UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 13E-3

RULE 13E-3 TRANSACTION STATEMENT UNDER

SECTION 13(E) OF THE SECURITIES EXCHANGE

ACT OF 1934

VOXX INTERNATIONAL CORPORATION

(Name of the Issuer)

VOXX International Corporation

Gentex Corporation

Instrument Merger Sub, Inc.

(Names of Persons Filing Statement)

Class A Common Stock, Par Value $0.01

per share

Class B Common Stock, Par Value $0.01

per share

(Title of Class of Securities)

Class A Common Stock: 91829F104

(CUSIP

Number of Class of Securities)

|

Patrick M. Lavelle

Chief Executive Officer

VOXX International Corporation

2531 J Lawson Blvd

Orlando, FL 32824

(800) 645-7750 |

|

Instrument Merger Sub, Inc.

c/o Gentex Corporation

Steven Downing

Chief Executive Officer

600 North Centennial Street

Zeeland, MI 49464

(616) 772-1800 |

(Name, Address and Telephone Number of Person Authorized to Receive

Notices and Communications on Behalf of the Persons Filing Statement)

With copies to

Kenneth Henderson

Aaron Lang

Andrew Rodman

Bryan Cave Leighton Paisner LLP

1290 Avenue of the Americas

New York, NY 10104

(212) 541-2000 |

Larry Stopol

Stopol & Camelo, LLP

180 Marcus Blvd.

Happauge, NY 11788

(516) 317-2869 |

Benjamin Stulberg

Ashley Gullett

Jones Day

901 Lakeside Avenue

Cleveland, OH 44114

(216) 586-3939 |

This statement is filed in connection with (check the appropriate

box):

| a. | x |

The filing of solicitation materials or an information statement subject to Regulation 14A, Regulation 14C or Rule 13e-3(c) under

the Securities Exchange Act of 1934. |

| | |

|

| b. | ¨ |

The filing of a registration statement under the Securities Act of 1933. |

| | |

|

| c. | ¨ |

A tender offer. |

| | |

|

| d. | ¨ |

None of the above. |

Check the following box if the soliciting

materials or information statement referred to in checking box (a) are preliminary copies: x

Check the following box if the filing

is a final amendment reporting the results of the transaction: ¨

INTRODUCTION

This Rule 13e-3 Transaction Statement on Schedule

13E-3, together with the exhibits hereto (this “Schedule 13E-3” or “Transaction Statement”), is

being filed with the Securities and Exchange Commission (the “SEC”) pursuant to Section 13(e) of the Securities

Exchange Act of 1934, as amended (together with the rules and regulations promulgated thereunder, the “Exchange Act”),

jointly by the following persons (each, a “Filing Person,” and collectively, the “Filing Persons”):

(i) VOXX International Corporation (“VOXX” or the “Company”), a Delaware corporation and the

issuer of the shares of Class A common stock, par value $0.01 per share (the “Class A Common Stock”), and

the shares of Class B common stock, par value $0.01 (together with the Class A Common Stock, the “Company Common Stock”),

that is subject to the Rule 13e-3 transaction, (ii) Gentex Corporation, a Michigan corporation (“Gentex”),

and (iii) Instrument Merger Sub, Inc., a Delaware corporation and wholly owned subsidiary of Gentex (“Merger Sub”).

Gentex and Merger Sub are Filing Persons of this Transaction Statement because they may be deemed affiliates of the Company under a possible

interpretation of the SEC rules governing “going-private” transactions.

On December 17, 2024, the Company, Gentex

and Merger Sub entered into an Agreement and Plan of Merger (as amended, restated, supplemented or otherwise modified from time to time,

the “Merger Agreement”), pursuant to which, subject to the satisfaction or waiver of certain conditions and on the

terms set forth therein, Merger Sub will merge with and into the Company, with the Company as the surviving corporation as a wholly owned

subsidiary of Gentex (the “Merger”). Concurrently with the filing of this Schedule 13E-3, the Company is filing with

the SEC a preliminary proxy statement (the “Proxy Statement”) under Regulation 14A of the Exchange Act, relating to

a special meeting of the stockholders of the Company (the “Special Meeting”), at which the stockholders of the Company

will consider and vote upon a proposal to approve and adopt the Merger Agreement, a non-binding, advisory vote to approve certain items

of compensation that are based on or otherwise related to the Merger and may become payable to certain named executive officers of the

Company under existing agreements with the Company and a proposal to adjourn the Special Meeting, if necessary or appropriate, including

adjournments to solicit additional proxies if there are insufficient votes at the time of the Special Meeting to adopt the Merger Agreement.

The adoption of the Merger Agreement will require the affirmative vote of (i) the holders of at least a majority of the voting power

of all outstanding shares of Company Common Stock entitled to vote in accordance with the General Corporation Law of the State of Delaware

(the “DGCL”), and (ii) at least 66 and two-thirds percent of the voting power of the outstanding shares of Company

Common Stock that is not held by Gentex, Merger Sub or their affiliates, as required pursuant to Section 203 of the DGCL, in each

case outstanding as of the close of business on the record date for the Special Meeting. A copy of the preliminary Proxy Statement is

attached hereto as Exhibit (a)(2)(i) and incorporated herein by reference. A copy of the Merger Agreement is attached hereto

as Exhibit (d)(i) and is also included as Annex A to the preliminary Proxy Statement and incorporated herein by reference.

Under the terms of the Merger Agreement, if the

Merger is completed, each share of Company Common Stock outstanding immediately prior to the consummation of the Merger, other than as

provided below, will be converted into the right to receive $7.50 per share of Company Common Stock in cash (the “Per Share Merger

Consideration”), without interest and less any applicable withholding taxes. The following shares of Company Common Stock will

not be converted into the right to receive the Per Share Merger Consideration in connection with the Merger: (i) shares of Company

Common Stock owned by Gentex, Merger Sub or the Company or any of their respective subsidiaries immediately prior to the Merger becoming

effective (the “Effective Time”), and (ii) shares of Company Common Stock whose holders are entitled to demand

and have properly exercised and validly perfected appraisal rights with respect to such shares of Company Common Stock in accordance with

Section 262 of the DGCL, a copy of which is attached hereto as Exhibit (f) and is also included as Annex D to the preliminary

Proxy Statement and incorporated herein by reference.

The Merger is subject to the satisfaction or waiver

of the conditions set forth in the Merger Agreement, including the approval and adoption of the Merger Agreement by the Company’s

stockholders. The cross-references below are being supplied pursuant to General Instruction G to Schedule 13E-3 and show the location

in the Proxy Statement of the information required to be included in response to the items of Schedule 13E-3. Pursuant to General Instruction

F to Schedule 13E-3, the information contained in the Proxy Statement, including all appendices thereto, is incorporated in its entirety

herein by reference, and the responses to each item in this Schedule 13E-3 are qualified in their entirety by the information contained

in the Proxy Statement and the appendices thereto.

As of the date hereof, the Proxy Statement is in

preliminary form and is subject to completion and/or amendment. Capitalized terms used but not expressly defined in this Schedule 13E-3

shall have the respective meanings given to them in the Proxy Statement.

The information concerning the Company contained

in or incorporated by reference into this Schedule 13E-3 and the Proxy Statement was supplied by the Company. Similarly, all information

concerning such other Filing Person contained in or incorporated by reference into this Schedule 13E-3 and the Proxy Statement was supplied

by such Filing Person. No Filing Person, including the Company, is responsible for the accuracy of any information supplied by any other

Filing Person.

While each of the Filing Persons acknowledges that

the Merger is a “going private” transaction for purposes of Rule 13E-3 under the Exchange Act, the filing of this Transaction

Statement shall not be construed as an admission by any Filing Person, or by any affiliate of a Filing Person, that the Company is “controlled”

by any other Filing Person.

Item 1. Summary Term Sheet

The information set forth in the Proxy Statement

under the following captions is incorporated herein by reference:

“SUMMARY TERM SHEET”

“QUESTIONS AND ANSWERS ABOUT THE PROPOSALS AND

THE SPECIAL MEETING”

Item 2. Subject Company Information

(a)

Name and Address. The information set forth in the Proxy Statement under the following caption is incorporated herein by reference:

“PARTIES TO THE MERGER”

(b)

Securities. The information set forth in the Proxy Statement under the following captions is incorporated herein by reference:

“SUMMARY TERM SHEET”

“QUESTIONS AND ANSWERS ABOUT THE PROPOSALS AND

THE SPECIAL MEETING”

“SPECIAL FACTORS - Certain Effects of the Merger”

“THE SPECIAL MEETING - Record Date

and Quorum”

“OTHER IMPORTANT INFORMATION REGARDING THE COMPANY - Market

Price of Shares of Class A Common Stock and Dividends”

“OTHER IMPORTANT INFORMATION REGARDING THE COMPANY - Security

Ownership of Certain Beneficial Owners and Management”

(c)

Trading Market and Price. The information set forth in the Proxy Statement under the following captions is incorporated herein by reference:

“SUMMARY TERM SHEET”

“OTHER IMPORTANT INFORMATION REGARDING THE COMPANY - Market

Price of Shares of Class A Common Stock and Dividends”

(d)

Dividends. The information set forth in the Proxy Statement under the following caption is incorporated herein by reference:

“OTHER IMPORTANT INFORMATION REGARDING THE COMPANY - Market

Price of Shares of Class A Common Stock and Dividends”

(e)

Prior Public Offerings. The information set forth in the Proxy Statement under the following caption is incorporated herein by reference:

“OTHER IMPORTANT INFORMATION REGARDING THE COMPANY - Prior

Public Offerings”

(f)

Prior Stock Purchases. The information set forth in the Proxy Statement under the following caption is incorporated herein by reference:

“OTHER IMPORTANT INFORMATION REGARDING THE COMPANY - Certain

Transactions in the Shares of the Company Common Stock”

Item 3. Identity and Background of Filing Person

(a)-(c)

Name and Address; Business and Background of Entities; Business and Background of Natural Persons. VOXX International Corporation

is the subject company. The information set forth in the Proxy Statement under the following captions is incorporated herein by reference:

“SUMMARY TERM SHEET”

“PARTIES TO THE MERGER”

“OTHER IMPORTANT INFORMATION REGARDING THE COMPANY”

“OTHER IMPORTANT INFORMATION REGARDING THE GENTEX

GROUP”

Item 4. Terms of the Transaction

(a)(1)

Tender Offers. Not Applicable.

