Net Sales of $2.6 Billion Compared to $2.5

Billion in the Year-Ago Quarter

Comparable Sales Decreased 1.2%

Net Income of $252.6 Million or $5.30 Per

Diluted Share

Ulta Beauty, Inc. (NASDAQ: ULTA) today announced financial

results for the thirteen-week period (“second quarter”) and

twenty-six-week period (“first six months”) ended August 3, 2024

compared to the same periods ended July 29, 2023.

13 Weeks Ended

26 Weeks Ended

August 3,

July 29,

August 3,

July 29,

(Dollars in

millions, except per share data)

2024

2023

2024

2023

Net sales

$

2,552.1

$

2,529.8

$

5,277.9

$

5,164.1

Comparable sales (1)

(1.2%)

8.0%

0.2%

8.7%

Gross profit (as a percentage of net

sales)

38.3%

39.3%

38.8%

39.7%

Selling, general and administrative

expenses

$

644.8

$

600.7

$

1,310.7

$

1,212.8

Operating income (as a percentage of net

sales)

12.9%

15.5%

13.8%

16.1%

Diluted earnings per share

$

5.30

$

6.02

$

11.78

$

12.90

New store openings, net

16

3

26

7

_____________

(1) Comparable sales are calculated based on the comparable 13

and 26 calendar weeks in the current and prior year.

“While we are encouraged by many positive indicators across our

business, our second quarter performance did not meet our

expectations, driven primarily by a decline in comparable store

sales. We are clear about the factors that adversely impacted our

store performance, and we have actions underway to address the

trends,” said Dave Kimbell, chief executive officer. “We are

focused on driving stronger sales and traffic and continuing to

exercise financial discipline. In light of our first half trends

and a more cautious outlook, we have updated our full year

expectations. I remain confident in the power of our differentiated

model, the strength of our financial foundation, and our ability to

deliver value for our shareholders over the long term.”

Second Quarter of Fiscal 2024 Compared to Second Quarter of

Fiscal 2023

- Net sales increased 0.9% to $2.6 billion compared to $2.5

billion, primarily due to new store contribution and growth in

other revenue.

- Comparable sales (sales for stores open at least 14 months and

e-commerce sales) decreased 1.2% compared to an increase of 8.0%,

driven by a 1.8% decrease in transactions and a 0.6% increase in

average ticket.

- Gross profit was $978.2 million compared to $993.6 million. As

a percentage of net sales, gross profit decreased to 38.3% compared

to 39.3%, primarily due to lower merchandise margins and deleverage

of store fixed costs, partially offset by growth in other revenue

and lower inventory shrink.

- Selling, general and administrative (SG&A) expenses were

$644.8 million compared to $600.7 million. As a percentage of net

sales, SG&A expenses increased to 25.3% compared to 23.7%,

primarily due to deleverage of store payroll and benefits,

corporate overhead primarily due to strategic investments, store

expenses, and marketing expenses, partially offset by lower

incentive compensation.

- Operating income was $329.2 million, or 12.9% of net sales,

compared to $391.6 million, or 15.5% of net sales.

- The tax rate was 24.3% compared to 24.2%.

- Net income was $252.6 million compared to $300.1 million.

- Diluted earnings per share was $5.30 compared to $6.02.

First Six Months of Fiscal 2024 Compared to First Six Months

of Fiscal 2023

- Net sales increased 2.2% to $5.3 billion compared to $5.2

billion, primarily due to new store contribution and growth in

other revenue.

- Comparable sales increased 0.2% compared to an increase of

8.7%, driven by a 0.4% increase in average ticket and a 0.2%

decrease in transactions.

- Gross profit was flat at $2.0 billion. As a percentage of net

sales, gross profit decreased to 38.8% compared to 39.7%, primarily

due to lower merchandise margin and deleverage of store fixed

costs, partially offset by growth in other revenue.

- SG&A expenses were $1.3 billion compared to $1.2 billion.

As a percentage of net sales, SG&A expenses increased to 24.8%

compared to 23.5%, primarily due to deleverage of corporate

overhead primarily due to strategic investments, store payroll and

benefits, store expenses, and marketing expenses, partially offset

by lower incentive compensation.

- Operating income was $730.1 million, or 13.8% of net sales,

compared to $833.7 million, or 16.1% of net sales.

- The tax rate was 23.7% compared to 23.5%.

- Net income was $565.7 million compared to $647.2 million.

- Diluted earnings per share was $11.78, including a $0.10

benefit due to income tax accounting for stock-based compensation,

compared to $12.90, including a $0.14 benefit due to income tax

accounting for stock-based compensation.

Balance Sheet

Cash and cash equivalents at the end of the second quarter of

fiscal 2024 totaled $414.0 million.

