UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

REPORT OF FOREIGN PRIVATE ISSUER

PURSUANT TO RULE 13a-16 OR 15d-16

UNDER THE SECURITIES EXCHANGE ACT OF 1934

For the month of February 2025

Commission File Number: 001-39257

WiMi

Hologram Cloud Inc.

(Registrant’s Name)

Room#1508, 4th Building, Zhubang 2000 Business

Center,

No. 97, Balizhuang Xili,

Chaoyang District, Beijing

(Address of Principal Executive Offices)

Indicate by check mark whether the registrant files or will file annual

reports under cover Form 20-F or Form 40-F.

Form 20-F ☒ Form 40-F

☐

EXHIBIT INDEX

SIGNATURES

Pursuant to the requirements of the Securities

Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| |

WiMi Hologram Cloud Inc. |

| |

|

|

| |

By: |

/s/ Shuo Shi |

| |

Name: |

Shuo Shi |

| |

Title: |

Chief Executive Officer |

Date: February 24, 2025

2

Exhibit 99.1

WiMi Hologram Cloud Inc. to Hold Extraordinary

General Meeting on March 25, 2025

BEIJING, February 24, 2025

WiMi Hologram Cloud Inc. (Nasdaq: WIMI) (“WiMi” or the

“Company”), a leading AR services provider in China, today announced that it will (i) terminate the Deposit Agreement dated

March 20, 2020, among the Company, JPMorgan Chase Bank N.A. (the “Depositary”), and the holders of American depositary shares

(the “ADSs”) from time to time, effective April 2, 2025, and (ii) hold its extraordinary general meeting of shareholders (the

“EGM”) at Room#1508, 4th Building, Zhubang 2000 Business Center, No. 97, Balizhuang Xili, Chaoyang District, Beijing on March

25, 2025 at 9:00 a.m. Beijing Time. The Company’s board of directors has fixed February 24, 2025, as the record date (the “Record

Date”) for determining the shareholders entitled to receive notice of the extraordinary general meeting or any adjournment or postponement

thereof. Holders of the Company’s Class A ordinary shares (the “Class A ordinary shares”) and Class B ordinary shares

(the “Class B ordinary shares”), par value US$0.0001 per share (collective, the “ordinary shares”) of record at

the close of business on the Record Date are entitled to attend and vote at the EGM. Holders of American Depositary Shares (the “ADSs”)

who wish to exercise their voting rights for the underlying Class B ordinary shares must act through JPMorgan Chase Bank, N.A., the depositary

of the Company’s ADS program.

On or about February 24, 2025, the Depositary of the Company’s

American depositary receipts (the “ADRs”), will distribute to all holders and beneficial owners of the Company’s ADRs

a notification regarding the termination of ADR facility for the Company’s ADSs pursuant to the Deposit Agreement. The effective

date of the termination of the Deposit Agreement will be April 2, 2025 (the “Effective Date”). On the Effective Date, holders

of ADSs will have their ADSs automatically cancelled and would be entitled to receive the corresponding underlying Deposited Securities

(the “Mandatory Exchange”) at a rate of two (2) Class B ordinary shares for each ADS cancelled, subject to further adjustment

in accordance with the share consolidation (defined below) described below.

Subject to shareholder approval at the EGM and concurrent to the Mandatory

Exchange, a consolidation of the Company’s Shares at a ratio of one (1) consolidated ordinary share for every twenty (20) existing

ordinary share (the “share consolidation”). If the share consolidation is approved, on the Effective Date, former

ADS holders should expect to receive one (1) consolidated Class B ordinary share for every ten (10) ADS previously held. If the

share consolidation is not approved or delayed, on the Effective Date, former ADS holders should expect to receive two (2) existing Class

B ordinary shares for every one (1) ADS previously held.

