Wah Fu Education Group Limited (“Wah Fu” or the “Company”)

(Nasdaq:WAFU), a provider of online education and exam preparation

services, as well as related training materials and technology

solutions for both institutions and individuals, today announced

its unaudited financial results for the six months ended September

30, 2023.

Financial Highlights for the Six Months

Ended September 30, 2023

|

|

|

For the Six Months EndedSeptember

30, |

|

|

($’000, except per share data) |

|

2023 |

|

|

2022 |

|

|

% Change |

|

|

Revenue |

|

$ |

3,648 |

|

|

$ |

5,453 |

|

|

(33.1 |

)% |

| Gross profit |

|

$ |

2,063 |

|

|

$ |

2,788 |

|

|

(26.0 |

)% |

| Gross margin |

|

|

56.6 |

% |

|

|

51.1 |

% |

|

(5.4 |

)pp |

| Income (loss) from

operations |

|

$ |

273 |

|

|

$ |

1,117 |

|

|

(75.6 |

)% |

| Operating profit (loss)

margin |

|

|

7.5 |

% |

|

|

20.5 |

% |

|

(13.0 |

)pp |

| Net income (loss) |

|

$ |

125 |

|

|

$ |

1,056 |

|

|

88.2 |

% |

| Basic and diluted earnings

(loss) per share |

|

$ |

0.05 |

|

|

$ |

0.19 |

|

|

(73.1 |

)% |

| |

|

|

|

|

|

|

|

|

|

|

|

| * pp: percentage points |

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

- Revenue decreased by 33.1% year-over-year to $3.65 million for

the six months ended September 30, 2023 from $5.45 million for the

same period of the prior fiscal year. The decrease in revenue is

primarily attributable to a decrease in one course offering from

our online education services.

- Gross profit decreased by 26.0% to $2.01 million for the six

months ended September 30, 2023 from $2.79 million for the same

period of the prior fiscal year. Gross margins were 56.6% and 51.1%

for the six months ended September 30, 2023 and 2022, respectively.

The decrease in gross profit of online education services is

primarily due to the decrease in revenue.

- Incomes from operations were $0.27 million and $1.12 million

for the each of six months ended September 30, 2023 and 2022.

Operating profit margin was 7.5% for the six months ended September

30, 2023, compared to operating profit margin of 20.5% for the same

period of the prior fiscal year.

- Net income was $0.13 million or, income per share of $0.05 for

the six months ended September 30, 2023, compared to net income of

$1.06 million, or income per share of $0.19, for the same period of

the prior fiscal year.

Unaudited Financial Results for the six months ended

September 30, 2023

Revenue

For the six months ended September 30, 2023,

revenue decreased by $1.81 million, or 33.1%, to $3.65 million from

$5.45 million for the same period of the prior fiscal year. The

decrease in revenue was primarily due to the decrease of revenue

from one course offering from our online education services.

For the six months ended September 30, 2023,

revenue from providing online education services decreased by $1.83

million for the same period of the prior fiscal year. The decrease

was mainly due to a decrease in revenue from one course offering in

our Business-to-Business-to-Customer (“B2B2C”) platforms. During

the six months ended September 30, 2023, due to the implementation

of local policies in Hunan province, some universities canceled the

self-study examination, thus the courses provided to self-study

examination decreased, the revenue from

Business-to-Business-to-Customer (“B2B2C”) decrease gradually.

Cost of revenue

Cost of revenue decreased by $1.08 million, or

40.8%, to $1.57 million for the six months ended September 30, 2023

from $2.65 million for the same period of the prior fiscal year.

The decrease of overall cost of revenue was mainly due to decrease

of cost of revenue for online education services. Cost of revenue

mainly comprised of salaries and related expenses for our teaching

support, course and content development, website maintenance and

information technology engineers and other employees, fees paid to

our course lecturers, depreciation and amortization expenses,

server relocation and bandwidth leasing fees paid to third-party

providers and other miscellaneous expenses. As the decrease of

online education service revenue, cost related to online education

service deceased for the six months ended September 30, 2023

compared to the same period last year.

Gross profit

Gross profit decreased by $0.73 million, or

26.0%, to $2.06 million for the six months ended September 30, 2023

from $2.79 million for the same period of the prior fiscal year.