Merchandise inventories, net at the end of the second quarter of

fiscal 2024 increased 10.1% to $2.0 billion compared to $1.8

billion at the end of the second quarter of fiscal 2023. The

increase was primarily due to inventory to support new brand

launches, the opening of the new market fulfillment center in

Greer, SC, and the addition of 49 net new stores since July 29,

2023.

Share Repurchase Program

During the second quarter of fiscal 2024, the Company

repurchased 549,852 shares of its common stock at a cost of $212.3

million. During the first six months of fiscal 2024, the Company

repurchased 1.1 million shares of its common stock at a cost of

$497.5 million. As of August 3, 2024, $1.6 billion remained

available under the $2.0 billion share repurchase program announced

in March 2024.

Store Update

During the second quarter of fiscal 2024, the Company opened 17

new stores, relocated one store, remodeled nine stores, and closed

one store. During the first six months of fiscal 2024, the Company

opened 29 new stores, relocated two stores, remodeled nine stores,

and closed three stores. At the end of the second quarter of fiscal

2024, the Company operated 1,411 stores totaling 14.8 million

square feet.

Fiscal 2024 Outlook

For fiscal 2024, the Company plans to:

Prior FY24 Outlook

Updated FY24 Outlook

Net sales

$11.5 billion to $11.6

billion

$11.0 billion to $11.2

billion

Comparable sales

2% to 3%

(2%) to 0%

New stores, net

60-65

no change

Remodel and relocation projects

40-45

no change

Operating margin

13.7% to 14.0%

12.7% to 13.0%

Diluted earnings per share

$25.20 to $26.00

$22.60 to $23.50

Share repurchases

approximately $1 billion

no change

Interest income

approximately $13 million

no change

Effective tax rate

approximately 24%

no change

Capital expenditures

$415 million to $490 million

$400 million to $450 million

Depreciation and amortization expense

$270 million to $275 million

$265 million to $270 million

Conference Call Information

A conference call to discuss second quarter of fiscal 2024

results is scheduled for today, August 29, 2024 at 4:30 p.m. ET /

3:30 p.m. CT. Investors and analysts who are interested in

participating in the call are invited to dial (877) 704-4453.

Participants may also listen to a real-time audio webcast of the

conference call by visiting the Investor Relations section of the

Company’s website located at https://www.ulta.com/investor. A

replay will be made available online approximately two hours

following the live call for a period of 30 days.

About Ulta Beauty

At Ulta Beauty (NASDAQ: ULTA), the possibilities are beautiful.

Ulta Beauty is the largest specialty U.S. beauty retailer and the

premier beauty destination for cosmetics, fragrance, skin care

products, hair care products and salon services. In 1990, the

Company reinvented the beauty retail experience by offering a new

way to shop for beauty – bringing together All Things Beauty, All

in One Place®. Today, Ulta Beauty operates 1,411 retail stores

across 50 states and also distributes its products through its

website, which includes a collection of tips, tutorials, and social

content. For more information, visit www.ulta.com.

Forward‑Looking Statements

This press release contains forward-looking statements within

the meaning of Section 21E of the Securities Exchange Act of 1934,

as amended, and the safe harbor provisions of the Private

Securities Litigation Reform Act of 1995, which reflect the

Company’s current views with respect to, among other things, future

events and financial performance. These statements can be

identified by the use of forward-looking words such as “outlook,”

“believes,” “expects,” “plans,” “estimates,” “targets,”

“strategies” or other comparable words. Any forward-looking

statements contained in this press release are based upon the

Company’s historical performance and on current plans, estimates

and expectations. The inclusion of this forward-looking information

should not be regarded as a representation by the Company or any

other person that the future plans, estimates, targets, strategies

or expectations contemplated by the Company will be achieved. Such

forward-looking statements are subject to various risks and

uncertainties, which include, without limitation:

- macroeconomic conditions, including inflation, elevated

interest rates and recessionary concerns, as well as continuing

labor cost pressures, and transportation and shipping cost

pressures, have had, and may continue to have, a negative impact on

our business, financial condition, profitability, and cash flows

(including future uncertain impacts);

- changes in the overall level of consumer spending and

volatility in the economy, including as a result of macroeconomic

conditions and geopolitical events;

- our ability to sustain our growth plans and successfully

implement our long-range strategic and financial plan;

- the ability to execute our operational excellence priorities,

including continuous improvement, Project SOAR (the replacement of

our enterprise resource planning platform), and supply chain

optimization;

- our ability to gauge beauty trends and react to changing

consumer preferences in a timely manner;

- the possibility that we may be unable to compete effectively in

our highly competitive markets;

- the possibility of significant interruptions in the operations

of our distribution centers, fast fulfillment centers, and market

fulfillment centers;

- the possibility that cybersecurity or information security

breaches and other disruptions could compromise our information or

result in the unauthorized disclosure of confidential

information;

