SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

REPORT OF FOREIGN PRIVATE ISSUER

Pursuant to Rule 13a-16 or 15d-16

under the Securities Exchange Act of 1934

For the month of November 2023

Commission File Number

001-40554

Eco Wave Power Global AB (publ)

(Translation of registrant’s name into

English)

52 Derech Menachem Begin St.

Tel Aviv – Yafo, Israel 6713701

(Address of principal executive offices)

Indicate by check mark whether the registrant files or will file annual

reports under cover Form 20-F or Form 40-F.

Form 20-F ☒ Form

40-F ☐

CONTENTS

On November 30, 2023, Eco Wave Power Global AB (publ) (“Eco Wave

Power”) issued a press release titled “Eco Wave Power: Q3 sees a significant net loss decrease, with new orders increasing

Q4 revenues. Progress in Israel, U.S., and Portugal’s commercial installation,” a copy of which is furnished as Exhibit 99.1

with this Report of Foreign Private Issuer on Form 6-K.

The first eight

paragraphs, the section titled “First Nine Months 2023 Financial Overview”, and the section titled

“Forward-Looking Statements” in the press release furnished as Exhibit 99.1 hereto are incorporated by reference

into the Company’s Registration Statement on Form F-3 (Registration No. 333-275728)

filed with the Securities and Exchange Commission to be a part thereof from the date on which this Report of Foreign Private Issuer

on Form 6-K is submitted, to the extent not superseded by documents or reports subsequently filed or furnished.

SIGNATURES

Pursuant to the requirements of the Securities

Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| |

Eco Wave Power Global AB (publ) |

| |

|

|

| |

By: |

/s/ Inna Braverman |

| |

|

Name: |

Inna Braverman |

| |

|

Title: |

Chief Executive Officer |

Date: November 30, 2023

2

Exhibit 99.1

Eco

Wave Power: Q3 sees a significant net loss decrease, with new orders increasing Q4 revenues.

Progress

in Israel, U.S., and Portugal’s commercial installation.

Stockholm,

Sweden, November 30, 2023 – Eco Wave Power Global AB (publ) (“Eco Wave Power” or the “Company”) (Nasdaq:

WAVE), a leading, publicly traded onshore wave energy technology company that has developed a patented, smart and cost-efficient technology

for turning ocean and sea waves into green electricity, is pleased to report its financial results as of and for the three and nine months

ended September 30, 2023 and provide a corporate update.

Management

Commentary

During

the third quarter of 2023, we achieved several key milestones:

| ● | In

Israel, we successfully connected the EWP EDF One Project in the Port of Jaffa to the national

electrical grid. We have also performed an initial grid connection test, which effectively

supplied electricity extracted from the power of the waves to the Israeli national electric

grid for the very first time. Currently, our focus is on upgrading the power plants’

automation system to enable optimal electricity production and supply to the grid. Additionally,

we were awarded a GREENinMED grant from the European Union as part of the ENI CBC Mediterranean

Sea Basin Programme. This grant is intended to enhance Eco Wave Power’s energy station

by integrating educational features. This funding will support the creation and installation

of unique educational experiences, transforming the EDF-EWP One wave energy power station

into a distinctive tourist attraction and showcasing Israeli innovation. |

| ● | Moreover,

on September 22nd, 2023, Eco Wave Power was notified that a consortium of which

we are a part won a UK grant in the total amount of GBP 1,499,644 (approximately $1.83 million),

out of which Eco Wave Power share will be GBP 456,500 (approximately $558 thousand). The

grant amount Eco Wave Power will be eligible for is GBP 319,550 (approximately $390,905). |

| ● | At

the Port of Los Angeles, we are proceeding with the licensing for the installation of our

first U.S.-based project. Recently, a local engineering firm examined the integrity of the

jetty and approved our construction design and assembly plans for the floaters to be installed

on the jetty. With this approval, we submitted our comprehensive project plan to the port

authorities and made a request for the final necessary licenses from the Port of Los Angeles

and the Army Corps of Engineers. In addition, in the beginning of October 2023, California

Governor Gavin Newsom signed California Senate Bill 605 (“SB 605”) into law –

a historic moment for wave energy in America. The legislation directs the California Energy

Commission to evaluate the feasibility of wave and tidal energy in California, including

the costs and benefits of implementing the technology along the state’s coastline.