At the EGM, shareholders will be asked for vote on the following proposals:

| (i) | With effect from 5 P.M. on April 02, 2025, Eastern time, (a) every

twenty (20) Class A ordinary shares of a par value of US$0.0001 each in the Company’s issued and unissued share capital be and are

hereby consolidated into one (1) Class A ordinary share (each a “consolidated Class A share”) of a par value of US$0.002,

and such consolidated Class A shares shall have the same rights and subject to the same restrictions as the Class A ordinary shares as

set out in the Company’s currently effective Second Amended and Restated Memorandum and Articles of Association (the “M&A”),

(b) every twenty (20) Class B ordinary shares of a par value of US$0.0001 each in the Company’s issued and unissued share capital

be and are hereby consolidated into one (1) Class B ordinary share (each a “consolidated Class B share”) of a par value of

US$0.002, and such consolidated Class B shares shall have the same rights and subject to the same restrictions as the Class B ordinary

shares as set out in the Company’s M&A, and (c) every twenty (20) undesignated shares of a par value of US$0.0001 each in the

Company’s unissued share capital be and are hereby consolidated into one (1) share of a par value of US$0.002 (collectively, the

“share consolidation”), such that immediately following the share consolidation, the authorized share capital of the Company

shall be changed |

FROM

US$50,000 divided into 500,000,000 shares comprising (i)

25,000,000 Class A ordinary shares of a par value of US$0.0001 each; (ii) 275,000,000 Class B ordinary shares of a par value of US$0.0001

each; and (iii) 200,000,000 shares of a par value of US$0.0001 each of such class or classes (however designated) as the board of directors

may determine;

TO

US$50,000 divided into 25,000,000 shares comprising (i) 1,250,000 Class

A ordinary shares of a par value of US$0.002 each; (ii) 13,750,000 Class B ordinary shares of a par value of US$0.002 each; and (iii)

10,000,000 shares of a par value of US$0.002 each of such class or classes (however designated) as the board of directors may determine,

and no fractional shares be issued in connection with the share consolidation and the Company’s transfer agent would aggregate all

fractional shares and sell them as soon as practicable after the effective time of the share consolidation at the then-prevailing prices

on the open market, on behalf of those shareholders who would otherwise be entitled to receive a fractional share as a result of the share

consolidation.

| (ii) | Immediately following the share consolidation, the authorized

share capital of the Company be increased |

FROM US$50,000 divided into 25,000,000 shares comprising

(i) 1,250,000 Class A ordinary shares of a par value of US$0.002 each; (ii) 13,750,000 Class B ordinary shares of a par value of US$0.002

each; and (iii) 10,000,000 shares with a par value of US$0.002 each of such class or classes (however designated) as the board of directors

may determine.

TO US$1,500,000 divided into 750,000,000 shares comprising

(i) 37,500,000 Class A ordinary shares of a par value of US$0.002 each; (ii) 412,500,000 Class B ordinary shares of a par value of US$0.002

each; and (iii) 300,000,000 shares with a par value of US$0.002 each of such class or classes (however designated) as the board of directors

may determine.

(the “share capital increase”.)

| (iii) | any one or more of Directors of the Company be and is/are hereby

authorized to do all such acts and things and execute all such documents, which are ancillary to the share consolidation and share capital

increase and of administrative nature, on behalf of the Company, including under seal where applicable, as he/they consider necessary,

desirable or expedient to give effect to the foregoing arrangements for the share consolidation and share capital increase; the Company’s

registered office provider be instructed to make all necessary filings with the Companies Registry in the Cayman Islands in connection

with the share consolidation and share capital increase; and the Company’s share registrar be instructed to update the register

of members of the Company and that upon the surrender to the Company of the existing share certificates (if any) that they be cancelled

and that any Director be instructed to prepare, sign, seal and deliver on behalf of the Company new share certificates accordingly. |

Shareholders and ADS holders may obtain

a copy of the Company’s annual report, free of charge, from the Company’s website at http://ir.wimiar.com/ and from the SEC’s

website at www.sec.gov, or by contacting WiMi Hologram Cloud Inc., Room#1508, 4th Building, Zhubang 2000 Business Center, No. 97, Balizhuang

Xili, Chaoyang District , telephone: +86-10-5338-4913, email: Pr@wimiar.com

About WIMI Hologram Cloud Inc.