- the possibility of material disruptions to our information

systems, including our Ulta.com website and mobile

applications;

- the failure to maintain satisfactory compliance with applicable

privacy and data protection laws and regulations;

- changes in the good relationships we have with our brand

partners, our ability to continue to obtain sufficient merchandise

from our brand partners, and/or our ability to continue to offer

permanent or temporary exclusive products of our brand

partners;

- our ability to effectively manage our inventory and protect

against inventory shrink;

- changes in the wholesale cost of our products and/or

interruptions at our brand partners’ or third-party vendors’

operations;

- epidemics, pandemics or natural disasters, which could

negatively impact sales;

- the possibility that new store openings and existing locations

may be impacted by developer or co-tenant issues;

- our ability to attract and retain key executive personnel;

- the impact of climate change on our business operations and/or

supply chain;

- our ability to successfully execute our common stock repurchase

program or implement future common stock repurchase programs;

- a decline in operating results which could lead to asset

impairment and store closure charges; and

- other risk factors detailed in the Company’s public filings

with the Securities and Exchange Commission (the SEC), including

risk factors contained in its Annual Report on Form 10‑K for the

fiscal year ended February 3, 2024, as such may be amended or

supplemented in its subsequently filed Quarterly Reports on Form

10-Q.

The Company’s filings with the SEC are available at www.sec.gov.

Except to the extent required by the federal securities laws, the

Company does not undertake to publicly update or revise its

forward-looking statements, whether as a result of new information,

future events or otherwise.

Exhibit 1

Ulta Beauty, Inc.

Consolidated Statements of

Income

(In thousands, except per

share data)

13 Weeks Ended

August 3,

July 29,

2024

2023

(Unaudited)

(Unaudited)

Net sales

$

2,552,087

100.0

%

$

2,529,809

100.0

%

Cost of sales

1,573,910

61.7

%

1,536,197

60.7

%

Gross profit

978,177

38.3

%

993,612

39.3

%

Selling, general and administrative

expenses

644,821

25.3

%

600,692

23.7

%

Pre-opening expenses

4,155

0.2

%

1,278

0.1

%

Operating income

329,201

12.9

%

391,642

15.5

%

Interest income, net

(4,526

)

(0.2

%)

(4,449

)

(0.2

%)

Income before income taxes

333,727

13.1

%

396,091

15.7

%

Income tax expense

81,171

3.2

%

95,989

3.8

%

Net income

$

252,556

9.9

%

$

300,102

11.9

%

Net income per common share:

Basic

$

5.32

$

6.05

Diluted

$

5.30

$

6.02

Weighted average common shares

outstanding:

Basic

47,505

49,617

Diluted

47,667

49,849

Exhibit 2

Ulta Beauty, Inc.

Consolidated Statements of

Income

(In thousands, except per

share data)

26 Weeks Ended

August 3,

July 29,

2024

2023

(Unaudited)

(Unaudited)

Net sales

$

5,277,935

100.0

%

$

5,164,072

100.0

%

Cost of sales

3,229,978

61.2

%

3,115,603

60.3

%

Gross profit

2,047,957

38.8

%

2,048,469

39.7

%

Selling, general and administrative

expenses

1,310,734

24.8

%

1,212,821

23.5

%

Pre-opening expenses

7,074

0.1

%

1,936

0.0

%

Operating income

730,149

13.8

%

833,712

16.1

%

Interest income, net

(11,426

)

(0.2

%)

(11,797

)

(0.2

%)

Income before income taxes

741,575

14.1

%

845,509

16.4

%

Income tax expense

175,906

3.3

%

198,356

3.8

%

Net income

$

565,669

10.7

%

$

647,153

12.5

%

Net income per common share:

Basic

$

11.83

$

12.97

Diluted

$

11.78

$

12.90

Weighted average common shares

outstanding:

Basic

47,815

49,885

Diluted

48,022

50,157

Exhibit 3

Ulta Beauty, Inc.

Condensed Consolidated Balance

Sheets

(In thousands)

August 3,

February 3,

July 29,

2024

2024

2023

(Unaudited)

(Unaudited)

Assets

Current assets:

Cash and cash equivalents

$

413,962

$

766,594

$

388,627

Receivables, net

200,863

207,939

174,444

Merchandise inventories, net

1,998,286

1,742,136

1,815,539

Prepaid expenses and other current

assets

132,023

115,598

110,524

Prepaid income taxes

53,607

4,251

30,114

Total current assets

2,798,741

2,836,518

2,519,248

Property and equipment, net

1,225,850

1,182,335

1,073,144

Operating lease assets

1,599,735

1,574,530

1,549,146

Goodwill

10,870

10,870

10,870

Other intangible assets, net

357

510

718

Deferred compensation plan assets

46,280

43,516

40,087

Other long-term assets

55,575

58,732

55,547

Total assets

$

5,737,408

$

5,707,011

$

5,248,760

Liabilities and stockholders’

equity

Current liabilities:

Accounts payable

$

566,904

$

544,001

$

521,315

Accrued liabilities

348,042

382,468

328,247

Deferred revenue

394,987

436,591

354,253

Current operating lease liabilities

281,301

283,821

287,359

Accrued income taxes

—

11,310

—

Total current liabilities

1,591,234

1,658,191

1,491,174

Non-current operating lease

liabilities

1,647,698

1,627,271

1,593,040

Deferred income taxes

88,461

85,921

56,012

Other long-term liabilities

61,855

56,300

56,657

Total liabilities

3,389,248

3,427,683

3,196,883

Commitments and contingencies

Total stockholders’ equity

2,348,160

2,279,328

2,051,877

Total liabilities and stockholders’

equity

$

5,737,408

$

5,707,011

$

5,248,760

Exhibit 4

Ulta Beauty, Inc.

Condensed Consolidated

Statements of Cash Flows

(In thousands)

26 Weeks Ended

August 3,

July 29,

2024

2023

(Unaudited)

(Unaudited)

Operating activities

Net income

$

565,669

$

647,153

Adjustments to reconcile net income to net

cash provided by operating activities:

Depreciation and amortization

130,053

119,862

Non-cash lease expense

163,481

152,867

Deferred income taxes

2,540

666

Stock-based compensation expense

19,272

21,539

Loss on disposal of property and

equipment

5,204

3,878

Change in operating assets and

liabilities:

Receivables

7,076

24,978

Merchandise inventories

(256,150

)

(212,088

)

Prepaid expenses and other current

assets

(16,425

)

19,722

Income taxes

(60,666

)

8,194

Accounts payable

29,715

(38,752

)

Accrued liabilities

(33,634

)

(102,763

)

Deferred revenue

(41,604

)

(40,424

)

Operating lease liabilities

(170,779

)

(163,527

)

Other assets and liabilities

15,127

(12,497

)

Net cash provided by operating

activities

358,879

428,808

Investing activities

Capital expenditures

(186,301

)

(204,748

)

Other investments

(5,091

)

(1,687

)

Net cash used in investing activities

(191,392

)

(206,435

)

Financing activities

Repurchase of common shares

(501,768

)

(559,011

)

Stock options exercised

9,196

9,147

Purchase of treasury shares

(23,459

)

(21,759

)

Debt issuance costs

(4,088

)

—

Net cash used in financing activities

(520,119

)

(571,623

)

Net decrease in cash and cash

equivalents

(352,632

)

(349,250

)

Cash and cash equivalents at beginning of

period

766,594

737,877

Cash and cash equivalents at end of

period

$

413,962

$

388,627

Exhibit 5

Ulta Beauty, Inc.

Store Update

Total stores open

Number of stores

Number of stores

Total stores

at beginning of the

opened during the

closed during the

open at

Fiscal 2024

quarter

quarter

quarter

end of the quarter

1st Quarter

1,385

12

2

1,395

2nd Quarter

1,395

17

1

1,411

Gross square feet for

Total gross square

stores opened or

Gross square feet for

Total gross square

feet at beginning of

expanded during the

stores closed

feet at end of the

Fiscal 2024

the quarter

quarter

during the quarter

quarter

1st Quarter

14,515,593

114,786

15,615

14,614,764

2nd Quarter

14,614,764

178,624

10,800

14,782,588

Exhibit 6

Ulta Beauty, Inc.

Sales by Category

The following tables set forth

the approximate percentage of net sales by primary category:

13 Weeks Ended

August 3,

July 29,

2024

2023

Cosmetics

39%

40%

Skincare

24%

23%

Haircare

20%

22%

Fragrance

11%

9%

Services

4%

4%

Other

2%

2%

100%

100%

26 Weeks Ended

August 3,

July 29,

2024

2023

Cosmetics

40%

42%

Skincare

24%

22%

Haircare

19%

21%

Fragrance

11%

9%

Services

4%

4%

Other

2%

2%

100%

100%

Certain sales departments were reclassified between categories

in the prior year to conform to current year presentation,

including moving the bath category from Fragrance to Skincare.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240829270411/en/

Investor Contact: Kiley Rawlins, CFA Vice President, Investor

Relations krawlins@ulta.com

Media Contact: Crystal Carroll Senior Director, Public Relations

ccarroll@ulta.com

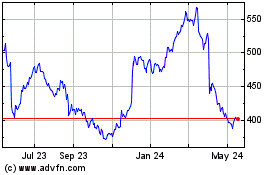

Ulta Beauty (NASDAQ:ULTA)

Historical Stock Chart

From Nov 2024 to Dec 2024

Ulta Beauty (NASDAQ:ULTA)

Historical Stock Chart

From Dec 2023 to Dec 2024