This legislative initiative aligns with California’s goal of achieving a carbon-free

energy grid by 2045. SB 605 recognizes the potential of wave and tidal energy to provide

economic and environmental benefits and is expected to assist in our project’s progress

and advance other potential projects in the U.S. |

| ● | In

Portugal, we received the last approval necessary for the commencement of the works of our

first megawatt (MW) in the city of Porto (TURH license). The next steps include finalizing

detailed construction plans for the first 1 MW power plan to be followed by commencing actual

construction, which is expected to take up to 24 months. The Portuguese project is expected

to be Eco Wave Power’s first MW scale project, which will position Eco Wave Power as

a leading wave energy developer and serve as a significant milestone towards the commercialization

of wave energy globally. |

| ● | With

respect to our new collaborations, as previously announced in Q2 report, we would like to

update that our collaboration with Lian Tat Company (LTC) in Taiwan is progressing as planned.

In October, the president of Taiwan visited LTC’s exhibition of Eco Wave Power’s

technology in the Taipei Nangang International Exhibition Center and announced that the Taiwanese

government will actively promote the development of forward-looking renewable energy, such

as wave power. Eco Wave Power and LTC are currently working towards EWP’s official

visit to Taiwan and towards finding a first location for their planned joint wave energy

pilot. |

| ● | With

the potential project in the port of Heraklion, Greece, Eco Wave Power has finalized the

feasibility studies for the implementation of our technology in the port, in collaboration

with Rogan Associates. The parties are currently working towards applying for a grant from

the European Union to fund the execution of a 2MW wave energy project. In parallel, we have

finalized feasibility studies for the implementation of Eco Wave Power’s technology

on a breakwater in Morocco and on Chevron Corp’s offshore gas drilling platform in

Israel. We have also commenced a new feasibility study, funded by a large-scale U.S. energy

company, for wave energy potential in the U.S. and around strategic locations around the

globe. |

| ● | At

the same time, the Company has shown a significant decrease in its Net Financial Loss for

the 9 months of 2023, where Net loss was $1,052,000, compared to a net loss of $2,011,000,

in the same period last year. , while announcing new orders, which will be recognized as

revenues in the fourth quarter of 2023. |

“Although

in these challenging times Eco Wave Power has prioritized the well-being of our employees in Israel, we have also stayed extremely focused

on the continuity of our business growth and goals. We are proud to share that during the third quarter of 2023, we have made significant

progress with all our existing projects while adding new projects and collaborations to our pipeline,

In

the third quarter of 2023, Eco Wave Power officially commenced the test-run operation of our power station in the Port of Jaffa, Israel

and is finalizing a civil engineering design that is getting us closer to the deployment of our first project in the Port of Los Angeles.

In addition, by securing the final requisite license for our first MW scale project in Portugal, we are striding with confidence towards

our first commercial scale project in Porto, Portugal.

In

parallel, we have also finalized feasibility studies for an installation of EWP’s innovative technology in a port in Morocco, on

a gas drilling platform in Israel, and a feasibility study for a first of its kind 2MW project in the Port of Heraklion in Greece. We

have also commenced a new feasibility study, ordered by a large scale US energy company, to examine wave energy potential in the U.S.

and around the globe.

Now,

more than ever, we remain strong, resilient, and deeply committed to advancing our wave energy projects.

First

Nine Months 2023 Financial Overview

| ● | For

the nine months ended September 30, 2023, revenues were $27,000 compared to $26,000 in the

same period last year. |

| ● | Operating

expenses were $1.9 million, down by 33% from the same period last year. |

| ● | Research

and development (“R&D”) expenses were $383,000 compared to $755,000 in the

same period last year. R&D costs decreased mainly due to a one off non-recurring loss

of $278,000 pertaining to the disposal of the floater mechanisms of the Gibraltar wave energy

array in 2022 and due to the relocation of the Gibraltar conversion unit to the Port of Los