Gross margin increased by 5.4 percent to 56.6% for the six months

ended September 30, 2023 from 51.1% for the same period of the

prior fiscal year. The decrease of gross profit was mainly due to

the decrease of online education service revenue from one course

offering. The minor increase in gross margin in the six months

ended September 30, 2023 compared to the same period last year was

due to the fact that our online education service has lower gross

margin than technology development and other service revenue. The

revenue of online education service decreased significantly in this

period, thus the gross margin of total revenue increased for the

six months ended September 30, 2023 compared to the same period

last year.

Operating expenses

Selling expenses increased by $0.23 million, or

40.2%, to $0.80 million for the six months ended September 30, 2023

from $0.57 million for the same period of the prior fiscal year.

The increase was mainly due to the fact that the Company increased

the input in marketing promotion for this period.

General and administrative expenses decreased by

$0.11 million, or 10.2%, to $0.99 million for the six months ended

September 30, 2023 from $1.10 million for the same period of the

prior fiscal year

Total operating expenses increased by $0.12

million, or 7.1%, to $1.79 million for the six months ended

September 30, 2023 from $1.67 million for the same period of the

prior fiscal year.

Income (loss) from operations

Incomes from operations were $0.27 million and

$1.12 million for each of the six months ended September 30, 2023

and 2022. Please see above for a detailed description of such

Income (loss) from operations.

Other income (expenses)

Total other expenses, including interest income,

loss from investments in unconsolidated entity, net of other

expenses, was $0.1 million for the six months ended September 30,

2023 when it was a net income of $0.1 million in the same period of

the prior fiscal year.

Income before income taxes

Income before income taxes was $0.18 million for

the six months ended September 30, 2023, compared to income before

income taxes of $1.22 million for the same period of the prior

fiscal year.

Net income and earnings per share

Net income was $0.12 million for the six months

ended September 30, 2023, compared to net income of $1.06 million

for the same period of the prior fiscal year. Net profit margin was

3.4% for the six months ended September 30, 2023, compared to net

profit margin of 19.4% for the same period of the prior fiscal

year.

After deducting non-controlling interests, net

profit attributable to the Company was $0.23 million, or profit of

$0.05 basic and diluted share, for the six months ended September

30, 2022. This compared to net profit of $0.86 million, or profit

of $0.19 per basic and diluted share, for the same period of the

prior fiscal year.

Weighted average number of shares outstanding

was 4,440,085 for the six months ended September 30, 2023 and

2022.

Financial Condition

As of September 30, 2023, the Company had cash

of $11.42 million, compared to $12.57 million as of March 31, 2023.

Total working capital was $11.10 million as of September 30, 2023,

compared to $11.69 million as of March 31, 2023.

Net cash used in operating activities was $0.10

million for the six months ended September 30, 2023 compared to net

cash provided by operating activities $0.30 million for the same

period last year. There was no cash used in or provided by

investing activities for the six months ended September 30, 2023,

compared to net cash used in investing activities $0.18 million for

the same period last year. There was no cash used in or provided by

financing activities for the six months ended September 30, 2023,

compared to net cash provided by financing activities $0.04 million

for the same period of last year.

Subsequent Events

Management has evaluated subsequent events

through April 1, 2024, the date which the financial statements were

available to be issued. All subsequent events requiring recognition

as of September 30, 2023 have been incorporated into these

financial statements and there are no subsequent events that

require disclosure in accordance with FASB ASC Topic 855,

“Subsequent Events.”

About Wah Fu Education Group

Limited

Headquartered in Beijing, China, Wah Fu

Education Group Limited provides online training and exam

preparation services, as well as related training materials and

technology solutions for both institutions, such as universities

and training institutions, and students. For more information about

Wah Fu, please visit www.edu-edu.cn.