(a)(2)

Merger or Similar Transactions. The information set forth in the Proxy Statement under the following captions is incorporated herein

by reference:

“SUMMARY TERM SHEET”

“QUESTIONS AND ANSWERS ABOUT THE PROPOSALS AND

THE SPECIAL MEETING”

“SPECIAL FACTORS - Background of

the Merger”

“SPECIAL FACTORS - Purpose and Reasons

of the Company for the Merger; Recommendation of the Company Board and the Transaction Committee; Fairness of the Merger”

“SPECIAL FACTORS - Position of the

Gentex Group as to the Fairness of the Merger”

“SPECIAL FACTORS - Purpose and Reasons

of the Gentex Group for the Merger”

“SPECIAL FACTORS - Plans for the

Company After the Merger”

“SPECIAL FACTORS - Certain Effects

of the Merger”

“SPECIAL FACTORS - Interests of Executive

Officers and Directors of the Company in the Merger”

“SPECIAL FACTORS - Material U.S.

Federal Income Tax Consequences of the Merger”

“SPECIAL FACTORS - Financing of the

Merger”

“SPECIAL FACTORS - Effective Time

of the Merger”

“SPECIAL FACTORS - Payment of Merger

Consideration and Surrender of Stock Certificates”

“SPECIAL FACTORS - Fees and Expenses”

“SPECIAL FACTORS - Accounting Treatment”

“SPECIAL FACTORS - Regulatory Approvals”

“SPECIAL FACTORS - Voting and Support

Agreement”

“THE MERGER AGREEMENT”

“THE SPECIAL MEETING - Vote Required”

Annex A - Agreement and Plan of Merger

(c)

Different Terms. The information set forth in the Proxy Statement under the following captions is incorporated herein by reference:

“SUMMARY TERM SHEET”

“SPECIAL FACTORS - Plans for the

Company After the Merger”

“SPECIAL FACTORS - Certain Effects

of the Merger”

“SPECIAL FACTORS - Interests of Executive

Officers and Directors of the Company in the Merger”

“SPECIAL FACTORS - Voting and Support

Agreement”

“THE MERGER AGREEMENT - Treatment

of Company Common Stock and Equity Awards”

“THE MERGER AGREEMENT - Covenants

of Gentex”

“MERGER-RELATED EXECUTIVE COMPENSATION ARRANGEMENTS

(THE COMPENSATION PROPOSAL - PROPOSAL 2)”

Annex A - Agreement and Plan of Merger

Annex B - Voting and Support Agreement

(d)

Appraisal Rights. The information set forth in the Proxy Statement under the following captions is incorporated herein by reference:

“QUESTIONS AND ANSWERS ABOUT THE PROPOSALS AND

THE SPECIAL MEETING”

“SPECIAL FACTORS - Purpose and Reasons of the Company

for the Merger; Recommendation of the Company Board and the Transaction Committee; Fairness of the Merger”

“SPECIAL FACTORS - Appraisal Rights”

“THE MERGER AGREEMENT - Dissenter’s

Rights”

“THE SPECIAL MEETING - Appraisal

Rights”

“THE MERGER (THE MERGER PROPOSAL - PROPOSAL

1) - Appraisal Rights”

Annex A - Agreement and Plan of Merger

Annex D - Section 262 of the DGCL

(e)

Provisions for Unaffiliated Security Holders. The information set forth in the Proxy Statement under the following captions is incorporated

herein by reference:

“SPECIAL FACTORS - Purpose and Reasons

of the Company for the Merger; Recommendation of the Company Board and the Transaction Committee; Fairness of the Merger”

(f)

Eligibility for Listing or Trading. Not Applicable.

Item 5. Past Contacts, Transactions, Negotiations and Agreements

(a)

Transactions. The information set forth in the Proxy Statement under the following captions is incorporated herein by reference:

“SUMMARY TERM SHEET”

“SPECIAL FACTORS - Background of

the Merger”

“SPECIAL FACTORS - Interests of Executive

Officers and Directors of the Company in the Merger”

“THE MERGER AGREEMENT”

“OTHER IMPORTANT INFORMATION REGARDING THE COMPANY - Certain

Transactions in the Shares of Company Common Stock”

“WHERE YOU CAN FIND MORE INFORMATION”

Annex A - Agreement and Plan of Merger

(b)

Significant Corporate Events. The information set forth in the Proxy Statement under the following captions is incorporated herein

by reference:

“SUMMARY TERM SHEET”

“QUESTIONS AND ANSWERS ABOUT THE PROPOSALS AND

THE SPECIAL MEETING”

“SPECIAL FACTORS - Background of

the Merger”

“SPECIAL FACTORS - Plans for the

Company After the Merger”

“SPECIAL FACTORS - Certain Effects

of the Merger”

“SPECIAL FACTORS - Interests of Executive

Officers and Directors of the Company in the Merger”

“SPECIAL FACTORS - Voting and Support

Agreement”

“THE MERGER AGREEMENT”

“MERGER-RELATED EXECUTIVE COMPENSATION ARRANGEMENTS

(THE COMPENSATION PROPOSAL - PROPOSAL 2)”

Annex A - Agreement and Plan of Merger

Annex B - Voting and Support Agreement

(c)

Negotiations or Contacts. The information set forth in the Proxy Statement under the following captions is incorporated herein by

reference:

“SPECIAL FACTORS - Background of

the Merger”

“SPECIAL FACTORS - Interests of Executive

Officers and Directors of the Company in the Merger”

“SPECIAL FACTORS - Voting and Support

Agreement”

“THE MERGER AGREEMENT”

“MERGER-RELATED EXECUTIVE COMPENSATION ARRANGEMENTS

(THE COMPENSATION PROPOSAL - PROPOSAL 2)”

(e)

Agreements Involving the Subject Company’s Securities. The information set forth in the Proxy Statement under the following

captions is incorporated herein by reference:

“SUMMARY TERM SHEET”

“QUESTIONS AND ANSWERS ABOUT THE PROPOSALS AND

THE SPECIAL MEETING”

“SPECIAL FACTORS - Background of

the Merger”

“SPECIAL FACTORS - Plans for the

Company After the Merger”

“SPECIAL FACTORS - Certain Effects

of the Merger”

“SPECIAL FACTORS - Interests of Executive

Officers and Directors of the Company in the Merger”

“SPECIAL FACTORS - Intent of the

Directors and Executive Officers to Vote in Favor of the Merger”

“SPECIAL FACTORS - Intent of Gentex

to Vote in Favor of the Merger”

“SPECIAL FACTORS - Payment of Merger Consideration

and Surrender of Stock Certificates”

“SPECIAL FACTORS - Voting and Support

Agreement”

“THE MERGER AGREEMENT”

“MERGER-RELATED EXECUTIVE COMPENSATION ARRANGEMENTS

(THE COMPENSATION PROPOSAL - PROPOSAL 2)”

“OTHER IMPORTANT INFORMATION REGARDING THE COMPANY - Security

Ownership of Certain Beneficial Owners and Management”

“OTHER IMPORTANT INFORMATION REGARDING THE COMPANY - Prior

Public Offerings”

“OTHER IMPORTANT INFORMATION REGARDING THE COMPANY - Certain

Transactions in the Shares of Company Common Stock”

“WHERE YOU CAN FIND MORE INFORMATION”

Annex A - Agreement and Plan of Merger

Annex B - Voting and Support Agreement

Item 6. Purposes of the Transaction and Plans or Proposals

(b)

Use of Securities Acquired. The information set forth in the Proxy Statement under the following captions is incorporated herein by

reference:

“SUMMARY TERM SHEET”

“QUESTIONS AND ANSWERS ABOUT THE PROPOSALS AND

THE SPECIAL MEETING”

“SPECIAL FACTORS - Plans for the

Company After the Merger”

“SPECIAL FACTORS - Certain Effects

of the Merger”

“THE MERGER AGREEMENT”

“DELISTING AND DEREGISTRATION OF COMMON STOCK”

Annex A - Agreement and Plan of Merger

(c)(1)-(8) Plans.

The information set forth in the Proxy Statement under the following captions is incorporated herein by reference:

“SUMMARY TERM SHEET”

“QUESTIONS AND ANSWERS ABOUT THE PROPOSALS AND

THE SPECIAL MEETING”

“SPECIAL FACTORS”

“THE MERGER AGREEMENT”

“THE SPECIAL MEETING”

“THE MERGER (THE MERGER AGREEMENT PROPOSAL - PROPOSAL

1)”

“MERGER-RELATED EXECUTIVE COMPENSATION ARRANGEMENTS

(THE COMPENSATION PROPOSAL - PROPOSAL 2)”

“DELISTING AND DEREGISTRATION OF COMMON STOCK”

Annex A - Agreement and Plan of Merger

Annex B - Voting and Support Agreement

Item 7. Purposes, Alternatives, Reasons and Effects

(a)

Purposes. The information set forth in the Proxy Statement under the following captions is incorporated herein by reference:

“SUMMARY TERM SHEET”

“QUESTIONS AND ANSWERS ABOUT THE PROPOSALS AND

THE SPECIAL MEETING”

“SPECIAL FACTORS - Background of

the Merger”

“SPECIAL FACTORS - Purpose and Reasons

of the Company for the Merger; Recommendation of the Company Board and the Transaction Committee; Fairness of the Merger”

“SPECIAL FACTORS - Position of the

Gentex Group as to the Fairness of the Merger”

“SPECIAL FACTORS - Purpose and Reasons

of the Gentex Group for the Merger”

“SPECIAL FACTORS - Plans for the

Company After the Merger”

“SPECIAL FACTORS - Certain Effects

of the Merger”

(b)

Alternatives. The information set forth in the Proxy Statement under the following captions is incorporated herein by reference:

“SPECIAL FACTORS - Background of

the Merger”

“SPECIAL FACTORS - Purpose and Reasons

of the Company for the Merger; Recommendation of the Company Board and the Transaction Committee; Fairness of the Merger”

“SPECIAL FACTORS - Position of the

Gentex Group as to the Fairness of the Merger”

“SPECIAL FACTORS - Purpose and Reasons

of the Gentex Group for the Merger”

(c)