Angeles. Although our R&D expenses have significantly decreased during the last nine

months, we expect our R&D expenses to materially increase due to the finalization of

the EWP-EDF One project, the planned implementation of our first U.S. project in the Port

of Los Angeles, and the implementation of our first commercial scale project in Portugal. |

| ● | Sales

and marketing expenses were $262,000 compared to $435,000 in the same period last year. Although

our expenses have significantly decreased during the first nine months period, we expect

that our sales and marketing expenses will materially increase as we add more projects to

our project pipeline, which will result in the need for marketing in new areas of operation. |

| ● | General

and administrative expenses were $1,217,000 compared to $1,610,000 in the same period last

year. Although our general and administrative expenses have significantly decreased during

the first nine months period, we expect that our general and administrative expenses will

materially increase as we grow our operations, specifically in terms of employee headcount,

professional support and legal costs due to the finalization of the EWP-EDF One project,

the planned implementation of our first U.S. project in the Port of Los Angeles, and the

implementation of our first commercial scale project in Portugal. |

| ● | Other

income of $14,000 was generated mainly from management fees in a joint venture. |

| ● | Share

of net loss of the EWP EDF One Project accounted for using the equity method for the nine

months ended September 30, 2023 was $14,000. |

| ● | Operating

loss was $1.9 million compared to $2.8 million in the same period last year. |

| ● | Net

financial income was $802,000, compared to $783,000 in the same period last year. |

| ● | Net

loss was $1,052,000, or $0.02 per basic and diluted share, compared to a net loss of $2,011,000,

or $0.05 per basic and diluted share in the same period last year. |

| ● | The

Company ended the period with $3.7 million in cash and cash equivalents and $5.1 million

in short term bank deposits, compared to $5.3 million and $5 million, respectively, as of

December 31, 2022. |

Conference

Call and Webcast Information

The

Chief Executive Officer of Eco Wave Power, Inna Braverman will host a conference call to discuss the financial results and outlook on

Tuesday, December 5, 2023, at 5 p.m. Eastern time.

| |

● |

The dial-in numbers for the conference call are 888-506-0062 (toll-free) or 973-528-0011. |

If

requested, please provide participant access code: 802479

| |

● |

The event will be webcast live, available at: https://www.webcaster4.com/Webcast/Page/2922/49564 |

A

replay will be available by telephone approximately four hours after the call’s completion until Tuesday, December 19, 2022. You

may access the replay by dialing 877-481-4010 from the U.S. or 919-882-2331 for international callers, using the Replay ID 49564. The

archived webcast will also be available on the investor relations section of the Company’s website.

About

Eco Wave Power Global AB (publ)

Eco

Wave Power is a leading onshore wave energy technology company that developed a patented, smart and cost-efficient technology for turning

ocean and sea waves into green electricity. Eco Wave Power’s mission is to assist in the fight against climate change by enabling

commercial power production from the ocean and sea waves.

The

Company completed construction of its grid connected project in Israel, with co-investment from the Israeli Energy Ministry, which recognized

the Eco Wave Power technology as “Pioneering Technology.” The EWP-EDF One station project marks the first grid-connected

wave energy system in Israeli history.

Eco

Wave Power will soon commence the installation of its newest pilot in AltaSea’s premises in the Port of Los Angeles and its first

MW scale wave energy power station in Portugal, Europe.

The

Company also holds concession agreements for commercial installations in Europe and has a total projects pipeline of 404.7 MW.

Eco

Wave Power received funding from the European Union Regional Development Fund, Innovate UK and the European Commission’s Horizon

2020 framework program. The Company has also received the “Global Climate Action Award” from the United Nations.

Eco

Wave Power’s American Depositary Shares (WAVE) are traded on the Nasdaq Capital Market.

Read

more about Eco Wave Power at www.ecowavepower.com

Information

on, or accessible through, the websites mentioned above does not form part of this press release.

For

more information, please contact:

Inna

Braverman, CEO

Inna@ecowavepower.com

+97235094017

Forward-Looking

Statements

This

press release contains forward-looking statements within the meaning of the “safe harbor” provisions of the U.S. Private

Securities Litigation Reform Act of 1995 and other Federal securities laws. For example, the Company is using forward-looking statements

in this press release when it discusses the prospective use of the UK grant, that SB 605 is expected to assist the progress of its projects

and advance other potential projects in the U.S, the next steps in the Portugal project and the expected timing thereof, the potential

project in Morocco, that the LTC project is expected to create several economic benefits, the impending application for a grant to facilitate

the project in Heraklion, Greece, the expected recognition of new orders as revenues in the fourth quarter of 2023, and the Company’s

expectation that its research and development, sales and marketing and general and administrative expenses to materially increase, and

the Company’s planned conference call to discuss these financial results. Forward-looking statements can be identified by words

such as: “anticipate,” “intend,” “plan,” “goal,” “seek,” “believe,”

