0001360565

false

0001360565

2023-08-10

2023-08-10

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

WASHINGTON,

D.C. 20549

FORM

8-K

CURRENT

REPORT

Pursuant

to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date

of Report (Date of earliest event reported): August 10, 2023

WHERE

FOOD COMES FROM, INC.

(Exact

Name of Registrant as Specified in its Charter)

| Colorado |

|

001-40314 |

|

43-1802805 |

(State

or Other Jurisdiction

of

Incorporation) |

|

(Commission

File

Number) |

|

(I.R.S.

Employer

Identification No.) |

| 202

6th Street, Suite 400 |

|

|

| Castle

Rock, Colorado |

|

80104 |

| (Address

of Principal Executive Offices) |

|

(Zip

Code) |

(303)

895-3002

(Registrant’s

Telephone Number, Including Area Code)

Not

applicable

(Former

name or former address, if changed since last report.)

Check

the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under

any of the following provisions:

| ☐ |

Written

communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

|

| ☐ |

Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

|

| ☐ |

Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

|

| ☐ |

Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities

registered pursuant to Section 12(b) of the Act:

| Title

of each class |

|

Trading

Symbol(s) |

|

Name

of each exchange on which registered |

| Common

Stock, $0.001 par value |

|

WFCF |

|

The

NASDAQ Stock Market LLC |

| Item

2.02 |

Results

of Operations and Financial Condition |

Reference

is made to the Where Food Comes From, Inc. (the “Company”) press release on August 10, 2023 and conference call transcript,

attached hereto as Exhibits 99.1 and 99.2, respectively, and incorporated by reference herein (including, without limitation, the information

set forth in the cautionary statement contained in the press release and conference call transcript), relating to the Company’s

financial results for the three and six month period ended June 30, 2023.

| Item

9.01 |

Financial

Statements and Exhibits |

SIGNATURE

Pursuant

to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by

the undersigned hereunto duly authorized.

| |

WHERE

FOOD COMES FROM, INC.

(Registrant) |

| |

|

| |

By:

|

/s/

Dannette Henning |

| Date:

August 14, 2023 |

|

Dannette

Henning |

| |

|

Chief

Financial Officer |

Exhibit 99.1

Where Food Comes From,

Inc. Reports 2023 Second Quarter Financial Results

Second Quarter Highlights – 2023 vs. 2022

| |

● |

Revenue increased 15% to $6.1 million from $5.3 million |

| |

|

|

| |

● |

Net income increased 140% to $532,000 from $222,000 |

| |

|

|

| |

● |

Diluted EPS of $0.09 vs. $0.04 |

| |

|

|

| |

● |

Adjusted EBITDA increased 61% to $917,000 from $570,000 |

| |

|

|

| |

● |

Company buys back $836,000 of its stock in Q2, or 61,000 shares at average price of $13.70 per share |

Six-Month Highlights – 2023 vs. 2022

| |

● |

Revenue decreased 1% to $11.4 million from $11.5 million based on anomalous Q1 events |

| |

|

|

| |

● |

Net income of $653,000 vs. $719,000 |

| |

|

|

| |

● |

Diluted EPS of $0.11 vs. $0.12 |

| |

|

|

| |

● |

Adjusted EBITDA of $1.3 million vs. $1.5 million |

| |

|

|

| |

● |

Cash generated from operations declined to $1.3 million from $2.3 million |

| |

|

|

| |

● |

Cash & cash equivalents at $3.4 million vs. $4.4 million at 2022 year-end, reflecting impact of stock buybacks |

| |

|

|

| |

● |

Company buys back more than $2.0 million of its stock through first six months of 2023 |

CASTLE ROCK, Colo., Aug. 10, 2023 (GLOBE NEWSWIRE)

— Where Food Comes From, Inc. (WFCF) (Nasdaq: WFCF), the most trusted resource for independent, third-party verification of food

production practices in North America, today announced financial results for its second quarter and six-month period ended June 30, 2023.

“We are pleased to announce a solid second quarter

highlighted by 15% revenue growth, a 140% increase in net income and 61% growth in adjusted EBITDA,” said John Saunders, chairman

and CEO. “This strong performance underscores the resiliency of our company following a challenging first quarter in which we encountered

several anomalous events that impacted both revenue and profitability. While we continue to deal with the effects of inflationary pressures

and cyclical cattle trends, we are confident in our ability to drive long-term growth and profitability based on the broad scope of our

product and service offerings combined and high customer retention rates. Accordingly, we continued our aggressive share repurchase program

in the second quarter and, over the past 10 quarters, have returned a total of $7.5 million in value to stockholders through share buybacks

and one special dividend.