Safe Harbor Statement

This press release contains forward-looking

statements as defined by the Private Securities Litigation Reform

Act of 1995. Forward-looking statements include statements

concerning plans, objectives, goals, strategies, future events or

performance, and underlying assumptions and other statements that

are not statements of historical facts. When the Company uses words

such as “may, “will, “intend,” “should,” “believe,” “expect,”

“anticipate,” “project,” “estimate” or similar expressions that do

not relate solely to historical matters, it is making

forward-looking statements. Forward-looking statements are not

guarantees of future performance and involve risks and

uncertainties that may cause the actual results to differ

materially from the Company’s expectations discussed in the

forward-looking statements. These statements are subject to

uncertainties and risks including, but not limited to, the

following: the Company’s goals and strategies; the Company’s

future business development; product and service demand and

acceptance; changes in technology; economic conditions; the growth

of the online training industry in China and the other markets the

Company serves or plans to serve; reputation and brand; the impact

of competition and pricing; government regulations; fluctuations in

general economic and business conditions in China and the other

markets the Company serves or plans to serve and assumptions

underlying or related to any of the foregoing and other risks

contained in reports filed by the Company with the Securities and

Exchange Commission (the “SEC”). For these reasons, among

others, investors are cautioned not to place undue reliance upon

any forward-looking statements in this press release. Additional

factors are discussed in the Company’s filings with the SEC, which

are available for review at www.sec.gov. The Company undertakes no

obligation to publicly update these forward-looking statements to

reflect events or circumstances that arise after the date

hereof.

For more information, please contact:

Raincy Duir@edu-edu.com.cn

|

WAH FU EDUCATION GROUP LIMITED AND

SUBSIDIARIES |

|

UNAUDITED CONDENSED CONSOLIDATED BALANCE

SHEETS |

| |

| |

As ofSeptember 30, |

|

|

As ofMarch 31, |

|

| |

2023 |

|

|

2023 |

|

| ASSETS |

|

|

|

|

|

| CURRENT

ASSETS: |

|

|

|

|

|

|

Cash |

$ |

11,421,498 |

|

|

$ |

12,567,463 |

|

| Accounts receivable, net |

|

777,440 |

|

|

|

793,212 |

|

| Other receivables, net |

|

253,700 |

|

|

|

251,953 |

|

| Loan to third parties,

current |

|

603,165 |

|

|

|

551,930 |

|

| Loan to related parties |

|

1,745,384 |

|

|

|

1,761,979 |

|

| Other current assets |

|

216,393 |

|

|

|

69,104 |

|

| TOTAL CURRENT

ASSETS |

|

15,017,580 |

|

|

|

15,995,641 |

|

| |

|

|

|

|

|

|

|

| Loan to third parties,

noncurrent |

|

92,218 |

|

|

|

171,004 |

|

| Property and equipment,

net |

|

499,659 |

|

|

|

495,255 |

|

| Intangible assets, net |

|

16,834 |

|

|

|

54,382 |

|

| Operating lease right-of-use

assets |

|

448,862 |

|

|

|

391,189 |

|

| Long-term rent deposit |

|

52,749 |

|

|

|

56,040 |

|

| Deferred tax assets, net |

|

352,681 |

|

|

|

374,681 |

|

| TOTAL

ASSETS |

$ |

16,480,583 |

|

|

$ |

17,538,192 |

|

| |

|

|

|

|

|

|

|

| LIABILITIES AND

SHAREHOLDERS’ EQUITY |

|

|

|

|

|

|

|

| CURRENT

LIABILITIES: |

|

|

|

|

|

|

|

| Due to related parties |

$ |

315,512 |

|

|

$ |

315,512 |

|

| Deferred revenue |

|

1,874,303 |

|

|

|

2,110,628 |

|

| Operating lease liabilities,

current |

|

219,072 |

|

|

|

210,274 |

|

| Taxes payable |

|

1,042,037 |

|

|

|

1,119,601 |

|

| Other payables |

|

116,830 |

|

|

|

136,110 |

|

| Accrued expenses and other

liabilities |

|

171,732 |

|

|

|

179,440 |

|

| Accounts payable |

|

91,640 |

|

|

|

233,473 |

|

| TOTAL CURRENT

LIABILITIES |

|

3,831,126 |

|

|

|

4,305,038 |

|

| |

|

|

|

|

|

|

|

| Operating lease liabilities,

noncurrent |

|

227,661 |

|

|

|

203,171 |

|

| TOTAL

LIABILITIES |

|

4,058,787 |

|

|

|

5,993,766 |

|

|

|

|

|

|

|

|

|

|

| COMMITMENTS AND

CONTINGENCIES |

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

| SHAREHOLDERS’

