Total payment dollars processed through all

payment channels up 19% versus the prior year period

Reiterates Full Year 2024 Expectation of

10 – 12% Revenue Growth

Separately, Usio Today Announced Entry into

Contract with Potential to Ultimately Add $20 Million in Annual

Recurring Revenues

Usio, Inc: (Nasdaq: USIO), a leading FinTech company that

operates a full stack of integrated, cloud-based electronic payment

and embedded financial solutions, today announced financial results

for the first quarter, which ended March 31, 2024.

Louis Hoch, President and Chief Executive Officer of Usio, said,

“It’s been a good start to the new year, with volumes up across

almost all business segments and first quarter financial

performance is on track to meet our 2024 top and bottom line

guidance. More importantly, we expect our sales growth to continue

this year, and recently announced what could potentially be the

largest single program in the Company’s history. This particular

opportunity has the potential to nearly double our annual Credit

Card revenues. While this opportunity wasn't explicitly included in

our full year 2024 guidance, we did anticipate additional volume

from new independent software vendors. Revenues were within $100

thousand of our internal forecast, however the quarterly comparison

from last year was unfavorably skewed by a large Prepaid program.

If the impact of this prepaid card program was excluded, Usio first

quarter revenues would have been up from a year ago. Our business

is fundamentally strong and our growth prospects are bright. The

increasing awareness we have been earning by delivering exceptional

financial solutions for our customers continues to bring new

opportunities and the amount of potential new business has never

been greater for Usio. We can be creative and capitalize on these

opportunities in part because the Company is also in an excellent

financial position with over $7 million in cash at quarter end with

the expectation of positive cash flow for the year, including an

estimated $3 million in interest income. With the first quarter’s

volume growth, an extremely robust pipeline and one of our largest

ever programs now in implementation, it is clear we continue to

provide the services and solutions in high demand in the market

that will enable us to grow both this year as well as over the long

term. Consequently, we are reiterating our full year 2024

Guidance.”

For the first quarter, ACH & Complementary Services revenues

were up 16% on strong processing volume growth, with electronic

check dollars processed up 22% and returned check transactions

processed up 9% as compared to the same quarter in 2023. Credit

card revenues were also up primarily due to PayFac revenue growth

of 14%. Total credit card dollars processed were an all-time

record, and were up 8% with transactions up 18%, also a new

all-time record, with Payfac volume and transactions up 12% as

compared to the same quarter in 2023. The decrease in Prepaid card

services revenues is attributable to the planned wind down of a

large New York City COVID Incentive Program. Notably, in the

quarter, prepaid card load volume more than doubled from a year ago

this quarter, to a record $116 million, and exceeded $100 million

for the third consecutive quarter. Revenues for Output Solutions

were down for the quarter, though once again underlying volumes

were up. The decrease is due to a strong year ago first quarter.

Output Solutions revenues were up sequentially from the fourth

quarter of 2023, which led to a significant improvement in business

unit profitability as we are now leveraging our recently installed,

higher volume equipment.

Gross profit for the quarter ended March 31, 2024 was $4.2

million, and gross margins contracted 2.2% compared to the first

quarter of 2023 reflecting a less favorable sales mix and a

decrease in the margins on NYC COVID Incentive Program prepaid card

breakage and spoilage. Other selling, general and administrative

expenses were up moderately due to increases in professional fees

and marketing, including increased sales-related travel, and salary

and benefit increases and, on an annual basis, are expected to be

nominally up versus the prior year to support the anticipated

acceleration in revenue growth. The Company reported a net loss of

$0.3 million, or ($0.01) per share, compared to net income of

$0.015 million, or $0.00 per share, a year ago. Adjusted EBITDA1

was $0.1 million, a $0.9 million decline from the $1.0 million

Adjusted EBITDA1 a year ago. The Company’s financial position

remains strong as the Company generated $0.1 million in Adjusted

Operating Cash Flows1 over the first three months of this fiscal

year, while significantly reducing our accounts payable and accrued

expenses by $1.2 million.

