Energous Corporation (NASDAQ: WATT), a leading developer of

RF-based charging for wireless power networks, today announced

financial results for its first quarter ended March 31, 2023, and

provided an update on its partnership and regulatory

highlights.

Unaudited 2023 First-Quarter Financial Results

For the first quarter ended March 31, 2023, Energous

reported:

- Revenue of approximately $96,676, compared to $215,961 in the

2022 first quarter

- Costs and expenses of approximately $6.4 million, with

approximately $138,813 in cost of revenue, $3.1 million in research

and development, and $3.2 million in sales, marketing, general and

administrative expenses

- Net loss of approximately $(6.7) million, or $(0.08) per basic

and diluted share

- Adjusted net non-GAAP loss of approximately $(5.5) million

- Approximately $26.3 million in cash and cash equivalents at the

end of the first quarter, with no debt

Partnership Momentum

- Energous and InnoTractor — a European provider of IoT-based

solutions for logistics and supply chain applications to integrate

wireless power solutions for real-time asset tracking across

various industries witnessing significant IoT growth. The

partnership will integrate and deploy Energous’ PowerBridge

technology and Wiliot’s IoT Pixel tags, providing customers with a

solution featuring lower costs, increased mobility and improved

sustainability.

- Energous and Thinaer — a leading industrial IoT SaaS platform

provider to incorporate Energous' wireless power transfer

technology as part of a joint offering to help organizations

improve efficiency, reduce costs, and enhance outcomes in various

settings, including industrial manufacturing and warehousing.

- Energous and LIXIL — a maker of pioneering water and housing

products is working to combine Energous’ WattUp wireless power

transfer technology and its suite of housing technology, including

IoT home solutions, to deliver a joint solution that removes the

need for battery maintenance via reliable and consistent power

delivered wirelessly.

- Energous and SATO — a global pioneer in auto-ID and labelling

solutions partnering to develop joint solutions that combine

Energous’ 1W WattUp PowerBridge transmitters with IoT solutions for

next-generation smart store applications.

- Energous and Catapult — the global leader in sports technology

solutions for elite teams, has created the football of the future

with an embedded tracker that can charge wirelessly, providing the

data precision that Catapult customers expect from its wearables

and video solutions.

- Energous and amsOSRAM — a global leader in optical solutions is

collaborating on a wirelessly powered multi-spectral light sensor

for Controlled-Environment Agriculture (CEA) and vertical farming.

The joint solution is based on the multi-channel AS7343 spectral

sensor from ams OSRAM and the WattUp PowerBridge from

Energous.

Regulatory Progress

- Energous’1W WattUp PowerBridge has been approved by Japan’s

regulatory body for unlimited power distance transmission. This

enables Energous to deploy its active energy harvesting technology

throughout the technologically advanced Japanese market.

- AirFuel RF, the radio frequency-based wireless charging

technology from AirFuel Alliance, was established as an industry

standard to further support the growing power needs of the rapidly

expanding IoT ecosystem of devices such as sensors, smart tags,

asset trackers and other IoT applications. Representatives of

Energous have served on the AirFuel Alliance board of directors

since 2016 and have supported the development of this new industry

standard.

“Energous continues to gain momentum for its solutions with a

number of new partnerships and proof of concept deployments as its

solutions are recognized as supporting the rapid deployment of IoT

devices,” said Cesar Johnston, CEO of Energous. “The adoption of

the AirFuel RF standard and the increased international

certification of our devices will ensure that we are at the

forefront of this significant technological change.”

2023 First-Quarter Conference Call

Energous will host a conference call to discuss first-quarter

financial results, recent progress and prospects for the

future.

- When: Wednesday, May 10, 2023

- Time: 1:30 p.m. PT (4:30 p.m. ET)

- Phone: 888-317-6003 (domestic); +1 412-317-6061

(international)

- Participant entry #: 3588640

- Conference replay: Accessible through May 24, 2023

877-344-7529 (domestic); +1 412-317-0088 (international); passcode

9312029

- Webcast: Accessible at Energous.com; archive available

through May 2024

About Energous Corporation

Energous Corporation (Nasdaq: WATT) is leading the advancement

of Wireless Power Networks to meet the growing power demands of

today’s devices and tomorrow’s innovations. Its award-winning,

RF-based WattUp® technology is the only solution that supports both

near field and at-a-distance wireless power, enabling flexible

device designs without cumbersome power cables or replaceable

batteries. Energous develops silicon-based wireless power transfer

(WPT) technologies and customizable reference designs for the

expanding ecosystem of devices within industrial and retail IoT,

smart homes, smart cities, and medical applications. The company

has received the world’s first FCC Part 18 certification for

at-a-distance WPT and has been awarded more than 200 patents for

its WattUp® technology.