EQUITY |

|

|

|

|

|

|

|

| EQUITY |

|

|

|

|

|

|

|

| Common stock, $0.01 par value,

30,000,000 shares authorized; 4,440,085 shares issued and

outstanding as of September 30, 2023 and March 31, 2023,

respectively |

|

44,401 |

|

|

|

44,401 |

|

| Additional paid-in

capital |

|

5,123,941 |

|

|

|

5,123,941 |

|

| Statutory reserve |

|

907,869 |

|

|

|

867,530 |

|

| Retained earnings |

|

6,604,632 |

|

|

|

6,417,842 |

|

| Accumulated other

comprehensive loss |

|

(1,487,484 |

) |

|

|

(752,391 |

) |

| Total shareholders’

equity |

|

11,193,359 |

|

|

|

11,701,323 |

|

| Non-controlling interest |

|

1,228,437 |

|

|

|

1,328,660 |

|

| TOTAL SHAREHOLDERS’

EQUITY |

|

12,421,796 |

|

|

|

13,029,983 |

|

| TOTAL LIABILITIES AND

SHAREHOLDERS’ EQUITY |

$ |

16,480,583 |

|

|

$ |

17,538,192 |

|

| |

|

|

|

|

|

|

|

| WAH FU

EDUCATION GROUP LIMITED AND SUBSIDIARIES |

| UNAUDITED

CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS AND COMPREHENSIVE

INCOME (LOSS) |

| |

| |

For the Six Months EndedSeptember

30, |

|

| |

2023 |

|

|

2022 |

|

| |

|

|

|

|

|

|

REVENUE |

$ |

3,647,954 |

|

|

$ |

5,453,052 |

|

|

|

|

|

|

|

|

|

|

|

COST OF REVENUE AND RELATED TAX |

|

|

|

|

|

|

|

|

Cost of revenue |

|

1,569,477 |

|

|

|

2,650,570 |

|

|

Business and sales related tax |

|

15,606 |

|

|

|

14,379 |

|

|

|

|

|

|

|

|

|

|

|

GROSS PROFIT |

|

2,062,871 |

|

|

|

2,788,103 |

|

|

|

|

|

|

|

|

|

|

|

OPERATING EXPENSES |

|

|

|

|

|

|

|

|

Selling expenses |

|

804,790 |

|

|

|

573,881 |

|

|

General and administrative expenses |

|

985,346 |

|

|

|

1,097,104 |

|

|

Total operating expenses |

|

1,790,136 |

|

|

|

1,670,985 |

|

|

|

|

|

|

|

|

|

|

|

INCOME FROM OPERATIONS |

|

272,735 |

|

|

|

1,117,118 |

|

|

|

|

|

|

|

|

|

|

|

OTHER INCOME (EXPENSE) |

|

|

|

|

|

|

|

|

Interest income |

|

98,240 |

|

|

|

104,846 |

|

|

Other income (expense) |

|

(190,929 |

) |

|

|

1,596 |

|

|

Total other income (expense), net |

|

(92,689 |

) |

|

|

106,442 |

|

|

|

|

|

|

|

|

|

|

|

INCOME BEFORE INCOME TAX PROVISION |

|

180,046 |

|

|

|

1,223,560 |

|

|

|

|

|

|

|

|

|

|

|

PROVISION FOR INCOME TAXES |

|

55,492 |

|

|

|

167,071 |

|

|

|

|

|

|

|

|

|

|

|

NET INCOME |

|

124,554 |

|

|

|

1,056,489 |

|

|

|

|

|

|

|

|

|

|

|

Less: net income (loss) attributable to non-controlling

interest |

|

(102,575 |

) |

|

|

193,622 |

|

|

|

|

|

|

|

|

|

|

|

NET INCOME ATTRIBUTABLE TO WAH FU EDUCATION GROUP

LIMITED |

$ |

227,129 |

|

|

$ |

862,867 |

|

|

|

|

|

|

|

|

|

|

|

COMPREHENSIVE INCOME (LOSS) |

|

|

|

|

|

|

|

|

Net income |

|

124,554 |

|

|

|

1,056,489 |

|

|

Other comprehensive loss: foreign currency translation loss |

|

(732,741 |

) |

|

|

(1,044,121 |

) |

|

Total comprehensive income (loss) |

|

(608,187 |