Reasons. The information set forth in the Proxy Statement under the following captions is incorporated herein by reference:

“SPECIAL FACTORS - Background of

the Merger”

“SPECIAL FACTORS - Purpose and Reasons

of the Company for the Merger; Recommendation of the Company Board and the Transaction Committee; Fairness of the Merger”

“SPECIAL FACTORS - Opinion of Solomon

Partners”

“SPECIAL FACTORS - Position of the

Gentex Group as to the Fairness of the Merger”

“SPECIAL FACTORS - Purpose and Reasons

of the Gentex Group for the Merger”

“SPECIAL FACTORS - Plans for the

Company After the Merger”

“SPECIAL FACTORS - Certain Effects

of the Merger”

Annex C - Opinion of Solomon Partners Securities,

LLC

(d)

Effects. The information set forth in the Proxy Statement under the following captions is incorporated herein by reference:

“SUMMARY TERM SHEET”

“QUESTIONS AND ANSWERS ABOUT THE PROPOSALS AND

THE SPECIAL MEETING”

“SPECIAL FACTORS - Background of

the Merger”

“SPECIAL FACTORS - Purpose and Reasons

of the Company for the Merger; Recommendation of the Company Board and the Transaction Committee; Fairness of the Merger”

“SPECIAL FACTORS - Position of the

Gentex Group as to the Fairness of the Merger”

“SPECIAL FACTORS - Purpose and Reasons

of the Gentex Group for the Merger”

“SPECIAL FACTORS - Plans for the

Company After the Merger”

“SPECIAL FACTORS - Certain Effects

of the Merger”

“SPECIAL FACTORS - Certain Effects

on the Company if the Merger is not Completed”

“SPECIAL FACTORS - Interests of Executive

Officers and Directors of the Company in the Merger”

“SPECIAL FACTORS - Material U.S.

Federal Income Tax Consequences of the Merger”

“SPECIAL FACTORS - Financing of the

Merger”

“SPECIAL FACTORS - Payment of Merger

Consideration and Surrender of Stock Certificates”

“SPECIAL FACTORS - Fees and Expenses”

“SPECIAL FACTORS - Accounting Treatment”

“THE

MERGER AGREEMENT - Effects of the Merger; Directors and Officers; Articles of Incorporation; Bylaws”

“THE MERGER AGREEMENT - Treatment

of Company Common Stock and Equity Awards”

“THE MERGER AGREEMENT - Exchange

and Payment Procedures”

“THE MERGER AGREEMENT - Dissenter’s

Rights”

“THE MERGER AGREEMENT - Covenants

of the Company”

“THE MERGER AGREEMENT - Covenants

of Gentex”

“MERGER-RELATED EXECUTIVE COMPENSATION ARRANGEMENTS

(THE COMPENSATION PROPOSAL - PROPOSAL 2)”

“DELISTING AND DEREGISTRATION OF COMMON STOCK”

Annex A - Agreement and Plan of Merger

Item 8. Fairness of the Transaction

(a),

(b) Fairness; Factors Considered in Determining Fairness. The information set forth in the Proxy Statement under the following

captions is incorporated herein by reference:

“SUMMARY TERM SHEET”

“QUESTIONS AND ANSWERS ABOUT THE PROPOSALS AND

THE SPECIAL MEETING”

“SPECIAL FACTORS - Background of

the Merger”

“SPECIAL FACTORS - Purpose and Reasons

of the Company for the Merger; Recommendation of the Company Board and the Transaction Committee; Fairness of the Merger”

“SPECIAL FACTORS - Opinion of Solomon

Partners”

“SPECIAL FACTORS - Position of the

Gentex Group as to the Fairness of the Merger”

“SPECIAL FACTORS - Purpose and Reasons

of the Gentex Group for the Merger”

“SPECIAL FACTORS - Interests of Executive

Officers and Directors of the Company in the Merger”

“THE MERGER AGREEMENT - Covenants of Gentex”

Annex C - Opinion of Solomon Partners Securities,

LLC

(c)

Approval of Security Holders. The information set forth in the Proxy Statement under the following captions is incorporated herein

by reference:

“SUMMARY TERM SHEET”

“QUESTIONS AND ANSWERS ABOUT THE PROPOSALS AND

THE SPECIAL MEETING”

“SPECIAL FACTORS - Purpose and Reasons of the Company

for the Merger; Recommendation of the Company Board and the Transaction Committee; Fairness of the Merger”

“SPECIAL FACTORS – Intent of the Directors

and Executive Officers to Vote in Favor of the Merger”

“THE SPECIAL MEETING - Vote Required”

“THE SPECIAL MEETING - Voting Intentions

of the Company’s Directors and Executive Officers”

“THE SPECIAL MEETING - Voting”

“THE MERGER (THE MERGER PROPOSAL - PROPOSAL

1)”

Annex A - Agreement and Plan of Merger

(d)

Unaffiliated Representative. The information set forth in the Proxy Statement under the following captions is incorporated herein

by reference:

“SUMMARY TERM SHEET”

“SPECIAL FACTORS - Background of

the Merger”

“SPECIAL FACTORS - Purpose and Reasons

of the Company for the Merger; Recommendation of the Company Board and the Transaction Committee; Fairness of the Merger”

“SPECIAL FACTORS - Opinion of Solomon Partners”

“SPECIAL FACTORS - Position of the

Gentex Group as to the Fairness of the Merger”

(e)

Approval of Directors. The information set forth in the Proxy Statement under the following captions is incorporated herein by reference:

“SUMMARY TERM SHEET”

“QUESTIONS AND ANSWERS ABOUT THE PROPOSALS AND

THE SPECIAL MEETING”

“SPECIAL FACTORS - Background of

the Merger”

“SPECIAL FACTORS - Purpose and Reasons

of the Company for the Merger; Recommendation of the Company Board and the Transaction Committee; Fairness of the Merger”

“SPECIAL FACTORS - Position of the

Gentex Group as to the Fairness of the Merger”

“THE SPECIAL MEETING - Recommendation of the Company

Board”

(f)

Other Offers. The information set forth in the Proxy Statement under the following captions is incorporated herein by reference:

“SPECIAL FACTORS - Background of

the Merger”

“SPECIAL FACTORS - Purpose and Reasons

of the Company for the Merger; Recommendation of the Company Board and the Transaction Committee; Fairness of the Merger”

“SPECIAL FACTORS - Position of the

Gentex Group as to the Fairness of the Merger”

“THE MERGER AGREEMENT - Acquisition

Proposals”

Annex A - Agreement and Plan of Merger

Item 9. Reports, Opinions, Appraisals and Negotiations

(a)-(c) Report,

Opinion or Appraisal; Preparer and Summary of the Report, Opinion or Appraisal; Availability of Documents. The information set forth

in the Proxy Statement under the following captions is incorporated herein by reference:

“SUMMARY TERM SHEET”

“QUESTIONS AND ANSWERS ABOUT THE PROPOSALS AND

THE SPECIAL MEETING”

“SPECIAL FACTORS - Background of

the Merger”

“SPECIAL FACTORS - Purpose and Reasons

of the Company for the Merger; Recommendation of the Company Board and the Transaction Committee; Fairness of the Merger”

“SPECIAL FACTORS - Opinion of Solomon

Partners”

“SPECIAL FACTORS - Position of the

Gentex Group as to the Fairness of the Merger”

“WHERE YOU CAN FIND MORE INFORMATION”

Annex C - Opinion of Solomon Partners Securities,

LLC

The reports, opinions or appraisals referenced

in this Item 9 will be made available for inspection and copying at the principal executive offices of the Company during its regular

business hours by any interested equity security holder of the Company or representative who has been so designated in writing.

Item 10. Source and Amount of Funds or Other Consideration

(a),

(b) Source of Funds; Conditions. The information set forth in the Proxy Statement under the following captions is incorporated

herein by reference:

“SUMMARY TERM SHEET”

“SPECIAL FACTORS - Financing of the

Merger”

“SPECIAL FACTORS - Interests of Executive

Officers and Directors of the Company in the Merger”

“THE MERGER AGREEMENT - Exchange

and Payment Procedures”

“THE MERGER AGREEMENT - Covenants

of the Company - Conduct of Our Business Pending the Merger”

“THE MERGER AGREEMENT - Conditions

to the Merger”

Annex A - Agreement

and Plan of Merger

(c)

Expenses. The information set forth in the Proxy Statement under the following captions is incorporated herein by reference:

“SPECIAL FACTORS - Fees and Expenses”

“THE MERGER AGREEMENT - Termination”

“THE MERGER AGREEMENT - Termination

Fee”

“THE MERGER AGREEMENT - Fees and

Expenses”

“THE SPECIAL MEETING - Solicitation

of Proxies; Payment of Solicitation Expenses”

Annex A - Agreement and Plan of Merger

(d)

Borrowed Funds. The information set forth in the Proxy Statement under the following captions is incorporated herein by reference:

“SUMMARY TERM SHEET”

“SPECIAL FACTORS - Financing of the

Merger”

Item 11. Interest in Securities of the Subject Company

(a)

Securities Ownership. The information set forth in the Proxy Statement under the following captions is incorporated herein by reference:

“SUMMARY TERM SHEET”

“QUESTIONS AND ANSWERS ABOUT THE PROPOSALS AND

THE SPECIAL MEETING”

“SPECIAL FACTORS - Certain Effects of the Merger”

“SPECIAL FACTORS - Interests of Executive

Officers and Directors of the Company in the Merger”

“SPECIAL FACTORS - Intent of the Directors and

Executive Officers to Vote in Favor of the Merger”

“SPECIAL FACTORS – Intent of the Gentex Group

to Vote in Favor of the Merger”

“SPECIAL FACTORS - Voting and Support

Agreement”

“THE SPECIAL MEETING - Voting Intentions of the

Company’s Directors and Executive Officers”

“OTHER IMPORTANT INFORMATION REGARDING THE COMPANY - Security

Ownership of Certain Beneficial Owners and Management”

Annex B - Voting and Support Agreement

(b)

Securities Transactions. The information set forth in the Proxy Statement under the following captions is incorporated herein by reference:

“SPECIAL FACTORS - Voting and Support

Agreement”

“OTHER IMPORTANT INFORMATION REGARDING THE COMPANY - Certain

Transactions in the Shares of Company Common Stock”