“project,” “estimate,” “expect,” “strategy,” “future,” “likely,”

“may,” “should,” “will”, or variations of such words, and similar references to future periods. These

forward-looking statements and their implications are neither historical facts nor assurances of future performance and are based on

the current expectations of the management of Eco Wave Power and are subject to a number of factors, uncertainties and changes in circumstances

that are difficult to predict and may be outside of Eco Wave Power’s control that could cause actual results to differ materially

from those described in the forward-looking statements. Therefore, you should not rely on any of these forward-looking statements. Except

as otherwise required by law, Eco Wave Power undertakes no obligation to publicly release any revisions to these forward-looking statements

to reflect events or circumstances after the date hereof or to reflect the occurrence of unanticipated events. More detailed information

about the risks and uncertainties affecting Eco Wave Power is contained under the heading “Risk Factors” in Eco Wave Power’s

Annual Report on Form 20-F for the fiscal year ended December 31, 2022 filed with the SEC on April 27, 2023, which is available on the

on the SEC’s website, www.sec.gov, and other documents filed or furnished to the SEC. Any forward-looking statement made in this

press release speaks only as of the date hereof. References and links to websites have been provided as a convenience and the information

contained on such websites is not incorporated by reference into this press release.

Eco

Wave Power Global AB (publ)

CONDENSED

CONSOLIDATED STATEMENTS OF FINANCIAL POSITION (Unaudited)

| | |

September 30

2023 | | |

December 31

2022 | |

| | |

In USD thousands | |

| Assets | |

| | |

| |

| CURRENT ASSETS: | |

| | |

| |

| Cash and cash equivalents | |

| 3,674 | | |

| 5,295 | |

| Short Term Bank Deposits | |

| 5,108 | | |

| 5,000 | |

| Restricted short-term bank deposits | |

| 59 | | |

| 63 | |

| Other receivables and prepaid expenses | |

| 211 | | |

| 161 | |

| TOTAL CURRENT ASSETS | |

| 9,052 | | |

| 10,519 | |

| | |

| | | |

| | |

| NON-CURRENT ASSETS: | |

| | | |

| | |

| Property and equipment, net | |

| 642 | | |

| 722 | |

| Right-of-use assets, net | |

| 105 | | |

| 166 | |

| Investments in a joint venture accounted for using the equity method | |

| 496 | | |

| 510 | |

| TOTAL NON-CURRENT ASSETS | |

| 1,243 | | |

| 1,398 | |

| TOTAL ASSETS | |

| 10,295 | | |

| 11,917 | |

| | |

| | | |

| | |

| Liabilities and equity | |

| | | |

| | |

| CURRENT LIABILITIES: | |

| | | |

| | |

| Current maturities of long-term loans from related party | |

| 966 | | |

| 941 | |

| Current maturities of other long-term loan | |

| 65 | | |

| 32 | |

| Accounts payable and accruals: | |

| | | |

| | |

| Trade | |

| 87 | | |

| 75 | |

| Other | |

| 879 | | |

| 733 | |

| Current maturities of lease liabilities | |

| 90 | | |

| 78 | |

| TOTAL CURRENT LIABILITIES | |

| 2,087 | | |

| 1,859 | |

| | |

| | | |

| | |

| NON-CURRENT LIABILITIES: | |

| | | |

| | |

| Other long-term loan | |

| 67 | | |

| 96 | |

| Lease liabilities, net of current maturities | |

| 15 | | |

| 88 | |

| TOTAL NON-CURRENT LIABILITIES | |

| 82 | | |

| 184 | |

| | |

| | | |

| | |

| TOTAL LIABILITIES | |

| 2,169 | | |

| 2,043 | |

| | |

| | | |

| | |

| EQUITY: | |

| | | |

| | |

| Common shares | |

| 98 | | |

| 98 | |

| Share premium | |

| 23,121 | | |

| 23,121 | |

| Foreign currency translation reserve | |

| (2,754 | ) | |

| (2,061 | ) |

| Accumulated deficit | |

| (12,338 | ) | |

| (11,284 | ) |

| TOTAL EQUITY | |

| 8,126 | | |

| 9,874 | |

| TOTAL LIABILITIES AND EQUITY | |

| 10,295 | | |

| 11,917 | |

Eco

Wave Power Global AB (publ)