“We also made important additions to our industry-leading

solutions portfolio in the first half of 2023,” Saunders added. “In the second quarter we were named exclusive third-party

verifier for the Bee Friendly Farming® Certification, a fast-growing program that supports farmers and ranchers implement regenerative

practices to protect and promote pollinators. That followed our first quarter announcement that WFCF customer Certified Piedmontese Beef

became the first brand to be certified to PaleoFLEX™, a Paleo Diet standard that is exclusively administered by Where Food Comes

From. We now certify to 56 different standards – by far the most comprehensive solutions set in the industry – and have the

unique ability to bundle multiple certifications to drive incremental revenue while reducing overall costs for our customers.”

Second Quarter Results – 2023 vs. 2022

Revenue in the second quarter ended June 30, 2023, increased 15% year over year to $6.1 million from $5.3 million.

Revenue mix included:

| |

● |

Verification and certification services, up 21% to $4.8 million from $4.0 million. |

| |

● |

Product revenue, up 7% to $0.94 million from $0.88 million. |

| |

● |

Consulting revenue, down 16% to $0.4 million from $0.5 million. |

Gross profit in the second quarter increased 18% year over year to $2.5

million from $2.1 million.

Selling, general and administrative expense was flat year over year at

$1.8 million.

Operating income increased 115% to $0.7 million from $0.3 million in the

same quarter last year.

Net income increased 140% year over year to $532,000, or $0.09 per diluted

share, from $222,000, or $0.04 per diluted share.

Adjusted EBITDA in the second quarter was up 61% to $917,000 from $570,000.

The Company bought back approximately $836,000 of its common stock in the

second quarter, or 61,000 shares at an average price of $13.70 per share.

Six Month Results – 2023 vs. 2022

Total revenue in the first half of 2023 decreased 1% to $11.4 million from $11.5 million in the same period last year.

Revenue mix included:

| |

● |

Verification and certification services, up 11% to $8.6 million from $7.7 million. |

| |

● |

Product revenue was flat at $1.9 million. |

| |

● |

Consulting revenue, down 52% year over year to $0.9 million from $1.9 million, due primarily to execution of a large, non-recurring project with a Japanese government entity in the first quarter of 2022. |

Gross profit in the first half of 2023 was up slightly to $4.6 million

from $4.5 million.

Selling, general and administrative expense increased 6% year over year

to $3.8 million from $3.6 million.

Operating income declined 12% year over year to $0.8 million from $0.9

million.

Net income in the first half was $653,000, or $0.11 per diluted share,

compared to net income of $719,000, or $0.12 per diluted share, in the same period last year.

Adjusted EBITDA through six months was $1.3 million versus $1.5 million

a year ago.

The cash and cash equivalents balance at June 30,

2023, declined to $3.4 million from $4.4 million at 2022 year-end due primarily to the Company’s aggressive share repurchase program.

Through the first six months of 2023, the Company bought back more than $2.0 million of its shares.

The Company will conduct a conference call today at 10:00 a.m. Mountain

Time.

Call-in numbers for the conference call:

Domestic Toll Free: 1-877-407-8289

International: 1-201-689-8341

Conference Code: 13740472

Phone replay:

A telephone replay of the conference call will be available through September 10, 2023, as follows:

Domestic Toll Free: 1-877-660-6853

International: 1-201-612-7415

Conference Code: 13736422

About Where Food Comes From, Inc.

Where Food Comes From, Inc. is America’s trusted resource for third party verification of food production practices. Through proprietary

technology and patented business processes, the Company estimates that it supports more than 17,500 farmers, ranchers, vineyards, wineries,

processors, retailers, distributors, trade associations, consumer brands and restaurants with a wide variety of value-added services.

Through its IMI Global, Validus Verification Services, SureHarvest, WFCF Organic, and Postelsia units, Where Food Comes From solutions

are used to verify food claims, optimize production practices and enable food supply chains with analytics and data driven insights.

In addition, the Company’s Where Food Comes From® retail and restaurant labeling program uses web-based customer education

tools to connect consumers to the sources of the food they purchase, increasing meaningful consumer engagement for our clients.