Annex B - Voting and Support Agreement

Item 12. The Solicitation or Recommendation

(d)

Intent to Tender or Vote in a Going-Private Transaction. The information set forth in the Proxy Statement under the following captions

is incorporated herein by reference:

“SUMMARY TERM SHEET”

“QUESTIONS AND ANSWERS ABOUT THE PROPOSALS AND

THE SPECIAL MEETING”

“SPECIAL FACTORS - Background of

the Merger”

“SPECIAL FACTORS - Purpose and Reasons

of the Company for the Merger; Recommendation of the Company Board and the Transaction Committee; Fairness of the Merger”

“SPECIAL FACTORS - Intent of the

Directors and Executive Officers to Vote in Favor of the Merger”

“SPECIAL FACTORS - Intent of the

Gentex Group to Vote in Favor of the Merger”

“SPECIAL FACTORS - Voting and Support

Agreement”

“THE SPECIAL MEETING - Voting Intentions

of the Company’s Directors and Executive Officers”

Annex B - Voting and Support Agreement

(e)

Recommendation of Others. The information set forth in the Proxy Statement under the following captions is incorporated herein by

reference:

“SUMMARY TERM SHEET”

“QUESTIONS AND ANSWERS ABOUT THE PROPOSALS AND

THE SPECIAL MEETING”

“SPECIAL FACTORS - Background of

the Merger”

“SPECIAL FACTORS - Purpose and Reasons

of the Company for the Merger; Recommendation of the Company Board and the Transaction Committee; Fairness of the Merger”

“SPECIAL FACTORS - Position of the

Gentex Group as to the Fairness of the Merger”

“SPECIAL FACTORS - Purpose and Reasons

of the Gentex Group for the Merger”

“THE SPECIAL MEETING – Recommendation of

the Company Board”

“THE MERGER (THE MERGER PROPOSAL - PROPOSAL

1) - Vote Recommendation”

Item 13. Financial Statements

(a)

Financial Information. The information set forth in the Proxy Statement under the following captions is incorporated herein by reference:

“SUMMARY TERM SHEET”

“SPECIAL FACTORS - Certain Effects

of the Merger”

“OTHER IMPORTANT INFORMATION REGARDING THE COMPANY - Book

Value per Share”

“WHERE YOU CAN FIND MORE INFORMATION”

(b)

Pro Forma Information. Not Applicable.

Item 14. Persons/Assets, Retained, Employed, Compensated or Used

(a)

Solicitations or Recommendations. The information set forth in the Proxy Statement under the following captions is incorporated herein

by reference:

“SUMMARY TERM SHEET”

“QUESTIONS AND ANSWERS ABOUT THE PROPOSALS AND

THE SPECIAL MEETING”

“SPECIAL FACTORS - Background of

the Merger”

“SPECIAL FACTORS - Purpose and Reasons

of the Company for the Merger; Recommendation of the Company Board and the Transaction Committee; Fairness of the Merger”

“SPECIAL FACTORS - Fees and Expenses”

“THE SPECIAL MEETING - Solicitation

of Proxies; Payment of Solicitation Expenses”

(b)

Employees and Corporate Assets. The information set forth in the Proxy Statement under the following captions is incorporated herein

by reference:

“SUMMARY TERM SHEET”

“QUESTIONS AND ANSWERS ABOUT THE PROPOSALS AND

THE SPECIAL MEETING”

“THE SPECIAL MEETING”

“SPECIAL FACTORS - Background of

the Merger”

“SPECIAL FACTORS - Purpose and Reasons

of the Company for the Merger; Recommendation of the Company Board and the Transaction Committee; Fairness of the Merger”

“THE SPECIAL MEETING - Solicitation

of Proxies; Payment of Solicitation Expenses”

Item 15. Additional Information

(b)

The information set forth in the Proxy Statement under the following captions is incorporated herein by reference:

“SUMMARY TERM SHEET”

“SPECIAL FACTORS - Certain Effects

of the Merger”

“SPECIAL FACTOR - Interests of Executive

Officers and Directors of the Company in the Merger”

“THE MERGER AGREEMENT”

“MERGER-RELATED EXECUTIVE COMPENSATION ARRANGEMENTS

(THE COMPENSATION PROPOSAL - PROPOSAL 2)”

Annex A - Agreement and Plan of Merger

(c)

Other Material Information. The entirety of the Proxy Statement, including all appendices thereto, is incorporated herein by reference.

Item 16. Exhibits

The following exhibits are filed herewith:

| Exhibit No. |

Description |

| (a)(2)(i) |

Preliminary Proxy Statement of VOXX International Corporation (incorporated herein by reference to the Schedule 14A filed concurrently with the SEC) (the “Preliminary Proxy Statement”) |

| (a)(2)(ii) |

Form of Proxy Card (included in the Preliminary Proxy Statement and incorporated herein by reference) |

| (a)(2)(iii) |

Letter to Stockholders (included in the Preliminary Proxy Statement and incorporated herein by reference) |

| (a)(2)(iv) |

Notice of Special Meeting of Stockholders (included in the Preliminary Proxy Statement and incorporated herein by reference) |

| (a)(5)(i) |

Press

Release of VOXX International Corporation, dated December 18, 2024 (incorporated by reference to Exhibit 99.1 to VOXX International

Corporation’s Form 8-K filed December 18, 2024) |

| (a)(5)(ii) |

Email to Customers, Partners and Suppliers of VOXX International Corporation, dated December 18, 2024 (incorporated by reference to the Schedule 14A filed on December 18, 2024) |

| (a)(5)(iii) |

Letter

to VOXX International Corporation employees, dated December 18, 2024 (incorporated by reference to the Schedule 14A filed on

December 18, 2024) |

| (a)(5)(iv) |

Press

Release of Gentex Corporation, dated December 18, 2024 (incorporated by reference to Exhibit 99.1 to Gentex Corporation's

Form 8-K filed December 18, 2024) |

| (b)(i) |

Amended Credit Agreement by Gentex Corporation as the Borrower, the Guarantors from Time to Time Party Thereto, and the Lenders Party Thereto, and PNC, National Association as Administrative Agent, dated as of February 21, 2023 (incorporated by reference to Exhibit 10.14 of the Annual Report on Form 10-K filed February 22, 2023) |

| (c)(i) |

Opinion of Solomon Partners Securities, LLC (included as Annex C to the Preliminary Proxy Statement, and incorporated herein by reference) |

| (c)(ii) |

Discussion Materials of Solomon Partners Securities, LLC prepared for the Transaction Committee, dated September 2024** |

| (c)(iii) |

Discussion Materials of Solomon Partners Securities, LLC prepared for the Transaction Committee, dated November 15, 2024** |

| (c)(iv) |

Discussion Materials of Solomon Partners Securities, LLC prepared for the Transaction Committee and the Company Board, dated December 13, 2024 |

| (c)(v) |

Discussion Materials of Solomon Partners Securities, LLC prepared for the Transaction Committee and the Company Board, dated December 17, 2024 |

| (d)(i) |

Agreement and Plan of Merger, dated December 17, 2024, by and among VOXX International Corporation, Gentex Corporation and Instrument Merger Sub, Inc. (included as Annex A to the Preliminary Proxy Statement, and incorporated herein by reference). |

| (d)(ii) |

Voting and Support Agreement, dated December 17, 2024, by and among Gentex Corporation, Instrument Merger Sub, Inc., Shalvoxx A Holdco LLC, Shalvoxx B Holdco LLC, Ari Shalam and certain Shalam family members (included as Annex B to the Preliminary Proxy Statement, and incorporated herein by reference). |

| (f) |

Section 262 of the DGCL (included as Annex D to the Proxy Statement, and incorporated herein by reference). |

| (g) |

Not Applicable. |

| 107 |

Filing Fee Table. |

** Certain portions of this exhibit have ben

redacted and separately filed with the SEC pursuant to a request for confidential treatment.

SIGNATURES

After due inquiry and to the best of my knowledge

and belief, I certify that the information set forth in this statement is true, complete and correct.

VOXX INTERNATIONAL CORPORATION

| By: | /s/ Patrick M. Lavelle |

|

| | Name: | Patrick M. Lavelle |

|

| | Title: | Chief Executive Officer |

|

After due inquiry and to the best of my knowledge

and belief, I certify that the information set forth in this statement is true, complete and correct.

GENTEX CORPORATION

| By: | /s/ Kevin Nash |

|

| | Name: | Kevin Nash |

|

| | Title: | Vice President, Finance, Chief Financial Officer and Treasurer |

|

After due inquiry and to the best of my knowledge

and belief, I certify that the information set forth in this statement is true, complete and correct.

INSTRUMENT MERGER SUB, INC.

| By: | /s/ Kevin Nash |

|

| | Name: | Kevin Nash |

|

| | Title: | Chief Financial Officer and Treasurer |

|

| Private and Confidential

AN AFFILIATE OF

PROJECT INSTRUMENT

PROCESS UPDATE AND BID SUMMARY

SEPTEMBER 2024

DRAFT as of 9/27/2024 11:51 AM

Exhibit (c)(ii)

The blacked out information indicates information has been omitted on the basis of a confidential treatment request pursuant to Rule 24b-2

of the Securities Exchange Act of 1934, as amended. This information has been filed separately with the Securities and Exchange

Commission. |

| 1 Private and Confidential

• Solomon began outreach to a targeted group of potential buyers, both

financial and strategic, on 8/12/24

— Strategic buyers have asset(s) that would have synergies and could

leverage VOXX brands

— Financial buyers have a relevant portfolio company or have

experience taking public companies private and optimizing assets

through sales

— Process was publicly announced on 8/27/24, allowing for inbound

interest from other potential interested parties

• 84 total parties were contacted as of 9/27/24, comprising 40 strategics

and 44 financial sponsors

— 25 parties have received the CIM (7 strategics, 18 sponsors), with

several conducting further diligence

— 18 parties gained access to the data room (4 strategics, 14

sponsors); 15 parties signed NRL and received Accordion report (3

strategics, 12 sponsors)

• Guitar, who had initially bid on 5/31/24, acquired additional shares from

Beat Kahli, resulting in a public announcement of the process on 8/27/24

— Guitar signed NDA on 8/26/24 and accessed data room, received

Accordion report and already enlisted advisors to assist with

diligence (Deloitte / Jones Day)