CONDENSED

CONSOLIDATED STATEMENTS OF LOSS (Unaudited)

| | |

Three months ended | | |

Nine months ended | |

| | |

September 30 | | |

September 30 | |

| | |

2023 | | |

2022 | | |

2023 | | |

2022 | |

| | |

In USD thousands | | |

In USD thousands | |

| REVENUES | |

| 27 | | |

| - | | |

| 27 | | |

| 26 | |

| COST OF REVENUES | |

| 19 | | |

| - | | |

| 19 | | |

| (22 | ) |

| GROSS PROFIT | |

| 8 | | |

| - | | |

| 8 | | |

| 4 | |

| OPERATING EXPENSES | |

| | | |

| | | |

| | | |

| | |

| Research and development expenses | |

| (60 | ) | |

| (120 | ) | |

| (383 | ) | |

| (755 | ) |

| Sales and marketing expenses | |

| (69 | ) | |

| (135 | ) | |

| (262 | ) | |

| (435 | ) |

| General and administrative expenses | |

| (363 | ) | |

| (424 | ) | |

| (1,217 | ) | |

| (1,610 | ) |

| Other income | |

| 5 | | |

| 3 | | |

| 14 | | |

| 18 | |

| Share of net loss of a joint venture accounted for using

the equity method | |

| (4 | ) | |

| (6 | ) | |

| (14 | ) | |

| (16 | ) |

| TOTAL OPERATING EXPENSES | |

| (491 | ) | |

| (682 | ) | |

| (1,862 | ) | |

| (2,798 | ) |

| | |

| | | |

| | | |

| | | |

| | |

| OPERATING LOSS | |

| (483 | ) | |

| (682 | ) | |

| (1,854 | ) | |

| (2,794 | ) |

| | |

| | | |

| | | |

| | | |

| | |

| Financial expenses | |

| (15 | ) | |

| (11 | ) | |

| (41 | ) | |

| (42 | ) |

| Financial income | |

| 305 | | |

| 113 | | |

| 843 | | |

| 825 | |

| FINANCIAL INCOME (EXPENSES) - NET | |

| 290 | | |

| 102 | | |

| 802 | | |

| 783 | |

| | |

| | | |

| | | |

| | | |

| | |

| NET LOSS | |

| (193 | ) | |

| (580 | ) | |

| (1,052 | ) | |

| (2,011 | ) |

| | |

| | | |

| | | |

| | | |

| | |

| ATTRIBUTABLE TO: | |

| | | |

| | | |

| | | |

| | |

| The parent company shareholders | |

| (193 | ) | |

| (580 | ) | |

| (1,052 | ) | |

| (2,011 | ) |

| | |

| (193 | ) | |

| (580 | ) | |

| (1,052 | ) | |

| (2,011 | ) |

| | |

| | | |

| | | |

| | | |

| | |

| | |

| In USD | |

| | |

| | | |

| | | |

| | | |

| | |

| LOSS PER COMMON SHARE – BASIC AND DILUTED | |

| (0.004 | ) | |

| (0.01 | ) | |

| (0.02 | ) | |

| (0.05 | ) |

| | |

| | | |

| | | |

| | | |

| | |

| WEIGHTED AVERAGE NUMBER OF COMMON SHARES USED IN CALCULATION OF LOSS PER COMMON SHARE | |

| 44,394,844 | | |

| 44,394,844 | | |

| 44,394,844 | | |

| 44,394,844 | |

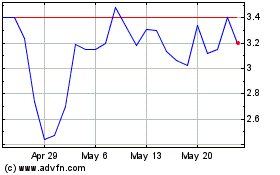

Eco Wave Power Global AB (NASDAQ:WAVE)

Historical Stock Chart

From Dec 2024 to Jan 2025

Eco Wave Power Global AB (NASDAQ:WAVE)

Historical Stock Chart

From Jan 2024 to Jan 2025