*Note on non-GAAP Financial Measures

This press release and the accompanying tables include a discussion of EBITDA and Adjusted EBITDA, which are non-GAAP financial measures

provided as a complement to the results provided in accordance with generally accepted accounting principles (“GAAP”). The

term “EBITDA” refers to a financial measure that we define as earnings (net income or loss) plus or minus net interest plus

taxes, depreciation and amortization. Adjusted EBITDA excludes from EBITDA stock-based compensation and, when appropriate, other items

that management does not utilize in assessing WFCF’s operating performance (as further described in the attached financial schedules).

None of these non-GAAP financial measures are recognized terms under GAAP and do not purport to be an alternative to net income as an

indicator of operating performance or any other GAAP measure. We have reconciled Adjusted EBITDA to GAAP net income in the Consolidated

Statements of Income table at the end of this release. We intend to continue to provide these non-GAAP financial measures as part of

our future earnings discussions and, therefore, the inclusion of these non-GAAP financial measures will provide consistency in our financial

reporting.

CAUTIONARY STATEMENT

This news release contains “forward-looking statements” within the meaning of the U.S. Private Securities Litigation Reform

Act of 1995, based on current expectations, estimates and projections that are subject to risk. Forward-looking statements are inherently

uncertain, and actual events could differ materially from the Company’s predictions. Important factors that could cause actual

events to vary from predictions include those discussed in our SEC filings. Specifically, statements in this news release about industry

leadership, diversity of services mix, potential for consumer trends to benefit the Company, ability to continue returning value and

delivering positive results for stockholders, and demand for, and impact and efficacy of, the Company’s products and services on

the marketplace are forward-looking statements that are subject to a variety of factors, including availability of capital, personnel

and other resources; competition; governmental regulation of the agricultural industry; the market for beef and other commodities; and

other factors. Financial results for 2023 and the Company’s pace of stock buybacks are not necessarily indicative of future results.

Readers should not place undue reliance on these forward-looking statements. The Company assumes no obligation to update its forward-looking

statements to reflect new information or developments. For a more extensive discussion of the Company’s business, please refer

to the Company’s SEC filings at www.sec.gov.

Company Contacts:

John Saunders

Chief Executive Officer

303-895-3002

Jay Pfeiffer

Director, Investor Relations

303-880-9000

jpfeiffer@wherefoodcomesfrom.com

Where Food Comes From, Inc.

Statements of Income (Unaudited)

| |

|

Three months ended

June 30, |

|

|

Six months ended

June 30, |

|

| (Amounts in thousands, except per share amounts) |

|

2023 |

|

|

2022 |

|

|

2023 |

|

|

2022 |

|

| Revenues: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Verification and certification service revenue |

|

$ |

4,779 |

|

|

$ |

3,964 |

|

|

$ |

8,585 |

|

|

$ |

7,748 |

|

| Product sales |

|

|

938 |

|

|

|

878 |

|

|

|

1,909 |

|

|

|

1,885 |

|

| Consulting revenue |

|

|

409 |

|

|

|

489 |

|

|

|

899 |

|

|

|

1,854 |

|

| Total revenues |

|

|

6,126 |

|

|

|

5,331 |

|

|

|

11,393 |

|

|

|

11,487 |

|

| Costs of revenues: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Costs of verification and certification services |

|

|

2,736 |

|

|

|

2,325 |

|

|

|

4,932 |

|

|

|

4,361 |

|

| Costs of products |

|

|

555 |

|

|

|

522 |

|

|

|

1,123 |

|

|

|

1,059 |

|

| Costs of consulting |

|

|

329 |

|

|

|

354 |

|

|

|

689 |

|

|

|

1,540 |

|

| Total costs of revenues |

|

|

3,620 |

|

|

|

3,201 |

|

|

|

6,744 |

|

|

|

6,960 |

|

| Gross profit |

|

|

2,506 |

|

|

|

2,130 |

|

|

|

4,649 |

|

|

|

4,527 |

|

| Selling, general and administrative expenses |

|

|

1,833 |

|

|

|

1,817 |

|

|

|

3,821 |

|

|

|

3,591 |

|

| Income from operations |

|

|

673 |

|

|

|

313 |

|

|

|

828 |

|

|

|

936 |

|

| Other income/(expense): |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Dividend income from Progressive Beef |