Quarterly Processing and Transaction

Volumes

Total payment transactions processed in the first quarter of

2024 were 9.8 million, an increase of 14% over the same quarter of

last year. Total payment dollars processed through all payment

channels in the first quarter of 2024 were $1.5 billion, an

improvement of 19% over last year's first quarter $1.2 billion

volume.

We set all-time records in operating metrics for both our Credit

card and Prepaid business units. In our Credit card segment,

dollars processed were up 8% and transactions processed were up 18%

from a year ago. Prepaid card load volume was up 108%, transactions

processed were up 26% and purchase dollars processed were up 42%,

in each case, from the same quarter a year ago. ACH electronic

check transaction volume was up 4%, electronic check dollars

processed were up 22% and return check transactions processed were

up 9%, all compared to the same quarter a year ago.

First Quarter 2024 Revenue Detail

Revenues for the quarter ended March 31, 2024 were $20.3

million, down 5% compared to the prior year quarter, primarily

reflecting a decrease in Prepaid revenues due to the planned wind

down of our NYC COVID Incentive program.

Three Months Ended March

31,

2024

2023

$ Change

% Change

ACH and complementary services

$

3,881,734

$

3,340,722

$

541,012

16

%

Credit card

7,560,734

7,339,898

220,836

3

%

Prepaid card services

3,341,224

4,807,404

(1,466,180

)

(30

)%

Output Solutions

5,537,923

5,958,220

(420,297

)

(7

)%

Total Revenue

$

20,321,615

$

21,446,244

$

(1,124,629

)

(5

)%

Gross profit for the first quarter of 2024 was $4.2 million

compared to $4.9 million for the first quarter of 2023, while gross

margins were 20.7%, which was 2.2% lower than the same period a

year ago. This decrease in gross margins reflects the impact of

lower residual revenues generated from prepaid card breakage and

spoilage, offsetting growth in our highly profitable ACH and

complementary service line of business.

Other selling, general and administrative expenses were $4.1

million for the quarter ended March 31, 2024, up slightly compared

to $3.9 million in the prior year period. The increase was

primarily attributable to increases in professional fees and

marketing, including increased sales-related travel, alongside

general salary and benefits increases. While we expect full year

expenses to be nominally higher from a year ago to support our

anticipated growth in revenues and implementations, we are

committed to achieving our goal to improve operating leverage as a

means to accelerate the improvement of profitability.

For the quarter, we reported an operating loss of $0.9 million

compared to positive $6.0 thousand in operating income for the same

quarter a year ago. Adjusted EBITDA1 was $0.1 million for the

quarter, compared to Adjusted EBITDA1 of $1.0 million a year ago.

Net loss for the quarter ended March 31, 2024 was $0.3 million, or

($0.01) per share, compared to net income of $0.015 million, or

$0.00 per share, for the same period in the prior year.

Adjusted Operating Cash Flows1 (excluding merchant reserve

funds, prepaid card load assets, customer deposits and net

operating lease assets and obligations) was $0.1 million for the

three months ended March 31, 2024. Cash flows used in operating

activities was $2.8 million for the three months ended March 31,

2024, compared to cash flows used in operating activities of $0.2

million in the same period a year ago, with the difference driven

primarily by the decrease in accounts payable and accrued expenses,

alongside lower merchant reserves.

We continue to be in solid financial condition with $7.1 million

in cash and cash equivalents as of March 31, 2024, despite using

$1.2 million to reduce accounts payable and accrued expenses,

aggregating to a $0.1 million decrease in cash balances over the

first quarter of the year. The Company generated over $0.7 million

in interest income in the first quarter of 2024.

1

Please see reconciliation of GAAP

to Non-GAAP Financial Measures

Conference Call and

Webcast

Usio, Inc.'s management will host a conference call on

Wednesday, May 15, 2024, at 4:30 pm Eastern time to review

financial results and provide a business update. To listen to the

conference call, interested parties within the U.S. should call

+1-844-883-3890. International callers should call +

1-412-317-9246. All callers should ask for the Usio conference

call. The conference call will also be available through a live

webcast, which can be accessed via the Company’s website at

www.usio.com/investors.

