- Current report filing (8-K)

January 27 2010 - 4:28PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

|

|

|

|

|

Date of Report (Date of Earliest Event Reported):

|

|

January 21, 2010

|

Aastrom Biosciences, Inc.

__________________________________________

(Exact name of registrant as specified in its charter)

|

|

|

|

|

Michigan

|

000-22025

|

94-3096597

|

_____________________

(State or other jurisdiction

|

_____________

(Commission

|

______________

(I.R.S. Employer

|

|

of incorporation)

|

File Number)

|

Identification No.)

|

|

|

|

|

|

24 Frank Lloyd Wright Drive, P.O. Box 376, Ann Arbor, Michigan

|

|

48106

|

_________________________________

(Address of principal executive offices)

|

|

___________

(Zip Code)

|

|

|

|

|

|

Registrant’s telephone number, including area code:

|

|

(734) 930-5555

|

Not Applicable

______________________________________________

Former name or former address, if changed since last report

Check the appropriate box below if the Form 8-K filing is intended to

simultaneously satisfy the filing obligation of the registrant under any

of the following provisions:

[ ] Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

[ ] Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

[ ] Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

[ ] Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Item 1.01 Entry into a Material Definitive Agreement.

On January 21, 2010, Aastrom Biosciences, Inc. (the "Company") entered into a warrant agreement (the "Warrant Agreements") with Continental Stock Transfer & Trust Company, as warrant agent (the "Warrant Agent"), for each of the Company’s Class A and Class B warrants, which were issued in a public offering of units under the Company’s shelf registration statement on Form S-3 (Registration No. 333-155739) (the "Registration Statement"), as amended, including a base prospectus dated February 19, 2009, as supplemented by a prospectus supplement dated January 15, 2010 (the "Offering"). The Offering was closed on January 21, 2010.

Each Class A warrant has an exercise price of $0.3718 per share, subject to adjustment as summarized below, and is exercisable at any time beginning six months after issuance until 5:30 p.m. (New York time) on the date that is five years from the date of exercisability.

Each Class B warrant has an exercise price of $0.26 per share, subject to adjustment as summarized below, and is immediately exercisable at any time until 5:30 p.m. (New York time) on the date that is six months from the date of issuance.

Each Warrant Agreement provides that the share ratio and exercise price of the Class A warrants and Class B warrants is subject to adjustment in the event of a subdivision or consolidation of the Company’s common stock (the "Common Stock"). Each Warrant Agreement also provides that if there is: (i) any reclassification or change of the Common Stock into other shares; (ii) any consolidation, amalgamation, arrangement or other business combination resulting in any reclassification or change of the Common Stock into other shares; or (iii) any sale, lease, exchange or transfer of the Company’s assets in their entirety or substantially in their entirety to another entity, then each holder of a Class A warrant or Class B warrant which is thereafter exercised shall receive, in lieu of Common Stock, the kind and number or amount of other securities or property which such holder would have been entitled to receive as a result of such event if such holder had exercised such warrants prior to the event.

Subject to certain exceptions, if the Company sells or issues shares of Common Stock, rights, options or warrants to purchase shares of Common Stock, other rights for shares of the Common Stock, or securities convertible or exchangeable into shares of Common Stock, in any case at a price per share less than the than applicable Class A warrant exercise price, then in each such case the Class A warrant exercise price will be reduced to the price determined by multiplying the exercise price in effect immediately prior to such issuance by a fraction, (A) the numerator of which will be the number of shares of Common Stock outstanding immediately prior to such issuance plus the number of shares which the aggregate consideration received for such issuance would purchase at the exercise price in effect immediately prior to such issuance, and (B) the denominator of which will be the number of shares of Common Stock outstanding immediately after such issuance.

The Company has also covenanted in each Warrant Agreement that, during the period in which the Class A warrants and Class B warrants are exercisable, it will give public notice of its intention to fix a record date for the issuance of rights, options or warrants (other than the Class A warrants and Class B warrants) to all or substantially all of the holders of the Common Stock at least 10 days prior to the record date of such event.

In the event that registration statement covering the Class A warrants is not effective at the time of exercise of the Class A warrants, then the holders of such Class A warrants resident in the United States or holding for the account or benefit of a person resident in the United States or a U.S. person (as such terms are defined under Regulation S under the U.S. Securities Act) shall be able to exercise such Class A warrants on a cashless basis. Holders of the Class A warrants resident outside the United States and not holding for the account or benefit of a person resident in the United States or a U.S. person may exercise the Class A warrants pursuant to Regulation S under the U.S. Securities Act. All holders of Class A warrants that exercise Class A warrants when a registration statement under the U.S. Securities Act is not effective will agree that the shares of Common Stock received on such exercise will only be resold pursuant to a registration statement under the U.S. Securities Act registering such resale or pursuant to an exemption from such registration requirements, including but not limited to, the exclusion provided by Rule 904 of Regulation S under the U.S. Securities Act.

This summary of the Warrant Agreements is qualified in its entirety by reference to the Warrant Agreements filed herewith as Exhibits 4.1 and 4.2 and incorporated into this Item 1.01 by reference.

The Company issued a press release announcing the closing of the Offering on January 21, 2010. A copy of the press release is attached hereto as Exhibit 99.1 and is incorporated herein by reference.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the

registrant has duly caused this report to be signed on its behalf by the

undersigned hereunto duly authorized.

|

|

|

|

|

|

|

|

|

Aastrom Biosciences, Inc.

|

|

|

|

|

|

|

|

January 27, 2010

|

|

By:

|

|

/s/ Timothy M. Mayleben

|

|

|

|

|

|

|

|

|

|

|

|

Name: Timothy M. Mayleben

|

|

|

|

|

|

Title: Chief Executive Officer and President

|

Exhibit Index

|

|

|

|

|

Exhibit No.

|

|

Description

|

|

|

|

|

4.1

|

|

Warrant Agreement for Class A Warrants.

|

|

4.2

|

|

Warrant Agreement for Class B Warrants.

|

|

99.1

|

|

Press Release dated January 21, 2010.

|

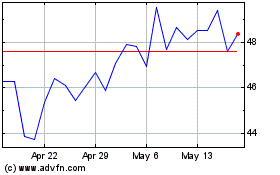

Vericel (NASDAQ:VCEL)

Historical Stock Chart

From Jun 2024 to Jul 2024

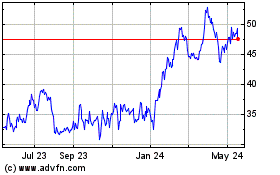

Vericel (NASDAQ:VCEL)

Historical Stock Chart

From Jul 2023 to Jul 2024