WiMi Hologram Cloud, Inc.(NASDAQ:WIMI), whose commercial operations

began in 2015, operates an integrated holographic AR application platform in China and has built a comprehensive and diversified holographic

AR content library among all holographic AR solution providers in China. Its extensive portfolio includes 4,654 AR holographic contents.

The company has also achieved a speed of image processing that is 80 percent faster than the industry average. While most peer companies

may identify and capture 40 to 50 blocks of image data within a specific space unit, WiMi collects 500 to 550 data blocks.

Safe Harbor Statement

This press release contains “forward-looking statements”

within the meaning of the Private Securities Litigation Reform Act of 1995. These forward-looking statements can be identified by terminology

such as “will,” “expects,” “anticipates,” “future,” “intends,” “plans,”

“believes,” “estimates” and similar statements. Statements that are not historical facts, including statements

about the Company’s beliefs and expectations, are forward-looking statements. Forward-looking statements involve inherent risks

and uncertainties. Further information regarding these and other risks is included in the Company’s annual report on Form 20-F and

current report on Form 6-K and other documents filed with the SEC. All information provided in this press release is as of the date of

this press release, and the Company does not undertake any obligation to update any forward-looking statement, except as required under

applicable laws.

For more information, please visit http://ir.wimiar.com/.

Exhibit 99.2

WIMI HOLOGRAM CLOUD INC.

(Incorporated in the Cayman Islands with limited liability)

(NASDAQ: WIMI)

NOTICE OF EXTRAORDINARY GENERAL MEETING

to be held on March 25, 2025

(or any adjourned or postponed meeting thereof)

NOTICE IS HEREBY GIVEN that an Extraordinary General Meeting

(“EGM”) of WiMi Hologram Cloud Inc. (the “Company”) will be held on March 25, 2025 at 9:00 a.m.

Beijing Time, or 9:00 p.m., Eastern Standard Time. The EGM will be held at Room#1508, 4th Building, Zhubang 2000 Business Center,

No. 97, Balizhuang Xili, Chaoyang District .

The EGM will be held for the following purposes:

| 1. |

To consider and, if thought fit, pass the following

resolution as an ordinary resolution:

“RESOLVED, as an ordinary resolution:

THAT “with effect from 5 P.M. on

April 02, 2025, Eastern time, (a) every twenty (20) Class A ordinary shares of a par value of US$0.0001 each in the Company’s issued

and unissued share capital be and are hereby consolidated into one (1) Class A ordinary share (each a “consolidated Class A share”)

of a par value of US$0.002, and such consolidated Class A shares shall have the same rights and subject to the same restrictions as the

Class A ordinary shares as set out in the Company’s currently effective Second Amended and Restated Memorandum and Articles of Association

(the “M&A”),(b) every twenty (20) Class B ordinary shares of a par value of US$0.0001 each in the Company’s issued

and unissued share capital be and are hereby consolidated into one (1) Class B ordinary share (each a “consolidated Class B share”)

of a par value of US$0.002, and such consolidated Class B shares shall have the same rights and subject to the same restrictions as the

Class B ordinary shares as set out in the Company’s M&A, and (c) every twenty (20) undesignated shares of a par value of US$0.0001

each in the Company’s unissued share capital be and are hereby consolidated into one (1) share of a par value of US$0.002 (collectively,

the “share consolidation”), such that immediately following the share consolidation, the authorized share capital of the Company

shall be changed

FROM

US$50,000 divided into 500,000,000 shares comprising

(i) 25,000,000 Class A ordinary shares of a par value of US$0.0001 each; (ii) 200,000,000 Class B ordinary shares of a par value of US$0.0001

each; and (iii) 275,000,000 shares of a par value of US$0.0001 each of such class or classes (however designated) as the board of directors

may determine;

TO

US$50,000 divided into 25,000,000 shares comprising

(i) 1,250,000 Class A ordinary shares of a par value of US$0.002 each; (ii) 13,750,000 Class B ordinary shares of a par value of US$0.002

each; and (iii) 10,000,000 shares of a par value of US$0.002 each of such class or classes (however designated) as the board of directors

may determine, and no fractional shares be issued in connection with the share consolidation and the Company’s transfer agent would

aggregate all fractional shares and sell them as soon as practicable after the effective time of the share consolidation at the then-prevailing

prices on the open market, on behalf of those shareholders who would otherwise be entitled to receive a fractional share as a result of

the share consolidation. |

| 2. |

To consider and, if thought fit, pass the following

resolution as an ordinary resolution:

“RESOLVED, as an ordinary resolution:

THAT immediately following the share consolidation,

the authorized share capital of the Company be increased

FROM US$50,000 divided into 25,000,000 shares comprising

(i) 1,250,000 Class A ordinary shares of a par value of US$0.002 each; (ii) 13,750,000 Class B ordinary shares of a par value of US$0.002

each; and (iii) 10,000,000 shares with a par value of US$0.002 each of such class or classes (however designated) as the board of directors

may determine.

TO US1,500,000 divided into 750,000,000 shares comprising (i) 37,500,000

Class A ordinary shares of a par value of US$0.002 each; (ii) 412,500,000 Class B ordinary shares of a par value of US$0.002 each; and

(iii) 300,000,000 shares with a par value of US$0.002 each of such class or classes (however designated) as the board of directors may

determine.

|

| 3. |

To consider and, if thought fit, pass the following

resolution as an ordinary resolution:

“RESOLVED, as an ordinary resolution:

THAT (i) any one or more of Directors of

the Company be and is/are hereby authorized to do all such acts and things and execute all such documents, which are ancillary to the

share consolidation and share capital increase and of administrative nature, on behalf of the Company, including under seal where applicable,

as he/they consider necessary, desirable or expedient to give effect to the foregoing arrangements for the share consolidation and share

capital increase, (ii) the Company’s registered office provider be instructed to make all necessary filings with the Companies Registry

in the Cayman Islands in connection with the share consolidation and share capital increase and (iii) the Company’s share registrar

be instructed to update the register of members of the Company and that upon the surrender to the Company of the existing share certificates

(if any) that they be cancelled and that any Director be instructed to prepare, sign, seal and deliver on behalf of the Company new share

certificates accordingly.

|

| 4. |

To consider and transact such other business as may properly come before the EGM or any adjournment or adjournments thereof. |

Further details of the Proposal are set out in the attached Proxy Form

(which is hereby incorporated into this notice by reference).

The board of directors of the Company has fixed the close of business

on February 24, 2025, Beijing Time, as the record date (the “Record Date”). Holders of record of the Company’s

Class A ordinary Shares and Class B ordinary Shares (collective, the “Ordinary Shares”) at the close of business on the Record

Date are entitled to attend and vote at the EGM and any adjourned meeting thereof. Holders of American Depositary Shares, each representing

two Class B ordinary shares of the Company (the “ADSs”), of record on the Record Date who wish to exercise their

voting rights for the underlying Class B ordinary shares must give voting instructions to JPMorgan Chase Bank, N.A., the depositary of

the ADSs.

Please refer to the proxy form (for holders of the Ordinary Shares)

or the ADS Voting Card (for holders of the ADSs), which are attached and made a part of this Notice of EGM. The proxy form is also available

for viewing on the Investor Relations section of our website at http://ir.wimiar.com/.

Your vote is important. You are urged to complete, sign, date and

return the accompanying proxy form to us (for holders of the Company’s Ordinary Shares) or your voting instructions to JPMorgan

Chase Bank, N.A. (for holders of the ADSs) as promptly as possible and before the prescribed deadline if you wish to exercise your voting

rights. We must receive the proxy form by no later than 9 a.m., Eastern Standard Time, on March 24, 2025 to ensure your representation

at the EGM, and JPMorgan Chase Bank, N.A. must receive your voting instructions by no later than 9 a.m., Eastern Standard Time, on March

20, 2025 to enable the votes attaching to the Class B ordinary shares represented by your ADSs to be cast at the EGM.