) |

|

|

12,368 |

|

|

Less: Comprehensive income (loss) attributable to non-controlling

interest |

|

2,352 |

|

|

|

(16,687 |

) |

|

|

|

|

|

|

|

|

|

|

COMPREHENSIVE INCOME (LOSS) ATTRIBUTABLE TO WAH FU

EDUCATION GROUP LIMITED |

$ |

(610,539 |

) |

|

$ |

29,055 |

|

|

|

|

|

|

|

|

|

|

|

Earnings per common share - basic and diluted |

$ |

0.05 |

|

|

$ |

0.19 |

|

|

Weighted average shares - basic and diluted |

|

4,440,085 |

|

|

|

4,440,085 |

|

| |

|

|

|

|

|

|

|

| WAH FU

EDUCATION GROUP LIMITED AND SUBSIDIARIES |

| UNAUDITED

CONDENSED CONSOLIDATION STATEMENTS OF CHANGES IN

EQUITY |

|

|

|

|

Ordinary Shares |

|

|

AdditionalPaid-in |

|

|

Statutory |

|

|

Retained |

|

|

AccumulatedOtherComprehensive |

|

|

Shareholders’ |

|

|

Non-controlling |

|

|

Total |

|

|

|

Shares |

|

|

Amount |

|

|

Capital |

|

|

Reserves |

|

|

Earnings |

|

|

Income (Loss) |

|

|

Equity |

|

|

Interest |

|

|

Equity |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Balance at March 31, 2023 |

|

4,440,085 |

|

|

$ |

44,401 |

|

|

$ |

5,123,941 |

|

|

$ |

867,530 |

|

|

$ |

6,417,842 |

|

|

$ |

(752,391 |

) |

|

$ |

11,701,323 |

|

|

$ |

1,328,660 |

|

|

$ |

13,029,983 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net income (loss) |

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

|

|

|

|

227,129 |

|

|

|

- |

|

|

|

227,129 |

|

|

|

(102,575 |

) |

|

|

124,554 |

|

| Appropriation of statutory

reserve |

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

40,339 |

|

|

|

(40,339 |

) |

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

| Foreign currency translation

adjustment |

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

(735,093 |

) |

|

|

(735,093 |

) |

|

|

2,352 |

|

|

|

(732,741 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Balance at September

30, 2023 |

|

4,440,085 |

|

|

$ |

44,401 |

|

|

$ |

5,123,941 |

|

|

$ |

907,869 |

|

|

$ |

6,604,632 |

|

|

$ |

(1,487,484 |

) |

|

$ |

11,193,359 |

|

|

$ |

1,228,437 |

|

|

$ |

12,421,796 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Balance at March 31,

2022 |

|

4,440,085 |

|

|

$ |

44,401 |

|

|

$ |

4,798,793 |

|

|

$ |

657,329 |

|

|

$ |

5,722,151 |

|

|

$ |

(1,190 |

) |

|

$ |

11,221,484 |

|

|

$ |

788,656 |

|

|

$ |

12,010,140 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Capital contribution |

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

42,174 |

|

|

|

42,174 |

|

| Net income (loss) |

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

921,007 |

|

|

|

- |

|

|

|

921,007 |

|

|

|

193,622 |

|

|

|

1,114,629 |

|

| Foreign currency translation

adjustment |

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

(1,027,437 |

) |

|

|

(1,027,437 |

) |

|

|

(16,687 |

) |

|

|

(1,044,124 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Balance at September