Forward-Looking Statements

This press release contains “forward-looking statements” within

the meaning of the Securities Act of 1933, as amended, the

Securities Exchange Act of 1934, as amended, and the safe-harbor

provisions of the Private Securities Litigation Reform Act of 1995.

All statements other than statements of historical fact included in

this press release are forward-looking statements. Forward-looking

statements may describe our future plans and expectations and are

based on the current beliefs, expectations and assumptions of

Energous. These statements generally use terms such as “believe,”

“expect,” “may,” “will,” “should,” “could,” “seek,” “intend,”

“plan,” “estimate,” “anticipate” or similar terms. Examples of

forward-looking statements in this release include but are not

limited to statements about our financial results and projections,

statements about the success of our collaborations with our

partners, statements about any governmental approvals we may need

to operate our business, statements about our technology and its

expected functionality, and statements with respect to expected

company growth. Factors that could cause actual results to differ

from current expectations include: uncertain timing of necessary

regulatory approvals; timing of customer product development and

market success of customer products; our dependence on distribution

partners; and intense industry competition. We urge you to consider

those factors, and the other risks and uncertainties described in

our most recent annual report on Form 10-K as filed with the

Securities and Exchange Commission (SEC), any subsequent quarterly

reports on Form 10-Q as well as in other documents that may be

subsequently filed by Energous, from time to time, with the SEC, in

evaluating our forward-looking statements. In addition, any

forward-looking statements represent Energous’ views only as of the

date of this release and should not be relied upon as representing

its views as of any subsequent date. Energous does not assume any

obligation to update any forward-looking statements unless required

by law.

Non-GAAP Financial Measures

We have provided in this release financial information that has

not been prepared in accordance with accounting standards generally

accepted in the United States of America (“GAAP”). We use these

non-GAAP financial measures internally in analyzing our financial

results and believe they are useful to investors, as a supplement

to GAAP measures, in evaluating our ongoing operational

performance. We believe that the use of these non-GAAP financial

measures provides an additional tool for investors to use in

evaluating ongoing operating results and trends, and in comparing

our financial results with other companies in our industry, many of

which present similar non-GAAP financial measures to investors.

Non-GAAP financial measures should not be considered in

isolation from, or as a substitute for, financial information

prepared in accordance with GAAP. Investors are encouraged to

review the reconciliation of these non-GAAP financial measures to

their most directly comparable GAAP financial measures below.

Our reported results include certain non-GAAP financial

measures, including non-GAAP net loss, non-GAAP costs and expenses,

non-GAAP sales, marketing, general and administrative expenses

(SG&A) and non-GAAP research and development expenses

(R&D). Non-GAAP net loss excludes depreciation and

amortization, stock-based compensation expense and offering

expenses relating to warrant liability. Non-GAAP costs and expenses

excludes depreciation and amortization and stock-based compensation

expense. Non-GAAP SG&A excludes depreciation and amortization

and stock-based compensation expense. Non-GAAP R&D excludes

depreciation and amortization and stock-based compensation expense.

A reconciliation of our non-GAAP financial measures to their most

directly comparable GAAP measures has been provided in the

financial statement tables included below in this press

release.