A replay of the call will be available approximately one hour

after the end of the call through May 29, 2024. The replay can be

accessed via the Company’s website or by dialing +1-877-344-7529

(U.S.) or 1-412-317-0088 (international). The replay conference

playback code is 5884852.

About Usio, Inc.

Usio, Inc. (Nasdaq: USIO), a leading, cloud-based, integrated

FinTech electronic payment solutions provider, offers a wide range

of payment solutions to merchants, billers, banks, service bureaus,

integrated software vendors and card issuers. The Company operates

credit, debit/prepaid, and ACH payment processing platforms to

deliver convenient, world-class payment solutions and services to

clients through its unique payment facilitation platform as a

service. The Company, through its Usio Output Solutions division

offers services relating to electronic bill presentment, document

composition, document decomposition and printing and mailing

services. The strength of the Company lies in its ability to

provide tailored solutions for card issuance, payment acceptance,

and bill payments as well as its unique technology in the card

issuing sector. Usio is headquartered in San Antonio, Texas, and

has offices in Austin, Texas. Websites: www.usio.com,

www.payfacinabox.com, www.akimbocard.com and www.usiooutput.com.

Find us on Facebook® and Twitter.

Comparisons

Unless otherwise indicated, all comparisons and growth rates

represent year-over-year comparisons, with the quarterly period of

this year compared to the corresponding quarter of the prior

year.

About Non-GAAP Financial

Measures

This press release includes non-GAAP financial measures, as

defined in Regulation G adopted by the Securities and Exchange

Commission, of EBITDA, adjusted EBITDA, adjusted EBITDA margins and

adjusted operating cash flows. The Company reports its financial

results in compliance with GAAP, but believes that also discussing

non-GAAP financial measures provides investors with financial

measures it uses in the management of its business. The Company

defines EBITDA as operating income (loss), before interest, taxes,

depreciation and amortization of intangibles. The Company defines

adjusted EBITDA as EBITDA, as defined above, plus non-cash stock

option costs and certain non-recurring items, such as costs related

to acquisitions. The Company defines adjusted EBITDA margins as the

adjusted EBITDA, as defined above, divided by total revenues. The

Company defines adjusted operating cash flow as net cash provided

by (used in) operating activities, less changes in prepaid card

load obligations, customer deposits, merchant reserves and net

operating lease assets and obligations. These adjustments to net

cash provided by (used in) operating activities are not inclusive

of any regular expense items, and only include changes in our

assets and liabilities accounts on our consolidated balance sheet.

These measures may not be comparable to similarly titled measures

reported by other companies. Management uses EBITDA, adjusted

EBITDA, adjusted EBITDA margins and adjusted operating cash flows

as indicators of the Company's operating performance and ability to

fund acquisitions, capital expenditures and other investments and,

in the absence of refinancing options, to repay debt

obligations.

Management believes EBITDA, adjusted EBITDA, adjusted EBITDA

margins and adjusted operating cash flows are helpful to investors

in evaluating the Company's operating performance because non-cash

costs and other items that management believes are not indicative

of its results of operations are excluded.

EBITDA, adjusted EBITDA, adjusted EBITDA margins and adjusted

operating cash flow should be considered in addition to, not as a

substitute for, or superior to, financial measures calculated in

accordance with GAAP. They are not measurements of our financial

performance under GAAP and should not be considered as alternatives

to revenue, net income, or cash provided by (used in) operating

activities, as applicable, or any other performance measures

derived in accordance with GAAP and may not be comparable to other

similarly titled measures of other businesses. EBITDA, adjusted

EBITDA, adjusted EBITDA margins and adjusted operating cash flow

have limitations as analytical tools and you should not consider

these non-GAAP financial measures in isolation or as a substitute

for analysis of our operating results as reported under GAAP.