You may obtain a copy of the Company’s annual

report, free of charge, from the Company’s website at http://ir.wimiar.com/ and from the SEC’s website at www.sec.gov, or

by contacting WiMi Hologram Cloud Inc., Room#1508, 4th Building, Zhubang 2000 Business Center, No. 97, Balizhuang Xili, Chaoyang District,

Beijing, the People’s Republic of China 100020, telephone: +86-10-5338-4913, email: Pr@wimiar.com

| |

By Order of the Board of Directors, |

| |

|

| Beijing, February 24, 2025 |

/s/ Shuo Shi |

| |

Name: |

Shuo Shi |

| |

Title: |

Chief Executive Officer |

Exhibit 99.3

WIMI HOLOGRAM CLOUD INC.

PROXY FOR EXTRAORDINARY GENERAL MEETING

CLASS B ORDINARY SHARES

To Be Held on March 25, 2025

I/We _____________________________________ [insert

name] of ____________________________________ [insert address] being the registered holder of ____________________ [insert

number] Class B ordinary shares1, par value US$0.0001 per share, of WIMI HOLOGRAM CLOUD INC., (the “Company”)

hereby appoint the Chairman (the “Chairman”)2 of the extraordinary general meeting (the “Meeting”)

of the Company as my/our proxy to attend and act for me/us at the Meeting to be held at our headquarters at Room#1508, 4th Building, Zhubang

2000 Business Center, No. 97, Balizhuang Xili, Chaoyang District, Beijing, at 9:00AM., Beijing time, on March 25, 2025, and in the event

of a poll, to vote for me/us as indicated below, or if no such indication is given, in his or her discretion.

| THE BOARD RECOMMENDS THAT YOU VOTE FOR EACH PROPOSAL. PROPOSAL NO. 1: |

|

To consider and vote upon an ordinary resolution

that,

With effect from 5 P.M. on April 02, 2025, Eastern time, (a) every

twenty (20) Class A ordinary shares of a par value of US$0.0001 each in the Company’s issued and unissued share capital be and are

hereby consolidated into one (1) Class A ordinary share (each a “consolidated Class A share”) of a par value of US$0.002,

and such consolidated Class A shares shall have the same rights and subject to the same restrictions as the Class A ordinary shares as

set out in the Company’s currently effective Second Amended and Restated Memorandum and Articles of Association (the “M&A”),(b)

every twenty (20) Class B ordinary shares of a par value of US$0.0001 each in the Company’s issued and unissued share capital be

and are hereby consolidated into one (1) Class B ordinary share (each a “consolidated Class B share”) of a par value of US$0.002,

and such consolidated Class B shares shall have the same rights and subject to the same restrictions as the Class B ordinary shares as

set out in the Company’s M&A, and (c) every twenty (20) undesignated shares of a par value of US$0.0001 each in the Company’s

unissued share capital be and are hereby consolidated into one (1) share of a par value of US$0.002 (collectively, the “share consolidation”),

such that immediately following the share consolidation, the authorized share capital of the Company shall be changed

FROM

US$50,000 divided into 500,000,000 shares comprising (i)

25,000,000 Class A ordinary shares of a par value of US$0.0001 each; (ii) 275,000,000 Class B ordinary shares of a par value of US$0.0001

each; and (iii) 200,000,000 shares of a par value of US$0.0001 each of such class or classes (however designated) as the board of directors

may determine;

TO

US$50,000 divided into 25,000,000 shares comprising (i) 1,250,000 Class

A ordinary shares of a par value of US$0.002 each; (ii) 13,750,000 Class B ordinary shares of a par value of US$0.002 each; and (iii)

10,000,000 shares of a par value of US$0.002 each of such class or classes (however designated) as the board of directors may determine,

and no fractional shares be issued in connection with the share consolidation and the Company’s transfer agent would aggregate all

fractional shares and sell them as soon as practicable after the effective time of the share consolidation at the then-prevailing prices

on the open market, on behalf of those shareholders who would otherwise be entitled to receive a fractional share as a result of the share

consolidation.

|

| ☐ FOR ☐ AGAINST ☐ ABSTAIN |

| PROPOSAL NO. 2: |

|

To consider and vote upon an ordinary resolution

that,

immediately following the share consolidation, the authorized share

capital of the Company be increased

FROM US$50,000 divided into 25,000,000 shares comprising (i) 1,250,000

Class A ordinary shares of a par value of US$0.002 each; (ii) 10,000,000 Class B ordinary shares of a par value of US$0.002 each; and

(iii) 13,750,000 shares with a par value of US$0.002 each of such class or classes (however designated) as the board of directors may

determine.