30, 2022 |

|

4,440,085 |

|

|

$ |

44,401 |

|

|

$ |

4,798,793 |

|

|

$ |

657,329 |

|

|

|

6,643,158 |

|

|

$ |

(1,028,627 |

) |

|

$ |

11,115,054 |

|

|

$ |

1,007,765 |

|

|

$ |

12,122,819 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| WAH FU

EDUCATION GROUP LIMITED AND SUBSIDIARIES |

| UNAUDITED

CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS |

| |

|

|

| |

For the six months

ended,September 30 |

|

| |

2023 |

|

|

2022 |

|

| Cash flows from

operating activities: |

|

|

|

|

|

|

Net Income |

$ |

124,554 |

|

|

$ |

1,056,489 |

|

| Adjustments to

reconcile net income to net cash provided by (used in) operating

activities: |

|

|

|

|

|

|

|

|

Depreciation and amortization |

|

37,158 |

|

|

|

81,492 |

|

|

Non-cash lease expense |

|

122,276 |

|

|

|

519,099 |

|

|

Loss from disposal of property and equipment |

|

- |

|

|

|

818 |

|

|

Provision for doubtful accounts |

|

194,014 |

|

|

|

19,658 |

|

|

Interest income from loan to third parties |

|

1,445 |

|

|

|

27,558 |

|

|

Deferred tax benefit |

|

- |

|

|

|

(31,120 |

) |

| Changes in operating

assets and liabilities: |

|

|

|

|

|

|

|

|

Accounts receivable, net |

|

(225,539 |

) |

|

|

(1,056,061 |

) |

|

Other receivable, net |

|

(33,407 |

) |

|

|

15,891 |

|

|

Other current assets |

|

(112,254 |

) |

|

|

(50,228 |

) |

|

Rent deposit |

|

- |

|

|

|

8,746 |

|

|

Deferred revenue |

|

(115,033 |

) |

|

|

(180,174 |

) |

|

Taxes payable |

|

(12,102 |

) |

|

|

281,809 |

|

|

Accounts payable |

|

(131,131 |

) |

|

|

- |

|

|

Other payable |

|

(1,551 |

) |

|

|

708 |

|

|

Operating lease liabilities |

|

58,915 |

|

|

|

(518,667 |

) |

|

Accrued expenses and other liabilities |

|

(7,708 |

) |

|

|

121,649 |

|

| Net cash provided by

(used in) operating activities |

|

(100,363 |

) |

|

|

297,667 |

|

| |

|

|

|

|

|

|

|

| Cash flows from

investing activities: |

|

|

|

|

|

|

|

| Purchase of property and

equipment |

|

- |

|

|

|

(4,205 |

) |

| Payments made for loans to

related party |

|

- |

|

|

|

- |

|

| Payments made for loans to

related party |

|

- |

|

|

|

(8,250 |

) |

| Payments made for loans to

third parties |

|

- |

|

|

|

(164,607 |

) |

| Net cash used in

investing activities |

|

- |

|

|

|

(177,062 |

) |

| |

|

|

|

|

|

|

|

| Cash flows from

financing activities: |

|

|

|

|

|

|

|

| Changes in due to related

parties |

|

- |

|

|

|

- |

|

| Capital contribution by

shareholders of non-controlling interest |

|

- |

|

|

|

42,174 |

|

| Net cash provided by

financing activities |

|

- |

|

|

|

42,174 |

|

| |

|

|

|

|

|

|

|

| Effect of exchange

rate fluctuation on cash |

|

(1,045,602 |

) |

|

|

(1,098,438 |

) |

| |

|

|

|

|

|

|

|

| Net decrease in

cash |

|

(1,145,965 |

) |

|

|

(935,659 |

) |

| Cash at beginning of

the period |

|

12,567,463 |

|

|

|

11,763,445 |

|

| Cash at end of the

period |

$ |

11,421,498 |

|

|

$ |

10,827,786 |

|

| |

|

|

|

|

|

|

|

| Supplemental cash flow

information |

|

|

|

|

|

|

|

| Cash paid for income

taxes |

$ |

(37,190 |

) |

|

$ |

(6,745 |

) |

|

|

|

|

|

|

|

|

|

| Non-cash financing

activities |

|

|

|

|

|

|

|

| Right of use assets obtained

in exchange for operating lease obligations |

$ |

200,115 |

|

|

$ |

766,584 |

|

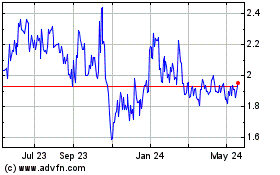

Wah Fu Education (NASDAQ:WAFU)

Historical Stock Chart

From Jan 2025 to Feb 2025

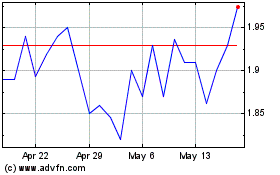

Wah Fu Education (NASDAQ:WAFU)

Historical Stock Chart

From Feb 2024 to Feb 2025