Current Report Filing (8-k)

December 06 2022 - 3:26PM

Edgar (US Regulatory)

0001013706

false

0001013706

2022-11-30

2022-11-30

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the

Securities Exchange Act of 1934

Date of Report (Date of earliest event reported):

November 30, 2022

WILHELMINA

INTERNATIONAL, INC.

(Exact name of registrant as specified in its charter)

| Delaware | |

001-36589 | |

74-2781950 |

| (State or other jurisdiction of incorporation) | |

(Commission File No.) | |

(IRS Employer Identification No.) |

| 5420 LBJ Freeway, Lockbox #25, Dallas, Texas |

75240 |

| (Address of Principal Executive Offices) |

(Zip Code) |

Registrant’s telephone number, including

area code: (214) 661-7488

N/A

(Former

name or former address, if changed since last report.)

Securities registered pursuant to Section 12(b)

of the Act:

| Title of each class |

Trading Symbol(s) |

Name of each exchange on which registered |

| Common Stock, $0.01 par value |

WHLM |

NASDAQ Capital Market |

Check the appropriate box below if the Form 8-K

filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General

Instruction A.2. below):

| ☐ | Written communications pursuant

to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ | Soliciting material pursuant to

Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ | Pre-commencement communications

pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ | Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Indicate by check mark whether the registrant

is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the

Securities Exchange Act of 1934 (§240.12b-2 of this chapter). Emerging growth company ☐

If an emerging growth company, indicate by check

mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting

standards provided pursuant to Section 13(a) of the Exchange Act. ☐

| Item 4.02 | Non-Reliance on Previously Issued Financial Statements or a Related Audit Report or Completed Interim

Review |

Wilhelmina International,

Inc. (“Wilhelmina” or the “Company”) has historically presented service revenues on a gross basis in its annual

audited and interim consolidated statements of operations and comprehensive income (loss) on the basis of the good faith judgment of both

its management and audit committee of its board of directors (“Audit Committee”) that the Company is the principal in the

contractual relationships with its end-user clients. However, the Staff of the Securities and Exchange Commission (“SEC”)

has recently objected to this presentation and communicated that service revenues should be presented net of model costs based on their

conclusion that the Company is only an agent in the arrangements with its end-user clients.

On November 30, 2022, the

Audit Committee determined that accepting the position of the SEC Staff was in the best interest of Wilhelmina’s shareholders. As

a result, the Audit Committee concluded that the consolidated statements of operations and comprehensive income (loss) included in its

Annual Report on Form 10-K for the year ended December 31, 2021, and in its Quarterly Report on Form 10-Q for the interim period ended

September 30, 2022, should no longer be relied upon.

The Company intends to amend

its Annual Report on Form 10-K for the year ended December 31, 2021, and its Quarterly Report on Form 10-Q for the interim period ended

September 30, 2022, to reflect the presentation of service revenue on a net basis as agent. This change in presentation will result in

reducing previously reported service revenues by an amount equal to model costs. Since model costs have historically been shown as a deduction

from total revenue, amounts previously reported as revenues net of model costs will become total revenue. This change in presentation

will have no impact on operating expenses, other expense (income), income before provision for income taxes, provision for income taxes,

net income, net income per share, or total comprehensive income (loss) for any period. Similarly, this change in income statement presentation

will have no impact on the consolidated balance sheets, consolidated statements of shareholders’ equity, or consolidated statements

of cash flows of the Company.

The Audit Committee of the

Company has discussed the foregoing matters with the Company’s independent registered public accounting firm, Baker Tilly US, LLP.

SIGNATURES

Pursuant to the requirements

of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned thereunto

duly authorized.

| Dated: December 6, 2022 |

WILHELMINA INTERNATIONAL, INC. |

| |

|

| |

|

| |

By: |

/s/ James A. McCarthy |

|

|

Name: |

James A. McCarthy |

| |

|

Title: |

Chief Financial Officer |

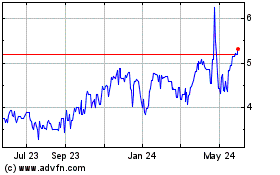

Wilhelmina (NASDAQ:WHLM)

Historical Stock Chart

From Dec 2024 to Jan 2025

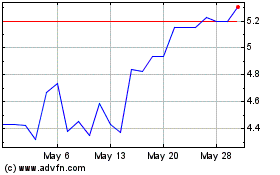

Wilhelmina (NASDAQ:WHLM)

Historical Stock Chart

From Jan 2024 to Jan 2025