• Initial indications received from 5 parties

— Whole Co. (4 IOIs)

▪ ($7.16 per share)

▪ Guitar ($6.50 per share)

▪ ($6.00-$7.00 per share)

▪ ($150mil Enterprise Value; $6.40 per share using

VOXX’s current capitalization)

— Segment (1 IOI)

▪ (Premium Audio: $50mil Enterprise Value)

EXECUTIVE SUMMARY (AS OF 9/27/24)

Outreach Summary

25

CIMs Sent

Parties Contacted

84

18

Data Room Access

Bids

5

Bids

Received |

| 2

**Declined after receiving data room access. Private and Confidential

OUTREACH DETAILS

Strategic

Financial

• ‘

• ‘ ‘

• ‘ ‘

• ‘ ‘

• ‘

‘

• ‘ ‘

• ‘ ‘

• ‘ ‘

‘ ‘

• ‘ ‘

• ‘ ‘

• ‘ ‘

‘ ‘

• ‘ ‘

• ‘ ‘

• ‘ ‘

• ‘ ‘

• ‘ ‘

• ‘ ‘

• ‘ ‘

• ‘ ‘

• ‘ ‘

• ‘ ‘

• ‘ ‘

• ‘ ‘

• ‘ ‘

• ‘ ‘

• ‘ ‘

• ‘ ‘

• ‘ ‘

• ‘ ‘

• ‘ ‘

• ‘ ‘

• ‘ ‘

Declined (32)

84 PARTIES WERE CONTACTED (40 STRATEGIC; 44 FINANCIAL), WITH 5 PARTIES REVIEWING MATERIALS

(1 REVIEWING THE NDA, 2 REVIEWING THE CIM, 2 REVIEWING THE DATA ROOM)

• ‘

‘

• ‘

• ‘

‘

• ‘

Submitted

IOI (4)

• ‘ • ‘

• ‘ • ‘

Data Room Access (2)

KEY: Segment Interest: Premium Audio Automotive ASA Declined after Gentex 13D

• ‘

Sent CIM (2)

Sent NDA (1)

• ‘ ‘

• ‘ ‘

‘ ‘

• ‘ ‘

• ‘ ‘

• ‘ ‘

• ‘ ‘

• ‘ ‘

‘ ‘

• ‘

• ‘ ‘

• ‘ ‘

• ‘ ‘

• ‘ ‘

• ‘ ‘

• ‘ ‘

• ‘ ‘

• ‘ ‘

• ‘ ‘

• ‘ ‘

• ‘ ‘

• ‘

• ‘ ‘

• ‘ ‘

• ‘ ‘

• ‘ ‘

• ‘ ‘

• ‘ ‘

• ‘ ‘

• ‘

• ‘ ‘

• ‘ ‘

• ‘ ‘

• ‘ ‘

• ‘ ‘

• ‘ ‘

• ‘ ‘

• ‘ ‘

• ‘

• ’

• ‘ ‘

• ’

Declined Post-CIM (14)

Declined (26)

• Gentex

Submitted IOI (1)

• ‘ • ‘

Declined Post-CIM (2) |

| 3 Private and Confidential

BUYERS’ KEY FEEDBACK THEMES

Strategic

• Outside of core interest / product offerings

• Looking for larger companies that are not

manufacturing focused

• Focused on developing internal brands

Areas of Concern

• Familiarity with company, especially premium

audio brands

• Interested in Premium Audio as a standalone

segment

• Interested in automotive side of business

Areas of Excitement

Financial

• Current financial profile

• Softness in macro consumer environment and

declining trends in automotive markets

• Not the right fit for their current portfolio

• Don’t have a clear angle to extract value

• Competition with Gentex to acquire VOXX

• Volatile / unprofitable track record

Areas of Concern

• Attractive scale and overall profile

• Strong brand recognition

• Opportunity for carveout / divestiture of

individual segments

• Progress made on debt paydown / profitability

initiatives

• Familiarity with premium home audio industry

• Opportunities in automotive industry

Areas of Excitement |

| 4 Private and Confidential

(Amounts in Millions, USD) Historical Budget Projected CAGR

FY 2021A FY 2022A FY 2023A FY 2024A FY 2025B FY 2026P FY '21-FY '26

Premium Audio $299.9 $344.0 $274.5 $237.9 $245.4 $268.0 (2.2%)

Automotive Aftermarket 117.7 135.6 101.8 84.1 79.5 102.0 (2.8%)

Automotive OEM 46.2 65.0 73.0 58.3 49.2 70.6 8.9%

European Accessory 33.1 33.5 33.1 43.6 34.6 39.8 3.8%

Corporate 0.7 0.5 0.4 (0.6) 0.2 0.2

Total Revenue $497.6 $578.6 $482.8 $423.3 $408.9 $480.6 (0.7%)

Growth 16.3% (16.6%) (12.3%) (3.4%) 17.5%

Premium Audio $92.2 $98.0 $72.0 $60.4 $77.3 $87.1 (1.1%)

Automotive Aftermarket 33.5 43.7 36.6 31.0 28.2 35.7 1.3%

Automotive OEM 5.8 3.6 5.8 (1.0) 6.1 17.0 23.9%

European Accessory 10.9 11.3 10.0 12.9 10.3 13.5 4.3%

Corporate 0.9 0.8 0.6 0.7 0.3 0.4

Total Gross Profit $143.4 $157.4 $125.1 $104.0 $122.2 $153.8 1.4%

Margin 28.8% 27.2% 25.9% 24.6% 29.9% 32.0%

Premium Audio $49.1 $42.2 $12.9 $8.9 $29.4 $39.8 (4.1%)

Automotive Aftermarket 12.4 16.4 12.1 8.2 5.4 12.0 (0.6%)

Automotive OEM (5.6) (11.2) (7.5) (13.0) (5.7) 4.8 N M

European Accessory 2.0 1.9 1.5 3.5 1.1 4.0 15.3%

Corporate (12.6) (9.6) (9.2) (9.9) (13.1) (13.6)

Total Adjusted EBITDA $45.3 $39.7 $9.8 ($2.4) $17.1 $47.0 0.8%

Growth (12.3%) (75.3%) N M N M 175.1%

Margin 9.1% 6.9% 2.0% N M 4.2% 9.8%

VOXX FINANCIAL SUMMARY

Source: “FY 2021-2026 Historical and Projected P&L (Excl. Domestic Accessory, EyeLock and BioCenturion”.

a) Represents EBITDA adjusted for non-recurring items.

(a) |

| 5 Private and Confidential

$7.16

$6.50

$6.00

$150.0 Enterprise Value

$7.00

$5.00 $6.00 $7.00 $8.00

WHOLE CO.(a)

Source: “FY 2021-2026 Historical and Projected P&L (Excl. Domestic Accessory, EyeLock and BioCenturion”.

a) Implied enterprise value calculated using 22.5mil shares, $11.2mil of debt and $5.2mil of cash as of August 31, 2024. Figures are reflective of an assumed closed sale of

Orlando headquarters, Domestic Accessory segment and Jamo / Energy brands.

b)Represents EBITDA adjusted for non-recurring items.

OVERVIEW OF INDICATIONS OF INTEREST

WHOLE CO. BIDS RANGED BETWEEN $6.00 AND $7.16 PER SHARE

($ in Millions, except share price data) Implied Enterprise Value Multiples(a)

2025B

Revenue

2025B Adj.

EBITDA(b)

2026P

Revenue

2026P Adj.

EBITDA(b)

$408.9 $17.1 $480.6 $47.0

0.4x 9.8x 0.3x 3.6x

0.4x 8.9x 0.3x 3.2x

0.3-0.4x 8.3-9.6x 0.3-0.3x 3.0-3.5x

0.4x 8.8x 0.3x 3.2x

Strategic Financial Sponsor

SEGMENT (PREMIUM AUDIO)

Implied Enterprise Value Multiples(a)

2025B

Revenue

2025B Adj.

EBITDA(b)

2026P

Revenue

2026P Adj.

EBITDA(b)

$245.4 $29.4 $268.0 $39.8

0.2x 1.7x 0.2x 1.3x

Premium

9/26 Share

Price

$6.05

18.3%

7.4%

(0.8%)-15.7%

5.7%

EV: $141 EV: $164

EV: $152

EV: $167

Implied Share Price: $6.40

$50.0 Enterprise

Value

$25.0 $50.0 $75.0 |

| 6 Private and Confidential

Valuation (and

Associated

Metrics)

• $5.50 per share ($124.0mil Equity Value)

• Implied Total Proposal Enterprise Value: $186.3mil

‒ (10.9x 2025B Adj. EBITDA of $17.1mil)

• Implied Total Current Enterprise Value: $129.8mil(a)

‒ (7.6x 2025B Adj. EBITDA of $17.1mil)

• $6.50 per share ($146.1mil Equity Value)

‒ (7.4% premium to 9/26 stock price)

• Implied Total Proposal Enterprise Value: $210.6mil

‒ (12.3x 2025B Adj. EBITDA of $17.1mil)

• Implied Total Current Enterprise Value: $152.3mil(a)

‒ (8.9x 2025B Adj. EBITDA of $17.1mil)

• Valuation based on financials and capital structure set forth

in VOXX’s 5/31 10-Q

Structure

• Reverse triangular merger

• Purchase of 100% of VOXX’s fully diluted equity

• Shares purchased with cash, Guitar stock or 50/50 combination

of both at VOXX’s discretion

• Anticipates entering into retention agreements with key

employees

• Reverse triangular merger

• Purchase of 100% of VOXX’s issued and outstanding shares not

already owned by Guitar

• Shares purchased with cash, not subject to any financing

contingency

Conditions /

Approvals

• Asked for exclusivity

• Board of Directors is in support of the proposal

• Transaction would not be subject to any financing contingency

• Mr. Shalam and family members with significant ownership

interests enter into agreements to vote in favor of transaction

• Amendment of ASA JV agreement so that any non-competition provisions apply solely to VOXX and not future

affiliates of VOXX (e.g., Guitar)

• Will not require any further corporate or shareholder approvals

beyond final Board approval

• Transaction would not be subject to any financing contingency

Advisors • Not Provided • Deloitte (Financial and Tax), Jones Day (Legal), Acropolis

(Valuation)

Key Diligence

Areas • Not Provided • Financial / Tax, Legal, Real Estate, Insurance, Employees

GUITAR PROPOSAL SUMMARY

a) Calculated using 22.5mil shares, $11.2mil of debt and $5.2mil of cash as of August 31, 2024. Figures are reflective of an assumed closed sale of Orlando headquarters,

Domestic Accessory segment and Jamo / Energy brands.