TO US1,500,000 divided into 750,000,000 shares comprising (i) 37,500,000

Class A ordinary shares of a par value of US$0.002 each; (ii) 412,500,000 Class B ordinary shares of a par value of US$0.002 each; and

(iii) 300,000,000 shares with a par value of US$0.002 each of such class or classes (however designated) as the board of directors may

determine. |

| PROPOSAL

NO. 3: |

To consider and vote upon an ordinary resolution that,

(i) any one or more of Directors of the Company be and is/are hereby

authorized to do all such acts and things and execute all such documents, which are ancillary to the share consolidation and share capital

increase and of administrative nature, on behalf of the Company, including under seal where applicable, as he/they consider necessary,

desirable or expedient to give effect to the foregoing arrangements for the share consolidation and share capital increase, (ii) the Company’s

registered office provider be instructed to make all necessary filings with the Companies Registry in the Cayman Islands in connection

with the share consolidation and share capital increase and (iii) the Company’s share registrar be instructed to update the register

of members of the Company and that upon the surrender to the Company of the existing share certificates (if any) that they be cancelled

and that any Director be instructed to prepare, sign, seal and deliver on behalf of the Company new share certificates accordingly.

|

| PROPOSAL NO. 4: |

| To adjourn the Meeting to a later date or dates, if necessary, to permit further solicitation and vote of proxies in the event that there are insufficient votes for, or otherwise in connection with, the approval of Proposals 1 – 3. |

| ☐ FOR ☐ AGAINST ☐ ABSTAIN |

| Dated ___________________ 2024 |

|

Signature(s)4 |

|

| 1. | Please insert the number of

Shares registered in your name(s) to which this proxy relates. If no number is inserted, this Form of Proxy will be deemed to relate

to all the Shares in the Company registered in your name(s). |

| 2. | A proxy need not be a shareholder

of the Company. A shareholder entitled to attend and vote at the Meeting is entitled to appoint one or more proxies to attend and vote

in his/her stead. Please insert the name of the person(s) of your own choice that you wish to be appointed proxy in the space provided,

failing which the Chairman will be appointed as your proxy. |

| i. | If any proxy other than the

Chairman is preferred, strike out the words “the Chairman of the Meeting” and insert the name and address of the proxy desired

in the space provided. A shareholder may appoint one or more proxies to attend and vote in his or her stead. ANY ALTERATION MADE TO THIS

FORM OF PROXY MUST BE INITIALED BY THE PERSON(S) WHO SIGN(S) IT. |

| 3. | The Shares represented by all

properly executed proxies returned to the Company will be voted at the Meeting as indicated or, if no instruction is given, the proxy

will vote the Shares in his or her discretion, unless a reference to the holder of the proxy having such discretion has been deleted

and initialed on this Form of Proxy. With regard to the items listed on the agenda and without any explicit instructions to the contrary,

the Chairman of the Meeting as proxy holder will vote all resolutions in accordance with the recommendation of the Board. |

| 4. | This Form of Proxy must be

signed by you or your attorney duly authorized in writing or, in the case of a corporation, must be either executed under the hand of

an officer or attorney duly authorized to sign the same. |

| 5. | Whether or not you propose

to attend the relevant meeting(s) in person, you are strongly advised to complete and return this Form of Proxy in accordance with these

instructions. If you are a registered shareholder, your proxy card, to be valid, must be completed, signed and returned in the envelope

provided so that it is received no later than March 24, 2025, at 5:00 p.m Eastern Time. |

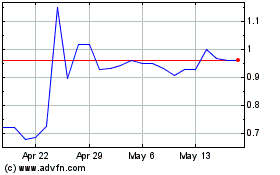

WiMi Hologram Cloud (NASDAQ:WIMI)

Historical Stock Chart

From Feb 2025 to Mar 2025

WiMi Hologram Cloud (NASDAQ:WIMI)

Historical Stock Chart

From Mar 2024 to Mar 2025