term”). The Agreement can be renewed with two (2) successive automatic

two (2) year renewal periods at the conclusion of the Initial term (each a “Renewal Term”), unless either Party provides

the other Party with at least six (6) months prior written notice of its intent to cancel this Agreement upon the expiration of the

Initial Term or any Renewal Term. |

| |

|

|

| |

12.2 |

Early Termination. Without prejudice to any other rights that it may have hereunder

or by law or in equity, either party may terminate this Agreement immediately by written notice to the other party upon the occurrence

of any of the following: |

| (a) | the other party becomes insolvent or an order for relief is entered against the other party under any bankruptcy or insolvency laws

or laws of similar import; |

| (b) | the other party makes an assignment for the benefit of its creditors or a receiver or custodian is appointed for it or its business

is placed under attachment, garnishment or other process involving a significant portion of its business; or |

| (c) | the other party is guilty of a material breach of its undertakings or warranties under this Agreement and, after thirty (30) days

written notice from the terminating party specifying the breach and stating its intent to so terminate, fails to cure the breach. |

| |

|

In addition to the termination rights above, UNITED

shall have the right to terminate this agreement should AMSINO’s Vernon Hills manufacturing site have any negative changes to its

accreditation or FDA registration for drug and medical devices, its manufacturing facility, its ability to manufacture Product in accordance

with cGMPs, or if any Form 483s are issued by the FDA and go unresolved as per required FDA guidelines, is debarred under subsection

306 (a) or (b) of the FD&C Act, has defective Product, or deliver Product late to UNITED. |

| |

12.3 |

Effect of Termination. Termination of this Agreement shall not release

either Party from fulfilling any obligations it may have incurred prior to such termination. Notwithstanding such termination or

expiration, the provisions set forth in the Sections 3.2, 7.1, 7.2, 8.1, 8.5, 10, and 11 shall survive termination of the Agreement.

Upon the expiration or termination of this Agreement, AMSINO shall reasonably cooperate with UNITED in the transfer of production

of the Product to such production facility designated by UNITED whereby UNITED shall bear cost and expense of transferring said Product

and equipment and, subject to UNITED’s reimbursement of all costs reasonably incurred by AMSINO, provide reasonable technical

and regulatory assistance, with a view to the continued supply to UNITED of Product as contemplated by this Agreement. Notwithstanding

anything herein, termination shall not relieve UNITED of its obligations to pay for Product ordered prior to the termination notice

nor shall either Party be relieved by virtue of a notice of termination of any of their obligations that by their nature survive

termination of this Agreement. |

| |

13.1 |

Product Recall. In the event

(i) any national government authority or other regulatory agency issues a request, directive or order that the Product be recalled, or

(ii) a court of competent jurisdiction orders such a recall, or (iii) UNITED reasonably determines after consultation with AMSINO that

the Product should be recalled because the Product does not conform to the specifications at the time of shipment by AMSINO, or (iv) UNITED

reasonably determines that the Product should be recalled for any reason, the parties shall take the appropriate actions to effect the

recall. UNITED shall be responsible for bearing all costs associated with a recall unless such recall results primarily from the breach

of AMSINO’s express warranty under Article 7.1 of this Agreement in which case AMSINO shall be responsible for all the reasonable

expenses of recalling the Product (including, but not limited to notification and shipping charges and man-hours spent arranging, coordinating

and conducting the recall). |

| |

|

|

| |

13.2 |

Recall Administration and Product Returns. UNITED will be responsible for all

returns and all aspects of any recall except as provided in Article 13.1 above. Procedures for handling returns will be covered by

communications from UNITED to AMSINO. UNITED will handle all returns. |

| 14. | ADVERSE REACTION RESPONSIBILITY |

| |

14.1 |

General. Except where

AMSINO is obligated by law to author a notification, UNITED will be solely responsible for processing and providing all legally required

notification to the proper authorities for all adverse reaction and/or complaint calls and or correspondence related to the Product.