5/31 PROPOSAL 9/26 PROPOSAL |

| 7 Private and Confidential

(Amounts in Millions, except share price)

5/31 Proposal

(2/29 Shares and Debt)

9/26 Proposal

(5/31 Shares and Debt)

Illustrative 9/26 Proposal

(8/31 Shares and Debt) (a)

Share Price $5.50 $6.50 $9.09

Shares Outstanding 22.54 22.48 22.51

Implied Total Proposal Equity Value $124.0 $146.1 $204.5

Plus: Debt $73.3 $68.6 $11.2

Less: Cash (11.0) (4.2) (5.2)

Implied Total Proposal Enterprise Value $186.3 $210.6 $210.6

Implied Total Current Enterprise Value (a) $129.8 $152.3 $210.6

2025B Adj. EBITDA $17.1 $17.1 $17.1

Implied Proposal EV / 2025B Adj. EBITDA 10.9 x 12.3 x 12.3 x

Implied Current EV / 2025B Adj. EBITDA 7.6 x 8.9 x 12.3 x

Existing Shares Owned by Guitar 3.3 6.5 6.5

% of VOXX Owned Through Existing Shares 14.7% 28.8% 28.7%

Per Share Price Paid for Total Existing Shares $10.00 $7.50 $7.50

Aggregate Value of Existing Shares $33.1 $48.5 $48.5

Cost to Purchase Remaining Shares 105.8 104.1 145.8

Implied Total Cost for All Shares Outstanding $138.9 $152.6 $194.3

Implied Per Share Cost Basis $6.16 $6.79 $8.63

GUITAR PROPOSAL ANALYSIS

Source: “VOXX International – Capitalization Summary (as of 08.31.2024)” and publicly available information.

a) Calculated using 22.5mil shares, $11.2mil of debt and $5.2mil of cash as of August 31, 2024. Figures are reflective of an assumed closed sale of Orlando headquarters,

Domestic Accessory segment and Jamo / Energy brands.

Guitar’s new

proposal assuming

VOXX’s capital

structure as of 5/31,

before the paydown

of debt

Illustrative proposal assumes

the same enterprise value as

Guitar’s 9/26 proposal, but

calculates share price based

on 8/31 capital structure

reflecting the paydown of

debt(a)

Guitar’s original

proposal which

assumed VOXX’s

capital structure as of

2/29, before the

paydown of debt

Original Proposal New Proposal Illustrative Proposal |

| 8 Private and Confidential

a) Implied current enterprise value calculated using 22.5mil shares, $11.2mil of debt and $5.2mil of cash as of August 31, 2024. Figures are reflective of an assumed closed

sale of Orlando headquarters, Domestic Accessory segment and Jamo / Energy brands.

DETAIL ON INDICATIONS OF INTEREST

Company

Description

• ‘ ‘

• ‘ ‘

‘ ‘

• ‘ ‘

• ‘ ‘

Whole Co. /

Segment • Whole Company • Whole Company

Valuation (and

Associated

Metrics)

• $7.16 per share ($161.2mil Equity Value)

• Implied Total Proposal / Current Enterprise Value: $167.2mil(a)

‒ (9.8x 2025B Adj. EBITDA of $17.1mil)

• $6.00 – $7.00 per share ($135.1mil – $157.6mil equity value)

• Implied Total Proposal Enterprise Value: $163.4mil - $185.9mil

‒ (9.6x – 10.9x 2025B Adj. EBITDA of $17.1mil)

• Implied Total Current Enterprise Value: $141.1mil – $163.6mil(a)

‒ (8.3x – 9.6x 2025B Adj. EBITDA of $17.1mil)

Valuation

Methodology

• 20% premium to 9/25 share price of $5.97

• Assumes net debt of $6.0mil

• Used financials presented in CIM, specifically FY 2024 / 2025 Revenue

and Adj. EBITDA for Whole Co. and PAC

• Assumes net debt of $28.3mil

Structure

• Will be funded with a combination of debt and equity, not subject to a

financing contingency

• Will offer competitive equity participation plans for Management

• Shares purchased with cash; financed with a combination of debt from

third-party sources and equity capital from

• Will offer an equity incentive program to go-forward Management

Timing

• Looking to move quickly through diligence

• Would complete confirmatory diligence in parallel with negotiation of

purchase agreement and other ancillary documents

• Looking to move quickly through diligence and prepared to commit full

resources to provide an LOI within a timeframe acceptable to VOXX

Conditions /

Approvals

• Senior members of IC have reviewed, final approval will require no more

than one day upon completion of diligence • Not subject to any additional internal or external approvals

Fund Size /

Similar Deals

• ‘ ‘

• ‘ ‘

• ‘ ‘

• ‘ ‘

• ‘ ‘

Advisors

• KPMG (FDD, Tax), Kirkland & Ellis (Legal)

• Additional advisors for Insurance, Environmental and IT

• Jones Day (Legal), RSM (Accounting and Tax), Lockton (Insurance and

Benefits)

Key Diligence

Areas

• Validation of operational improvement opportunities in Accordion report

• Confirmation of EBITDA and cash flow performance

• Insight and validation into Management’s projections, CapEx and

growth opportunities

• Operations and financial performance

• Legal, HR, Accounting, Tax and IT

Degree of

Expressed

Interest |

| 9 Private and Confidential

DETAIL ON INDICATIONS OF INTEREST (CONT.)

Company

Description

• ‘ ‘

• ‘ ‘

‘ ‘

• ‘ ‘

• ‘ ‘

‘ ‘

Whole Co. /

Segment • Whole Company • Segment (Premium Audio)

Valuation (and

Associated

Metrics)

• $150.0mil Proposed Enterprise Value

‒ (8.8x 2025B Adj. EBITDA of $17.1mil)

• Represents an Equity Value of $144.0mil and a $6.40 share price,

assuming 8/31 net debt of $6.0mil

• VOXX is entitled to receive 50% of any future dividends,

distributions, or sale proceeds from VOXX’s JV interests

• $50.0mil Proposed Enterprise Value (Premium Audio)

‒ (1.7x 2025B Adj. EBITDA of $29.4mil)

Valuation

Methodology • Not Provided

• Based on FY 2024 Revenue of $237.9mil and Adj. EBITDA of $8.9mil

• Represents 5.6x FY 2024 Adj. EBITDA

• Assumes all owned real estate, intellectual property and other assets

are included in the transaction

Structure

• Purchased with cash; financed with a combination of debt and equity

• Would acquire VOXX individually, through a stock purchase agreement

or asset purchase agreement, whichever is preferred by VOXX

• Cash-free and debt-free basis

• Purchased with cash; financed with a combination of debt and equity

• Would work with VOXX to determine most effective structure for tax

purposes

Timing • Believe transaction can be completed in 60 days • Expect to close within 60 days of execution of exclusive LOI

Conditions /

Approvals • No internal steps for approval aside from completion of diligence

• Satisfactory completion of diligence, IC approval

• Predicated on the opportunity to work with Management; expect to

retain key employees

Fund Size /

Similar Deals • ‘ ‘

• ‘ ‘

• ‘ ‘

• ‘ ‘

Advisors • Not Provided • Not Provided

Key Diligence

Areas

• Current performance and financial projections, working capital, real

estate, vendor and customer relationships, supply chain / distribution

• Believes additional due diligence can be completed within the next 60

days

• Current performance and financial projections, including a QoE

• Evaluation of growth plan and ability to operate as stand-alone segment

• Tax, Legal, Environmental and IT

Degree of

Expressed

Interest |

| 10 Private and Confidential

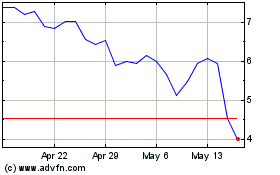

ANNOTATED 3-YEAR STOCK CHART

--

2.00

4.00

6.00

8.00

10.00

12.00

14.00

$16.00

Sep-21 Mar-22 Sep-22 Mar-23 Sep-23 Mar-24 Sep-24

5/31/2024: Guitar

proposal ($5.50 share)

8/27/2024: Public

announcement of

exploration of strategic

alternatives

3-year

average: $8.93

5/14/2024: VOXX

misses FY Q4 2024

earnings by ~14%

4/13/2023: VOXX 3-year

high of $13.92

Source: Capital IQ as of September 26, 2024, and publicly available information. |

| 11 Private and Confidential

Premium / (Discount) to EV / Revenue EV / Adjusted EBITDA

Unaffected Current 1-Year 1-Year 1-Year Actual Budget Projected Actual Budget Projected

Stock Stock Price Stock Price Average High Low Equity Enterprise FY 2024 FY 2025 FY 2026 FY 2024 FY 2025 FY 2026

Price $2.85 $6.05 $6.92 $11.45 $2.32 Value Value $423.3 $408.9 $480.6 ($2.4) $17.1 $47.0

$2.85 - - (52.9%) (58.8%) (75.1%) 22.8% $64 $70 0.2 x 0.2 x 0.1 x NM 4.1 x 1.5 x

$5.00 75.4% (17.4%) (27.7%) (56.3%) 115.5% $113 $119 0.3 x 0.3 x 0.2 x NM 6.9 x 2.5 x

$5.50 93.0% (9.1%) (20.5%) (52.0%) 137.1% $124 $130 0.3 x 0.3 x 0.3 x NM 7.6 x 2.8 x

$6.05 112.3% - - (12.5%) (47.2%) 160.8% $136 $142 0.3 x 0.3 x 0.3 x NM 8.3 x 3.0 x

$6.50 128.1% 7.4% (6.0%) (43.2%) 180.2% $146 $152 0.4 x 0.4 x 0.3 x NM 8.9 x 3.2 x

$7.00 145.6% 15.7% 1.2% (38.9%) 201.7% $158 $164 0.4 x 0.4 x 0.3 x NM 9.6 x 3.5 x

$7.50 163.2% 24.0% 8.5% (34.5%) 223.3% $169 $175 0.4 x 0.4 x 0.4 x NM 10.2 x 3.7 x

$8.00 180.7% 32.2% 15.7% (30.1%) 244.8% $180 $186 0.4 x 0.5 x 0.4 x NM 10.9 x 4.0 x

$8.50 198.2% 40.5% 22.9% (25.8%) 266.4% $191 $197 0.5 x 0.5 x 0.4 x NM 11.5 x 4.2 x

$9.00 215.8% 48.8% 30.1% (21.4%) 287.9% $203 $209 0.5 x 0.5 x 0.4 x NM 12.2 x 4.4 x

$9.50 233.3% 57.0% 37.4% (17.0%) 309.5% $214 $220 0.5 x 0.5 x 0.5 x NM 12.9 x 4.7 x

$10.00 250.9% 65.3% 44.6% (12.7%) 331.0% $225 $231 0.5 x 0.6 x 0.5 x NM 13.5 x 4.9 x

Source: “FY 2021-2026 Historical and Projected P&L (Excl. Domestic Accessory, EyeLock and BioCenturion”, “VOXX International – Capitalization Summary (as of 08.31.2024)”

and publicly available information.