|

|

50 |

|

|

|

50 |

|

|

|

100 |

|

|

|

100 |

|

| Gain on disposal of assets |

|

|

5 |

|

|

|

- |

|

|

|

5 |

|

|

|

- |

|

| Loss on foreign currency exchange |

|

|

(2 |

) |

|

|

(23 |

) |

|

|

(4 |

) |

|

|

(35 |

) |

| Other income, net |

|

|

11 |

|

|

|

1 |

|

|

|

20 |

|

|

|

1 |

|

| Interest expense |

|

|

(1 |

) |

|

|

(1 |

) |

|

|

(2 |

) |

|

|

(2 |

) |

| Income before income taxes |

|

|

736 |

|

|

|

340 |

|

|

|

947 |

|

|

|

1,000 |

|

| Income tax expense |

|

|

204 |

|

|

|

118 |

|

|

|

294 |

|

|

|

281 |

|

| Net income |

|

$ |

532 |

|

|

$ |

222 |

|

|

$ |

653 |

|

|

$ |

719 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Per share - net income: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Basic |

|

$ |

0.09 |

|

|

$ |

0.04 |

|

|

$ |

0.12 |

|

|

$ |

0.12 |

|

| Diluted |

|

$ |

0.09 |

|

|

$ |

0.04 |

|

|

$ |

0.11 |

|

|

$ |

0.12 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Weighted average number of common shares outstanding: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Basic |

|

|

5,670 |

|

|

|

6,013 |

|

|

|

5,693 |

|

|

|

6,053 |

|

| Diluted |

|

|

5,735 |

|

|

|

6,096 |

|

|

|

5,760 |

|

|

|

6,136 |

|

Where Food Comes From, Inc.

Calculation of Adjusted EBITDA*

(Unaudited)

| |

|

Three months ended

June 30, |

|

|

Six months ended

June 30, |

|

| (Amounts in thousands) |

|

2023 |

|

|

2022 |

|

|

2023 |

|

|

2022 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

| Net income |

|

$ |

532 |

|

|

$ |

222 |

|

|

$ |

653 |

|

|

$ |

719 |

|

| Adjustments to EBITDA: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Interest expense |

|

|

1 |

|

|

|

1 |

|

|

|

2 |

|

|

|

2 |

|

| Income tax expense |

|

|

204 |

|

|

|

118 |

|

|

|

294 |

|

|

|

281 |

|

| Depreciation and amortization |

|

|

163 |

|

|

|

197 |

|

|

|

335 |

|

|

|

392 |

|

| EBITDA* |

|

|

900 |

|

|

|

538 |

|

|

|

1,284 |

|

|

|

1,394 |

|

| Adjustments: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Stock-based compensation |

|

|

17 |

|

|

|

32 |

|

|

|

32 |

|

|

|

83 |

|

| Cost of acquisitions |

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

| ADJUSTED EBITDA* |

|

$ |

917 |

|

|

$ |

570 |

|

|

$ |

1,316 |

|

|

$ |

1,477 |

|

*Use of Non-GAAP Financial Measures: Non-GAAP results

are presented only as a supplement to the financial statements and for use within management’s discussion and analysis based on

U.S. generally accepted accounting principles (GAAP). The non-GAAP financial information is provided to enhance the reader’s understanding

of the Company’s financial performance, but non-GAAP measures should not be considered in isolation or as a substitute for financial

measures calculated in accordance with GAAP. Reconciliations of the most directly comparable GAAP measures to non-GAAP measures are provided

herein.

All of the items included in the reconciliation from

net income to EBITDA and from EBITDA to Adjusted EBITDA are either (i) non-cash items (e.g., depreciation, amortization of purchased intangibles,

stock-based compensation, etc.) or (ii) items that management does not consider to be useful in assessing the Company’s ongoing

operating performance (e.g., M&A costs, income taxes, gain on sale of investments, loss on disposal of assets, etc.). In the case

of the non-cash items, management believes that investors can better assess the Company’s operating performance if the measures

are presented without such items because, unlike cash expenses, these adjustments do not affect the Company’s ability to generate

free cash flow or invest in its business.