1

See reconciliation of non-GAAP financial measures below

FORWARD-LOOKING STATEMENTS

DISCLAIMER

Except for the historical information contained herein, the

matters discussed in this press release include forward-looking

statements which are covered by safe harbors. Those statements

include, but may not be limited to, all statements regarding

management's intent, belief and expectations, such as statements

concerning our future and our operating and growth strategy. These

forward-looking statements are identified by the use of words such

as "believe," "should," "intend," "look forward," "anticipate,"

"schedule,” and "expect" among others. Forward-looking statements

in this press release are subject to certain risks and

uncertainties inherent in the Company's business that could cause

actual results to vary, including such risks related to an economic

downturn, the realization of opportunities from the IMS

acquisition, the management of the Company's growth, the loss of

key resellers, the relationships with the Automated Clearing House

network, bank sponsors, third-party card processing providers and

merchants, the security of our software, hardware and information,

the volatility of the stock price, the need to obtain additional

financing, risks associated with new legislation, and compliance

with complex federal, state and local laws and regulations, and

other risks detailed from time to time in the Company's filings

with the Securities and Exchange Commission including its annual

report on Form 10-K for the fiscal year ended December 31, 2023.

One or more of these factors have affected, and in the future could

affect, the Company’s businesses and financial results and could

cause actual results to differ materially from plans and

projections. Although the Company believes that the assumptions

underlying the forward-looking statements included in this press

release are reasonable, the Company can give no assurance such

assumptions will prove to be correct. In light of the significant

uncertainties inherent in the forward-looking statements included

herein, the inclusion of such information should not be regarded as

a representation by us or any other person that the objectives and

plans will be achieved. All forward-looking statements made in this

press release are based on information presently available to

management. The Company assumes no obligation to update any

forward-looking statements, except as required by law.

USIO, INC.

CONSOLIDATED BALANCE

SHEETS

March 31, 2024

December 31, 2023

(Unaudited)

ASSETS

Cash and cash equivalents

$

7,053,812

$

7,155,687

Accounts receivable, net

4,862,227

5,564,138

Settlement processing assets

41,030,860

44,899,603

Prepaid card load assets

28,698,878

31,578,973

Customer deposits

1,808,263

1,865,731

Inventory

429,577

422,808

Prepaid expenses and other

687,415

444,071

Current assets before merchant

reserves

84,571,032

91,931,011

Merchant reserves

5,322,095

5,310,095

Total current assets

89,893,127

97,241,106

Property and equipment, net

3,478,654

3,660,092

Other assets:

Intangibles, net

1,535,366

1,753,333

Deferred tax asset, net

1,504,000

1,504,000

Operating lease right-of-use assets

2,318,388

2,420,782

Other assets

335,357

355,357

Total other assets

5,693,111

6,033,472

Total Assets

$

99,064,892

$

106,934,670

LIABILITIES AND STOCKHOLDERS'

EQUITY

Current liabilities:

Accounts payable

$

896,293

$

1,031,141

Accrued expenses

2,778,067

3,801,278

Operating lease liabilities, current

portion

490,184

633,616

Equipment loan, current portion

180,906

107,270

Settlement processing obligations

41,030,860

44,899,603

Prepaid card load obligations

28,698,878

31,578,973

Customer deposits

1,808,263

1,865,731

Current liabilities before merchant

reserve obligations

75,883,451

83,917,612

Merchant reserve obligations

5,322,095

5,310,095

Total current liabilities

81,205,546

89,227,707

Non-current liabilities:

Equipment loan, net of current portion

630,913

718,980

Operating lease liabilities, net of

current portion

1,955,333

1,919,144

Total liabilities

83,791,792

91,865,831

Commitments and contingencies

Stockholders' equity:

Preferred stock, $0.01 par value,

10,000,000 shares authorized; -0- shares outstanding at March 31,

2024 (unaudited) and December 31, 2023, respectively

—

—

Common stock, $0.001 par value,

200,000,000 shares authorized; 28,779,206 and 28,661,406 issued,

and 26,412,259 and 26,332,523 outstanding at March 31, 2024

(unaudited) and December 31, 2023, respectively

197,194

197,087

Additional paid-in capital

97,632,948

97,479,830

Treasury stock, at cost; 2,366,947 and

2,339,083 shares at March 31, 2024 (unaudited) and December 31,

2023, respectively

(4,406,973

)

(4,362,150

)

Deferred compensation

(6,561,728

)

(6,907,775

)

Accumulated deficit

(71,588,341

)

(71,338,153

)

Total stockholders' equity

15,273,100

15,068,839

Total Liabilities and Stockholders'

Equity

$

99,064,892

$

106,934,670

USIO, INC.

CONSOLIDATED STATEMENTS OF

OPERATIONS

(UNAUDITED)

Three Months Ended March 31,

2024

2023

Revenues

$

20,321,615

$

21,446,244

Cost of services

16,116,691

16,544,429

Gross profit

4,204,924

4,901,815

Selling, general and administrative

expenses:

Stock-based compensation

499,273

504,574

Other SG&A

4,060,225

3,873,219

Depreciation and amortization

576,154

518,029

Total selling, general and

administrative

5,135,652

4,895,822

Operating income (loss)

(930,728

)

5,993

Other income and (expense):

Interest income

764,125

92,928

Interest expense

(13,585

)

(662

)

Other income, net

750,540

92,266

Income (Loss) before income tax

expense

(180,188

)

98,259

Income tax expense

70,000

83,426

Net income (Loss)

$

(250,188

)

$

14,833

Income (Loss) Per Share

Basic income (loss) per common share:

$

(0.01

)

$

0.00

Diluted income (loss) per common

share:

$

(0.01

)

$

0.00

Weighted average common shares

outstanding

Basic - common stock

19,990,862

20,122,972

Basic - restricted stock awards

6,384,900

6,385,900

Weighted average shares used to compute

basic earnings per share

26,375,762

26,508,872

Diluted

26,375,762

27,454,471

USIO, INC.

CONSOLIDATED STATEMENTS OF

CASH FLOWS

(UNAUDITED)

Three Months Ended March 31,

2024

2023

Operating Activities

Net (loss)

$

(250,188

)

$

14,833

Adjustments to reconcile net income (loss)

to net cash (used in) operating activities:

Depreciation

358,187

300,061

Amortization

217,967

217,968

Employee stock-based compensation

499,273

504,574

Changes in operating assets and

liabilities:

Accounts receivable

701,911

(846,609

)

Prepaid expenses and other

(243,344

)

(10,616

)

Operating lease right-of-use assets

102,394

(31,459

)

Inventory

(6,769

)

12,898

Accounts payable and accrued expenses

(1,158,059

)

1,128,251

Operating lease liabilities

(107,243

)

4,548

Prepaid card load obligations

(2,880,095

)

(1,357,807

)

Merchant reserves

12,000

(164,886

)

Customer deposits

(57,468

)

20,953

Net cash (used in) operating

activities

(2,811,434

)

(207,291

)

Investing Activities

Purchases of property and equipment

(176,750

)

(217,735

)

Net cash (used in) investing

activities

(176,750

)

(217,735

)

Financing Activities

Payments on equipment loan

(14,431

)

(13,488

)

Purchases of treasury stock

(44,823

)

(8,529

)

Net cash (used in) financing

activities

(59,254

)

(22,017

)

Change in cash, cash equivalents, prepaid

card loads, customer deposits and merchant reserves

(3,047,438

)

(447,043

)

Cash, cash equivalents, prepaid card

loads, customer deposits and merchant reserves, beginning of

year

45,910,486

32,343,501

Cash, Cash Equivalents, Prepaid Card

Loads, Customer Deposits and Merchant Reserves, End of Period

$

42,863,048

$

31,896,458

Supplemental disclosures of cash flow

information

Cash paid during the period for:

Interest

$

13,585

$

662

Income taxes

—

13,426

Non-cash financing activity:

Issuance of deferred stock

compensation

—

2,444,054

USIO, INC.