Note: Fiscal year represents year end of February 28th.

a) Current stock price, 1-year average, high and low as of September 26, 2024.

b)Represents EBITDA adjusted for non-recurring items.

c) Represents close as of August 26, 2024, the day before VOXX's public announcement of their exploration of strategic alternatives.

d)Calculated on 22.5mil shares outstanding as of August 31, 2024. Includes 20.2mil Class A common stock and 2.3mil Class B common stock. Does not include any

restricted stock units due to the grant prices being higher than the average market price of VOXX’s common stock during the period.

e) Enterprise value calculated as equity value plus net debt of $6.0mil as of August 31, 2024 (total debt of $11.2mil less cash and cash equivalents of $5.2mil; figures are

reflective of an assumed closed sale of Orlando headquarters, Domestic Accessory segment and Jamo / Energy brands). Enterprise value does not include negative non-controlling interest of ($36.3mil) as of August 31, 2024.

ILLUSTRATIVE ANALYSIS AT VARIOUS PRICES

(c)

(d)

(Amounts in Millions USD, except per share data)

(a)

EXCLUDES DOMESTIC ACCESSORY AND EYELOCK / BIOCENTURION FINANCIALS

(b)

(e) |

| 12 Private and Confidential

SELECTED COMPARABLE COMPANIES SUMMARY

EV / CY2024E EBITDA EV / CY2025E EBITDA

Note: Figures represent median multiples.

Source: Capital IQ as of September 23, 2024.

8.6 x

5.0 x

4.4 x 4.6 x

Premium Audio Automotive |

| 13 Private and Confidential

EV / CY2024E EBITDA – PREMIUM AUDIO

SELECTED COMPARABLE COMPANIES BY INDUSTRY

Source: Capital IQ as of September 23, 2024.

EV / EBITDA BENCHMARKING – AUDIO AND AUTOMOTIVE

Median: 8.6x

EV / CY2024E EBITDA – AUTOMOTIVE

Median: 5.0x

13.1 x

4.1 x

NM

Dolby B&O Sonos

11.9 x

10.6 x

7.7 x

6.4 x 6.1 x 5.4 x 4.6 x 4.6 x 4.5 x

2.7 x 2.4 x 2.1 x

Dorman Gentex Aptiv Autoliv Denso Visteon Adient Lear Magna Forvia Valeo Tokai Rika |

| 14 Private and Confidential

SELECTED COMPARABLE COMPANIES DETAIL

Source: Capital IQ as of September 23, 2024.

(Amounts in Millions USD, Except Per Share Values) Valuation Multiples

Stock Price 52-Week 52-Week Equity Enterprise EV / Revenue EV / EBITDA

9/23/24 Low High Value Value CY2024 CY2025 CY2024 CY2025 CY2024 CY2025

Premium Audio

B&O $1.28 $1.24 $1.63 $154 $136 0.4 x 0.3 x 4.1 x 2.7 x 8.7% 11.8%

Dolby 72.85 66.75 89.38 6,946 6,092 4.7 x 4.4 x 13.1 x NA 36.1% NA

Sonos 12.58 9.86 19.51 1,522 1,246 0.9 x 0.8 x NM 6.1 x 2.7% 13.7%

Premium Audio Median 0.9 x 0.8 x 8.6 x 4.4 x 8.7% 12.8%

Premium Audio Mean 2.0 x 1.9 x 8.6 x 4.4 x 15.9% 12.8%

Automotive

Adient $22.12 $19.90 $37.10 $1,929 $3,934 0.3 x 0.3 x 4.6 x 4.2 x 5.8% 6.4%

Aptiv 71.56 65.38 99.14 19,018 24,143 1.2 x 1.1 x 7.7 x 7.1 x 15.5% 15.9%

Autoliv 92.99 90.17 129.11 7,447 9,047 0.9 x 0.8 x 6.4 x 5.5 x 13.3% 14.7%

Denso 14.66 13.04 20.54 42,686 42,062 0.8 x 0.8 x 6.1 x 5.5 x 13.8% 14.7%

Dorman 114.98 62.18 117.50 3,537 4,036 2.0 x 1.9 x 11.9 x 11.2 x 17.0% 17.2%

Forvia 8.93 8.88 23.43 1,753 10,212 0.3 x 0.3 x 2.7 x 2.4 x 12.5% 13.2%

Gentex 30.15 28.13 37.10 6,941 6,665 2.8 x 2.6 x 10.6 x 9.3 x 26.1% 27.5%

Lear 108.60 103.43 146.07 6,109 7,962 0.3 x 0.3 x 4.6 x 4.2 x 7.4% 7.7%

Magna 42.17 38.03 59.82 12,156 17,432 0.4 x 0.4 x 4.5 x 4.1 x 8.9% 9.6%

Tokai Rika 13.71 11.97 18.25 1,160 748 0.2 x 0.2 x 2.1 x 2.0 x 8.7% 8.6%

Valeo 10.74 9.63 18.71 2,608 7,312 0.3 x 0.3 x 2.4 x 2.1 x 12.6% 13.4%

Visteon 94.52 88.69 138.87 2,609 2,516 0.6 x 0.6 x 5.4 x 4.9 x 11.9% 12.2%

Automotive Median 0.5 x 0.5 x 5.0 x 4.6 x 12.6% 13.3%

Automotive Mean 0.8 x 0.8 x 5.7 x 5.2 x 12.8% 13.4%

EBITDA Margin |

| 15 Private and Confidential

10.0 x

7.2 x

Premium Audio Automotive

SELECTED PRECEDENT TRANSACTIONS SUMMARY

EV / LTM EBITDA

Note: Figures represent median multiples.

Source: Publicly available information. |

| 16 Private and Confidential

SELECTED PREMIUM AUDIO PRECEDENT TRANSACTIONS

Source: Publicly available information.

a) Figures are converted using USD / KRW exchange rate at time of transaction.

(Amounts in Millions)

Date Enterprise EV as a Multiple of:

Announced Acquiror Name Target Name Value LTM Sales LTM EBITDA

Dec-23 RODE Microphones Mackie $120 N A N A

Aug-23 AAC Technologies Premium Sounds Solutions ~$450 N A N A

Aug-23 Garmin JL Audio N A N A N A

Aug-23 Avpro Global Holdings Audiocontrol (Home Audio Division) N A N A N A

Jun-22 Highlander Partners McIntosh Group N A N A N A

Feb-22 Masimo Sound United $1,025 N A N A

May-21 VOXX International / Sharp Corporation Onkyo Home Entertainment (AV Business) $37 N A N A

May-21 Noritsu Koki JLab Audio $370 N A N A

Feb-21 Sonova Holding Sennheiser (Consumer Division) €200 ~0.8 x N A

Oct-20 Sound United Bowers & Wilkins N A N A N A

Oct-20 Loxone quadral N A N A N A

Sep-19 Sonance James Loudspeaker N A N A N A

Jul-19 Focusrite Pro Audio (ADAM Audio) €18 1.4 x 10.6 x

Apr-18 Naxicap Partners Lautsprecher Teufel N A N A N A

Jul-17 Samsung Electronics ARCAM N A N A N A

Mar-17 Sound United D+M Group N A N A N A

Feb-17 Control4 Corp Triad Speakers $10 ~1.1 x N A

Nov-16 Samsung Electronics Harman International Industries $8,198 (a) 1.2 x 9.5 x

Sep-16 Tessera Technologies DTS $850 5.2 x 24.9 x

Jun-16 Mill Road Capital Skullcandy $151 0.6 x 9.3 x

Apr-16 Logitech Jaybird $50 N A N A

Median 1.1 x 10.0 x

Mean 1.7 x 13.6 x |

| 17 Private and Confidential

SELECTED AUTOMOTIVE PRECEDENT TRANSACTIONS

Source: Publicly available information.

a) EBITDA includes noncontrolling interest.