We use, and we believe investors benefit from the

presentation of, EBITDA and Adjusted EBITDA in evaluating our operating performance because it provides us and our investors with an additional

tool to compare our operating performance on a consistent basis by removing the impact of certain items that management believes do not

directly reflect our core operations. We believe that EBITDA is useful to investors and other external users of our financial statements

in evaluating our operating performance because EBITDA is widely used by investors to measure a company’s operating performance

without regard to items such as interest expense, taxes, and depreciation and amortization, which can vary substantially from company

to company depending upon accounting methods and book value of assets, capital structure and the method by which assets were acquired.

Because not all companies use identical calculations,

the Company’s presentation of non-GAAP financial measures may not be comparable to other similarly titled measures of other companies.

However, these measures can still be useful in evaluating the Company’s performance against its peer companies because management

believes the measures provide users with valuable insight into key components of GAAP financial disclosures.

Where Food Comes From, Inc.

Balance Sheets

| | |

June 30, | | |

December 31, | |

| (Amounts in thousands, except per share amounts) | |

2023 | | |

2022 | |

| | |

(Unaudited) | | |

(Audited) | |

| Assets | |

| | | |

| | |

| Current assets: | |

| | | |

| | |

| Cash and cash equivalents | |

$ | 3,410 | | |

$ | 4,368 | |

| Accounts receivable, net of allowance | |

| 2,205 | | |

| 2,172 | |

| Inventory | |

| 1,196 | | |

| 888 | |

| Prepaid expenses and other current assets | |

| 713 | | |

| 463 | |

| Total current assets | |

| 7,524 | | |

| 7,891 | |

| Property and equipment, net | |

| 860 | | |

| 998 | |

| Right-of-use assets, net | |

| 2,460 | | |

| 2,607 | |

| Equity investments | |

| 1,191 | | |

| 991 | |

| Intangible and other assets, net | |

| 2,179 | | |

| 2,340 | |

| Goodwill, net | |

| 2,946 | | |

| 2,946 | |

| Deferred tax assets, net | |

| 514 | | |

| 523 | |

| Total assets | |

$ | 17,674 | | |

$ | 18,296 | |

| | |

| | | |

| | |

| Liabilities and Equity | |

| | | |

| | |

| Current liabilities: | |

| | | |

| | |

| Accounts payable | |

$ | 713 | | |

$ | 640 | |

| Accrued expenses and other current liabilities | |

| 1,001 | | |

| 769 | |

| Deferred revenue | |

| 1,841 | | |

| 1,278 | |

| Current portion of finance lease obligations | |

| 13 | | |

| 9 | |

| Current portion of operating lease obligations | |

| 323 | | |

| 341 | |

| Total current liabilities | |

| 3,891 | | |

| 3,037 | |

| Finance lease obligations, net of current portion | |

| 48 | | |

| 37 | |

| Operating lease obligation, net of current portion | |

| 2,593 | | |

| 2,745 | |

| Total liabilities | |

| 6,532 | | |

| 5,819 | |

| | |

| | | |

| | |

| Commitments and contingencies | |

| | | |

| | |

| | |

| | | |

| | |

| Equity: | |

| | | |

| | |

| Preferred stock, $0.001 par value; 5,000 shares authorized; none issued or

outstanding | |

| - | | |

| - | |

| Common stock, $0.001 par value; 95,000 shares authorized; 6,508 (2023) and 6,501 (2022) shares

issued, and 5,631 (2023) and 5,775 (2022) shares outstanding | |

| 6 | | |

| 6 | |

| Additional paid-in-capital | |

| 12,223 | | |

| 12,145 | |

| Treasury stock of 877 (2023) and 727 (2022) shares | |

| (9,329 | ) | |

| (7,263 | ) |

| Retained earnings | |

| 8,242 | | |

| 7,589 | |

| Total equity | |

| 11,142 | | |

| 12,477 | |

| Total liabilities and stockholders’ equity | |

$ | 17,674 | | |

$ | 18,296 | |

Exhibit 99.2

Where Food Comes From, Inc.

2023 Second Quarter Conference Call

Call date: Thursday August 10, 2023

Call time: 10:00 a.m. Mountain Time

Jay Pfeiffer – Investor Relations

Good morning and welcome to the Where Food Comes From 2023 second quarter

earnings call.

Joining me on the call today are CEO John Saunders, President Leann Saunders,

and Chief Financial Officer Dannette Henning.