STATEMENT OF CHANGES IN

STOCKHOLDERS' EQUITY

(UNAUDITED)

Common Stock

Additional Paid- In

Treasury

Deferred

Accumulated

Total Stockholders'

Shares

Amount

Capital

Stock

Compensation

Deficit

Equity

Balance at December 31, 2023

28,671,606

$

197,087

$

97,479,830

$

(4,362,150

)

$

(6,907,775

)

$

(71,338,153

)

$

15,068,839

Issuance of common stock under equity

incentive plan

107,600

107

153,118

—

—

—

153,226

Deferred compensation amortization

—

—

—

—

346,047

—

346,047

Purchase of treasury stock costs

—

—

—

(44,823

)

—

—

(44,823

)

Net (loss) for the period

—

—

—

—

—

(250,188

)

(250,188

)

Balance at March 31, 2024

28,779,206

$

197,194

$

97,632,948

$

(4,406,973

)

$

(6,561,728

)

$

(71,588,341

)

$

15,273,100

Balance at December 31, 2022

27,044,900

$

195,471

$

94,048,603

$

(3,749,027

)

$

(5,697,900

)

$

(70,863,049

)

$

13,934,098

Issuance of common stock under equity

incentive plan

1,421,250

1,421

2,638,529

—

(2,444,054

)

—

195,896

Deferred compensation amortization

—

—

—

—

308,676

—

308,676

Purchase of treasury stock costs

—

—

—

(8,529

)

—

—

(8,529

)

Net income for the period

—

—

—

—

—

14,833

14,833

Balance at March 31, 2023

28,466,150

$

196,892

$

96,687,132

$

(3,757,556

)

$

(7,833,278

)

$

(70,848,216

)

$

14,444,974

RECONCILIATION OF GAAP TO

NON-GAAP FINANCIAL MEASURES

(UNAUDITED)

Three Months Ended March 31,

2024

2023

Reconciliation from Operating income

(Loss) to Adjusted EBITDA:

Operating income (Loss)

$

(930,728

)

$

5,993

Depreciation and amortization

576,154

518,029

EBITDA

(354,574

)

524,022

Non-cash stock-based compensation expense,

net

499,273

504,574

Adjusted EBITDA

$

144,699

$

1,028,596

Calculation of Adjusted EBITDA

margins:

Revenues

$

20,321,615

$

21,446,244

Adjusted EBITDA

$

144,699

$

1,028,596

Adjusted EBITDA margins

0.7

%

4.8

%

RECONCILIATION OF GAAP TO

NON-GAAP FINANCIAL MEASURES

(UNAUDITED)

March 31, 2024

March 31, 2023

Reconciliation from net cash (used in)

operating activities to Non-GAAP Adjusted Operating Cash Flows:

Net cash provided by (used in) operating

activities

$

(2,791,434

)

$

(207,292

)

Operating cash flow adjustments:

Prepaid card load obligations

2,880,095

1,357,807

Customer deposits

57,468

(20,953

)

Merchant reserves

(12,000

)

164,886

Operating lease right-of-use assets

(102,394

)

31,459

Operating lease liabilities

107,243

(4,548

)

Total adjustments to net cash provided by

operating activities

$

2,930,412

$

1,528,651

Adjusted operating cash flows provided

$

138,978

$

1,321,359

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240515351868/en/

Paul Manley Senior Vice President, Investor Relations

paul.manley@usio.com 612-834-1804

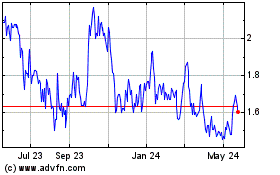

Usio (NASDAQ:USIO)

Historical Stock Chart

From Oct 2024 to Oct 2024

Usio (NASDAQ:USIO)

Historical Stock Chart

From Oct 2023 to Oct 2024