(Amounts in Millions)

Date Enterprise EV as a Multiple of:

Announced Acquiror Name Target Name Value LTM Sales LTM EBITDA

Mar-24 Usami Koyu Corp PIAA Corp ¥3,500 0.4 x N A

May-22 Lear IG Bauerhin €140 N A N A

Feb-22 Patrick Industries Rockford Fosgate ~$133 ~0.9 x N A

Feb-22 Apollo Tenneco $7,100 0.4 x 6.2 x (a)

Dec-21 CCL Industries McGavigan Holdings $106 1.9 x 7.2 x

Oct-21 Lear Kongsberg Automotive (ICS) €175 0.5 x N M

Aug-21 Faurecia Hella €6,667 1.2 x 10.1 x

Jul-20 VOXX International Directed (Automotive Aftermarket) $11.0 N A N A

Feb-20 VOXX International Vehicle Safety Holding Corp. $16.5 ~0.6 x ~5.5 x

Jul-18 Magna International OLSA €230 N A N A

Nov-17 Gentherm Etratech ~$64 ~1.0 x ~8.5 x

Jun-17 TE Connectivity Hirschmann Car Communication ~$170 N A N A

Apr-17 VOXX International Rosen Electronics $2 N A N A

Median 0.9 x 7.2 x

Mean 0.9 x 7.5 x |

| 18 Private and Confidential

PROCESS TIMELINE

Key Dates

• September 26: Initial Indications Due

• October 7 – October 31: Management Meetings / Final Due Diligence with Selected Parties

• October 14: Distribute Draft Agreement and Disclosure Schedules

• October 29: Markup to Draft Agreement and Disclosure Schedules Due

• November 5: Final Bid Submission Due

• November 6 – November 13: Negotiate and Execute Definitive Agreements

• Thereafter: HSR Filing, SEC Filing and Shareholder Vote; Closing

September October November

S M T W T F S S M T W T F S S M T W T F S

1 2 3 4 5 6 7 1 2 3 4 5 1 2

8 9 10 11 12 13 14 6 7 8 9 10 11 12 3 4 5 6 7 8 9

15 16 17 18 19 20 21 13 14 15 16 17 18 19 10 11 12 13 14 15 16

22 23 24 25 26 27 2 8 20 21 22 23 24 25 26 17 18 19 20 21 22 23

2 9 3 0 27 28 29 30 31 24 25 26 27 28 29 3 0

National Holiday Management Meetings / Final Due Diligence Final Bid Submission Due

with Selected Parties

Accommodate Due Diligence requests / Distribute Draft Agreement and Disclosure Negotiate and Execute Definitive

Management Calls Schedules Agreements

Initial Indications Due Markup to Draft Agreement and Disclosure HSR Filing, SEC Filing and Shareholder

Schedules Due Vote; Closing

National Holiday |

| Private and Confidential

AN AFFILIATE OF

PROJECT INSTRUMENT

FINAL BID SUMMARY

NOVEMBER 15, 2024

DRAFT as of 11/15/2024 10:00 AM

Exhibit (c)(iii)

The blacked out information indicates information has been omitted on the basis of a confidential treatment request pursuant to Rule 24b-2

of the Securities Exchange Act of 1934, as amended. This information has been filed separately with the Securities and Exchange

Commission. |

| 1 Private and Confidential

• 90 total parties were contacted beginning 08/12/2024, comprising

43 strategics and 47 financial sponsors

• Guitar, who had initially bid on 5/31/24, acquired additional shares

from Beat Kahli, resulting in a public announcement of the

strategic alternatives process on 8/27/24

• Initial bids received on 9/26/24 from 5 parties – 4 WholeCo,

1 Premium Audio (PAC) only

— Invited 4 parties to continue diligence; indicated to PAC

bidder that implied value ($50mil) was not in the desired

range

— Distributed downward-revised 2025B and 2026P financials on

10/10/24

— 2 parties dropped out shortly before scheduled management

meetings, citing downward revision of budget (specifically

lack of stabilization in PAC) timeline / planning concerns,

additional required post-close discovery work, and elevated

stock price

• Final bids received from 2 parties on 11/14/24

— ($6.00 per share)

▪ Bid $7.16 per share on 09/26/24

— Guitar ($7.00 per share)

▪ Bid $5.50 per share on 05/31/24

▪ Bid $6.50 per share on 09/26/24

EXECUTIVE SUMMARY (AS OF 11/15/24)

Outreach Summary

30

CIMs Sent

Parties Contacted

90

18

Data Room Access

Bids

5

IOIs Received

Final Bids

Received

2

CIM Data Room Accordion

Strategic 10 5 4

Sponsor 20 13 11

Total 30 18 15

DRAFT |

| 2 Private and Confidential

a) Implied equity value calculated on 23.5mil fully diluted shares outstanding. Includes 20.3mil Class A common stock, 2.3mil Class B common stock and 1.0mil RSUs as of

October 31, 2024.

b)Implied enterprise value calculated as equity value plus net debt of $17.0mil as of October 31, 2024 (total debt of $20.1mil less cash and cash equivalents of $3.1mil).

Enterprise value does not include negative non-controlling interest of ($36.3mil) as of August 31, 2024.

c) Represents EBITDA adjusted for non-recurring items.

DETAIL ON FINAL BIDS

Company Description

• ‘ ‘

• ‘ ‘

‘

• Global provider of dimmable devices, vision systems, sensors and

advanced electronic products

Price per Share • $6.00 • $7.00

Implied Equity Value (a) • $141.3mil equity value • $164.8mil equity value

Implied Enterprise

Value (b) • $158.3mil enterprise value

• $181.8mil enterprise value

• ($216.3mil implied enterprise value assuming Guitar uses 10/31 capital

structure)

EV / Adj. EBITDA (c) • 13.1x 2025B Adj. EBITDA of $12.1mil • 15.0x 2025B Adj. EBITDA of $12.1mil

• (17.8x 2025B Adj. EBITDA of $12.1mil assuming 10/31 capital structure)

Valuation

Methodology

• Assumes the same enterprise value implied in initial bid

• Deduction to equity value due to CIC and severance payments

• Attributes a $0.58 per share ($13.1mil of equity value) reduction to reflect

“performance impact”

• Would consider an acquisition of Premium Audio Company and

VOXX’s stake in Audiovox Specialized Applications, LLC for $65mil

• Assumes financials and capitalization will be consistent with August 31

figures

• CIC and severance payments will be paid according to agreements

Sources of Capital • Equity backstop for the entire purchase price

• Third party financing post-transaction • Cash on hand and cash currently available via revolving credit facility

Status of Financing

• Not subject to a financing contingency

• Received term sheets from financing partners and expect to close on

consistent terms

• Not subject to a financing contingency

Approvals for Signing • Investment committee has approved this transaction, final approval

would require no more than one day upon completion of due diligence

• Shalam family enters into voting and support agreements

• Amendment of ASA JV and Purchase Agreement to avoid Guitar’s inclusion

in any non-compete provisions

• Final review and approval by Guitar Board of Directors

Process / Timing

• Expect to complete work and sign transaction documents within 3

weeks

• 3-week exclusivity clause post signing of LOI

• Not provided

Outstanding Diligence

to Signing • 3

rd party confirmatory items (legal, HR, tax, environmental)

• Updated financial / accounting and tax due diligence requests provided

• Legal due diligence (corporate, HR, environmental, real estate, compliance)

DRAFT

GUITAR |

| 3 Private and Confidential

(Amounts in Millions, except share price)

11/14 Proposal

(10/31 Shares, 8/31 Debt)

Illustrative 11/14 Proposal

(10/31 Shares and 10/31 Debt)

Share Price $7.00 $8.47

Shares Outstanding 23.55 23.55

Implied Total Proposal Equity Value $164.8 $199.3

Plus: Debt $55.2 $20.1

Less: Cash (3.7) (3.1)

Implied Total Proposal Enterprise Value $216.3 $216.3

Implied Total Current Enterprise Value $181.8 $216.3

2025B Adj. EBITDA $12.1 $12.1

Implied Proposal EV / 2025B Adj. EBITDA 17.8 x 17.8 x

Implied Current EV / 2025B Adj. EBITDA 15.0 x 17.8 x

Existing Shares Owned by Guitar 6.5 6.5

% of VOXX Owned Through Existing Shares 27.5% 27.5%

Per Share Price Paid for Total Existing Shares $7.50 $7.50

Aggregate Value of Existing Shares $48.5 $48.5

Cost to Purchase Remaining Shares 119.6 144.6

Implied Total Cost for All Shares Outstanding $168.1 $193.1

Implied Per Share Cost Basis $7.14 $8.20

GUITAR PROPOSAL ANALYSIS

New Proposal Illustrative Proposal

Guitar’s new proposal

assuming VOXX’s

capital structure as of

8/31, before the full

paydown of debt

Illustrative proposal assumes

the same enterprise value as

Guitar’s 11/14 proposal, but

calculates share price based on

10/31 capital structure reflecting

the paydown of debt

DRAFT |

| 4 Private and Confidential

Premium / (Discount) to EV / Revenue EV / Adjusted EBITDA

Unaffected Current 1-Year 1-Year 1-Year Budget Projected Budget Projected Illustrative

Stock Stock Price Stock Price Average High Low Equity Enterprise FY 2025 FY 2026 FY 2025 FY 2026 EBITDA

Price $2.85 $6.80 $6.71 $11.45 $2.32 Value Value $405.1 $478.6 $12.1 $39.2 $28.0

$2.85 - - (58%) (58%) (75%) 23% $67 $84 0.2 x 0.2 x 6.9 x 2.1 x 3.0 x

$5.50 93% (19%) (18%) (52%) 137% $130 $147 0.4 x 0.3 x 12.1 x 3.7 x 5.2 x

$6.00 111% (12%) (11%) (48%) 159% $141 $158 0.4 x 0.3 x 13.1 x 4.0 x 5.7 x

$6.80 139% - - 1% (41%) 193% $160 $177 0.4 x 0.4 x 14.6 x 4.5 x 6.3 x

$7.00 146% 3% 4% (39%) 202% $165 $182 0.4 x 0.4 x 15.0 x 4.6 x 6.5 x

$7.25 154% 7% 8 % (37%) 213% $171 $188 0.5 x 0.4 x 15.5 x 4.8 x 6.7 x

$7.50 163% 10% 12% (34%) 223% $177 $194 0.5 x 0.4 x 16.0 x 4.9 x 6.9 x

$7.75 172% 14% 16% (32%) 234% $182 $199 0.5 x 0.4 x 16.5 x 5.1 x 7.1 x

$8.00 181% 18% 19% (30%) 245% $188 $205 0.5 x 0.4 x 16.9 x 5.2 x 7.3 x

$8.25 189% 21% 23% (28%) 256% $194 $211 0.5 x 0.4 x 17.4 x 5.4 x 7.5 x

$8.50 198% 25% 27% (26%) 266% $200 $217 0.5 x 0.5 x 17.9 x 5.5 x 7.8 x

$8.75 207% 29% 30% (24%) 277% $206 $223 0.6 x 0.5 x 18.4 x 5.7 x 8.0 x

$9.00 216% 32% 34% (21%) 288% $212 $229 0.6 x 0.5 x 18.9 x 5.8 x 8.2 x

Source: “FY 2021-2026 Historical and Projected P&L (Excl. Domestic Accessory, EyeLock and BioCenturion)(as of 8.31.24)”, “VOXX International – Capitalization Summary (as of

10.31.2024)” and publicly available information.

a) Current stock price, 1-year average, high and low as of November 14, 2024.

b)Represents EBITDA adjusted for non-recurring items.

c) Represents close as of August 26, 2024, the day before VOXX's public announcement of their exploration of strategic alternatives.