During this call we’ll make forward-looking

statements based on current expectations, estimates and projections that are subject to risk. Statements about current and future financial

performance, growth strategy, customers, business opportunities, market acceptance of our products and services, and potential acquisitions

are forward looking statements. Listeners should not place undue reliance on these statements as there are many factors that could cause

actual results to differ materially from our forward-looking statements. We encourage you to review our publicly filed documents as well

as our news releases and website for more information. Today we’ll also discuss Adjusted EBITDA, a non-GAAP financial measure provided

as a complement to GAAP results. Please refer to today’s earnings release for important disclosures regarding non-GAAP measures.

I’ll now turn the call over to John Saunders.

John Saunders

Good morning and thanks for joining the call today.

This morning we announced our second quarter financial

results for the period ended June 30, 2023. We were very pleased with the results – following as they did a challenging first quarter

in which we faced a confluence of headwinds that negatively impacted both our top and bottom lines. The strong results we delivered in

Q2 underscore the resiliency of our unique business model. We have by far the industry’s most expansive solutions portfolio and

are able to provide a level of value that fosters customer loyalty and high customer retention rates.

Going forward, we may experience a continuation of

certain headwinds over the next several quarters, particularly in the area of inflationary pressures and cyclical cattle trends. But again,

we believe our diversification and dominant position in the beef industry – combined with the impact of new solutions coming on

line – will keep us on a path of long-term sustainable growth and profitability.

Now to our Q2 results…

Revenue in second quarter increased 15% to $6.1 million from $5.3 million

in the same quarter last year. That growth included a 21% increase in core verification and certification revenue and a 7% increase in

product sales, partially offset by a 16% decline in consulting revenue.

Higher revenue and a stable expense base led to a 140% increase in net

income – to $532,000, or 9 cents per diluted share, from $222,000, or 4 cents per diluted share, in the second quarter last year.

Adjusted EBITDA in the quarter totaled $917,000, up 61% from $570,000 in

the year-ago second quarter.

The strong Q2 performance helped us make up some ground

on our year-to-date numbers. Six-month revenue pulled nearly flat at $11.4 million vs. $11.5 million last year. You’ll recall that

the year-ago total included a non-recurring $850,000 consulting fee booked in the first quarter of 2022. Absent that – on an apples-to-apples

basis – six-month revenue this year would have been well ahead of prior year levels. Again, verification and certification revenue

led the way with 11% growth year-over-year.

Net income at the mid-year point was $653,000, or

11 cents per diluted share, vs. $719,000, or 12 cents per diluted share, for the same period last year.

Adjusted EBITDA was $1.3 million vs. $1.5 million.

We generated $1.3 million in cash from operations

year-to-date and closed the quarter with $3.4 million in cash and cash equivalents, which was down from $4.4 million at year-end due to

the continuation of our stock repurchase program.

Speaking of which – during the second quarter

we bought back $836,000 of stock, raising our year-to-date total repurchases to more than $2.0 million. Over the past 10 quarters we have

returned approximately $7.5 million in value to stockholders through buybacks and a special dividend. The Board intends to continue considering

buybacks and other value creating measures for the foreseeable future.

Turning to some business highlights, you’ve

often heard me speak about the diversity of our business model and the resulting benefits that accrue to us as a company and to our customers.

The breadth and depth of our solutions portfolio is what sets us apart and what is responsible for the wide moat we have built around

our business.

We have been busy this year expanding on what was

already far and away the industry’s largest solutions set. In the first quarter, one of our long-time customers – Certified

Piedmontese Beef – became the first brand to be certified to PaleoFLEX diet, which is a relatively new standard of the Paleo Diet

that is exclusively administered by Where Food Comes From.

In the second quarter we were named exclusive third-party

verifier for the Bee Friendly Farming certification – a program that helps farmers and ranchers protect critical pollinators through

implementation of regenerative policies within their operations.

With these two additions, Where Food Comes From and

its divisions now certify customers to 56 different standards. This diversity affords us a distinct competitive advantage as it positions

us as a true one-stop-shop able to offer customers convenience and price advantages through the bundling of multiple verification services.

On a related note, in the second quarter we continued

to advance our aquaculture initiative through an investment in seafood traceability company BlueTrace, a privately-held tech company that

helps players in the North American shellfish industry comply with government regulations, manage their inventories and optimize profitability.

We are now collaborating with BlueTrace to strengthen our respective aquaculture efforts.

BlueTrace is currently focused on the North American

seafood industry, but our aquaculture initiative is very much geared toward global opportunities. The cornerstone of this effort is our

FishCARE sustainability standard, which helps seafood producers adhere to higher standards of care for seafood products, employees and

the environment.