Energous Corporation BALANCE SHEETS

(Unaudited) As of March 31, 2023 December 31, 2022

ASSETS Current assets: Cash and cash equivalents

$

26,339,960

$

26,287,293

Accounts receivable, net

100,935

143,353

Inventory

71,597

105,821

Prepaid expenses and other current assets

649,479

827,551

Total current assets

27,161,971

27,364,018

Property and equipment, net

383,238

429,035

Right-of-use lease asset

1,778,512

1,959,869

Total assets

$

29,323,721

$

29,752,922

LIABILITIES AND STOCKHOLDERS' EQUITY Current

liabilities: Accounts payable

$

1,351,018

$

900,765

Accrued expenses

1,370,046

1,790,414

Accrued severance

249,610

416,516

Warrant liability

3,135,000

-

Operating lease liabilities, current portion

702,780

705,894

Deferred revenue

35,891

29,727

Total current liabilities

6,844,345

3,843,316

Operating lease liabilities, long-term portion

1,090,639

1,264,131

Total liabilities

7,934,984

5,107,447

Stockholders’ equity: Preferred Stock, $0.00001 par value,

10,000,000 shares authorized at March 31, 2023 and December 31,

2022; no shares issued or outstanding.

-

-

Common Stock, $0.00001 par value, 200,000,000 shares authorized at

March 31, 2023 and

December 31, 2022; 91,032,030 and

78,944,954 shares issued and outstanding at

March 31, 2023 and December 31,

2022, respectively.

911

789

Additional paid-in capital

390,715,632

387,319,985

Accumulated deficit

(369,327,806

)

(362,675,299

)

Total stockholders’ equity

21,388,737

24,645,475

Total liabilities and stockholders’ equity

$

29,323,721

$

29,752,922

Energous Corporation STATEMENTS OF OPERATIONS

(Unaudited) For the Three Months Ended March 31,

2023

2022

Revenue

$

96,676

$

215,961

Costs and expenses: Cost of revenue

138,813

203,249

Research and development

3,078,524

3,527,146

Sales and marketing

1,211,938

1,613,590

General and administrative

1,961,460

2,027,520

Total costs and expenses

6,390,735

7,371,505

Loss from operations

(6,294,059

)

(7,155,544

)

Other (expense) income: Offering costs related to warrant

liability

(591,670

)

-

Interest income

233,222

2,826

Total

(358,448

)

2,826

Net loss

$

(6,652,507

)

$

(7,152,718

)

Basic and diluted net loss per common share

$

(0.08

)

$

(0.09

)

Weighted average shares outstanding, basic and diluted

81,408,347

76,930,919

Energous Corporation Reconciliation of Non-GAAP

Information (Unaudited) For the Three Months

Ended March 31,

2023

2022

Net loss (GAAP)

$

(6,652,507

)

$

(7,152,718

)

Add (subtract) the following items: Depreciation and amortization

45,797

70,119

Stock-based compensation

522,077

796,906

Offering costs related to warrant liability

591,670

-

Adjusted net non-GAAP loss

$

(5,492,963

)

$

(6,285,693

)

Total costs and expenses (GAAP)

$

6,390,735

$

7,371,505

Subtract the following items: Depreciation and amortization

(45,797

)

(70,119

)

Stock-based compensation

(522,077

)

(796,906

)

Adjusted non-GAAP costs and expenses

$

5,822,861

$

6,504,480

Total research and development expenses (GAAP)

$

3,078,524

$

3,527,146

Subtract the following items: Depreciation and amortization

(42,757

)

(37,683

)

Stock-based compensation

(208,731

)

(353,043

)

Adjusted non-GAAP research and development expenses

$

2,827,036

$

3,136,420

Total sales, marketing, general and administrative

expenses (GAAP)

$

3,173,398

$

3,641,110

Subtract the following items: Depreciation and amortization

(3,040

)

(32,436

)

Stock-based compensation

(313,346

)

(443,863

)

Adjusted non-GAAP sales, marketing, general and administrative

expenses

$

2,857,012

$

3,164,811

View source

version on businesswire.com: https://www.businesswire.com/news/home/20230510006014/en/

Energous Investor Relations: Padilla IR

IR@energous.com

Energous Corporate Communications: SHIFT COMMUNICATIONS

energous@shiftcomm.com

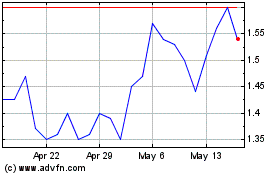

Energous (NASDAQ:WATT)

Historical Stock Chart

From Oct 2024 to Nov 2024

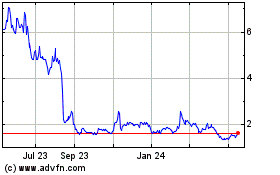

Energous (NASDAQ:WATT)

Historical Stock Chart

From Nov 2023 to Nov 2024