UNITED will notify AMSINO in writing of all adverse reactions and/or complaints related to alleged defects with the Manufacture of the

Product. AMSINO shall have the right to participate in and direct all responses related to the packaging and quality of Product Manufactured

by AMSINO. AMSINO agrees to report per its standard operating procedures by phone and in writing material adverse complaints including

complaints of adverse reactions to the Product or in relation to AMSINO’s Manufacture of the Product, regardless of what is being

alleged. |

| |

15.1 |

Force Majeure. Neither party

hereto shall be responsible or liable in any way for failure or delay in carrying out the terms of this Agreement (other than the obligation

to make payment for Products delivered) resulting from any cause or circumstance beyond its reasonable control, including, but not limited

to, fire, flood, other natural disasters, war, terrorism, interruption of transit, accident, explosion, civil commotion, epidemic, inability

of AMSINO to obtain packaging materials (in the event this occurs, the parties will mutually agree to work together to resolve the situation

as quickly as possible), and acts of any governmental authority; provided, that the party so affected shall give prompt notice thereof

to the other. No such failure or delay shall terminate this Agreement, and each party shall complete its obligations hereunder as promptly

as reasonably practicable following cessation of the cause or circumstances of such failure or delay; provided however, that if any of

the above conditions continues to exist for more than ninety (90) days after the date of notice given with regard thereto, either party

may terminate this Agreement forthwith upon notice to the other. |

| |

|

|

| |

15.2 |

No Agency. Neither party is, nor will it be deemed to be, an agent or legal

representative of the other party for any purpose. Neither party will be entitled to enter into any contracts in the name of, or

on behalf of the other party, nor will a party be entitled to pledge the credit of the other party in any way or hold itself out

as having authority to do so. |

| |

|

|

| |

15.3 |

Choice of Law and Jurisdiction. This Agreement, along with the schedules attached,

incorporated and referenced herein and all purchase orders issued hereunder shall be governed and interpreted, and all rights and

obligations of the parties shall be determined, in accordance with the laws of the State of New York, without regard to its conflict

of laws rules. Any dispute, controversy or claim under this Agreement shall be brought in a court of competent subject matter jurisdiction

in New York, and both parties agree to accept the personal jurisdiction of such court. Both Parties knowingly and willingly waive

their respective right to a trial by jury in any action or proceeding related to this Agreement. |

| |

|

|

| |

15.4 |

Notices. All notices, requests, demands, waivers, consents, approvals or other

communications to any party hereunder shall be in writing and shall be deemed to have been duly given if delivered personally to

such party or sent to such party by facsimile transmission or by registered or certified mail, postage prepaid, to the addresses

set forth below (or to such other address as the addressee may have specified in notice duly given to the sender as provided herein): |

If to AMSINO:

Richard Lee, CEO

AMSINO Healthcare (USA), Inc.

330 Corporate Woods Parkway

Vernon Hills, IL 60061

Email: Richard_lee@amsino.com

If to UNITED:

Beatriz Blanco, President & CEO

230 Marcus Blvd.

Hauppauge, NY 11788

Email: bblanco@u-g.com

| |

|

Such notice, request, demand, waiver, consent,

approval or other communications will be deemed to have been given as of the date so delivered, sent by facsimile transmission, or five

(5) days after so mailed. |

| |

15.5 |

Severability. In the event that

any provision of this Agreement shall be found in any jurisdiction to be in violation of public policy or illegal or unenforceable in

law or equity, such finding shall in no event invalidate any other provision of this Agreement in that jurisdiction, and this Agreement

shall be deemed amended to the minimum extent required to comply with the law of such jurisdiction. |

| |

|

|

| |

15.6 |

Entire Agreement. This Agreement, along with any schedules attached, incorporated

and referenced herein, states the entire agreement reached between the parties hereto with respect to the transactions contemplated

hereby and supersedes all prior and contemporaneous understandings, agreements, representations and warranties, both written and

oral, with respect to such subject matter and may not be amended or modified except by written instrument mutually agreed and signed

by the parties and attached hereto. To the extent of any conflict therein, the terms of the Quality Agreement shall take precedence

over all other terms, provisions, documents, schedules, or exhibits of this Agreement, while the terms of Schedule B shall take precedence

over all other terms, provisions, documents, schedules or exhibits of this Agreement with the exception of the Quality Agreement. |

| |

|

|

| |

15.7 |

No Waiver. The failure of either party hereto to enforce at any time, or for

any period of time, any provision of this Agreement shall not be construed as a waiver of such provision or of the right of such

party thereafter to enforce each and every provision. Any waiver by a party of any of its rights under this Agreement shall be in