We are making steady inroads with this project –

particularly as it pertains to shrimp – in Asian markets, where the majority of shrimp consumed in North America is farmed but where

less than 5% of producers are compliant with any broadly recognized certification. We’re still in the early stages of this effort,

but we believe it holds excellent potential to grow into a meaningful revenue stream over time.

So in conclusion, with another good quarter behind

us, we continue to execute our business plan and look forward to talking to you following our third quarter.

Thank you again for joining us on the call today. Operator, you may know

open the call to questions…

Question and Answer Session:

Question 1: John Nelson

Hi, good morning and thanks

for taking my call. I was just curious; shrimp interests me a lot because I know a lot of them do come from Asia. How is that going to

work in terms of you guys certifying those? Are you going to have to build out a lot of measurement services over in Asia? And does that

change your overall growth rate of the company and given the TAM there? And do you think it will increase your growth rate? And how soon

do you think that business will be profitable? So a couple of questions there. Sorry about that.

John Saunders

Yes. No, that’s great,

John. Thanks for the questions. In 2021 – we acquired Postelsia. Postelsia had a large footprint in Southeast Asia through a program

called ASIC, the Asian Seafood Innovation Consortium. That program has been around for about 15 years, John, and they’ve –

there’s a number of different certification bodies over there that we’ve worked with in the past that we’re evaluating

using in addition to creating our own infrastructure, but I think one of the things that we really believe is an opportunity there is

to partner or potentially acquire certification opportunities and businesses that currently exist. So we will have a little bit different

evolution of the FishCARE standard and specifically the shrimp care standard in Southeast Asia because it’s a global opportunity

for us, and it’s a new growth strategy for us. But we’re very excited about the potential we think that it has. It has some

of the same dynamics of the cattle industry in the United States, which is really a key driver for us in that there’s a lot of fragmentation

currently in the business. There’s a lot of different types of production systems.

So we’re very excited

about. The forecast, I would say, is probably still 12 to 24 months away for us before we really start to understand the trends and where

it’s coming from, but there is no doubt, it’s a huge growth opportunity for us, and there’s so many consumers here in

the United States and around the world that are looking for more information around shrimp. And I’ll kind of finish with this and

back to the BlueTrace comment. One of the things that’s lacking in shrimp, you probably know this, John, is there’s really

no true traceability related to where the shrimp is coming from, so we see that the opportunity for sustainable certification is there,

but we really believe that the core opportunity is just providing with BlueTrace or with other technologies to create a traceability system

within the shrimp industry. And that’s kind of what we’re tackling right now just trying to figure out that. So you have to

know where it comes from before you can really certify much about it. But great question. And hopefully, you get some of my excitement

about it because it’s an industry that we think there’s a lot of opportunity in.

Operator

This concludes today’s conference. You may disconnect

your lines at this time. Thank you for your participation.

v3.23.2

Cover

|

Aug. 10, 2023 |

| Cover [Abstract] |

|

| Document Type |

8-K

|

| Amendment Flag |

false

|

| Document Period End Date |

Aug. 10, 2023

|

| Entity File Number |

001-40314

|

| Entity Registrant Name |

WHERE

FOOD COMES FROM, INC.

|

| Entity Central Index Key |

0001360565

|

| Entity Tax Identification Number |

43-1802805

|

| Entity Incorporation, State or Country Code |

CO

|

| Entity Address, Address Line One |

202

6th Street,

|

| Entity Address, Address Line Two |

Suite 400

|

| Entity Address, City or Town |

Castle

Rock

|

| Entity Address, State or Province |

CO

|

| Entity Address, Postal Zip Code |

80104

|

| City Area Code |

(303)

|

| Local Phone Number |

895-3002

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Common

Stock, $0.001 par value

|

| Trading Symbol |

WFCF

|

| Security Exchange Name |

NASDAQ

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

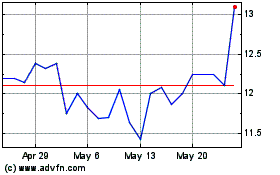

Where Food Comes From (NASDAQ:WFCF)

Historical Stock Chart

From Nov 2024 to Dec 2024

Where Food Comes From (NASDAQ:WFCF)

Historical Stock Chart

From Dec 2023 to Dec 2024