writing signed by such party. |

| |

|

|

| |

15.8 |

Assignment, Binding Effect. Neither party shall assign this Agreement nor any

of its respective rights or obligations hereunder without the prior written consent of the other party, which consent will not be

unreasonably withheld, conditioned or delayed except to any Affiliate in which event no consent from the other party is required

or as otherwise permitted hereunder. UNITED may, however, assign this Agreement to any third party that acquires UNITED’s rights

in the Product, provided the assignee shall have the resources to comply with all of UNITED’s obligations and shall agree in

writing to be bound by the terms of this Agreement. Either party may assign this Agreement in connection with a sale of all or substantially

all of its assets. AMSINO will assign this Agreement to any third party that acquires AMSINO. In the event of an acquisition of AMSINO

by any third party or discontinuation of AMSINO’s manufacturing operations at its Vernon Hills location, UNITED may move or

take possession of any equipment at any AMSINO location that it owns or has purchased, directly or indirectly, pursuant to AMSINO

completing the terms of this Agreement. Any attempted assignment except as provided herein shall be void and ineffective. This Agreement

and the rights herein granted shall be binding upon and shall inure to the benefit of UNITED and AMSINO and their respective successors

and permitted assigns. |

| |

|

|

| |

15.9 |

Headings. All section headings contained in this Agreement are for convenience

of reference only, do not form a part of this Agreement and shall not affect in any way the meaning or interpretation of this Agreement. |

| |

|

|

| |

15.10 |

Counterparts. This Agreement may be executed in any number of counterparts,

each of which when executed and delivered shall be deemed to be an original, and all of which taken together shall constitute one

and the same instrument. |

| |

|

|

| |

15.11 |

Amendments. No modification, alteration or amendment of this Agreement shall

be binding upon the parties unless contained in a writing signed by a duly authorized agent for each respective party and specifically

referring hereto. |

| |

|

|

| |

15.12 |

Judicial Proceeding. If any judicial proceeding is necessary to enforce or interpret

the terms of this agreement, the prevailing party shall be entitled to reasonable attorney’s fees, costs and expenses in addition

to any other relief to which such party is entitled. |

IN WITNESS WHEREOF, this Agreement has been duly executed and delivered as of the day

and year first above written.

| UNITED-GUARDIAN, INC. |

|

AMSINO HEALTHCARE (USA), INC. |

| |

|

|

| BY: /s/ Beatriz Blanco |

|

BY: /s/ Richard Lee |

| NAME: Beatriz Blanco |

|

NAME: Richard Lee |

| TITLE: President |

|

TITLE: CEO |

| |

|

|

| DATE: 3/30/23 |

|

DATE: 3/30/23 |

Schedule A

[***]

Schedule B

[***]

13

v3.24.0.1

Cover

|

Mar. 30, 2023 |

| Cover [Abstract] |

|

| Document Type |

8-K

|

| Amendment Flag |

false

|

| Document Period End Date |

Mar. 30, 2023

|

| Entity File Number |

001-10526

|

| Entity Registrant Name |

United-Guardian, Inc.

|

| Entity Central Index Key |

0000101295

|

| Entity Tax Identification Number |

11-1719724

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity Address, Address Line One |

230 Marcus Boulevard

|

| Entity Address, City or Town |

Hauppauge

|

| Entity Address, State or Province |

NY

|

| Entity Address, Postal Zip Code |

11788

|

| City Area Code |

(631)

|

| Local Phone Number |

273-0900

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Common Stock, $0.10 par value per share

|

| Trading Symbol |

UG

|

| Security Exchange Name |

NASDAQ

|

| Entity Emerging Growth Company |

false

|

| Entity Information, Former Legal or Registered Name |

Not Applicable

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

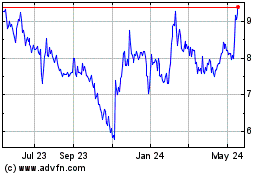

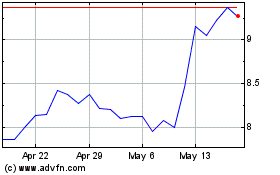

United Guardian (NASDAQ:UG)

Historical Stock Chart

From Oct 2024 to Nov 2024

United Guardian (NASDAQ:UG)

Historical Stock Chart

From Nov 2023 to Nov 2024